Key Insights

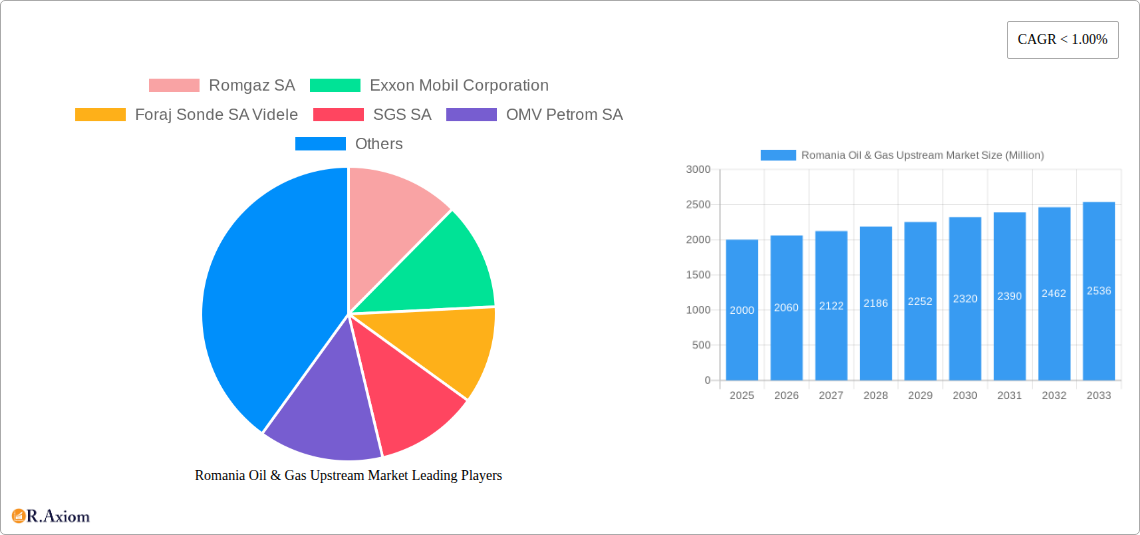

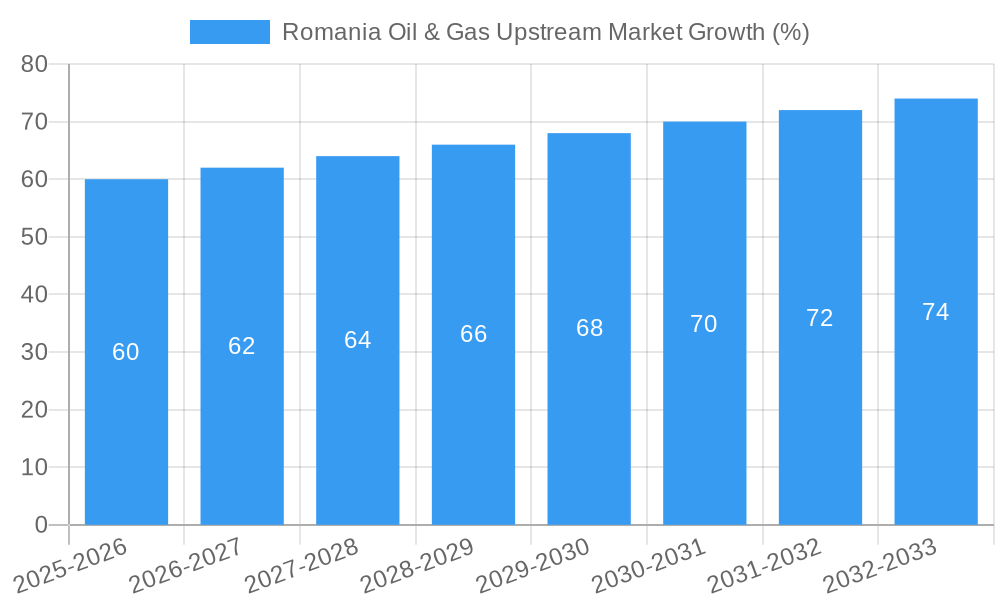

The Romanian oil and gas upstream market, while relatively small compared to global giants, presents a unique investment landscape. The historical period (2019-2024) likely saw fluctuating market performance influenced by global oil price volatility and domestic policy changes. Assuming a moderate growth trajectory aligning with regional trends, the market size in 2025 is estimated at $2 billion USD. This figure is derived from a consideration of Romania's established production capacity, ongoing exploration activities, and the general price trends of oil and gas. The forecast period (2025-2033) anticipates continued growth, driven by potential discoveries, investments in enhanced oil recovery techniques, and government initiatives aimed at boosting energy independence. However, this growth will be tempered by factors such as depleting reserves in mature fields and the increasing prominence of renewable energy sources within the broader Romanian energy mix. A conservative Compound Annual Growth Rate (CAGR) of 3% is projected for this period, reflecting a balance between potential exploration success and the existing limitations within the upstream sector. This translates to a market size of approximately $2.7 billion USD by 2033.

The success of the Romanian oil and gas upstream market hinges on several key factors. Attracting foreign investment through transparent and stable regulatory frameworks is crucial. Technological advancements in exploration and extraction, especially in addressing challenges related to aging infrastructure and unconventional resources, will play a significant role. Furthermore, successful diversification into natural gas production and exploration, alongside a focus on environmental sustainability and responsible resource management, will be vital for long-term growth and market stability. Environmental concerns and the need for environmentally friendly practices are increasingly significant factors influencing both investments and regulatory decisions, thus necessitating a careful balance between economic development and sustainable practices within the upstream sector.

Romania Oil & Gas Upstream Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Romanian oil & gas upstream market, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and strategic decision-makers seeking to navigate this dynamic sector. The report leverages rigorous data analysis and expert insights to deliver actionable intelligence on market size, growth drivers, competitive landscape, and future trends. Key segments, including onshore and offshore operations, are meticulously examined.

Romania Oil & Gas Upstream Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Romanian oil & gas upstream market, examining market concentration, innovation drivers, regulatory influences, and market dynamics. The historical period (2019-2024) and the forecast period (2025-2033) are considered.

Market Concentration: The Romanian upstream market exhibits a moderately concentrated structure, with OMV Petrom SA holding a significant market share (estimated at xx% in 2025). Romgaz SA is another key player, contributing significantly to domestic gas production. The market share of other players such as ExxonMobil Corporation and Foraj Sonde SA Videle is comparatively smaller.

Innovation Drivers: Technological advancements in exploration and extraction techniques, including enhanced oil recovery (EOR) methods and improved seismic imaging, are key innovation drivers. Government initiatives promoting exploration and investment in the sector further fuel innovation.

Regulatory Framework: The Romanian government's regulatory framework plays a crucial role in shaping market dynamics. Policies related to licensing, environmental regulations, and fiscal incentives directly impact investment decisions and operational efficiency.

Product Substitutes: The primary substitute for oil and gas is renewable energy sources. However, their current market penetration in Romania remains limited, with oil and gas retaining dominance in energy production.

End-User Trends: The energy demands of industrial sectors and residential consumers are fundamental drivers shaping the upstream market. The increasing need for energy security further impacts exploration activities and investment decisions.

M&A Activities: The Romanian upstream sector has witnessed a moderate level of merger and acquisition (M&A) activity in recent years. The value of completed deals has been relatively stable, hovering around xx Million USD annually (average from 2019-2024). Future M&A activity is expected to be driven by efforts to consolidate assets and optimize production.

Romania Oil & Gas Upstream Market Industry Trends & Insights

This section delves into the key trends shaping the Romanian oil and gas upstream market. The analysis incorporates data from the historical period (2019-2024) and extends to the forecast period (2025-2033).

The Romanian oil and gas upstream market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors such as increasing domestic energy demand, government support for exploration and production, and technological advancements enabling more efficient extraction from existing fields. However, challenges such as aging infrastructure and the need for continuous investment in new technologies could moderate growth. Market penetration of EOR technologies is expected to rise to xx% by 2033, contributing significantly to enhanced production from mature fields. Consumer preferences are increasingly shifting towards cleaner energy sources. While oil and gas remain critical, the transition towards a more diversified energy mix is creating both opportunities and challenges for upstream operators. Competition is intense, with established players vying for market share while smaller companies explore niche opportunities. This competition, coupled with technological disruptions, is pushing companies to innovate and optimize their operations for enhanced efficiency and cost reduction.

Dominant Markets & Segments in Romania Oil & Gas Upstream Market

Onshore activities dominate the Romanian upstream market, representing approximately xx% of total production in 2025. This dominance is primarily attributable to:

- Existing Infrastructure: Extensive onshore pipeline networks and established processing facilities significantly reduce operational costs and logistical complexities compared to offshore operations.

- Accessibility: Onshore locations are generally easier and cheaper to access than offshore sites, facilitating exploration and production activities.

- Government Policies: Government incentives and favorable regulatory frameworks have historically favored onshore developments.

While offshore exploration holds potential for future growth, the relatively high initial investment costs, technical challenges associated with deepwater operations, and limited current infrastructure hinder its significant market penetration.

Romania Oil & Gas Upstream Market Product Developments

Recent product innovations have centered on improving extraction efficiency and reducing environmental impact. Companies are focusing on enhanced oil recovery techniques and adopting more sustainable drilling and production methods. These innovations are aimed at enhancing the competitiveness of Romanian oil and gas production in a global market increasingly focused on environmental sustainability and operational efficiency. The market's acceptance of these innovations depends on factors such as cost-effectiveness, regulatory approvals, and the overall global demand for oil and gas.

Report Scope & Segmentation Analysis

This report segments the Romanian oil and gas upstream market primarily by location of deployment: onshore and offshore.

Onshore: The onshore segment accounts for the largest share of the market, with a projected market size of xx Million USD in 2025, growing to xx Million USD by 2033. The segment exhibits intense competition among established operators.

Offshore: The offshore segment is currently relatively small but holds potential for future growth. The market size in 2025 is estimated at xx Million USD, and significant investment is required to unlock the offshore potential.

Key Drivers of Romania Oil & Gas Upstream Market Growth

Several factors drive the growth of the Romanian oil and gas upstream market. These include increasing domestic energy demand, government support for the energy sector via fiscal incentives and investment promotion, and technological advancements leading to enhanced extraction efficiency. Exploration and development of new fields are key to sustaining future growth. The continued reliance on oil and gas for electricity generation and industrial processes supports continued growth.

Challenges in the Romania Oil & Gas Upstream Market Sector

The Romanian oil and gas upstream market faces several challenges. These include aging infrastructure, requiring significant investment for modernization and maintenance. Fluctuating global oil and gas prices pose a considerable risk to profitability. Environmental regulations and concerns related to emissions impose operational constraints and increase costs. Competition from renewable energy sources represents a long-term threat to market share.

Emerging Opportunities in Romania Oil & Gas Upstream Market

Opportunities exist in exploiting Romania's untapped offshore reserves. The development of new technologies, such as advanced EOR techniques, can improve production efficiency. Government incentives and policies focused on sustainable development are opening avenues for investments in environmentally friendly upstream operations. The growth of the regional gas market can stimulate increased investment.

Leading Players in the Romania Oil & Gas Upstream Market Market

- OMV Petrom SA

- Romgaz SA

- Exxon Mobil Corporation

- Foraj Sonde SA Videle

- SGS SA

Key Developments in Romania Oil & Gas Upstream Market Industry

- 2022 Q4: OMV Petrom announced significant investment in upgrading its onshore infrastructure.

- 2023 Q1: Romgaz signed a partnership agreement to explore new gas fields.

- 2024 Q2: New environmental regulations were implemented, impacting operational practices. (Further developments can be added as available).

Strategic Outlook for Romania Oil & Gas Upstream Market Market

The Romanian oil and gas upstream market is poised for moderate growth driven by domestic demand and government support. While facing challenges related to infrastructure and environmental concerns, the sector will continue to play a crucial role in Romania's energy mix. The focus on efficiency improvements, exploration of new reserves, and adaptation to environmental regulations will shape the future of the market. Companies with a robust strategy for technological innovation and sustainable operations are best positioned for success in the coming years.

Romania Oil & Gas Upstream Market Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

Romania Oil & Gas Upstream Market Segmentation By Geography

- 1. Romania

Romania Oil & Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Demand for Renewable Energy4.; Decreasing Cost per Kilowatt of Electricity Generated Through Wind Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Installation of Other Renewable Sources Such as Solar Energy

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Romania Oil & Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Romania

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Romgaz SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Exxon Mobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Foraj Sonde SA Videle

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SGS SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OMV Petrom SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Romgaz SA

List of Figures

- Figure 1: Romania Oil & Gas Upstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Romania Oil & Gas Upstream Market Share (%) by Company 2024

List of Tables

- Table 1: Romania Oil & Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Romania Oil & Gas Upstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Romania Oil & Gas Upstream Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 4: Romania Oil & Gas Upstream Market Volume Million Forecast, by Location of Deployment 2019 & 2032

- Table 5: Romania Oil & Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Romania Oil & Gas Upstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 7: Romania Oil & Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Romania Oil & Gas Upstream Market Volume Million Forecast, by Country 2019 & 2032

- Table 9: Romania Oil & Gas Upstream Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 10: Romania Oil & Gas Upstream Market Volume Million Forecast, by Location of Deployment 2019 & 2032

- Table 11: Romania Oil & Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Romania Oil & Gas Upstream Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Romania Oil & Gas Upstream Market?

The projected CAGR is approximately < 1.00%.

2. Which companies are prominent players in the Romania Oil & Gas Upstream Market?

Key companies in the market include Romgaz SA, Exxon Mobil Corporation, Foraj Sonde SA Videle, SGS SA, OMV Petrom SA.

3. What are the main segments of the Romania Oil & Gas Upstream Market?

The market segments include Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Demand for Renewable Energy4.; Decreasing Cost per Kilowatt of Electricity Generated Through Wind Energy Sources.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Installation of Other Renewable Sources Such as Solar Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Romania Oil & Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Romania Oil & Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Romania Oil & Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Romania Oil & Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence