Key Insights

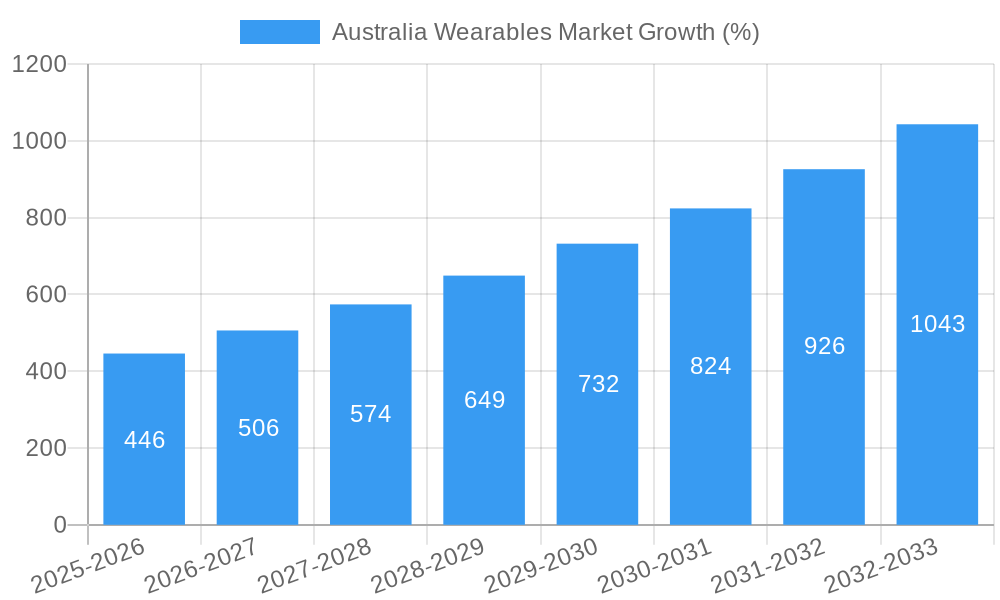

The Australian wearables market, valued at $3.53 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 12.90% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of fitness trackers and smartwatches amongst health-conscious Australians fuels market growth. Technological advancements leading to more sophisticated features, improved battery life, and sleeker designs are also significant contributors. Furthermore, the rising integration of wearables with smartphones and health applications enhances user experience and boosts demand. The market is segmented by end-user demographics (babies, kids, adults, elderly) and product types (smartwatches, head-mounted displays, ear-worn devices, fitness trackers, and other wearables). The adult segment currently dominates, driven by the popularity of fitness tracking and health monitoring features. However, the children's and elderly segments are poised for significant growth due to increasing awareness of health and safety applications for these demographics. Key players like Apple, Samsung, Garmin, and Fitbit are competing fiercely, driving innovation and competitive pricing, further benefiting consumers.

The continued growth trajectory hinges on several factors. Expanding mobile network infrastructure, particularly 5G, will improve data transmission speeds, enhancing the capabilities of wearable devices. Government initiatives promoting health and wellness will indirectly boost the market. However, challenges such as data privacy concerns, the high cost of premium wearables, and the relatively short lifespan of some devices pose potential restraints to market growth. Addressing these challenges through improved data security measures, more affordable product lines, and sustainable design practices will be crucial for sustained long-term market expansion. The Australian market presents significant opportunities for both established players and emerging companies seeking to capitalize on the rising demand for innovative and user-friendly wearable technology.

Australia Wearables Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australia wearables market, encompassing market size, segmentation, growth drivers, challenges, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is an essential resource for industry stakeholders, investors, and market entrants seeking a clear understanding of this dynamic market.

Australia Wearables Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Australian wearables market, exploring market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with key players like Apple, Samsung, and Garmin holding significant market share. However, smaller niche players and startups continue to emerge, driven by technological advancements and consumer demand for specialized wearables.

Market Concentration: The top 5 players account for approximately xx% of the market share in 2025. This concentration is expected to remain relatively stable over the forecast period, though competition will intensify.

Innovation Drivers: Continuous advancements in sensor technology, miniaturization, and battery life are major innovation drivers. The integration of artificial intelligence (AI) and machine learning (ML) into wearables is expanding their functionality, creating new market opportunities.

Regulatory Frameworks: Australian regulatory bodies are increasingly focused on data privacy and security related to wearable devices. Compliance with these regulations is crucial for market players.

Product Substitutes: Traditional fitness trackers and activity monitors are facing competition from increasingly sophisticated smartphones with integrated fitness features.

End-User Trends: Growing health consciousness and the adoption of fitness tracking amongst all age groups are driving demand for advanced wearable devices.

M&A Activities: The number of M&A deals in the Australian wearables market has been xx in the last five years. Deal values have ranged from xx Million to xx Million, reflecting both the consolidation within the sector and the emergence of new players. These activities have largely been driven by the desire to expand product portfolios and access new technologies.

Australia Wearables Market Industry Trends & Insights

The Australian wearables market is experiencing robust growth, fueled by several key factors. Technological advancements, such as improved sensor accuracy and longer battery life, are enhancing user experience and driving adoption. Rising health consciousness among consumers, coupled with increasing affordability of wearables, further contribute to market expansion. The market is also witnessing a shift towards more personalized and health-focused wearables, with features like sleep tracking, heart rate monitoring, and stress management gaining traction. The competitive landscape is dynamic, with established players and emerging startups vying for market share through innovation and product differentiation. The market is predicted to witness a CAGR of xx% during the forecast period (2025-2033). Market penetration is projected to reach approximately xx% by 2033, indicating considerable growth potential.

Dominant Markets & Segments in Australia Wearables Market

The Australian wearables market is largely driven by the adult segment, reflecting the high adoption rate of smartwatches and fitness trackers among this demographic. Within product categories, smartwatches currently dominate, accounting for xx% of the market share in 2025. However, the fitness trackers/activity trackers segment is expected to experience significant growth, driven by increasing affordability and wider availability of basic fitness-tracking functionalities.

By End-user:

- Adults: High adoption rates of smartwatches and fitness trackers are due to increased health awareness and disposable income.

- Kids: Growth is driven by parental interest in monitoring children's activity and safety.

- Elderly: Demand is fueled by the need for health monitoring and fall detection functionalities.

- Babies: This segment is relatively nascent but demonstrates potential for growth with the launch of baby monitoring wearables.

By Product:

- Smartwatches: The dominant segment due to their versatile functionality and integration with smartphones.

- Fitness Trackers/Activity Trackers: Experiencing significant growth due to affordability and widespread adoption.

- Ear Worn: Growing rapidly due to the popularity of wireless earbuds and hearing aid-like devices.

- Head Mounted Displays: Market penetration remains relatively low but is expected to grow with the adoption of AR/VR technologies.

- Other Wearables: Includes a variety of niche products, such as smart clothing and connected jewelry, with potential for future growth.

Australia Wearables Market Product Developments

Recent product innovations focus on enhanced health monitoring capabilities, improved battery life, and more seamless integration with smartphones and other devices. Wearables are becoming increasingly sophisticated, incorporating features like ECG monitoring, blood oxygen level tracking, and advanced sleep analysis. This trend aligns with growing consumer demand for personalized health solutions and increased focus on wellness. Companies are actively competing to deliver more accurate, user-friendly, and aesthetically appealing devices that cater to diverse lifestyles and preferences.

Report Scope & Segmentation Analysis

This report segments the Australian wearables market by end-user (babies, kids, adults, elderly) and product type (smartwatches, head-mounted displays, ear-worn devices, fitness trackers/activity trackers, other wearables). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The adult segment is expected to dominate, followed by the kids segment. Within product categories, smartwatches are predicted to retain a leading market share throughout the forecast period.

Key Drivers of Australia Wearables Market Growth

The Australian wearables market is propelled by several key factors. Technological advancements, such as improved sensor technology and longer battery life, are enhancing user experience and driving adoption. Rising health consciousness among consumers and the increasing affordability of wearables are also important drivers. Government initiatives promoting health and wellness further contribute to market expansion.

Challenges in the Australia Wearables Market Sector

Challenges include the need for enhanced data privacy and security measures, competition from established tech giants and new entrants, and potential supply chain disruptions. Maintaining product innovation and affordability while addressing consumer concerns about data security is critical for sustained growth.

Emerging Opportunities in Australia Wearables Market

Emerging opportunities include the integration of advanced health monitoring technologies, expansion into niche segments like elderly care, and the development of wearables for specific industry applications. There is also growing potential for personalized health and fitness solutions.

Leading Players in the Australia Wearables Market Market

- Microsoft

- Samsung Electronics Co Ltd

- Garmin Ltd

- Oppo

- OnePlus

- Huawei Technologies Co Ltd

- Fitbit Inc

- Wear OS

- Apple Inc

- Nuheara Limited

Key Developments in Australia Wearables Market Industry

- August 2022: Samsung Electronics Co., Ltd. announced the Galaxy Watch5 Pro and Galaxy Watch5, featuring advanced health monitoring capabilities.

- May 2022: Huawei Technologies launched the Watch GT 3 Pro, Watch D (with blood pressure and ECG monitoring), and Band 7, expanding its wearable product portfolio.

Strategic Outlook for Australia Wearables Market Market

The Australian wearables market is poised for continued growth, driven by technological innovation, rising health consciousness, and increasing affordability. Future market potential lies in the development of sophisticated, personalized health and fitness solutions. Companies focused on innovation and addressing consumer concerns regarding data privacy will be well-positioned for success.

Australia Wearables Market Segmentation

-

1. End-user

- 1.1. Babies

- 1.2. Kids

- 1.3. Adults

- 1.4. Elderly

-

2. Product

- 2.1. Smartwatches

- 2.2. Head Mounted Displays

- 2.3. Ear Worn

- 2.4. Fitness Trackers/Activity Trackesr

- 2.5. Other Wearables

Australia Wearables Market Segmentation By Geography

- 1. Australia

Australia Wearables Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Incremental Technological Advancements Aiding the Market Growth; Increase in Health Awareness among the Consumers

- 3.3. Market Restrains

- 3.3.1. ; High Infrastructure Setup Cost During the Initial Rollout Phase; Lack of User Handheld Devices Compatible to 5 GNR Infrastructure

- 3.4. Market Trends

- 3.4.1. Head-Mounted Display will Drive the Growth of this Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Wearables Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Babies

- 5.1.2. Kids

- 5.1.3. Adults

- 5.1.4. Elderly

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Smartwatches

- 5.2.2. Head Mounted Displays

- 5.2.3. Ear Worn

- 5.2.4. Fitness Trackers/Activity Trackesr

- 5.2.5. Other Wearables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Microsoft

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung Electronics Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Garmin Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oppo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OnePlus

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huawei Technologies Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fitbit Inc *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wear OS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Apple Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nuheara Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Microsoft

List of Figures

- Figure 1: Australia Wearables Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Wearables Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Wearables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Wearables Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 3: Australia Wearables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Australia Wearables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Wearables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Wearables Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 7: Australia Wearables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 8: Australia Wearables Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Wearables Market?

The projected CAGR is approximately 12.90%.

2. Which companies are prominent players in the Australia Wearables Market?

Key companies in the market include Microsoft, Samsung Electronics Co Ltd, Garmin Ltd, Oppo, OnePlus, Huawei Technologies Co Ltd, Fitbit Inc *List Not Exhaustive, Wear OS, Apple Inc, Nuheara Limited.

3. What are the main segments of the Australia Wearables Market?

The market segments include End-user, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Incremental Technological Advancements Aiding the Market Growth; Increase in Health Awareness among the Consumers.

6. What are the notable trends driving market growth?

Head-Mounted Display will Drive the Growth of this Market.

7. Are there any restraints impacting market growth?

; High Infrastructure Setup Cost During the Initial Rollout Phase; Lack of User Handheld Devices Compatible to 5 GNR Infrastructure.

8. Can you provide examples of recent developments in the market?

August 2022 - Samsung Electronics Co., Ltd. announced the Galaxy Watch5 Pro and Galaxy Watch5, shaping consumers' wellness and health habits with advanced features, intuitive insights, and even more powerful capabilities. With an increasing desire to better understand and act on consumers' health goals, the company has provided depth monitoring and experimental data, offering the information needed to help users along their health and wellness journey. Galaxy Watch5 is equipped with Samsung's unique BioActive Sensor that drives the next era of digital health monitoring.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Wearables Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Wearables Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Wearables Market?

To stay informed about further developments, trends, and reports in the Australia Wearables Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence