Key Insights

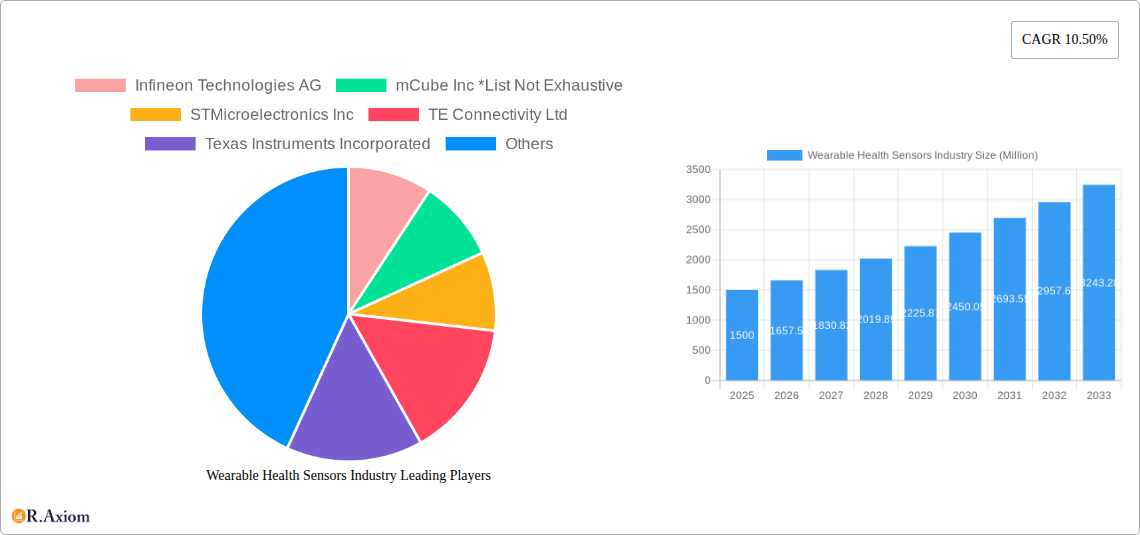

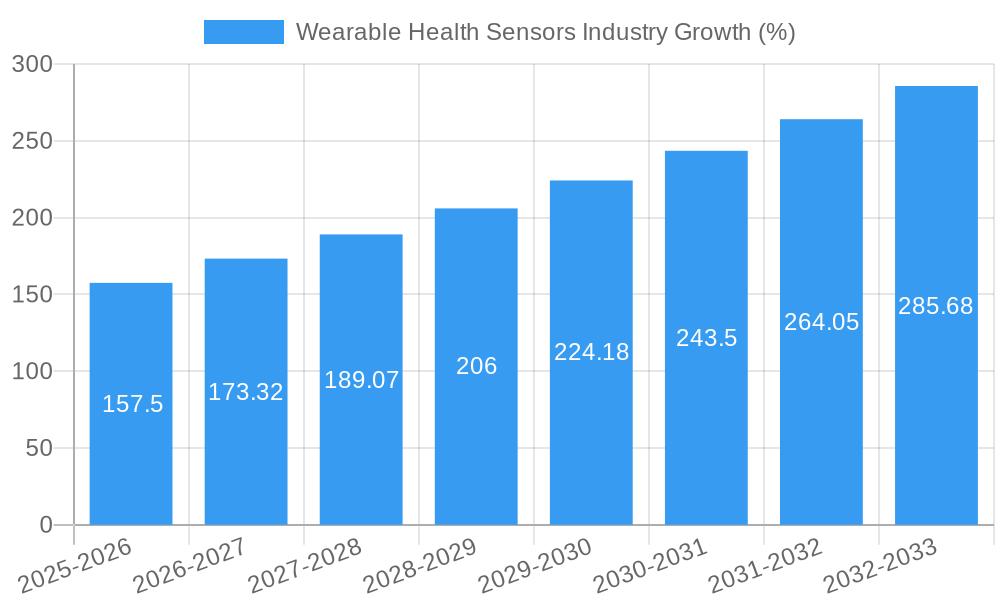

The Wearable Health Sensors market is experiencing robust growth, driven by the increasing prevalence of chronic diseases, rising demand for personalized healthcare, and advancements in sensor technology. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided CAGR and study period), is projected to expand at a Compound Annual Growth Rate (CAGR) of 10.50% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the miniaturization and improved accuracy of sensors are enabling the development of smaller, more comfortable, and data-rich wearable devices. Secondly, the increasing affordability of these devices is making them accessible to a wider consumer base. Thirdly, the integration of sophisticated data analytics and cloud-based platforms allows for remote patient monitoring and timely intervention, significantly impacting healthcare delivery and outcomes. The market segments by type (pressure, temperature, position, and other sensors) and by end-user industry (healthcare, consumer electronics, sports/fitness, and others) reflect diverse application areas, with healthcare currently holding the largest share.

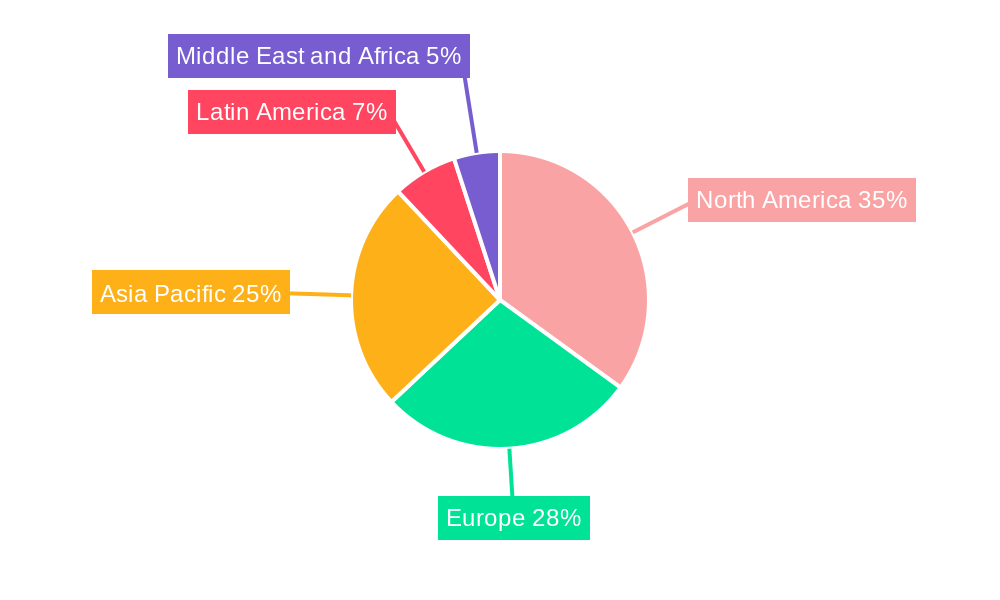

The competitive landscape is characterized by a mix of established players like Infineon Technologies AG, STMicroelectronics Inc., Texas Instruments Incorporated, and Analog Devices Inc., alongside innovative smaller companies. These companies are continuously investing in R&D to develop advanced sensor technologies with enhanced capabilities and functionalities. However, market growth faces certain restraints, including concerns related to data privacy and security, the need for robust regulatory frameworks, and the potential for high initial investment costs for consumers and healthcare providers. Despite these challenges, the long-term outlook for the Wearable Health Sensors market remains positive, driven by ongoing technological advancements, increasing health awareness, and the expanding adoption of telehealth services. The Asia Pacific region is expected to witness significant growth, owing to its large population base and rising disposable incomes. Further market segmentation and detailed regional analysis would provide a more precise understanding of this dynamic market.

This detailed report provides a comprehensive analysis of the Wearable Health Sensors industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, growth drivers, challenges, and opportunities within this rapidly evolving sector. The report leverages rigorous data analysis to project future market growth and identifies key players shaping the industry landscape. The study period is 2019-2033, the base year is 2025, and the forecast period is 2025-2033. The historical period covered is 2019-2024.

Estimated Market Size in 2025: xx Million

Wearable Health Sensors Industry Market Concentration & Innovation

The Wearable Health Sensors market exhibits a moderately concentrated landscape, with several key players holding significant market share. The top ten companies, including Infineon Technologies AG, mCube Inc, STMicroelectronics Inc, TE Connectivity Ltd, Texas Instruments Incorporated, Arm Limited, TDK Corporation, Fraunhofer IIS, Analog Devices Inc, and Maxim Integrated Products Inc, collectively account for an estimated xx% of the global market. However, the market also features a substantial number of smaller, niche players driving innovation.

- Market Share: The market share distribution among major players is dynamic, influenced by factors like technological advancements, strategic partnerships, and M&A activities. Precise market share data for each company varies and needs further study and analysis.

- Innovation Drivers: Miniaturization, improved power efficiency, advanced signal processing capabilities, and the integration of AI algorithms are key innovation drivers. These improvements enhance sensor accuracy, reliability, and data analysis.

- Regulatory Frameworks: Regulatory approvals and certifications (e.g., FDA approvals) significantly impact market entry and product adoption, especially in the healthcare segment. Stringent regulations for data privacy and security further shape industry practices.

- Product Substitutes: While direct substitutes are limited, alternative technologies and approaches to health monitoring (e.g., smartphone-based apps) represent indirect competition.

- End-User Trends: The increasing demand for personalized healthcare, remote patient monitoring, and fitness tracking is fueling growth. The rise of connected healthcare ecosystems also contributes to the rising demand.

- M&A Activities: Consolidation through mergers and acquisitions is a notable trend. The acquisition of Bend Labs, Inc. by Nitto Denko Corporation (June 2022), resulting in Nitto Bend Technologies, showcases a key example of this consolidating tendency, driven by access to technologies and expanded market reach. The total value of M&A deals in the Wearable Health Sensors market for the past five years is estimated at xx Million.

Wearable Health Sensors Industry Industry Trends & Insights

The Wearable Health Sensors industry is experiencing robust growth, driven by several converging factors. The global market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by increased consumer awareness of health and wellness, technological advancements resulting in smaller, more accurate and power-efficient sensors, and the increasing integration of these sensors into various consumer electronics and healthcare applications.

Technological disruptions, like the development of advanced materials, improved power management, and the integration of AI and machine learning in data analytics, are transforming the industry. Consumer preferences are shifting towards more comfortable, stylish, and user-friendly wearable devices that offer seamless data integration with smartphones and other connected devices. This is driving competition among manufacturers to differentiate their products through features, designs, and data-driven insights. Market penetration in key segments like healthcare and fitness is steadily increasing, with a significant portion of the population adopting wearable health monitoring devices.

Dominant Markets & Segments in Wearable Health Sensors Industry

Leading Region: North America currently holds the largest market share, driven by high healthcare expenditure, technological advancements, and early adoption of wearable health technologies.

Leading Country: The United States leads in market size and adoption within North America. This dominance is attributed to the strong healthcare infrastructure, high disposable income, and regulatory support for innovation.

Dominant Segment (By Type): The pressure sensor segment holds the largest market share, owing to its extensive applications in blood pressure monitoring, heart rate tracking, and other vital sign measurements.

Dominant Segment (By End-User Industry): The healthcare segment currently dominates the market, with applications in remote patient monitoring, chronic disease management, and post-operative care, however, the sports/fitness segment is experiencing rapid growth. This is owing to its increased market penetration amongst the general population seeking enhanced fitness and health insights.

Key Drivers (North America):

- Robust healthcare infrastructure and investment in digital health technologies.

- High consumer awareness and adoption of wearable health monitoring devices.

- Favorable regulatory environment promoting innovation and market entry.

Wearable Health Sensors Industry Product Developments

Recent product innovations focus on improved sensor accuracy, miniaturization, extended battery life, enhanced data analytics capabilities, and seamless integration with mobile applications. New sensor technologies, materials, and designs are continuously emerging, creating a competitive landscape. This constant evolution ensures market competitiveness and creates opportunities for further technological growth. The focus is shifting to more sophisticated data processing that allows for more comprehensive health insights beyond basic metrics, such as personalized health recommendations and early warning systems for potential health issues. This enhanced focus is leading to increased market fit and consumer appeal.

Report Scope & Segmentation Analysis

By Type: The report segments the market by sensor type: pressure sensors, temperature sensors, position sensors, and other types (including accelerometers, gyroscopes, and bio-impedance sensors). Each segment’s growth is analyzed, considering factors like technology advancements and market demand.

By End-User Industry: The market is segmented by end-user industries: healthcare, consumer electronics, sports/fitness, and other end-user industries. Growth projections, market sizes, and competitive dynamics are analyzed for each segment. The report forecasts market sizes and growth for each type and end-user industry segment, providing a granular understanding of the market landscape.

Key Drivers of Wearable Health Sensors Industry Growth

Several factors contribute to the industry's growth. These include advancements in sensor technology leading to improved accuracy and miniaturization, the rising prevalence of chronic diseases increasing the demand for remote patient monitoring, increasing consumer awareness of health and wellness promoting self-monitoring, and supportive government initiatives and regulations promoting the adoption of digital health technologies. Moreover, decreasing costs of wearable health sensors make them accessible to a wider population.

Challenges in the Wearable Health Sensors Industry Sector

The industry faces challenges including maintaining data privacy and security due to the sensitive nature of collected health data. Regulatory hurdles and varying standards across different countries complicate market entry and expansion. The complexity of integrating diverse sensor data also hinders the market's growth. Supply chain disruptions and shortages of components can affect the production and availability of wearable health sensors. Finally, increasing competition and pricing pressures from various manufacturers can lead to difficulties in sustaining profitability.

Emerging Opportunities in Wearable Health Sensors Industry

Significant opportunities exist in integrating wearable health sensors with Artificial Intelligence (AI) for enhanced data analysis and personalized healthcare recommendations. The development of bio-integrated sensors that seamlessly integrate with the human body represents another major opportunity. Expansion into new markets, particularly in developing countries with growing healthcare needs, presents significant potential. Finally, the growing emphasis on preventative healthcare and wellness is increasing market demand.

Leading Players in the Wearable Health Sensors Industry Market

- Infineon Technologies AG

- mCube Inc

- STMicroelectronics Inc

- TE Connectivity Ltd

- Texas Instruments Incorporated

- Arm Limited

- TDK Corporation

- Fraunhofer IIS

- Analog Devices Inc

- Maxim Integrated Products Inc

Key Developments in Wearable Health Sensors Industry Industry

- June 2022: Nitto Denko Corporation acquired Bend Labs, Inc., merging its sensor technologies into Nitto Bend Technologies, fostering next-generation product development. This merger signifies a strategic move towards technological advancement and market expansion.

- February 2022: Abbott received FDA approval for an expanded indication of its Cardio MEMS HF System, benefiting an additional 1.2 Million US heart failure patients. This development significantly broadens the market reach of the company's sensor technology and demonstrates regulatory endorsement.

Strategic Outlook for Wearable Health Sensors Industry Market

The Wearable Health Sensors market exhibits considerable future potential, driven by technological innovation, expanding applications, and an increasing focus on preventative healthcare. The continued miniaturization, improved accuracy, and affordability of sensors will facilitate broader adoption across various healthcare and consumer segments. Strategic partnerships and collaborations between sensor manufacturers, technology companies, and healthcare providers will be crucial in driving market expansion and developing innovative solutions. The market's trajectory indicates substantial growth and market opportunities.

Wearable Health Sensors Industry Segmentation

-

1. Type

- 1.1. Pressure Sensor

- 1.2. Temperature Sensor

- 1.3. Position Sensor

- 1.4. Other Types

-

2. End User Industry

- 2.1. Healthcare

- 2.2. Consumer Electronic

- 2.3. Sports/Fitness

- 2.4. Other End User Industries

Wearable Health Sensors Industry Segmentation By Geography

- 1. Asia Pacific

- 2. Europe

- 3. Latin America

- 4. Middle East and Africa

- 5. North America

Wearable Health Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Continuous Monitoring In Healthcare Services; Rising Growth toward Advanced Functions Sensors in Smart Gadgets; Miniaturization of Physiological Sensors

- 3.3. Market Restrains

- 3.3.1. Dearth of Common Standards and Interoperability Issues

- 3.4. Market Trends

- 3.4.1. Healthcare Industry Holds a Dominant Share in Wearable Health Sensors Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pressure Sensor

- 5.1.2. Temperature Sensor

- 5.1.3. Position Sensor

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Healthcare

- 5.2.2. Consumer Electronic

- 5.2.3. Sports/Fitness

- 5.2.4. Other End User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. Europe

- 5.3.3. Latin America

- 5.3.4. Middle East and Africa

- 5.3.5. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pressure Sensor

- 6.1.2. Temperature Sensor

- 6.1.3. Position Sensor

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User Industry

- 6.2.1. Healthcare

- 6.2.2. Consumer Electronic

- 6.2.3. Sports/Fitness

- 6.2.4. Other End User Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pressure Sensor

- 7.1.2. Temperature Sensor

- 7.1.3. Position Sensor

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User Industry

- 7.2.1. Healthcare

- 7.2.2. Consumer Electronic

- 7.2.3. Sports/Fitness

- 7.2.4. Other End User Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Latin America Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pressure Sensor

- 8.1.2. Temperature Sensor

- 8.1.3. Position Sensor

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User Industry

- 8.2.1. Healthcare

- 8.2.2. Consumer Electronic

- 8.2.3. Sports/Fitness

- 8.2.4. Other End User Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Pressure Sensor

- 9.1.2. Temperature Sensor

- 9.1.3. Position Sensor

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User Industry

- 9.2.1. Healthcare

- 9.2.2. Consumer Electronic

- 9.2.3. Sports/Fitness

- 9.2.4. Other End User Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Pressure Sensor

- 10.1.2. Temperature Sensor

- 10.1.3. Position Sensor

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End User Industry

- 10.2.1. Healthcare

- 10.2.2. Consumer Electronic

- 10.2.3. Sports/Fitness

- 10.2.4. Other End User Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Asia Pacific Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Latin America Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Middle East and Africa Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. North America Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Infineon Technologies AG

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 mCube Inc *List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 STMicroelectronics Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 TE Connectivity Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Texas Instruments Incorporated

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Arm Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 TDK Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Fraunhofer IIS

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Analog Devices Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Maxim Integrated Products Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Wearable Health Sensors Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Latin America Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Latin America Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Asia Pacific Wearable Health Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: Asia Pacific Wearable Health Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: Asia Pacific Wearable Health Sensors Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 15: Asia Pacific Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 16: Asia Pacific Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Asia Pacific Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Wearable Health Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Wearable Health Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Wearable Health Sensors Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 21: Europe Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 22: Europe Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Wearable Health Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Latin America Wearable Health Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Latin America Wearable Health Sensors Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 27: Latin America Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 28: Latin America Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Latin America Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Wearable Health Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: Middle East and Africa Wearable Health Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: Middle East and Africa Wearable Health Sensors Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 33: Middle East and Africa Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 34: Middle East and Africa Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: North America Wearable Health Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: North America Wearable Health Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: North America Wearable Health Sensors Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 39: North America Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 40: North America Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: North America Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Wearable Health Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 4: Global Wearable Health Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Wearable Health Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Wearable Health Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Wearable Health Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Wearable Health Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Wearable Health Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 17: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 20: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 23: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 26: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 29: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wearable Health Sensors Industry?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the Wearable Health Sensors Industry?

Key companies in the market include Infineon Technologies AG, mCube Inc *List Not Exhaustive, STMicroelectronics Inc, TE Connectivity Ltd, Texas Instruments Incorporated, Arm Limited, TDK Corporation, Fraunhofer IIS, Analog Devices Inc, Maxim Integrated Products Inc.

3. What are the main segments of the Wearable Health Sensors Industry?

The market segments include Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Continuous Monitoring In Healthcare Services; Rising Growth toward Advanced Functions Sensors in Smart Gadgets; Miniaturization of Physiological Sensors.

6. What are the notable trends driving market growth?

Healthcare Industry Holds a Dominant Share in Wearable Health Sensors Market.

7. Are there any restraints impacting market growth?

Dearth of Common Standards and Interoperability Issues.

8. Can you provide examples of recent developments in the market?

June 2022 : Nitto Denko Corporation agreed to acquire Bend Labs, Inc. In line with this acquisition, Bend merged into the Nitto Group from June 1, 2022 to continue its business operations as Nitto Bend Technologies. As a result of this merger agreement, Bend's sensor device technologies were combined with Nitto's strengths for developing a next-generation technologies and products portfolio and new businesses utilizing sensor-acquired data.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wearable Health Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wearable Health Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wearable Health Sensors Industry?

To stay informed about further developments, trends, and reports in the Wearable Health Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence