Key Insights

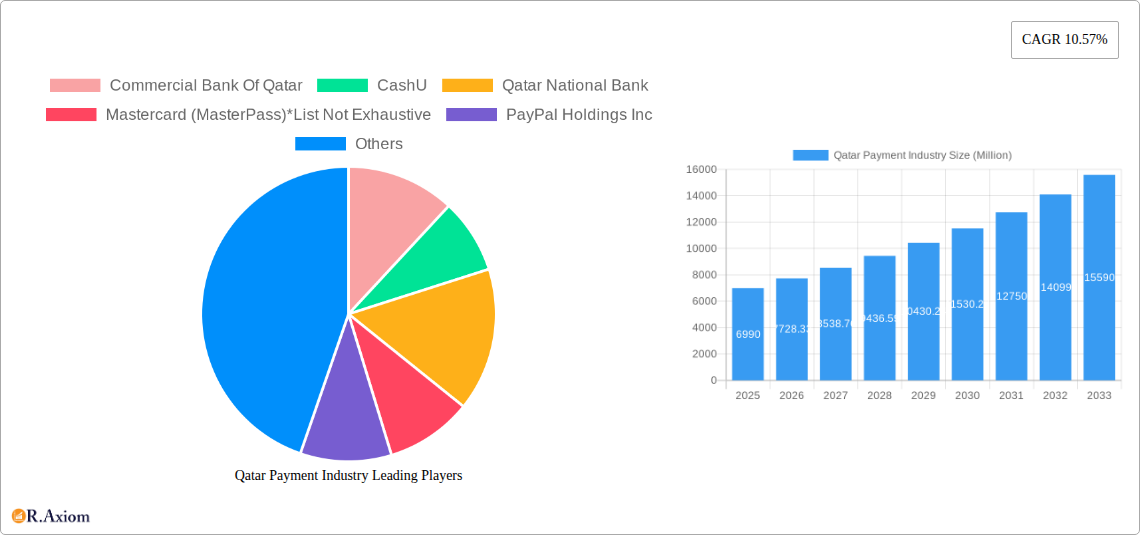

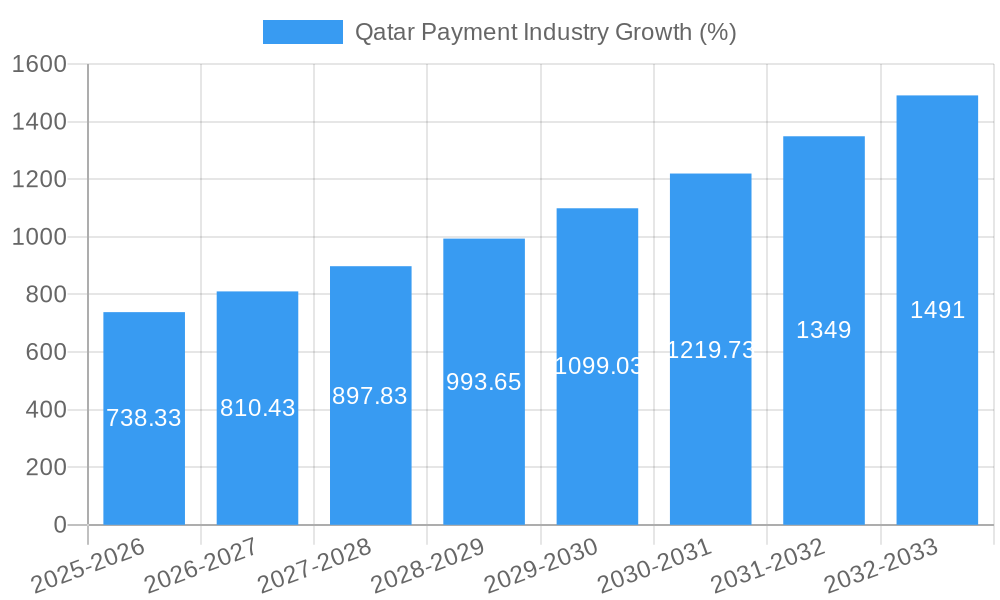

The Qatari payment industry, valued at $6.99 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 10.57% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of digital payment methods, spurred by a young and tech-savvy population and government initiatives promoting digitalization, is a significant driver. Furthermore, the burgeoning e-commerce sector and the expansion of contactless payment technologies, like mobile wallets (Apple Pay, Samsung Pay), are contributing to this upward trajectory. The growth is also being propelled by the rising popularity of online services across various sectors, including retail, entertainment, and healthcare, necessitating secure and efficient payment solutions. Major players like Commercial Bank of Qatar, Qatar National Bank, Mastercard, and PayPal are actively shaping the market landscape through strategic partnerships and technological innovations.

However, certain challenges persist. While cash remains a significant mode of payment, particularly in smaller transactions, the industry faces the task of further enhancing financial inclusion and promoting widespread digital adoption among all segments of the population. Security concerns related to online transactions and data privacy remain crucial aspects that need to be addressed to maintain consumer confidence and foster continued growth. Regulatory frameworks will also play a vital role in shaping the future of the industry, balancing innovation with the need for secure and transparent financial practices. The forecast period (2025-2033) promises significant expansion opportunities for both established players and new entrants, emphasizing the strategic importance of adapting to evolving consumer preferences and technological advancements.

Qatar Payment Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Qatar payment industry, covering market size, growth drivers, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers actionable insights for industry stakeholders, investors, and businesses operating within or seeking entry into this dynamic market. The report leverages extensive data analysis and incorporates recent key developments to provide a holistic understanding of the sector's current state and future trajectory. The total market value in 2025 is estimated at xx Million.

Qatar Payment Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Qatari payment industry, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities from 2019 to 2024. The industry exhibits a moderately concentrated structure with key players such as Qatar National Bank and Commercial Bank of Qatar holding significant market share. However, the emergence of fintech companies and international players like PayPal and Mastercard is gradually increasing competition.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2024. This is expected to slightly decrease to xx% by 2033 due to increasing competition.

- Innovation Drivers: Government initiatives promoting digitalization, rising smartphone penetration, and a young, tech-savvy population drive innovation. Contactless payments and mobile wallets are key areas of focus.

- Regulatory Framework: The Qatar Central Bank's regulations shape the industry, promoting financial stability and consumer protection. The regulatory framework is continuously evolving to accommodate technological advancements.

- Product Substitutes: The main substitutes are cash transactions and alternative online payment systems. However, the trend is towards a cashless society, reducing the impact of substitutes.

- End-User Trends: Consumers increasingly favor convenient and secure digital payment options, driving the adoption of mobile wallets and online payment platforms.

- M&A Activities: The value of M&A deals in the Qatari payment industry between 2019 and 2024 totaled approximately xx Million. Further consolidation is anticipated in the coming years.

Qatar Payment Industry Industry Trends & Insights

This section explores the key trends shaping the Qatar payment industry, analyzing market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The Qatari payment market is experiencing robust growth, fueled by a combination of factors including increased government spending, rising disposable incomes, and the widespread adoption of digital technologies. The market has witnessed significant growth in recent years and is poised for continued expansion.

- The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033).

- Market penetration of digital payment methods is expected to reach xx% by 2033.

- The shift towards cashless transactions is a significant trend, driven by government initiatives and consumer preferences.

- Technological advancements such as mobile wallets, contactless payments, and biometric authentication are revolutionizing the industry.

- The increasing adoption of e-commerce platforms and online services is bolstering the growth of online payment solutions.

- Intense competition among established players and emerging fintech companies is creating a dynamic environment.

Dominant Markets & Segments in Qatar Payment Industry

This section identifies the leading segments within the Qatar payment industry. The point-of-sale (POS) segment currently dominates the market, driven by increasing card penetration and the expansion of retail networks. The online sales segment is also experiencing rapid growth, reflecting the rise of e-commerce.

By Mode of Payment:

- Point of Sale (POS): This segment is the largest, driven by increased card usage and infrastructure development. Key drivers include rising retail sales, growing tourism, and government initiatives supporting digitalization.

- Online Sale: Rapid growth is fueled by the rising popularity of e-commerce and online shopping platforms. Increased internet and smartphone penetration are key factors.

- Cash: While declining, cash remains a significant mode of payment, particularly in smaller businesses and among older demographics.

By End-user Industry:

- Retail: The retail sector is the dominant end-user industry, owing to its large market size and high transaction volumes.

- Entertainment: This segment is expanding due to the growth of tourism and the increasing popularity of online entertainment services.

- Healthcare: The adoption of digital payment methods in the healthcare sector is growing steadily, facilitated by government initiatives to improve efficiency and transparency.

- Hospitality: The hospitality sector is witnessing an increase in digital payment adoption, driven by the rising popularity of online booking platforms and the need for efficient payment processing.

- Other End-user Industries: This includes government, education, and other sectors, with varying levels of digital payment adoption.

Qatar Payment Industry Product Developments

The Qatar payment industry is witnessing a surge in product innovation, driven by technological advancements and changing consumer preferences. Contactless payments, mobile wallets, and biometric authentication are gaining significant traction. New payment systems are being integrated with existing infrastructure, improving security and user experience. This leads to increased competition and improved services for consumers.

Report Scope & Segmentation Analysis

This report comprehensively segments the Qatar payment industry by mode of payment (Point of Sale, Online Sale, Cash) and end-user industry (Retail, Entertainment, Healthcare, Hospitality, Other). Each segment is analyzed in detail, presenting market size, growth projections, and competitive dynamics. Specific growth rates vary among segments, reflecting the unique factors affecting each area.

Key Drivers of Qatar Payment Industry Growth

Several factors drive the growth of the Qatar payment industry. Government initiatives promoting financial inclusion and digitalization are key catalysts. The rapid adoption of smartphones and internet penetration further fuels the expansion of digital payment solutions. Rising disposable incomes and a growing middle class contribute to increased spending and transaction volumes.

Challenges in the Qatar Payment Industry Sector

Despite robust growth, the Qatari payment industry faces challenges. Maintaining cybersecurity and protecting sensitive data are crucial concerns. Competition from international players and the need to keep pace with technological advancements also pose significant challenges. Furthermore, ensuring financial inclusion and reaching all segments of the population requires strategic efforts. These challenges represent a potential impediment to the market’s further growth.

Emerging Opportunities in Qatar Payment Industry

The Qatar payment industry presents several opportunities. The growing adoption of mobile wallets and contactless payments creates a large market for innovative solutions. The expansion of e-commerce and the increasing demand for secure online payment methods provide further opportunities. Moreover, the development of sophisticated payment technologies and the expansion into untapped market segments offer significant potential for growth.

Leading Players in the Qatar Payment Industry Market

- Commercial Bank Of Qatar

- CashU

- Qatar National Bank

- Mastercard (MasterPass)

- PayPal Holdings Inc

- Alphabet Inc

- ACI Worldwide Inc

- Apple Inc

- Doha Bank

- Samsung Pay

Key Developments in Qatar Payment Industry Industry

- November 2022: Visa, FIFA's Official Payment Technology Partner, deployed 5,300 contactless payment terminals at FIFA World Cup Qatar 2022 venues, facilitating over one million contactless transactions. This significantly boosted the adoption of contactless payments.

- November 2022: SADAD Payment Solutions partnered with QNB to expand electronic financial payments and fintech in Qatar. This collaboration aims to enhance the digital payment infrastructure and broaden the reach of electronic transactions.

- November 2022: QNB Group launched a collaboration with Samsung Gulf Electronics to integrate Samsung Wallet, expanding access to secure digital payment systems for Samsung smartphone users. This enhances the bank's digital payment offerings and improves convenience for customers.

Strategic Outlook for Qatar Payment Industry Market

The Qatar payment industry is poised for continued growth, driven by technological advancements, government support, and increasing consumer demand for digital payment solutions. The market presents significant opportunities for both established players and new entrants, particularly in areas such as mobile payments, contactless technologies, and financial inclusion. Further expansion into untapped market segments and the adoption of innovative technologies will shape the industry's future.

Qatar Payment Industry Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (Includes Mobile Wallets)

- 1.1.3. Cash

-

1.2. Online Sale

- 1.2.1. Other On

-

1.1. Point of Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

Qatar Payment Industry Segmentation By Geography

- 1. Qatar

Qatar Payment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Real-time Payment Systems being launched in key GCC countries; High proliferation of e-commerce and rising adoption of m-commerce

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness About Identity Standardization

- 3.4. Market Trends

- 3.4.1. High Proliferation of e-commerce and Rising Adoption of m-commerce Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Payment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (Includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.2. Online Sale

- 5.1.2.1. Other On

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Commercial Bank Of Qatar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CashU

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Qatar National Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mastercard (MasterPass)*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PayPal Holdings Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alphabet Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ACI Worldwide Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Apple Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Doha Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung Pay

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Commercial Bank Of Qatar

List of Figures

- Figure 1: Qatar Payment Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Payment Industry Share (%) by Company 2024

List of Tables

- Table 1: Qatar Payment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Payment Industry Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 3: Qatar Payment Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Qatar Payment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Qatar Payment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Qatar Payment Industry Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 7: Qatar Payment Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Qatar Payment Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Payment Industry?

The projected CAGR is approximately 10.57%.

2. Which companies are prominent players in the Qatar Payment Industry?

Key companies in the market include Commercial Bank Of Qatar, CashU, Qatar National Bank, Mastercard (MasterPass)*List Not Exhaustive, PayPal Holdings Inc, Alphabet Inc, ACI Worldwide Inc, Apple Inc, Doha Bank, Samsung Pay.

3. What are the main segments of the Qatar Payment Industry?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Real-time Payment Systems being launched in key GCC countries; High proliferation of e-commerce and rising adoption of m-commerce.

6. What are the notable trends driving market growth?

High Proliferation of e-commerce and Rising Adoption of m-commerce Drives the Market Growth.

7. Are there any restraints impacting market growth?

; Lack of Awareness About Identity Standardization.

8. Can you provide examples of recent developments in the market?

November 2022: Visa, FIFA's Official Payment Technology Partner, has developed a payments network allowing contactless purchases at all official venues, including eight stadiums and the FIFA Fan Festival. With over one million fans anticipated to attend the event, Visa has placed 5,300 contactless payment terminals at official FIFA venues, making FIFA World Cup Qatar 2022 one of the largest payment-enabled FIFA tournaments ever. Visa also tested new payment technologies to give fans convenient and secure digital payment options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Payment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Payment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Payment Industry?

To stay informed about further developments, trends, and reports in the Qatar Payment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence