Key Insights

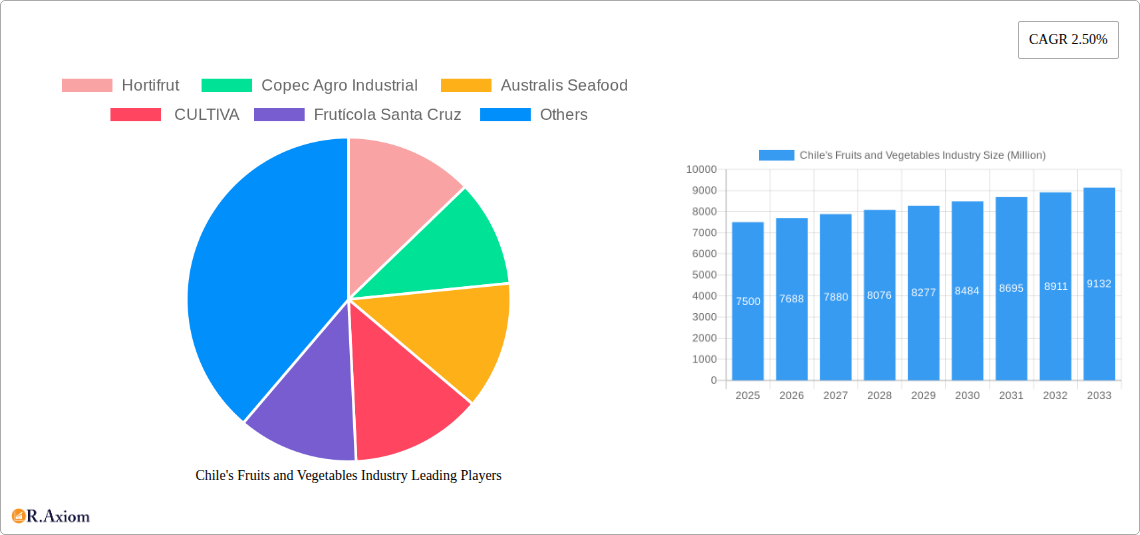

Chile's Fruits and Vegetables Industry is poised for steady expansion, projected to reach a market size of approximately USD 7,500 million by 2025, growing at a Compound Annual Growth Rate (CAGR) of 2.50% through 2033. This growth is underpinned by robust demand both domestically and internationally for high-quality produce. Key drivers include a growing consumer preference for healthy and sustainable food options, coupled with advancements in agricultural technology and improved export infrastructure. The industry is witnessing significant trends such as the increasing popularity of exotic fruits and berries, a surge in organic and sustainably grown produce, and the adoption of precision agriculture techniques to enhance yield and reduce environmental impact. Furthermore, Chile's favorable climate and diverse microclimates make it an ideal location for cultivating a wide variety of fruits and vegetables, positioning it as a significant global supplier.

Chile's Fruits and Vegetables Industry Market Size (In Billion)

However, the sector faces certain restraints that could temper its growth trajectory. These include increasing competition from other fruit and vegetable producing nations, fluctuating global commodity prices, and the impact of climate change, which can lead to unpredictable weather patterns and affect crop yields. Labor shortages and rising operational costs also present challenges for producers. Despite these hurdles, the industry's focus on value-added products, diversification of export markets, and investment in research and development are expected to mitigate these risks. The market segmentation leans towards Vegetables and Fruits, with a dynamic interplay between these categories driven by consumer dietary shifts and evolving market demands. Prominent players like Hortifrut, Copec Agro Industrial, and Frutícola Santa Cruz are actively investing in innovation and sustainable practices to maintain their competitive edge within this evolving landscape.

Chile's Fruits and Vegetables Industry Company Market Share

Chile's fruits and vegetables industry exhibits a moderate level of market concentration, with a blend of large established players and a significant number of smaller to medium-sized enterprises. Innovation is a key differentiator, driven by a strong focus on quality, sustainability, and the adoption of advanced agricultural technologies. Regulatory frameworks, while supportive of growth, are continuously evolving to meet international standards, particularly concerning food safety and environmental practices. Key innovation drivers include the demand for organic and sustainably grown produce, investment in precision agriculture, and the development of new varieties with enhanced shelf-life and nutritional value. Product substitutes are primarily other global agricultural exporting nations. End-user trends indicate a growing preference for convenient, healthy, and traceable food options. Mergers and acquisitions (M&A) activity is present, notably illustrated by Hortifrut's acquisition of Atlantic Blue for USD 280 Million, signifying consolidation and expansion strategies within the berry segment. The market share of top companies, while dynamic, is influenced by global demand and the ability to meet stringent export requirements.

Chile's Fruits and Vegetables Industry Industry Trends & Insights

Chile's vibrant fruits and vegetables industry is experiencing robust growth, propelled by escalating global demand for high-quality, diverse produce, particularly from key markets in North America and Europe. The industry is characterized by a significant Compound Annual Growth Rate (CAGR) driven by increasing consumer awareness regarding health benefits associated with fruit and vegetable consumption, coupled with Chile's favorable climate and agricultural expertise. Technological disruptions are playing a pivotal role, with widespread adoption of precision agriculture, including AI-driven analytics for crop management, automated irrigation systems, and advanced pest and disease detection. Vertical farming and controlled environment agriculture (CEA) are also gaining traction, exemplified by the partnership between Aerofarms and Hortifrut SA, aiming to bolster R&D for berries. This move towards controlled environments enhances yield consistency and reduces reliance on traditional agricultural constraints.

Consumer preferences are shifting towards organic, sustainably sourced, and ethically produced food items. Chilean exporters are increasingly focusing on certifications and transparent supply chains to meet these demands. The industry is also witnessing a growing demand for exotic and specialty fruits, alongside a consistent demand for staple vegetables. Competitive dynamics are intensifying, not only among Chilean producers but also in the global arena. Chile's strategic location and established export infrastructure provide a competitive edge, but producers must continuously innovate to maintain their market position. Investments in cold chain logistics and efficient transportation networks are crucial for preserving product quality during transit. The market penetration of Chilean produce in international markets is expected to deepen as global economies recover and disposable incomes rise, particularly in emerging markets. The industry's ability to adapt to climate change challenges through water-efficient practices and resilient crop varieties will be a significant factor in its sustained growth. Furthermore, the government's proactive strategies, such as the removal of mandatory methyl bromide fumigation for table grapes, are aimed at improving market access and competitiveness in key export destinations.

Dominant Markets & Segments in Chile's Fruits and Vegetables Industry

The Fruits segment consistently dominates Chile's fruits and vegetables industry, driven by the country's unparalleled success in producing and exporting a wide array of high-value fruits to global markets. The Type (Pr: Fruits) segment holds a substantial market share, benefiting from favorable agro-climatic conditions and a well-established export infrastructure. This dominance is further bolstered by the country's specialization in berry production, including blueberries, raspberries, and cranberries, which have seen explosive demand growth internationally.

Key Drivers of Fruit Segment Dominance:

- Global Demand for Berries: The surge in demand for nutrient-rich and antioxidant-packed berries, particularly in North America and Europe, has been a primary catalyst for the fruits segment's growth.

- Export Competitiveness: Chile's advantageous geographical location, with counter-seasonal supply capabilities to Northern Hemisphere markets, grants it a significant competitive edge. This allows Chilean fruits to fill supply gaps and command premium prices.

- Investment in Technology and R&D: Companies like Hortifrut are heavily investing in advanced agricultural technologies and research and development, focusing on improving yield, quality, and sustainability in fruit cultivation.

- Government Support and Trade Agreements: Proactive government strategies, such as streamlining export regulations and forging beneficial trade agreements, have significantly facilitated market access and expanded export volumes for Chilean fruits. The recent removal of mandatory methyl bromide fumigation for table grapes is a prime example of a policy aimed at boosting export competitiveness.

- Diversification of Fruit Varieties: While berries are a major export, Chile also excels in producing and exporting cherries, apples, kiwis, and avocados, further solidifying the fruits segment's broad appeal and market penetration.

The Type (Pr: Vegetables) segment, while not reaching the same export magnitude as fruits, is also a critical component of the Chilean agricultural landscape. Its dominance is more pronounced in the domestic market and for specific export products like onions, garlic, and certain processed vegetables. Key drivers for the vegetable segment include domestic consumption patterns, the burgeoning food processing industry, and niche export opportunities. Infrastructure development, improved irrigation techniques, and the adoption of more efficient cultivation methods are crucial for enhancing the competitiveness of Chilean vegetables in both domestic and international arenas. The synergy between the fruit and vegetable sectors, in terms of shared infrastructure and expertise, also contributes to the overall strength of Chile's agricultural exports.

Chile's Fruits and Vegetables Industry Product Developments

Product development in Chile's fruits and vegetables industry is highly focused on enhancing export competitiveness and meeting evolving consumer demands. Innovations include the development of new fruit varieties with improved shelf-life, disease resistance, and superior taste profiles, particularly within the highly successful berry and cherry categories. Advancements in controlled environment agriculture, such as vertical farms pioneered by companies like Hortifrut in partnership with Aerofarms, are leading to more consistent, high-quality production of delicate crops like blueberries and cranberries. Furthermore, there's a growing emphasis on ready-to-eat and minimally processed vegetable products for convenience-seeking consumers, alongside a rise in demand for organically certified and sustainably grown produce, offering significant competitive advantages in discerning international markets.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of Chile's fruits and vegetables industry, encompassing a detailed breakdown by key segments. The market is segmented by Type (Pr: Vegetables) and Type (Pr: Fruits).

Within the Type (Pr: Vegetables) segment, the analysis covers various vegetable categories, including root vegetables, leafy greens, cruciferous vegetables, and others. Growth projections and market sizes will be provided for this segment, with a focus on domestic consumption trends and niche export opportunities. Competitive dynamics among local producers and their ability to meet specific international demand will be highlighted.

The Type (Pr: Fruits) segment, which represents the larger portion of Chile's agricultural exports, is further detailed. This includes a deep dive into major fruit categories such as berries (blueberries, raspberries, cranberries), stone fruits (cherries, plums), pome fruits (apples, pears), citrus, and other specialty fruits. The report will present detailed growth projections, market sizes, and an in-depth analysis of competitive landscapes, considering both domestic players and international market penetration. Emphasis will be placed on export-oriented segments and their contribution to Chile's economy.

Key Drivers of Chile's Fruits and Vegetables Industry Growth

Several key drivers are propelling the growth of Chile's fruits and vegetables industry. Economically, robust global demand for high-quality, counter-seasonal produce from established markets like North America and Europe is a primary catalyst. Technologically, the widespread adoption of precision agriculture, including AI-driven analytics, automated irrigation, and advanced pest management, is enhancing efficiency and yield. Regulatory frameworks, such as the removal of mandatory methyl bromide fumigation for table grapes, are opening up new market access and reducing export barriers. Furthermore, significant investments in R&D by leading companies like Hortifrut and strategic partnerships are fostering innovation in crop development and cultivation techniques, particularly in the high-demand berry sector.

Challenges in the Chile's Fruits and Vegetables Industry Sector

Despite its strong growth trajectory, the Chile's fruits and vegetables industry faces several challenges. Climate change poses a significant threat, with increasing risks of drought and extreme weather events impacting agricultural output. Water scarcity is a persistent concern, requiring continued investment in water-efficient technologies. Labor availability and rising labor costs can also impact production efficiency. Furthermore, intense global competition from other agricultural exporting nations, coupled with fluctuating international market prices, creates a dynamic and often unpredictable environment. Stringent phytosanitary and quality standards in export markets require continuous adaptation and investment in compliance. Supply chain disruptions, including transportation and logistics issues, can also lead to product spoilage and increased costs.

Emerging Opportunities in Chile's Fruits and Vegetables Industry

Emerging opportunities within Chile's fruits and vegetables industry are diverse and promising. The growing global consumer preference for organic and sustainably produced food presents a significant avenue for market expansion, with certifications and transparent supply chains becoming key differentiators. Technological advancements in vertical farming and controlled environment agriculture offer potential for year-round production and enhanced quality control, particularly for high-value crops. The development of novel, value-added products, such as frozen fruits, fruit purees, and ready-to-eat vegetable mixes, caters to the increasing demand for convenience. Exploring new export markets in Asia and other emerging economies, beyond traditional trading partners, also represents a substantial growth opportunity. Finally, leveraging Chile's expertise in fruit breeding and innovation for climate-resilient varieties can provide a long-term competitive advantage.

Leading Players in the Chile's Fruits and Vegetables Industry Market

- Hortifrut

- Copec Agro Industrial

- Australis Seafood

- CULTIVA

- Frutícola Santa Cruz

Key Developments in Chile's Fruits and Vegetables Industry Industry

- November 2022: The Chilean government adopted a new strategy for increasing the sales of table grapes from the country to other regions, such as North America and Europe, by removing the mandatory requirement of methyl bromide fumigation.

- March 2021: Aerofarms and Hortifrut SA signed a partnership agreement to expand the R&D capabilities for producing blueberries and cranberries in fully-controlled indoor environments and vertical farms.

- October 2021: Chilean fruit company Hortifrut announced the acquisition of berry producer Atlantic Blue for USD 280 Million to expand their growing area.

Strategic Outlook for Chile's Fruits and Vegetables Industry Market

The strategic outlook for Chile's fruits and vegetables industry is one of continued growth and global leadership, driven by a commitment to innovation, sustainability, and market adaptation. Future growth catalysts will include further investments in advanced agricultural technologies, such as AI and automation, to enhance productivity and resource efficiency. The industry is well-positioned to capitalize on the escalating global demand for healthy, premium produce, particularly in the berry and specialty fruit segments. Expanding into new, high-growth international markets, coupled with deepening penetration in existing ones, will be a key focus. Furthermore, the industry's ability to develop and promote climate-resilient crop varieties and embrace circular economy principles in its operations will solidify its long-term competitive advantage and contribute to sustainable economic development.

Chile's Fruits and Vegetables Industry Segmentation

-

1. Type (Pr

- 1.1. Vegetables

- 1.2. Fruits

-

2. Type (Pr

- 2.1. Vegetables

- 2.2. Fruits

Chile's Fruits and Vegetables Industry Segmentation By Geography

- 1. Chile

Chile's Fruits and Vegetables Industry Regional Market Share

Geographic Coverage of Chile's Fruits and Vegetables Industry

Chile's Fruits and Vegetables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming

- 3.3. Market Restrains

- 3.3.1. Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply

- 3.4. Market Trends

- 3.4.1. Increasing Exports of Fruits and Vegetables

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile's Fruits and Vegetables Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 5.1.1. Vegetables

- 5.1.2. Fruits

- 5.2. Market Analysis, Insights and Forecast - by Type (Pr

- 5.2.1. Vegetables

- 5.2.2. Fruits

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hortifrut

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Copec Agro Industrial

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Australis Seafood

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CULTIVA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frutícola Santa Cruz

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Hortifrut

List of Figures

- Figure 1: Chile's Fruits and Vegetables Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Chile's Fruits and Vegetables Industry Share (%) by Company 2025

List of Tables

- Table 1: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 2: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2020 & 2033

- Table 3: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 4: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2020 & 2033

- Table 5: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 7: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 8: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2020 & 2033

- Table 9: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 10: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2020 & 2033

- Table 11: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile's Fruits and Vegetables Industry?

The projected CAGR is approximately 2.50%.

2. Which companies are prominent players in the Chile's Fruits and Vegetables Industry?

Key companies in the market include Hortifrut , Copec Agro Industrial , Australis Seafood , CULTIVA, Frutícola Santa Cruz .

3. What are the main segments of the Chile's Fruits and Vegetables Industry?

The market segments include Type (Pr, Type (Pr.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming.

6. What are the notable trends driving market growth?

Increasing Exports of Fruits and Vegetables.

7. Are there any restraints impacting market growth?

Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply.

8. Can you provide examples of recent developments in the market?

November 2022: The Chilean government adopted a new strategy for increasing the sales of table grapes from the country to other regions, such as North America and Europe, by removing the mandatory requirement of methyl bromide fumigation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile's Fruits and Vegetables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile's Fruits and Vegetables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile's Fruits and Vegetables Industry?

To stay informed about further developments, trends, and reports in the Chile's Fruits and Vegetables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence