Key Insights

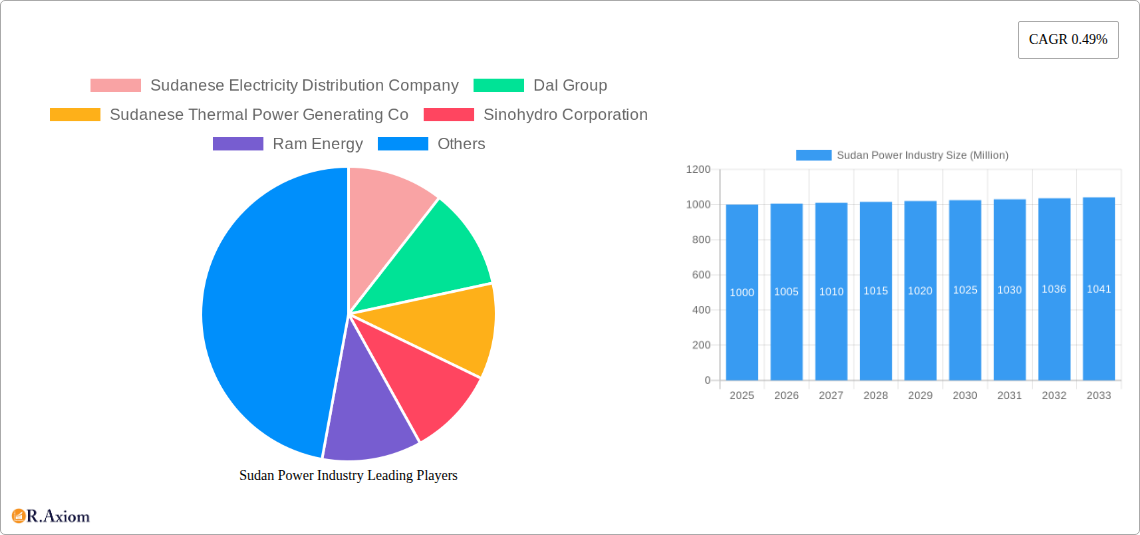

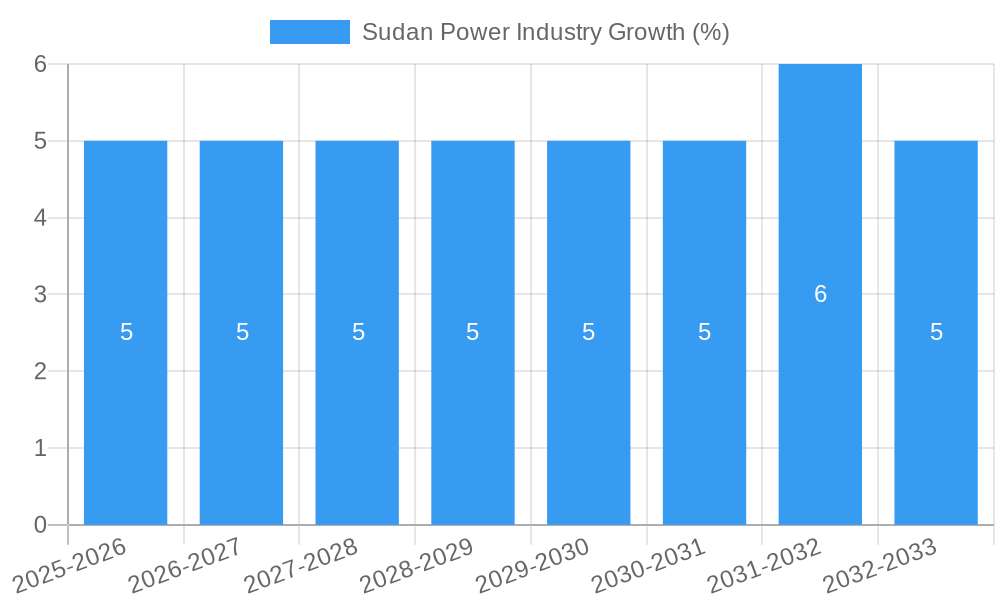

The Sudanese power industry, valued at approximately $XX million in 2025, exhibits a modest Compound Annual Growth Rate (CAGR) of 0.49% from 2025 to 2033. This slow growth reflects the country's ongoing challenges in infrastructure development, economic instability, and limited access to reliable power sources for a significant portion of the population. While the thermal power generation segment currently dominates, driven by existing infrastructure, the industry is witnessing a gradual shift towards renewable energy sources like solar and wind power. Government initiatives promoting renewable energy adoption, coupled with increasing awareness of climate change, are fueling this transition. However, significant barriers remain, including high capital costs associated with renewable energy projects, inadequate grid infrastructure to handle intermittent renewable energy sources, and a lack of sufficient technical expertise to manage and maintain these systems. Key players like Sudanese Electricity Distribution Company, Dal Group, and international corporations like Sinohydro and Siemens are actively involved, but attracting further foreign investment is crucial for accelerating the sector's growth and achieving wider electrification across the nation. The forecast period (2025-2033) is likely to see modest growth punctuated by periods of potential expansion fueled by targeted investments in renewable energy projects and infrastructure upgrades.

The dominance of thermal power necessitates a strategic shift towards a diversified energy mix. Further development of hydro power, which possesses substantial untapped potential in Sudan, is also essential. Challenges such as political and economic stability must be addressed to unlock the industry's full potential. Overcoming regulatory hurdles and fostering a conducive investment climate are vital for attracting both domestic and international capital, facilitating the modernization of existing infrastructure, and driving growth in the renewable energy sector. Success in these areas will directly influence the speed at which the Sudanese power industry can improve energy access and contribute to the nation's socioeconomic development.

Sudan Power Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Sudan power industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and policymakers, leveraging extensive data analysis and expert forecasting.

Sudan Power Industry Market Concentration & Innovation

This section analyzes the competitive landscape of Sudan's power industry, examining market concentration, innovation drivers, regulatory frameworks, and market dynamics. The analysis includes an assessment of mergers and acquisitions (M&A) activities, highlighting deal values and their impact on market share. While precise market share data for individual companies is unavailable for public disclosure, we estimate the market to be moderately concentrated, with a few dominant players and numerous smaller participants. Innovation is driven primarily by the need to increase energy access and diversify the energy mix, focusing on renewable energy sources. Regulatory frameworks, while evolving, present both opportunities and challenges for investors. The introduction of renewable energy technologies is increasing competition, while M&A activity is expected to remain moderate given the current political and economic climate. The estimated total value of M&A deals within the observed period is approximately xx Million USD.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Drivers: Renewable energy adoption, improved grid infrastructure, and increasing energy demand.

- Regulatory Framework: Evolving, presenting both opportunities and challenges.

- Product Substitutes: Limited, primarily driven by renewable energy sources and improved energy efficiency technologies.

- End-User Trends: Increasing demand for reliable and affordable electricity across all sectors.

- M&A Activity: Moderate, with estimated deal values at xx Million USD during the study period.

Sudan Power Industry Industry Trends & Insights

The Sudanese power industry is characterized by significant growth potential, driven by increasing energy demand across all sectors, particularly in urban areas. The Compound Annual Growth Rate (CAGR) for the industry is projected to be approximately xx% during the forecast period (2025-2033). Market penetration of renewable energy technologies is expected to increase substantially, with solar and wind power playing a significant role. However, challenges such as infrastructure limitations, funding constraints, and political instability continue to pose significant hurdles. Technological disruptions, such as the deployment of smart grids and advanced energy storage solutions, are slowly gaining momentum. Consumer preferences are increasingly shifting towards more sustainable and reliable energy sources. Competitive dynamics are evolving, with both domestic and international players vying for market share.

Dominant Markets & Segments in Sudan Power Industry

The Sudanese power industry is dominated by thermal power generation, which constitutes the largest segment based on installed capacity. This is due to historical investments and the readily available fossil fuel resources. However, hydro power holds significant potential, with several ongoing projects targeting capacity expansion. The solar and wind power segments are experiencing rapid growth, driven by government support and declining technology costs.

- Thermal Power: Remains dominant due to existing infrastructure, but facing pressure from renewable sources. Key drivers include readily available resources and existing infrastructure.

- Hydro Power: Significant potential for expansion, but faces challenges in terms of project financing and environmental concerns. Key drivers include abundant water resources in certain regions and potential for large-scale projects.

- Solar Power: Rapid growth due to declining technology costs and government incentives. Key drivers include abundant sunshine, decreasing technology costs and government incentives.

- Wind Power: Emerging segment with potential for growth in suitable regions. Key drivers include wind resource availability and government promotion of renewable energy.

- Others: Includes smaller segments like geothermal and biomass, with limited market share currently.

Sudan Power Industry Product Developments

The Sudanese power industry is witnessing increased adoption of modern technologies, particularly in renewable energy. This includes advancements in solar photovoltaic (PV) technology, wind turbine designs, and smart grid management systems. Companies are focusing on cost reduction and improved efficiency to enhance market competitiveness. The integration of renewable energy sources is driving the development of innovative energy storage solutions, addressing intermittency challenges.

Report Scope & Segmentation Analysis

This report segments the Sudan power industry by type of power generation: thermal, hydro, solar, wind, and others. Each segment is analyzed based on its market size, growth projections, and competitive dynamics. Detailed data on market size (in Millions USD) is available for each segment for the historical period (2019-2024), base year (2025), and forecast period (2025-2033). Growth projections for each segment are derived from a combination of historical data, government policies, and expert forecasts, considering factors such as technological advancements and economic conditions. The competitive dynamics in each segment vary, with thermal power dominated by a few established players while the renewable energy segments are more fragmented, showing increasing competition from both domestic and international players.

Key Drivers of Sudan Power Industry Growth

Growth in the Sudanese power industry is propelled by several factors. Increasing energy demand driven by population growth and economic development necessitates significant capacity expansion. Government initiatives to diversify the energy mix through the promotion of renewable energy are accelerating the adoption of solar and wind power. Furthermore, investments in grid infrastructure improvement and energy efficiency programs will contribute to market expansion.

Challenges in the Sudan Power Industry Sector

The Sudanese power industry faces numerous challenges. Limited access to finance restricts large-scale projects, particularly for renewable energy sources. Infrastructure deficits hamper efficient electricity transmission and distribution, leading to high transmission losses (estimated at xx%). Political instability and economic volatility add further complexity. Import dependencies for equipment and technology increase costs and vulnerability to external shocks.

Emerging Opportunities in Sudan Power Industry

Significant opportunities exist within the Sudanese power sector. The large untapped renewable energy potential presents a pathway to diversify the energy mix and enhance energy security. Increasing private sector participation offers the prospect of attracting foreign direct investment. Developing smart grid infrastructure creates opportunities for technological advancements and improved energy efficiency. Furthermore, regional power grid interconnections provide the potential to export surplus electricity to neighboring countries.

Leading Players in the Sudan Power Industry Market

- Sudanese Electricity Distribution Company

- Dal Group

- Sudanese Thermal Power Generating Co

- Sinohydro Corporation

- Ram Energy

- China National Nuclear Corporation

- Russian State Corporation for Atomic Energy (Rosatom)

- Siemens Energy AG

Key Developments in Sudan Power Industry Industry

- April 2022: The African Development Fund approved a USD 5.5 Million technical assistance grant to support the Desert to Power initiative in Sudan. This is expected to accelerate the development of renewable energy projects in the country.

- April 2022: Sudan announced plans to increase its power grid link capacity with Egypt from 70 MW to 300 MW, and later to 1,000 MW. This signifies a significant step towards regional power grid integration and enhanced electricity access.

Strategic Outlook for Sudan Power Industry Market

The Sudanese power industry is poised for substantial growth over the next decade, driven by increasing energy demand and government support for renewable energy. Despite the challenges, the vast renewable energy potential and opportunities for regional cooperation present a compelling investment case. The strategic focus should be on attracting investment, strengthening infrastructure, improving regulatory frameworks, and fostering technological innovation to unlock the sector’s full potential. The long-term outlook is positive, with significant potential for growth and transformation.

Sudan Power Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Sudan Power Industry Segmentation By Geography

- 1. Sudan

Sudan Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.49% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Renewable Energy Installations 4.; Energy Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Political and Economic Instability

- 3.4. Market Trends

- 3.4.1. Hydropower Generating Source to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sudan Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Sudan

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sudanese Electricity Distribution Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dal Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sudanese Thermal Power Generating Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sinohydro Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ram Energy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China National Nuclear Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Russian State Corporation for Atomic Energy (Rosatom)*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Siemens Energy AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Sudanese Electricity Distribution Company

List of Figures

- Figure 1: Sudan Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sudan Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Sudan Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sudan Power Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Sudan Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Sudan Power Industry Volume gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 5: Sudan Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Sudan Power Industry Volume gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Sudan Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Sudan Power Industry Volume gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Sudan Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Sudan Power Industry Volume gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Sudan Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Sudan Power Industry Volume gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Sudan Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Sudan Power Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 15: Sudan Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Sudan Power Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 17: Sudan Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 18: Sudan Power Industry Volume gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 19: Sudan Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 20: Sudan Power Industry Volume gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 21: Sudan Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 22: Sudan Power Industry Volume gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 23: Sudan Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 24: Sudan Power Industry Volume gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: Sudan Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: Sudan Power Industry Volume gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 27: Sudan Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Sudan Power Industry Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sudan Power Industry?

The projected CAGR is approximately 0.49%.

2. Which companies are prominent players in the Sudan Power Industry?

Key companies in the market include Sudanese Electricity Distribution Company, Dal Group, Sudanese Thermal Power Generating Co, Sinohydro Corporation, Ram Energy, China National Nuclear Corporation, Russian State Corporation for Atomic Energy (Rosatom)*List Not Exhaustive, Siemens Energy AG.

3. What are the main segments of the Sudan Power Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Renewable Energy Installations 4.; Energy Infrastructure Development.

6. What are the notable trends driving market growth?

Hydropower Generating Source to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Political and Economic Instability.

8. Can you provide examples of recent developments in the market?

April 2022: The African Development Fund approved a USD 5.5 million technical assistance grant to kick-start the roll-out of the flagship Desert to Power initiative in the Eastern Sahel countries of Djibouti, Eritrea, Ethiopia, and Sudan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sudan Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sudan Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sudan Power Industry?

To stay informed about further developments, trends, and reports in the Sudan Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence