Key Insights

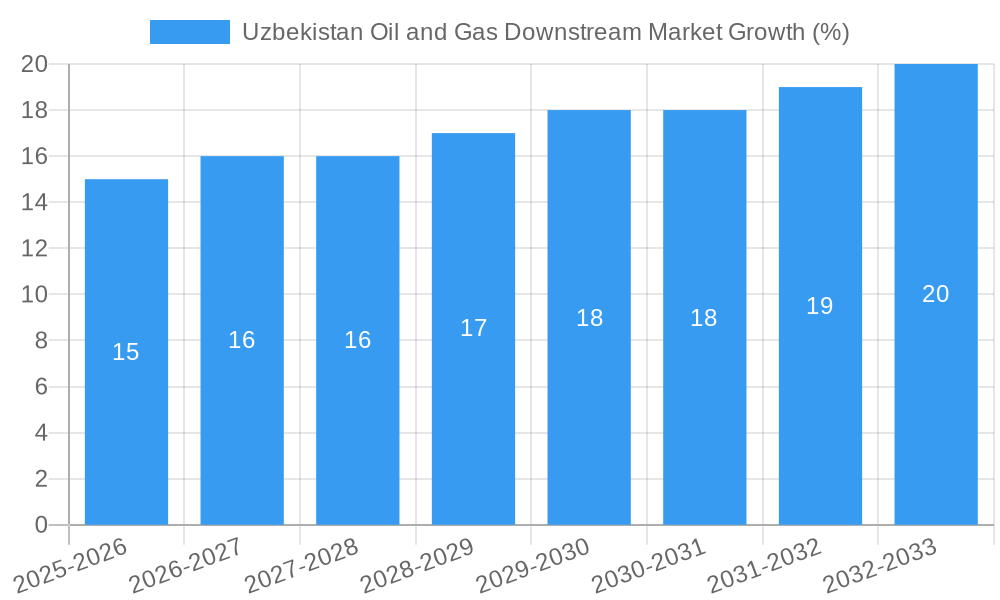

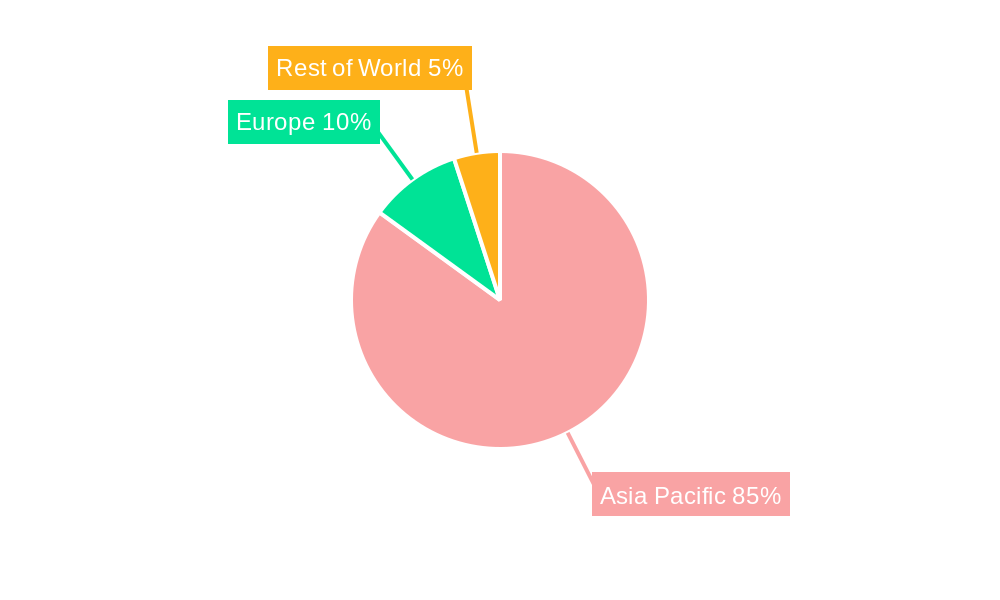

The Uzbekistan Oil and Gas Downstream Market presents a compelling investment opportunity, exhibiting a robust Compound Annual Growth Rate (CAGR) exceeding 3% from 2025 to 2033. Driven by increasing industrialization, a burgeoning transportation sector, and rising energy demands within the power generation segment, the market is poised for significant expansion. Key segments include gasoline, diesel, jet fuel, LPG, and CNG, catering primarily to transportation, industrial, and power generation end-users. The market's growth is fueled by government initiatives aimed at improving infrastructure and attracting foreign investment in the energy sector. Companies like Jizzakh Petroleum JV, Sanoat Energetika Guruhi LLC (SEG), and JSC Uzbekneftegaz play a crucial role in shaping the market landscape, along with international players such as Sasol Limited, Petronas, Gazprom, and TotalEnergies. While the Asia-Pacific region, particularly countries like China, Japan, and India, influences the global demand, Uzbekistan's domestic market growth remains a primary driver. However, potential restraints include global economic fluctuations, geopolitical uncertainties, and the need for consistent investment in upgrading refining infrastructure and distribution networks.

The forecast period (2025-2033) suggests a considerable increase in market value, driven by sustained economic growth and expanding energy consumption across various sectors. The historical period (2019-2024) likely saw moderate growth, influenced by local economic conditions and global energy price dynamics. While precise figures for market size are not provided, a reasonable estimation based on the given CAGR and considering the regional context suggests a multi-million dollar market value in 2025, with substantial growth projected throughout the forecast period. The focus on diversifying energy sources and promoting cleaner energy technologies might influence the future composition of the market, particularly the relative growth of LPG and CNG segments. The competitive landscape features a mix of domestic and international companies, suggesting both opportunities and challenges for participants.

Uzbekistan Oil & Gas Downstream Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Uzbekistan oil and gas downstream market, covering the period from 2019 to 2033. It offers crucial insights for industry stakeholders, investors, and policymakers seeking to understand the market dynamics, growth potential, and future trends. The report leverages rigorous data analysis and market intelligence to provide a clear and actionable strategic roadmap. With a base year of 2025 and a forecast period extending to 2033, this report is an indispensable resource for navigating the complexities of this evolving market. The estimated market size in 2025 is xx Million USD.

Uzbekistan Oil and Gas Downstream Market Market Concentration & Innovation

The Uzbekistan oil and gas downstream market exhibits a moderate level of concentration, with JSC Uzbekneftegaz holding a significant market share. However, the increasing participation of international players like Sasol Limited, Petroliam Nasional Berhad, PJSC Gazprom, and TotalEnergies SE is fostering competition and driving innovation. Market share dynamics are influenced by government policies, investment in refining capacity, and the adoption of advanced technologies.

Several key factors contribute to market innovation:

- Regulatory Framework: The government's policies regarding fuel pricing, environmental regulations, and foreign investment significantly shape market dynamics and the rate of technological advancements.

- Product Substitutes: The emergence of biofuels and alternative energy sources presents both opportunities and challenges for traditional oil and gas companies. The market penetration of these alternatives is currently xx%, projected to reach xx% by 2033.

- End-User Trends: The shift towards cleaner fuels and the growth of the transportation sector are driving demand for specific products like gasoline and CNG. Industrial and power generation sectors also influence demand patterns.

- M&A Activities: Mergers and acquisitions play a vital role in shaping market consolidation and technological integration. While precise deal values are not publicly available for all transactions, it is estimated that M&A activity in the period 2019-2024 totaled xx Million USD. Significant transactions included xx (details unavailable).

Uzbekistan Oil and Gas Downstream Market Industry Trends & Insights

The Uzbekistan oil and gas downstream market is projected to experience significant growth during the forecast period (2025-2033), driven by several key factors. The Compound Annual Growth Rate (CAGR) is estimated to be xx% from 2025-2033. Increased vehicle ownership and industrialization are fueling demand for gasoline, diesel, and LPG. Furthermore, government investments in infrastructure projects are creating opportunities for market expansion. Technological disruptions, such as the adoption of cleaner fuel technologies and digitalization across the supply chain, are reshaping market dynamics. The increasing adoption of CNG technology presents a significant opportunity for market growth. Consumer preferences are shifting towards higher-quality fuels and environmentally friendly options, putting pressure on companies to innovate. Competitive dynamics are characterized by both domestic players and increasingly active international oil and gas companies.

Dominant Markets & Segments in Uzbekistan Oil and Gas Downstream Market

The transportation sector dominates the end-use segment, accounting for approximately xx% of the total market share in 2025. Growth is primarily driven by the increasing number of vehicles and rising personal incomes. The industrial and power generation sectors also hold significant market shares.

Key Drivers:

- Economic Growth: Continued economic development fuels the demand for energy in all end-use sectors.

- Infrastructure Development: Government initiatives to expand transportation infrastructure and modernize power generation capacity directly impact market demand.

Dominant Product Segments:

- Gasoline: Remains the largest product segment due to its widespread use in the transportation sector.

- Diesel: Significant demand from the transportation and industrial sectors contributes to its strong market presence.

- LPG: Growing usage as a household fuel and industrial feedstock supports this segment's growth.

Uzbekistan Oil and Gas Downstream Market Product Developments

The Uzbekistan oil and gas downstream market is witnessing advancements in fuel quality, with a focus on reducing sulfur content to meet environmental standards. Companies are investing in upgrading refineries and adopting technologies to produce cleaner fuels. This includes blending programs to improve gasoline and diesel characteristics and expansion of LPG and CNG infrastructure. The market shows clear preference for higher-octane gasoline, and the introduction of Euro-standard compliant fuels is gaining traction.

Report Scope & Segmentation Analysis

This report segments the Uzbekistan oil and gas downstream market based on product type (gasoline, diesel, jet fuel, LPG, CNG) and end-use sectors (transportation, industrial, power generation). Each segment is analyzed in detail, including market size, growth projections, and competitive dynamics. Growth projections vary significantly across segments, with gasoline and diesel experiencing steady growth but LPG and CNG poised for more rapid expansion owing to supportive government policies and increased infrastructure investment. The competitive landscape includes both domestic and international players, with market share varying across segments.

Key Drivers of Uzbekistan Oil and Gas Downstream Market Growth

The growth of the Uzbekistan oil and gas downstream market is driven by a combination of factors: robust economic growth boosting energy demand across various sectors; government investment in infrastructure, particularly in transportation and power generation; a growing vehicle ownership rate and expanding middle class; and the ongoing modernization of refineries and upgrading of fuel quality to meet international standards.

Challenges in the Uzbekistan Oil and Gas Downstream Market Sector

The Uzbekistan oil and gas downstream market faces several challenges: reliance on imported crude oil and the volatility of global oil prices create uncertainty; the need for significant investment in infrastructure upgrades to support demand and ensure fuel quality; and stringent environmental regulations requiring investments in cleaner technologies. These factors, combined with potential supply chain disruptions, constrain market growth.

Emerging Opportunities in Uzbekistan Oil and Gas Downstream Market

Growing demand for cleaner fuels and expanding industrial activity offer significant opportunities. The increased focus on CNG and LPG as cleaner alternatives presents a lucrative opportunity for market players. Government initiatives to promote energy efficiency and diversification offer additional avenues for growth. The development of petrochemical industries also creates an opportunity for utilizing by-products from refineries.

Leading Players in the Uzbekistan Oil and Gas Downstream Market Market

- JSC Uzbekneftegaz

- Sanoat Energetika Guruhi LLC (SEG)

- Jizzakh Petroleum JV

- Sasol Limited

- Petroliam Nasional Berhad

- PJSC Gazprom

- TotalEnergies SE

Key Developments in Uzbekistan Oil and Gas Downstream Market Industry

- November 2022: Enter Engineering Pte Ltd secured a USD 3 Billion EPC contract for Uzbekistan's MTO (Methanol to Olefin) Gas Chemical Complex, signaling significant investment in downstream petrochemicals.

- August 2022: Wood Plc's contract for engineering and procurement assistance for the MTO complex highlights the increasing role of advanced technologies in the sector.

Strategic Outlook for Uzbekistan Oil and Gas Downstream Market Market

The Uzbekistan oil and gas downstream market presents significant long-term growth potential. Continued economic development, coupled with government support for infrastructure upgrades and cleaner fuel technologies, will drive market expansion. The increasing focus on petrochemical production and diversification of the energy mix offer further opportunities. Companies that can adapt to changing consumer preferences and embrace technological innovation are best positioned to succeed.

Uzbekistan Oil and Gas Downstream Market Segmentation

- 1. Refineries

- 2. Petrochemical Pants

Uzbekistan Oil and Gas Downstream Market Segmentation By Geography

- 1. Uzbekistan

Uzbekistan Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Refineries to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.2. Market Analysis, Insights and Forecast - by Petrochemical Pants

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Uzbekistan

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. China Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 8. India Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Jizzakh Petroleum JV

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Sanoat Energetika Guruhi LLC (SEG)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 JSC Uzbekneftegaz

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Sasol Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Petroliam Nasional Berhad

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 PJSC Gazprom

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 TotalEnergies SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 Jizzakh Petroleum JV

List of Figures

- Figure 1: Uzbekistan Oil and Gas Downstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Uzbekistan Oil and Gas Downstream Market Share (%) by Company 2024

List of Tables

- Table 1: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Refineries 2019 & 2032

- Table 3: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Petrochemical Pants 2019 & 2032

- Table 4: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Refineries 2019 & 2032

- Table 14: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Petrochemical Pants 2019 & 2032

- Table 15: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uzbekistan Oil and Gas Downstream Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Uzbekistan Oil and Gas Downstream Market?

Key companies in the market include Jizzakh Petroleum JV, Sanoat Energetika Guruhi LLC (SEG), JSC Uzbekneftegaz, Sasol Limited, Petroliam Nasional Berhad, PJSC Gazprom, TotalEnergies SE.

3. What are the main segments of the Uzbekistan Oil and Gas Downstream Market?

The market segments include Refineries, Petrochemical Pants.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Refineries to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

November 2022: Enter Engineering Pte Ltd has been selected as the EPC contractor for Uzbekistan's MTO (Methanol to Olefin) Gas Chemical Complex Central Asia LLC. The USD 3-billion contract includes design, purchase of equipment, construction of facilities, and essential infrastructure for the project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uzbekistan Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uzbekistan Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uzbekistan Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Uzbekistan Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence