Key Insights

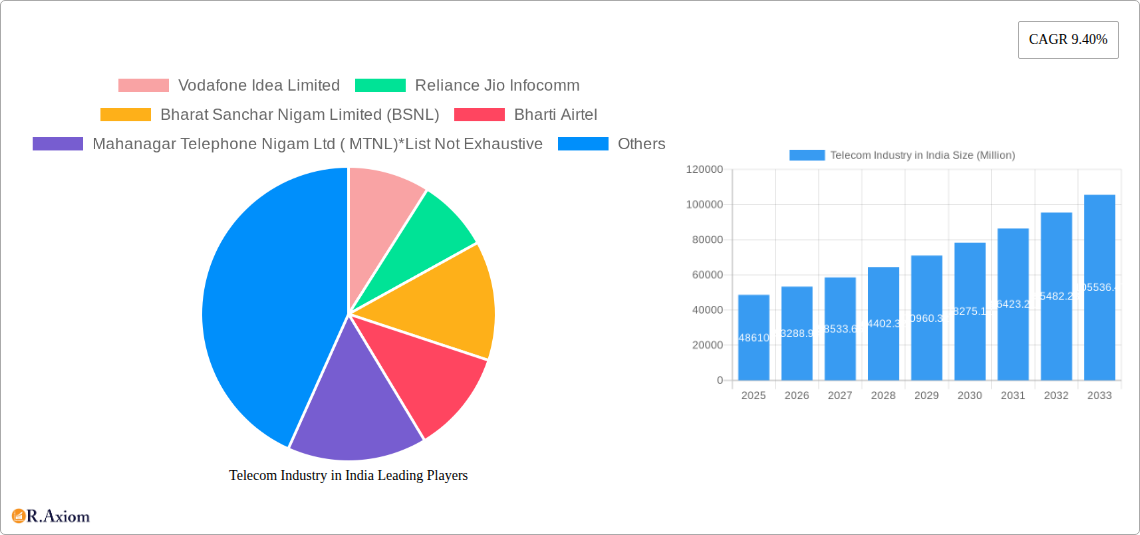

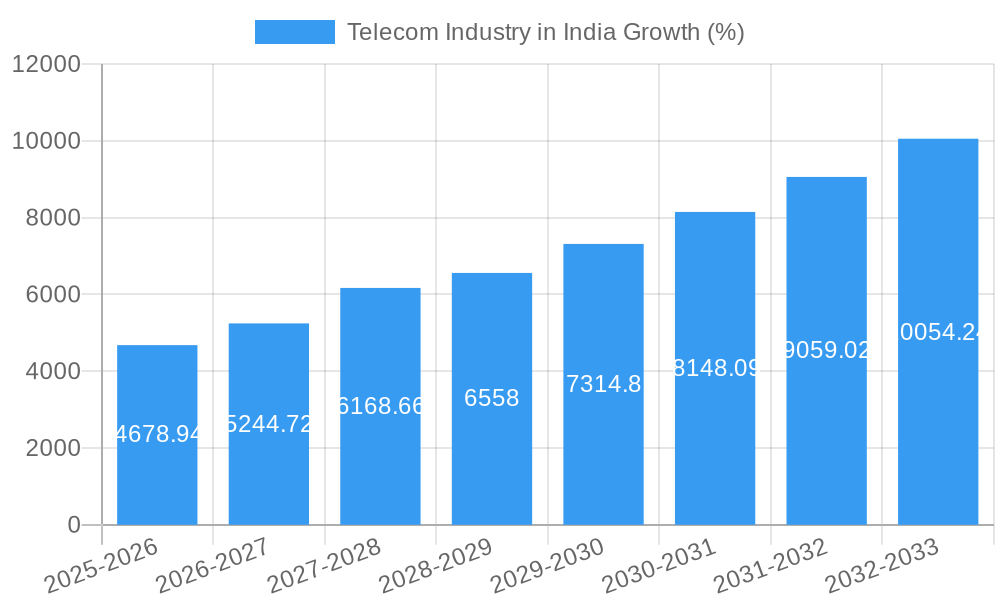

The Indian telecom industry, a dynamic and rapidly evolving sector, is projected to reach a market size of $48.61 billion in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 9.40%. This growth is fueled by increasing smartphone penetration, rising data consumption driven by the popularity of OTT platforms and social media, and the expanding reach of 4G and 5G networks across diverse regions of India. The industry is witnessing a shift towards data-centric services, with voice services gradually declining in relative importance. Wireless data and messaging, including internet and handset data packages, along with attractive bundled discounts, are key revenue drivers. The rise of Over-the-Top (OTT) and Pay-TV services further contributes to the market's expansion, demanding substantial network capacity and compelling service offerings from telecom providers. Competitive pressures among major players like Reliance Jio Infocomm, Bharti Airtel, Vodafone Idea Limited, BSNL, and MTNL necessitate continuous innovation and strategic investments in network infrastructure and service diversification.

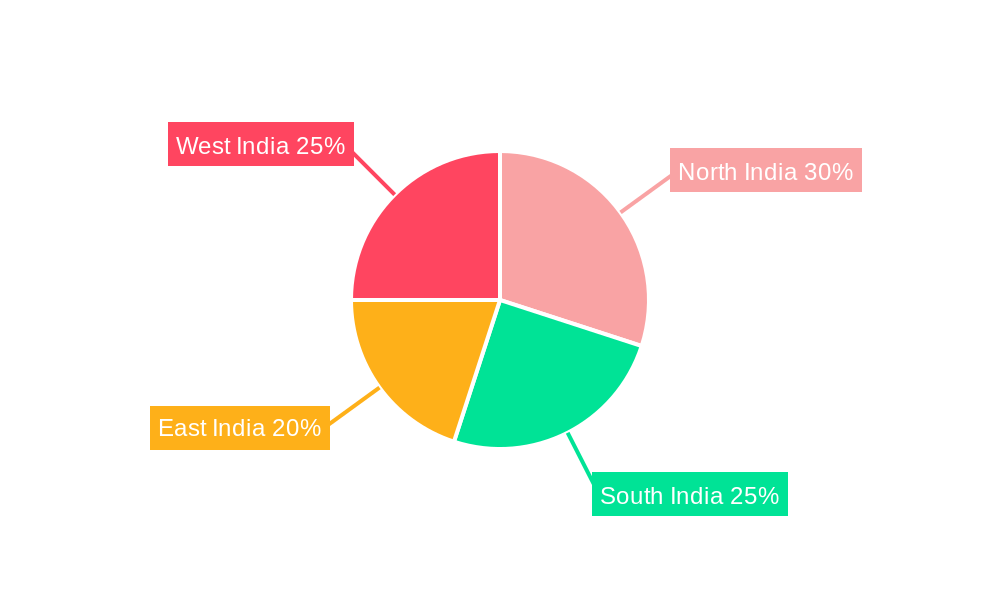

While the industry enjoys significant growth potential, challenges remain. Regulatory hurdles, infrastructure limitations in certain regions (particularly in rural areas), and intense competition create pressure on profit margins. Effective strategies for customer acquisition and retention, coupled with investment in advanced technologies like 5G and improved customer service, are crucial for sustained success. Analyzing regional variations in market penetration and consumption patterns across North, South, East, and West India reveals distinct market opportunities and necessitates region-specific strategies for optimal market penetration and sustainable revenue growth. The forecast period (2025-2033) suggests continued growth, albeit potentially at a moderated CAGR as the market matures. The historical period (2019-2024) data points to a strong upward trajectory indicating sustainable growth in future.

Telecom Industry in India: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indian telecom industry, covering market trends, competitive landscape, technological advancements, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The report incorporates detailed segmentation analysis, key player profiles, and in-depth insights into market dynamics. This report is an invaluable resource for industry stakeholders, investors, and anyone seeking a comprehensive understanding of this dynamic market.

Telecom Industry in India Market Concentration & Innovation

The Indian telecom market exhibits a high degree of concentration, dominated by a few key players. Reliance Jio Infocomm, Bharti Airtel, and Vodafone Idea Limited account for a significant portion of the overall market share. However, the entry of new players and technological advancements are steadily reshaping the competitive landscape. The market share of these players fluctuates yearly; xx% for Reliance Jio, xx% for Bharti Airtel, xx% for Vodafone Idea, and the remainder distributed amongst smaller players including BSNL and MTNL.

Innovation is a key driver in this sector, fueled by the increasing demand for high-speed data services and the proliferation of connected devices. 5G deployment, advancements in network infrastructure, and the integration of IoT technologies are key aspects of this. The regulatory framework, while aiming to promote competition and affordability, also presents challenges. The government's initiatives to expand digital connectivity across the country and the push for digital inclusion create both opportunities and complexities for industry players.

Product substitutes, such as Wi-Fi and other wireless technologies, continue to compete for market share. However, the growing demand for mobile broadband services and the expanding capabilities of mobile networks make them remain dominant. Mergers and acquisitions (M&A) activities have also played a significant role in shaping the industry’s landscape. While recent large-scale M&A activity has reduced, smaller deals continue to occur. The estimated total value of M&A deals in the last five years is approximately xx Million. The competitive dynamics are further influenced by continuous innovations in pricing strategies, bundling offerings and customer service.

Telecom Industry in India Industry Trends & Insights

The Indian telecom industry is characterized by significant growth driven by increasing smartphone penetration, rising internet usage, and government initiatives promoting digital inclusion. The Compound Annual Growth Rate (CAGR) for the overall market during the forecast period (2025-2033) is estimated to be xx%. Market penetration of mobile services is already high, exceeding xx%, leaving room for growth primarily in data services and the adoption of newer technologies.

Technological disruptions, particularly the roll-out of 5G networks, are dramatically transforming the industry. 5G's enhanced speed and capacity will unlock new applications and use cases, creating further market expansion in sectors like IoT and Smart Cities. Consumer preferences are shifting towards higher data allowances, faster speeds, and more affordable plans. The competitive intensity remains high, forcing companies to innovate with pricing strategies, service bundles, and value-added offerings. This dynamic environment leads to considerable churn and ongoing competition for market share.

Dominant Markets & Segments in Telecom Industry in India

The Indian telecom market is characterized by a geographically widespread presence, although urban areas show higher usage and revenue. The largest segment is Wireless Data and Messaging Services, driven by a significant increase in mobile internet usage.

- Key Drivers for Wireless Data & Messaging:

- Increasing smartphone penetration.

- Rising mobile internet usage.

- Affordable data plans and packages.

- Growing demand for OTT services.

- Investments in network infrastructure.

The Average Revenue Per User (ARPU) for the overall services segment is approximately xx per month as of 2024. The market size for the overall services segment is estimated to be xx Million in 2025, projected to reach xx Million by 2027.

- Voice Services: This segment is showing a decline in revenue, as consumers shift towards data-centric usage.

- Wireless Data and Messaging Services: The fastest growing segment. Market size is xx Million in 2025, anticipated to reach xx Million by 2027. Significant growth in internet and handset data packages is observed, fuelled by attractive package discounts and promotions.

- OTT and Pay-tv Services: This segment is experiencing robust growth, propelled by increasing internet penetration and consumer preference for online streaming.

Telecom Industry in India Product Developments

The industry is witnessing rapid product innovation, focusing on enhancing data speeds, expanding network coverage, and providing a wider range of value-added services. Key trends include 5G network deployment, advanced data analytics solutions for network optimization, and the introduction of integrated communication packages that bundle data, voice, and entertainment services. These products focus on enhancing consumer experience through superior speed, reliability, and personalized offers. The competition is driving companies to create packages that address the diverse price sensitivities of the market.

Report Scope & Segmentation Analysis

This report segments the Indian telecom market by services:

- Voice Services: This segment is mature but continues to provide a foundational element of the market, with growth constrained by data service dominance.

- Wireless: Data and Messaging Services: This is the fastest-growing segment, driven by increasing data consumption and the rise of mobile internet. The market size is projected to grow from xx Million in 2020 to xx Million in 2027.

- OTT and Pay-tv Services: This segment reflects the increasing preference for online entertainment, leveraging high-speed mobile data. Competitive dynamics in this segment are shaped by a large number of players and varying business models.

Key Drivers of Telecom Industry in India Growth

The growth of the Indian telecom industry is fueled by several factors, including:

- Rising smartphone penetration: The increasing affordability and availability of smartphones are driving higher mobile internet usage.

- Government initiatives: The government's focus on digital India and expanding connectivity, is actively fostering market growth.

- Technological advancements: The introduction of 5G and other innovative technologies will open up new avenues for growth.

- Expanding rural connectivity: Government-led schemes are bridging the digital divide, expanding the market to new demographics.

Challenges in the Telecom Industry in India Sector

The Indian telecom industry faces several challenges:

- Intense competition: The highly competitive environment puts pressure on pricing and profitability.

- High debt levels: Some operators are burdened by significant debt, impacting their ability to invest.

- Regulatory complexities: The regulatory environment can be challenging, creating hurdles for investment and expansion. This includes spectrum allocation and licensing regulations.

- Infrastructure limitations: Addressing infrastructural gaps and ensuring last-mile connectivity remains a significant hurdle for market expansion in certain regions.

Emerging Opportunities in Telecom Industry in India

Several opportunities are emerging in the Indian telecom market:

- 5G deployment: 5G will unlock new services and revenue streams through enhanced speed, capacity, and low latency.

- IoT growth: The increasing adoption of IoT devices presents a significant opportunity for data and connectivity services.

- Rural market expansion: Significant untapped potential exists in rural areas, requiring investment in infrastructure and tailored solutions.

- Enterprise solutions: The growth of the enterprise sector provides a considerable market for tailored communication and networking services.

Leading Players in the Telecom Industry in India Market

- Bharti Airtel

- Reliance Jio Infocomm

- Vodafone Idea Limited

- Bharat Sanchar Nigam Limited (BSNL)

- Mahanagar Telephone Nigam Ltd (MTNL)

Key Developments in Telecom Industry in India Industry

- February 2022: Jio Platforms Limited and SES formed Jio Space Technology Limited, a joint venture to deliver satellite broadband services.

- October 2022: Vi (Vodafone Idea Limited) expanded its 4G network capacity in Andhra Pradesh and Telangana.

Strategic Outlook for Telecom Industry in India Market

The Indian telecom market holds significant long-term growth potential, fueled by increasing data consumption, technological advancements, and government initiatives. The strategic focus will be on expanding 5G deployment, investing in network infrastructure, and developing innovative services to meet evolving consumer needs. Competition will continue to intensify, necessitating strategic partnerships, mergers and acquisitions, and operational efficiencies to maintain profitability in this dynamic environment. The market’s future hinges on successful adoption of new technologies and efficient navigation of regulatory complexities.

Telecom Industry in India Segmentation

-

1. Segmenta

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and Pay-tv Services

-

1.1. Voice Services

Telecom Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Telecom Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Penetration of 4G and Upgradation of 5G; Foreign Direct Investment (FDI)

- 3.3. Market Restrains

- 3.3.1. High Initial Cost and Lower Awareness

- 3.4. Market Trends

- 3.4.1. Increasing Penetration of 4G and Upgradation of 5G

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telecom Industry in India Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and Pay-tv Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 6. North America Telecom Industry in India Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Segmenta

- 6.1.1. Voice Services

- 6.1.1.1. Wired

- 6.1.1.2. Wireless

- 6.1.2. Data and

- 6.1.3. OTT and Pay-tv Services

- 6.1.1. Voice Services

- 6.1. Market Analysis, Insights and Forecast - by Segmenta

- 7. South America Telecom Industry in India Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Segmenta

- 7.1.1. Voice Services

- 7.1.1.1. Wired

- 7.1.1.2. Wireless

- 7.1.2. Data and

- 7.1.3. OTT and Pay-tv Services

- 7.1.1. Voice Services

- 7.1. Market Analysis, Insights and Forecast - by Segmenta

- 8. Europe Telecom Industry in India Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Segmenta

- 8.1.1. Voice Services

- 8.1.1.1. Wired

- 8.1.1.2. Wireless

- 8.1.2. Data and

- 8.1.3. OTT and Pay-tv Services

- 8.1.1. Voice Services

- 8.1. Market Analysis, Insights and Forecast - by Segmenta

- 9. Middle East & Africa Telecom Industry in India Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Segmenta

- 9.1.1. Voice Services

- 9.1.1.1. Wired

- 9.1.1.2. Wireless

- 9.1.2. Data and

- 9.1.3. OTT and Pay-tv Services

- 9.1.1. Voice Services

- 9.1. Market Analysis, Insights and Forecast - by Segmenta

- 10. Asia Pacific Telecom Industry in India Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Segmenta

- 10.1.1. Voice Services

- 10.1.1.1. Wired

- 10.1.1.2. Wireless

- 10.1.2. Data and

- 10.1.3. OTT and Pay-tv Services

- 10.1.1. Voice Services

- 10.1. Market Analysis, Insights and Forecast - by Segmenta

- 11. North India Telecom Industry in India Analysis, Insights and Forecast, 2019-2031

- 12. South India Telecom Industry in India Analysis, Insights and Forecast, 2019-2031

- 13. East India Telecom Industry in India Analysis, Insights and Forecast, 2019-2031

- 14. West India Telecom Industry in India Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Vodafone Idea Limited

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Reliance Jio Infocomm

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Bharat Sanchar Nigam Limited (BSNL)

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Bharti Airtel

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Mahanagar Telephone Nigam Ltd ( MTNL)*List Not Exhaustive

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.1 Vodafone Idea Limited

List of Figures

- Figure 1: Global Telecom Industry in India Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: India Telecom Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 3: India Telecom Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Telecom Industry in India Revenue (Million), by Segmenta 2024 & 2032

- Figure 5: North America Telecom Industry in India Revenue Share (%), by Segmenta 2024 & 2032

- Figure 6: North America Telecom Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Telecom Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Telecom Industry in India Revenue (Million), by Segmenta 2024 & 2032

- Figure 9: South America Telecom Industry in India Revenue Share (%), by Segmenta 2024 & 2032

- Figure 10: South America Telecom Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Telecom Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Telecom Industry in India Revenue (Million), by Segmenta 2024 & 2032

- Figure 13: Europe Telecom Industry in India Revenue Share (%), by Segmenta 2024 & 2032

- Figure 14: Europe Telecom Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Telecom Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Telecom Industry in India Revenue (Million), by Segmenta 2024 & 2032

- Figure 17: Middle East & Africa Telecom Industry in India Revenue Share (%), by Segmenta 2024 & 2032

- Figure 18: Middle East & Africa Telecom Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Telecom Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Telecom Industry in India Revenue (Million), by Segmenta 2024 & 2032

- Figure 21: Asia Pacific Telecom Industry in India Revenue Share (%), by Segmenta 2024 & 2032

- Figure 22: Asia Pacific Telecom Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Telecom Industry in India Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Telecom Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Telecom Industry in India Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 3: Global Telecom Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Telecom Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Telecom Industry in India Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 10: Global Telecom Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Telecom Industry in India Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 15: Global Telecom Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Argentina Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of South America Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Telecom Industry in India Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 20: Global Telecom Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Telecom Industry in India Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 31: Global Telecom Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Telecom Industry in India Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 39: Global Telecom Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 40: China Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: India Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Korea Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: ASEAN Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Oceania Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia Pacific Telecom Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Industry in India?

The projected CAGR is approximately 9.40%.

2. Which companies are prominent players in the Telecom Industry in India?

Key companies in the market include Vodafone Idea Limited, Reliance Jio Infocomm, Bharat Sanchar Nigam Limited (BSNL), Bharti Airtel, Mahanagar Telephone Nigam Ltd ( MTNL)*List Not Exhaustive.

3. What are the main segments of the Telecom Industry in India?

The market segments include Segmenta.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of 4G and Upgradation of 5G; Foreign Direct Investment (FDI).

6. What are the notable trends driving market growth?

Increasing Penetration of 4G and Upgradation of 5G.

7. Are there any restraints impacting market growth?

High Initial Cost and Lower Awareness.

8. Can you provide examples of recent developments in the market?

October 2022 - Vi (Vodafone Idea Limited) expanded network capacity in Andhra Pradesh and Telangana to ensure superior giganet 4G speed. It increased the deployment of the 1,800 MHz spectrum band to provide higher download and upload speeds. It also launched a campaign to emphasize Andhra Pradesh and Telangana's stronger and superior network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecom Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecom Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecom Industry in India?

To stay informed about further developments, trends, and reports in the Telecom Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence