Key Insights

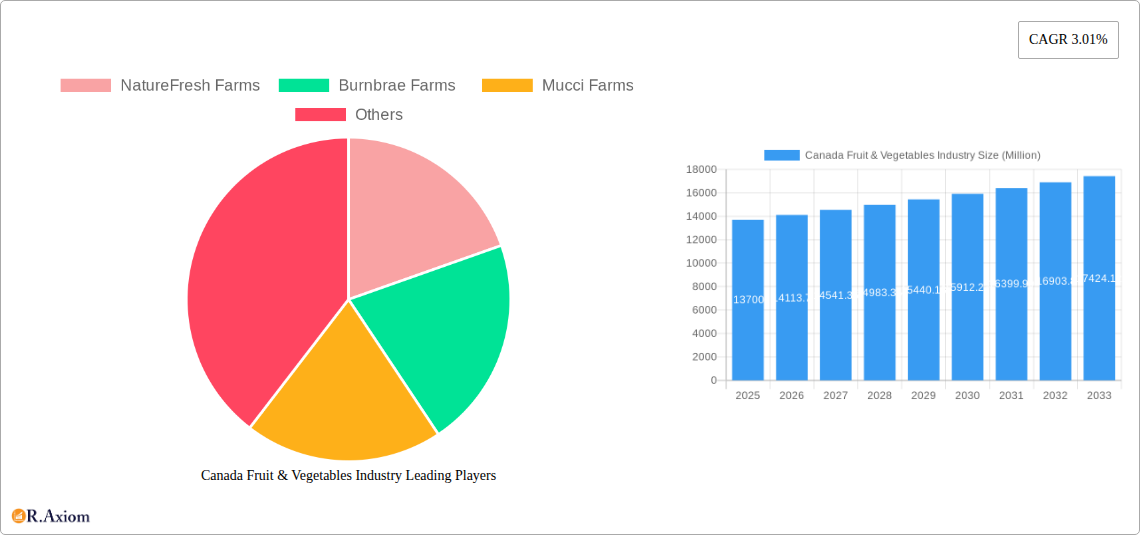

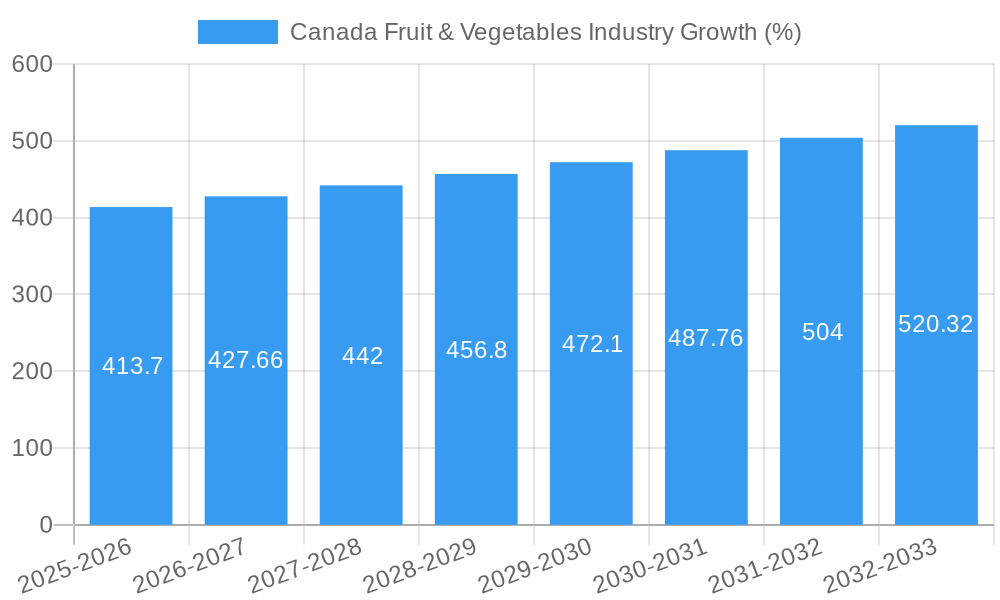

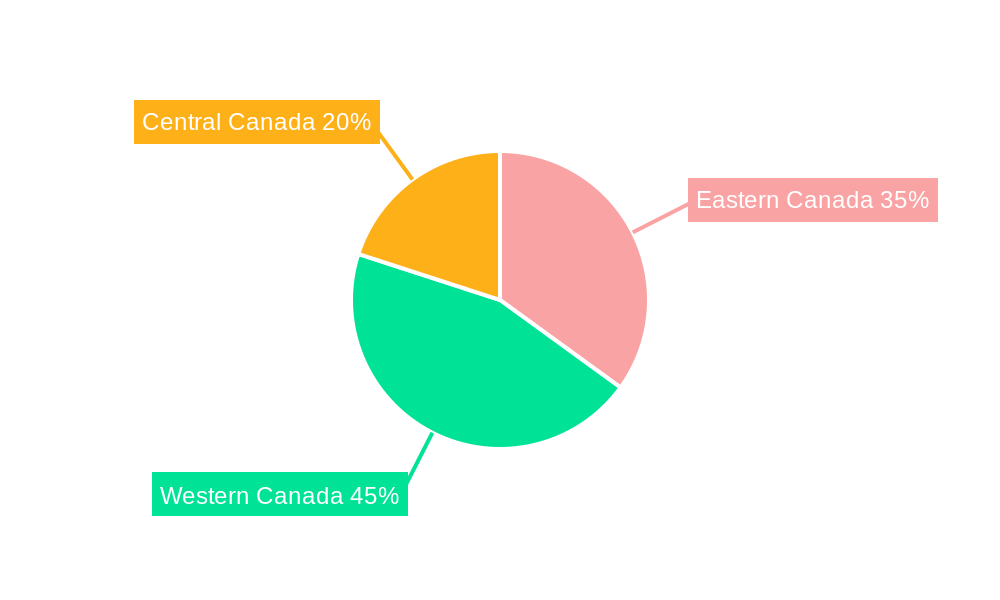

The Canadian fruit and vegetable industry, valued at $13.70 billion in 2025, exhibits a steady growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 3.01% from 2025 to 2033. This growth is driven by several factors. Increasing consumer awareness of health and wellness fuels demand for fresh produce, supporting higher consumption volumes. Furthermore, innovative farming techniques, such as hydroponics and vertical farming, are enhancing production efficiency and year-round availability. The industry also benefits from government initiatives promoting sustainable agriculture and food security, encouraging both domestic production and strategic imports to meet consumer needs. However, challenges remain. Climate change poses a significant risk to crop yields, while fluctuating energy and transportation costs impact profitability. Competition from imported produce, especially from regions with lower labor costs, also presents an ongoing hurdle. Market segmentation reveals strong performance across both fruits and vegetables. The demand for diverse product offerings, including organic and specialty varieties, is rising, driving further specialization within the industry. Regional variations exist, with Western Canada's larger agricultural lands potentially exhibiting faster growth than the East, although all regions experience consistent demand. Major players like NatureFresh Farms, Burnbrae Farms, and Mucci Farms are well-positioned to capitalize on these trends through investments in technology, supply chain optimization, and brand building.

The forecast period (2025-2033) anticipates continued market expansion, albeit at a moderate pace. This suggests a need for ongoing adaptation and innovation within the sector. Companies focused on enhancing production efficiency, managing supply chain vulnerabilities, and meeting evolving consumer preferences (e.g., sustainable packaging, traceability) are expected to thrive. The industry’s success will also hinge on effective policy measures addressing climate change impacts, ensuring fair competition, and fostering sustainable agricultural practices to preserve long-term growth and profitability. Furthermore, leveraging e-commerce platforms to reach wider consumer bases and promoting local produce will prove crucial for sustained growth. Finally, a focus on value-added products and processing to minimize post-harvest losses will offer significant avenues for expansion.

Canada Fruit & Vegetables Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Canadian fruit and vegetable industry, offering invaluable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines production, consumption, import/export dynamics, pricing trends, and key market developments, providing actionable intelligence to navigate the complexities of this dynamic sector. The report leverages extensive data analysis to forecast market trends and identify lucrative opportunities within the Canadian fruit and vegetable landscape.

Canada Fruit & Vegetables Industry Market Concentration & Innovation

The Canadian fruit and vegetable industry exhibits a moderately concentrated market structure, with several large players dominating specific segments. Market share data reveals that the top five producers account for approximately xx% of the overall market in 2025. Innovation is driven by factors such as evolving consumer preferences towards organic and sustainably produced products, technological advancements in farming practices (e.g., precision agriculture, vertical farming), and increasing demand for convenience-oriented processed products. Regulatory frameworks, including food safety standards and environmental regulations, significantly influence industry operations. Product substitutes, such as imported fruits and vegetables, pose a competitive challenge. The increasing prevalence of plant-based diets and health-conscious lifestyles fuels market growth. M&A activity has been moderate in recent years, with deal values averaging xx Million annually. Key acquisitions typically involve consolidation within specific segments, or expansion into new geographic markets.

- Market Share: Top 5 producers: xx% (2025)

- M&A Deal Value (Avg. Annual): xx Million

- Key Innovation Drivers: Sustainable farming, technological advancements, consumer preference shifts.

Canada Fruit & Vegetables Industry Industry Trends & Insights

The Canadian fruit and vegetable industry is witnessing robust growth, driven by factors such as rising disposable incomes, increasing health consciousness, and government initiatives promoting domestic agriculture. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), with market penetration primarily driven by the increasing popularity of fresh, convenient, and value-added products. Technological disruptions, including precision agriculture, automation, and data analytics, are enhancing efficiency and productivity. The shift towards organic and locally sourced produce is reshaping consumer preferences, while competitive dynamics are characterized by intense rivalry amongst established players and the emergence of innovative startups.

- CAGR (2025-2033): xx%

- Market Penetration: xx% (2025)

- Key Growth Drivers: Rising disposable incomes, health consciousness, government support, technological advancements.

Dominant Markets & Segments in Canada Fruit & Vegetables Industry

Dominance within the Canadian fruit and vegetable industry varies across segments. Ontario consistently ranks as the leading producer for both fruits and vegetables, benefitting from favorable climatic conditions and established agricultural infrastructure. British Columbia is a significant player in fruit production, particularly berries and cherries.

Vegetables:

- Production: Ontario (xx Million tonnes in 2025)

- Consumption: Ontario and Quebec (xx Million tonnes & xx Million value in 2025)

- Import: Imports predominantly from the US (xx Million volume & xx Million value in 2025).

- Export: Exports primarily to the US and other international markets (xx Million volume & xx Million value in 2025).

- Price Trends: Fluctuations influenced by weather patterns and global market conditions.

Fruits:

- Production: British Columbia and Ontario (xx Million tonnes in 2025)

- Consumption: Ontario and Quebec (xx Million tonnes & xx Million value in 2025)

- Import: Imports primarily from the US and other international markets (xx Million volume & xx Million value in 2025).

- Export: Exports mainly to the US and international markets (xx Million volume & xx Million value in 2025).

- Price Trends: Subject to seasonal variations and global market dynamics.

Key drivers for regional dominance include favorable climatic conditions, established agricultural infrastructure, and supportive government policies.

Canada Fruit & Vegetables Industry Product Developments

Recent product innovations focus on enhanced convenience, extended shelf life, and value-added features, such as pre-cut vegetables, ready-to-eat salads, and frozen fruit blends. Technological trends, including improved packaging solutions and modified atmosphere packaging (MAP), play a crucial role in maintaining product quality and extending shelf life, improving market fit and competitive advantage.

Report Scope & Segmentation Analysis

This report segments the Canadian fruit and vegetable market by product type (fruits, vegetables), processing method (fresh, processed), distribution channel (retail, food service), and region. Growth projections vary across segments based on evolving consumer preferences, technological innovations, and government initiatives. Competitive dynamics differ across segments, with some segments characterized by intense competition, while others exhibit a more fragmented structure. Market sizes are provided for each segment for the historical period (2019-2024), the base year (2025), and the forecast period (2026-2033).

Key Drivers of Canada Fruit & Vegetables Industry Growth

The Canadian fruit and vegetable industry's growth is driven by multiple factors: increasing health consciousness leading to higher consumption of fresh produce; advancements in agricultural technologies improving yields and efficiency; supportive government policies promoting domestic agriculture and exports; and the expanding food processing and retail sectors creating demand for processed and value-added products.

Challenges in the Canada Fruit & Vegetables Industry Sector

Challenges facing the industry include fluctuating weather patterns impacting crop yields, increasing labor costs, competition from imports, and the need to enhance food safety and traceability systems. Supply chain disruptions and climate change also pose significant threats. These factors can result in price volatility and reduced profitability for producers.

Emerging Opportunities in Canada Fruit & Vegetables Industry

Emerging opportunities include growing demand for organic and sustainably produced products, increasing interest in functional foods and value-added products, and the potential for growth in e-commerce and direct-to-consumer sales channels. The development of new processing technologies and innovative packaging solutions also presents significant opportunities for industry expansion.

Leading Players in the Canada Fruit & Vegetables Industry Market

- NatureFresh Farms

- Burnbrae Farms

- Mucci Farms

Key Developments in Canada Fruit & Vegetables Industry Industry

- December 2022: CMA CGM launches MOCANA, a seasonal export service for fruits and vegetables from the US East Coast & Canada.

- June 2022: USD 700,000 invested in four British Columbia fruit industry initiatives to boost exports.

- February 2022: The USD 33 Million Homegrown Innovation Challenge launched to foster sustainable fruit and vegetable production.

Strategic Outlook for Canada Fruit & Vegetables Industry Market

The Canadian fruit and vegetable industry is poised for continued growth, driven by favorable demographic trends, increasing health awareness, and technological advancements. Opportunities exist in value-added products, organic farming, and sustainable practices, presenting a positive outlook for both established players and new entrants. The industry's success hinges on addressing challenges related to climate change, supply chain efficiency, and global competition.

Canada Fruit & Vegetables Industry Segmentation

-

1. Fruits

- 1.1. Production Analysis (Volume)

- 1.2. Consumption Analysis (Volume & Value)

- 1.3. Import Analysis (Volume & Value)

- 1.4. Export Analysis (Volume & Value)

- 1.5. Price Trend Analysis

-

2. Vegetables

- 2.1. Production Analysis (Volume)

- 2.2. Consumption Analysis (Volume & Value)

- 2.3. Import Analysis (Volume & Value)

- 2.4. Export Analysis (Volume & Value)

- 2.5. Price Trend Analysis

-

3. Fruits

- 3.1. Production Analysis (Volume)

- 3.2. Consumption Analysis (Volume & Value)

- 3.3. Import Analysis (Volume & Value)

- 3.4. Export Analysis (Volume & Value)

- 3.5. Price Trend Analysis

-

4. Vegetables

- 4.1. Production Analysis (Volume)

- 4.2. Consumption Analysis (Volume & Value)

- 4.3. Import Analysis (Volume & Value)

- 4.4. Export Analysis (Volume & Value)

- 4.5. Price Trend Analysis

Canada Fruit & Vegetables Industry Segmentation By Geography

- 1. Canada

Canada Fruit & Vegetables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan

- 3.3. Market Restrains

- 3.3.1. ; Volatility in the Prices; Adverse Weather Conditions Affecting Yield

- 3.4. Market Trends

- 3.4.1. Increased demand for fruits and vegetables

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Fruit & Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fruits

- 5.1.1. Production Analysis (Volume)

- 5.1.2. Consumption Analysis (Volume & Value)

- 5.1.3. Import Analysis (Volume & Value)

- 5.1.4. Export Analysis (Volume & Value)

- 5.1.5. Price Trend Analysis

- 5.2. Market Analysis, Insights and Forecast - by Vegetables

- 5.2.1. Production Analysis (Volume)

- 5.2.2. Consumption Analysis (Volume & Value)

- 5.2.3. Import Analysis (Volume & Value)

- 5.2.4. Export Analysis (Volume & Value)

- 5.2.5. Price Trend Analysis

- 5.3. Market Analysis, Insights and Forecast - by Fruits

- 5.3.1. Production Analysis (Volume)

- 5.3.2. Consumption Analysis (Volume & Value)

- 5.3.3. Import Analysis (Volume & Value)

- 5.3.4. Export Analysis (Volume & Value)

- 5.3.5. Price Trend Analysis

- 5.4. Market Analysis, Insights and Forecast - by Vegetables

- 5.4.1. Production Analysis (Volume)

- 5.4.2. Consumption Analysis (Volume & Value)

- 5.4.3. Import Analysis (Volume & Value)

- 5.4.4. Export Analysis (Volume & Value)

- 5.4.5. Price Trend Analysis

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Fruits

- 6. Eastern Canada Canada Fruit & Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Fruit & Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Fruit & Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 NatureFresh Farms

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Burnbrae Farms

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Mucci Farms

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.1 NatureFresh Farms

List of Figures

- Figure 1: Canada Fruit & Vegetables Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Fruit & Vegetables Industry Share (%) by Company 2024

List of Tables

- Table 1: Canada Fruit & Vegetables Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Fruit & Vegetables Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Canada Fruit & Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 4: Canada Fruit & Vegetables Industry Volume Kiloton Forecast, by Fruits 2019 & 2032

- Table 5: Canada Fruit & Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 6: Canada Fruit & Vegetables Industry Volume Kiloton Forecast, by Vegetables 2019 & 2032

- Table 7: Canada Fruit & Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 8: Canada Fruit & Vegetables Industry Volume Kiloton Forecast, by Fruits 2019 & 2032

- Table 9: Canada Fruit & Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 10: Canada Fruit & Vegetables Industry Volume Kiloton Forecast, by Vegetables 2019 & 2032

- Table 11: Canada Fruit & Vegetables Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Canada Fruit & Vegetables Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 13: Canada Fruit & Vegetables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Canada Fruit & Vegetables Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 15: Eastern Canada Canada Fruit & Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Eastern Canada Canada Fruit & Vegetables Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 17: Western Canada Canada Fruit & Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Western Canada Canada Fruit & Vegetables Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Central Canada Canada Fruit & Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Central Canada Canada Fruit & Vegetables Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Canada Fruit & Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 22: Canada Fruit & Vegetables Industry Volume Kiloton Forecast, by Fruits 2019 & 2032

- Table 23: Canada Fruit & Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 24: Canada Fruit & Vegetables Industry Volume Kiloton Forecast, by Vegetables 2019 & 2032

- Table 25: Canada Fruit & Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 26: Canada Fruit & Vegetables Industry Volume Kiloton Forecast, by Fruits 2019 & 2032

- Table 27: Canada Fruit & Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 28: Canada Fruit & Vegetables Industry Volume Kiloton Forecast, by Vegetables 2019 & 2032

- Table 29: Canada Fruit & Vegetables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Canada Fruit & Vegetables Industry Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Fruit & Vegetables Industry?

The projected CAGR is approximately 3.01%.

2. Which companies are prominent players in the Canada Fruit & Vegetables Industry?

Key companies in the market include NatureFresh Farms , Burnbrae Farms , Mucci Farms .

3. What are the main segments of the Canada Fruit & Vegetables Industry?

The market segments include Fruits, Vegetables, Fruits, Vegetables.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.70 Million as of 2022.

5. What are some drivers contributing to market growth?

; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan.

6. What are the notable trends driving market growth?

Increased demand for fruits and vegetables.

7. Are there any restraints impacting market growth?

; Volatility in the Prices; Adverse Weather Conditions Affecting Yield.

8. Can you provide examples of recent developments in the market?

December 2022: CMA CGM has announced the launch of MOCANA, its new seasonal offer dedicated to exporting fruit and vegetables from the US East Coast & Canada during the fruit and vegetable season.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Fruit & Vegetables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Fruit & Vegetables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Fruit & Vegetables Industry?

To stay informed about further developments, trends, and reports in the Canada Fruit & Vegetables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence