Key Insights

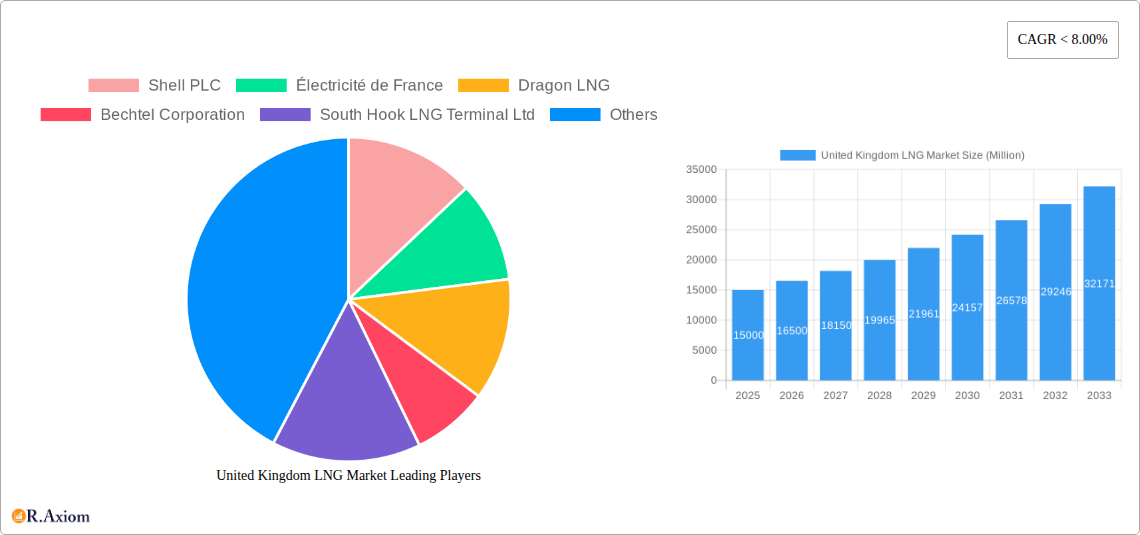

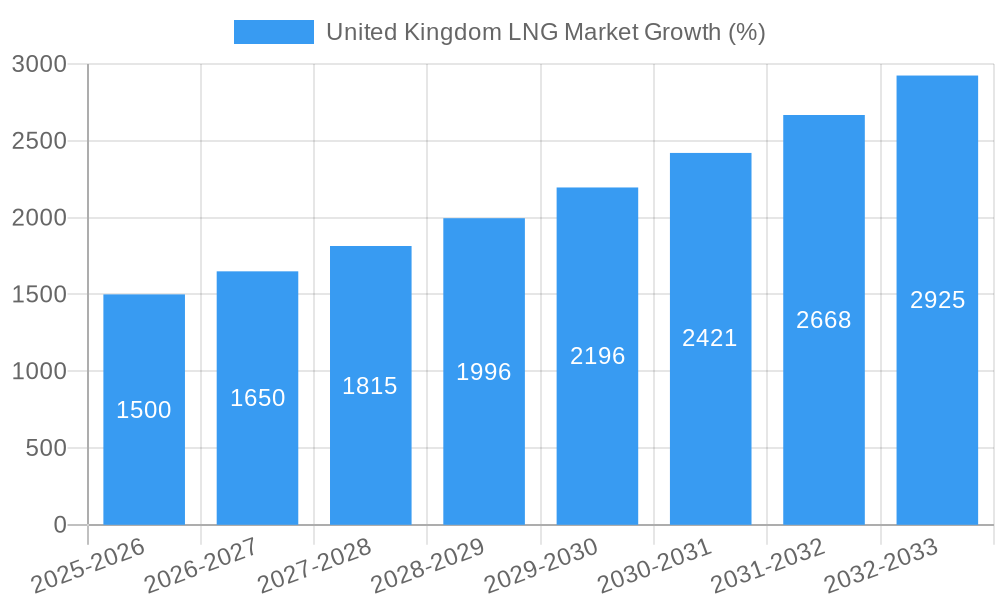

The United Kingdom LNG market is experiencing significant growth, driven by factors such as increasing energy demand, the need for energy security diversification away from reliance on pipeline gas, and the UK's commitment to reducing carbon emissions. The historical period (2019-2024) likely saw fluctuating market size influenced by global gas price volatility and intermittent supply disruptions. However, a positive Compound Annual Growth Rate (CAGR) throughout the forecast period (2025-2033) suggests a robust and expanding market. The base year of 2025 serves as a crucial point of reference, representing a likely stabilization and consolidation phase after previous market uncertainties. Looking forward, continued investment in LNG import infrastructure, including regasification terminals and pipelines, is anticipated to fuel market expansion. Furthermore, governmental policies promoting cleaner energy sources, while also acknowledging the crucial role of natural gas as a transition fuel, are expected to contribute to sustained market growth. This growth is further supported by the ongoing development of renewable energy sources, which indirectly boosts the demand for flexible gas supplies to balance intermittent renewable energy generation.

The estimated market size for 2025 is a crucial indicator of the UK LNG market's current state. This figure, combined with the projected CAGR, allows for the calculation of future market size estimates. Factors influencing this CAGR include the consistent demand from power generation, industrial processes, and potentially increasing residential consumption depending on government policies and energy pricing. Competition among LNG suppliers will also play a role, influencing pricing and ultimately impacting market size projections. The later years of the forecast period (2030-2033) will likely see the impact of long-term energy strategies, technological advancements in LNG handling and storage, and global geopolitical events affecting energy supply chains. The market's resilience to external shocks will be a key factor determining the accuracy of the projected CAGR.

United Kingdom LNG Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom LNG market, covering the period from 2019 to 2033. It offers actionable insights for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market. With a focus on market concentration, innovation, industry trends, and key players, this report is an essential resource for informed decision-making. The report uses 2025 as the base year and provides forecasts up to 2033, incorporating historical data from 2019-2024. The total market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

United Kingdom LNG Market Market Concentration & Innovation

The UK LNG market exhibits a moderately concentrated structure, with key players like Shell PLC, Électricité de France, and Dragon LNG holding significant market share. Precise market share figures are unavailable for public disclosure due to competitive reasons. The total market value is estimated to be xx Million for the year 2025. However, the market is witnessing increasing competition from smaller players and new entrants. Innovation is driven by the need for cleaner energy solutions, with a focus on improving LNG transportation, storage, and regasification technologies.

Regulatory frameworks, such as those concerning emissions and environmental impact, significantly influence market dynamics. Product substitutes, such as renewable energy sources, pose a growing challenge, although LNG still holds a significant advantage in terms of reliability and energy density. End-user trends reflect a growing demand for cleaner energy, particularly in the power generation sector. M&A activity in the sector remains relatively modest; however, there are ongoing investments from major players in infrastructure expansions, thereby suggesting significant industry growth. Notable M&A deal values during the historical period (2019-2024) remain undisclosed for competitive reasons.

United Kingdom LNG Market Industry Trends & Insights

The UK LNG market is experiencing significant growth, driven by factors such as increasing energy demand, the transition towards a lower-carbon energy mix, and government policies supportive of gas-fired power generation as a bridge fuel. Technological advancements in LNG transportation and storage are enhancing efficiency and reducing costs. Consumer preference is shifting towards cleaner energy sources, with LNG playing a key role in the transition. The competitive landscape is intensifying, with existing players expanding their capacities and new entrants seeking market share. The market penetration of LNG in various sectors is steadily rising, particularly in power generation. This growth trajectory indicates a positive outlook for the UK LNG market in the forecast period, with continuous investment expected in infrastructure development and new technologies.

Dominant Markets & Segments in United Kingdom LNG Market

The power generation segment dominates the UK LNG market, driven by its role as a key fuel source for electricity production.

- Key Drivers for Power Generation Dominance:

- Existing gas-fired power plant infrastructure.

- Government policies supporting gas-fired power generation as a transition fuel.

- Relatively low cost compared to other alternatives.

- Reliable and readily available supply.

The transportation sector shows modest but steady growth, fuelled by the increasing use of LNG as a marine fuel and (to a lesser extent) in road transport. The “Other Applications” segment encompasses various industrial uses, which are expected to witness moderate growth in line with industrial expansion.

United Kingdom LNG Market Product Developments

Recent product developments focus on improving the efficiency and sustainability of LNG handling and transportation. This includes advancements in liquefaction technologies, optimized storage solutions, and the development of cleaner burning LNG blends. These advancements are improving the market fit and competitive advantage of LNG as a fuel source, enhancing its appeal in various applications.

Report Scope & Segmentation Analysis

This report segments the UK LNG market by application:

Power Generation: This segment is expected to exhibit strong growth, driven by increasing energy demand and the transition to cleaner energy sources. The segment accounts for a significant portion of the total market. Competitive dynamics are intense, with major players vying for market share.

Transportation: This segment is showing moderate growth, with LNG increasingly used as marine fuel. The growth is expected to continue, but at a slower pace compared to power generation. Competitive dynamics involve companies offering LNG bunkering services.

Other Applications: This segment encompasses various industrial uses and is expected to exhibit moderate growth, reflecting broader industrial activities. This segment's competitive landscape is relatively less concentrated.

Key Drivers of United Kingdom LNG Market Growth

Growth in the UK LNG market is driven by several factors, including:

Increasing Energy Demand: The UK’s growing energy needs fuel demand for LNG.

Transition to Cleaner Energy: LNG is viewed as a transitional fuel towards decarbonization goals.

Government Policies: Policies favoring gas-fired power generation and supportive infrastructure development bolster market growth.

Technological Advancements: Innovations in LNG handling, storage, and transport increase efficiency and lower costs.

Challenges in the United Kingdom LNG Market Sector

The UK LNG market faces several challenges, including:

Regulatory Hurdles: Stringent environmental regulations and evolving carbon emission targets could impact market dynamics.

Supply Chain Issues: Global LNG supply chain disruptions can lead to price volatility and shortages.

Competitive Pressures: The presence of alternative energy sources, such as renewables, creates competitive pressure on LNG's market share. The exact quantifiable impact remains difficult to predict precisely but is a factor that requires ongoing monitoring.

Emerging Opportunities in United Kingdom LNG Market

Emerging opportunities include:

Growth in LNG bunkering infrastructure: Expanding LNG as marine fuel presents substantial growth potential.

Development of carbon capture and storage technologies: Integrating these technologies with LNG infrastructure would greatly reduce environmental impact.

Expansion into niche industrial applications: Exploration of LNG's suitability for specific industrial applications could open new market segments.

Leading Players in the United Kingdom LNG Market Market

- Shell PLC

- Électricité de France

- Dragon LNG

- Bechtel Corporation

- South Hook LNG Terminal Ltd

- Ramboll Group A/S

- Fluor Corporation

- Npower Limited

Key Developments in United Kingdom LNG Market Industry

- August 2022: Houston-based Delfin LNG signed a deal to supply 1 Million metric tons of LNG annually to Centrica, a UK energy company, for its planned floating LNG import terminal. This deal signifies increasing reliance on LNG imports and the potential for new import terminal infrastructure development.

Strategic Outlook for United Kingdom LNG Market Market

The UK LNG market is poised for continued growth, driven by a combination of factors including rising energy demand, the transition towards cleaner energy sources, and ongoing investments in infrastructure. Technological advancements, especially in carbon capture and storage, will play a crucial role in shaping the market's future trajectory. The market's strategic outlook remains positive, with opportunities for growth in various segments and the potential for new players to enter the market.

United Kingdom LNG Market Segmentation

-

1. Application

- 1.1. Power Generation

- 1.2. Transportation

- 1.3. Other Applications

United Kingdom LNG Market Segmentation By Geography

- 1. United Kingdom

United Kingdom LNG Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Drivers; Restraints

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Transportation Segment to dominate the market during the forecast period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation

- 5.1.2. Transportation

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 7. United Kingdom United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 8. France United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 9. Spain United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 10. Italy United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 11. Spain United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 12. Belgium United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 13. Netherland United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 14. Nordics United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Europe United Kingdom LNG Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Shell PLC

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Électricité de France

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Dragon LNG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Bechtel Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 South Hook LNG Terminal Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Ramboll Group A/S

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Fluor Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Npower Limited

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 Shell PLC

List of Figures

- Figure 1: United Kingdom LNG Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom LNG Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom LNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom LNG Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: United Kingdom LNG Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: United Kingdom LNG Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: United Kingdom United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Spain United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Spain United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Belgium United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Netherland United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Nordics United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe United Kingdom LNG Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom LNG Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: United Kingdom LNG Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom LNG Market?

The projected CAGR is approximately < 8.00%.

2. Which companies are prominent players in the United Kingdom LNG Market?

Key companies in the market include Shell PLC, Électricité de France, Dragon LNG, Bechtel Corporation, South Hook LNG Terminal Ltd, Ramboll Group A/S, Fluor Corporation, Npower Limited.

3. What are the main segments of the United Kingdom LNG Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Drivers; Restraints.

6. What are the notable trends driving market growth?

Transportation Segment to dominate the market during the forecast period..

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

In August 2022, Houston-based Delfin LNG signed a deal to supply LNG to a United Kingdom energy company that plans to construct a floating LNG export terminal off Louisiana's coast. This agreement involves Delfin LNG providing 1 million metric tons of LNG annually to Centrica, an energy company located in Windsor, England, which owns British Gas and Bord Gais Energy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom LNG Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom LNG Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom LNG Market?

To stay informed about further developments, trends, and reports in the United Kingdom LNG Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence