Key Insights

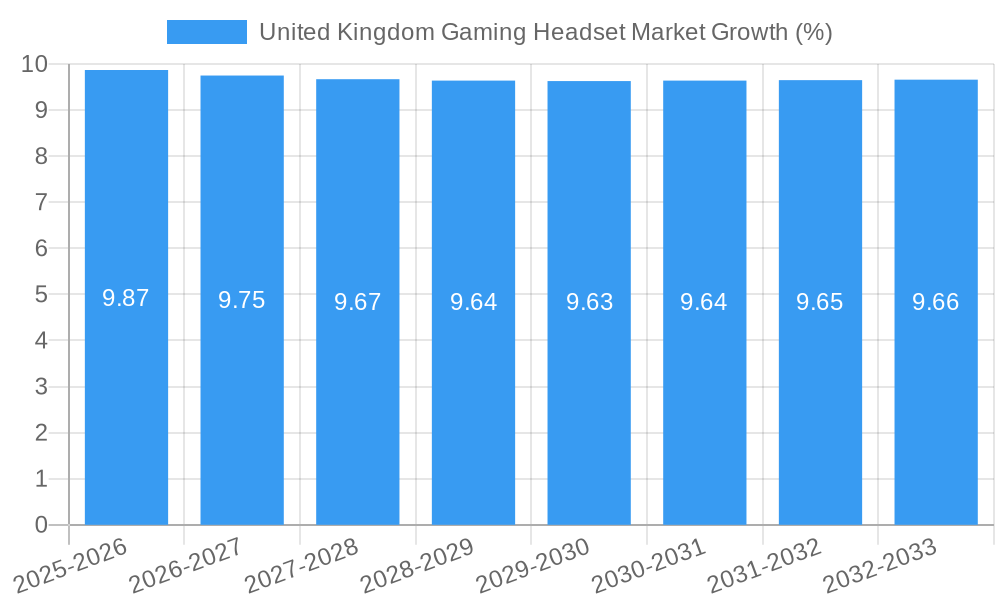

The United Kingdom gaming headset market is poised for significant expansion, with a current valuation of approximately $197.07 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 9.85% through 2033. This robust growth is fueled by several key drivers, including the increasing popularity of esports, the rising adoption of advanced gaming technologies, and a growing demand for immersive audio experiences among gamers of all levels. The UK's vibrant gaming culture, characterized by a high penetration of consoles and PCs, provides a fertile ground for market expansion. Furthermore, advancements in wireless technology, noise-cancellation features, and ergonomic designs are continuously enhancing product appeal and driving consumer spending. The accessibility of online sales channels has also democratized access to a wider array of gaming headsets, catering to diverse budgets and preferences.

The market segmentation reveals a dynamic landscape. Console headsets and PC headsets are expected to command significant shares, reflecting the dual ecosystems of gaming. Connectivity type, with wireless options rapidly gaining traction due to their convenience and freedom of movement, is a crucial differentiator. Sales channels like online platforms are anticipated to dominate, supported by the convenience and competitive pricing they offer, while retail continues to play a role in allowing hands-on product evaluation. Key players such as Logitech International S.A., Corsair Gaming Inc., Razer Inc., SteelSeries, and Turtle Beach Corporation are actively innovating and competing to capture market share through product differentiation and strategic marketing. Despite the positive outlook, potential restraints may include rising component costs and intense competition, which could impact pricing strategies and profit margins for manufacturers.

This in-depth report provides a thorough examination of the United Kingdom gaming headset market, covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033. With an estimated market size of £350 Million in 2025, the market is poised for significant growth driven by increasing gamer adoption, technological advancements, and the booming esports scene. We analyze key market players, segmentation by compatibility, connectivity, and sales channels, alongside crucial industry developments and future strategic outlooks to equip stakeholders with actionable insights for navigating this dynamic landscape.

United Kingdom Gaming Headset Market Market Concentration & Innovation

The United Kingdom gaming headset market exhibits a moderate concentration, with a few key players like Logitech International S A, Corsair Gaming Inc, Razer Inc, SteelSeries, and Turtle Beach Corporation holding significant market shares. Innovation remains a primary driver, with companies continuously introducing advanced features such as immersive audio, active noise cancellation, low-latency wireless connectivity, and ergonomic designs to enhance the gaming experience. The market is influenced by evolving regulatory frameworks, particularly concerning consumer electronics and data privacy. Product substitutes include integrated audio solutions in gaming consoles and mobile devices, but the superior audio fidelity and specialized features of gaming headsets ensure their sustained demand. End-user trends indicate a growing preference for wireless connectivity, comfort for extended gaming sessions, and compatibility with multiple platforms. Mergers and acquisitions (M&A) activity, while not as prevalent as in other tech sectors, plays a role in market consolidation and technological integration, with deal values varying based on strategic importance and target company performance.

United Kingdom Gaming Headset Market Industry Trends & Insights

The United Kingdom gaming headset market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025-2033). This expansion is fueled by several interconnected factors. The increasing penetration of gaming across all age demographics, coupled with the rising popularity of esports and competitive gaming events, directly translates to a higher demand for premium gaming peripherals, including high-fidelity headsets. Technological advancements are playing a pivotal role, with manufacturers investing heavily in research and development to offer superior audio quality, immersive surround sound capabilities, and advanced noise-cancellation technologies. The transition towards wireless connectivity continues to be a dominant trend, driven by consumer demand for convenience and freedom of movement, with manufacturers offering increasingly sophisticated low-latency wireless solutions that rival wired performance.

Consumer preferences are evolving, with gamers increasingly seeking headsets that offer not only exceptional audio performance but also comfort for prolonged gaming sessions, customizable features through companion apps, and aesthetic appeal. The integration of virtual reality (VR) and augmented reality (AR) gaming experiences also presents a growing opportunity, necessitating specialized headsets that can deliver precise positional audio and seamless integration with these immersive technologies. Furthermore, the rise of content creation, particularly streaming on platforms like Twitch and YouTube, has spurred demand for headsets with high-quality microphones for clear communication and commentary. This confluence of technological innovation, changing consumer habits, and the expanding gaming ecosystem solidifies the upward trajectory of the UK gaming headset market.

Dominant Markets & Segments in United Kingdom Gaming Headset Market

The United Kingdom gaming headset market is characterized by distinct dominant segments that dictate overall market performance and strategic focus for manufacturers and retailers.

Compatibility Type:

- PC Headset: This segment currently holds the largest market share, estimated at over 60% of the total market value in 2025. The PC gaming ecosystem, with its diverse range of titles and highly engaged player base, consistently drives demand for high-performance and feature-rich headsets. Key drivers include the popularity of PC-exclusive titles, the prevalence of esports on PC platforms, and the ability for PC gamers to customize and upgrade their hardware readily.

- Console Headset: This segment is experiencing rapid growth, projected to capture approximately 35% of the market by 2033. The widespread adoption of next-generation consoles like the PlayStation 5 and Xbox Series X/S, coupled with a robust library of exclusive games, is significantly boosting demand for console-specific gaming headsets. The ease of plug-and-play functionality and manufacturer-supported audio enhancements for consoles are key advantages.

Connectivity Type:

- Wireless: The wireless segment is the fastest-growing, expected to command over 55% of the market by 2033. Gamers prioritize the convenience and freedom of movement offered by wireless technology. Advancements in low-latency wireless solutions have largely mitigated previous concerns about audio lag, making them a preferred choice for many.

- Wired: While gradually losing market share to wireless alternatives, wired headsets remain a significant segment, particularly for budget-conscious consumers or those prioritizing absolute zero latency in competitive scenarios. Their reliability and often lower price point ensure their continued relevance.

Sales Channel:

- Online: The online sales channel dominates the market, accounting for an estimated 70% of sales in 2025. E-commerce platforms offer a wider selection, competitive pricing, and the convenience of home delivery, appealing to a broad spectrum of consumers. Key drivers include the extensive reach of online retailers, the availability of customer reviews and comparisons, and targeted digital marketing strategies.

- Retail: The retail segment, including electronics stores and specialized gaming retailers, still plays a crucial role, capturing approximately 30% of sales. Physical stores offer the advantage of allowing consumers to try before they buy, experience the comfort and build quality firsthand, and receive immediate product support. The experiential aspect of retail remains valuable for driving purchasing decisions, especially for premium products.

United Kingdom Gaming Headset Market Product Developments

The UK gaming headset market is characterized by continuous product innovation aimed at enhancing the gamer's audio experience. Companies are focusing on developing headsets with superior sound drivers for immersive spatial audio, advanced microphone technology for crystal-clear voice communication, and ergonomic designs for maximum comfort during extended play sessions. Key trends include the integration of customizable RGB lighting, haptic feedback for enhanced immersion, and proprietary software for fine-tuning audio profiles and microphone settings. Competitive advantages are being built on features like low-latency wireless connectivity, multi-platform compatibility, and robust build quality.

Report Scope & Segmentation Analysis

This report meticulously analyzes the United Kingdom gaming headset market across several key segmentation dimensions. The Compatibility Type segment includes Console Headsets and PC Headsets, each with distinct growth trajectories influenced by platform popularity and exclusive game releases. The Connectivity Type segment differentiates between Wired and Wireless headsets, with wireless technology demonstrating a higher growth rate due to consumer demand for convenience. The Sales Channel segmentation examines Retail and Online platforms, highlighting the dominance of e-commerce in driving market penetration. Each segment is analyzed for its current market size, projected growth, and the competitive dynamics influencing its performance.

Key Drivers of United Kingdom Gaming Headset Market Growth

Several factors are propelling the growth of the United Kingdom gaming headset market. The burgeoning esports industry, with its increasing prize pools and viewership, encourages serious gamers to invest in high-performance audio equipment. The widespread adoption of high-speed internet and robust gaming infrastructure supports seamless online multiplayer experiences, where effective team communication via headsets is paramount. Furthermore, the growing popularity of game streaming and content creation necessitates high-quality microphones and clear audio output, further boosting demand. Economic factors, such as disposable income and consumer spending on entertainment, also play a significant role.

Challenges in the United Kingdom Gaming Headset Market Sector

Despite its growth potential, the UK gaming headset market faces several challenges. Intense competition among established brands and emerging players can lead to price wars, potentially impacting profit margins. The rapid pace of technological advancement requires continuous investment in research and development, which can be costly. Supply chain disruptions, as experienced in recent years, can affect product availability and lead times. Moreover, the market is susceptible to economic downturns that may reduce consumer discretionary spending on gaming accessories. Navigating intellectual property rights and ensuring product compliance with electronic waste regulations also present ongoing challenges.

Emerging Opportunities in United Kingdom Gaming Headset Market

Significant emerging opportunities exist within the UK gaming headset market. The increasing adoption of virtual reality (VR) and augmented reality (AR) gaming creates demand for specialized headsets with advanced spatial audio capabilities. The continued growth of the mobile gaming segment, with an increasing number of high-fidelity mobile titles, presents an opportunity for versatile gaming headsets that can connect seamlessly to smartphones. The rising interest in personalized gaming experiences opens avenues for customizable headsets with advanced audio tuning and aesthetic options. Furthermore, partnerships with game developers and esports organizations can provide valuable market penetration and brand visibility.

Leading Players in the United Kingdom Gaming Headset Market Market

- Logitech International S A

- Corsair Gaming Inc

- Razer Inc

- SteelSeries

- Turtle Beach Corporation

Key Developments in United Kingdom Gaming Headset Market Industry

- June 2024: AVID Products introduced its newest headset, the AVIGA gaming headset, showcasing cutting-edge technology. The AVIGA is crafted to offer top-tier sound quality, exceptional performance, and comfort, all at an affordable price. With this launch, AVID Products seeks to enhance the esports experience for gamers across the spectrum.

- May 2024: SteelSeries unveiled its latest headset line, the Arctis Nova 5 series, accompanied by the debut of the Nova 5 Companion App. This app boasts an impressive repertoire of over 100 gaming audio presets. While the series is tailored for PC gaming, it also offers specialized versions for PlayStation (Arctis Nova 5P) and Xbox (Arctis Nova 5X), ensuring compatibility across a broad spectrum of devices.

Strategic Outlook for United Kingdom Gaming Headset Market Market

The strategic outlook for the United Kingdom gaming headset market remains highly optimistic. Key growth catalysts include continued technological innovation, particularly in wireless audio and immersive sound technologies, and the sustained popularity of esports and competitive gaming. Companies that focus on delivering superior audio fidelity, exceptional comfort, and seamless multi-platform compatibility will be well-positioned for success. Strategic partnerships with game developers and the exploration of emerging markets like VR/AR gaming are crucial for long-term growth. A customer-centric approach, emphasizing personalized experiences and responsive after-sales support, will be vital for building brand loyalty and capturing market share in this competitive landscape.

United Kingdom Gaming Headset Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

United Kingdom Gaming Headset Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Gaming Headset Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Wireless Headsets is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Gaming Headset Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Logitech International S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Corsair Gaming Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Razer Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SteelSeries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Turtle Beach Corporatio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Logitech International S A

List of Figures

- Figure 1: United Kingdom Gaming Headset Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Gaming Headset Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Gaming Headset Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Gaming Headset Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: United Kingdom Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 4: United Kingdom Gaming Headset Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 5: United Kingdom Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 6: United Kingdom Gaming Headset Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 7: United Kingdom Gaming Headset Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 8: United Kingdom Gaming Headset Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 9: United Kingdom Gaming Headset Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United Kingdom Gaming Headset Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: United Kingdom Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 12: United Kingdom Gaming Headset Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 13: United Kingdom Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 14: United Kingdom Gaming Headset Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 15: United Kingdom Gaming Headset Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 16: United Kingdom Gaming Headset Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 17: United Kingdom Gaming Headset Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Gaming Headset Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Gaming Headset Market?

The projected CAGR is approximately 9.85%.

2. Which companies are prominent players in the United Kingdom Gaming Headset Market?

Key companies in the market include Logitech International S A, Corsair Gaming Inc, Razer Inc, SteelSeries, Turtle Beach Corporatio.

3. What are the main segments of the United Kingdom Gaming Headset Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 197.07 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Wireless Headsets is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2024: AVID Products introduced its newest headset, the AVIGA gaming headset, showcasing cutting-edge technology. The AVIGA is crafted to offer top-tier sound quality, exceptional performance, and comfort, all at an affordable price. With this launch, AVID Products seeks to enhance the esports experience for gamers across the spectrum.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Gaming Headset Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Gaming Headset Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Gaming Headset Market?

To stay informed about further developments, trends, and reports in the United Kingdom Gaming Headset Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence