Key Insights

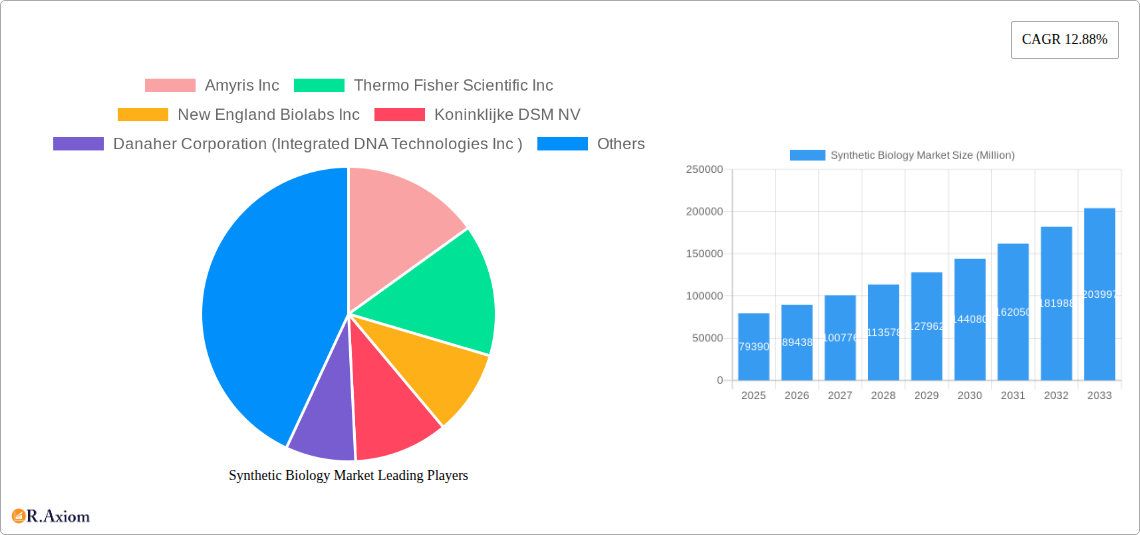

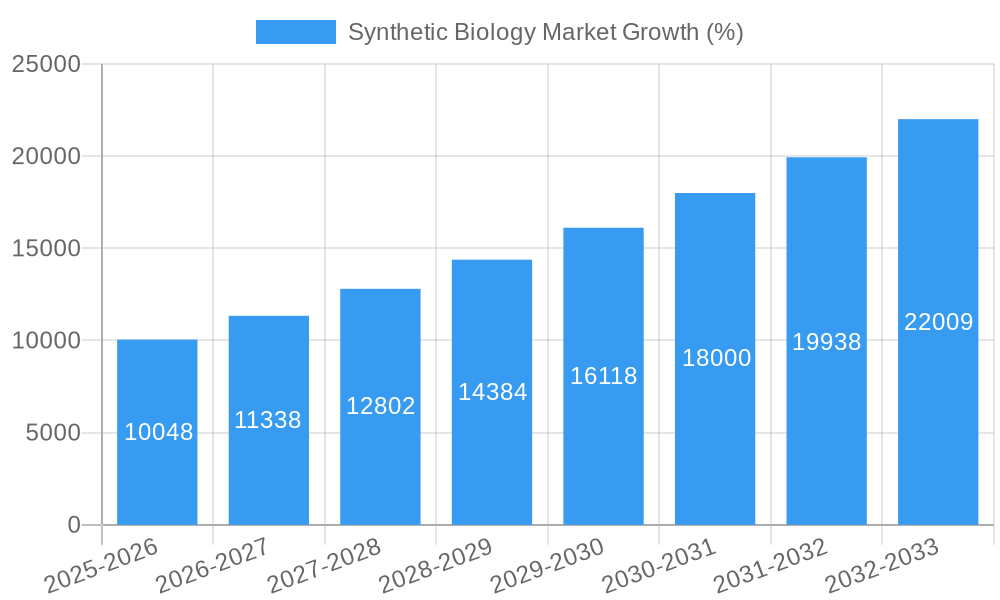

The synthetic biology market is experiencing robust growth, projected to reach $79.39 billion in 2025 and exhibiting a compound annual growth rate (CAGR) of 12.88%. This expansion is driven by several key factors. Firstly, the increasing demand for sustainable and cost-effective solutions across diverse sectors like healthcare, chemicals (including biofuels), and food and agriculture is fueling market expansion. Advancements in gene editing technologies, particularly CRISPR-Cas9, are enabling more precise and efficient genetic engineering, accelerating the development of novel products and applications. Furthermore, the rising global population and increasing awareness of environmental concerns are bolstering investments in research and development within the synthetic biology space. The market's segmentation into core, enabling, and enabled products reflects the intricate ecosystem of this innovative field, with core technologies driving the development of enabling tools and subsequently leading to the creation of new enabled products across multiple applications. The prominent players – Amyris, Thermo Fisher Scientific, New England Biolabs, and others – are actively shaping this market landscape through continuous innovation and strategic partnerships.

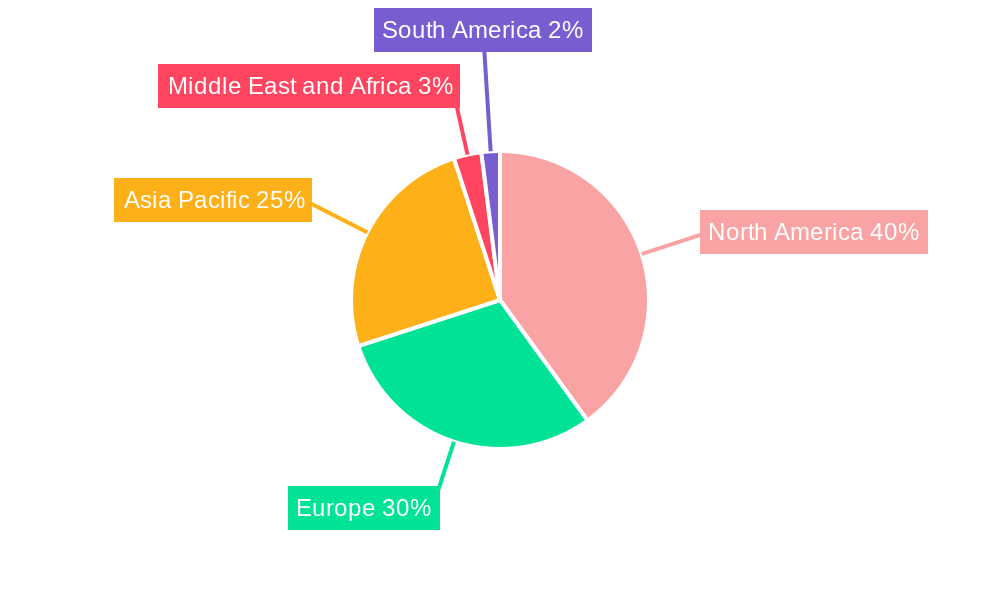

The geographical distribution of the synthetic biology market mirrors the global distribution of research and development capabilities and industrial production. North America currently holds a significant market share, largely due to its established biotechnology infrastructure and regulatory frameworks. However, the Asia-Pacific region is poised for rapid growth, driven by increasing investments in biotechnology and a burgeoning demand for innovative solutions in rapidly developing economies. Europe, while a significant player, is expected to maintain a steady but perhaps less dynamic growth compared to Asia-Pacific. The competitive landscape is characterized by a mix of established biotechnology companies and emerging startups, leading to both intense competition and collaborative partnerships, furthering innovation within the industry. The market's continuous evolution requires a vigilant approach to regulatory hurdles and ethical considerations to ensure responsible and sustainable growth. Projections for 2033 suggest a market considerably larger than the 2025 figure, reflecting continued growth and technological advancements.

This comprehensive report provides an in-depth analysis of the Synthetic Biology Market, covering its current state, future projections, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes data from the historical period (2019-2024) to forecast market trends from 2025 to 2033. The report segments the market by product (Core Products, Enabling Products, Enabled Products) and application (Healthcare, Chemicals (including Biofuels), Food and Agriculture, Other Applications). This detailed analysis provides actionable insights for industry stakeholders, investors, and researchers.

Synthetic Biology Market Concentration & Innovation

The Synthetic Biology market exhibits a moderately concentrated landscape, with several large players holding significant market share. Amyris Inc, Thermo Fisher Scientific Inc, and Danaher Corporation (Integrated DNA Technologies Inc) are among the leading companies, although the exact market share for each requires further proprietary research, we can estimate xx% market share for the top 3 players combined by 2025. Innovation is a key driver, fueled by advancements in gene editing technologies (e.g., CRISPR-Cas9), synthetic pathways, and high-throughput screening methods. The regulatory landscape, though evolving, presents both opportunities and challenges. Strict regulations in certain regions can hinder market growth while incentives and funding in others can boost it. Product substitutes, primarily traditional chemical and biological processes, pose some competition, though synthetic biology often offers superior efficiency and customization. End-user trends towards sustainability and personalized solutions are positively impacting market growth. M&A activity in this sector has been significant. Several deals, with values ranging from xx Million to xx Million, have been recorded in recent years, illustrating a trend of consolidation and expansion within the synthetic biology industry. This consolidation is driven by the desire to gain access to new technologies, expand product portfolios, and secure market share.

Synthetic Biology Market Industry Trends & Insights

The Synthetic Biology market is experiencing robust growth, driven by several key factors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements such as improved gene editing techniques and automation are pushing market penetration in multiple sectors. Consumer preference for sustainable and ethically sourced products is driving demand for synthetic biology-derived alternatives. The competitive landscape is dynamic, with companies constantly striving for innovation and market differentiation. This competitiveness is largely driven by high R&D investment and the ongoing development of novel applications. Market penetration varies widely across different applications, with healthcare and chemicals currently leading, while food and agriculture segments are expected to experience accelerated growth in the coming years.

Dominant Markets & Segments in Synthetic Biology Market

The global synthetic biology market is experiencing substantial growth across diverse regions and segments. While a definitive leading region requires more detailed research, preliminary data suggests a strong presence in North America and Europe, driven by robust R&D investment and a supportive regulatory environment. Within the product segments, Enabling Products, such as enzymes, reagents and platforms, are currently a major segment but the segment showing the fastest growth rate is predicted to be Enabled Products, representing advanced applications using the tools provided by other segments.

Key Drivers by Segment:

- Healthcare: High R&D spending, growing prevalence of chronic diseases, and demand for personalized medicine.

- Chemicals (including Biofuels): Government incentives for renewable energy, rising fossil fuel prices, and increasing demand for sustainable alternatives.

- Food and Agriculture: Demand for sustainable food production, growing global population, and need for enhanced crop yields.

- Other Applications: Increasing focus on biosecurity, environmental remediation, and sustainable energy solutions.

Dominance analysis indicates that Enabling Products and Healthcare applications currently occupy the largest market share, but the rapid advancement of Enabled Products and the burgeoning Food and Agriculture applications suggest a potential shift in dominance over the forecast period. Economic policies promoting green technologies and investments in advanced research infrastructure are also crucial factors shaping market dominance.

Synthetic Biology Market Product Developments

Recent product developments in synthetic biology showcase a clear shift towards more sophisticated and efficient tools and processes. Advances in gene editing, pathway engineering, and high-throughput screening technologies are enabling the creation of novel products with improved performance characteristics. These innovations are leading to broader applications across diverse sectors, from pharmaceuticals and biofuels to agriculture and environmental remediation. Competitive advantages are being built by companies through the development of proprietary technologies, strategic partnerships, and intellectual property protection.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Synthetic Biology market, segmented by product type and application.

By Product:

- Core Products: This segment encompasses basic components like genes, proteins, and plasmids. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033. The growth is driven by the expanding research and development activities.

- Enabling Products: Includes tools like gene editing technologies and DNA synthesis, offering a current market size of xx Million in 2025. We forecast a market size of xx Million in 2033 with the growth driven by technological improvements and ease of access to research.

- Enabled Products: This segment encompasses end products like biofuels, pharmaceuticals, and biomaterials. Currently, the market size is xx Million in 2025. It’s expected to reach xx Million by 2033 with a high growth rate.

By Application:

- Healthcare: This segment includes therapeutic proteins, diagnostics, and gene therapies. The current market size is xx Million in 2025; it’s projected to reach xx Million by 2033. Growth is primarily driven by increase in disease prevalence and rising demand for advanced healthcare treatments.

- Chemicals (including Biofuels): This sector includes bio-based chemicals and biofuels, with a 2025 market size of xx Million, expected to reach xx Million by 2033. This is driven by the growing demand for sustainable alternatives and government policies supporting renewable energy sources.

- Food and Agriculture: This segment focuses on improved crops, animal feed, and food ingredients. This segment is valued at xx Million in 2025, and is projected to grow at xx Million by 2033. Growth is fuelled by the growing global population and increasing need for efficient and sustainable food production.

- Other Applications: This category includes applications in biosecurity, energy, and the environment. The market size is xx Million in 2025, and is expected to reach xx Million by 2033. This is driven by increasing demand for environmental-friendly solutions and government investments.

Competitive dynamics vary across segments, influenced by factors like technological expertise, intellectual property, and regulatory approvals.

Key Drivers of Synthetic Biology Market Growth

Several factors are driving the growth of the Synthetic Biology market. Technological advancements, particularly in gene editing and synthetic pathway design, are enabling the creation of novel products and processes. Economic incentives, such as government grants and tax breaks for green technologies, are encouraging investment in the sector. Favorable regulatory frameworks in certain regions facilitate faster market entry and product commercialization. For instance, the launch of the Rice Synthetic Biology Institute in 2024 shows a proactive governmental push to catalyze the sector.

Challenges in the Synthetic Biology Market Sector

The Synthetic Biology market faces certain challenges. Stringent regulatory approvals can delay product launches and increase development costs. Supply chain disruptions, especially for essential raw materials, can impact production efficiency. Intense competition among established players and new entrants puts pressure on pricing and profitability. These factors, if not carefully managed, could collectively result in slowing the overall growth rate by an estimated xx% by 2033.

Emerging Opportunities in Synthetic Biology Market

The Synthetic Biology market presents several exciting opportunities. New applications are constantly emerging in areas such as bioremediation, personalized medicine, and sustainable materials. Advancements in artificial intelligence and machine learning are further enhancing the design and optimization of synthetic biological systems. Growing consumer awareness of sustainability is creating a demand for bio-based alternatives. These developments collectively offer significant potential for expansion and innovation in the years to come.

Leading Players in the Synthetic Biology Market Market

- Amyris Inc

- Thermo Fisher Scientific Inc

- New England Biolabs Inc

- Koninklijke DSM NV

- Danaher Corporation (Integrated DNA Technologies Inc)

- GenScript

- Precigen Inc (Intrexon Corporation)

- Illumina Inc

- Viridos Inc (Synthetic Genomics Inc)

- Novozymes AS

Key Developments in Synthetic Biology Market Industry

- January 2024: Rice University launched the Rice Synthetic Biology Institute, boosting collaborative research and technology translation.

- May 2023: GenScript Biotech Corporation showcased advanced synthetic biology tools and techniques at the SynBioBeta Conference, highlighting industry collaboration and innovation.

Strategic Outlook for Synthetic Biology Market Market

The Synthetic Biology market is poised for significant growth over the next decade. Continued technological advancements, coupled with increasing demand for sustainable and personalized solutions, will drive market expansion. Strategic partnerships, M&A activities, and investments in R&D will shape the competitive landscape. The focus on developing environmentally friendly technologies and addressing global challenges will further accelerate market growth, creating new opportunities for innovation and commercialization.

Synthetic Biology Market Segmentation

-

1. Product

- 1.1. Core Products

- 1.2. Enabling Products

- 1.3. Enabled Products

-

2. Applications

- 2.1. Healthcare

- 2.2. Chemicals (Including Biofuels)

- 2.3. Food and Agriculture

- 2.4. Other Ap

Synthetic Biology Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Synthetic Biology Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.88% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Support from Government and Private Institutions; Increasing R&D Investments in Drug Discovery and Development; Declining Cost of DNA Sequencing and Synthesizing

- 3.3. Market Restrains

- 3.3.1. Bio-safety and Bio-security; Ethical Issues Related to Synthetic Biology; Reimbursement Cuts Causing Pricing Pressure

- 3.4. Market Trends

- 3.4.1. The Healthcare Segment is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Synthetic Biology Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Core Products

- 5.1.2. Enabling Products

- 5.1.3. Enabled Products

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Healthcare

- 5.2.2. Chemicals (Including Biofuels)

- 5.2.3. Food and Agriculture

- 5.2.4. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Synthetic Biology Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Core Products

- 6.1.2. Enabling Products

- 6.1.3. Enabled Products

- 6.2. Market Analysis, Insights and Forecast - by Applications

- 6.2.1. Healthcare

- 6.2.2. Chemicals (Including Biofuels)

- 6.2.3. Food and Agriculture

- 6.2.4. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Synthetic Biology Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Core Products

- 7.1.2. Enabling Products

- 7.1.3. Enabled Products

- 7.2. Market Analysis, Insights and Forecast - by Applications

- 7.2.1. Healthcare

- 7.2.2. Chemicals (Including Biofuels)

- 7.2.3. Food and Agriculture

- 7.2.4. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Synthetic Biology Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Core Products

- 8.1.2. Enabling Products

- 8.1.3. Enabled Products

- 8.2. Market Analysis, Insights and Forecast - by Applications

- 8.2.1. Healthcare

- 8.2.2. Chemicals (Including Biofuels)

- 8.2.3. Food and Agriculture

- 8.2.4. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Synthetic Biology Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Core Products

- 9.1.2. Enabling Products

- 9.1.3. Enabled Products

- 9.2. Market Analysis, Insights and Forecast - by Applications

- 9.2.1. Healthcare

- 9.2.2. Chemicals (Including Biofuels)

- 9.2.3. Food and Agriculture

- 9.2.4. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Synthetic Biology Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Core Products

- 10.1.2. Enabling Products

- 10.1.3. Enabled Products

- 10.2. Market Analysis, Insights and Forecast - by Applications

- 10.2.1. Healthcare

- 10.2.2. Chemicals (Including Biofuels)

- 10.2.3. Food and Agriculture

- 10.2.4. Other Ap

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Synthetic Biology Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Synthetic Biology Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Synthetic Biology Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Synthetic Biology Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Synthetic Biology Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Amyris Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Thermo Fisher Scientific Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 New England Biolabs Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Koninklijke DSM NV

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Danaher Corporation (Integrated DNA Technologies Inc )

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 GenScript

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Precigen Inc (Intrexon Corporation)

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Illumina Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Viridos Inc (Synthetic Genomics Inc )*List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Novozymes AS

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Amyris Inc

List of Figures

- Figure 1: Global Synthetic Biology Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Synthetic Biology Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Synthetic Biology Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Synthetic Biology Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Synthetic Biology Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Synthetic Biology Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Synthetic Biology Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Synthetic Biology Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Synthetic Biology Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Synthetic Biology Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Synthetic Biology Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Synthetic Biology Market Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Synthetic Biology Market Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Synthetic Biology Market Revenue (Million), by Applications 2024 & 2032

- Figure 15: North America Synthetic Biology Market Revenue Share (%), by Applications 2024 & 2032

- Figure 16: North America Synthetic Biology Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Synthetic Biology Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Synthetic Biology Market Revenue (Million), by Product 2024 & 2032

- Figure 19: Europe Synthetic Biology Market Revenue Share (%), by Product 2024 & 2032

- Figure 20: Europe Synthetic Biology Market Revenue (Million), by Applications 2024 & 2032

- Figure 21: Europe Synthetic Biology Market Revenue Share (%), by Applications 2024 & 2032

- Figure 22: Europe Synthetic Biology Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Synthetic Biology Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Synthetic Biology Market Revenue (Million), by Product 2024 & 2032

- Figure 25: Asia Pacific Synthetic Biology Market Revenue Share (%), by Product 2024 & 2032

- Figure 26: Asia Pacific Synthetic Biology Market Revenue (Million), by Applications 2024 & 2032

- Figure 27: Asia Pacific Synthetic Biology Market Revenue Share (%), by Applications 2024 & 2032

- Figure 28: Asia Pacific Synthetic Biology Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Synthetic Biology Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Synthetic Biology Market Revenue (Million), by Product 2024 & 2032

- Figure 31: Middle East and Africa Synthetic Biology Market Revenue Share (%), by Product 2024 & 2032

- Figure 32: Middle East and Africa Synthetic Biology Market Revenue (Million), by Applications 2024 & 2032

- Figure 33: Middle East and Africa Synthetic Biology Market Revenue Share (%), by Applications 2024 & 2032

- Figure 34: Middle East and Africa Synthetic Biology Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Synthetic Biology Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Synthetic Biology Market Revenue (Million), by Product 2024 & 2032

- Figure 37: South America Synthetic Biology Market Revenue Share (%), by Product 2024 & 2032

- Figure 38: South America Synthetic Biology Market Revenue (Million), by Applications 2024 & 2032

- Figure 39: South America Synthetic Biology Market Revenue Share (%), by Applications 2024 & 2032

- Figure 40: South America Synthetic Biology Market Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Synthetic Biology Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Synthetic Biology Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Synthetic Biology Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Synthetic Biology Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 4: Global Synthetic Biology Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Synthetic Biology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Synthetic Biology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Synthetic Biology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Synthetic Biology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Synthetic Biology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Synthetic Biology Market Revenue Million Forecast, by Product 2019 & 2032

- Table 32: Global Synthetic Biology Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 33: Global Synthetic Biology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Synthetic Biology Market Revenue Million Forecast, by Product 2019 & 2032

- Table 38: Global Synthetic Biology Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 39: Global Synthetic Biology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Synthetic Biology Market Revenue Million Forecast, by Product 2019 & 2032

- Table 47: Global Synthetic Biology Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 48: Global Synthetic Biology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Synthetic Biology Market Revenue Million Forecast, by Product 2019 & 2032

- Table 56: Global Synthetic Biology Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 57: Global Synthetic Biology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Synthetic Biology Market Revenue Million Forecast, by Product 2019 & 2032

- Table 62: Global Synthetic Biology Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 63: Global Synthetic Biology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Synthetic Biology Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Synthetic Biology Market?

The projected CAGR is approximately 12.88%.

2. Which companies are prominent players in the Synthetic Biology Market?

Key companies in the market include Amyris Inc, Thermo Fisher Scientific Inc, New England Biolabs Inc, Koninklijke DSM NV, Danaher Corporation (Integrated DNA Technologies Inc ), GenScript, Precigen Inc (Intrexon Corporation), Illumina Inc, Viridos Inc (Synthetic Genomics Inc )*List Not Exhaustive, Novozymes AS.

3. What are the main segments of the Synthetic Biology Market?

The market segments include Product, Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD 79.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Support from Government and Private Institutions; Increasing R&D Investments in Drug Discovery and Development; Declining Cost of DNA Sequencing and Synthesizing.

6. What are the notable trends driving market growth?

The Healthcare Segment is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Bio-safety and Bio-security; Ethical Issues Related to Synthetic Biology; Reimbursement Cuts Causing Pricing Pressure.

8. Can you provide examples of recent developments in the market?

January 2024: Rice University of the United States launched the Rice Synthetic Biology Institute, which aims to catalyze collaborative research in synthetic biology and its translation into technologies that benefit society.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Synthetic Biology Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Synthetic Biology Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Synthetic Biology Market?

To stay informed about further developments, trends, and reports in the Synthetic Biology Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence