Key Insights

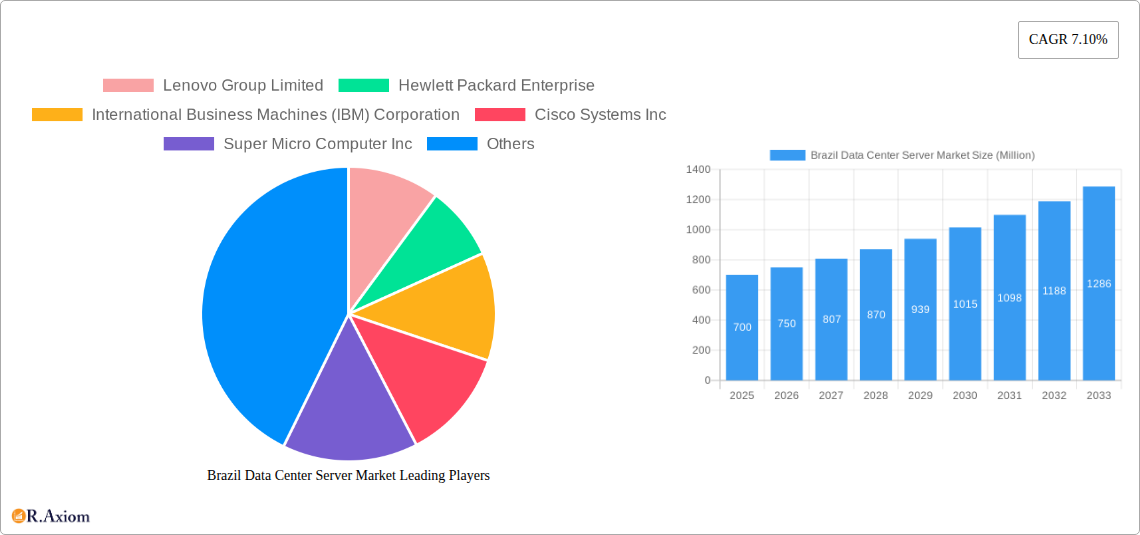

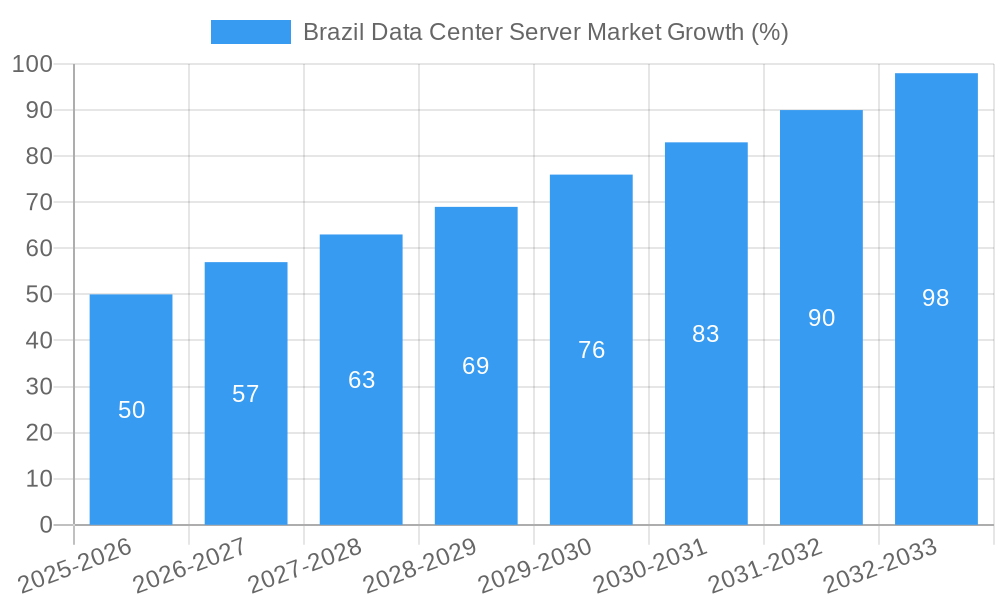

The Brazil data center server market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.10% from 2019 to 2024, is poised for continued expansion through 2033. This growth is fueled by several key drivers. The burgeoning digital economy in Brazil is significantly increasing demand for data storage and processing capabilities, necessitating substantial investment in data center infrastructure. Furthermore, the government's initiatives to promote digital transformation and improve digital infrastructure are creating favorable conditions for market expansion. The increasing adoption of cloud computing services and the rising need for high-performance computing (HPC) solutions in sectors like BFSI (Banking, Financial Services, and Insurance), IT & Telecommunications, and Media & Entertainment are further propelling market growth. While the market faces potential restraints like economic volatility and fluctuations in currency exchange rates, the overall long-term outlook remains positive. The market segmentation reveals a diverse landscape, with Rack Servers likely holding the largest market share due to their scalability and cost-effectiveness in data center deployments. The IT & Telecommunication sector is expected to remain the dominant end-user segment given its significant reliance on robust server infrastructure.

Considering the provided CAGR of 7.10% and assuming a 2024 market size of approximately $500 million (a logical estimation based on typical market sizes for developing economies and the given information), the market is projected to reach approximately $700 million by 2025 and continue its growth trajectory throughout the forecast period (2025-2033). This projected growth is based on the continuous expansion of the digital economy and the sustained investments in data center infrastructure within Brazil. The key players in the Brazilian data center server market include established global vendors and local players, creating a competitive environment that further drives innovation and cost-optimization. This competitive landscape ensures a healthy balance between supply and demand, supporting consistent market growth.

Brazil Data Center Server Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Brazil Data Center Server Market, offering invaluable insights for stakeholders seeking to understand and capitalize on growth opportunities within this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, competitive landscapes, and future projections. The study period spans 2019-2033, with 2025 serving as the base and estimated year, and the forecast period extending from 2025-2033. The historical period analyzed is 2019-2024. The report is segmented by form factor (Blade Server, Rack Server, Tower Server) and end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other End-User). Key players analyzed include Lenovo Group Limited, Hewlett Packard Enterprise, International Business Machines (IBM) Corporation, Cisco Systems Inc, Super Micro Computer Inc, Dell Inc, Quanta Computer Inc, Kingston Technology Company Inc, Inspur Group, and Huawei Technologies Co Ltd. Expected market value data points are represented by "xx" where precise figures are unavailable.

Brazil Data Center Server Market Concentration & Innovation

This section analyzes the market concentration, identifying dominant players and their market share. The report explores the drivers of innovation, including technological advancements and regulatory changes. It also examines the impact of regulatory frameworks, the presence of substitute products, evolving end-user trends, and recent mergers and acquisitions (M&A) activities. The analysis includes estimations of M&A deal values and their influence on market dynamics. For example, the consolidation of smaller players could lead to increased market concentration, while significant investments in R&D might accelerate innovation. The xx% market share held by the top three players reflects a moderately concentrated market, with opportunities for both expansion by existing players and entry by new entrants. The analysis further considers the impact of government policies promoting digital infrastructure development on market growth and innovation. Successful M&A activities exceeding xx Million in value have resulted in increased market consolidation and technological advancements, enhancing the overall competitiveness of the market.

Brazil Data Center Server Market Industry Trends & Insights

This section delves into the key drivers propelling the growth of the Brazil Data Center Server Market. It examines technological disruptions, including cloud computing and edge computing, and their impact on market dynamics. The analysis includes a detailed assessment of consumer preferences, emphasizing the demand for high-performance, energy-efficient servers. Competitive dynamics, such as pricing strategies and product differentiation, are also explored. The report projects a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors such as increasing digitalization, rising data consumption, and government initiatives to promote technological advancement. Market penetration for high-performance servers is expected to reach xx% by 2033, reflecting the growing need for efficient data processing across various sectors. Furthermore, the influence of the growing adoption of advanced technologies like AI and machine learning on server demand is discussed. The overall market size is projected to reach xx Million by 2033.

Dominant Markets & Segments in Brazil Data Center Server Market

This section identifies the leading segments within the Brazil Data Center Server Market. The analysis focuses on both form factor and end-user segments.

Form Factor:

- Rack Servers: This segment is projected to maintain its dominance due to its versatility and scalability, offering high capacity and flexibility for various data center applications. Key drivers include the widespread adoption of modular data center designs and the growing preference for standardized server configurations.

- Blade Servers: The blade server segment is expected to experience moderate growth driven by increasing demand for virtualization and high-density deployments. Cost optimization and increased energy efficiency are other contributing factors.

- Tower Servers: This segment holds a smaller market share compared to rack and blade servers, primarily serving smaller businesses or as standalone servers for specific applications.

End-User:

- IT & Telecommunication: This sector remains the leading end-user segment due to the extensive use of servers for data storage, processing, and network management. Strong investments in digital infrastructure development and the expansion of telecommunication networks are key growth drivers.

- BFSI (Banking, Financial Services, and Insurance): The BFSI sector demonstrates significant growth potential, driven by the increasing demand for secure and high-performance computing solutions for transactions, data analytics, and risk management. Stringent regulatory compliance and security protocols also fuel demand.

- Government: Government initiatives aimed at digital transformation and the establishment of smart cities are stimulating the demand for data center servers within this sector. Investments in e-governance initiatives and national cybersecurity programs further contribute to growth.

- Media & Entertainment: This sector is experiencing rapid growth due to the increase in digital content creation, streaming services, and the rising demand for high-bandwidth infrastructure to support advanced video processing and distribution.

- Other End-User: This segment encompasses diverse applications across various industries, with steadily growing adoption of cloud-based services and digitization initiatives.

Brazil Data Center Server Market Product Developments

Recent product innovations focus on enhancing server performance, energy efficiency, and security. Key advancements include the integration of advanced processors, improved cooling systems, and enhanced virtualization capabilities. Manufacturers are increasingly focusing on server solutions that align with cloud computing architectures and support software-defined data centers. The market is witnessing a shift towards energy-efficient designs and sustainable practices, driven by growing environmental concerns and operational cost savings. These advancements aim to improve overall cost efficiency, reduce carbon footprint, and cater to the ever-increasing data processing needs of various sectors.

Report Scope & Segmentation Analysis

This report segments the Brazil Data Center Server Market by form factor (Blade, Rack, Tower) and end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other). Each segment's growth projections, market size, and competitive dynamics are analyzed. The report provides detailed market size estimations for each segment for the historical, base, and forecast periods, along with projections for future growth. Competitive analysis highlights key players within each segment and their market share.

Key Drivers of Brazil Data Center Server Market Growth

The Brazil Data Center Server Market is driven by several factors, including:

- Technological advancements: The rapid pace of technological innovation, particularly in areas like cloud computing, big data, and AI, is creating a significant demand for high-performance servers.

- Economic growth: Brazil's growing economy fuels investment in IT infrastructure, leading to increased demand for data center servers across various sectors.

- Government initiatives: Government policies promoting digital transformation and e-governance are creating substantial demand for advanced server technologies.

Challenges in the Brazil Data Center Server Market Sector

Challenges facing the market include:

- Regulatory hurdles: Complex regulatory frameworks and compliance requirements can pose significant challenges for vendors operating in the market.

- Supply chain issues: Dependence on global supply chains for components can lead to vulnerabilities in the face of global disruptions.

- Competitive pressure: The presence of numerous established and emerging players creates intense competition, putting pressure on pricing and margins.

Emerging Opportunities in Brazil Data Center Server Market

Opportunities in the market include:

- Expansion of cloud computing: The growing adoption of cloud-based services presents substantial opportunities for server vendors to cater to the evolving needs of cloud providers.

- Growth of edge computing: The emergence of edge computing creates opportunities for specialized server solutions optimized for low-latency applications.

- Increased adoption of AI and machine learning: The proliferation of AI and machine learning applications fuels the demand for high-performance computing capabilities.

Leading Players in the Brazil Data Center Server Market Market

- Lenovo Group Limited

- Hewlett Packard Enterprise

- International Business Machines (IBM) Corporation

- Cisco Systems Inc

- Super Micro Computer Inc

- Dell Inc

- Quanta Computer Inc

- Kingston Technology Company Inc

- Inspur Group

- Huawei Technologies Co Ltd

Key Developments in Brazil Data Center Server Market Industry

- August 2023: Dell, Intel, and VMware launched vSAN 8.0 with Express Storage Architecture (ESA), improving performance and efficiency of ReadyNode infrastructure solutions.

- May 2023: Cisco introduced UCS X servers, reducing data center energy consumption by up to 52% at a 4:1 server consolidation rate, leveraging the Cisco Intersight platform.

Strategic Outlook for Brazil Data Center Server Market Market

The Brazil Data Center Server Market is poised for significant growth over the next decade, driven by strong economic growth, increasing digitalization, and supportive government policies. Opportunities exist for vendors to focus on developing innovative, energy-efficient solutions that meet the evolving needs of various end-user segments. The market will see increased competition, requiring players to differentiate their offerings through technological innovation and superior customer service. The focus on sustainability and green data centers will also play a crucial role in shaping market trends.

Brazil Data Center Server Market Segmentation

-

1. Form Factor

- 1.1. Blade Server

- 1.2. Rack Server

- 1.3. Tower Server

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-User

Brazil Data Center Server Market Segmentation By Geography

- 1. Brazil

Brazil Data Center Server Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Significant investment in IT infrastructure; Rapid Expansion in 5G network

- 3.3. Market Restrains

- 3.3.1. Increasing number of Data Security Breaches

- 3.4. Market Trends

- 3.4.1. Blade Servers to Grow At A Faster Pace In The Coming Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 5.1.1. Blade Server

- 5.1.2. Rack Server

- 5.1.3. Tower Server

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Lenovo Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hewlett Packard Enterprise

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 International Business Machines (IBM) Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Super Micro Computer Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dell Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Quanta Computer Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kingston Technology Company Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Inspur Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huawei Technologies Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Lenovo Group Limited

List of Figures

- Figure 1: Brazil Data Center Server Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Data Center Server Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Data Center Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 3: Brazil Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Brazil Data Center Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 7: Brazil Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Brazil Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Data Center Server Market?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Brazil Data Center Server Market?

Key companies in the market include Lenovo Group Limited, Hewlett Packard Enterprise, International Business Machines (IBM) Corporation, Cisco Systems Inc, Super Micro Computer Inc, Dell Inc, Quanta Computer Inc, Kingston Technology Company Inc, Inspur Group, Huawei Technologies Co Ltd.

3. What are the main segments of the Brazil Data Center Server Market?

The market segments include Form Factor, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Significant investment in IT infrastructure; Rapid Expansion in 5G network.

6. What are the notable trends driving market growth?

Blade Servers to Grow At A Faster Pace In The Coming Years.

7. Are there any restraints impacting market growth?

Increasing number of Data Security Breaches.

8. Can you provide examples of recent developments in the market?

August 2023: Dell, Intel, and VMware offer an updated ReadyNode infrastructure solution called vSAN 8.0 with Express Storage Architecture (ESA). This release includes performance and efficiency improvements to meet customers' evolving data center needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Data Center Server Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Data Center Server Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Data Center Server Market?

To stay informed about further developments, trends, and reports in the Brazil Data Center Server Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence