Key Insights

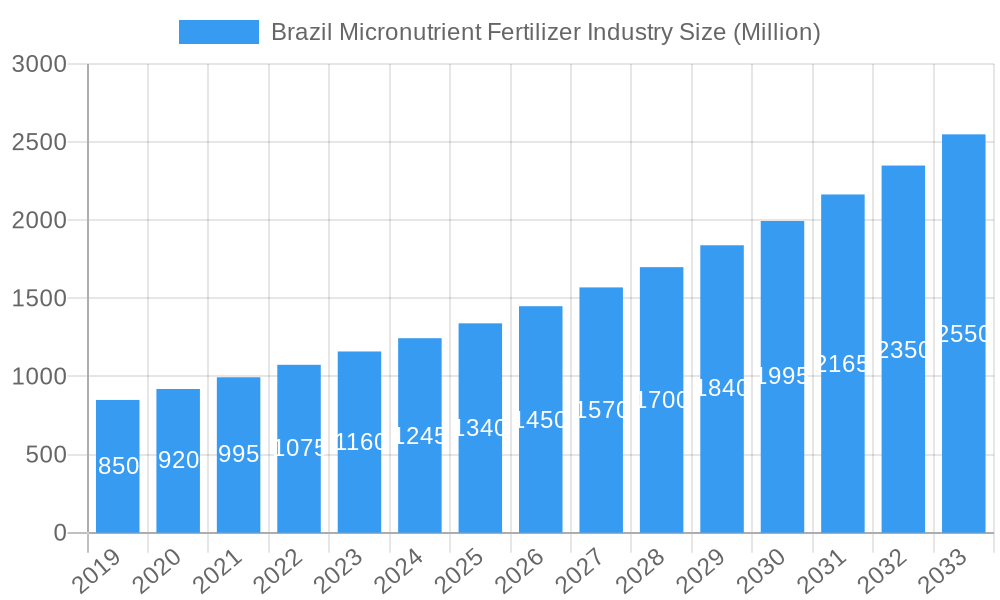

The Brazilian micronutrient fertilizer market is poised for substantial growth, projecting a market size of approximately $1,200 million by 2025 and expanding at a robust CAGR of 9.02% through 2033. This upward trajectory is primarily fueled by the increasing demand for high-yield crops, driven by Brazil's pivotal role as a global agricultural powerhouse. The nation's vast arable land, coupled with its expanding population and rising global food demand, necessitates optimized agricultural practices. Micronutrient fertilizers are crucial for addressing soil deficiencies, enhancing crop resilience, improving nutritional content, and ultimately boosting farmer profitability. Key drivers include government initiatives promoting sustainable agriculture, increasing farmer awareness regarding soil health management, and the adoption of advanced farming techniques. The market is segmented across production, consumption, imports, exports, and price trends, all indicating a dynamic and expanding landscape.

Brazil Micronutrient Fertilizer Industry Market Size (In Million)

The market's growth is further bolstered by advancements in fertilizer technology, leading to more efficient and targeted application methods. While the market experiences strong growth, certain restraints, such as the initial cost of advanced micronutrient formulations and the need for greater farmer education on their specific benefits and application, need to be addressed. However, the inherent benefits of improved crop quality and yield significantly outweigh these challenges. Major global and regional players are actively engaged in Brazil, offering a diverse range of micronutrient solutions. The Brazil micronutrient fertilizer industry is characterized by a strong domestic consumption base and significant import activities, reflecting the country's reliance on specialized agricultural inputs to maintain its competitive edge in global food production.

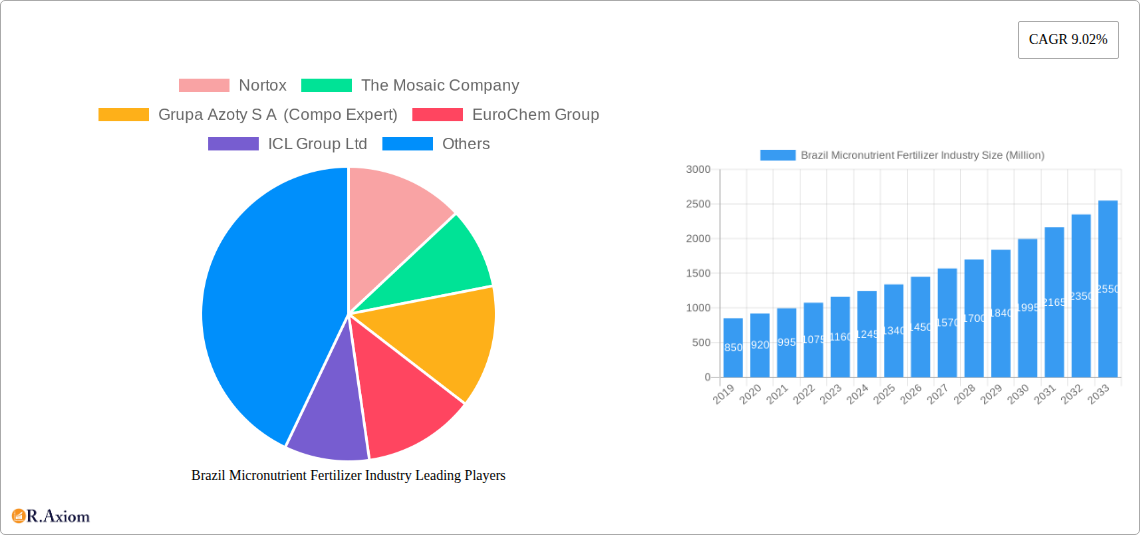

Brazil Micronutrient Fertilizer Industry Company Market Share

Brazil Micronutrient Fertilizer Industry Market Concentration & Innovation

The Brazil micronutrient fertilizer industry is characterized by a moderate to high market concentration, with several large multinational corporations and prominent domestic players vying for market share. Innovation in this sector is primarily driven by the increasing demand for specialized fertilizers that address specific nutrient deficiencies in Brazilian soils and crops, alongside a growing emphasis on sustainable agriculture and precision farming techniques. Regulatory frameworks, including government initiatives promoting soil health and crop productivity, play a significant role in shaping market dynamics. While direct product substitutes for micronutrient fertilizers are limited, advancements in soil amendment technologies and integrated nutrient management practices can be considered indirect competitive forces. End-user trends indicate a strong preference for tailored solutions, products with improved bioavailability, and environmentally friendly formulations. Mergers and acquisitions (M&A) are crucial for market consolidation and expansion. For instance, EuroChem Group's acquisition of 51.48% of Fertilizantes Heringer SA in March 2022, valued at approximately $500 million, significantly bolstered its production and distribution capabilities in Brazil. Similarly, Haifa Group's acquisition of Horticoop Andina aimed to expand its presence in the Latin American market, with a deal value estimated at $20 million. These strategic moves underscore the industry's focus on enhancing competitive positioning and operational scale.

- Market Concentration: Moderate to High, dominated by key global players.

- Innovation Drivers: Precision agriculture, sustainable practices, soil health initiatives, crop-specific nutrient needs.

- Regulatory Frameworks: Government incentives for soil health, environmental compliance standards.

- Product Substitutes: Advanced soil amendments, integrated nutrient management strategies.

- End-User Trends: Demand for tailored solutions, bioavailable micronutrients, eco-friendly products.

- M&A Activities: Strategic consolidation for market expansion and enhanced distribution networks.

- EuroChem Group acquisition of Fertilizantes Heringer SA (March 2022): ~$500 Million.

- Haifa Group acquisition of Horticoop Andina: ~$20 Million.

Brazil Micronutrient Fertilizer Industry Industry Trends & Insights

The Brazil micronutrient fertilizer industry is poised for substantial growth, driven by a confluence of evolving agricultural practices, increasing crop yields, and a deeper understanding of soil nutrient management. A key trend is the escalating demand for specialized micronutrient formulations designed to address specific deficiencies prevalent in Brazil's diverse agricultural landscapes. This demand is fueled by the need to enhance crop quality and yield for both domestic consumption and export markets, a critical factor given Brazil's status as a global agricultural powerhouse. The industry is witnessing a significant CAGR of approximately 8.5% during the forecast period (2025-2033). Market penetration of micronutrient fertilizers is steadily increasing, projected to reach 65% of the total fertilizer market by 2033, up from an estimated 45% in 2025.

Technological disruptions are playing a pivotal role, with advancements in controlled-release fertilizers, chelated micronutrients, and nanotechnology enabling more efficient nutrient uptake and reduced environmental impact. Precision agriculture technologies, including soil testing and variable rate application, are empowering farmers to optimize micronutrient application, leading to increased efficacy and cost savings. Consumer preferences are shifting towards healthier and more nutritious food products, indirectly driving the demand for micronutrient-fortified crops, which in turn boosts the need for advanced fertilizers.

The competitive dynamics are intensifying, with both established multinational players and agile local companies competing for market share. Strategic partnerships and acquisitions are common strategies employed to gain a competitive edge, expand product portfolios, and strengthen distribution networks. For instance, EuroChem Group's strategic moves to integrate its distribution channels with acquisitions like Fertilizantes Heringer SA demonstrate a commitment to solidifying its market presence. Similarly, Haifa Group's acquisition of Horticoop Andina signifies a broader strategy to enhance its foothold in the Latin American agricultural sector. The growing awareness among farmers about the critical role of micronutrients in plant physiology, disease resistance, and overall crop health is a fundamental growth driver. Furthermore, government policies supporting sustainable farming practices and incentivizing the use of efficient fertilizers are creating a favorable market environment. The expansion of high-value crop cultivation, such as soybeans, corn, sugarcane, and fruits, which are particularly responsive to micronutrient application, further propels market growth. The drive to improve soil fertility and mitigate the effects of intensive farming practices are also significant contributors to the increasing adoption of micronutrient fertilizers.

Dominant Markets & Segments in Brazil Micronutrient Fertilizer Industry

The Brazil micronutrient fertilizer industry exhibits distinct dominant markets and segments, each influenced by unique drivers and market dynamics. This analysis covers Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis.

Production Analysis:

- Dominant Segment: The production of micronutrient fertilizers in Brazil is dominated by large-scale chemical manufacturers and specialized fertilizer producers. The Southeast region, due to its well-established agricultural infrastructure and proximity to major farming hubs, leads in production capacity.

- Key Drivers:

- Proximity to Agricultural Hubs: Easy access to major crop-producing regions like São Paulo, Minas Gerais, and Paraná.

- Technological Advancement: Investment in modern manufacturing facilities and efficient production processes.

- Raw Material Availability: Access to necessary chemical inputs and minerals.

- Government Support: Policies encouraging domestic production and agricultural self-sufficiency.

- Dominance Analysis: Production is concentrated among a few key players who have invested heavily in large-scale facilities. This concentration ensures economies of scale and allows for competitive pricing. The production capacity is continuously being enhanced through strategic investments and expansions by leading companies to meet the surging domestic demand.

Consumption Analysis:

- Dominant Segment: The consumption of micronutrient fertilizers is overwhelmingly driven by the agricultural sector, with soybeans, corn, sugarcane, and coffee being the largest end-users. The Center-West region, being the primary grain-producing belt, stands out as the largest consumer.

- Key Drivers:

- Crop Yield Enhancement: Farmers' focus on maximizing output for profitability.

- Soil Health Degradation: Addressing deficiencies caused by intensive farming and nutrient depletion.

- Precision Agriculture Adoption: Increased use of soil testing and targeted nutrient application.

- Government Subsidies & Extension Services: Promoting the adoption of advanced fertilizers.

- Dominance Analysis: Consumption is highly fragmented across numerous agricultural producers but concentrated geographically in regions with intensive cultivation of staple crops. The increasing awareness among farmers about the critical role of micronutrients in achieving optimal yields and crop quality is a primary driver. The shift towards more sustainable and efficient farming practices also encourages the use of these specialized fertilizers.

Import Market Analysis (Value & Volume):

- Dominant Segment: Brazil is a net importer of certain specialized micronutrient formulations and raw materials that may not be produced domestically in sufficient quantities or with the required purity. The import value is estimated to be around $800 Million in 2025, with a volume of approximately 1.5 Million Metric Tons.

- Key Drivers:

- Technological Gap: Need for specialized products and advanced formulations not readily available locally.

- Cost-Effectiveness: Importing certain micronutrients can be more economical than domestic production.

- Supply Chain Diversification: Reducing reliance on single sources.

- Specific Crop Requirements: Importing micronutrients crucial for niche high-value crops.

- Dominance Analysis: Imports are significant for specific chelates and complex micronutrient blends. The major import origins include Europe and Asia, attracted by Brazil's vast agricultural market. Logistics and trade agreements play a crucial role in the efficiency and cost of imports.

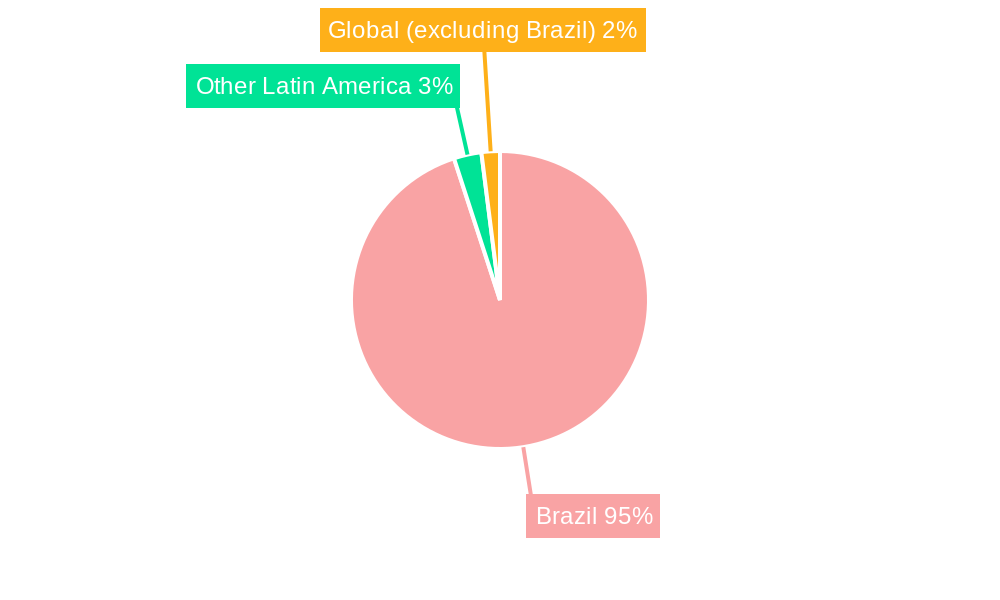

Export Market Analysis (Value & Volume):

- Dominant Segment: While Brazil is a major consumer, its export of finished micronutrient fertilizers is relatively nascent and focused on specific regional markets within Latin America. The export market is projected to reach approximately $200 Million in 2025, with a volume of around 0.4 Million Metric Tons.

- Key Drivers:

- Regional Demand: Supplying neighboring South American countries with similar agricultural needs.

- Competitive Pricing: Leveraging domestic production efficiencies.

- Established Trade Relationships: Existing agricultural trade networks.

- Product Specialization: Exporting unique formulations developed for Brazilian conditions.

- Dominance Analysis: The export market is less developed compared to imports and domestic consumption. However, there is potential for growth as Brazilian manufacturers gain scale and develop specialized products that cater to a broader regional market. The focus remains on establishing a strong domestic base before aggressively pursuing international markets.

Price Trend Analysis:

- Dominant Segment: Prices are influenced by global commodity prices for raw materials (e.g., sulfur, zinc, copper), energy costs for production, and domestic currency fluctuations. The average price for micronutrient fertilizers is expected to range between $800 to $1200 per Metric Ton in 2025.

- Key Drivers:

- Raw Material Costs: Volatility in global supply and demand for key minerals.

- Energy Prices: Impact on production and transportation costs.

- Currency Exchange Rates: Affecting the cost of imported inputs and the competitiveness of exports.

- Supply and Demand Dynamics: Market saturation or scarcity of specific micronutrients.

- Technological Innovations: Introduction of more efficient or complex formulations.

- Dominance Analysis: Price trends are closely monitored by farmers and distributors. Government policies on subsidies and import duties can also influence pricing. The market is generally competitive, with price sensitivity being a significant factor for large-scale agricultural operations. The trend indicates a gradual increase in prices due to rising input costs and growing demand.

Brazil Micronutrient Fertilizer Industry Product Developments

Product developments in the Brazil micronutrient fertilizer industry are increasingly focused on enhancing nutrient delivery and efficacy. Innovations include the development of advanced chelated forms of micronutrients like zinc, iron, and manganese, which improve their solubility and plant uptake, especially in alkaline soils common in Brazil. Slow-release and controlled-release formulations are gaining traction, ensuring a steady supply of nutrients to crops throughout their growth cycle, thereby reducing leaching and environmental impact. Nanotechnology is emerging as a frontier, with research into nano-encapsulated micronutrients promising significantly improved bioavailability and reduced application rates. Furthermore, the development of customized blends tailored to specific crop needs and soil types is a key competitive advantage, addressing the diverse agricultural landscape of Brazil.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the Brazil Micronutrient Fertilizer Industry across key segments. The Production Analysis will detail manufacturing capacities and regional distribution, projecting a growth rate of 7.8% through 2033. Consumption Analysis will highlight end-user demand drivers and market penetration, with an estimated market size of $6.5 Billion by 2033 and a CAGR of 8.5%. The Import Market Analysis (Value & Volume) will examine trade flows and key import sources, forecasting an import value of $1.2 Billion by 2033. The Export Market Analysis (Value & Volume) will assess Brazil's outbound trade potential, anticipating an export value of $0.5 Billion by 2033. Finally, the Price Trend Analysis will explore price determinants and forecasts, with an estimated average price increase of 4.5% annually. The competitive landscape and M&A activities are also integral to the scope.

Key Drivers of Brazil Micronutrient Fertilizer Industry Growth

The Brazil micronutrient fertilizer industry is propelled by several key drivers. Technologically, the increasing adoption of precision agriculture and advanced fertilizer formulations, such as chelated and slow-release micronutrients, enhances nutrient use efficiency and crop yields. Economically, Brazil's robust agricultural sector, as a major global producer of commodities like soybeans, corn, and sugarcane, creates substantial and growing demand for inputs that optimize productivity. Government policies, including incentives for sustainable farming practices and initiatives to improve soil health, further encourage the adoption of micronutrient fertilizers. The rising awareness among farmers about the critical role of micronutrients in disease resistance, stress tolerance, and overall crop quality directly contributes to market expansion.

Challenges in the Brazil Micronutrient Fertilizer Industry Sector

Despite its growth potential, the Brazil micronutrient fertilizer industry faces several challenges. Regulatory hurdles, including complex registration processes for new products and evolving environmental standards, can slow down market entry and innovation. Supply chain disruptions, exacerbated by Brazil's vast geography and infrastructure limitations, can lead to increased logistics costs and delivery delays. Intense competitive pressures from both domestic and international players, coupled with price sensitivity among farmers, can squeeze profit margins. Furthermore, a lack of widespread farmer education on the optimal use and benefits of specific micronutrients can hinder market penetration in some regions. The volatile nature of raw material prices also poses a significant challenge to cost management and pricing strategies.

Emerging Opportunities in Brazil Micronutrient Fertilizer Industry

Emerging opportunities in the Brazil micronutrient fertilizer industry lie in the growing demand for organic and bio-fertilizer-based micronutrient solutions, aligning with the global trend towards sustainable agriculture. The expansion of high-value horticultural crops, such as fruits and vegetables, which are particularly responsive to micronutrient applications, presents a significant growth avenue. Furthermore, the development and adoption of digital agriculture platforms that offer personalized nutrient management recommendations can drive the demand for tailored micronutrient products. Untapped potential exists in remote agricultural regions of Brazil, where improved logistics and targeted educational programs can unlock new markets. The increasing focus on enhancing the nutritional quality of food products also opens doors for specialized micronutrient-fortified fertilizers.

Leading Players in the Brazil Micronutrient Fertilizer Industry Market

- Nortox

- The Mosaic Company

- Grupa Azoty S A (Compo Expert)

- EuroChem Group

- ICL Group Ltd

- Haifa Group

- Inquima LTDA

- K+S Aktiengesellschaft

- Yara International AS

- BMS Micro-Nutrients NV

Key Developments in Brazil Micronutrient Fertilizer Industry Industry

- March 2022: EuroChem Group has purchased 51.48% of the shares of the Brazilian distributor Fertilizantes Heringer SA, this purchase will further strengthen its production and distribution capacity in Brazil.

- March 2022: The Haifa Group entered a purchase agreement with HORTICOOP BV to acquire Horticoop Andina, the distributor of nutritional products for agriculture. Through this acquisition of the brand, Haifa intends to expand its market presence in the Latin American market and strengthen its position as a global superbrand in advanced plant nutrition.

- August 2020: EuroChem Group and Fertilizantes Tocantins (FTO) completed the trade integration agreement which will help EuroChem to offer farmers the full range of products in the Brazilian market.

Strategic Outlook for Brazil Micronutrient Fertilizer Industry Market

The strategic outlook for the Brazil micronutrient fertilizer industry is exceptionally positive, driven by the nation's indispensable role in global food security and its commitment to agricultural innovation. The market is poised for sustained growth, fueled by the ongoing adoption of precision agriculture technologies and the increasing demand for higher crop yields and quality. Strategic investments in research and development for novel, environmentally sustainable micronutrient formulations, alongside the expansion of distribution networks to reach more remote agricultural areas, will be critical for success. Companies that can offer tailored solutions, demonstrate a strong understanding of Brazilian soil conditions and crop requirements, and align with the government's objectives for sustainable farming are expected to thrive. Mergers, acquisitions, and strategic partnerships will continue to shape the competitive landscape, enabling players to enhance their market presence and product portfolios. The industry is well-positioned to capitalize on the growing need for efficient nutrient management to support Brazil's agricultural expansion and meet the demands of a growing global population.

Brazil Micronutrient Fertilizer Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Brazil Micronutrient Fertilizer Industry Segmentation By Geography

- 1. Brazil

Brazil Micronutrient Fertilizer Industry Regional Market Share

Geographic Coverage of Brazil Micronutrient Fertilizer Industry

Brazil Micronutrient Fertilizer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Custom Product Development; Use of CROs for Regulatory Services

- 3.3. Market Restrains

- 3.3.1. Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Micronutrient Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nortox

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Mosaic Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Grupa Azoty S A (Compo Expert)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EuroChem Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ICL Group Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haifa Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Inquima LTDA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 K+S Aktiengesellschaft

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yara International AS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BMS Micro-Nutrients NV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nortox

List of Figures

- Figure 1: Brazil Micronutrient Fertilizer Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Micronutrient Fertilizer Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Micronutrient Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Brazil Micronutrient Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Brazil Micronutrient Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Brazil Micronutrient Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Brazil Micronutrient Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Brazil Micronutrient Fertilizer Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Brazil Micronutrient Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Brazil Micronutrient Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Brazil Micronutrient Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Brazil Micronutrient Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Brazil Micronutrient Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Brazil Micronutrient Fertilizer Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Micronutrient Fertilizer Industry?

The projected CAGR is approximately 9.02%.

2. Which companies are prominent players in the Brazil Micronutrient Fertilizer Industry?

Key companies in the market include Nortox, The Mosaic Company, Grupa Azoty S A (Compo Expert), EuroChem Group, ICL Group Ltd, Haifa Group, Inquima LTDA, K+S Aktiengesellschaft, Yara International AS, BMS Micro-Nutrients NV.

3. What are the main segments of the Brazil Micronutrient Fertilizer Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Custom Product Development; Use of CROs for Regulatory Services.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry.

8. Can you provide examples of recent developments in the market?

March 2022: EuroChem Group has purchased 51.48% of the shares of the Brazilian distributor Fertilizantes Heringer SA, this purchase will further strengthen its production and distribution capacity in Brazil.March 2022: The Haifa Group entered a purchase agreement with HORTICOOP BV to acquire Horticoop Andina, the distributor of nutritional products for agriculture. Through this acquisition of the brand, Haifa intends to expand its market presence in the Latin American market and strengthen its position as a global superbrand in advanced plant nutrition.August 2020: EuroChem Group and Fertilizantes Tocantins (FTO) completed the trade integration agreement which will help EuroChem to offer farmers the full range of products in the Brazilian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Micronutrient Fertilizer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Micronutrient Fertilizer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Micronutrient Fertilizer Industry?

To stay informed about further developments, trends, and reports in the Brazil Micronutrient Fertilizer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence