Key Insights

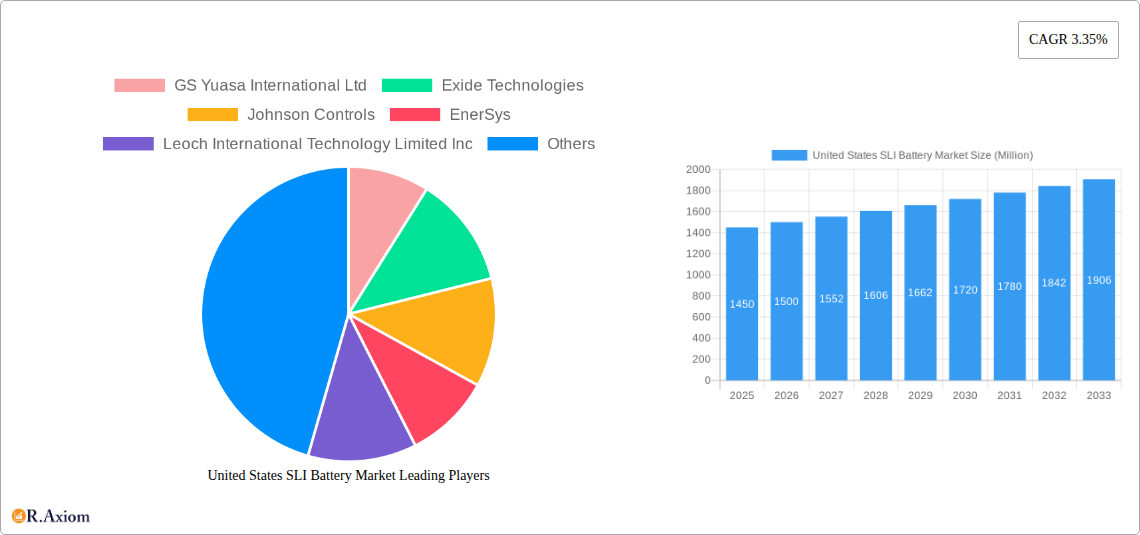

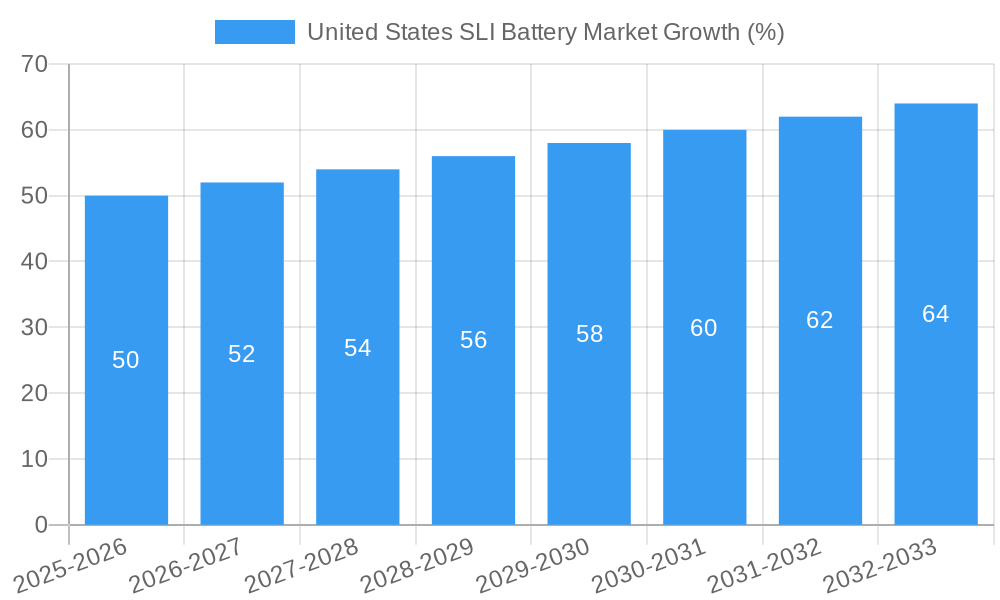

The United States SLI (Starting, Lighting, and Ignition) battery market, valued at $1.45 billion in 2025, is projected to experience steady growth, driven by the robust automotive sector and increasing demand for replacement batteries. A compound annual growth rate (CAGR) of 3.35% from 2025 to 2033 suggests a market size exceeding $2 billion by the end of the forecast period. This growth is fueled by several factors, including the rising number of vehicles on the road, the increasing lifespan of vehicles requiring periodic battery replacements, and the growing adoption of advanced battery technologies offering improved performance and longer lifespans. Furthermore, government regulations promoting fuel efficiency and reduced emissions indirectly contribute to market expansion by incentivizing vehicle ownership and use. However, challenges such as fluctuating raw material prices and increasing competition from alternative energy sources could temper growth.

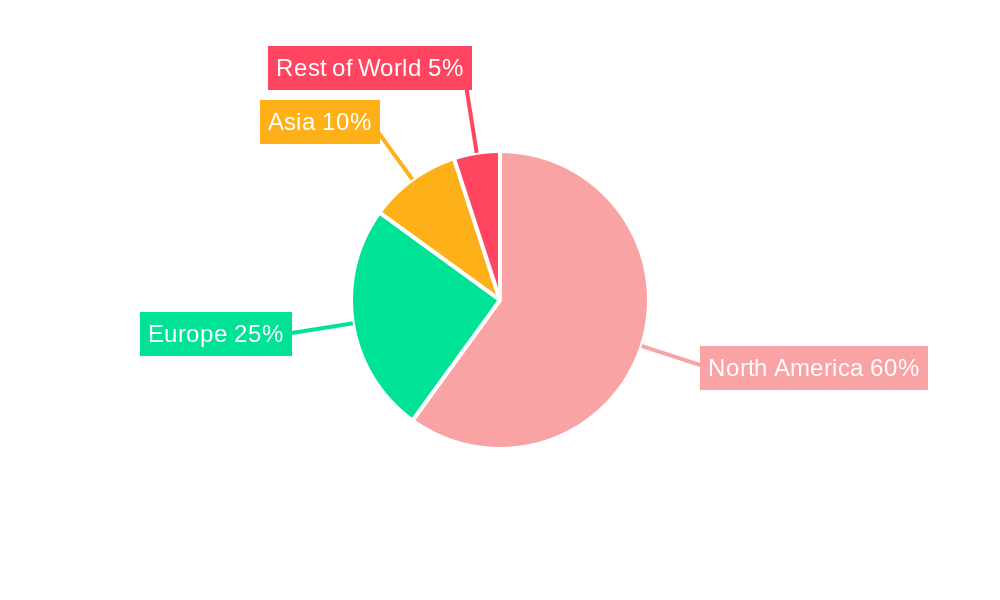

The market segmentation, while not explicitly provided, can be reasonably inferred. Major segments likely include passenger vehicles, commercial vehicles, and motorcycles, with further subdivisions based on battery type (flooded lead-acid, absorbed glass mat (AGM), gel cell). The competitive landscape is dominated by established players like GS Yuasa, Exide Technologies, Johnson Controls, and Clarios, all vying for market share through product innovation, distribution networks, and brand recognition. The increasing focus on sustainability and environmental regulations is pushing manufacturers to develop more eco-friendly battery solutions, a trend expected to shape the market in the coming years. Analyzing regional variations within the US market could reveal growth hotspots driven by population density, industrial activity, and infrastructure development. The historical period (2019-2024) likely reflects a period of moderate growth, laying the foundation for the projected expansion in the forecast period (2025-2033).

United States SLI Battery Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the United States SLI (Starting, Lighting, and Ignition) battery market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unravels the market dynamics, growth drivers, challenges, and emerging opportunities shaping this crucial sector. The report features in-depth analysis of market concentration, technological advancements, and competitive landscape, utilizing extensive data and projections to facilitate informed business strategies.

Key Highlights:

- Comprehensive Market Sizing and Forecasting: Detailed analysis of historical (2019-2024), current (2025), and future (2025-2033) market values in Millions.

- In-depth Segmentation: Granular segmentation allows for a nuanced understanding of market dynamics across various application segments.

- Competitive Landscape Analysis: Detailed profiles of key players, including market share analysis, competitive strategies, and recent developments.

- Growth Drivers and Challenges: Identification of key growth catalysts and potential market restraints, offering a balanced perspective on future trends.

- Emerging Opportunities: Exploration of promising new technologies, market segments, and growth avenues.

United States SLI Battery Market Market Concentration & Innovation

The US SLI battery market exhibits a moderately concentrated landscape, with several key players holding significant market shares. Market concentration is influenced by factors like economies of scale in manufacturing, established distribution networks, and brand recognition. The market share analysis reveals that the top 10 players account for approximately xx% of the total market in 2025, with GS Yuasa International Ltd., Exide Technologies, Johnson Controls, EnerSys, and Clarios International Inc. among the leading contenders. However, smaller, niche players also contribute significantly.

Innovation Drivers:

- Advancements in lead-acid battery technology: Development of Absorbent Glass Mat (AGM) and enhanced flooded batteries improves performance and lifespan.

- Focus on sustainability: Growing emphasis on reducing environmental impact drives innovation in recycling and material sourcing.

- Stringent regulatory frameworks: Environmental regulations and safety standards fuel innovation in battery design and manufacturing processes.

- Product substitutes: The emergence of alternative technologies like lithium-ion batteries necessitates continuous innovation to maintain competitiveness.

M&A Activities: The US SLI battery market has witnessed several mergers and acquisitions in recent years, driven by a desire for consolidation, expansion, and access to new technologies. Total M&A deal value between 2019 and 2024 is estimated at $xx Million.

United States SLI Battery Market Industry Trends & Insights

The US SLI battery market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is driven by several key factors: the increasing demand for automobiles, particularly in the light commercial vehicle segment; the growing adoption of renewable energy sources (like solar power, which relies on SLI batteries for storage); and the ongoing infrastructure development projects across the country. Furthermore, technological advancements, such as the development of longer-lasting and higher-performance batteries, are further fueling market expansion. Consumer preferences for longer warranties and environmentally friendly options are also shaping market trends. However, the market faces challenges from the increasing adoption of alternative energy sources and the rising competition from lithium-ion batteries in niche applications. Currently, market penetration of AGM batteries is approximately xx%, steadily increasing as consumers recognize their performance advantages.

Dominant Markets & Segments in United States SLI Battery Market

The automotive segment constitutes the largest share of the US SLI battery market, with xx% in 2025. This dominance stems from the widespread use of SLI batteries in passenger vehicles, light commercial vehicles, and heavy-duty trucks. The growth in this segment is projected to continue, fuelled by robust sales of automobiles, particularly in regions experiencing rapid economic growth. The key drivers for this dominance include:

- High vehicle ownership: A significant portion of the US population owns vehicles, creating high demand for SLI batteries.

- Robust automotive industry: A strong and diverse automotive manufacturing sector supports high demand.

- Government incentives: Government initiatives promoting vehicle sales and upgrading infrastructure indirectly boost battery demand.

Other significant market segments include industrial, and other applications, which contribute xx% and xx% to the total market, respectively.

United States SLI Battery Market Product Developments

Recent product innovations have focused on enhancing battery performance, lifespan, and safety. Manufacturers are increasingly incorporating advanced materials and technologies to improve energy density, reduce self-discharge rates, and enhance resistance to extreme temperatures. AGM technology continues to gain traction, owing to its superior performance compared to conventional flooded batteries. The focus on improved recycling processes aligns with broader sustainability goals within the industry. These developments contribute to a more competitive market and offer consumers a broader range of options with improved performance and reliability.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the United States SLI battery market, segmented by:

- Battery Type: Flooded, AGM, Gel, and others. AGM batteries are experiencing the highest growth rate, driven by superior performance and reliability.

- Vehicle Type: Passenger cars, light commercial vehicles, heavy-duty trucks, and motorcycles. Passenger cars represent the largest segment, followed by light commercial vehicles.

- Distribution Channel: OEMs, aftermarket retailers, and online channels. OEMs currently dominate, but the aftermarket is experiencing significant growth.

- Region: The report offers regional analysis, revealing the varying growth rates and market dynamics across different states and regions.

Key Drivers of United States SLI Battery Market Growth

The growth of the US SLI battery market is primarily propelled by:

- Expanding Automotive Sector: The robust growth of the US automotive industry directly fuels demand for SLI batteries.

- Technological Advancements: Innovations in battery chemistry and design deliver improved performance and longevity.

- Government Regulations: Environmental regulations support the adoption of advanced, eco-friendly batteries.

- Rising Disposable Incomes: Higher consumer spending power increases vehicle ownership and battery replacements.

Challenges in the United States SLI Battery Market Sector

Several factors hinder the growth of the US SLI battery market:

- Fluctuating Raw Material Prices: Price volatility in lead and other raw materials impacts production costs.

- Intense Competition: The market faces increasing competition from alternative battery technologies and established players.

- Environmental Concerns: Stringent environmental regulations necessitate costly compliance measures.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact battery availability and costs. The impact of these disruptions in 2024 alone resulted in a xx% increase in prices.

Emerging Opportunities in United States SLI Battery Market

Several opportunities exist for growth in the US SLI battery market:

- Growth of Electric Vehicles (EVs): While not directly related to SLI, the growth in EVs drives demand for high-performance battery technologies that can support auxiliary systems.

- Renewable Energy Integration: The integration of solar and wind power systems necessitates energy storage, creating demand for SLI batteries in off-grid applications.

- Technological Innovation: Advances in battery technology will continue to improve performance and lifespan, creating new market segments.

- Focus on Sustainability: The growing interest in sustainable solutions provides opportunities for eco-friendly battery solutions.

Leading Players in the United States SLI Battery Market Market

- GS Yuasa International Ltd.

- Exide Technologies

- Johnson Controls

- EnerSys

- Leoch International Technology Limited Inc

- East Penn Manufacturing Company

- C&D Technologies Inc

- Clarios International Inc

- Trojan Battery Company

- Crown Battery Manufacturing Company

- List Not Exhaustive

Key Developments in United States SLI Battery Market Industry

- May 2024: Monbat announces expansion of its Montana plant, adding an assembly line for terminal inserts and separator washing, bolstering US SLI battery production.

- January 2024: TAB establishes its first US facility in Liberty, Missouri, enhancing North American distribution and establishing a hub for assembly, distribution, and sales.

Strategic Outlook for United States SLI Battery Market Market

The US SLI battery market presents significant growth potential, driven by technological advancements, increasing vehicle sales, and the rising adoption of renewable energy. Focusing on innovation, particularly in AGM and other advanced battery technologies, will be crucial for manufacturers to maintain a competitive edge. The market is expected to witness increased consolidation, with larger players potentially acquiring smaller companies to expand their market share and product portfolios. Sustainability initiatives and improved recycling processes will also play a vital role in shaping the future of the market. Opportunities exist for players focusing on niche applications and offering customized solutions tailored to specific customer needs.

United States SLI Battery Market Segmentation

-

1. Type

- 1.1. Flooded Battery

- 1.2. VRLA Battery

- 1.3. EBF Battery

-

2. End User

- 2.1. Automotive

- 2.2. Others

United States SLI Battery Market Segmentation By Geography

- 1. United States

United States SLI Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Electric Vehicle Sales4.; Growing Adoption of Batteries in the Industrial Applications

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Electric Vehicle Sales4.; Growing Adoption of Batteries in the Industrial Applications

- 3.4. Market Trends

- 3.4.1. The Automotive End-user Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States SLI Battery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flooded Battery

- 5.1.2. VRLA Battery

- 5.1.3. EBF Battery

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 GS Yuasa International Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Exide Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson Controls

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EnerSys

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Leoch International Technology Limited Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 East Penn Manufacturing Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 C&D Technologies Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Clarios International Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Trojan Battery Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Crown Battery Manufacturing Company*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GS Yuasa International Ltd

List of Figures

- Figure 1: United States SLI Battery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States SLI Battery Market Share (%) by Company 2024

List of Tables

- Table 1: United States SLI Battery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States SLI Battery Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States SLI Battery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United States SLI Battery Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: United States SLI Battery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: United States SLI Battery Market Volume Billion Forecast, by End User 2019 & 2032

- Table 7: United States SLI Battery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States SLI Battery Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: United States SLI Battery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: United States SLI Battery Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: United States SLI Battery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: United States SLI Battery Market Volume Billion Forecast, by End User 2019 & 2032

- Table 13: United States SLI Battery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States SLI Battery Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States SLI Battery Market?

The projected CAGR is approximately 3.35%.

2. Which companies are prominent players in the United States SLI Battery Market?

Key companies in the market include GS Yuasa International Ltd, Exide Technologies, Johnson Controls, EnerSys, Leoch International Technology Limited Inc, East Penn Manufacturing Company, C&D Technologies Inc, Clarios International Inc, Trojan Battery Company, Crown Battery Manufacturing Company*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi.

3. What are the main segments of the United States SLI Battery Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.45 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Electric Vehicle Sales4.; Growing Adoption of Batteries in the Industrial Applications.

6. What are the notable trends driving market growth?

The Automotive End-user Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Growing Electric Vehicle Sales4.; Growing Adoption of Batteries in the Industrial Applications.

8. Can you provide examples of recent developments in the market?

May 2024: Monbat, a leading European player in lead batteries, revealed its blueprint for expansion, earmarking a new assembly line at its Montana plant. This expansion, beyond AGM and SLI batteries, will encompass lines dedicated to terminal insert manufacturing and washing separators. The move is poised to bolster the market for SLI batteries in the United States.January 2024: TAB, a global manufacturer specializing in industrial, SLI, and lithium-ion batteries, chose Liberty, Missouri, as the site for its inaugural US facility. This strategic move not only positioned TAB for enhanced distribution across North America but also established Liberty as the nerve center for TAB's US operations, spanning industrial battery assembly, distribution, and sales.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States SLI Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States SLI Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States SLI Battery Market?

To stay informed about further developments, trends, and reports in the United States SLI Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence