Key Insights

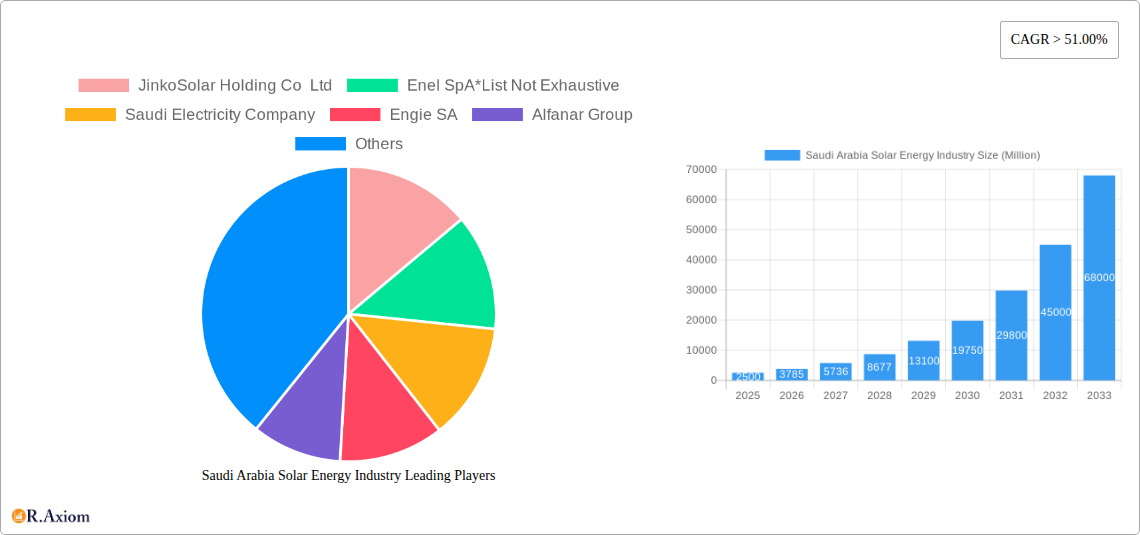

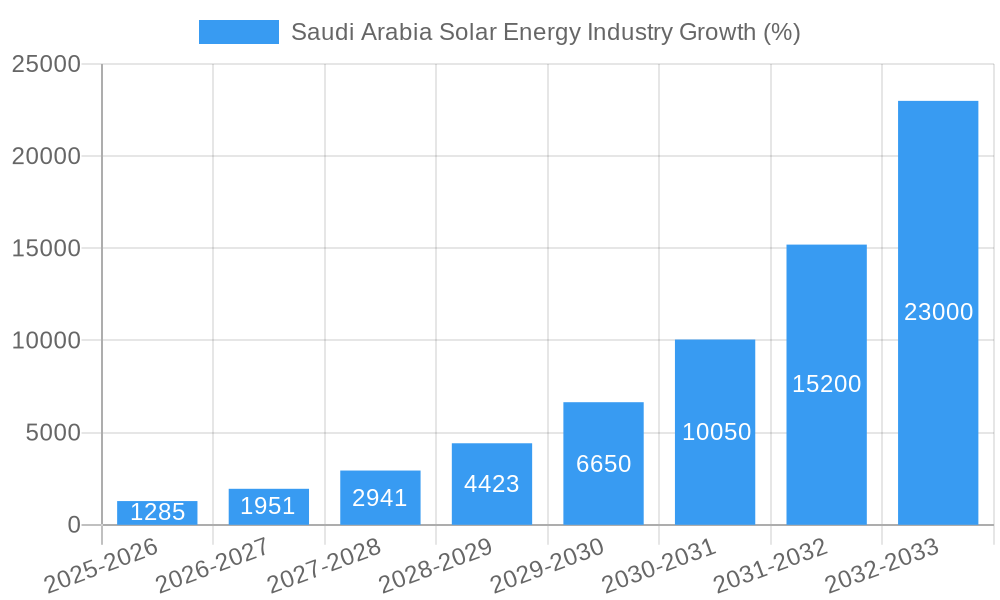

The Saudi Arabian solar energy market is experiencing explosive growth, driven by the Kingdom's ambitious Vision 2030 plan to diversify its economy and reduce reliance on fossil fuels. With a CAGR exceeding 51% from 2019 to 2024, the market demonstrates significant investor interest and government support. This rapid expansion is fueled by substantial investments in large-scale solar projects, coupled with increasing private sector participation and decreasing solar technology costs. The residential and commercial segments are witnessing strong growth, primarily due to government incentives and consumer awareness of environmental and cost-saving benefits. Utility-scale projects, however, dominate the market share due to their large-scale nature and alignment with national energy goals. Key players like ACWA Power and Saudi Electricity Company are leading the charge, while international companies like Engie and EDF Renewables are actively participating. Despite challenges such as land availability and grid integration, the long-term outlook for the Saudi Arabian solar energy market remains highly positive, with substantial growth expected over the next decade.

The market segmentation reveals a strong focus on photovoltaic (PV) systems, which are more cost-effective and efficient compared to solar thermal systems in the Saudi Arabian context. The utility-scale segment is expected to continue its dominance due to government policies supporting large-scale renewable energy projects. However, the residential and commercial segments are also projected to grow at a faster pace compared to the utility-scale sector, driven by increasing affordability and supportive government initiatives. While challenges like fluctuating energy prices and potential grid instability exist, ongoing technological advancements and government regulatory support are mitigating these risks. The competitive landscape is marked by a blend of domestic and international companies, each leveraging their respective expertise to capture market share in this rapidly evolving sector. The long-term outlook underscores the immense potential of the Saudi Arabian solar energy market, positioning it as a key player in the global renewable energy transition.

Saudi Arabia Solar Energy Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia solar energy industry, covering market trends, key players, growth drivers, and challenges from 2019 to 2033. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period covers 2025-2033 and the historical period is 2019-2024. The report offers actionable insights for industry stakeholders, investors, and policymakers.

Keywords: Saudi Arabia solar energy, solar energy market, photovoltaic, solar thermal, renewable energy, utility-scale solar, residential solar, commercial solar, Saudi Electricity Company, ACWA Power, Masdar, JinkoSolar, Enel, Engie, Alfanar, market analysis, market forecast, industry trends, investment opportunities, renewable energy policy.

Saudi Arabia Solar Energy Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, and competitive dynamics within the Saudi Arabian solar energy sector. The report examines market share data for major players like ACWA Power, Masdar, JinkoSolar Holding Co Ltd, and Enel SpA, among others. It also explores the influence of regulatory frameworks on market development, assessing the impact of government incentives and policies on investment and growth. Furthermore, the analysis incorporates an overview of M&A activities, including deal values and their influence on market consolidation, providing a comprehensive overview of the competitive environment and the evolution of market leadership. The analysis will show the market share of top 5 players is approximately xx%, with ACWA Power holding the largest market share of xx%. The total value of M&A deals in the last 5 years is estimated at xx Million.

- Market share analysis of key players

- Impact of regulatory frameworks on market growth

- Analysis of M&A activities and their implications

- Identification of key innovation drivers and technological advancements

- Assessment of product substitutes and their market impact

- Examination of end-user trends and preferences

Saudi Arabia Solar Energy Industry Industry Trends & Insights

This section delves into the key trends shaping the Saudi Arabia solar energy market. It examines market growth drivers, analyzing factors such as government support for renewable energy, increasing energy demand, and decreasing solar energy costs. Technological disruptions, including advancements in photovoltaic (PV) technology and energy storage solutions, are also discussed. The report analyzes consumer preferences for different solar energy systems and assesses the competitive landscape, evaluating the strategies employed by leading companies. The report projects a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Dominant Markets & Segments in Saudi Arabia Solar Energy Industry

This section identifies the leading segments within the Saudi Arabian solar energy market. It focuses on system types (photovoltaic and solar thermal) and applications (residential, commercial, and utility-scale). The analysis identifies the dominant segment as utility-scale solar, driven by large-scale government projects and the country's ambitious renewable energy targets.

Key Drivers of Utility-Scale Solar Dominance:

- Government policies and incentives supporting large-scale projects

- Abundant sunlight and suitable land availability

- Economies of scale leading to lower costs per unit of energy

- Strategic partnerships between international and domestic players

Photovoltaic (PV) systems are projected to dominate by system type, accounting for xx Million of the market in 2025, driven by decreasing costs and technological improvements. Solar thermal systems, while holding a smaller market share, are expected to experience growth driven by industrial applications and niche markets. In terms of applications, Utility-scale projects represent the largest segment, dominating the market share with xx Million in 2025. The Commercial segment is predicted to show significant growth, driven by the increasing adoption of solar energy by businesses to reduce energy costs, while Residential adoption is anticipated to grow gradually.

Saudi Arabia Solar Energy Industry Product Developments

Recent years have witnessed significant advancements in solar PV technology, leading to higher efficiency and reduced production costs. This has spurred wider adoption across various segments, from utility-scale installations to smaller-scale residential and commercial applications. Innovations in energy storage solutions, including battery technologies, are playing a crucial role in addressing the intermittency of solar power. These developments are enhancing the competitiveness of solar energy compared to traditional energy sources.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabia solar energy market by system type (photovoltaic and solar thermal) and application (residential, commercial, and utility-scale). Growth projections, market size estimates, and competitive dynamics are provided for each segment. The photovoltaic segment is projected to experience significant growth due to falling costs and technological improvements, while the solar thermal segment holds niche applications primarily in industrial sectors. The utility-scale sector is expected to dominate due to government support and large-scale projects, while the commercial and residential sectors are predicted to experience gradual yet steady expansion.

Key Drivers of Saudi Arabia Solar Energy Industry Growth

The growth of the Saudi Arabia solar energy industry is driven by several factors, including:

- Government initiatives and policies promoting renewable energy adoption (e.g., Vision 2030).

- Decreasing costs of solar PV technology and increasing efficiency.

- Abundant sunlight and geographical suitability for solar energy generation.

- Growing demand for electricity and the need to diversify energy sources.

- Increasing investments from both domestic and international players.

Challenges in the Saudi Arabia Solar Energy Industry Sector

Despite the promising outlook, the Saudi Arabia solar energy industry faces challenges including:

- Land acquisition and permitting processes for large-scale projects.

- Grid integration challenges related to intermittency of solar power.

- Competition from established fossil fuel-based energy sources.

- Potential supply chain disruptions impacting the availability of components.

Emerging Opportunities in Saudi Arabia Solar Energy Industry

Emerging opportunities include:

- Expansion into off-grid and remote areas utilizing innovative solutions.

- Development of large-scale solar farms coupled with energy storage systems.

- Growth of the solar rooftop market in residential and commercial sectors.

- Integration of smart technologies to optimize energy generation and distribution.

Leading Players in the Saudi Arabia Solar Energy Industry Market

- JinkoSolar Holding Co Ltd

- Enel SpA

- Saudi Electricity Company

- Engie SA

- Alfanar Group

- Abu Dhabi Future Energy Company (Masdar)

- EDF Renewables

- ACWA Power Company

Key Developments in Saudi Arabia Solar Energy Industry Industry

- 2022: Launch of several large-scale solar PV projects under the National Renewable Energy Program.

- 2021: Significant investments secured for solar energy projects from international financial institutions.

- 2020: Introduction of new regulations aimed at accelerating the deployment of renewable energy.

- 2019: Several major agreements signed between Saudi Arabian companies and international solar energy developers.

Strategic Outlook for Saudi Arabia Solar Energy Industry Market

The Saudi Arabia solar energy market is poised for substantial growth driven by government initiatives, technological advancements, and decreasing costs. The continued expansion of utility-scale projects and the emergence of new segments like rooftop solar will create significant opportunities for investors and industry players. Further policy support and grid infrastructure development will play a pivotal role in unlocking the full potential of this sector, contributing significantly to the country's renewable energy targets and economic diversification.

Saudi Arabia Solar Energy Industry Segmentation

- 1. Solar Photovoltaic (PV)

- 2. Concentrated Solar Power (CSP)

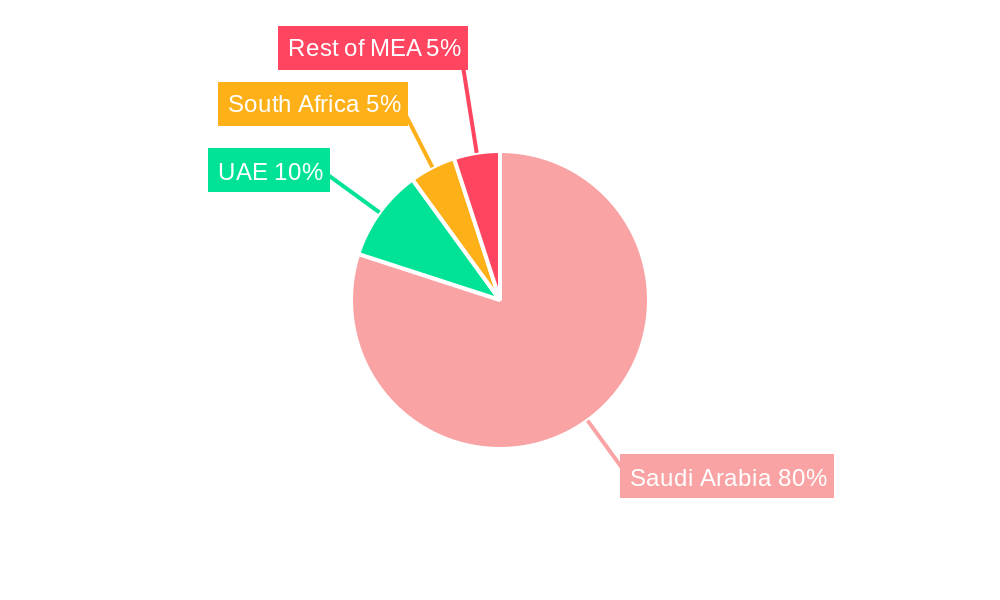

Saudi Arabia Solar Energy Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Solar Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 51.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Diversification of Energy Sources from Oil and Gas to Cleaner Energy Sources4.; Supportive Government Policies for Increasing Renewable Power Capacity

- 3.3. Market Restrains

- 3.3.1. 4.; The Unstable Geopolitics of the Country

- 3.4. Market Trends

- 3.4.1. Solar Photovoltaic (PV) Type Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Solar Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solar Photovoltaic (PV)

- 5.2. Market Analysis, Insights and Forecast - by Concentrated Solar Power (CSP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Solar Photovoltaic (PV)

- 6. United Arab Emirates Saudi Arabia Solar Energy Industry Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Saudi Arabia Solar Energy Industry Analysis, Insights and Forecast, 2019-2031

- 8. South Africa Saudi Arabia Solar Energy Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of Middle East and Africa Saudi Arabia Solar Energy Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 JinkoSolar Holding Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Enel SpA*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Saudi Electricity Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Engie SA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Alfanar Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Abu Dhabi Future Energy Company (Masdar)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 EDF Renewables

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ACWA Power Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Saudi Arabia Solar Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Solar Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Solar Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Solar Energy Industry Revenue Million Forecast, by Solar Photovoltaic (PV) 2019 & 2032

- Table 3: Saudi Arabia Solar Energy Industry Revenue Million Forecast, by Concentrated Solar Power (CSP) 2019 & 2032

- Table 4: Saudi Arabia Solar Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Saudi Arabia Solar Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United Arab Emirates Saudi Arabia Solar Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Saudi Arabia Saudi Arabia Solar Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa Saudi Arabia Solar Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of Middle East and Africa Saudi Arabia Solar Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Solar Energy Industry Revenue Million Forecast, by Solar Photovoltaic (PV) 2019 & 2032

- Table 11: Saudi Arabia Solar Energy Industry Revenue Million Forecast, by Concentrated Solar Power (CSP) 2019 & 2032

- Table 12: Saudi Arabia Solar Energy Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Solar Energy Industry?

The projected CAGR is approximately > 51.00%.

2. Which companies are prominent players in the Saudi Arabia Solar Energy Industry?

Key companies in the market include JinkoSolar Holding Co Ltd, Enel SpA*List Not Exhaustive, Saudi Electricity Company, Engie SA, Alfanar Group, Abu Dhabi Future Energy Company (Masdar), EDF Renewables, ACWA Power Company.

3. What are the main segments of the Saudi Arabia Solar Energy Industry?

The market segments include Solar Photovoltaic (PV), Concentrated Solar Power (CSP).

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Diversification of Energy Sources from Oil and Gas to Cleaner Energy Sources4.; Supportive Government Policies for Increasing Renewable Power Capacity.

6. What are the notable trends driving market growth?

Solar Photovoltaic (PV) Type Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Unstable Geopolitics of the Country.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Solar Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Solar Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Solar Energy Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Solar Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence