Key Insights

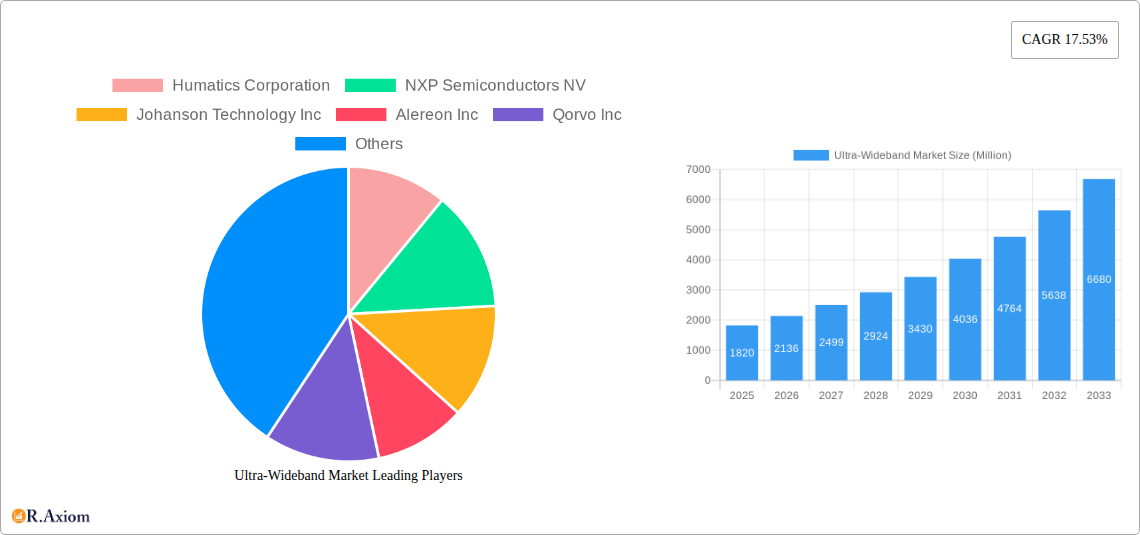

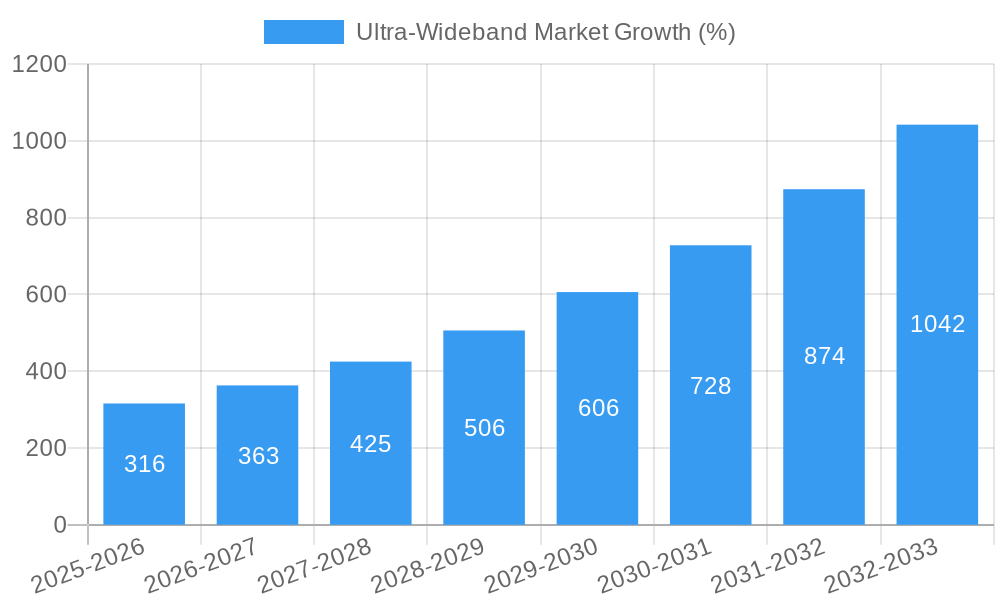

The Ultra-Wideband (UWB) market is experiencing robust growth, projected to reach \$1.82 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 17.53% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for precise location tracking in various applications, such as Real-Time Location Systems (RTLS) in healthcare and asset tracking in manufacturing, is a major catalyst. Furthermore, the rising adoption of UWB technology in automotive and transportation for advanced driver-assistance systems (ADAS) and autonomous driving is significantly contributing to market growth. The integration of UWB into smartphones for enhanced security features like contactless payments and precise indoor navigation is also a powerful driver. Emerging trends, such as the miniaturization of UWB chips and the development of more energy-efficient solutions, are further accelerating market expansion. While challenges remain, such as the relatively higher cost compared to other short-range technologies and the need for wider infrastructure deployment, the significant advantages of UWB in terms of accuracy, security, and bandwidth are overcoming these limitations. The segmentation of the market by application (RTLS, Imaging, Communication) and end-user vertical (Healthcare, Automotive, Manufacturing, Consumer Electronics) highlights the diverse opportunities for UWB adoption across multiple industries. Major players like NXP, Texas Instruments, and Qorvo are strategically positioned to capitalize on this growth, continuously innovating to improve the technology and expand its reach.

The future of the UWB market appears exceptionally promising. The convergence of IoT, AI, and 5G technologies with UWB is expected to unlock new applications and drive further market expansion. The development of more robust and cost-effective solutions will enable wider adoption across various sectors, including smart homes, retail, and logistics. The ongoing evolution of UWB technology, along with strategic partnerships and collaborations within the industry, will play a pivotal role in shaping the market's trajectory in the coming years. The market's steady growth signifies a promising investment opportunity and a crucial role for UWB technology in the future of connected devices and digital transformation across various industries.

Ultra-Wideband (UWB) Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Ultra-Wideband (UWB) market, encompassing market size, growth projections, key players, technological advancements, and emerging trends from 2019 to 2033. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is crucial for industry stakeholders, investors, and researchers seeking actionable insights into this rapidly evolving market.

Ultra-Wideband Market Concentration & Innovation

The Ultra-Wideband (UWB) market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the market is witnessing increasing innovation, driven by the development of more energy-efficient and cost-effective UWB chips and modules. This leads to a wider adoption across diverse applications. Regulatory frameworks, while largely supportive, vary across different regions, influencing market penetration. Product substitutes, such as Bluetooth and Wi-Fi, pose some competition, primarily in applications where high precision is not critical. End-user trends strongly favor precise location tracking and secure communication, propelling the demand for UWB technology.

Several key mergers and acquisitions (M&A) have shaped the market landscape. While precise deal values are often confidential, notable M&A activities have involved strategic partnerships to expand market reach and integrate UWB technology into existing product lines. The market share distribution among key players (estimated for 2025) is as follows:

- NXP Semiconductors NV: xx%

- Texas Instruments Incorporated: xx%

- Qorvo Inc: xx%

- Apple Inc: xx%

- Others: xx%

The overall M&A activity in the UWB market during the historical period (2019-2024) resulted in an estimated total deal value of $xx Million.

Ultra-Wideband Market Industry Trends & Insights

The UWB market is experiencing robust growth, driven by several key factors. The increasing demand for precise location tracking systems in various industries, coupled with advancements in UWB technology, such as improved power efficiency and miniaturization, fuels market expansion. The compound annual growth rate (CAGR) for the UWB market during the forecast period (2025-2033) is projected to be xx%. Market penetration is particularly strong in the consumer electronics and automotive sectors, while other segments like healthcare and manufacturing are demonstrating considerable growth potential. Technological disruptions, including the integration of UWB with other technologies like artificial intelligence (AI) and the Internet of Things (IoT), are further accelerating market growth. Consumer preferences are shifting towards seamless, secure, and precise location-based services, creating favorable conditions for UWB adoption. Competitive dynamics are characterized by both collaboration and competition, with established players investing heavily in R&D and strategic partnerships to maintain their market positions.

Dominant Markets & Segments in Ultra-Wideband Market

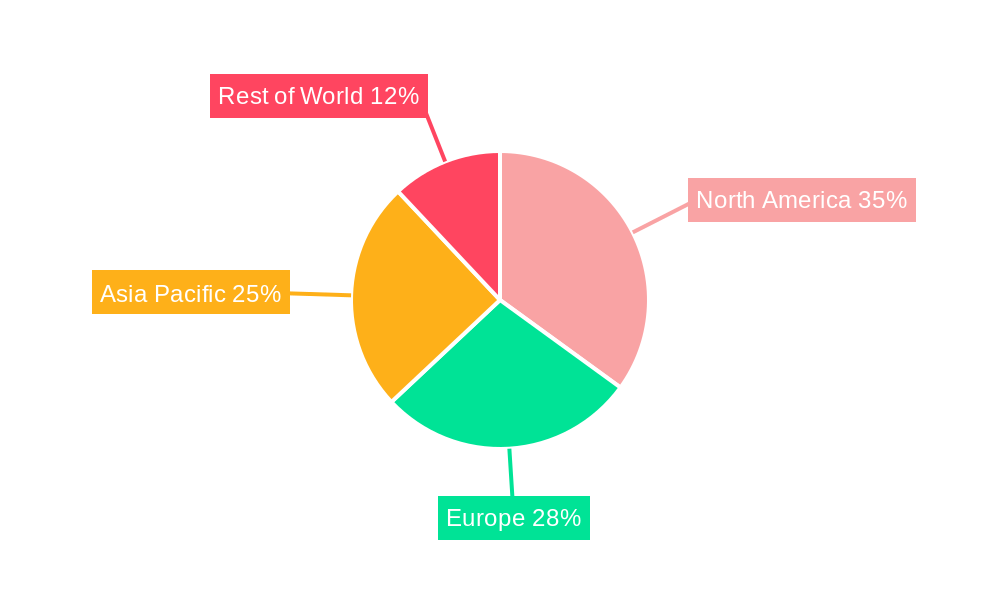

The North American region currently holds a dominant position in the global UWB market, driven by strong demand from the consumer electronics and automotive sectors. Within North America, the United States represents the largest national market. However, the Asia-Pacific region is expected to witness significant growth in the coming years.

Key Drivers for Regional Dominance:

- North America: Strong consumer electronics market, robust automotive industry, favorable regulatory environment, and early adoption of UWB technology.

- Asia-Pacific: Rapid growth in the smartphone market, increasing investment in smart infrastructure, and government initiatives promoting technological advancement.

Dominant Segments:

- By Application: RTLS (Real-Time Location Services) holds the largest market share, driven by its application in various sectors, including warehousing, healthcare, and manufacturing.

- By End-user Vertical: The automotive and transportation sector is projected to show the highest growth rate in the forecast period, driven by the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles.

Ultra-Wideband Market Product Developments

Recent product developments in the UWB market focus on enhancing accuracy, power efficiency, and cost-effectiveness. New UWB chips and modules boast smaller form factors, enabling their integration into a wider range of devices. Improved power management circuits extend battery life in portable devices, and advancements in antenna design are improving range and signal reliability. These innovations are improving market fit across various applications, including high-precision location tracking, contactless payments, and secure access control. The trend is towards integrating UWB technology seamlessly with existing systems and communication protocols, creating a more user-friendly and functional experience.

Report Scope & Segmentation Analysis

This report segments the UWB market by application (RTLS, Imaging, Communication) and end-user vertical (Healthcare, Automotive and Transportation, Manufacturing, Consumer Electronics, Retail, Other End-user Verticals) and major UWB suppliers for Smartphone Companies. Each segment offers unique growth opportunities and presents distinct competitive landscapes. The growth projections for each segment vary, with RTLS and the Automotive and Transportation sectors expected to show the highest growth rates. Market sizes for each segment are detailed within the full report, and competitive dynamics are analyzed by considering the key players active in each area.

Key Drivers of Ultra-Wideband Market Growth

The UWB market’s growth is propelled by several factors: the increasing demand for precise location tracking in various industries, advancements in UWB technology (such as miniaturization and enhanced power efficiency), the rising adoption of IoT and AI, and favorable government regulations promoting technological innovation. Government initiatives focusing on smart cities and autonomous vehicles are further driving market growth.

Challenges in the Ultra-Wideband Market Sector

The UWB market faces challenges such as the relatively high cost of UWB chips and modules, potential interference from other wireless technologies, and the need for standardization across different devices and platforms. Supply chain disruptions and competition from established wireless technologies also pose significant challenges. These factors can impact market penetration and growth. The estimated impact of these challenges on market growth is xx% in the forecast period.

Emerging Opportunities in Ultra-Wideband Market

Emerging opportunities exist in new applications such as contactless payment systems, asset tracking in logistics, and enhanced security features in smart homes. The integration of UWB with other technologies like AR/VR and the development of low-power, long-range UWB systems present significant opportunities for future market growth. The expansion into new geographical regions and vertical markets also offers substantial potential.

Leading Players in the Ultra-Wideband Market Market

- Humatics Corporation

- NXP Semiconductors NV

- Johanson Technology Inc

- Alereon Inc

- Qorvo Inc

- Texas Instruments Incorporated

- Pulse~Link Inc

- Zebra Technologies Corporation

- Fractus S

- Apple Inc

Key Developments in Ultra-Wideband Market Industry

- June 2024: Google enhanced its Find My Device network with ultra-wideband (UWB) and augmented reality (AR) support, improving location tracking for Android users.

- May 2024: Easelink and NXP Semiconductors launched a UWB-based positioning system for automated inductive charging, improving parking and charging efficiency for electric vehicles.

Strategic Outlook for Ultra-Wideband Market Market

The UWB market holds significant growth potential, driven by technological advancements, increasing demand for precise location tracking, and the expansion into new applications and markets. The integration of UWB with other technologies and the development of more cost-effective solutions will further fuel market growth in the coming years. The market is poised for significant expansion across various sectors, presenting lucrative opportunities for players to capitalize on this burgeoning technology.

Ultra-Wideband Market Segmentation

-

1. Application

- 1.1. RTLS

- 1.2. Imaging

- 1.3. Communication

Ultra-Wideband Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East

Ultra-Wideband Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for RTLS applications; Increased Adoption of the Industrial Internet of Things (IIoT)

- 3.3. Market Restrains

- 3.3.1. Competition from the Substitute Products

- 3.4. Market Trends

- 3.4.1. Consumer Electronics to be the Largest End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. RTLS

- 5.1.2. Imaging

- 5.1.3. Communication

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. RTLS

- 6.1.2. Imaging

- 6.1.3. Communication

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. RTLS

- 7.1.2. Imaging

- 7.1.3. Communication

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. RTLS

- 8.1.2. Imaging

- 8.1.3. Communication

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Australia and New Zealand Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. RTLS

- 9.1.2. Imaging

- 9.1.3. Communication

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Latin America Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. RTLS

- 10.1.2. Imaging

- 10.1.3. Communication

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Middle East Ultra-Wideband Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. RTLS

- 11.1.2. Imaging

- 11.1.3. Communication

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Humatics Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 NXP Semiconductors NV

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Johanson Technology Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Alereon Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Qorvo Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Texas Instruments Incorporated

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Pulse~Link Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Zebra Technologies Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Fractus S

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Apple Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Humatics Corporation

List of Figures

- Figure 1: Global Ultra-Wideband Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Ultra-Wideband Market Revenue (Million), by Application 2024 & 2032

- Figure 3: North America Ultra-Wideband Market Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ultra-Wideband Market Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Ultra-Wideband Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Ultra-Wideband Market Revenue (Million), by Application 2024 & 2032

- Figure 7: Europe Ultra-Wideband Market Revenue Share (%), by Application 2024 & 2032

- Figure 8: Europe Ultra-Wideband Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Europe Ultra-Wideband Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Asia Pacific Ultra-Wideband Market Revenue (Million), by Application 2024 & 2032

- Figure 11: Asia Pacific Ultra-Wideband Market Revenue Share (%), by Application 2024 & 2032

- Figure 12: Asia Pacific Ultra-Wideband Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Asia Pacific Ultra-Wideband Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Australia and New Zealand Ultra-Wideband Market Revenue (Million), by Application 2024 & 2032

- Figure 15: Australia and New Zealand Ultra-Wideband Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: Australia and New Zealand Ultra-Wideband Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Australia and New Zealand Ultra-Wideband Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Latin America Ultra-Wideband Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Latin America Ultra-Wideband Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Latin America Ultra-Wideband Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Latin America Ultra-Wideband Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East Ultra-Wideband Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Middle East Ultra-Wideband Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Middle East Ultra-Wideband Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East Ultra-Wideband Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ultra-Wideband Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Ultra-Wideband Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Ultra-Wideband Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Global Ultra-Wideband Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 9: Global Ultra-Wideband Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 11: Global Ultra-Wideband Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Global Ultra-Wideband Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Ultra-Wideband Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Ultra-Wideband Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultra-Wideband Market?

The projected CAGR is approximately 17.53%.

2. Which companies are prominent players in the Ultra-Wideband Market?

Key companies in the market include Humatics Corporation, NXP Semiconductors NV, Johanson Technology Inc, Alereon Inc, Qorvo Inc, Texas Instruments Incorporated, Pulse~Link Inc, Zebra Technologies Corporation, Fractus S, Apple Inc.

3. What are the main segments of the Ultra-Wideband Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for RTLS applications; Increased Adoption of the Industrial Internet of Things (IIoT).

6. What are the notable trends driving market growth?

Consumer Electronics to be the Largest End-user Industry.

7. Are there any restraints impacting market growth?

Competition from the Substitute Products.

8. Can you provide examples of recent developments in the market?

June 2024: Google enhanced its Find My Device network with ultra-wideband (UWB) and augmented reality (AR) support. These features, available in version 3.1.078-1, aim to provide precise location tracking for Android users.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultra-Wideband Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultra-Wideband Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultra-Wideband Market?

To stay informed about further developments, trends, and reports in the Ultra-Wideband Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence