Key Insights

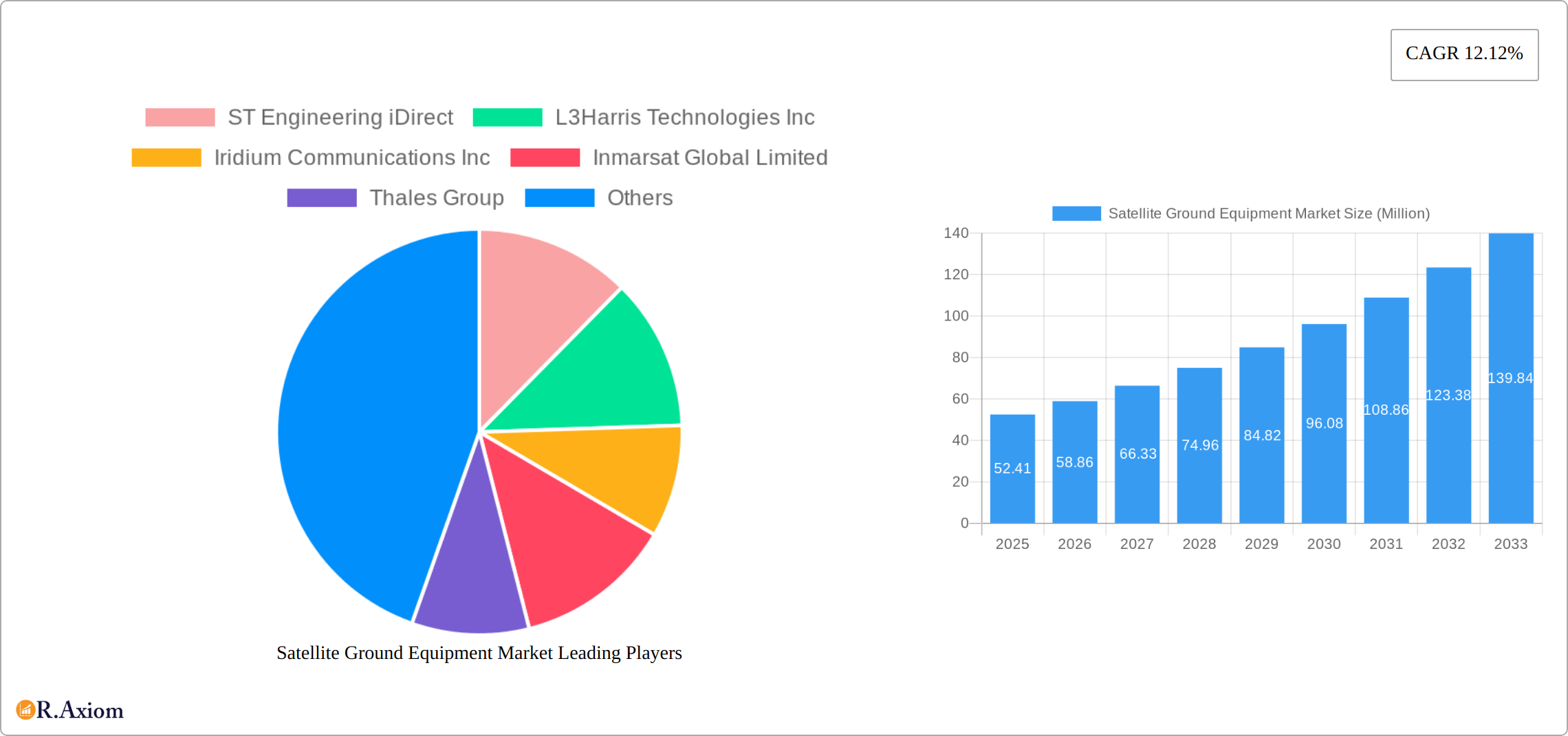

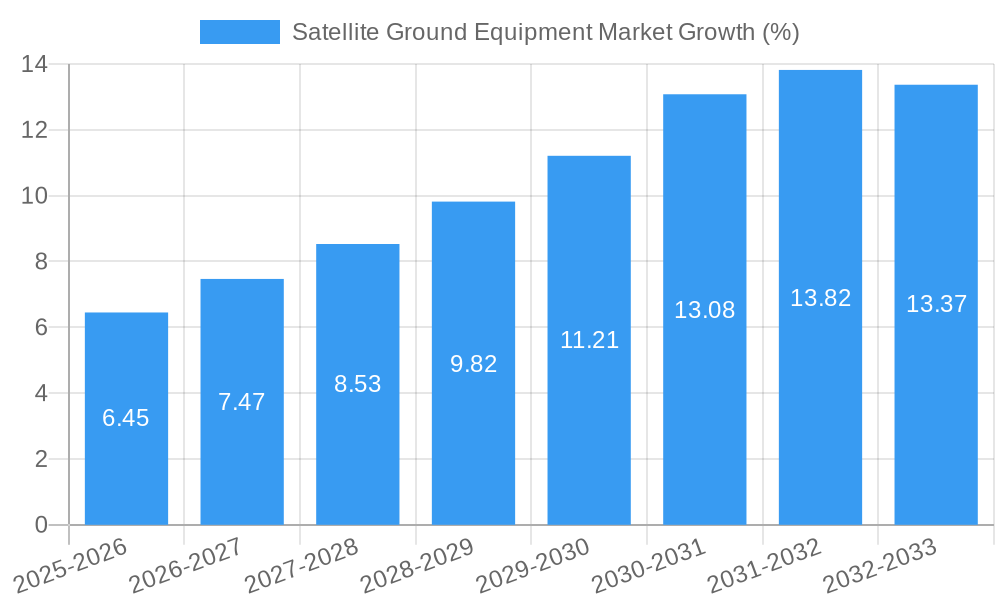

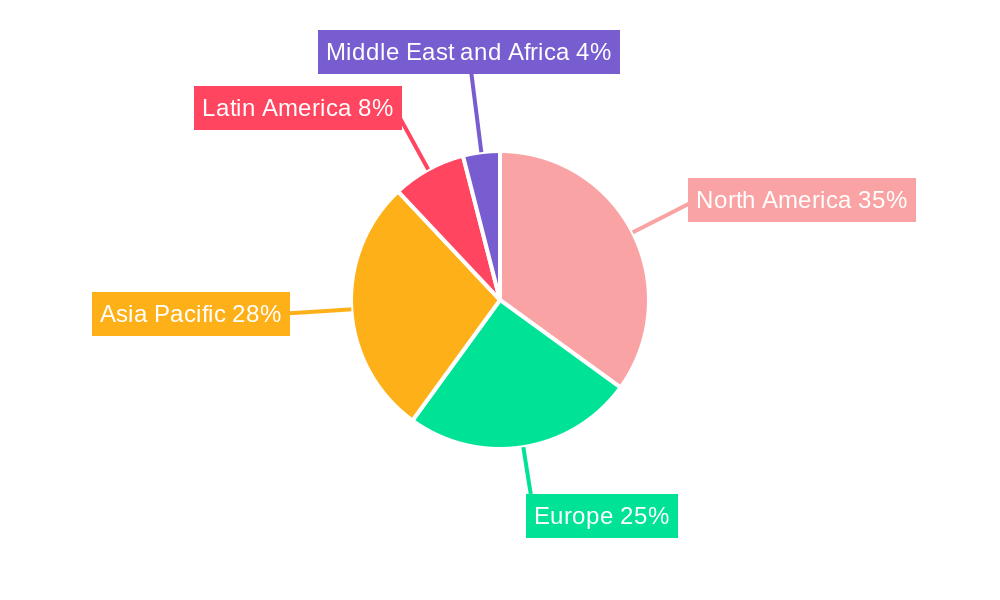

The global satellite ground equipment market, valued at $52.41 million in 2025, is projected to experience robust growth, driven by increasing demand across diverse sectors. The Compound Annual Growth Rate (CAGR) of 12.12% from 2025 to 2033 indicates a significant expansion, fueled primarily by the maritime, defense & government, and enterprise sectors' adoption of advanced satellite communication technologies. Growth is further propelled by evolving trends such as the rise of IoT applications requiring reliable satellite connectivity, the need for enhanced network security, and the increasing adoption of cloud-based satellite communication management solutions. While some restraints exist, such as high initial investment costs and the complexities of regulatory compliance, the overall market outlook remains highly positive. The market segmentation reveals a strong presence of both ground equipment and service segments, catering to a broad spectrum of user needs. Key players like ST Engineering iDirect, L3Harris Technologies, and Inmarsat are driving innovation and competition within the market. The Asia-Pacific region is anticipated to exhibit significant growth potential due to burgeoning infrastructure development and increasing demand for reliable communication networks.

The market's growth trajectory is expected to be influenced by ongoing technological advancements, such as the development of higher-throughput satellites and improved ground station technology. This translates into improved data transmission speeds, reduced latency, and increased overall network efficiency. Furthermore, the expanding use of satellite communication in remote areas and challenging environments, including disaster relief and environmental monitoring, will contribute significantly to market expansion. Competition amongst existing players and the emergence of new entrants are expected to drive innovation and price competitiveness, benefiting end-users. The continued focus on providing robust and reliable satellite communication solutions will further solidify the market's position as a crucial component of global connectivity infrastructure.

Satellite Ground Equipment Market: A Comprehensive Analysis 2019-2033

This in-depth report provides a comprehensive analysis of the Satellite Ground Equipment market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous research methodologies to deliver actionable intelligence on market dynamics, growth drivers, and future trends. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Satellite Ground Equipment Market Concentration & Innovation

The Satellite Ground Equipment market exhibits a moderately concentrated landscape, with several key players holding significant market share. While precise market share figures for each company require further research and may vary based on specific segment analysis, companies like ST Engineering iDirect, L3Harris Technologies Inc, and ViaSat Inc are recognized as major players. The market's innovative capacity is driven by the continuous demand for higher bandwidth, improved reliability, and advanced functionalities in satellite communication systems. This leads to ongoing research and development in areas such as Software Defined Radio (SDR) technology, higher-frequency bands (e.g., Ka-band), and improved antenna designs.

Regulatory frameworks, particularly concerning spectrum allocation and international communication regulations, significantly impact market growth. The presence of substitute technologies, such as terrestrial fiber optic networks and 5G cellular networks, presents a competitive challenge, forcing continued innovation to maintain a competitive edge. End-user trends towards increased connectivity and data demand across various verticals, including maritime, defense, and enterprise sectors, fuel market expansion. M&A activity in the industry is moderate, with deal values varying significantly depending on the size and strategic importance of the acquired entity. For instance, some deals may involve smaller, specialized firms being acquired by larger companies to expand their product portfolios or enter new market segments.

Satellite Ground Equipment Market Industry Trends & Insights

The Satellite Ground Equipment market is experiencing robust growth fueled by several key factors. The increasing adoption of satellite communication for various applications, including broadband internet access in remote areas, IoT device connectivity, and high-definition video transmission, is a primary driver. The rising demand for high-throughput satellites (HTS) and the development of new satellite constellations, such as those focused on Low Earth Orbit (LEO) communications, are significantly impacting the market. These advancements are driving the need for more sophisticated and efficient ground equipment to handle increased data traffic and manage complex satellite networks.

Technological disruptions, such as the adoption of cloud-based services and artificial intelligence (AI) for network management, are transforming industry operations. Consumer preferences are shifting towards more integrated, user-friendly, and cost-effective solutions, emphasizing the need for flexible and adaptable ground equipment. The competitive dynamics are shaped by ongoing innovation, pricing pressures, and the emergence of new entrants offering disruptive technologies. The market witnesses significant competition based on technological advancements, service offerings, and pricing strategies.

Dominant Markets & Segments in Satellite Ground Equipment Market

By End-user Vertical: The Defense and Government segment is currently a dominant market driver, characterized by large-scale deployments and high demand for secure and reliable communication systems. Key drivers include government initiatives promoting national security and defense modernization, along with stringent regulations supporting secure communication technologies. The Maritime segment is another significant contributor due to the expanding global shipping industry's growing demand for reliable communication at sea.

By Type: The Ground Equipment segment holds a larger market share than the service segment due to the substantial investments in hardware infrastructure and equipment required for satellite communication systems.

Dominance analysis reveals that North America and Europe are currently the leading regions, driven by strong technological advancements, robust infrastructure, and significant government investment in satellite communication technologies. However, emerging economies in Asia-Pacific are exhibiting significant growth potential, fueled by increasing demand for connectivity and infrastructure development.

Satellite Ground Equipment Market Product Developments

Recent product innovations focus on enhancing efficiency, improving reliability, and expanding functionality. These include advancements in antenna technologies, such as electronically steered antennas, allowing for flexible beamforming and improved signal acquisition. Software-defined radios (SDRs) provide adaptability and scalability, enabling seamless integration with various satellite constellations and communication protocols. Market fit is determined by the ability of new products to address the evolving needs of end-users across various industries, particularly focusing on higher data throughput, enhanced security, and reduced operating costs.

Report Scope & Segmentation Analysis

This report segments the Satellite Ground Equipment market by end-user vertical (Maritime, Defense and Government, Enterprises, Media and Entertainment, Other End-user Verticals) and by type (Ground Equipment, Service). Growth projections vary across segments, with the Defense and Government segment showing significant growth due to increased government spending and security concerns. The Maritime segment is expected to grow steadily due to rising demand for reliable connectivity at sea. Market sizes for each segment are detailed in the full report. Competitive dynamics vary across segments, with intense competition in some areas and more niche players in others.

Key Drivers of Satellite Ground Equipment Market Growth

Technological advancements, such as the development of high-throughput satellites and advanced antenna technologies, are significantly driving market growth. Economic factors like increasing investment in infrastructure and rising demand for broadband internet access, especially in remote areas, are also important. Favorable regulatory policies that promote the development and adoption of satellite communication technologies play a vital role. For instance, government initiatives aimed at expanding broadband access in underserved areas are boosting the market.

Challenges in the Satellite Ground Equipment Market Sector

Regulatory hurdles, including complex licensing procedures and spectrum allocation issues, pose significant challenges to market expansion. Supply chain disruptions and the increasing cost of components can affect profitability and timely delivery of products. Intense competition among established players and the emergence of new entrants create pricing pressure and necessitate continuous innovation to maintain a competitive advantage. The impact of these challenges can be quantified through reduced market penetration, delayed project timelines, and constrained profitability for industry participants.

Emerging Opportunities in Satellite Ground Equipment Market

The growing demand for IoT connectivity and the rise of new satellite constellations, such as LEO networks, present significant opportunities. Advancements in technologies like AI and machine learning for network management and optimization offer further growth potential. The expansion of satellite broadband services into underserved regions and the development of new applications in industries such as autonomous vehicles and precision agriculture offer exciting new markets.

Leading Players in the Satellite Ground Equipment Market Market

- ST Engineering iDirect

- L3Harris Technologies Inc

- Iridium Communications Inc

- Inmarsat Global Limited

- Thales Group

- KVH Industries Inc

- Thuraya Telecommunications Company

- Orbcomm Inc

- Cobham SATCOM (Cobham Limited)

- Gilat Satellite Networks Ltd

- Advantech Wireless Technologies Inc (Baylin Technologies)

- ViaSat Inc

Key Developments in Satellite Ground Equipment Market Industry

February 2023: CobhamSatcom and RBC Signals announced an extended agreement to deploy CobhamSatcom's ground stations worldwide, expanding RBC Signals' network for NGSO missions. This collaboration significantly strengthens the market position of both companies in providing integrated communication services.

February 2023: China Aerospace Science and Technology Corporation (CASC) launched the Zhongxing-26 communications satellite, featuring speeds exceeding 100 Gbps. This launch showcases technological advancements and potential market expansion in the high-speed satellite communication sector.

Strategic Outlook for Satellite Ground Equipment Market Market

The future of the Satellite Ground Equipment market is promising, with continued growth driven by technological advancements, increasing demand for connectivity, and government initiatives. Expanding applications in IoT, autonomous systems, and high-bandwidth services will fuel market expansion. The adoption of innovative technologies, such as AI and machine learning, will further enhance efficiency and create new opportunities for market growth. Strategic partnerships and collaborations will be crucial for companies to navigate competitive pressures and capitalize on emerging trends.

Satellite Ground Equipment Market Segmentation

-

1. Type

- 1.1. Ground Equipment

- 1.2. Service

-

2. End-user Vertical

- 2.1. Maritime

- 2.2. Defense and Government

- 2.3. Enterprises

- 2.4. Media and Entertainment

- 2.5. Other End-user Verticals

Satellite Ground Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Satellite Ground Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Increasing Demand for Satellite Based Services

- 3.3. Market Restrains

- 3.3.1. Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Defense and Government is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Satellite Ground Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ground Equipment

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Maritime

- 5.2.2. Defense and Government

- 5.2.3. Enterprises

- 5.2.4. Media and Entertainment

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Satellite Ground Equipment Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ground Equipment

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Maritime

- 6.2.2. Defense and Government

- 6.2.3. Enterprises

- 6.2.4. Media and Entertainment

- 6.2.5. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Satellite Ground Equipment Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ground Equipment

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Maritime

- 7.2.2. Defense and Government

- 7.2.3. Enterprises

- 7.2.4. Media and Entertainment

- 7.2.5. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Satellite Ground Equipment Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ground Equipment

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Maritime

- 8.2.2. Defense and Government

- 8.2.3. Enterprises

- 8.2.4. Media and Entertainment

- 8.2.5. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Satellite Ground Equipment Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ground Equipment

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Maritime

- 9.2.2. Defense and Government

- 9.2.3. Enterprises

- 9.2.4. Media and Entertainment

- 9.2.5. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Satellite Ground Equipment Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ground Equipment

- 10.1.2. Service

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Maritime

- 10.2.2. Defense and Government

- 10.2.3. Enterprises

- 10.2.4. Media and Entertainment

- 10.2.5. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Satellite Ground Equipment Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Satellite Ground Equipment Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Satellite Ground Equipment Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Satellite Ground Equipment Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Satellite Ground Equipment Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 ST Engineering iDirect

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 L3Harris Technologies Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Iridium Communications Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Inmarsat Global Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Thales Group

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 KVH Industries Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Thuraya Telecommunications Company

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Orbcomm Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Cobham SATCOM (Combham Limited)

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Gilat Satellite Networks Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Advantech Wireless Technologies Inc (Baylin Technologies)

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 ViaSat Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 ST Engineering iDirect

List of Figures

- Figure 1: Global Satellite Ground Equipment Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Satellite Ground Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Satellite Ground Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Satellite Ground Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Satellite Ground Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Satellite Ground Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Satellite Ground Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Satellite Ground Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Satellite Ground Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Satellite Ground Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Satellite Ground Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Satellite Ground Equipment Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Satellite Ground Equipment Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Satellite Ground Equipment Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 15: North America Satellite Ground Equipment Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 16: North America Satellite Ground Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Satellite Ground Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Satellite Ground Equipment Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Satellite Ground Equipment Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Satellite Ground Equipment Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 21: Europe Satellite Ground Equipment Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 22: Europe Satellite Ground Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Satellite Ground Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Satellite Ground Equipment Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Satellite Ground Equipment Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Satellite Ground Equipment Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 27: Asia Pacific Satellite Ground Equipment Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 28: Asia Pacific Satellite Ground Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Satellite Ground Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Satellite Ground Equipment Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Latin America Satellite Ground Equipment Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Latin America Satellite Ground Equipment Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 33: Latin America Satellite Ground Equipment Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 34: Latin America Satellite Ground Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Satellite Ground Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Satellite Ground Equipment Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Satellite Ground Equipment Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Satellite Ground Equipment Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 39: Middle East and Africa Satellite Ground Equipment Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 40: Middle East and Africa Satellite Ground Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Satellite Ground Equipment Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Satellite Ground Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Satellite Ground Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Satellite Ground Equipment Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Global Satellite Ground Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Satellite Ground Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Satellite Ground Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Satellite Ground Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Satellite Ground Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Satellite Ground Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Satellite Ground Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Satellite Ground Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Satellite Ground Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Satellite Ground Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Satellite Ground Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Satellite Ground Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Satellite Ground Equipment Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: Global Satellite Ground Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Satellite Ground Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Satellite Ground Equipment Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 20: Global Satellite Ground Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Satellite Ground Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Satellite Ground Equipment Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 23: Global Satellite Ground Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Satellite Ground Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Satellite Ground Equipment Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 26: Global Satellite Ground Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Satellite Ground Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Satellite Ground Equipment Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 29: Global Satellite Ground Equipment Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Satellite Ground Equipment Market?

The projected CAGR is approximately 12.12%.

2. Which companies are prominent players in the Satellite Ground Equipment Market?

Key companies in the market include ST Engineering iDirect, L3Harris Technologies Inc, Iridium Communications Inc, Inmarsat Global Limited, Thales Group, KVH Industries Inc, Thuraya Telecommunications Company, Orbcomm Inc, Cobham SATCOM (Combham Limited), Gilat Satellite Networks Ltd, Advantech Wireless Technologies Inc (Baylin Technologies), ViaSat Inc.

3. What are the main segments of the Satellite Ground Equipment Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Increasing Demand for Satellite Based Services.

6. What are the notable trends driving market growth?

Defense and Government is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

February 2023 - CobhamSatcom and RBC Signals, a global satellite data communication solutions provider, announced an extended agreement to deploy CobhamSatcom's adaptable Tracker 6000 and 3700 series ground stations worldwide. The collaborative partnership between the two parties would dramatically expand RBC Signals' vast owned and partner ground network, providing integrated communication services to NGSO missions and constellations for Earth Observation, IoT, and Space Situational Awareness.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Satellite Ground Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Satellite Ground Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Satellite Ground Equipment Market?

To stay informed about further developments, trends, and reports in the Satellite Ground Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence