Key Insights

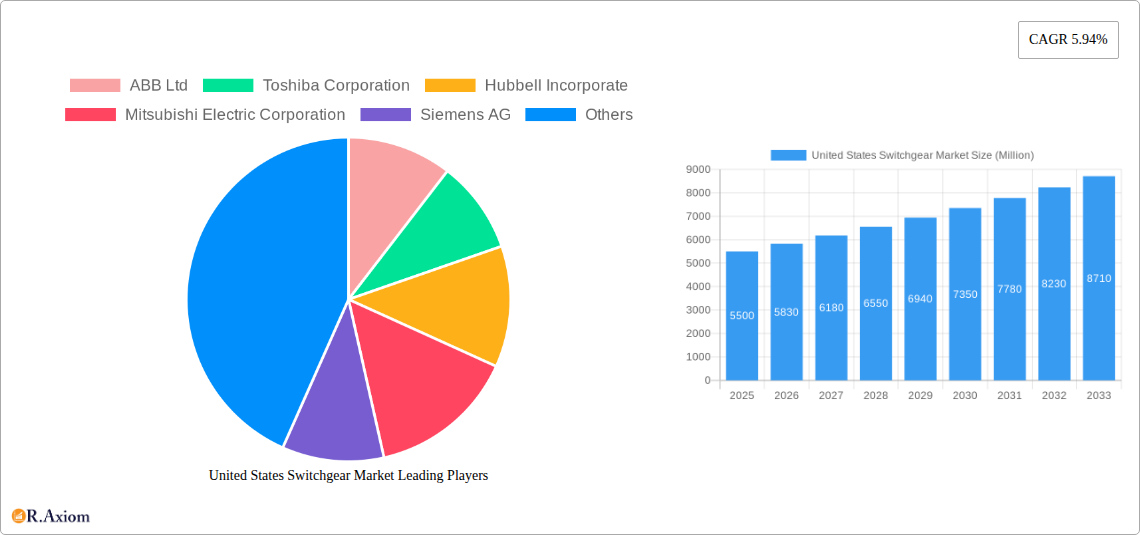

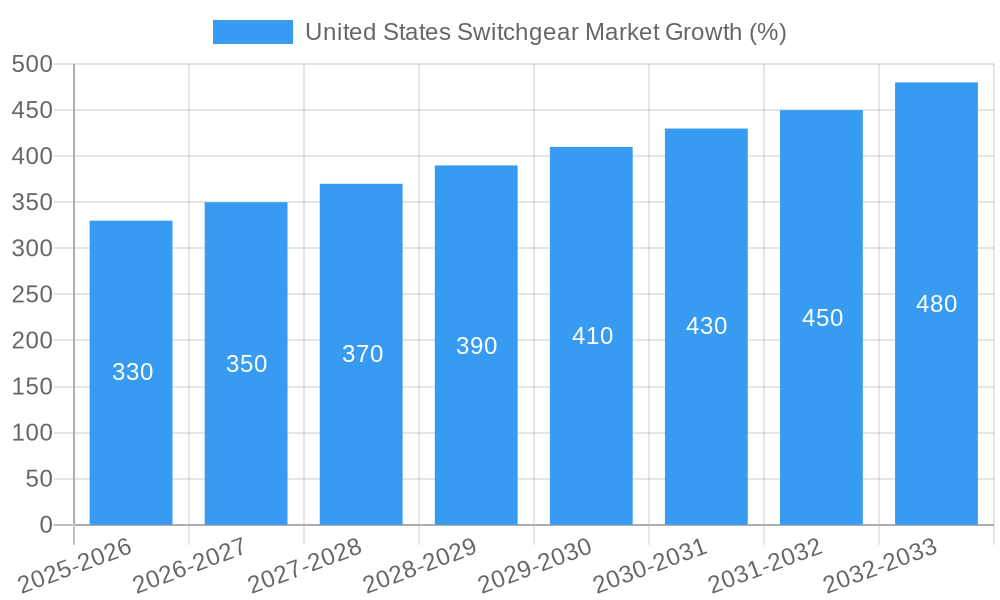

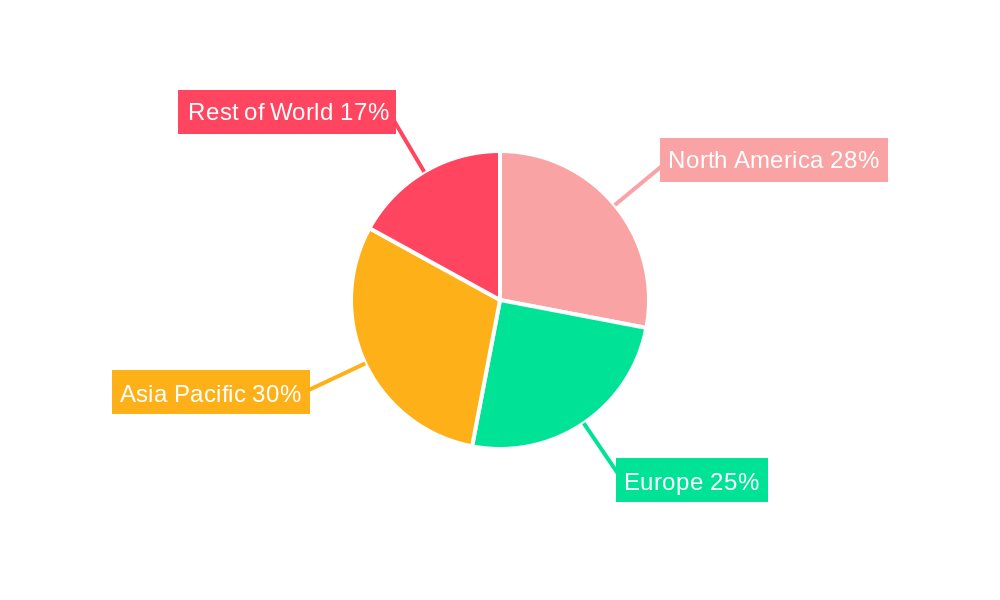

The United States switchgear market, a critical component of the power distribution infrastructure, is projected to experience robust growth over the forecast period (2025-2033). While precise figures for the US market size in 2025 are unavailable from the provided data, we can extrapolate a reasonable estimate based on the global market size of $20.32 billion and the global CAGR of 5.94%. Considering the significant size and technological advancement of the US power sector, a reasonable assumption would place the US market share at around 25-30% of the global market. This would put the 2025 US switchgear market size in the range of $5 billion to $6 billion. Growth will be fueled by increasing investments in renewable energy infrastructure, smart grid modernization initiatives, and expanding industrial and commercial construction activities. The rising demand for reliable and efficient power distribution solutions across various sectors, including residential, commercial, and industrial, will further propel market expansion. Stringent safety regulations and the need for advanced switchgear technologies to enhance grid resilience against extreme weather events are also key drivers. Market segmentation will likely favor medium- and high-voltage switchgear due to their applications in large-scale power distribution networks. Competitive rivalry among leading players such as ABB, Siemens, Schneider Electric, and GE will further intensify innovation and market penetration.

However, market expansion may face certain challenges. Supply chain disruptions, fluctuating raw material prices, and potential skill shortages in the workforce for installation and maintenance could act as temporary restraints. Furthermore, the market's growth is intricately linked to broader economic conditions and government policies related to energy infrastructure development. Despite these potential headwinds, the long-term outlook for the US switchgear market remains positive, driven by sustained demand for advanced and reliable power distribution solutions across diverse sectors. The ongoing trend towards digitalization and smart grid technologies will further shape market dynamics, with increased adoption of intelligent switchgear systems capable of remote monitoring and control.

United States Switchgear Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States switchgear market, encompassing historical data (2019-2024), current estimates (2025), and future projections (2025-2033). It offers valuable insights into market dynamics, competitive landscape, technological advancements, and growth opportunities for stakeholders across the industry. The report covers key segments including insulation type (air-insulated, gas-insulated, other types), installation (indoor, outdoor), end-user (commercial, residential, industrial), and voltage type (low-voltage, medium-voltage, high-voltage).

United States Switchgear Market Market Concentration & Innovation

The United States switchgear market exhibits a moderately concentrated structure, with a few dominant players commanding a significant market share. ABB Ltd, Siemens AG, and Schneider Electric SE are among the key players, collectively holding an estimated xx% market share in 2025. However, the market also features several regional and specialized players, fostering competition and innovation. Innovation in the sector is driven by the need for enhanced safety, improved efficiency, greater reliability, and integration with smart grid technologies. Stringent regulatory frameworks, particularly concerning safety and environmental standards, further shape the market landscape. The increasing adoption of digital technologies, such as IoT and AI, presents considerable opportunities for innovation. Product substitutes, such as solid-state circuit breakers, are emerging but are currently niche players. The market witnessed several M&A activities during the study period, with deal values exceeding xx Million in the past five years, primarily focused on expanding product portfolios and geographical reach.

United States Switchgear Market Industry Trends & Insights

The United States switchgear market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by robust growth in the industrial and commercial sectors. The increasing demand for reliable power infrastructure, coupled with modernization initiatives across various industries, fuels market expansion. Technological disruptions, including the adoption of smart switchgear and digitalization, are reshaping the industry, improving efficiency, and creating new revenue streams. Consumer preferences are shifting towards energy-efficient and sustainable solutions, prompting manufacturers to focus on developing environmentally friendly switchgear technologies. Competitive dynamics are characterized by intense competition among established players and the emergence of new entrants. Market penetration of advanced switchgear technologies, such as gas-insulated switchgear, is increasing, driven by its superior performance and reliability characteristics.

Dominant Markets & Segments in United States Switchgear Market

Leading Region/Segment: The industrial end-user segment dominates the market, driven by the high demand for power distribution solutions across various manufacturing and processing industries. Medium-voltage switchgear also holds a significant market share due to its widespread application in industrial and commercial settings. The gas-insulated switchgear segment demonstrates robust growth owing to its enhanced safety and reliability features.

Key Drivers:

- Robust industrial growth: Expansion across key industrial sectors fuels the demand for reliable power distribution systems.

- Infrastructure development: Government initiatives to upgrade power infrastructure create opportunities for switchgear deployment.

- Stringent safety regulations: Regulations mandating improved safety standards drive adoption of advanced switchgear technologies.

The outdoor installation segment demonstrates faster growth compared to the indoor segment, reflecting the growing need for switchgear solutions in outdoor power distribution networks. Geographically, the market is concentrated in the densely populated eastern and western regions of the United States, where industrial and commercial activities are concentrated.

United States Switchgear Market Product Developments

Recent product innovations include the development of smart switchgear equipped with advanced monitoring and control capabilities, enhancing operational efficiency and reliability. Manufacturers are also focusing on miniaturization, improving the compactness and space-saving features of switchgear units. These advancements address the growing demand for space-efficient solutions in urban areas and high-density industrial settings. The focus on digitalization is significantly improving remote monitoring and predictive maintenance capabilities. New applications extend to renewable energy integration and smart grid technologies, enabling seamless power distribution and management.

Report Scope & Segmentation Analysis

This report segments the United States switchgear market based on insulation type (air-insulated, gas-insulated, other types), installation (indoor, outdoor), end-user (commercial, residential, industrial), and voltage type (low-voltage, medium-voltage, high-voltage). Each segment is analyzed with respect to its market size, growth rate, and competitive landscape. Projections for the forecast period are provided for each segment, allowing for a comprehensive understanding of the market's evolution. The air-insulated segment currently holds a significant share but faces increasing competition from gas-insulated products.

Key Drivers of United States Switchgear Market Growth

The United States switchgear market's growth is driven by several factors. Firstly, robust economic growth and industrial expansion fuel the demand for reliable power distribution solutions. Secondly, increasing government investment in infrastructure development, particularly in the energy sector, creates significant opportunities. Thirdly, stringent safety regulations and environmental concerns promote the adoption of advanced, efficient, and sustainable switchgear technologies.

Challenges in the United States Switchgear Market Sector

The market faces challenges such as fluctuations in raw material prices, impacting production costs. Supply chain disruptions and the increasing complexity of integrating switchgear with smart grid technologies pose obstacles. Intense competition among established players also adds pressure on pricing and profitability. Furthermore, stringent regulatory compliance requirements and obtaining necessary certifications can create delays and increase project costs.

Emerging Opportunities in United States Switchgear Market

The integration of smart technologies, such as IoT and AI, in switchgear creates numerous opportunities for enhanced monitoring, predictive maintenance, and remote control. Growth in the renewable energy sector, particularly solar and wind power, further enhances demand for advanced switchgear solutions. Increasing focus on energy efficiency and sustainability opens avenues for innovative and environmentally friendly switchgear products.

Leading Players in the United States Switchgear Market Market

- ABB Ltd

- Toshiba Corporation

- Hubbell Incorporate

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Powell Industries Inc

- Larson & Turbo Limited

- General Electric Company

Key Developments in United States Switchgear Market Industry

- August 2023: Eaton announced plans to expand its manufacturing capacity for power distribution equipment, signifying investment in supporting growing infrastructure demands.

- May 2022: Schneider Electric launched SureSeT MV switchgear, a smaller, more robust solution for primary switchgear applications, highlighting a move towards improved digital operation management.

Strategic Outlook for United States Switchgear Market Market

The United States switchgear market is poised for continued growth driven by sustained infrastructure investment, the increasing adoption of smart grid technologies, and the growing demand for reliable power distribution across various sectors. The focus on sustainable and efficient solutions will further shape market dynamics, creating opportunities for manufacturers offering innovative, energy-efficient switchgear technologies. The integration of digital technologies will continue to drive innovation, offering opportunities for improved monitoring, control, and predictive maintenance.

United States Switchgear Market Segmentation

-

1. Insulation

- 1.1. Air-insulated

- 1.2. Gas-insulated

- 1.3. Other Types

-

2. Installation

- 2.1. Indoor

- 2.2. Outdoor

-

3. End User

- 3.1. Commercial

- 3.2. Residential

- 3.3. Industrial

-

4. Type

- 4.1. Low-Voltage

- 4.2. Medium-Voltage

- 4.3. High-Voltage

United States Switchgear Market Segmentation By Geography

- 1. United States

United States Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.94% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Electricity Generation and Consumption

- 3.2.2 along with Network Expansions4.; Growing Focus on Infrastructure and Renewable Energy Sources Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Environmental and Safety Regulations

- 3.4. Market Trends

- 3.4.1. Gas-Insulated Switchgear to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insulation

- 5.1.1. Air-insulated

- 5.1.2. Gas-insulated

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Indoor

- 5.2.2. Outdoor

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Type

- 5.4.1. Low-Voltage

- 5.4.2. Medium-Voltage

- 5.4.3. High-Voltage

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Insulation

- 6. China United States Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. India United States Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Japan United States Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Rest of Asia Pacific United States Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Toshiba Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hubbell Incorporate

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mitsubishi Electric Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Schneider Electric SE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Powell Industries Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Larson & Turbo Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 General Electric Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: United States Switchgear Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Switchgear Market Share (%) by Company 2024

List of Tables

- Table 1: United States Switchgear Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Switchgear Market Revenue Million Forecast, by Insulation 2019 & 2032

- Table 3: United States Switchgear Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 4: United States Switchgear Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: United States Switchgear Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: United States Switchgear Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: United States Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United States Switchgear Market Revenue Million Forecast, by Insulation 2019 & 2032

- Table 16: United States Switchgear Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 17: United States Switchgear Market Revenue Million Forecast, by End User 2019 & 2032

- Table 18: United States Switchgear Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: United States Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Switchgear Market?

The projected CAGR is approximately 5.94%.

2. Which companies are prominent players in the United States Switchgear Market?

Key companies in the market include ABB Ltd, Toshiba Corporation, Hubbell Incorporate, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Powell Industries Inc, Larson & Turbo Limited, General Electric Company.

3. What are the main segments of the United States Switchgear Market?

The market segments include Insulation , Installation, End User, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.32 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Generation and Consumption. along with Network Expansions4.; Growing Focus on Infrastructure and Renewable Energy Sources Drives the Market Growth.

6. What are the notable trends driving market growth?

Gas-Insulated Switchgear to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; Stringent Environmental and Safety Regulations.

8. Can you provide examples of recent developments in the market?

August 2023: Eaton announced plans to add capacity to increase supplies of essential power distribution equipment to support infrastructure projects across industries. The company’s considerable recent investments enrich its manufacturing facilities for switchgear and switchboards, which provide the power backbone for clients across the Americas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Switchgear Market?

To stay informed about further developments, trends, and reports in the United States Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence