Key Insights

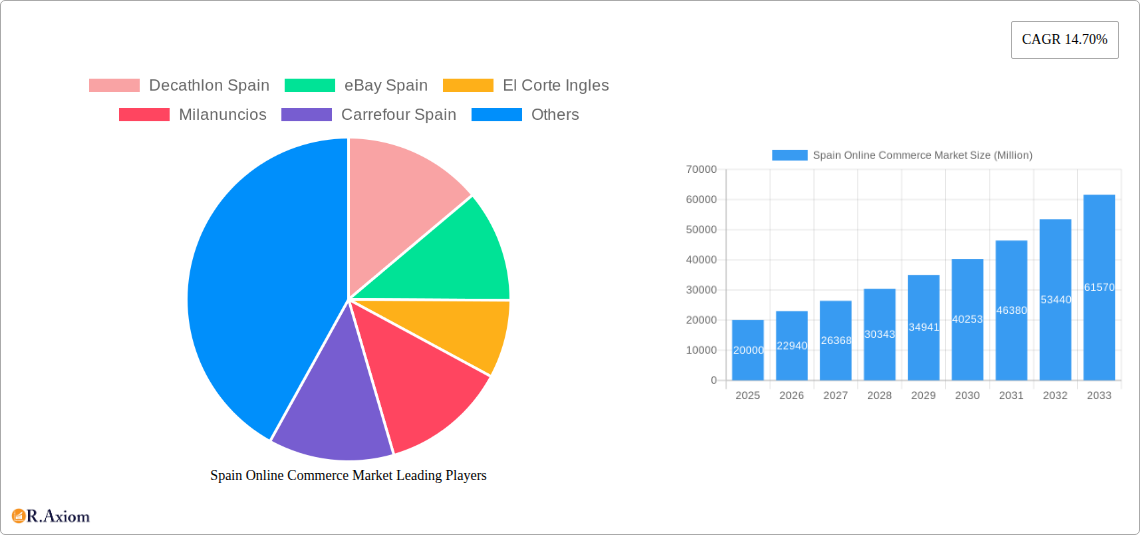

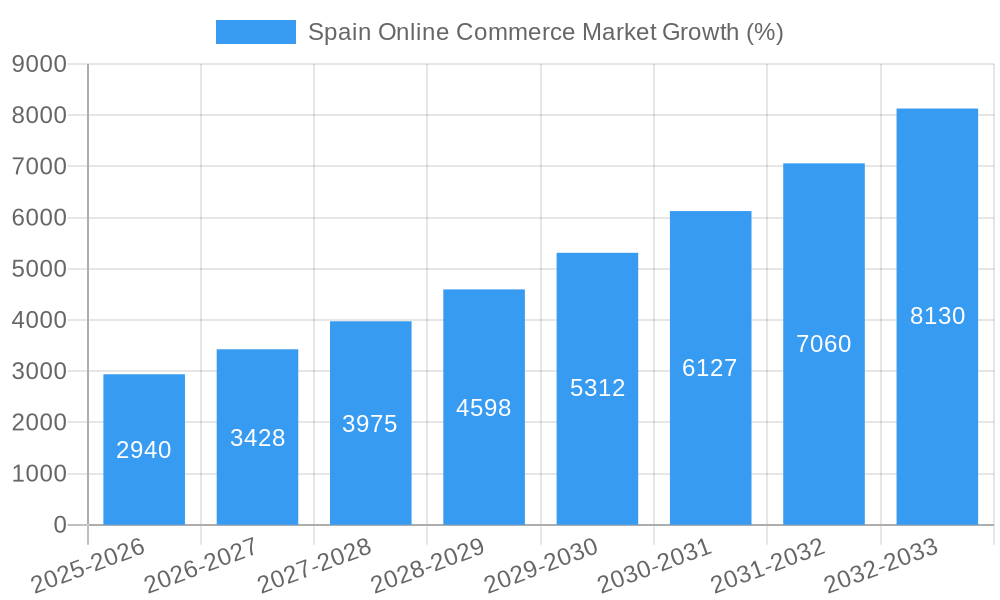

The Spanish online commerce market exhibits robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 14.70% from 2025 to 2033. This expansion is fueled by several key drivers: increasing internet and smartphone penetration, rising consumer preference for convenience and ease of shopping, and the expanding adoption of e-commerce among older demographics. Furthermore, the diverse range of online retailers, from major international players like Amazon Spain and AliExpress to established Spanish companies such as Decathlon, El Corte Ingles, and Carrefour, fosters competition and innovation, continually improving the online shopping experience. The market segmentation by application is likely diverse, encompassing electronics, apparel, groceries, and other consumer goods. The thriving ecosystem benefits from a well-developed logistics infrastructure and a supportive regulatory environment, all contributing to the market's remarkable trajectory.

However, the market faces certain restraints. Increased competition could lead to price wars, impacting profitability for some retailers. Concerns about cybersecurity and data privacy can influence consumer trust. Furthermore, the digital divide, particularly amongst older or less digitally savvy consumers, could limit market penetration. Despite these challenges, the strong growth trajectory is expected to continue, driven by ongoing technological advancements, innovative marketing strategies, and the evolving shopping habits of Spanish consumers. To illustrate, assuming a 2025 market size of €20 billion (based on a typical market size for a developed nation with a similar population and economic structure), the market size is projected to surpass €70 billion by 2033. This robust growth makes the Spanish online commerce market an attractive investment destination.

This detailed report provides a comprehensive analysis of the Spain online commerce market, encompassing market size, growth projections, key players, industry trends, and future opportunities. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is designed for industry stakeholders, investors, and businesses seeking to understand and capitalize on the dynamic Spanish e-commerce landscape.

Spain Online Commerce Market Market Concentration & Innovation

The Spanish online commerce market exhibits a moderately concentrated structure, with a few dominant players alongside numerous smaller businesses. Amazon Spain, El Corte Ingles, and AliExpress hold significant market share, exceeding xx%, xx%, and xx% respectively in 2025. However, the market also shows significant dynamism, with smaller players specializing in niche segments. Innovation is driven by technological advancements, including AI-powered personalization, improved logistics, and the emergence of new payment solutions.

The regulatory framework plays a crucial role, influencing data privacy, consumer protection, and taxation. Product substitutes, such as traditional brick-and-mortar stores, are increasingly challenged by the convenience and reach of online commerce. End-user trends point toward increased mobile commerce and the adoption of omnichannel strategies by retailers. M&A activity in the sector has been moderate, with deal values averaging xx Million Euros in recent years. Key M&A activities include:

- Consolidation among smaller players to enhance market reach.

- Strategic acquisitions by larger firms to expand product portfolios and geographical presence.

Spain Online Commerce Market Industry Trends & Insights

The Spanish online commerce market is experiencing robust growth, driven by rising internet and smartphone penetration, increasing consumer trust in online transactions, and the expanding adoption of digital payment methods. The CAGR for the forecast period (2025-2033) is projected at xx%, exceeding the global average. Market penetration is estimated at xx% in 2025, indicating significant growth potential.

Technological disruptions, including the rise of AI, big data analytics, and mobile commerce, are reshaping the competitive landscape. Consumer preferences are shifting towards personalized experiences, seamless omnichannel integration, and sustainable practices. Intense competition necessitates continuous innovation and strategic agility for businesses to maintain their market positions.

Dominant Markets & Segments in Spain Online Commerce Market

The Spanish online commerce market is characterized by strong regional variations, with major metropolitan areas like Madrid and Barcelona accounting for the largest share of online sales. The dominance of these regions is attributed to:

- Higher internet and smartphone penetration rates

- Stronger consumer purchasing power

- Well-developed logistics infrastructure

Key Drivers for Regional Dominance:

- Economic Factors: Higher disposable income and economic activity in major urban centers drive online spending.

- Infrastructure: Robust internet connectivity and efficient delivery networks facilitate seamless e-commerce transactions.

- Consumer Behavior: Urban populations exhibit higher levels of familiarity and comfort with online shopping.

Spain Online Commerce Market Product Developments

Product innovation is a key aspect of the Spanish online commerce market. Retailers are focusing on enhancing product offerings, personalization features, and convenient payment options. The adoption of AI-powered recommendation engines, personalized marketing campaigns, and augmented reality (AR) shopping experiences is transforming the customer journey. This focus on technological advancement improves market fit and builds competitive advantage.

Report Scope & Segmentation Analysis

This report segments the Spain online commerce market by product type (e.g., electronics, apparel, groceries, etc.), consumer demographics (e.g., age, income), and geographical regions. The market size and growth projections for each segment are provided. The competitive dynamics within each segment are analyzed, highlighting market leaders, emerging players, and growth opportunities. Each segment shows strong growth potential, driven by varying factors like the increasing adoption of smartphones and internet usage, the ongoing rise of e-commerce, and shifting consumer preferences.

Key Drivers of Spain Online Commerce Market Growth

The growth of the Spain online commerce market is fueled by several key drivers. The rapid increase in internet and mobile penetration is a primary catalyst. Additionally, the rising adoption of digital payment methods, coupled with growing consumer trust in online transactions, significantly boosts market growth. Government initiatives to promote digitalization and supportive regulatory frameworks contribute to the sector's expansion.

Challenges in the Spain Online Commerce Market Sector

Despite its robust growth, the Spanish online commerce market faces challenges. High logistics costs, especially in rural areas, can impact profitability. The need for robust cybersecurity measures to protect against data breaches and fraud poses another challenge. Increasing competition from international players and the rising dominance of large marketplaces further intensifies the pressures on smaller businesses.

Emerging Opportunities in Spain Online Commerce Market

The Spanish online commerce market presents significant opportunities. Growth in niche segments, like sustainable and ethically sourced products, offers untapped potential. The adoption of new technologies, such as blockchain for enhanced security and transparency, is poised to revolutionize the market. The rise of social commerce, enabling direct interaction between brands and consumers, presents another avenue for growth.

Leading Players in the Spain Online Commerce Market Market

- Decathlon Spain

- eBay Spain

- El Corte Ingles

- Milanuncios

- Carrefour Spain

- Media Markt Spain

- Leroy Merlin

- PC Componentes

- Ali Express

- Amazon Spain

Key Developments in Spain Online Commerce Market Industry

- November 2021: AliExpress launched a supermarket service in its Spanish app, partnering with Lola Market, offering thousands of products from various Spanish supermarket chains. This significantly expanded product categories and attracted new customer segments.

- April 2022: Media Markt installed Bitcoin ATMs in twelve Austrian branches, potentially indicating a future expansion of this payment method to Spain.

- April 2022: Veepee expanded its services in Spain, leveraging its flash-sale model and Re-Cycle initiative (focused on circularity) to attract environmentally conscious consumers.

- May 2022: The increasing use of AI in fashion e-commerce in Spain is impacting business strategies by enhancing product recommendations, optimizing search behavior analysis, and streamlining inventory management.

Strategic Outlook for Spain Online Commerce Market Market

The Spain online commerce market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and supportive government policies. Expanding into niche markets, leveraging AI and data analytics, and focusing on sustainable practices will be crucial for businesses seeking long-term success. The market's dynamic nature presents opportunities for both established players and innovative startups to capture market share and contribute to the sector's sustained expansion.

Spain Online Commerce Market Segmentation

-

1. Industry vertical

- 1.1. Beauty & Personal Care

- 1.2. Consumer Electronics

- 1.3. Fashion & Apparel

- 1.4. Food & Beverage

- 1.5. Furniture & Home

- 1.6. Others (Toys, DIY, Media, etc.)

-

2. Type

- 2.1. B2C E-commerce

- 2.2. B2B E-commerce

Spain Online Commerce Market Segmentation By Geography

- 1. Spain

Spain Online Commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Smartphone Users and Increasing Use of Healthcare Applications; Rising Prevalence of Chronic Disorders

- 3.3. Market Restrains

- 3.3.1. Lack of Structured Data in the Healthcare Industry; Concerns Regarding Data Privacy

- 3.4. Market Trends

- 3.4.1. Increasing smartphone penetration

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Online Commerce Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Industry vertical

- 5.1.1. Beauty & Personal Care

- 5.1.2. Consumer Electronics

- 5.1.3. Fashion & Apparel

- 5.1.4. Food & Beverage

- 5.1.5. Furniture & Home

- 5.1.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. B2C E-commerce

- 5.2.2. B2B E-commerce

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Industry vertical

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Decathlon Spain

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 eBay Spain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 El Corte Ingles

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Milanuncios

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Carrefour Spain

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Media Markt Spain

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Leroy Merlin

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PC Componentes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ali Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amazon Spain

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Decathlon Spain

List of Figures

- Figure 1: Spain Online Commerce Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Online Commerce Market Share (%) by Company 2024

List of Tables

- Table 1: Spain Online Commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Online Commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Spain Online Commerce Market Revenue Million Forecast, by Industry vertical 2019 & 2032

- Table 4: Spain Online Commerce Market Volume K Unit Forecast, by Industry vertical 2019 & 2032

- Table 5: Spain Online Commerce Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Spain Online Commerce Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 7: Spain Online Commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Spain Online Commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Spain Online Commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Spain Online Commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Spain Online Commerce Market Revenue Million Forecast, by Industry vertical 2019 & 2032

- Table 12: Spain Online Commerce Market Volume K Unit Forecast, by Industry vertical 2019 & 2032

- Table 13: Spain Online Commerce Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Spain Online Commerce Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 15: Spain Online Commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Spain Online Commerce Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Online Commerce Market?

The projected CAGR is approximately 14.70%.

2. Which companies are prominent players in the Spain Online Commerce Market?

Key companies in the market include Decathlon Spain, eBay Spain, El Corte Ingles, Milanuncios, Carrefour Spain, Media Markt Spain, Leroy Merlin, PC Componentes, Ali Express, Amazon Spain.

3. What are the main segments of the Spain Online Commerce Market?

The market segments include Industry vertical, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Smartphone Users and Increasing Use of Healthcare Applications; Rising Prevalence of Chronic Disorders.

6. What are the notable trends driving market growth?

Increasing smartphone penetration.

7. Are there any restraints impacting market growth?

Lack of Structured Data in the Healthcare Industry; Concerns Regarding Data Privacy.

8. Can you provide examples of recent developments in the market?

May 2022- Artificial intelligence (AI) has changed the pattern of fashion business strategies by artificial intelligence (AI). There are numerous ways in which artificial intelligence has aided the fashion industry. This includes recognizing product features using predictive analytics and computer vision. The use of AI in the fashion industry has grown, primarily to analyze search behaviors and provide similar product recommendations based on consumer preferences.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Online Commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Online Commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Online Commerce Market?

To stay informed about further developments, trends, and reports in the Spain Online Commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence