Key Insights

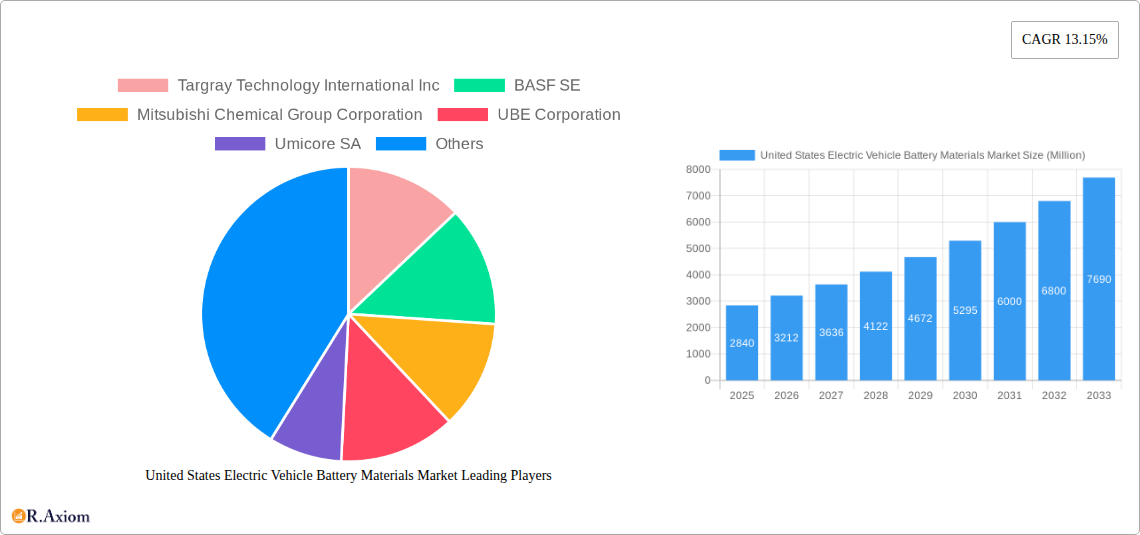

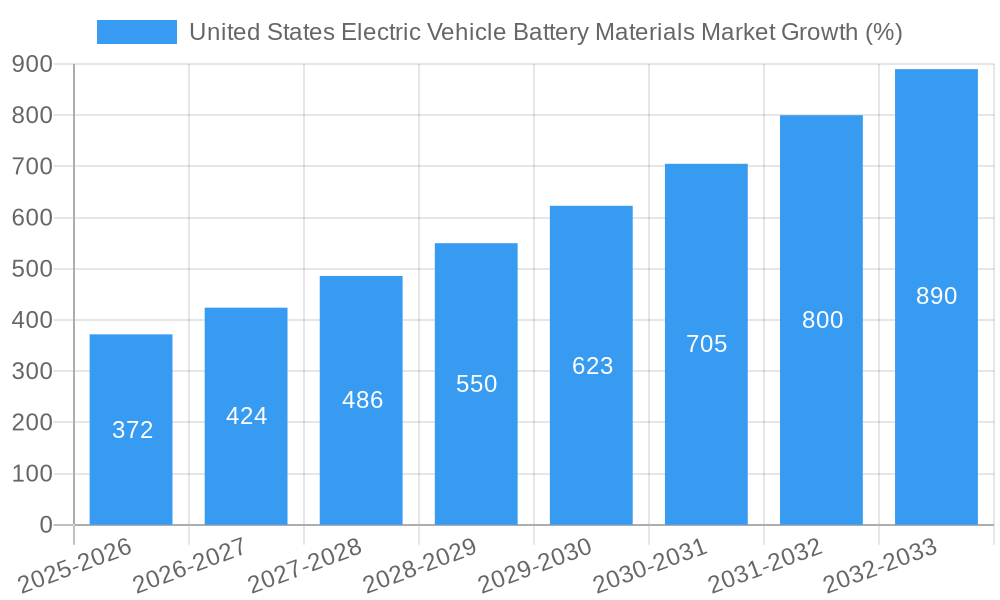

The United States electric vehicle (EV) battery materials market is experiencing robust growth, driven by the surging demand for EVs and government initiatives promoting clean energy. With a 2025 market size estimated at $2.84 billion and a compound annual growth rate (CAGR) of 13.15%, the market is projected to reach significant value by 2033. Key drivers include the increasing adoption of EVs due to environmental concerns and falling battery prices, coupled with substantial government investments in charging infrastructure and battery manufacturing within the US. Furthermore, technological advancements leading to higher energy density batteries and improved battery lifespan are fueling market expansion. Major players like Targray Technology International Inc., BASF SE, and Mitsubishi Chemical Group Corporation are actively competing in this dynamic landscape, investing in R&D and expanding their production capacities to meet the growing demand. However, challenges remain, including the reliance on imported raw materials, potential supply chain disruptions, and the need for sustainable and ethical sourcing of critical battery components. The market is segmented by material type (lithium, cobalt, nickel, graphite, manganese, etc.), battery chemistry (lithium-ion, solid-state, etc.), and application (passenger vehicles, commercial vehicles, energy storage systems). Regional variations exist, with significant growth expected in states with strong EV adoption rates and supportive policies. The market's future hinges on continued technological innovation, robust government support, and the successful development of a resilient and sustainable supply chain for EV battery materials.

The forecast period of 2025-2033 reveals substantial opportunities for market participants. Strategic partnerships, mergers and acquisitions, and vertical integration are anticipated as companies seek to secure raw material supplies and strengthen their market positions. The focus on developing domestically sourced battery materials is gaining momentum, aiming to reduce reliance on foreign suppliers and enhance national energy security. Companies are investing in recycling technologies to recover valuable materials from end-of-life batteries, promoting sustainability and reducing environmental impact. The market's evolution will be shaped by the interplay of technological advancements, government regulations, consumer demand, and geopolitical factors, creating a complex and highly competitive yet lucrative environment.

United States Electric Vehicle Battery Materials Market: A Comprehensive Report (2019-2033)

This meticulously researched report provides a detailed analysis of the United States Electric Vehicle (EV) Battery Materials market, offering invaluable insights for stakeholders across the industry value chain. Spanning the period 2019-2033, with a focus on 2025, this report leverages extensive data analysis and expert forecasts to illuminate market dynamics, growth drivers, and emerging opportunities. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). This report is crucial for strategic decision-making, investment planning, and understanding the competitive landscape of this rapidly evolving sector.

United States Electric Vehicle Battery Materials Market Market Concentration & Innovation

This section analyzes the level of market concentration within the US EV battery materials sector, identifying key players and their market share. It examines the innovation landscape, highlighting recent technological advancements and their impact on market dynamics. Further, this section delves into the regulatory environment, the influence of substitute products, evolving end-user trends, and the role of mergers and acquisitions (M&A) in shaping market competition.

Market Concentration: The US EV battery materials market exhibits a moderately concentrated structure, with a few major players holding significant market share. Precise figures are available in the full report, including a detailed market ranking and share analysis. For example, the top five companies account for approximately xx% of the market.

Innovation Drivers: Ongoing research and development efforts focused on improving battery energy density, lifespan, and cost-effectiveness are driving significant innovation. This includes advancements in cathode materials, such as the emerging DRX technology, and anode materials.

Regulatory Landscape: Government policies supporting EV adoption, along with regulations concerning battery safety and environmental impact, significantly influence market growth and technological choices. Incentives like tax credits and mandates for EV sales are strong growth catalysts.

Product Substitutes: While lithium-ion batteries currently dominate, alternative battery technologies are emerging, creating potential for substitution and impacting market share. However, these alternatives currently hold relatively low market penetration.

End-User Trends: Growing demand for EVs across various segments (passenger vehicles, commercial vehicles) fuels the need for battery materials. Increasing consumer awareness of environmental concerns further bolsters market demand.

M&A Activity: The report details significant M&A activity in the sector, including deal values and rationale behind acquisitions. These activities are reshaping the market landscape and often lead to increased investment in R&D and production capacity. For instance, the total M&A deal value in the sector during 2022-2024 is estimated at approximately $xx Million.

United States Electric Vehicle Battery Materials Market Industry Trends & Insights

This section provides a detailed overview of the key trends shaping the US EV battery materials market. It explores market growth drivers, identifies technological disruptions, examines shifting consumer preferences, and analyzes the competitive dynamics among major players. The analysis incorporates key performance indicators (KPIs) such as Compound Annual Growth Rate (CAGR) and market penetration rate.

The market is experiencing rapid growth, driven by the increasing adoption of EVs. The CAGR for the forecast period (2025-2033) is projected at xx%, indicating substantial expansion. Factors such as improving battery technology, falling battery costs, and increasing government support are all key contributors to market growth. Furthermore, technological disruptions, such as the development of solid-state batteries, are poised to reshape the market in the coming years. Consumer preferences are also shifting toward EVs with longer ranges and faster charging times, putting pressure on material suppliers to innovate and improve product performance. Competition is intensifying, with companies investing heavily in R&D, expanding production capacity, and exploring strategic partnerships to gain market share. The market penetration rate of EVs is expected to significantly increase over the forecast period, driving a substantial rise in demand for battery materials.

Dominant Markets & Segments in United States Electric Vehicle Battery Materials Market

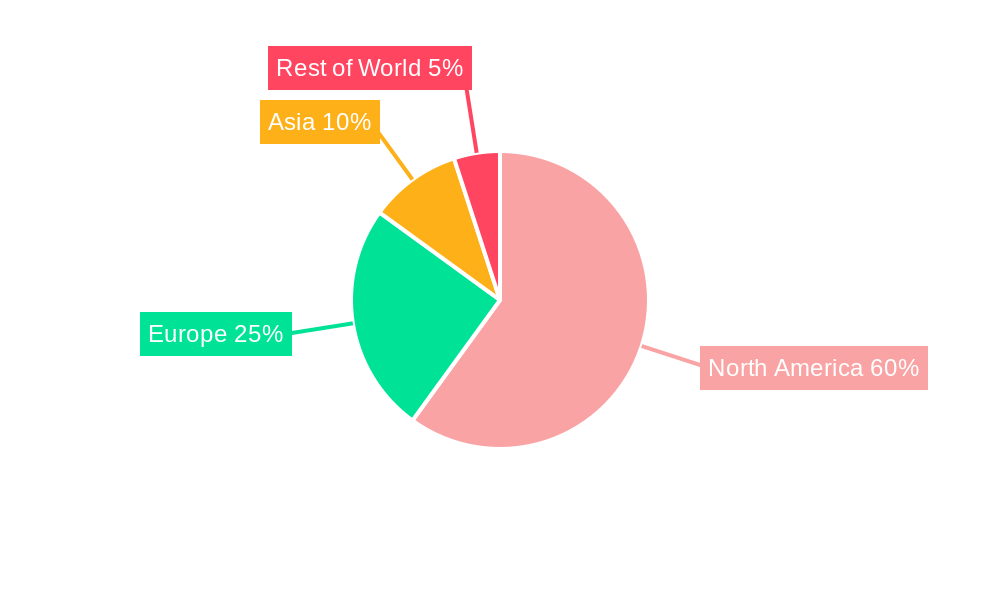

This section identifies the leading regions, countries, or segments within the US EV battery materials market, providing a comprehensive dominance analysis. Key drivers specific to each dominant region are detailed.

Dominant Regions/States: [The report will identify the dominant region/state within the US market based on data analysis and provide detailed reasons for its dominance. For example, California, Michigan, or Tennessee could be highlighted based on the concentration of EV manufacturing, supporting infrastructure, or regulatory policies].

Key Drivers of Regional Dominance: Several factors contribute to regional dominance within the market. These include:

- Favorable Government Policies: Specific states might offer attractive tax incentives, subsidies, or regulations promoting EV adoption and domestic battery material production.

- Developed Infrastructure: Presence of well-developed infrastructure, including electricity grids and transportation networks, is essential for facilitating EV adoption and material supply chains.

- Presence of Major Automakers: Regions with significant automotive manufacturing hubs experience higher demand for battery materials.

- Availability of Raw Materials: Access to key raw materials required for battery production plays a crucial role in fostering regional dominance.

[The report will contain a paragraph elaborating on the specific reasons behind the dominance of the identified region(s), including a quantification of the above-listed factors wherever possible.]

United States Electric Vehicle Battery Materials Market Product Developments

Recent product innovations focus primarily on improving battery energy density, cycle life, and safety. New cathode and anode materials are constantly being developed to enhance performance and reduce reliance on critical materials like cobalt. These innovations address the market demand for longer-range, faster-charging, and more cost-effective EVs. Competition among suppliers is driving continuous improvements in materials quality, manufacturing efficiency, and cost-effectiveness. The market is seeing a shift toward more sustainable and ethically sourced materials, further influencing product development strategies.

Report Scope & Segmentation Analysis

This report segments the US EV battery materials market based on material type (e.g., cathode, anode, electrolyte), battery chemistry (e.g., lithium-ion, solid-state), vehicle type (e.g., passenger cars, commercial vehicles), and region. Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed.

[Detailed breakdown of each segment including its growth projections, market sizes and competitive dynamics will be included in the report. For example, a paragraph for each material type (cathode, anode, electrolyte) outlining the market size, growth rate, and major competitors within that segment.]

Key Drivers of United States Electric Vehicle Battery Materials Market Growth

Several factors are driving the growth of the US EV battery materials market. These include:

- Rising EV Adoption: The increasing popularity of EVs, spurred by environmental concerns and government incentives, is the primary growth driver.

- Technological Advancements: Continuous improvements in battery technology, leading to better performance and reduced costs, are significantly increasing demand.

- Government Regulations and Policies: Stringent emission standards and supportive government policies are accelerating EV adoption and the associated demand for battery materials.

- Growing Infrastructure: Expansion of charging infrastructure is making EVs more convenient and accessible, thus boosting their adoption rate.

Challenges in the United States Electric Vehicle Battery Materials Market Sector

The US EV battery materials market faces several challenges:

- Supply Chain Disruptions: The market remains vulnerable to supply chain disruptions affecting the availability of critical raw materials. This can lead to production delays and price volatility. For example, xx% of lithium production is concentrated in a few countries, making it susceptible to geopolitical issues.

- High Raw Material Costs: The cost of raw materials like lithium, cobalt, and nickel remains a significant hurdle. Fluctuations in these prices directly impact the final cost of EV batteries.

- Environmental Concerns: Environmental impacts associated with mining and processing of raw materials pose challenges to sustainable development. Stricter environmental regulations will increase costs and complexities.

- Competition: Intense competition among battery materials suppliers and battery manufacturers can put downward pressure on prices and profit margins.

Emerging Opportunities in United States Electric Vehicle Battery Materials Market

Several emerging opportunities exist in the US EV battery materials market:

- Development of Next-Generation Batteries: Advancements in solid-state batteries and other alternative technologies present significant opportunities for innovation and market leadership.

- Recycling and Reuse of Battery Materials: Developing efficient and economically viable battery recycling technologies will help address sustainability concerns and secure access to raw materials.

- Expansion into New Markets: The market continues to expand in new segments, such as electric buses and trucks, and exploring those opportunities is important for companies.

- Strategic Partnerships and Collaborations: Developing strategic alliances with automakers, technology companies, and raw material suppliers will help companies strengthen their positions in the market.

Leading Players in the United States Electric Vehicle Battery Materials Market Market

- Targray Technology International Inc

- BASF SE

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Umicore SA

- Sumitomo Chemical Co Ltd

- Nichia Corporation

- ENTEK International LLC

- Arkema SA

- Kureha Corporation

- List Not Exhaustive

Key Developments in United States Electric Vehicle Battery Materials Market Industry

July 2024: Amplify Cell Technologies, a joint venture between Accelera, Daimler Trucks & Buses US Holding LLC, and PACCAR, commenced construction of its battery cell manufacturing plant in Marshall County, Mississippi. This facility, upon completion in 2027, will significantly increase domestic LFP battery cell production capacity. This development signals a major step towards reducing reliance on foreign battery supplies and supporting the growth of the domestic EV industry.

September 2023: Lawrence Berkeley National Laboratory's advancements in DRX cathode material hold the potential to disrupt the market by offering higher energy density than current nickel and cobalt-based cathodes. This could address supply chain challenges associated with cobalt and nickel and lead to more cost-effective and energy-efficient EV batteries.

Strategic Outlook for United States Electric Vehicle Battery Materials Market Market

The US EV battery materials market is poised for sustained growth, fueled by increasing EV adoption, technological advancements, and supportive government policies. The development of domestic manufacturing capacity, combined with breakthroughs in battery technology, presents substantial opportunities for companies operating in this sector. Further innovation in battery materials, particularly in areas such as solid-state batteries and improved recycling technologies, will be crucial for maintaining long-term growth and addressing environmental sustainability concerns. The market is expected to witness increased competition, with both established players and new entrants vying for market share. Strategic partnerships and investments in R&D will be critical for companies seeking to capitalize on the market’s growth potential.

United States Electric Vehicle Battery Materials Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion Battery

- 1.2. Lead-Acid Battery

- 1.3. Others

-

2. Material

- 2.1. Cathode

- 2.2. Anode

- 2.3. Electrolyte

- 2.4. Separator

- 2.5. Others

United States Electric Vehicle Battery Materials Market Segmentation By Geography

- 1. United States

United States Electric Vehicle Battery Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Electric Vehicle Infrastructure4.; Supportive Government Policies and Regulations

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Electric Vehicle Infrastructure4.; Supportive Government Policies and Regulations

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-Acid Battery

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cathode

- 5.2.2. Anode

- 5.2.3. Electrolyte

- 5.2.4. Separator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Targray Technology International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BASF SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mitsubishi Chemical Group Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UBE Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Umicore SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sumitomo Chemical Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nichia Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ENTEK International LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Arkema SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kureha Corporation*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Targray Technology International Inc

List of Figures

- Figure 1: United States Electric Vehicle Battery Materials Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Electric Vehicle Battery Materials Market Share (%) by Company 2024

List of Tables

- Table 1: United States Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 4: United States Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2019 & 2032

- Table 5: United States Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2019 & 2032

- Table 6: United States Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2019 & 2032

- Table 7: United States Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: United States Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 10: United States Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2019 & 2032

- Table 11: United States Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: United States Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2019 & 2032

- Table 13: United States Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Electric Vehicle Battery Materials Market?

The projected CAGR is approximately 13.15%.

2. Which companies are prominent players in the United States Electric Vehicle Battery Materials Market?

Key companies in the market include Targray Technology International Inc, BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, Umicore SA, Sumitomo Chemical Co Ltd, Nichia Corporation, ENTEK International LLC, Arkema SA, Kureha Corporation*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi.

3. What are the main segments of the United States Electric Vehicle Battery Materials Market?

The market segments include Battery Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.84 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Electric Vehicle Infrastructure4.; Supportive Government Policies and Regulations.

6. What are the notable trends driving market growth?

Lithium-ion Battery to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growing Electric Vehicle Infrastructure4.; Supportive Government Policies and Regulations.

8. Can you provide examples of recent developments in the market?

July 2024: Amplify Cell Technologies, a collaboration between Accelera, Daimler Trucks & Buses US Holding LLC, and PACCAR commenced construction at its cutting-edge battery cell manufacturing plant in Marshall County, Mississippi. Spanning 500 acres, the site will host a two million-square-foot, eco-friendly facility capable of producing 21 gigawatt hours (GWh) of lithium-iron-phosphate (LFP) battery cells and associated battery materials annually. Amplify is set to kick off its battery cell production in 2027.September 2023: Lawrence Berkeley National Laboratory (Berkeley Lab) was spearheading a group of top battery scientists to fast-track the market entry of a novel battery cathode material known as DRX, short for "disordered rock salt." These DRX cathodes boast the potential to offer batteries greater energy density compared to the prevalent nickel and cobalt-based cathodes in lithium-ion batteries, both of which face severe supply shortages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Electric Vehicle Battery Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Electric Vehicle Battery Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Electric Vehicle Battery Materials Market?

To stay informed about further developments, trends, and reports in the United States Electric Vehicle Battery Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence