Key Insights

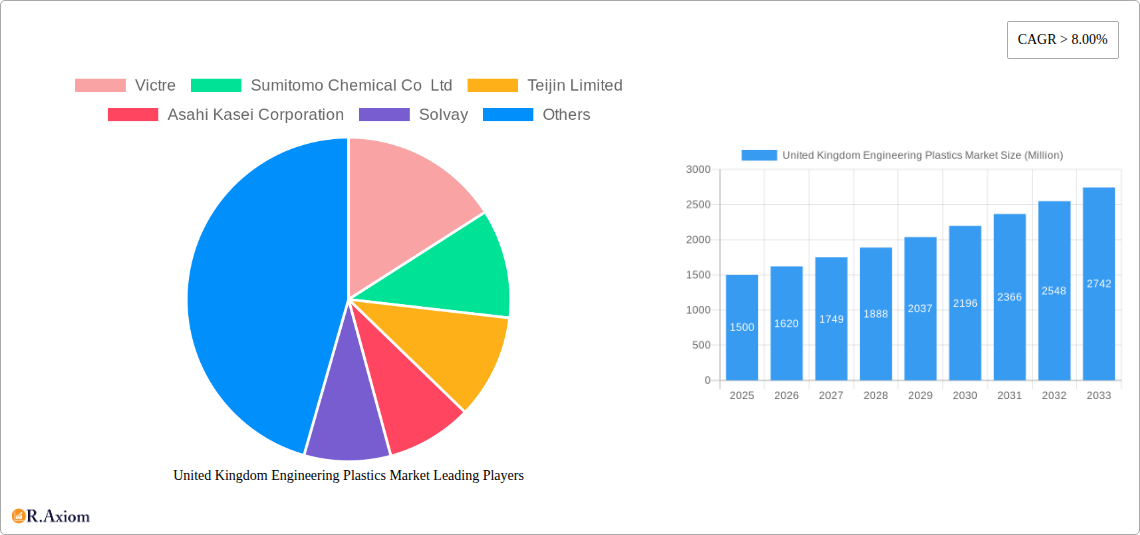

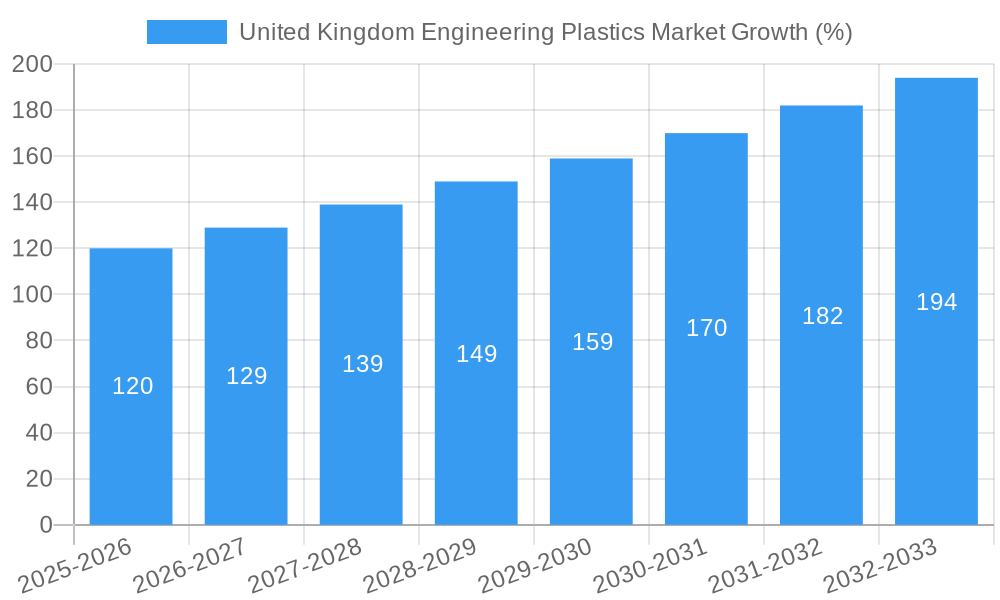

The United Kingdom engineering plastics market is experiencing robust growth, driven by the increasing demand across diverse end-use industries. With a market size exceeding £X million (estimated based on available information and global market trends) in 2025 and a compound annual growth rate (CAGR) exceeding 8%, the market is projected to reach a substantial value by 2033. Key drivers include the flourishing automotive sector, particularly electric vehicle (EV) manufacturing requiring high-performance plastics, and the expanding aerospace industry demanding lightweight yet durable materials. Furthermore, the building and construction sector's adoption of advanced engineering plastics for improved structural integrity and energy efficiency contributes significantly to market growth. The strong presence of major players like Victrex, Sumitomo Chemical, and others, coupled with continuous innovation in resin types such as Polyphthalamide (PA), Polyetheretherketone (PEEK), and high-performance fluoropolymers, further fuels this expansion. The UK's focus on sustainable manufacturing practices also presents opportunities for bio-based and recyclable engineering plastics.

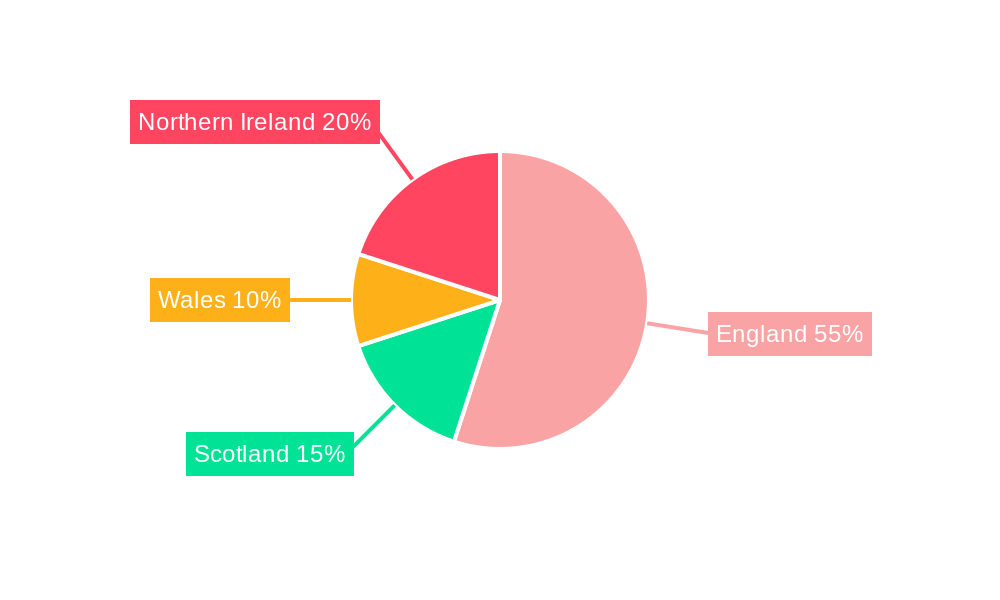

However, market growth is not without its challenges. Price fluctuations in raw materials and potential supply chain disruptions could impact profitability. Furthermore, stringent environmental regulations and the increasing demand for sustainable alternatives necessitates continuous innovation and investment in eco-friendly materials and manufacturing processes. Market segmentation by resin type reveals strong demand for high-performance materials like PEEK and fluoropolymers, while the automotive and aerospace sectors represent the most significant end-use segments. Regional analysis within the UK, encompassing England, Scotland, Wales, and Northern Ireland, highlights a relatively even distribution of market share across these regions, reflecting strong industrial activity throughout the country. The forecast period (2025-2033) anticipates sustained growth, making the UK engineering plastics market an attractive investment opportunity for both established players and new entrants. Detailed market analysis demonstrates a promising future for this industry despite the potential headwinds.

United Kingdom Engineering Plastics Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the United Kingdom engineering plastics market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities. The study encompasses key segments, prominent players, and recent industry developments, providing a 360-degree view of this dynamic market.

United Kingdom Engineering Plastics Market Market Concentration & Innovation

The UK engineering plastics market exhibits a moderately concentrated landscape, with several multinational corporations holding significant market share. Key players such as Victrex, Sumitomo Chemical Co Ltd, and BASF SE compete fiercely, driving innovation and shaping market dynamics. The market share of the top five players is estimated at xx%. The market is characterized by ongoing innovation, driven by the need for lighter, stronger, and more sustainable materials across diverse applications. Regulatory frameworks, including REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and waste management directives, significantly influence material selection and manufacturing processes. The increasing demand for high-performance materials in sectors like aerospace and automotive fuels innovation in specialized polymers like PEEK and Polyimide. Furthermore, the presence of substitute materials, such as metal alloys and composites, introduces competitive pressure, compelling manufacturers to continuously enhance product performance and cost-effectiveness. M&A activities in the sector, though not frequent, are typically driven by strategies to expand product portfolios or access new technologies. Recent deals, such as those involving smaller specialty players, represent a value of approximately xx Million. The report details these activities and their impact on market consolidation.

United Kingdom Engineering Plastics Market Industry Trends & Insights

The UK engineering plastics market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by the increasing demand from key end-user industries such as automotive, aerospace, and electronics. The automotive sector's push for lightweighting and enhanced fuel efficiency drives the adoption of advanced engineering plastics. Similarly, the burgeoning aerospace industry requires high-performance materials with exceptional durability and thermal stability, bolstering the demand for specialized polymers like PEEK and fluoropolymers. Technological advancements in additive manufacturing (3D printing) are also shaping market trends, allowing for greater design flexibility and customized solutions. Consumer preferences are shifting towards sustainable and recyclable materials, creating opportunities for bio-based and recycled engineering plastics. Intense competition among established players necessitates continuous innovation and differentiation strategies, including the development of new materials with improved properties and cost-effective manufacturing processes. Market penetration of high-performance polymers, like PEEK, is gradually increasing, fueled by their unique properties.

Dominant Markets & Segments in United Kingdom Engineering Plastics Market

Dominant End-User Industries: The automotive and electrical and electronics sectors represent the largest segments of the UK engineering plastics market, driven by high production volumes and increasing adoption of lightweight and high-performance materials. The aerospace industry, although smaller in volume, demands high-performance materials, driving premium segment growth.

Dominant Resin Types: Polybutylene Terephthalate (PBT) and Polycarbonate (PC) currently dominate the market due to their versatility and cost-effectiveness. However, the demand for high-performance polymers like Polyether Ether Ketone (PEEK) is rapidly increasing, driven by its unique properties in demanding applications.

Key Drivers: Government policies promoting sustainable materials and infrastructure development projects further support market growth. Economic factors influencing consumer spending and industrial investment play a crucial role, while regional variations in industrial activity influence segment dominance. The UK’s automotive sector is a strong driver for many polymer types, due to the adoption of high-performance materials.

United Kingdom Engineering Plastics Market Product Developments

Recent product developments highlight a strong emphasis on performance enhancement and sustainability. Victrex's introduction of a new implantable PEEK-OPTIMA polymer for medical applications exemplifies the innovation in high-performance materials. Similarly, Covestro AG's Makrolon 3638 polycarbonate for healthcare demonstrates the expansion of engineering plastics into specialized niche markets. These advancements, coupled with ongoing research in bio-based and recycled plastics, reflect the industry's commitment to meeting evolving market demands and sustainability goals.

Report Scope & Segmentation Analysis

This report segments the UK engineering plastics market by End-User Industry (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, Other End-user Industries) and Resin Type (Fluoropolymer, Polyphthalamide, Polybutylene Terephthalate (PBT), Polycarbonate (PC), Polyether Ether Ketone (PEEK), Polyethylene Terephthalate (PET), Polyimide (PI), Polymethyl Methacrylate (PMMA), Polyoxymethylene (POM), Styrene Copolymers (ABS and SAN)). Each segment's growth is analyzed, considering market size, competitive dynamics, and projected future growth. For instance, the automotive segment exhibits strong growth, driven by lightweighting trends, while the aerospace segment demonstrates high value growth, focused on specialized, high-performance materials. Similarly, the demand for PBT and PC remains robust, while specialized polymers like PEEK experience a higher growth rate due to their niche applications.

Key Drivers of United Kingdom Engineering Plastics Market Growth

The UK engineering plastics market growth is propelled by several key factors. Firstly, the automotive industry's continuous pursuit of lightweight vehicles, improving fuel efficiency and safety, significantly drives demand. Secondly, advancements in electronics and electrical applications require materials with high performance and durability, fueling market expansion. Government initiatives supporting sustainability and investment in infrastructure projects further stimulate demand for advanced and environmentally friendly plastics. Finally, ongoing technological innovations in polymer chemistry and processing techniques contribute to enhanced material properties and broader applications.

Challenges in the United Kingdom Engineering Plastics Market Sector

The UK engineering plastics market faces challenges, including fluctuating raw material prices impacting profitability and supply chain disruptions impacting production timelines. Stringent environmental regulations require manufacturers to adopt sustainable practices, increasing production costs. Furthermore, intensifying competition from established players and the emergence of substitute materials necessitates continuous innovation and cost optimization strategies. These factors can negatively influence profit margins and hinder market expansion unless strategically addressed.

Emerging Opportunities in United Kingdom Engineering Plastics Market

The market presents promising opportunities, including the rising demand for sustainable and bio-based engineering plastics, catering to growing environmental consciousness. Advancements in additive manufacturing (3D printing) open new avenues for customized product development and improved production efficiency. Expansion into niche sectors like medical devices and renewable energy further presents growth potential. Capitalizing on these trends through strategic investments in R&D and sustainable manufacturing practices is crucial for market success.

Leading Players in the United Kingdom Engineering Plastics Market Market

- Victrex PLC

- Sumitomo Chemical Co Ltd

- Teijin Limited

- Asahi Kasei Corporation

- Solvay

- INEOS

- Mitsubishi Chemical Corporation

- Celanese Corporation

- Domo Chemicals

- Polymer Extrusion Technologies (UK) Ltd

- BASF SE

- Alfa S A B de C V

- Radici Partecipazioni SpA

- Covestro AG

- AGC Inc

Key Developments in United Kingdom Engineering Plastics Market Industry

February 2023: Victrex PLC announced plans to expand its medical division, Invibio Biomaterial Solutions, establishing a new product development facility in Leeds, UK. This signals a significant investment in the medical applications of PEEK polymers, strengthening its market position.

February 2023: Covestro AG launched Makrolon 3638 polycarbonate for healthcare and life sciences applications. This product expansion broadens Covestro's reach in the high-growth medical sector.

March 2023: Victrex PLC introduced a new implantable PEEK-OPTIMA polymer for medical device additive manufacturing. This innovation leverages the growing adoption of 3D printing in medical device production and highlights Victrex’s commitment to technological advancement.

Strategic Outlook for United Kingdom Engineering Plastics Market Market

The UK engineering plastics market exhibits considerable future potential, driven by continuous innovation in material science and increasing demand from key end-user industries. Strategic investments in R&D, sustainable manufacturing practices, and expansion into niche markets will be crucial for success. The growing adoption of advanced technologies like additive manufacturing and the increasing focus on sustainability will shape future market dynamics. Companies that effectively integrate these trends into their strategies are poised for significant growth in the coming years.

United Kingdom Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

United Kingdom Engineering Plastics Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Low-pressure Membrane Technologies; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Poor Fouling Resistance of Nano porous Membranes; Other Restraints

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. England United Kingdom Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 7. Scotland United Kingdom Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 8. Wales United Kingdom Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Ireland United Kingdom Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Victre

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sumitomo Chemical Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Teijin Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Asahi Kasei Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Solvay

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 INEOS

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mitsubishi Chemical Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Celanese Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Domo Chemicals

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Polymer Extrusion Technologies (UK) Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BASF SE

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Alfa S A B de C V

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Radici Partecipazioni SpA

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Covestro AG

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 AGC Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Victre

List of Figures

- Figure 1: United Kingdom Engineering Plastics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Engineering Plastics Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Engineering Plastics Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: United Kingdom Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 4: United Kingdom Engineering Plastics Market Volume K Tons Forecast, by End User Industry 2019 & 2032

- Table 5: United Kingdom Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 6: United Kingdom Engineering Plastics Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 7: United Kingdom Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United Kingdom Engineering Plastics Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: United Kingdom Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Engineering Plastics Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: England United Kingdom Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: England United Kingdom Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Scotland United Kingdom Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Scotland United Kingdom Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Wales United Kingdom Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Wales United Kingdom Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Northern Ireland United Kingdom Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Northern Ireland United Kingdom Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 20: United Kingdom Engineering Plastics Market Volume K Tons Forecast, by End User Industry 2019 & 2032

- Table 21: United Kingdom Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 22: United Kingdom Engineering Plastics Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 23: United Kingdom Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Kingdom Engineering Plastics Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Engineering Plastics Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the United Kingdom Engineering Plastics Market?

Key companies in the market include Victre, Sumitomo Chemical Co Ltd, Teijin Limited, Asahi Kasei Corporation, Solvay, INEOS, Mitsubishi Chemical Corporation, Celanese Corporation, Domo Chemicals, Polymer Extrusion Technologies (UK) Ltd, BASF SE, Alfa S A B de C V, Radici Partecipazioni SpA, Covestro AG, AGC Inc.

3. What are the main segments of the United Kingdom Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Low-pressure Membrane Technologies; Other Drivers.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Poor Fouling Resistance of Nano porous Membranes; Other Restraints.

8. Can you provide examples of recent developments in the market?

March 2023: Victrex PLC introduced a new type of implantable PEEK-OPTIMA polymer that is specifically designed for use in the manufacturing processes of medical device additives, such as fused deposition modeling (FDM) and fused filament fabrication (FFF).February 2023: Victrex PLC revealed its plans to invest in the expansion of its medical division, Invibio Biomaterial Solutions, which includes establishing a new product development facility in Leeds, United Kingdom.February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications such as drug delivery devices, wellness and wearable devices, and single-use containers for biopharmaceutical manufacturing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the United Kingdom Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence