Key Insights

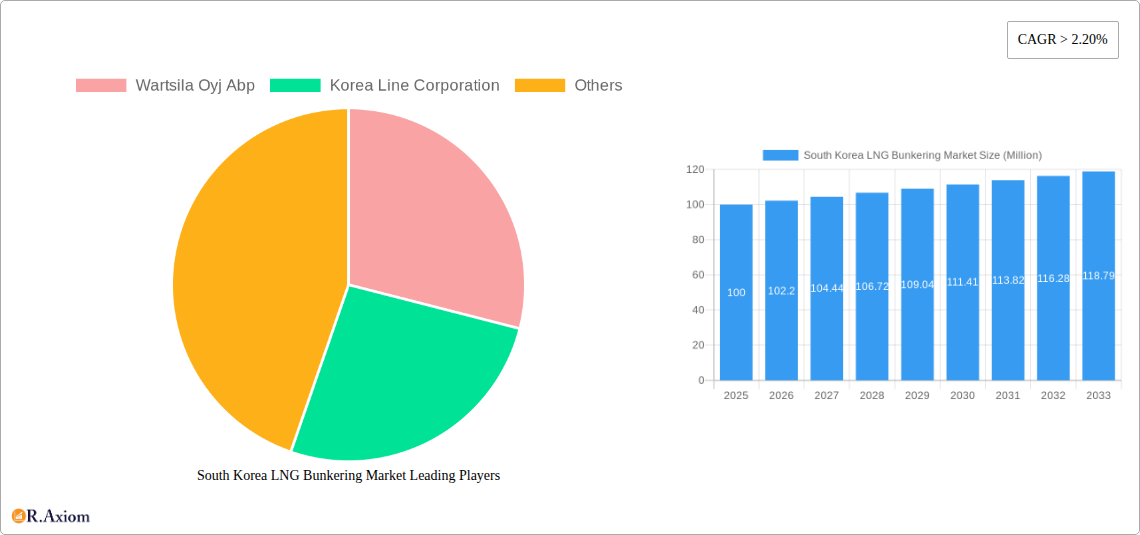

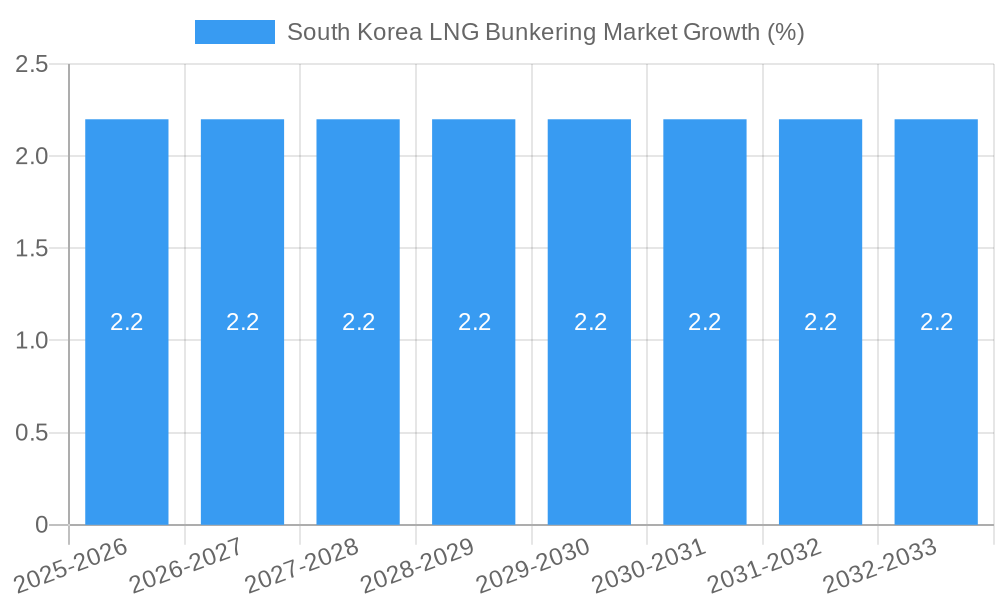

The South Korea LNG bunkering market is experiencing robust growth, driven by the country's commitment to decarbonizing its maritime sector and meeting stringent environmental regulations. The increasing adoption of LNG as a cleaner marine fuel, coupled with government incentives and supportive policies, is fueling market expansion. While precise market size data for 2019-2024 is unavailable, a conservative estimate based on a CAGR of 2.20% from a 2025 market value (assuming a starting point of approximately $100 million in 2025, this figure is estimated and used for calculation purposes only) would indicate a significant increase in value by 2033. This growth is particularly fueled by the strong demand from the tanker fleet and container fleet segments, representing the largest contributors to the market’s overall volume. The expanding Ferry and OSV segment also shows promising potential for growth. Key players like Wartsila Oyj Abp and Korea Line Corporation are strategically positioning themselves within this rapidly evolving landscape, investing in infrastructure and technology to meet the escalating demand for LNG bunkering services.

However, challenges remain. While the South Korean government actively encourages the shift to LNG, the relatively high initial investment costs associated with LNG bunkering infrastructure and the lack of widespread LNG refueling stations could potentially hinder the market's rapid acceleration. The volatile price fluctuations of LNG compared to traditional marine fuels also pose a risk. Furthermore, the competitiveness of alternative cleaner fuels, such as biofuels and ammonia, should be monitored. Nonetheless, the strong regulatory push and commitment to sustainability are expected to propel the South Korea LNG bunkering market toward substantial expansion throughout the forecast period (2025-2033), making it a strategically important sector for both domestic and international players.

South Korea LNG Bunkering Market: A Comprehensive Forecast & Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the South Korea LNG bunkering market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a holistic view of market dynamics, growth drivers, challenges, and future opportunities. The report leverages rigorous data analysis and industry expertise to provide actionable intelligence, supporting informed strategic planning.

South Korea LNG Bunkering Market Concentration & Innovation

This section analyzes the competitive landscape of the South Korea LNG bunkering market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is characterized by a moderate level of concentration, with key players such as Wärtsilä Oyj Abp and Korea Line Corporation holding significant market share. However, the emergence of new entrants and technological advancements are gradually increasing competition.

- Market Share: Wärtsilä Oyj Abp holds an estimated xx% market share in 2025, while Korea Line Corporation holds approximately xx%. Other players contribute to the remaining market share.

- M&A Activity: The past five years have witnessed xx M&A deals in the South Korean LNG bunkering sector, with a total deal value estimated at xx Million. These activities reflect the consolidation trend within the industry and the strategic importance of securing market share and expanding capabilities.

- Innovation Drivers: Stringent environmental regulations, particularly the International Maritime Organization (IMO) 2020 sulfur cap, are driving innovation in LNG bunkering technologies. This is further fueled by advancements in LNG carrier design, bunkering infrastructure, and safety protocols. The pursuit of reduced emissions and improved operational efficiency is also a major driver.

- Regulatory Framework: The South Korean government’s supportive policies towards LNG as a marine fuel, along with investments in LNG bunkering infrastructure, are crucial factors shaping market dynamics. Regulatory changes and policies related to environmental sustainability further influence the market.

- Product Substitutes: While LNG is increasingly preferred due to its lower environmental impact, alternative marine fuels like methanol and ammonia are emerging as potential substitutes, although currently holding a smaller market share. The long-term competitiveness of LNG will depend on its cost-effectiveness and technological advancements.

- End-User Trends: The increasing adoption of LNG as a marine fuel among different vessel types, including tankers, container ships, and ferries, is significantly driving market growth. The shift towards environmentally friendly shipping practices is a major catalyst.

South Korea LNG Bunkering Market Industry Trends & Insights

The South Korea LNG bunkering market is experiencing significant growth driven by a confluence of factors. The stringent environmental regulations, including the IMO 2020 sulfur cap, have prompted a global shift towards cleaner marine fuels, with LNG emerging as a viable alternative. South Korea's proactive approach in developing its LNG bunkering infrastructure, coupled with governmental support and investments, has further facilitated market expansion. Technological advancements, including improvements in LNG bunkering technology and the efficiency of LNG-fueled vessels, are also crucial contributors to market growth.

The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected at xx%. Market penetration is estimated to reach xx% by 2033, signifying substantial growth in LNG adoption within the South Korean maritime sector. The increasing demand for LNG-powered vessels from both domestic and international shipping companies is another significant trend. Competitive dynamics are shaped by the presence of established players alongside emerging companies, leading to strategic partnerships and technological innovations. Consumer preferences are strongly influenced by environmental concerns and operational cost efficiency, further solidifying the demand for LNG as a preferred marine fuel.

Dominant Markets & Segments in South Korea LNG Bunkering Market

The Tanker Fleet segment currently dominates the South Korea LNG bunkering market, holding the largest market share in 2025 (xx%). This dominance is attributed to the significant size of the tanker fleet operating in and around South Korea and the high fuel consumption associated with these vessels.

- Key Drivers for Tanker Fleet Dominance:

- High fuel consumption of tankers.

- Significant number of tankers operating in South Korean waters.

- Early adoption of LNG as a fuel by some tanker operators.

- Government incentives and policies favoring LNG adoption in the tanker segment.

The Container Fleet segment is also expected to experience considerable growth in the coming years, driven by increasing global trade and the growing adoption of LNG-powered container ships. The Bulk and General Cargo Fleet and Ferries and OSV segments are anticipated to exhibit moderate growth, while the "Others" segment may witness relatively slower growth compared to the dominant segments. The specific economic policies and infrastructure development geared towards each segment significantly influence their individual market share and growth trajectories. Further detailed analysis of regional variations and economic drivers within South Korea is required to completely understand the nuanced growth dynamics of each segment.

South Korea LNG Bunkering Market Product Developments

Recent product innovations in the South Korea LNG bunkering market focus on enhancing safety, efficiency, and environmental performance. These include advancements in LNG bunkering equipment, such as improved bunkering arms and automated systems, to minimize risks and optimize the bunkering process. The development of innovative LNG storage and handling technologies for ships also contributes to greater efficiency and reduced emissions. Moreover, the integration of digital technologies for real-time monitoring and data analysis allows for better optimization of LNG bunkering operations, further enhancing the overall market appeal of LNG as a cost-effective and sustainable fuel. The market fit of these innovations is strong, given the industry’s increasing focus on sustainability and operational excellence.

Report Scope & Segmentation Analysis

This report segments the South Korea LNG bunkering market by end-user: Tanker Fleet, Container Fleet, Bulk and General Cargo Fleet, Ferries and OSV, and Others. Each segment's growth projections, market size (in Million), and competitive dynamics are analyzed in detail. The Tanker Fleet segment is projected to experience the highest growth rate due to the large number of tankers and high fuel consumption. The Container Fleet segment is expected to show robust growth driven by increasing global trade. Bulk and General Cargo Fleet and Ferries and OSV segments will also contribute to the overall market growth, although at a potentially slower pace. The "Others" segment includes miscellaneous vessel types and is expected to experience moderate growth.

Key Drivers of South Korea LNG Bunkering Market Growth

Several factors drive the growth of the South Korea LNG bunkering market. Stringent environmental regulations, particularly the IMO 2020 sulfur cap, are significantly pushing the adoption of cleaner fuels, like LNG. Government incentives and support for the development of LNG bunkering infrastructure play a pivotal role. The increasing availability of LNG as a marine fuel, along with improvements in LNG bunkering technologies, also contribute to the market's expansion. Furthermore, the growing awareness among shipping companies regarding the environmental and economic benefits of LNG further propels market growth.

Challenges in the South Korea LNG Bunkering Market Sector

Despite its growth potential, the South Korea LNG bunkering market faces several challenges. The high initial investment required for LNG-fueled vessels and bunkering infrastructure can be a significant barrier to entry for some operators. Supply chain constraints in securing sufficient LNG supply and potential price volatility can also impact market growth. Furthermore, competition from alternative marine fuels poses a challenge to LNG's long-term dominance. These challenges necessitate strategic planning and proactive measures to overcome these hurdles and ensure sustainable market development.

Emerging Opportunities in South Korea LNG Bunkering Market

The South Korea LNG bunkering market presents several promising opportunities. The expansion of LNG bunkering infrastructure to new ports and regions will create new market avenues. Technological advancements in LNG bunkering technologies, such as the development of automated and remote-controlled bunkering systems, will also drive growth. The exploration of new markets for LNG-powered vessels, such as short-sea shipping and coastal transport, will further contribute to market expansion. Finally, exploring collaborations and partnerships among stakeholders will strengthen the industry's overall growth trajectory.

Leading Players in the South Korea LNG Bunkering Market Market

- Wärtsilä Oyj Abp

- Korea Line Corporation

Key Developments in South Korea LNG Bunkering Market Industry

- 2022-Q4: Significant investment in new LNG bunkering infrastructure announced by a major port authority.

- 2023-Q1: Successful completion of the first LNG bunkering operation at a new port facility.

- 2023-Q3: Launch of a new LNG-fueled container ship by a major shipping company.

- 2024-Q2: Partnership formed between a major energy company and a shipping company to enhance LNG bunkering services.

Further key developments will be included in the full report.

Strategic Outlook for South Korea LNG Bunkering Market Market

The South Korea LNG bunkering market is poised for robust growth driven by stringent environmental regulations, expanding infrastructure, and technological advancements. The continued focus on sustainability, coupled with government support and investments, will further accelerate market expansion. Opportunities for strategic partnerships and technological innovations are abundant, promising substantial growth potential in the years to come. The market's future success hinges on addressing existing challenges through collaborative efforts and proactive measures. This creates a positive outlook for investors and market participants willing to adapt to the dynamic nature of this sector.

South Korea LNG Bunkering Market Segmentation

-

1. End-User

- 1.1. Tanker Fleet

- 1.2. Container Fleet

- 1.3. Bulk and General Cargo Fleet

- 1.4. Ferries and OSV

- 1.5. Others

South Korea LNG Bunkering Market Segmentation By Geography

- 1. South Korea

South Korea LNG Bunkering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Demand across Industrial Sector4.; Remote Location of Several Industries and the Unreliability of the Power Supply

- 3.3. Market Restrains

- 3.3.1. 4.; High Capital and Operational Expenditures

- 3.4. Market Trends

- 3.4.1. Upcoming Projects is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Tanker Fleet

- 5.1.2. Container Fleet

- 5.1.3. Bulk and General Cargo Fleet

- 5.1.4. Ferries and OSV

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Wartsila Oyj Abp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Korea Line Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.1 Wartsila Oyj Abp

List of Figures

- Figure 1: South Korea LNG Bunkering Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea LNG Bunkering Market Share (%) by Company 2024

List of Tables

- Table 1: South Korea LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 3: South Korea LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: South Korea LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Korea LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: South Korea LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea LNG Bunkering Market?

The projected CAGR is approximately > 2.20%.

2. Which companies are prominent players in the South Korea LNG Bunkering Market?

Key companies in the market include Wartsila Oyj Abp, Korea Line Corporation.

3. What are the main segments of the South Korea LNG Bunkering Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Demand across Industrial Sector4.; Remote Location of Several Industries and the Unreliability of the Power Supply.

6. What are the notable trends driving market growth?

Upcoming Projects is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; High Capital and Operational Expenditures.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea LNG Bunkering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea LNG Bunkering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea LNG Bunkering Market?

To stay informed about further developments, trends, and reports in the South Korea LNG Bunkering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence