Key Insights

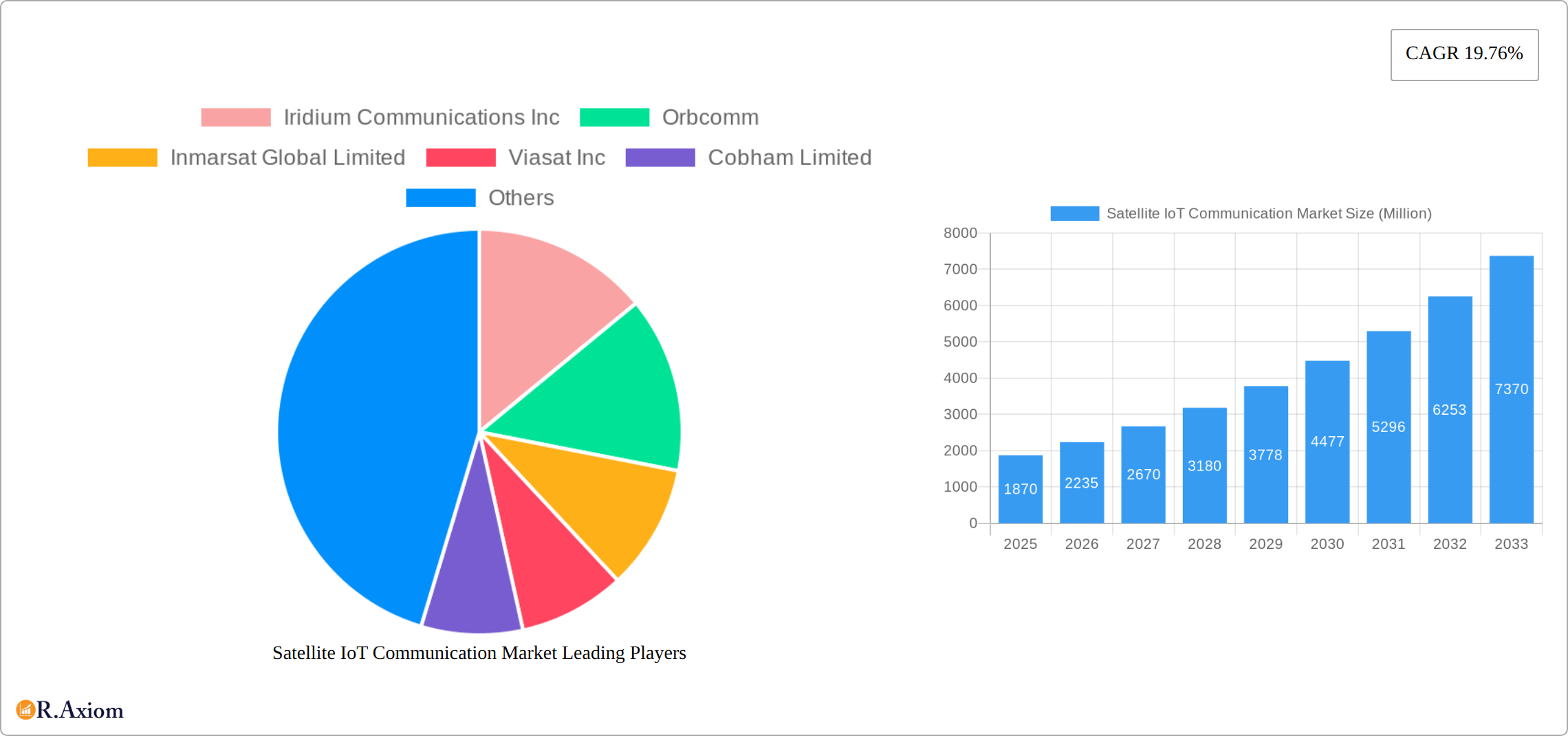

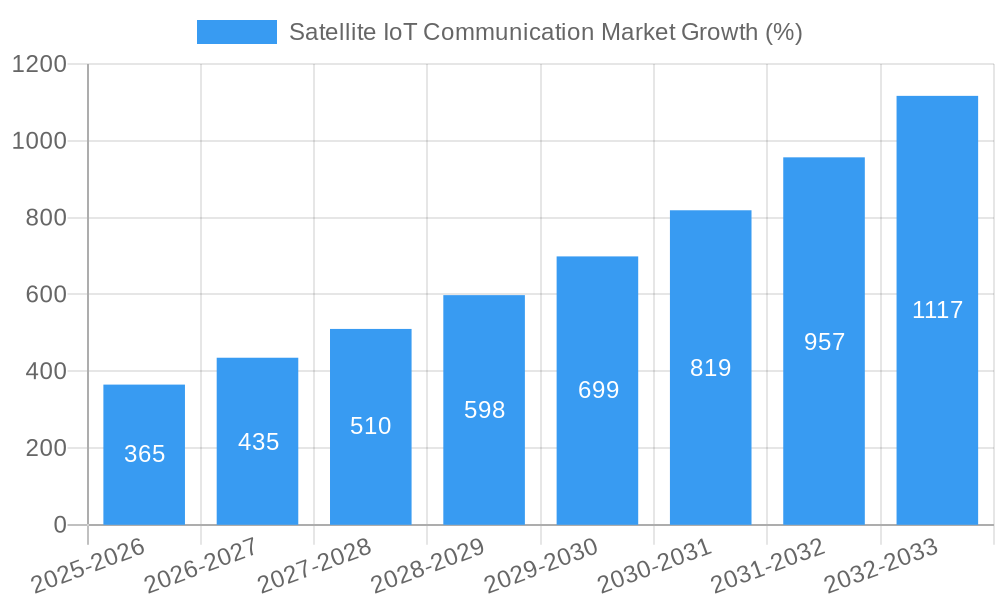

The Satellite IoT Communication market is experiencing robust growth, projected to reach $1.87 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 19.76% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for reliable connectivity in remote areas and applications requiring continuous global coverage, such as maritime, aviation, and agriculture, fuels market growth. Furthermore, advancements in satellite technology, miniaturization of IoT devices, and declining launch costs are making satellite IoT solutions more accessible and cost-effective. Government initiatives promoting the development and deployment of satellite-based infrastructure, particularly in developing nations, also contribute significantly. The market is segmented by orbit type, with Low Earth Orbit (LEO) constellations gaining significant traction due to their improved latency and data transfer rates compared to traditional Geostationary Earth Orbit (GEO) systems. The competitive landscape is characterized by established players like Iridium Communications, Inmarsat, and Viasat, alongside emerging companies focusing on innovative solutions and niche applications.

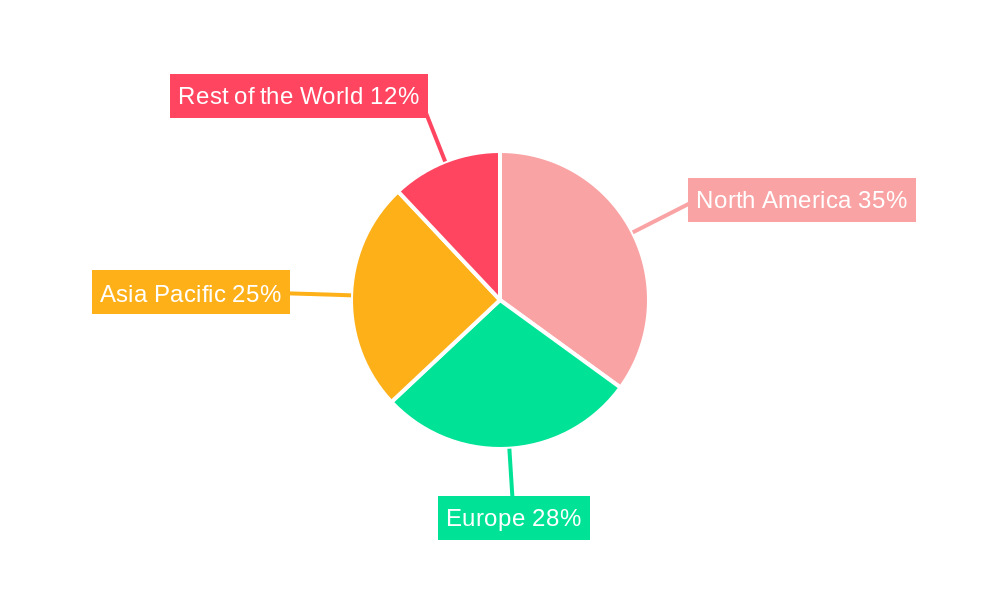

The market's future trajectory indicates continued strong growth, propelled by the expanding adoption of IoT across various sectors. The emergence of 5G and its integration with satellite networks promises enhanced capabilities, further driving market expansion. While regulatory hurdles and the high initial investment costs associated with satellite infrastructure present challenges, the long-term benefits of global connectivity and reliable data transmission are expected to outweigh these restraints. The Asia-Pacific region is anticipated to showcase significant growth potential due to rapid technological advancements and increasing IoT adoption across various industries in the region. North America and Europe will also continue to contribute substantially to the market, driven by the presence of established players and robust technology infrastructure. The market's success hinges on continuous technological innovation, strategic partnerships, and effective regulatory frameworks to support the seamless integration of satellite-based IoT solutions.

This in-depth report provides a comprehensive analysis of the global Satellite IoT Communication market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, growth drivers, challenges, and opportunities, equipping stakeholders with actionable intelligence for strategic decision-making. The report incorporates extensive data and analysis, focusing on key segments, leading players, and significant industry developments. The base year for this report is 2025, with estimations for the same year and a forecast period spanning 2025-2033, alongside a review of the historical period (2019-2024).

Satellite IoT Communication Market Concentration & Innovation

The Satellite IoT Communication market exhibits a moderately concentrated landscape with a few dominant players commanding significant market share. Iridium Communications Inc, Orbcomm, Inmarsat Global Limited, Viasat Inc, and Cobham Limited are among the key players, although the market also includes several smaller, specialized firms like Fleet Space Technologies Private Limited, L3Harris Technologies, Globalstar Inc, and Boeing. Precise market share data varies by segment and is detailed within the full report, but the leading companies often hold shares ranging from xx% to xx%. Innovation is a key driver, spurred by the demand for higher bandwidth, lower latency, and improved network coverage. This is particularly evident in the development of new satellite constellations utilizing Low Earth Orbit (LEO) technology.

Regulatory frameworks, both national and international, significantly influence market dynamics. These frameworks dictate spectrum allocation, licensing, and operational safety, affecting market entry and expansion plans. The emergence of alternative communication technologies, such as 5G and LoRaWAN, presents competitive pressure. However, satellite communication offers unique advantages in terms of global coverage and reliability, making it indispensable for certain applications.

Mergers and acquisitions (M&A) activities are another crucial aspect of market concentration. While precise M&A deal values are not publicly disclosed for all transactions, significant deals have consolidated market power and driven innovation. For instance, the consolidation within the ground station infrastructure through partnerships, as seen with Cobham Satcom and RBC Signals, illustrates a focus on network expansion.

Satellite IoT Communication Market Industry Trends & Insights

The global Satellite IoT Communication market is experiencing robust growth, driven by the expanding Internet of Things (IoT) ecosystem and the increasing demand for reliable connectivity in remote and underserved areas. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. Technological advancements, particularly in satellite constellations and miniaturization of satellite components, are crucial catalysts. The rise of nanosatellites and the associated reduced launch costs have democratized access to space, fostering innovation and driving down overall service costs. Consumer preferences are shifting towards more affordable, flexible, and scalable solutions, influencing providers to adopt innovative business models such as Software as a Service (SaaS). The competitive landscape remains dynamic, with established players continuously innovating and newer entrants challenging existing market norms, fostering a highly competitive landscape. Market penetration rates in various sectors like maritime, aerospace, and agriculture are growing steadily, showing the increasing adoption of Satellite IoT communication technologies.

Dominant Markets & Segments in Satellite IoT Communication Market

The Satellite IoT Communication market exhibits diverse geographic dominance and segmentation by orbit type. While detailed quantitative data is available in the full report, North America currently holds a substantial market share, driven by robust government support for space exploration and a mature satellite infrastructure. However, the Asia-Pacific region is projected to experience rapid growth, fueled by escalating investments in infrastructure development and the proliferation of IoT applications. Europe also presents a significant market, with strong governmental support and a focus on innovative technologies.

By Type of Orbit:

- Low Earth Orbit (LEO): LEO constellations are rapidly becoming the dominant segment due to their ability to provide significantly lower latency and higher bandwidth compared to GEO. Key drivers include decreasing launch costs, advancements in miniaturization, and the deployment of massive constellations offering ubiquitous coverage.

- Medium Earth Orbit (MEO): MEO offers a compelling balance between latency and global coverage, making it suitable for a range of applications requiring both broad reach and relatively low latency.

- Geostationary Orbit (GEO): GEO satellites continue to provide extensive geographical coverage, but their inherent high latency limits their suitability for certain time-sensitive IoT applications. However, they remain crucial for applications prioritizing broad, consistent coverage.

Key Drivers for Dominant Regions:

- Governmental Investment and Regulatory Frameworks: Supportive government policies, substantial investments in space infrastructure, and streamlined regulatory processes are pivotal factors driving market expansion in key regions.

- Advanced Technological Infrastructure: The presence of robust ground infrastructure, including advanced processing capabilities and network management systems, is essential for seamless satellite communication deployment and operation.

- Economic Growth and Industrial Expansion: The robust economic growth and expansion of various sectors, such as maritime, agriculture, environmental monitoring, and energy, significantly fuel the demand for reliable and efficient satellite IoT communication solutions.

- Increased Demand for Remote Connectivity: The growing need for reliable connectivity in remote and underserved areas is driving adoption across various sectors, including disaster relief and environmental monitoring.

Satellite IoT Communication Market Product Developments

Recent product developments have focused on enhancing data throughput, reducing latency, and improving overall network reliability. The miniaturization of satellite payloads and the development of advanced ground segment technologies have enabled the creation of more affordable and flexible solutions. New constellations of small satellites are being launched, enhancing coverage and resilience while lowering operational costs. These advancements have widened the appeal of satellite IoT solutions across various industries, catering to both established and emerging applications. The market is seeing a move toward Software-Defined Radios (SDRs) which are improving flexibility and reducing costs.

Report Scope & Segmentation Analysis

This report segments the Satellite IoT Communication market primarily by type of orbit: Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO). Each segment is analyzed based on market size, growth projections, and competitive dynamics. The LEO segment is expected to exhibit the highest growth rate due to its technological advantages, while GEO retains significance for wide-area coverage. The MEO segment plays a niche role, offering a balance between latency and coverage. Further segmentation by application (e.g., maritime, agriculture, etc.) and region is included in the complete report, offering a detailed granular view of the market.

Key Drivers of Satellite IoT Communication Market Growth

Several factors are driving the growth of the Satellite IoT Communication market. Technological advancements, such as the development of smaller, more efficient satellites and improved ground segment infrastructure, are reducing costs and improving network performance. The increasing demand for reliable connectivity in remote areas, particularly for applications like precision agriculture, environmental monitoring, and disaster relief, fuels expansion. Growing government investment in space exploration and supportive regulatory frameworks also contribute significantly. The Internet of Things (IoT) explosion, where the need for ubiquitous connectivity is paramount, presents a key catalyst for the Satellite IoT Communication Market's growth.

Challenges in the Satellite IoT Communication Market Sector

The Satellite IoT Communication market faces several challenges. High upfront investment costs associated with satellite development and launch can deter smaller companies. Regulatory complexities and spectrum allocation issues can slow deployment. Competition from terrestrial communication technologies, such as 5G, presents a significant challenge, though Satellite communication retains advantages in global reach and reliability. Furthermore, supply chain disruptions and the need for skilled workforce can impose constraints on market expansion. These challenges are quantified and analyzed in detail in the complete report.

Emerging Opportunities in Satellite IoT Communication Market

The market presents numerous opportunities. New applications in the Internet of Things (IoT), particularly in sectors like remote sensing, precision agriculture, and environmental monitoring, are driving demand. The development of advanced technologies like Software Defined Radios (SDRs) and Artificial Intelligence (AI) is enhancing the efficiency and capabilities of satellite communication systems. Emerging markets in developing economies present vast untapped potential for growth. The expansion into new segments such as autonomous vehicles, which require consistent connectivity even in remote areas, is another emerging area.

Leading Players in the Satellite IoT Communication Market Market

- Iridium Communications Inc

- Orbcomm

- Inmarsat Global Limited

- Viasat Inc

- Cobham Limited

- Fleet Space Technologies Private Limited

- L3Harris Technologies

- Globalstar Inc

- Boeing

Key Developments in Satellite IoT Communication Market Industry

- February 2023: Hispasat launched the Amazonas Nexus, a high-performance geostationary satellite enhancing high-speed internet connectivity across the Americas and bridging the digital gap in Latin America. This launch significantly expands coverage and capacity for satellite IoT communications.

- February 2023: Cobham Satcom and RBC Signals extended their agreement to deploy Cobham Satcom's ground stations globally, boosting the reach and capacity of integrated communication services for NGSO missions and constellations used in IoT applications.

- October 2023: A SAR1 billion (USD 266.6 Million) contract was signed to establish satellite manufacturing facilities in Saudi Arabia, boosting the global manufacturing capacity for advanced satellites (representing 70% of the global satellite market) and enhancing the Kingdom's space capabilities. This investment significantly impacts the future supply and cost of satellite technology.

Strategic Outlook for Satellite IoT Communication Market Market

The Satellite IoT Communication market is poised for continued significant growth, driven by the converging trends of the IoT explosion, decreasing satellite launch costs, and advancements in technology leading to more efficient and affordable solutions. The expansion into new applications and markets, coupled with ongoing technological innovations, will further fuel market expansion. The strategic focus will be on delivering cost-effective, scalable, and high-performance solutions catering to a diverse range of applications in various industries worldwide. The increased competition will likely lead to further consolidations and innovation within the sector.

Satellite IoT Communication Market Segmentation

-

1. Type of Orbit

- 1.1. Low Earth Orbit (LEO)

- 1.2. Medium Earth Orbit (MEO)

- 1.3. Geostationary Orbit (GEO)

Satellite IoT Communication Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Satellite IoT Communication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Development and Growth of 5G Wireless Connectivity; Considerable Investments in the LEO Satellite Constellations

- 3.3. Market Restrains

- 3.3.1. Safety Concerns Associated with the Use of Surgical Robots; High Initial and Maintenance Costs of the Equipment

- 3.4. Market Trends

- 3.4.1. Low Earth Orbit (LEO) drives the Growth of the Satellite IoT Communication

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Satellite IoT Communication Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 5.1.1. Low Earth Orbit (LEO)

- 5.1.2. Medium Earth Orbit (MEO)

- 5.1.3. Geostationary Orbit (GEO)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 6. North America Satellite IoT Communication Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 6.1.1. Low Earth Orbit (LEO)

- 6.1.2. Medium Earth Orbit (MEO)

- 6.1.3. Geostationary Orbit (GEO)

- 6.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 7. Europe Satellite IoT Communication Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 7.1.1. Low Earth Orbit (LEO)

- 7.1.2. Medium Earth Orbit (MEO)

- 7.1.3. Geostationary Orbit (GEO)

- 7.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 8. Asia Pacific Satellite IoT Communication Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 8.1.1. Low Earth Orbit (LEO)

- 8.1.2. Medium Earth Orbit (MEO)

- 8.1.3. Geostationary Orbit (GEO)

- 8.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 9. Rest of the World Satellite IoT Communication Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 9.1.1. Low Earth Orbit (LEO)

- 9.1.2. Medium Earth Orbit (MEO)

- 9.1.3. Geostationary Orbit (GEO)

- 9.1. Market Analysis, Insights and Forecast - by Type of Orbit

- 10. North America Satellite IoT Communication Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Satellite IoT Communication Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Satellite IoT Communication Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Satellite IoT Communication Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Iridium Communications Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Orbcomm

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Inmarsat Global Limited

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Viasat Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Cobham Limited

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Fleet Space Technologies Private Limited

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 L3Harris Technologies*List Not Exhaustive

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Globalstar Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Boeing

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.1 Iridium Communications Inc

List of Figures

- Figure 1: Global Satellite IoT Communication Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Satellite IoT Communication Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Satellite IoT Communication Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Satellite IoT Communication Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Satellite IoT Communication Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Satellite IoT Communication Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Satellite IoT Communication Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Satellite IoT Communication Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Satellite IoT Communication Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Satellite IoT Communication Market Revenue (Million), by Type of Orbit 2024 & 2032

- Figure 11: North America Satellite IoT Communication Market Revenue Share (%), by Type of Orbit 2024 & 2032

- Figure 12: North America Satellite IoT Communication Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Satellite IoT Communication Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Satellite IoT Communication Market Revenue (Million), by Type of Orbit 2024 & 2032

- Figure 15: Europe Satellite IoT Communication Market Revenue Share (%), by Type of Orbit 2024 & 2032

- Figure 16: Europe Satellite IoT Communication Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Satellite IoT Communication Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Satellite IoT Communication Market Revenue (Million), by Type of Orbit 2024 & 2032

- Figure 19: Asia Pacific Satellite IoT Communication Market Revenue Share (%), by Type of Orbit 2024 & 2032

- Figure 20: Asia Pacific Satellite IoT Communication Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Satellite IoT Communication Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Satellite IoT Communication Market Revenue (Million), by Type of Orbit 2024 & 2032

- Figure 23: Rest of the World Satellite IoT Communication Market Revenue Share (%), by Type of Orbit 2024 & 2032

- Figure 24: Rest of the World Satellite IoT Communication Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Satellite IoT Communication Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Satellite IoT Communication Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Satellite IoT Communication Market Revenue Million Forecast, by Type of Orbit 2019 & 2032

- Table 3: Global Satellite IoT Communication Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Satellite IoT Communication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Satellite IoT Communication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Satellite IoT Communication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Satellite IoT Communication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Satellite IoT Communication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Satellite IoT Communication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Satellite IoT Communication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Satellite IoT Communication Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Satellite IoT Communication Market Revenue Million Forecast, by Type of Orbit 2019 & 2032

- Table 13: Global Satellite IoT Communication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Satellite IoT Communication Market Revenue Million Forecast, by Type of Orbit 2019 & 2032

- Table 15: Global Satellite IoT Communication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Satellite IoT Communication Market Revenue Million Forecast, by Type of Orbit 2019 & 2032

- Table 17: Global Satellite IoT Communication Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Satellite IoT Communication Market Revenue Million Forecast, by Type of Orbit 2019 & 2032

- Table 19: Global Satellite IoT Communication Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Satellite IoT Communication Market?

The projected CAGR is approximately 19.76%.

2. Which companies are prominent players in the Satellite IoT Communication Market?

Key companies in the market include Iridium Communications Inc, Orbcomm, Inmarsat Global Limited, Viasat Inc, Cobham Limited, Fleet Space Technologies Private Limited, L3Harris Technologies*List Not Exhaustive, Globalstar Inc, Boeing.

3. What are the main segments of the Satellite IoT Communication Market?

The market segments include Type of Orbit.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Development and Growth of 5G Wireless Connectivity; Considerable Investments in the LEO Satellite Constellations.

6. What are the notable trends driving market growth?

Low Earth Orbit (LEO) drives the Growth of the Satellite IoT Communication.

7. Are there any restraints impacting market growth?

Safety Concerns Associated with the Use of Surgical Robots; High Initial and Maintenance Costs of the Equipment.

8. Can you provide examples of recent developments in the market?

October 2023 - An SAR1 billion (USD 266.6 million) contract has been signed with the Hong Kong space company, which will set up satellite manufacturing facilities in Saudi Arabia. ASPACE will continue to increase its investment in line with the project phases, including R&D, component production, subsystems, and final assembly of satellites, as the Kingdom cements its position as a global manufacturing hub for foreign companies. By investing in advanced satellites, which represent 70% of the global satellite market, this deal will ensure that ASPACE is leveraging the strategically located region to improve its space capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Satellite IoT Communication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Satellite IoT Communication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Satellite IoT Communication Market?

To stay informed about further developments, trends, and reports in the Satellite IoT Communication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence