Key Insights

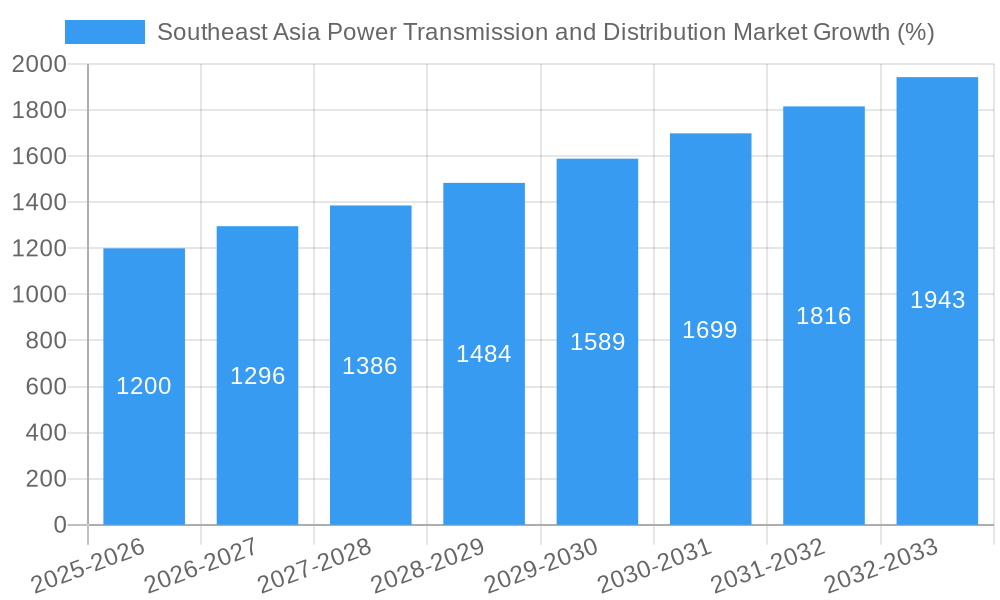

The Southeast Asia power transmission and distribution market is experiencing robust growth, driven by increasing energy demand fueled by rapid urbanization and industrialization across the region. A compound annual growth rate (CAGR) exceeding 8% from 2019 to 2033 indicates a significant expansion, with the market size projected to reach substantial figures. Key drivers include government initiatives promoting renewable energy integration, upgrades to aging infrastructure, and the rising adoption of smart grid technologies to improve efficiency and reliability. The transmission segment is expected to witness higher growth compared to distribution due to large-scale investments in high-voltage transmission lines to connect remote renewable energy sources to load centers. Growth is particularly strong in countries like China, India, and Vietnam, reflecting their massive energy consumption and ongoing infrastructure development programs. The utilities sector dominates the application segment, reflecting the crucial role of power transmission and distribution in ensuring reliable electricity supply. However, growth is also observed in the industrial and commercial sectors, spurred by rising energy demands from manufacturing and business activities. While challenges such as regulatory hurdles and geographical constraints exist, the overall market outlook remains positive, driven by consistent government support and substantial private sector investment.

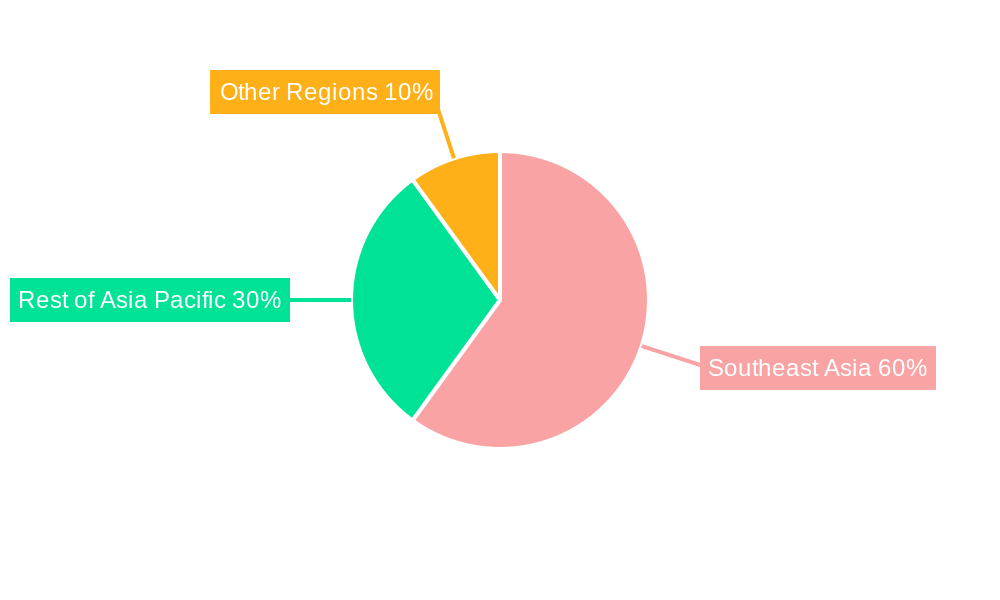

The market segmentation reveals a diverse landscape, with the Utilities sector leading in application, followed by Industrial and Commercial segments. Transmission equipment holds a larger market share compared to distribution, owing to significant investments in long-distance power transfer infrastructure. Key players, such as Toshiba, Mitsubishi Electric, and General Electric, are strategically positioned to benefit from this growth, leveraging their technological expertise and established market presence. Competition is expected to intensify as new players enter the market, leading to innovation and price optimization. The Asia Pacific region, particularly Southeast Asia, is the focal point for growth, driven by its substantial energy needs and ongoing economic expansion. Countries like Vietnam, the Philippines, and Indonesia are experiencing particularly rapid growth, as they invest heavily in upgrading their power infrastructure to meet the increasing demands of their growing economies. This growth trajectory is further reinforced by continuous government investment and a positive regulatory environment, making Southeast Asia an attractive market for both established and emerging players in the power transmission and distribution sector.

Southeast Asia Power Transmission and Distribution Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Southeast Asia power transmission and distribution market, offering invaluable insights for industry stakeholders, investors, and strategic planners. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The report utilizes a robust methodology, incorporating historical data (2019-2024) and predictive modeling to deliver accurate market sizing and growth projections. Key players such as Toshiba Corporation, Mitsubishi Electric Corporation, Vietnam Electricity, Romelectro Group, and General Electric Company are profiled, alongside analysis of market segments (transmission & distribution) and applications (utilities, industrial, commercial, residential).

Southeast Asia Power Transmission and Distribution Market Concentration & Innovation

This section analyzes the competitive landscape of the Southeast Asia power transmission and distribution market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities.

The market exhibits a moderately concentrated structure, with a few large players holding significant market share. For example, Toshiba Corporation and Mitsubishi Electric Corporation likely hold a combined xx% market share in 2025, driven by their established presence and technological expertise. Smaller players compete by focusing on niche applications or geographical areas. Innovation is driven by the need for improved grid efficiency, renewable energy integration, and smart grid technologies. Regulatory frameworks vary across Southeast Asian nations, impacting market access and investment decisions. The emergence of smart grid technologies represents a key substitute for traditional power transmission and distribution systems, while end-user trends towards greater energy efficiency and sustainability shape market demand. M&A activity in the sector remains relatively modest, with deal values averaging around xx Million USD annually in recent years, reflecting both consolidation opportunities and strategic partnerships among players. Key indicators of future M&A activity might include increasing demand for grid upgrades or the rise of smart grid technologies.

Southeast Asia Power Transmission and Distribution Market Industry Trends & Insights

This section explores key market trends influencing growth within the Southeast Asia power transmission and distribution market. The market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several factors: increasing energy demand fueled by rapid economic development and urbanization across the region; the growing adoption of renewable energy sources, requiring significant upgrades to existing transmission and distribution infrastructure; government initiatives promoting energy efficiency and grid modernization; and technological advancements in smart grid technologies, enabling improved grid management and reduced energy losses. Market penetration of smart grid solutions is expected to increase from xx% in 2025 to xx% by 2033. However, competitive dynamics are characterized by both intense competition among established players and the emergence of new entrants, especially in the renewable energy and smart grid sectors. Consumer preferences are shifting towards reliable, affordable, and sustainable energy solutions, which influence investment decisions and technology adoption within the market.

Dominant Markets & Segments in Southeast Asia Power Transmission and Distribution Market

This section identifies the leading segments and regions within the Southeast Asia power transmission and distribution market. Indonesia and Vietnam are anticipated to be the dominant markets, driven by their large populations, rapid economic growth, and significant investments in infrastructure development. The transmission segment is expected to hold a larger market share compared to the distribution segment, primarily due to the considerable investments required for large-scale transmission projects connecting renewable energy sources to consumption centers.

- Key Drivers for Indonesia & Vietnam:

- High population growth and rising energy demand.

- Government investments in infrastructure development and grid modernization.

- Increasing adoption of renewable energy sources.

- Favorable regulatory environment promoting private sector participation.

The utilities segment will be the largest application segment, accounting for a significant portion of the overall market. However, the industrial and commercial segments are projected to experience faster growth rates driven by the increasing energy consumption of industrial and commercial establishments and the growing demand for reliable power supply.

Southeast Asia Power Transmission and Distribution Market Product Developments

Recent product developments focus on enhancing grid reliability, improving efficiency, and integrating renewable energy sources. Advancements in High Voltage Direct Current (HVDC) technology, smart grid solutions, and digital grid management systems are transforming the landscape. These innovations enable improved power transmission over long distances, reduced energy losses, and greater grid stability. The market fit for these advanced technologies is strong, given the increasing need to accommodate large-scale renewable energy integration and enhance grid resilience.

Report Scope & Segmentation Analysis

The report segments the Southeast Asia power transmission and distribution market by type (Transmission and Distribution) and application (Utilities, Industrial, Commercial, and Residential). The transmission segment is projected to grow at a CAGR of xx%, while the distribution segment is estimated to witness a CAGR of xx% during the forecast period. Within applications, the utilities segment dominates, followed by industrial and commercial sectors. The residential segment's growth is comparatively slower, although still significant in terms of absolute market size. Each segment’s competitive dynamics vary, reflecting the specific needs and technological requirements of each user group.

Key Drivers of Southeast Asia Power Transmission and Distribution Market Growth

The growth of the Southeast Asia power transmission and distribution market is primarily fueled by several factors: increasing urbanization and industrialization leading to heightened electricity demand; government initiatives promoting renewable energy integration and grid modernization; investments in large-scale power generation projects requiring robust transmission infrastructure; and technological advancements enabling improved grid efficiency and reliability. For instance, government policies incentivizing renewable energy integration are directly driving demand for upgraded transmission and distribution networks to accommodate the influx of solar and wind power.

Challenges in the Southeast Asia Power Transmission and Distribution Market Sector

The market faces several challenges. These include: high initial capital costs associated with grid upgrades and expansion; the need to navigate complex regulatory landscapes across diverse nations; the risk of geographical constraints impacting project development; and potential supply chain disruptions affecting the timely procurement of equipment and materials. These factors can lead to project delays and cost overruns, impacting overall market growth. For example, securing land rights for new transmission lines or obtaining necessary permits can significantly delay project implementation.

Emerging Opportunities in Southeast Asia Power Transmission and Distribution Market

Significant opportunities exist in the development and deployment of smart grid technologies, particularly in the areas of advanced metering infrastructure (AMI), distribution automation, and grid modernization. The integration of renewable energy sources, including solar, wind, and hydro, creates opportunities for specialized transmission and distribution solutions. Furthermore, the growing demand for energy storage solutions and microgrids presents opportunities for companies offering associated equipment and services. This also opens up avenues for digitalization and data analytics to enhance grid optimization and operational efficiency.

Leading Players in the Southeast Asia Power Transmission and Distribution Market Market

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Vietnam Electricity

- Romelectro Group

- General Electric Company

Key Developments in Southeast Asia Power Transmission and Distribution Market Industry

- March 2022: The SunCable-led 'Australia-Asia PowerLink' HVDC project received a USD 152 Million investment, accelerating the construction of an undersea cable delivering solar power from Australia to Singapore.

- 2021: The Indonesian government granted a subsea permit to the Australia-Asia PowerLink project, recommending a route through Indonesian waters. This project involves a significant solar park, battery storage, and a long-distance power transmission line. These developments signify major investments in cross-border power transmission and the integration of renewable energy sources, influencing the market's growth trajectory and technological advancements.

Strategic Outlook for Southeast Asia Power Transmission and Distribution Market Market

The Southeast Asia power transmission and distribution market is poised for significant growth, driven by increasing energy demand, renewable energy integration, and ongoing grid modernization efforts. The adoption of smart grid technologies and innovative solutions will play a key role in shaping the future of the market. Strategic partnerships, investments in infrastructure development, and a focus on technological advancements will be crucial for success in this dynamic and rapidly evolving market. The market’s future potential is substantial, particularly in countries with ambitious renewable energy targets and robust economic growth.

Southeast Asia Power Transmission and Distribution Market Segmentation

-

1. Type

- 1.1. Transmission

- 1.2. Distribution

-

2. Geography

- 2.1. Vietnam

- 2.2. Indonesia

- 2.3. Malaysia

- 2.4. Thailand

- 2.5. Rest of Southeast Asia

Southeast Asia Power Transmission and Distribution Market Segmentation By Geography

- 1. Vietnam

- 2. Indonesia

- 3. Malaysia

- 4. Thailand

- 5. Rest of Southeast Asia

Southeast Asia Power Transmission and Distribution Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Hydropower Generation4.; Favorable Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Transmission Type Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Transmission

- 5.1.2. Distribution

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Vietnam

- 5.2.2. Indonesia

- 5.2.3. Malaysia

- 5.2.4. Thailand

- 5.2.5. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.3.2. Indonesia

- 5.3.3. Malaysia

- 5.3.4. Thailand

- 5.3.5. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Vietnam Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Transmission

- 6.1.2. Distribution

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Vietnam

- 6.2.2. Indonesia

- 6.2.3. Malaysia

- 6.2.4. Thailand

- 6.2.5. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Indonesia Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Transmission

- 7.1.2. Distribution

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Vietnam

- 7.2.2. Indonesia

- 7.2.3. Malaysia

- 7.2.4. Thailand

- 7.2.5. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Malaysia Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Transmission

- 8.1.2. Distribution

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Vietnam

- 8.2.2. Indonesia

- 8.2.3. Malaysia

- 8.2.4. Thailand

- 8.2.5. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Thailand Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Transmission

- 9.1.2. Distribution

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Vietnam

- 9.2.2. Indonesia

- 9.2.3. Malaysia

- 9.2.4. Thailand

- 9.2.5. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Southeast Asia Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Transmission

- 10.1.2. Distribution

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Vietnam

- 10.2.2. Indonesia

- 10.2.3. Malaysia

- 10.2.4. Thailand

- 10.2.5. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. China Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2019-2031

- 13. India Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Southeast Asia Power Transmission and Distribution Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Toshiba Corporation

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Mitsubishi Electric Corporation

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Vietnam Electricity

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Romelectro Group

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 General Electric Company

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.1 Toshiba Corporation

List of Figures

- Figure 1: Southeast Asia Power Transmission and Distribution Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Southeast Asia Power Transmission and Distribution Market Share (%) by Company 2024

List of Tables

- Table 1: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Type 2019 & 2032

- Table 5: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 7: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Region 2019 & 2032

- Table 9: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Country 2019 & 2032

- Table 11: China Southeast Asia Power Transmission and Distribution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Southeast Asia Power Transmission and Distribution Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: Japan Southeast Asia Power Transmission and Distribution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Southeast Asia Power Transmission and Distribution Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: India Southeast Asia Power Transmission and Distribution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Southeast Asia Power Transmission and Distribution Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: South Korea Southeast Asia Power Transmission and Distribution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Southeast Asia Power Transmission and Distribution Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Taiwan Southeast Asia Power Transmission and Distribution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan Southeast Asia Power Transmission and Distribution Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: Australia Southeast Asia Power Transmission and Distribution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Southeast Asia Power Transmission and Distribution Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Southeast Asia Power Transmission and Distribution Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Southeast Asia Power Transmission and Distribution Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Type 2019 & 2032

- Table 27: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 29: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Country 2019 & 2032

- Table 31: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Type 2019 & 2032

- Table 33: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 35: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Country 2019 & 2032

- Table 37: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Type 2019 & 2032

- Table 39: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 41: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Country 2019 & 2032

- Table 43: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Type 2019 & 2032

- Table 45: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 47: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Country 2019 & 2032

- Table 49: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Type 2019 & 2032

- Table 51: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 52: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 53: Southeast Asia Power Transmission and Distribution Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Southeast Asia Power Transmission and Distribution Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Power Transmission and Distribution Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Southeast Asia Power Transmission and Distribution Market?

Key companies in the market include Toshiba Corporation, Mitsubishi Electric Corporation, Vietnam Electricity, Romelectro Group, General Electric Company.

3. What are the main segments of the Southeast Asia Power Transmission and Distribution Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Hydropower Generation4.; Favorable Government Policies.

6. What are the notable trends driving market growth?

Transmission Type Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

In March 2022, the SunCable led 'Australia-Asia PowerLink' HVDC project, received a significant boost as Australian billionaires Mike Cannon-Brookes and Andrew Forrest invested a further USD 152 million into the undersea cable link construction meant to deliver solar-generated power from Australia to Singapore. According to Sun Cable, the solar energy developer in Australia, the USD 152 million will accelerate the construction of Australia-Asia PowerLink (AA PowerLink).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Power Transmission and Distribution Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Power Transmission and Distribution Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Power Transmission and Distribution Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Power Transmission and Distribution Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence