Key Insights

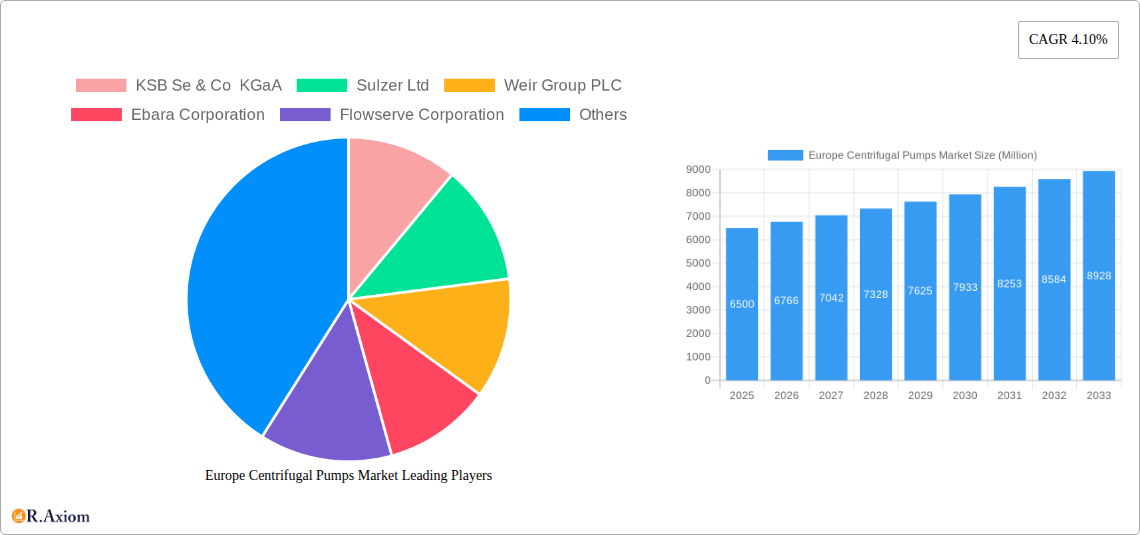

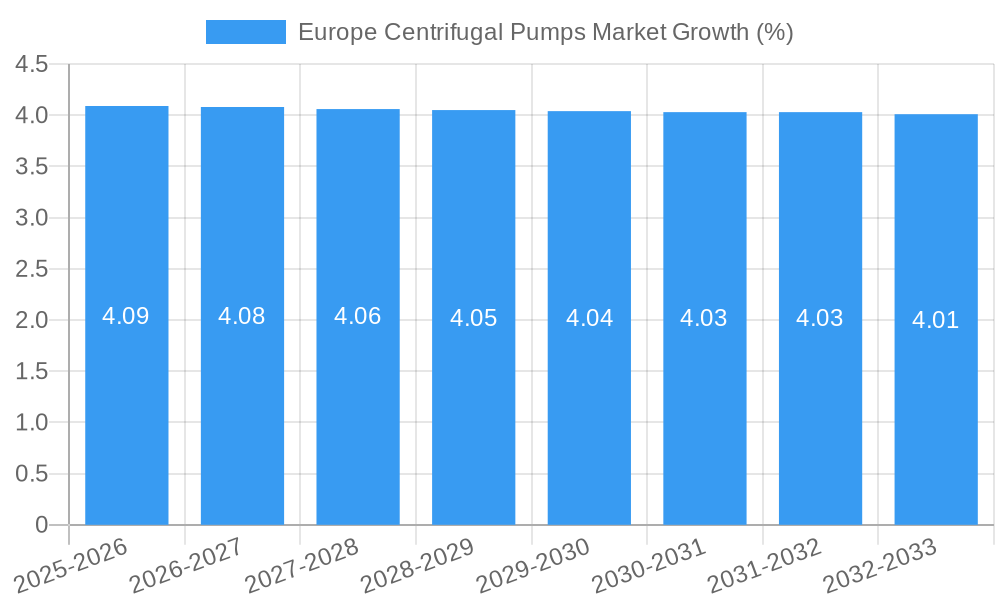

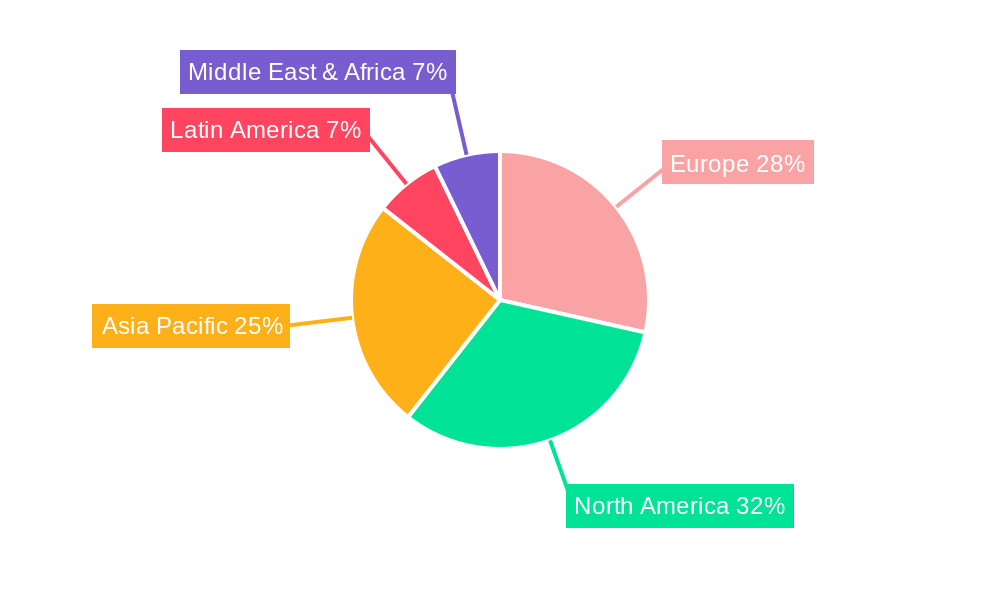

The European centrifugal pumps market is projected to experience robust growth, driven by increasing industrialization and infrastructure development across key sectors such as oil & gas, chemicals, and water & wastewater management. With an estimated market size of USD 6,500 million in 2025, and a Compound Annual Growth Rate (CAGR) of 4.10% projected from 2025 to 2033, the market is expected to reach approximately USD 8,968 million by the end of the forecast period. This expansion is fueled by the demand for energy-efficient and reliable pumping solutions, particularly in the power generation and construction industries. Technological advancements, including the integration of smart technologies for predictive maintenance and enhanced operational efficiency, are also playing a significant role in shaping market trends. The stringent environmental regulations across Europe are further stimulating the adoption of advanced centrifugal pumps that offer improved performance and reduced energy consumption, thereby contributing to the market's positive trajectory.

However, the market faces certain restraints, primarily the high initial capital investment required for advanced centrifugal pump systems and the availability of cost-effective alternatives in certain applications. Despite these challenges, the overall outlook remains optimistic. The demand for multi-stage pumps, essential for high-pressure applications in industries like oil and gas, is anticipated to remain strong. Similarly, the water and wastewater treatment sector, a cornerstone of European infrastructure, will continue to be a significant end-user, demanding efficient and durable pumping solutions. Key companies are actively investing in research and development to innovate and expand their product portfolios to meet evolving industry needs and regulatory requirements, ensuring a competitive landscape and sustained market expansion within Europe. The European region, with its strong industrial base and focus on sustainable practices, represents a significant market for centrifugal pumps.

Europe Centrifugal Pumps Market: Comprehensive Growth Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the Europe Centrifugal Pumps Market, offering a 360-degree view of its current status, historical trends, and future trajectory. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report is designed to equip industry stakeholders with actionable insights for strategic decision-making. We delve into market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions, alongside key industry trends, dominant markets, product developments, and emerging opportunities.

Europe Centrifugal Pumps Market Market Concentration & Innovation

The Europe Centrifugal Pumps Market exhibits a moderate to high level of market concentration, with a few key players holding significant market share, estimated to be around 65% by revenue. Innovation is a critical driver for maintaining competitive advantage, particularly in sectors demanding high efficiency, reliability, and advanced materials. Key innovation areas include the development of smart pumps with integrated sensors for predictive maintenance, energy-efficient designs to meet stringent environmental regulations, and customized solutions for specialized industrial applications. The market is influenced by evolving regulatory frameworks concerning energy efficiency standards and environmental protection, such as the Ecodesign Directive. Product substitutes, while existing in the form of positive displacement pumps for specific applications, are generally less suitable for high-volume liquid transfer. End-user trends are leaning towards digitalization, automation, and sustainable practices, driving demand for intelligent pumping systems. Mergers and acquisitions (M&A) activity is evident as companies seek to expand their product portfolios, geographical reach, and service capabilities. Notable M&A activities are anticipated to contribute significantly to market consolidation and technological advancement, with estimated deal values reaching several hundred million Euros in strategic acquisitions.

Europe Centrifugal Pumps Market Industry Trends & Insights

The Europe Centrifugal Pumps Market is poised for substantial growth, driven by several interconnected industry trends and insights. The Compound Annual Growth Rate (CAGR) is projected to be approximately 4.2% over the forecast period (2025-2033), with the market size estimated to reach €38,500 Million by 2033. A significant driver of this growth is the increasing demand for centrifugal pumps across various end-user industries, particularly in water and wastewater management, oil & gas, and chemical processing, where robust infrastructure development and operational efficiency are paramount. Technological disruptions, such as the integration of IoT capabilities for remote monitoring and control, advancements in material science for enhanced durability and corrosion resistance, and the adoption of variable frequency drives (VFDs) for improved energy efficiency, are reshaping the market landscape. Consumer preferences are increasingly shifting towards sustainable and energy-efficient solutions, compelling manufacturers to invest in R&D for eco-friendly pump designs. The competitive dynamics are characterized by intense rivalry among established global players and emerging regional manufacturers, all vying for market share through product differentiation, competitive pricing, and strong distribution networks. Market penetration of advanced centrifugal pump technologies is steadily increasing as industries recognize the long-term operational cost savings and performance benefits. The ongoing industrial modernization across Europe, coupled with investments in infrastructure upgrades, particularly in water and wastewater treatment facilities, further bolsters the demand for reliable and efficient centrifugal pumping solutions. The energy sector's transition towards cleaner energy sources also necessitates specialized pumping systems for renewable energy infrastructure, contributing to market expansion. Furthermore, the pharmaceutical and food & beverage sectors continue to demand high-purity and hygienic pumping solutions, creating niche growth opportunities. The market is also witnessing a trend towards the adoption of digital twins and artificial intelligence in pump design and operation, promising optimized performance and reduced downtime.

Dominant Markets & Segments in Europe Centrifugal Pumps Market

The Water & Wastewater sector stands out as the dominant end-user industry in the Europe Centrifugal Pumps Market, accounting for an estimated 35% of the market share by revenue. This dominance is driven by a confluence of factors including stringent European Union regulations mandating advanced water treatment and recycling, substantial ongoing investments in upgrading and expanding municipal and industrial wastewater infrastructure, and a growing awareness of water scarcity leading to increased demand for efficient water management. Countries like Germany, France, and the United Kingdom are leading this trend due to significant public and private sector investments.

- Key Drivers for Water & Wastewater Dominance:

- EU Directives & Environmental Regulations: Strict compliance with directives like the Urban Wastewater Treatment Directive and Water Framework Directive necessitates advanced pumping solutions.

- Infrastructure Investment: Significant government funding for upgrading aging water and wastewater treatment plants.

- Population Growth & Urbanization: Increased demand for clean water and effective wastewater disposal.

- Water Scarcity Concerns: Driving the need for efficient water reuse and recycling technologies.

Among the flow types, Radial pumps hold the largest market share, estimated at 45%, due to their versatility and suitability for a wide range of flow rates and head pressures, making them ideal for numerous industrial and municipal applications. The Single Stage pumps segment also demonstrates significant traction, representing approximately 55% of the market, primarily driven by their cost-effectiveness, simpler design, and widespread use in lower to medium-pressure applications.

Key Drivers for Radial Flow Pump Dominance:

- Versatility: Applicable across diverse industries from water supply to chemical processing.

- Efficiency at Varying Flow Rates: Adaptable to fluctuating demand in many industrial processes.

Key Drivers for Single Stage Pump Dominance:

- Cost-Effectiveness: Lower manufacturing and maintenance costs.

- Simplicity & Reliability: Fewer moving parts lead to higher uptime.

- Broad Application Range: Suitable for most general-purpose pumping needs.

The Oil & Gas sector, while not the largest, presents a segment with high-value opportunities, particularly in upstream exploration and production, refining, and petrochemical industries. The Chemical industry also represents a substantial market, driven by the need for robust, corrosion-resistant pumps for handling a wide array of aggressive fluids.

Europe Centrifugal Pumps Market Product Developments

Product innovation in the Europe Centrifugal Pumps Market is actively shaping competitive advantages. Manufacturers are focusing on enhancing energy efficiency through advanced impeller designs and aerodynamic optimization, reducing operational costs for end-users. The integration of smart technologies, including IoT sensors and predictive analytics capabilities, allows for real-time performance monitoring, remote diagnostics, and proactive maintenance, minimizing downtime and improving operational reliability. Developments in material science are leading to pumps with superior corrosion and abrasion resistance, extending product lifespans in harsh environments. Furthermore, the trend towards compact and modular pump designs facilitates easier installation, maintenance, and space optimization, particularly in demanding industrial settings.

Report Scope & Segmentation Analysis

The Europe Centrifugal Pumps Market is meticulously segmented to provide granular insights into its diverse landscape. The Flow Type segmentation includes Axial, Radial, and Mixed flow pumps, each catering to specific hydraulic requirements and applications. The Number of Stages segmentation comprises Single Stage and Multi Stage pumps, reflecting varying pressure and performance needs. The comprehensive End-User Industry segmentation covers Oil & Gas, Chemicals, Food & Beverage, Water & Wastewater, Pharmaceuticals, Power, Construction, Metal & Mining, and Others. For the Water & Wastewater segment, growth is projected at a CAGR of 4.5%, driven by infrastructure upgrades, with an estimated market size of €13,475 Million by 2033. The Oil & Gas segment is expected to grow at a CAGR of 3.8%, influenced by exploration activities and refinery modernization, reaching €6,650 Million by 2033. The Chemical sector projects a CAGR of 4.1%, fueled by expansion in specialty chemicals and petrochemicals, with a market size of €7,935 Million by 2033.

Key Drivers of Europe Centrifugal Pumps Market Growth

Several key factors are propelling the growth of the Europe Centrifugal Pumps Market. Firstly, increasing investments in infrastructure development, particularly in water and wastewater treatment across European nations, are a primary growth catalyst. Secondly, stringent environmental regulations and a focus on energy efficiency are driving demand for advanced, low-power-consumption centrifugal pumps. Thirdly, the expansion of the oil & gas sector, including upstream exploration and downstream refining operations, necessitates reliable pumping solutions. Fourthly, growing industrialization and modernization initiatives in sectors like chemicals, pharmaceuticals, and food & beverage are creating sustained demand. Lastly, technological advancements, such as smart pumps with IoT integration for predictive maintenance and enhanced operational intelligence, are creating new market opportunities and driving adoption.

Challenges in the Europe Centrifugal Pumps Market Sector

Despite the positive growth outlook, the Europe Centrifugal Pumps Market faces several challenges. Intense price competition among manufacturers, particularly for standard pump configurations, can put pressure on profit margins. Fluctuations in raw material prices, such as stainless steel and specialized alloys, can impact manufacturing costs and product pricing. Complex regulatory landscapes and varying standards across European countries can create compliance hurdles for manufacturers. The availability of skilled labor for the manufacturing, installation, and maintenance of advanced pumping systems can also be a constraint. Furthermore, economic downturns or geopolitical instability can lead to reduced industrial investment, impacting overall demand for centrifugal pumps.

Emerging Opportunities in Europe Centrifugal Pumps Market

The Europe Centrifugal Pumps Market is ripe with emerging opportunities. The growing focus on renewable energy infrastructure, such as solar and wind farms, requires specialized pumping solutions for water management and cooling systems. The increasing adoption of digitalization and Industry 4.0 technologies presents opportunities for smart, connected pumps with advanced analytics capabilities. The demand for high-efficiency and low-maintenance pumps in sectors like food & beverage and pharmaceuticals, driven by stringent hygiene and quality standards, offers significant potential. Furthermore, the circular economy initiatives and the drive for water conservation are creating opportunities for innovative pumping solutions in wastewater recycling and resource recovery. Expansion into emerging Eastern European markets with developing industrial sectors also presents untapped growth potential.

Leading Players in the Europe Centrifugal Pumps Market Market

- KSB Se & Co KGaA

- Sulzer Ltd

- Weir Group PLC

- Ebara Corporation

- Flowserve Corporation

- Ruhrpumpen Group

- Schlumberger Ltd

- Dover Corporation

- Baker Hughes Company

- Edur Pumpenfabrik Eduard Redlien GmbH & Co

Key Developments in Europe Centrifugal Pumps Market Industry

- June 2021: AxFlow Italy, a provider of centrifugal pumps, acquired RPT S.r.l., a leading company in the overhaul and technical revision of centrifugal and volumetric pumps and industrial mixers. The acquisition is expected to help the company further strengthen its service business for centrifugal and other pumps in Europe.

- May 2021: The KSB Group launched a new generation of its submersible grey water pumps. The AmaDrainer 3I is compact with an integrated float switch and a maximum diameter of 155mm, making the pump suitable for narrow spaces such as light wells. According to the company, the product is highly versatile and can be used for cellar rooms, draining shafts, and extracting water from reservoirs and rivers.

Strategic Outlook for Europe Centrifugal Pumps Market Market

The strategic outlook for the Europe Centrifugal Pumps Market is highly promising, driven by a sustained demand for efficient, reliable, and technologically advanced pumping solutions. Key growth catalysts include ongoing investments in water and wastewater infrastructure, stringent environmental regulations, and the industrial sector's push for digitalization and automation. Companies are expected to focus on developing smart pumps with predictive maintenance capabilities and enhanced energy efficiency to meet evolving market needs. Strategic partnerships, mergers, and acquisitions will likely play a crucial role in expanding market reach and consolidating competitive positions. Furthermore, exploring opportunities in the renewable energy sector and emerging Eastern European markets will be vital for long-term growth and market leadership in this dynamic industry.

Europe Centrifugal Pumps Market Segmentation

-

1. Flow Type

- 1.1. Axial

- 1.2. Radial

- 1.3. Mixed

-

2. Number of Stages

- 2.1. Single Stage

- 2.2. Multi Stage

-

3. End-User Indsutry

- 3.1. Oil & Gas

- 3.2. Chemicals

- 3.3. Food & Beverage

- 3.4. Water & Wastewater

- 3.5. Pharmaceuticals

- 3.6. Power

- 3.7. Construction

- 3.8. Metal & Mining

- 3.9. Others

Europe Centrifugal Pumps Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Centrifugal Pumps Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization to Drive the Market Growth; Increasing Investment in Water & Wastewater Infrastructure

- 3.3. Market Restrains

- 3.3.1. High Acquisition and Maintenace Cost of Industrial CT systems

- 3.4. Market Trends

- 3.4.1. Rapid Urbanization to Drive the Market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Centrifugal Pumps Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Flow Type

- 5.1.1. Axial

- 5.1.2. Radial

- 5.1.3. Mixed

- 5.2. Market Analysis, Insights and Forecast - by Number of Stages

- 5.2.1. Single Stage

- 5.2.2. Multi Stage

- 5.3. Market Analysis, Insights and Forecast - by End-User Indsutry

- 5.3.1. Oil & Gas

- 5.3.2. Chemicals

- 5.3.3. Food & Beverage

- 5.3.4. Water & Wastewater

- 5.3.5. Pharmaceuticals

- 5.3.6. Power

- 5.3.7. Construction

- 5.3.8. Metal & Mining

- 5.3.9. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Flow Type

- 6. Germany Europe Centrifugal Pumps Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Centrifugal Pumps Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Centrifugal Pumps Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Centrifugal Pumps Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Centrifugal Pumps Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Centrifugal Pumps Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Centrifugal Pumps Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 KSB Se & Co KGaA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Sulzer Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Weir Group PLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Ebara Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Flowserve Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Ruhrpumpen Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Schlumberger Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Dover Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Baker Hughes Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Edur Pumpenfabrik Eduard Redlien GmbH & Co

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 KSB Se & Co KGaA

List of Figures

- Figure 1: Europe Centrifugal Pumps Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Centrifugal Pumps Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Centrifugal Pumps Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Centrifugal Pumps Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Centrifugal Pumps Market Revenue Million Forecast, by Flow Type 2019 & 2032

- Table 4: Europe Centrifugal Pumps Market Volume K Unit Forecast, by Flow Type 2019 & 2032

- Table 5: Europe Centrifugal Pumps Market Revenue Million Forecast, by Number of Stages 2019 & 2032

- Table 6: Europe Centrifugal Pumps Market Volume K Unit Forecast, by Number of Stages 2019 & 2032

- Table 7: Europe Centrifugal Pumps Market Revenue Million Forecast, by End-User Indsutry 2019 & 2032

- Table 8: Europe Centrifugal Pumps Market Volume K Unit Forecast, by End-User Indsutry 2019 & 2032

- Table 9: Europe Centrifugal Pumps Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Europe Centrifugal Pumps Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Europe Centrifugal Pumps Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Europe Centrifugal Pumps Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Germany Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: France Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Netherlands Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Sweden Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Europe Centrifugal Pumps Market Revenue Million Forecast, by Flow Type 2019 & 2032

- Table 28: Europe Centrifugal Pumps Market Volume K Unit Forecast, by Flow Type 2019 & 2032

- Table 29: Europe Centrifugal Pumps Market Revenue Million Forecast, by Number of Stages 2019 & 2032

- Table 30: Europe Centrifugal Pumps Market Volume K Unit Forecast, by Number of Stages 2019 & 2032

- Table 31: Europe Centrifugal Pumps Market Revenue Million Forecast, by End-User Indsutry 2019 & 2032

- Table 32: Europe Centrifugal Pumps Market Volume K Unit Forecast, by End-User Indsutry 2019 & 2032

- Table 33: Europe Centrifugal Pumps Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Centrifugal Pumps Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: United Kingdom Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Germany Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Germany Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: France Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Italy Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Italy Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Spain Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Netherlands Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Netherlands Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Belgium Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Belgium Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Sweden Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Sweden Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Norway Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Norway Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Poland Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Poland Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Denmark Europe Centrifugal Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Denmark Europe Centrifugal Pumps Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Centrifugal Pumps Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Europe Centrifugal Pumps Market?

Key companies in the market include KSB Se & Co KGaA, Sulzer Ltd, Weir Group PLC, Ebara Corporation, Flowserve Corporation, Ruhrpumpen Group, Schlumberger Ltd, Dover Corporation, Baker Hughes Company, Edur Pumpenfabrik Eduard Redlien GmbH & Co.

3. What are the main segments of the Europe Centrifugal Pumps Market?

The market segments include Flow Type, Number of Stages, End-User Indsutry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization to Drive the Market Growth; Increasing Investment in Water & Wastewater Infrastructure.

6. What are the notable trends driving market growth?

Rapid Urbanization to Drive the Market growth.

7. Are there any restraints impacting market growth?

High Acquisition and Maintenace Cost of Industrial CT systems.

8. Can you provide examples of recent developments in the market?

June 2021 - AxFlow Italy, a provider of centrifugal pumps, acquired RPT S.r.l., a leading company in the overhaul and technical revision of centrifugal and volumetric pumps and industrial mixers. The acquisition is expected to help the company further strengthen its service business for centrifugal and other pumps in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Centrifugal Pumps Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Centrifugal Pumps Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Centrifugal Pumps Market?

To stay informed about further developments, trends, and reports in the Europe Centrifugal Pumps Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence