Key Insights

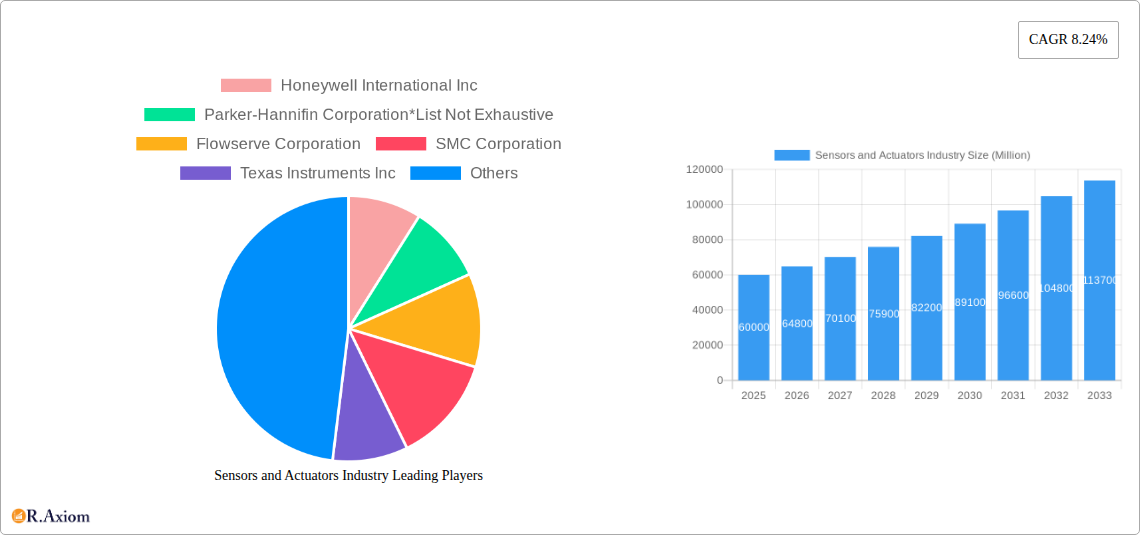

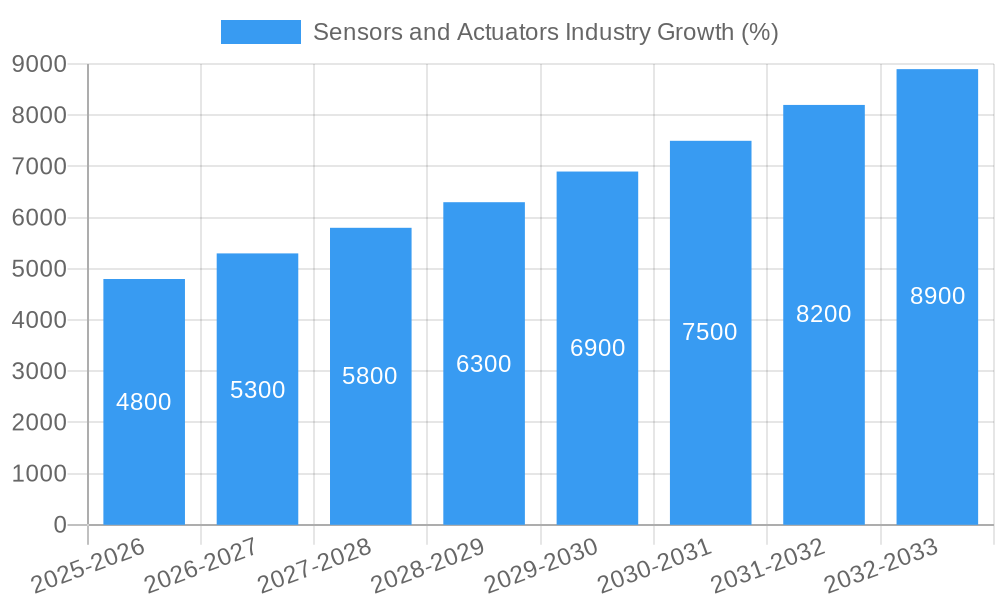

The global sensors and actuators market is experiencing robust growth, driven by increasing automation across diverse industries and the burgeoning Internet of Things (IoT). The market, currently valued in the billions (a precise figure requires the missing market size data, but considering a CAGR of 8.24% and the listed companies, a reasonable estimate would place the 2025 market size in the range of $50-70 billion), is projected to maintain a strong CAGR of approximately 8% through 2033. Key growth drivers include the rising demand for precise motion control in industrial automation, the proliferation of smart devices and connected systems in consumer electronics, and the increasing adoption of advanced sensor technologies in automotive applications (like ADAS and autonomous vehicles). Significant trends include the miniaturization of sensors and actuators, the integration of advanced functionalities like AI and machine learning, and the development of energy-efficient designs. Despite this positive outlook, market growth faces certain restraints, including high initial investment costs for advanced technologies and potential supply chain disruptions. The segmentation reveals strong performance across various product types (sensors and actuators), power sources (hydraulic, pneumatic, electrical, magnetic, and mechanical), motion types (linear and rotary), and end-user industries. The automotive, healthcare, and industrial automation sectors are currently leading the demand, although growth is expected across all sectors due to widespread technological integration.

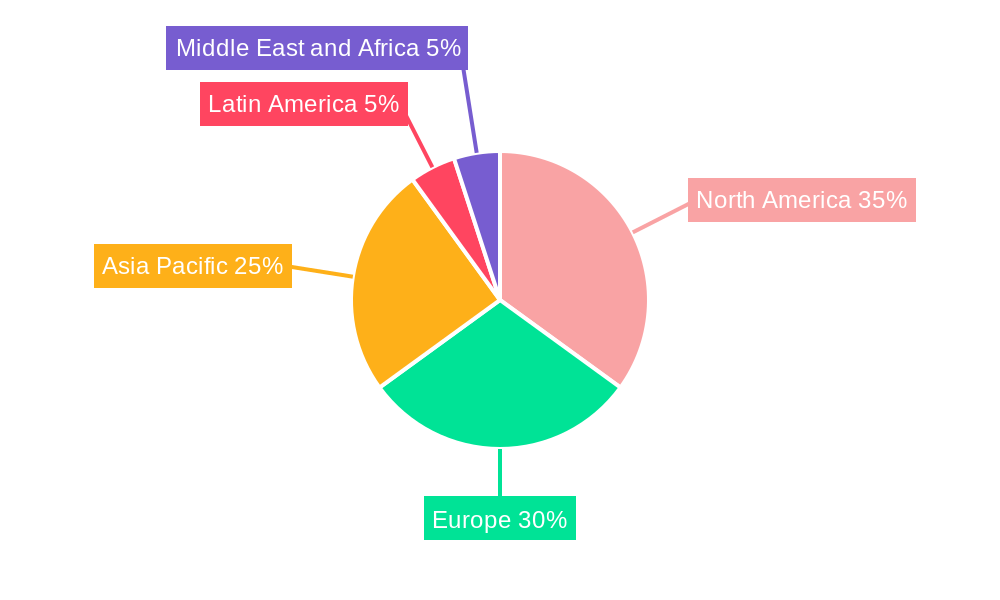

The competitive landscape is characterized by a mix of established players and emerging technology companies. Companies like Honeywell, Parker-Hannifin, and Texas Instruments are leveraging their existing expertise and market presence to capitalize on the expanding market. Meanwhile, smaller companies are focusing on developing innovative solutions and specialized applications within niche segments. Regional market analysis suggests a significant concentration of market share in North America and Europe, driven by established industrial infrastructure and technological advancements. However, the Asia-Pacific region is witnessing rapid growth due to its burgeoning manufacturing sector and increasing adoption of automation technologies. The continued expansion of the IoT and increasing reliance on automation across diverse industrial sectors will ensure the sustained growth and evolution of the sensors and actuators market in the coming years. Further research into specific market segments will allow for more refined market projections and investment strategies.

Sensors and Actuators Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global Sensors and Actuators industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, competitive landscapes, and future growth projections. The report encompasses various segments, including key players like Honeywell International Inc, Parker-Hannifin Corporation, Flowserve Corporation, SMC Corporation, Texas Instruments Inc, Bosch Sensortec GmbH, TE Connectivity, Emerson Electric Co, Renesas Electronics Corporation, and Schlumberger Limited. The global market size in 2025 is estimated at xx Million.

Sensors and Actuators Industry Market Concentration & Innovation

The sensors and actuators market exhibits a moderately concentrated structure, with a few major players holding significant market share. Honeywell International Inc. and Parker-Hannifin Corporation, for example, are estimated to collectively control approximately xx% of the market in 2025. However, the presence of numerous smaller, specialized companies fosters innovation and competition.

- Market Share: The top 5 players account for approximately xx% of the global market (2025 estimate).

- M&A Activity: The historical period (2019-2024) witnessed xx Million in M&A deals, primarily focused on expanding product portfolios and geographic reach. The projected M&A activity for 2025-2033 is estimated at xx Million, driven by the need for technological advancements and market consolidation.

- Innovation Drivers: The market is driven by increasing demand for automation across various industries, advancements in sensor technology (e.g., MEMS, IoT sensors), and the development of sophisticated actuators for precision control. Stringent regulatory frameworks promoting safety and efficiency in industries like automotive and aerospace further propel innovation.

- Regulatory Frameworks: Regulations concerning safety, performance, and environmental impact significantly influence product design and market entry. Compliance costs and evolving standards create both challenges and opportunities for innovation.

- Product Substitutes: Technological advancements are leading to the emergence of alternative technologies with improved performance or cost-effectiveness, posing a competitive challenge to existing products. For example, the rise of solid-state sensors presents a potential substitute for certain traditional technologies.

- End-User Trends: The increasing adoption of automation, Industry 4.0, and the Internet of Things (IoT) in various end-user industries, notably automotive, healthcare, and manufacturing, significantly drives market growth.

Sensors and Actuators Industry Industry Trends & Insights

The sensors and actuators market is projected to experience robust growth during the forecast period (2025-2033), with a CAGR of xx%. This growth is fueled by several key factors: increasing automation across industries, the rise of smart devices and the Internet of Things (IoT), technological advancements leading to miniaturization and improved performance, and growing demand for precise and reliable control systems in diverse applications. The market penetration of smart sensors and actuators in various end-user industries is increasing rapidly, with a significant shift toward advanced functionalities and improved integration capabilities. Competitive dynamics are characterized by both consolidation through mergers and acquisitions and intense competition among established players and emerging technology providers. Consumer preferences are shifting towards higher accuracy, greater reliability, energy efficiency, and cost-effectiveness.

Dominant Markets & Segments in Sensors and Actuators Industry

The North American region currently holds the largest market share, driven by a strong manufacturing base, high technological adoption rates, and considerable investments in automation across key industries. However, the Asia-Pacific region is projected to witness the fastest growth rate due to rapid industrialization, rising disposable income, and increasing adoption of automation in various sectors.

- Product Type: Sensors currently dominate the market, driven by high demand for data acquisition and monitoring across multiple applications.

- Actuator Type: Electrical actuators are the fastest growing segment, fueled by the increasing preference for energy efficiency and precise control systems.

- Type of Power Used: Electrical actuators hold the largest market share, while the demand for hydraulic and pneumatic actuators remains significant in specific niche applications.

- Type of Motion: Linear actuators are currently the most widely used type, though rotary actuators are gaining traction in applications demanding rotational movements.

- End-user Industry: The automotive industry is the largest end-user segment, followed by manufacturing and healthcare. Growth in the aerospace and defense sector is also significant, driven by increasing demand for advanced control systems in aviation and defense applications. Other end-user industries like energy, water & wastewater, and mining also contribute significantly to market growth.

Key Drivers:

- Automotive: Stringent emission norms and the push for fuel efficiency are driving the demand for advanced sensors and actuators in automotive applications.

- Healthcare: The increasing demand for advanced medical devices and surgical equipment is driving the adoption of miniaturized and high-precision sensors and actuators in the healthcare industry.

- Manufacturing: The rapid adoption of Industry 4.0 and smart manufacturing initiatives in the manufacturing sector is a key driver of market expansion.

Sensors and Actuators Industry Product Developments

Recent years have witnessed significant advancements in sensor and actuator technology, particularly in miniaturization, increased precision, improved energy efficiency, and enhanced integration capabilities. The emergence of smart sensors and actuators with embedded intelligence and communication capabilities is transforming various applications. Innovations are focused on developing robust, reliable, and cost-effective solutions that meet the evolving needs of diverse industries. The market is also witnessing a shift towards wireless sensors and actuators, enhancing flexibility and ease of integration.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the sensors and actuators market, segmented by product type (sensors and actuators), type of power used (hydraulic, pneumatic, electrical, magnetic, mechanical), type of motion (linear and rotary), and end-user industry (automotive, healthcare, oil & gas, consumer electronics, manufacturing, aerospace & defense, and others). Each segment’s growth projection, market size, and competitive dynamics are thoroughly examined.

Key Drivers of Sensors and Actuators Industry Growth

The growth of the sensors and actuators market is propelled by several key factors. Technological advancements, particularly in miniaturization, improved accuracy, and energy efficiency of sensors and actuators, are driving widespread adoption across various industries. Government regulations promoting safety and automation in critical sectors, such as automotive and aerospace, further stimulate market demand. Furthermore, the increasing demand for automation and smart devices across diverse applications, ranging from industrial automation to consumer electronics, is a primary growth driver.

Challenges in the Sensors and Actuators Industry Sector

The sensors and actuators industry faces several challenges, including stringent regulatory requirements that can increase compliance costs and hinder market entry for new players. Supply chain disruptions and volatility in raw material prices pose significant challenges to profitability. The industry is also characterized by intense competition among established players and emerging technology providers, leading to pricing pressures. Furthermore, the need for continuous innovation to meet evolving technological demands and enhance performance represents a constant challenge.

Emerging Opportunities in Sensors and Actuators Industry

Emerging opportunities exist in several areas, including the growing demand for sophisticated control systems in autonomous vehicles, the proliferation of IoT devices and smart homes, and the expanding use of sensors and actuators in healthcare applications, particularly minimally invasive surgery and remote patient monitoring. The development of new materials and advanced manufacturing techniques further presents potential for innovation and cost reduction. The exploration of new applications in emerging markets, particularly in developing economies, also offers substantial growth opportunities.

Leading Players in the Sensors and Actuators Industry Market

- Honeywell International Inc

- Parker-Hannifin Corporation

- Flowserve Corporation

- SMC Corporation

- Texas Instruments Inc

- Bosch Sensortec GmbH

- TE Connectivity

- Emerson Electric Co

- Renesas Electronics Corporation

- Schlumberger Limited

Key Developments in Sensors and Actuators Industry Industry

- October 2021: Curtiss-Wright launched its Exlar SA-R080 rotary and SA-L080 linear actuators with integral controls, expanding its offerings in the harsh environment control and sense series.

- October 2021: Ewellix introduced the CAHB-2xS smart electro-mechanical actuator with enhanced features like accurate position sensors, built-in monitoring, and improved communication capabilities, targeting demanding applications in construction and agriculture.

Strategic Outlook for Sensors and Actuators Industry Market

The sensors and actuators market is poised for continued strong growth, driven by technological advancements, increasing automation, and the expanding adoption of smart devices across diverse industries. The focus on miniaturization, improved accuracy, and enhanced integration capabilities will continue to shape product development and market dynamics. New applications in emerging sectors, such as renewable energy and smart infrastructure, offer significant growth potential. The market will witness increased competition among established players and emerging technology providers, leading to innovation and pricing pressures.

Sensors and Actuators Industry Segmentation

-

1. Product Type

-

1.1. Sensors

- 1.1.1. Pressure Sensors

- 1.1.2. Temperature Sensors

- 1.1.3. Position Sensors

- 1.1.4. Level Sensors

- 1.1.5. Image Sensors

- 1.1.6. Chemical Sensors

- 1.1.7. Torque Sensors

-

1.2. Actuators

-

1.2.1. Type of Power Used

- 1.2.1.1. Hydraulic Actuators

- 1.2.1.2. Pneumatic Actuators

- 1.2.1.3. Electrical Actuators

- 1.2.1.4. Magnetic Actuators

- 1.2.1.5. Mechanical Actuators

-

1.2.2. Type of Motion

- 1.2.2.1. Linear Actuators

- 1.2.2.2. Rotary Actuators

-

1.2.1. Type of Power Used

-

1.1. Sensors

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Healthcare

- 2.3. Oil & Gas

- 2.4. Consumer Electronics

- 2.5. Manufacturing

- 2.6. Aerospace & Defense

- 2.7. Other En

Sensors and Actuators Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Sensors and Actuators Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Automation and Industry 4.; Increasing Demand from Automotive Industry

- 3.3. Market Restrains

- 3.3.1. ; Continuous Change in Manufacturing Process.

- 3.4. Market Trends

- 3.4.1. Emergence of Automation and Industry 4.0

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sensors and Actuators Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sensors

- 5.1.1.1. Pressure Sensors

- 5.1.1.2. Temperature Sensors

- 5.1.1.3. Position Sensors

- 5.1.1.4. Level Sensors

- 5.1.1.5. Image Sensors

- 5.1.1.6. Chemical Sensors

- 5.1.1.7. Torque Sensors

- 5.1.2. Actuators

- 5.1.2.1. Type of Power Used

- 5.1.2.1.1. Hydraulic Actuators

- 5.1.2.1.2. Pneumatic Actuators

- 5.1.2.1.3. Electrical Actuators

- 5.1.2.1.4. Magnetic Actuators

- 5.1.2.1.5. Mechanical Actuators

- 5.1.2.2. Type of Motion

- 5.1.2.2.1. Linear Actuators

- 5.1.2.2.2. Rotary Actuators

- 5.1.2.1. Type of Power Used

- 5.1.1. Sensors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Healthcare

- 5.2.3. Oil & Gas

- 5.2.4. Consumer Electronics

- 5.2.5. Manufacturing

- 5.2.6. Aerospace & Defense

- 5.2.7. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Sensors and Actuators Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Sensors

- 6.1.1.1. Pressure Sensors

- 6.1.1.2. Temperature Sensors

- 6.1.1.3. Position Sensors

- 6.1.1.4. Level Sensors

- 6.1.1.5. Image Sensors

- 6.1.1.6. Chemical Sensors

- 6.1.1.7. Torque Sensors

- 6.1.2. Actuators

- 6.1.2.1. Type of Power Used

- 6.1.2.1.1. Hydraulic Actuators

- 6.1.2.1.2. Pneumatic Actuators

- 6.1.2.1.3. Electrical Actuators

- 6.1.2.1.4. Magnetic Actuators

- 6.1.2.1.5. Mechanical Actuators

- 6.1.2.2. Type of Motion

- 6.1.2.2.1. Linear Actuators

- 6.1.2.2.2. Rotary Actuators

- 6.1.2.1. Type of Power Used

- 6.1.1. Sensors

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Healthcare

- 6.2.3. Oil & Gas

- 6.2.4. Consumer Electronics

- 6.2.5. Manufacturing

- 6.2.6. Aerospace & Defense

- 6.2.7. Other En

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Sensors and Actuators Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Sensors

- 7.1.1.1. Pressure Sensors

- 7.1.1.2. Temperature Sensors

- 7.1.1.3. Position Sensors

- 7.1.1.4. Level Sensors

- 7.1.1.5. Image Sensors

- 7.1.1.6. Chemical Sensors

- 7.1.1.7. Torque Sensors

- 7.1.2. Actuators

- 7.1.2.1. Type of Power Used

- 7.1.2.1.1. Hydraulic Actuators

- 7.1.2.1.2. Pneumatic Actuators

- 7.1.2.1.3. Electrical Actuators

- 7.1.2.1.4. Magnetic Actuators

- 7.1.2.1.5. Mechanical Actuators

- 7.1.2.2. Type of Motion

- 7.1.2.2.1. Linear Actuators

- 7.1.2.2.2. Rotary Actuators

- 7.1.2.1. Type of Power Used

- 7.1.1. Sensors

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Healthcare

- 7.2.3. Oil & Gas

- 7.2.4. Consumer Electronics

- 7.2.5. Manufacturing

- 7.2.6. Aerospace & Defense

- 7.2.7. Other En

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Sensors and Actuators Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Sensors

- 8.1.1.1. Pressure Sensors

- 8.1.1.2. Temperature Sensors

- 8.1.1.3. Position Sensors

- 8.1.1.4. Level Sensors

- 8.1.1.5. Image Sensors

- 8.1.1.6. Chemical Sensors

- 8.1.1.7. Torque Sensors

- 8.1.2. Actuators

- 8.1.2.1. Type of Power Used

- 8.1.2.1.1. Hydraulic Actuators

- 8.1.2.1.2. Pneumatic Actuators

- 8.1.2.1.3. Electrical Actuators

- 8.1.2.1.4. Magnetic Actuators

- 8.1.2.1.5. Mechanical Actuators

- 8.1.2.2. Type of Motion

- 8.1.2.2.1. Linear Actuators

- 8.1.2.2.2. Rotary Actuators

- 8.1.2.1. Type of Power Used

- 8.1.1. Sensors

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Healthcare

- 8.2.3. Oil & Gas

- 8.2.4. Consumer Electronics

- 8.2.5. Manufacturing

- 8.2.6. Aerospace & Defense

- 8.2.7. Other En

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Sensors and Actuators Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Sensors

- 9.1.1.1. Pressure Sensors

- 9.1.1.2. Temperature Sensors

- 9.1.1.3. Position Sensors

- 9.1.1.4. Level Sensors

- 9.1.1.5. Image Sensors

- 9.1.1.6. Chemical Sensors

- 9.1.1.7. Torque Sensors

- 9.1.2. Actuators

- 9.1.2.1. Type of Power Used

- 9.1.2.1.1. Hydraulic Actuators

- 9.1.2.1.2. Pneumatic Actuators

- 9.1.2.1.3. Electrical Actuators

- 9.1.2.1.4. Magnetic Actuators

- 9.1.2.1.5. Mechanical Actuators

- 9.1.2.2. Type of Motion

- 9.1.2.2.1. Linear Actuators

- 9.1.2.2.2. Rotary Actuators

- 9.1.2.1. Type of Power Used

- 9.1.1. Sensors

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Healthcare

- 9.2.3. Oil & Gas

- 9.2.4. Consumer Electronics

- 9.2.5. Manufacturing

- 9.2.6. Aerospace & Defense

- 9.2.7. Other En

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Sensors and Actuators Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Sensors

- 10.1.1.1. Pressure Sensors

- 10.1.1.2. Temperature Sensors

- 10.1.1.3. Position Sensors

- 10.1.1.4. Level Sensors

- 10.1.1.5. Image Sensors

- 10.1.1.6. Chemical Sensors

- 10.1.1.7. Torque Sensors

- 10.1.2. Actuators

- 10.1.2.1. Type of Power Used

- 10.1.2.1.1. Hydraulic Actuators

- 10.1.2.1.2. Pneumatic Actuators

- 10.1.2.1.3. Electrical Actuators

- 10.1.2.1.4. Magnetic Actuators

- 10.1.2.1.5. Mechanical Actuators

- 10.1.2.2. Type of Motion

- 10.1.2.2.1. Linear Actuators

- 10.1.2.2.2. Rotary Actuators

- 10.1.2.1. Type of Power Used

- 10.1.1. Sensors

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Healthcare

- 10.2.3. Oil & Gas

- 10.2.4. Consumer Electronics

- 10.2.5. Manufacturing

- 10.2.6. Aerospace & Defense

- 10.2.7. Other En

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Sensors and Actuators Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Sensors and Actuators Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Sensors and Actuators Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Sensors and Actuators Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Sensors and Actuators Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Honeywell International Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Parker-Hannifin Corporation*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Flowserve Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 SMC Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Texas Instruments Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Bosch Sensortec GmbH

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 TE Connectivity

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Emerson Electric Co

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Renesas Electronics Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Schlumberger Limited

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Sensors and Actuators Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Sensors and Actuators Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Sensors and Actuators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Sensors and Actuators Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Sensors and Actuators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Sensors and Actuators Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Sensors and Actuators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Sensors and Actuators Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Sensors and Actuators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Sensors and Actuators Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Sensors and Actuators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Sensors and Actuators Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Sensors and Actuators Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Sensors and Actuators Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Sensors and Actuators Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Sensors and Actuators Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Sensors and Actuators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Sensors and Actuators Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe Sensors and Actuators Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Sensors and Actuators Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Sensors and Actuators Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Sensors and Actuators Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Sensors and Actuators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Sensors and Actuators Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia Pacific Sensors and Actuators Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia Pacific Sensors and Actuators Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Sensors and Actuators Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Sensors and Actuators Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Sensors and Actuators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Sensors and Actuators Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Latin America Sensors and Actuators Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Latin America Sensors and Actuators Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Sensors and Actuators Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Sensors and Actuators Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Sensors and Actuators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Sensors and Actuators Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Middle East and Africa Sensors and Actuators Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Middle East and Africa Sensors and Actuators Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa Sensors and Actuators Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa Sensors and Actuators Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Sensors and Actuators Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sensors and Actuators Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Sensors and Actuators Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Sensors and Actuators Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Sensors and Actuators Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Sensors and Actuators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Sensors and Actuators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Sensors and Actuators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Sensors and Actuators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Sensors and Actuators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Sensors and Actuators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Sensors and Actuators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Sensors and Actuators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Sensors and Actuators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Sensors and Actuators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Sensors and Actuators Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global Sensors and Actuators Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Sensors and Actuators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Sensors and Actuators Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global Sensors and Actuators Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Sensors and Actuators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Sensors and Actuators Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global Sensors and Actuators Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Sensors and Actuators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Sensors and Actuators Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Global Sensors and Actuators Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Sensors and Actuators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Sensors and Actuators Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global Sensors and Actuators Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Sensors and Actuators Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sensors and Actuators Industry?

The projected CAGR is approximately 8.24%.

2. Which companies are prominent players in the Sensors and Actuators Industry?

Key companies in the market include Honeywell International Inc, Parker-Hannifin Corporation*List Not Exhaustive, Flowserve Corporation, SMC Corporation, Texas Instruments Inc, Bosch Sensortec GmbH, TE Connectivity, Emerson Electric Co, Renesas Electronics Corporation, Schlumberger Limited.

3. What are the main segments of the Sensors and Actuators Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Automation and Industry 4.; Increasing Demand from Automotive Industry.

6. What are the notable trends driving market growth?

Emergence of Automation and Industry 4.0.

7. Are there any restraints impacting market growth?

; Continuous Change in Manufacturing Process..

8. Can you provide examples of recent developments in the market?

October 2021 - Curtiss-Wright announced the launch of its newest actuators with integral controls, the Exlar SA-R080 rotary, and SA-L080 linear actuator. The SA-080 is a frame size (80 mm) in the harsh environment control and sense series of industrial electro-mechanical actuators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sensors and Actuators Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sensors and Actuators Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sensors and Actuators Industry?

To stay informed about further developments, trends, and reports in the Sensors and Actuators Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence