Key Insights

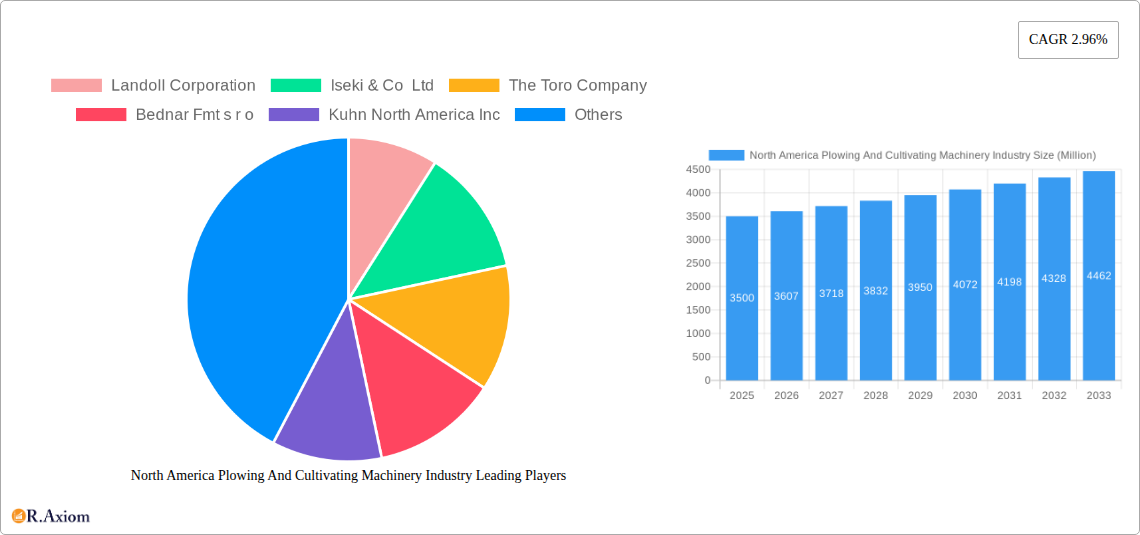

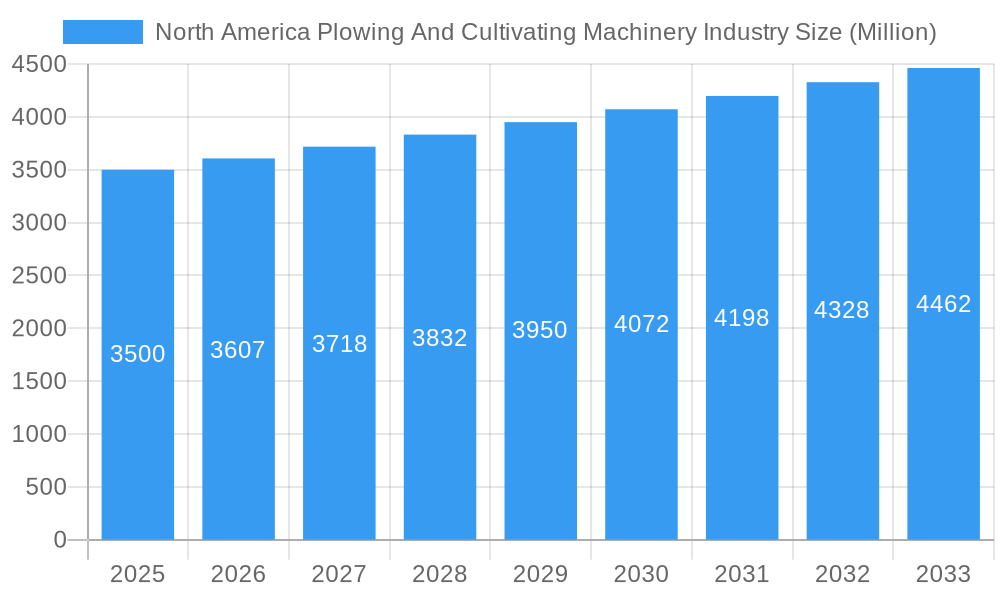

The North American Plowing and Cultivating Machinery market is poised for steady growth, driven by an increasing demand for efficient agricultural practices and the need to enhance crop yields. With a projected market size of approximately USD 3,500 million in 2025 and a Compound Annual Growth Rate (CAGR) of 2.96% from 2025 to 2033, this sector is a crucial component of modern agriculture. Key growth drivers include the adoption of advanced farming technologies, the ongoing need for soil preparation to optimize planting, and the expansion of large-scale farming operations. Furthermore, government initiatives promoting agricultural modernization and sustainable farming techniques are expected to provide a significant boost to the market. The industry is also witnessing a trend towards the development and adoption of precision agriculture tools, integrated with plowing and cultivating machinery, to improve resource management and reduce environmental impact. This includes GPS-guided systems and variable rate technology that optimize field operations, contributing to higher productivity and profitability for farmers.

North America Plowing And Cultivating Machinery Industry Market Size (In Billion)

Despite the positive outlook, the market faces certain restraints that could temper growth. Fluctuations in commodity prices, for instance, can impact farmers' investment capacity in new machinery. Additionally, the high initial cost of sophisticated plowing and cultivating equipment, coupled with the operational expenses for maintenance and repair, can be a barrier for smaller agricultural enterprises. However, the increasing focus on mechanization and automation in agriculture, particularly in regions like North America with a significant landmass dedicated to farming, continues to propel demand. The market segmentation analysis, encompassing production, consumption, import/export dynamics, and price trends, will offer a granular view of regional performance and opportunities within the United States, Canada, and Mexico. Leading companies like Deere & Co., CNH Industrial NV, and Kubota Corporation are actively innovating and expanding their product portfolios to cater to these evolving market needs, ensuring continued relevance and growth in this essential agricultural sector.

North America Plowing And Cultivating Machinery Industry Company Market Share

Here is an SEO-optimized, detailed report description for the North America Plowing And Cultivating Machinery Industry:

North America Plowing And Cultivating Machinery Industry Market Concentration & Innovation

The North America Plowing and Cultivating Machinery Industry exhibits a moderate to high market concentration, with a few dominant players controlling significant market share. Leading companies like Deere & Co, CNH Industrial NV, AGCO Corporation, and Kubota Corporation are at the forefront, driving innovation and setting industry standards. The report meticulously analyzes the market share of these key entities, estimated to be around 70% held by the top five players in the base year of 2025. Innovation is a critical growth catalyst, with substantial investments in research and development focused on precision agriculture, automation, and sustainable farming practices. Regulatory frameworks, particularly those concerning environmental impact and emissions, are increasingly shaping product development. For instance, stricter emission standards for diesel engines are pushing manufacturers towards cleaner technologies and electric or hybrid-powered machinery. Product substitutes, such as advanced soil conditioning techniques and alternative farming methods, are present but have yet to significantly erode the demand for traditional plowing and cultivating equipment. End-user trends reveal a growing preference for multifunctional, fuel-efficient, and technologically advanced machinery that can enhance productivity and reduce labor costs. Mergers and acquisitions (M&A) activities are strategic moves to consolidate market presence, expand product portfolios, and acquire innovative technologies. M&A deal values are projected to reach approximately $1,500 Million by 2028, reflecting the industry's dynamic consolidation phase.

North America Plowing And Cultivating Machinery Industry Industry Trends & Insights

The North America Plowing and Cultivating Machinery Industry is poised for robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive economic policies. The market is experiencing a Compound Annual Growth Rate (CAGR) of approximately 5.2% from 2019 to 2033, indicating sustained expansion. A primary growth driver is the escalating demand for increased agricultural productivity to meet the needs of a growing global population and the rising consumption of processed foods. This necessitates the adoption of more efficient and advanced farm machinery. Technological disruptions are revolutionizing the sector, with the integration of Artificial Intelligence (AI), the Internet of Things (IoT), and GPS technology leading to the development of smart and autonomous plowing and cultivating solutions. These innovations enable precision farming, optimizing resource utilization such as water, fertilizers, and pesticides, thereby enhancing crop yields and reducing environmental impact. Consumer preferences are shifting towards machinery that offers greater fuel efficiency, reduced operational costs, and enhanced operator comfort and safety. The demand for precision cultivation equipment, capable of detailed soil analysis and tailored tilling, is also on the rise. Competitive dynamics are intense, with established global players continuously innovating and expanding their product lines to cater to diverse agricultural needs. Emerging manufacturers are also making inroads by focusing on niche markets or specialized technologies. The penetration of advanced plowing and cultivating machinery is projected to reach 55% by 2033, up from an estimated 38% in 2025, underscoring the increasing adoption of sophisticated agricultural tools. Market penetration of smart farming technologies within this segment is a key indicator of future growth.

Dominant Markets & Segments in North America Plowing And Cultivating Machinery Industry

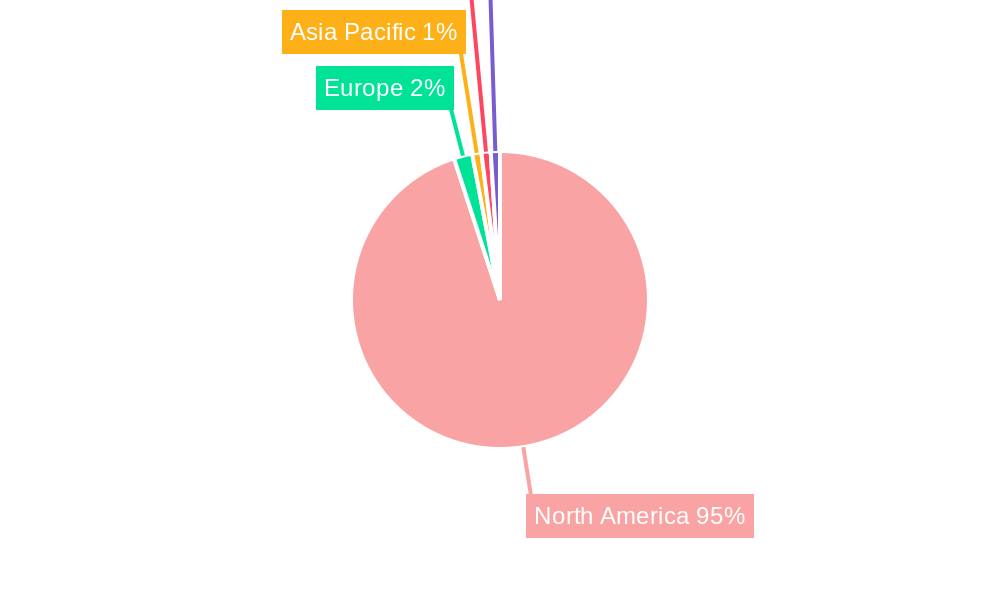

The United States stands as the dominant market within the North America Plowing and Cultivating Machinery Industry, accounting for an estimated 75% of the total market value in 2025. This dominance is fueled by its vast agricultural land, advanced farming practices, and significant adoption of agricultural technology. Canada follows as the second-largest market, contributing approximately 20% of the regional demand.

- Production Analysis: The US is the primary production hub, with key manufacturing facilities located in agricultural heartlands. Production volume is projected to reach 250,000 units in 2025, with a value of $5,000 Million. Key drivers include government incentives for agricultural modernization and a robust domestic demand for farm equipment.

- Consumption Analysis: The US also leads in consumption, driven by large-scale commercial farming operations and the need for efficient land preparation. Consumption volume is estimated at 230,000 units in 2025, with a market value of $4,600 Million. Factors like crop diversification and the adoption of conservation tillage practices influence consumption patterns.

- Import Market Analysis (Value & Volume): While domestic production is strong, imports play a crucial role in diversifying the market and offering specialized machinery. The import market value is estimated at $700 Million in 2025, with a volume of 40,000 units. Key import sources include European countries known for their high-quality engineering in specialized cultivating equipment. Economic policies and trade agreements influence import dynamics.

- Export Market Analysis (Value & Volume): North America is a significant exporter of plowing and cultivating machinery, with exports valued at $1,200 Million in 2025 and a volume of 60,000 units. The primary export destinations are Latin America and other regions with developing agricultural sectors. Competitiveness is driven by product quality, technological innovation, and established brand reputation.

- Price Trend Analysis: The average price of plowing and cultivating machinery is expected to see a moderate increase, with an estimated CAGR of 2.8% over the forecast period. This is attributed to rising raw material costs, technological advancements, and increasing demand for sophisticated features. The average selling price for a tractor-mounted plow is projected to be around $15,000 in 2025, while a high-end precision cultivator could range from $50,000 to $100,000. Factors like fuel prices and the cost of advanced components directly impact price trends.

North America Plowing And Cultivating Machinery Industry Product Developments

Product developments are intensely focused on enhancing efficiency, precision, and sustainability. Innovations include intelligent plows with variable tillage capabilities, GPS-guided cultivators for unparalleled accuracy in seedbed preparation, and the integration of sensor technologies to monitor soil health in real-time. Autonomous and semi-autonomous machinery is gaining traction, promising reduced labor requirements and increased operational efficiency. Companies are also developing lighter-weight yet more durable equipment to minimize soil compaction, alongside machinery optimized for specific crop types and soil conditions, offering significant competitive advantages.

Report Scope & Segmentation Analysis

This report segments the North America Plowing and Cultivating Machinery Industry based on several key areas including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. Production is analyzed by manufacturing location and capacity. Consumption is segmented by end-user application and farm size. Import and Export analyses detail key trading partners, product categories, and trade values. Price trends examine average selling prices across different machinery types and their forecasted evolution. The report offers growth projections and market size estimations for each segment, alongside an analysis of competitive dynamics within them.

Key Drivers of North America Plowing And Cultivating Machinery Industry Growth

The growth of the North America Plowing and Cultivating Machinery Industry is propelled by several key factors.

- Technological Advancements: The integration of AI, IoT, and GPS technologies in precision agriculture is a significant driver.

- Increasing Demand for Food Security: The need to enhance agricultural output to feed a growing global population necessitates efficient machinery.

- Government Initiatives and Subsidies: Supportive agricultural policies and financial incentives for adopting modern farming equipment play a crucial role.

- Focus on Sustainable Agriculture: The demand for machinery that minimizes environmental impact and optimizes resource usage is on the rise.

Challenges in the North America Plowing And Cultivating Machinery Industry Sector

Despite the positive outlook, the industry faces several challenges.

- High Initial Investment Costs: The upfront cost of advanced plowing and cultivating machinery can be a barrier for small to medium-sized farms.

- Skilled Labor Shortage: Operating and maintaining sophisticated machinery requires skilled labor, which is increasingly scarce in the agricultural sector.

- Fluctuating Raw Material Prices: Volatility in the prices of steel, aluminum, and other raw materials can impact manufacturing costs and profitability.

- Environmental Regulations: Increasingly stringent environmental regulations, while driving innovation, can also add to compliance costs for manufacturers.

Emerging Opportunities in North America Plowing And Cultivating Machinery Industry

Emerging opportunities abound in the North America Plowing and Cultivating Machinery Industry.

- Growth in Precision Agriculture: The expanding adoption of data-driven farming techniques presents significant opportunities for smart machinery.

- Development of Electric and Hybrid Machinery: Increasing demand for environmentally friendly and cost-effective solutions fuels innovation in alternative powertrains.

- Aftermarket Services and Digital Solutions: Opportunities exist in providing comprehensive after-sales services, predictive maintenance, and data analytics platforms.

- Expansion in Emerging Markets: Untapped potential in regions with developing agricultural sectors offers avenues for growth through exports and strategic partnerships.

Leading Players in the North America Plowing And Cultivating Machinery Industry Market

- Landoll Corporation

- Iseki & Co Ltd

- The Toro Company

- Bednar Fmt s r o

- Kuhn North America Inc

- Horsch L L C

- Deere & Co

- Lemken GmbH & Co KG

- CNH Industrial NV

- Titan Machinery

- Bush Hog Inc

- Great Plains Manufacturing Inc

- Dewulf B V

- Kubota Corporation

- Opico Corporation

- Kverneland AS

- McFarlane Mfg Co

- Gregoire-Besson S A S

- Poettinger US Inc

- AGCO Corporation

Key Developments in North America Plowing And Cultivating Machinery Industry Industry

- 2023: Deere & Company launched a new line of autonomous tractors, enhancing operational efficiency and reducing labor dependency.

- 2023: CNH Industrial NV announced significant investments in developing electric-powered agricultural machinery, focusing on sustainability.

- 2022: AGCO Corporation acquired a significant stake in a precision planting technology firm, bolstering its smart farming offerings.

- 2022: Kuhn North America Inc introduced advanced cultivators with integrated soil sensing capabilities for optimal seedbed preparation.

- 2021: Kubota Corporation expanded its product portfolio with new models of compact plows and cultivators designed for smaller farms and specialized applications.

Strategic Outlook for North America Plowing And Cultivating Machinery Industry Market

The strategic outlook for the North America Plowing and Cultivating Machinery Industry is characterized by innovation, sustainability, and market consolidation. Companies are investing heavily in R&D to develop smart, autonomous, and eco-friendly machinery that meets the evolving demands of modern agriculture. The increasing focus on precision farming and data analytics will drive the adoption of technologically advanced equipment. Strategic partnerships, mergers, and acquisitions are anticipated to continue as companies seek to expand their market reach, technological capabilities, and product offerings, ensuring continued growth and competitiveness in the years ahead.

North America Plowing And Cultivating Machinery Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Plowing And Cultivating Machinery Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Plowing And Cultivating Machinery Industry Regional Market Share

Geographic Coverage of North America Plowing And Cultivating Machinery Industry

North America Plowing And Cultivating Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization

- 3.3. Market Restrains

- 3.3.1. Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 3.4. Market Trends

- 3.4.1. Scarcity of Low Cost Labor influencing Increased Adoption of Farm Mechanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Plowing And Cultivating Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Landoll Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Iseki & Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Toro Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bednar Fmt s r o

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuhn North America Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Horsch L L C

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Deere & Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lemken GmbH & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CNH Industrial NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Titan Machinery

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bush Hog Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Great Plains Manufacturing Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Dewulf B V

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Kubota Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Opico Corporation

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Kverneland AS

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 McFarlane Mfg Co

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Gregoire-Besson S A S

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Poettinger US Inc *List Not Exhaustive

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 AGCO Corporation

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 Landoll Corporation

List of Figures

- Figure 1: North America Plowing And Cultivating Machinery Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Plowing And Cultivating Machinery Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Plowing And Cultivating Machinery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Plowing And Cultivating Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Plowing And Cultivating Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Plowing And Cultivating Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Plowing And Cultivating Machinery Industry?

The projected CAGR is approximately 2.96%.

2. Which companies are prominent players in the North America Plowing And Cultivating Machinery Industry?

Key companies in the market include Landoll Corporation, Iseki & Co Ltd, The Toro Company, Bednar Fmt s r o, Kuhn North America Inc, Horsch L L C, Deere & Co, Lemken GmbH & Co KG, CNH Industrial NV, Titan Machinery, Bush Hog Inc, Great Plains Manufacturing Inc, Dewulf B V, Kubota Corporation, Opico Corporation, Kverneland AS, McFarlane Mfg Co, Gregoire-Besson S A S, Poettinger US Inc *List Not Exhaustive, AGCO Corporation.

3. What are the main segments of the North America Plowing And Cultivating Machinery Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization.

6. What are the notable trends driving market growth?

Scarcity of Low Cost Labor influencing Increased Adoption of Farm Mechanization.

7. Are there any restraints impacting market growth?

Heavy Initial Procurement Cost and High Expenditure on Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Plowing And Cultivating Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Plowing And Cultivating Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Plowing And Cultivating Machinery Industry?

To stay informed about further developments, trends, and reports in the North America Plowing And Cultivating Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence