Key Insights

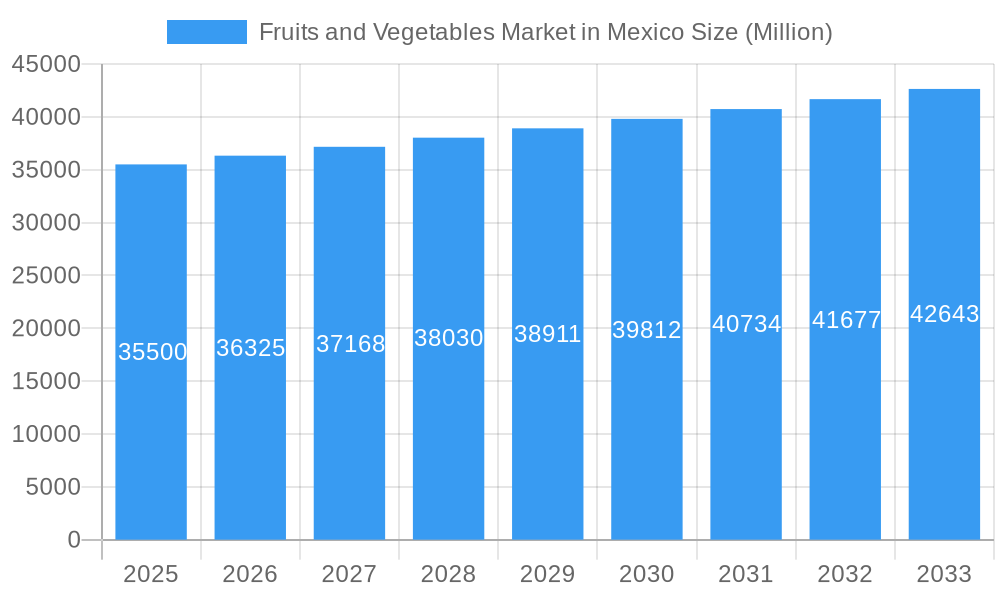

Mexico's Fruits and Vegetables Market is projected for significant expansion, with an estimated market size of 13740.1 million in 2024, driven by a compound annual growth rate (CAGR) of 4.6% through the forecast period (2024-2033). Growth is fueled by Mexico's advanced agricultural infrastructure, favorable climate for diverse produce, and rising demand for healthy foods domestically and internationally. The nation's proximity to the United States, a major importer, strongly supports export growth. Increasing consumer awareness of fresh produce health benefits also boosts domestic demand. Investments in modern agricultural technologies and sustainable practices enhance yields and quality, contributing to the market's upward trend.

Fruits and Vegetables Market in Mexico Market Size (In Billion)

Key trends influencing the Mexican Fruits and Vegetables Market include a rising demand for organic and sustainably grown produce, a growing segment of health-conscious consumers. Innovations in post-harvest handling and cold chain logistics are vital for minimizing waste and extending shelf life, enhancing export competitiveness. The market features a diverse product portfolio, including avocados, berries, citrus, and staple vegetables, catering to various culinary preferences. However, potential restraints such as regional water scarcity, climate change impacts on crop yields, and global commodity price volatility could affect market potential. Logistical complexities and ongoing infrastructure development for efficient supply chains also require continued attention for sustained growth and market resilience.

Fruits and Vegetables Market in Mexico Company Market Share

This comprehensive report offers an in-depth analysis of the Mexican Fruits and Vegetables Market, providing critical insights for industry stakeholders. Covering the historical period 2019–2024, with a base year of 2024, and projecting future growth to 2033, the report examines market dynamics, key players, technological advancements, and emerging opportunities in Mexico's agricultural sector. We analyze the entire value chain, from cultivation to export, highlighting traditional and innovative practices in Mexican produce. This report is indispensable for investors, producers, distributors, and policymakers seeking to understand and leverage the substantial potential of the Mexican fruit and vegetable industry.

Fruits and Vegetables Market in Mexico Market Concentration & Innovation

The Fruits and Vegetables Market in Mexico exhibits a moderate level of market concentration, with a blend of large-scale commercial operations and a significant number of small to medium-sized enterprises (SMEs). Innovation is a key driver, spurred by the need to enhance crop yields, improve product quality for export markets, and adopt sustainable agricultural practices. Regulatory frameworks, while evolving, generally support agricultural development through trade agreements and domestic policies aimed at boosting production and market access. The threat of product substitutes is relatively low for fresh fruits and vegetables due to their unique nutritional profiles and consumer demand for natural products. End-user trends are increasingly leaning towards health-conscious consumption, demand for organic produce, and convenience. Mergers and acquisitions (M&A) activity is observed, particularly among larger players seeking to consolidate supply chains, expand their product portfolios, and gain market share. Deal values in the sector are influenced by factors such as land acquisition, technological integration, and brand recognition. For instance, strategic partnerships and investments in agricultural technology are becoming more prevalent. Market share is often dictated by export capabilities, adherence to international quality standards, and the ability to navigate complex global supply chains.

Fruits and Vegetables Market in Mexico Industry Trends & Insights

The Fruits and Vegetables Market in Mexico is experiencing robust growth, driven by a confluence of favorable factors including Mexico's advantageous climate, diverse agro-ecological zones, and established export infrastructure. The market’s expansion is further amplified by increasing global demand for fresh produce, particularly from North America and Europe, where Mexican fruits and vegetables are highly sought after for their quality and competitive pricing. A significant trend is the adoption of advanced agricultural technologies, such as precision farming, smart irrigation systems, and predictive analytics, which are enhancing crop yields, reducing resource consumption, and improving overall operational efficiency. The industry is also witnessing a growing consumer preference for healthy, sustainably grown, and traceable produce, pushing producers to adopt eco-friendly farming methods and obtain certifications. Technological disruptions, including the integration of AI in pest and disease management and the development of climate-resilient crop varieties, are playing a crucial role in ensuring consistent supply and mitigating risks associated with climate change. The competitive dynamics within the Mexican market are characterized by intense competition among domestic producers and significant participation from international buyers and investors. Market penetration is steadily increasing, with producers actively seeking new export destinations and expanding their domestic distribution networks. The continuous drive for innovation and the strategic leveraging of trade agreements are fundamental to the sustained growth of the Mexican fruit and vegetable sector. The Compound Annual Growth Rate (CAGR) is projected to remain strong, reflecting the resilience and dynamism of this vital industry.

Dominant Markets & Segments in Fruits and Vegetables Market in Mexico

The Fruits and Vegetables Market in Mexico is segmented by Crop Type into Fruits and Vegetables, both of which hold significant importance but exhibit distinct market dynamics and dominance patterns.

Fruits Segment Dominance:

- Key Drivers: Favorable climatic conditions in regions like Michoacán, Sinaloa, and Jalisco for avocado, berry, and citrus production. Strong export demand, particularly for avocados, berries (strawberries, blueberries, raspberries), and limes, driving significant market share. The presence of large-scale commercial orchards and packing facilities optimized for export.

- Detailed Dominance Analysis: Mexico is a global leader in avocado production and export, with a substantial portion of the market controlled by established cooperatives and large agribusinesses that have invested heavily in advanced cultivation and post-harvest technologies. The berry segment, especially strawberries, has also witnessed remarkable growth due to consistent demand from international markets and investments in protected cultivation techniques. The Mexican fruit market benefits from established trade relationships, especially with the United States, which accounts for a vast majority of its fruit exports. Economic policies that encourage agricultural exports, coupled with efficient logistics and cold chain infrastructure, further cement the dominance of fruits in key export-oriented regions.

Vegetables Segment Dominance:

- Key Drivers: Sinaloa province is a powerhouse for vegetable production, particularly tomatoes, cucumbers, peppers, and leafy greens, serving both domestic and export markets. The adoption of greenhouse technology and controlled environment agriculture (CEA) is enhancing yield and quality for vegetables, especially for niche and high-value crops. Government support for agricultural modernization and initiatives promoting food security contribute to the vegetable sector’s growth.

- Detailed Dominance Analysis: The vegetable segment is characterized by its broad range of products catering to diverse culinary needs. Tomatoes, a staple for both domestic consumption and export, represent a significant portion of the vegetable market. The sector's dominance is sustained by continuous investment in modern farming techniques, including hydroponics and precision irrigation, which optimize resource use and improve crop resilience. The Mexican vegetable market is also influenced by the growing trend of agritourism and the demand for locally sourced produce, although export markets remain a primary revenue driver for many producers. Infrastructure development in key agricultural states and the ongoing efforts to improve supply chain efficiency are critical to maintaining and expanding the vegetable segment’s competitive edge.

Fruits and Vegetables Market in Mexico Product Developments

Product developments in the Fruits and Vegetables Market in Mexico are increasingly focused on enhancing crop resilience, nutritional value, and shelf life. Innovations include the development and commercialization of disease-resistant varieties, such as ToBRFV-resistant tomatoes, which significantly reduce crop losses and increase profitability. Advances in controlled environment agriculture (CEA) and vertical farming are enabling the year-round cultivation of high-value crops, irrespective of external climate conditions. Furthermore, there's a growing emphasis on developing niche products and organic certified produce to cater to evolving consumer preferences for healthier and sustainably produced food. These developments offer producers competitive advantages by enabling them to meet stringent international quality standards, access premium markets, and diversify their product offerings, thereby strengthening their position in the global Mexican produce market.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Fruits and Vegetables Market in Mexico, segmenting it primarily by Crop Type: Fruits and Vegetables. The "Fruits" segment encompasses a wide array of produce including, but not limited to, avocados, berries (strawberries, blueberries, raspberries), citrus fruits (limes, oranges), mangoes, and papayas. The "Vegetables" segment covers staples such as tomatoes, peppers, cucumbers, onions, potatoes, and leafy greens. Each segment is further examined for its market size, growth projections, and competitive dynamics within the Mexican agricultural sector. The analysis considers historical performance (2019–2024), the base and estimated year of 2025, and forecasts growth through 2033, providing a comprehensive view of each segment's trajectory and potential.

Key Drivers of Fruits and Vegetables Market in Mexico Growth

The growth of the Fruits and Vegetables Market in Mexico is propelled by several key factors. Mexico's strategic geographical location, facilitating easy access to major export markets like the United States and Canada, is a significant economic driver. The country's diverse and favorable climate zones allow for the cultivation of a wide variety of fruits and vegetables year-round. Technological advancements in agriculture, including precision farming techniques, advanced irrigation systems, and the development of disease-resistant crop varieties, are enhancing productivity and reducing operational costs. Furthermore, robust government support through various agricultural policies, trade agreements (like USMCA), and investment in infrastructure plays a crucial role in fostering growth. Growing global demand for healthy and fresh produce, coupled with rising disposable incomes in key importing nations, also contributes significantly to market expansion.

Challenges in the Fruits and Vegetables Market in Mexico Sector

Despite its robust growth, the Fruits and Vegetables Market in Mexico faces several challenges. Water scarcity and the increasing impact of climate change pose significant risks to agricultural productivity, necessitating greater investment in water management technologies. Regulatory hurdles and complex compliance requirements for export markets can be a burden, particularly for smaller producers. Supply chain inefficiencies, including inadequate cold chain infrastructure and transportation logistics in certain regions, can lead to post-harvest losses and affect product quality. Intense competition from other global agricultural exporters, as well as price volatility in international markets, can impact profitability. Additionally, labor availability and costs, along with concerns regarding sustainable farming practices and environmental impact, are ongoing challenges that require continuous attention and strategic solutions.

Emerging Opportunities in Fruits and Vegetables Market in Mexico

Emerging opportunities within the Fruits and Vegetables Market in Mexico are abundant and diverse. There is a significant opportunity in the expanding global demand for organic and specialty produce, catering to health-conscious consumers. The development and adoption of innovative agricultural technologies, such as AI-powered pest management and vertical farming, present avenues for enhanced efficiency and increased yields. Furthermore, exploring new export markets beyond North America, particularly in Asia and Europe, offers substantial growth potential. Investments in value-added products, such as processed fruits and vegetables, can further diversify revenue streams. Sustainable agricultural practices and certifications are becoming increasingly important, creating opportunities for producers who prioritize environmental stewardship and social responsibility. The ongoing digitalization of agriculture also offers opportunities for improved data management and market access.

Leading Players in the Fruits and Vegetables Market in Mexico Market

- Grupo Bama

- Empacadora Frutícola de Sonora

- AgroIndustrias

- Hortifrut

- Berrymex

- San Miguel

- Unidad de Producción Agrícola Integral (UPAI)

- Gama Agrícola

- Danone

- Walmart Foundation

Key Developments in Fruits and Vegetables Market in Mexico Industry

- November 2022: Hazera launched ToBRFV-resistant varieties in Mexico, aiming to significantly increase crop yield and enable growers to produce more crops from less arable land, thereby enhancing profitability.

- July 2021: Fortune Growers, a prominent broccoli producer in Mexico, partnered with ec2ce, a Spanish agricultural technology company, to implement advanced predictive analytics in their broccoli operations, focusing on maximizing high-quality produce for the export market.

- March 2020: The "Madre Tierra" project was initiated to support small strawberry producers in Mexico with an investment of USD 2.14 billion over four years (2019-2022). This initiative aims to enhance producer competitiveness through capacity building, involving stakeholders like DanTrade, Danone Ecosystem, the Walmart Foundation in Mexico, Altex, TechnoServe, and GIZ.

Strategic Outlook for Fruits and Vegetables Market in Mexico Market

The strategic outlook for the Fruits and Vegetables Market in Mexico is highly optimistic, driven by sustained global demand and Mexico's intrinsic advantages. Future growth will be propelled by further investments in agricultural technology, focusing on sustainability, water efficiency, and climate resilience. Expanding value-added processing capabilities will unlock new revenue streams and reduce reliance on primary commodity markets. Diversification of export markets beyond traditional partners will be crucial for mitigating risks and capturing new opportunities. The continued development of infrastructure, particularly cold chain logistics, will be essential for maintaining product quality and reducing post-harvest losses. Embracing digital solutions for better farm management, traceability, and market access will also be a key differentiator. Strategic collaborations and government support for innovation will further solidify Mexico's position as a leading global supplier of fruits and vegetables.

Fruits and Vegetables Market in Mexico Segmentation

-

1. Crop Typ

- 1.1. Fruits

- 1.2. Vegetables

-

2. Crop Typ

- 2.1. Fruits

- 2.2. Vegetables

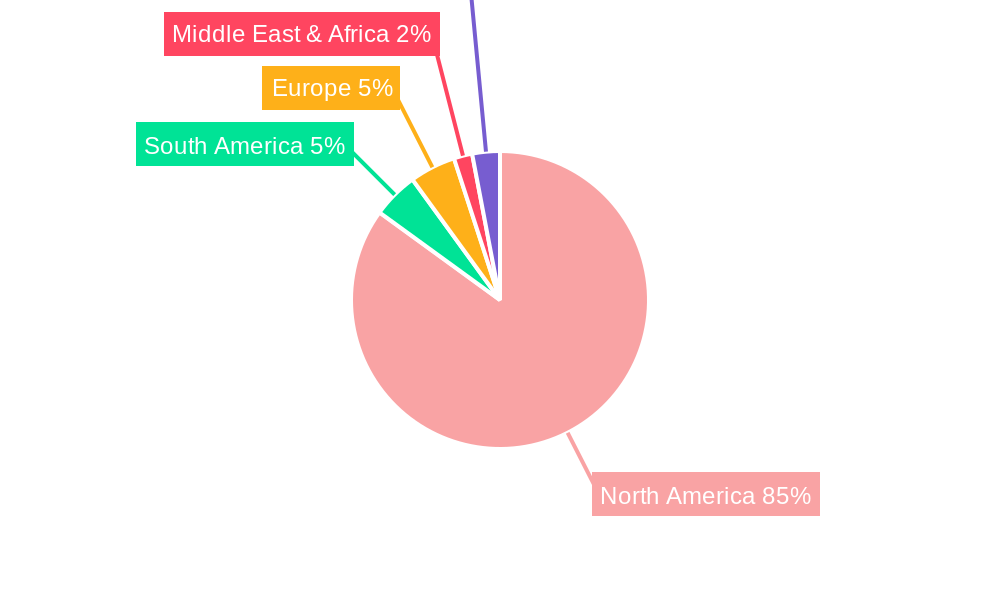

Fruits and Vegetables Market in Mexico Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fruits and Vegetables Market in Mexico Regional Market Share

Geographic Coverage of Fruits and Vegetables Market in Mexico

Fruits and Vegetables Market in Mexico REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. Oranges and Tomatoes Dominate the Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fruits and Vegetables Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Crop Typ

- 5.1.1. Fruits

- 5.1.2. Vegetables

- 5.2. Market Analysis, Insights and Forecast - by Crop Typ

- 5.2.1. Fruits

- 5.2.2. Vegetables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Crop Typ

- 6. North America Fruits and Vegetables Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Crop Typ

- 6.1.1. Fruits

- 6.1.2. Vegetables

- 6.2. Market Analysis, Insights and Forecast - by Crop Typ

- 6.2.1. Fruits

- 6.2.2. Vegetables

- 6.1. Market Analysis, Insights and Forecast - by Crop Typ

- 7. South America Fruits and Vegetables Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Crop Typ

- 7.1.1. Fruits

- 7.1.2. Vegetables

- 7.2. Market Analysis, Insights and Forecast - by Crop Typ

- 7.2.1. Fruits

- 7.2.2. Vegetables

- 7.1. Market Analysis, Insights and Forecast - by Crop Typ

- 8. Europe Fruits and Vegetables Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Crop Typ

- 8.1.1. Fruits

- 8.1.2. Vegetables

- 8.2. Market Analysis, Insights and Forecast - by Crop Typ

- 8.2.1. Fruits

- 8.2.2. Vegetables

- 8.1. Market Analysis, Insights and Forecast - by Crop Typ

- 9. Middle East & Africa Fruits and Vegetables Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Crop Typ

- 9.1.1. Fruits

- 9.1.2. Vegetables

- 9.2. Market Analysis, Insights and Forecast - by Crop Typ

- 9.2.1. Fruits

- 9.2.2. Vegetables

- 9.1. Market Analysis, Insights and Forecast - by Crop Typ

- 10. Asia Pacific Fruits and Vegetables Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Crop Typ

- 10.1.1. Fruits

- 10.1.2. Vegetables

- 10.2. Market Analysis, Insights and Forecast - by Crop Typ

- 10.2.1. Fruits

- 10.2.2. Vegetables

- 10.1. Market Analysis, Insights and Forecast - by Crop Typ

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1. ompany Profile

List of Figures

- Figure 1: Global Fruits and Vegetables Market in Mexico Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Fruits and Vegetables Market in Mexico Revenue (million), by Crop Typ 2025 & 2033

- Figure 3: North America Fruits and Vegetables Market in Mexico Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 4: North America Fruits and Vegetables Market in Mexico Revenue (million), by Crop Typ 2025 & 2033

- Figure 5: North America Fruits and Vegetables Market in Mexico Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 6: North America Fruits and Vegetables Market in Mexico Revenue (million), by Country 2025 & 2033

- Figure 7: North America Fruits and Vegetables Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Fruits and Vegetables Market in Mexico Revenue (million), by Crop Typ 2025 & 2033

- Figure 9: South America Fruits and Vegetables Market in Mexico Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 10: South America Fruits and Vegetables Market in Mexico Revenue (million), by Crop Typ 2025 & 2033

- Figure 11: South America Fruits and Vegetables Market in Mexico Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 12: South America Fruits and Vegetables Market in Mexico Revenue (million), by Country 2025 & 2033

- Figure 13: South America Fruits and Vegetables Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Fruits and Vegetables Market in Mexico Revenue (million), by Crop Typ 2025 & 2033

- Figure 15: Europe Fruits and Vegetables Market in Mexico Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 16: Europe Fruits and Vegetables Market in Mexico Revenue (million), by Crop Typ 2025 & 2033

- Figure 17: Europe Fruits and Vegetables Market in Mexico Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 18: Europe Fruits and Vegetables Market in Mexico Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Fruits and Vegetables Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Fruits and Vegetables Market in Mexico Revenue (million), by Crop Typ 2025 & 2033

- Figure 21: Middle East & Africa Fruits and Vegetables Market in Mexico Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 22: Middle East & Africa Fruits and Vegetables Market in Mexico Revenue (million), by Crop Typ 2025 & 2033

- Figure 23: Middle East & Africa Fruits and Vegetables Market in Mexico Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 24: Middle East & Africa Fruits and Vegetables Market in Mexico Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Fruits and Vegetables Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Fruits and Vegetables Market in Mexico Revenue (million), by Crop Typ 2025 & 2033

- Figure 27: Asia Pacific Fruits and Vegetables Market in Mexico Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 28: Asia Pacific Fruits and Vegetables Market in Mexico Revenue (million), by Crop Typ 2025 & 2033

- Figure 29: Asia Pacific Fruits and Vegetables Market in Mexico Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 30: Asia Pacific Fruits and Vegetables Market in Mexico Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Fruits and Vegetables Market in Mexico Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Crop Typ 2020 & 2033

- Table 2: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Crop Typ 2020 & 2033

- Table 3: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Crop Typ 2020 & 2033

- Table 5: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Crop Typ 2020 & 2033

- Table 6: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Crop Typ 2020 & 2033

- Table 11: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Crop Typ 2020 & 2033

- Table 12: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Crop Typ 2020 & 2033

- Table 17: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Crop Typ 2020 & 2033

- Table 18: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Crop Typ 2020 & 2033

- Table 29: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Crop Typ 2020 & 2033

- Table 30: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Crop Typ 2020 & 2033

- Table 38: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Crop Typ 2020 & 2033

- Table 39: Global Fruits and Vegetables Market in Mexico Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Fruits and Vegetables Market in Mexico Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fruits and Vegetables Market in Mexico?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Fruits and Vegetables Market in Mexico?

Key companies in the market include ompany Profile.

3. What are the main segments of the Fruits and Vegetables Market in Mexico?

The market segments include Crop Typ, Crop Typ.

4. Can you provide details about the market size?

The market size is estimated to be USD 13740.1 million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

Oranges and Tomatoes Dominate the Sector.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

November 2022: Hazera launched ToBRFV-resistant varieties in Mexico to increase crop yield and help grow more crops from less arable land with high profits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fruits and Vegetables Market in Mexico," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fruits and Vegetables Market in Mexico report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fruits and Vegetables Market in Mexico?

To stay informed about further developments, trends, and reports in the Fruits and Vegetables Market in Mexico, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence