Key Insights

Vietnam's agro machinery market is set for significant expansion, projected to reach $425.79 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 10.6%. Key growth catalysts include the escalating adoption of advanced agricultural technologies to boost productivity, government support for farm mechanization, and rising consumer demand for high-quality food. The growing embrace of precision farming, smart agricultural solutions, and eco-friendly machinery further fuels market development as farmers prioritize optimized resource management and environmental sustainability. Continuous innovation in sophisticated yet affordable machinery, tailored for Vietnam's diverse farming needs, from smallholders to large commercial operations, is also a significant contributor.

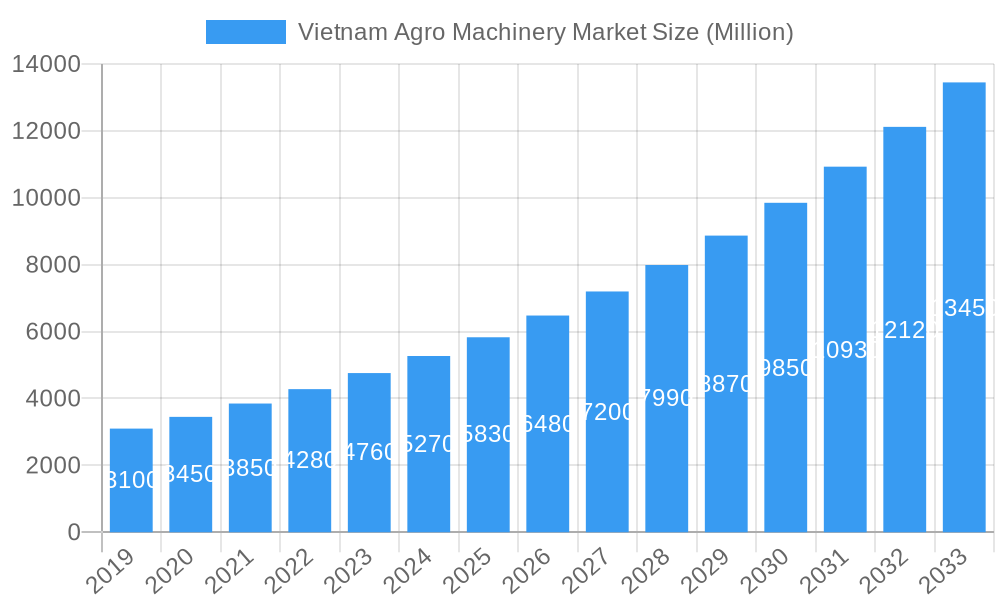

Vietnam Agro Machinery Market Market Size (In Million)

Despite the positive outlook, potential market constraints include the initial high investment for advanced machinery for small-scale farmers, limited access to credit, and the necessity for enhanced training and technical support for complex equipment. Market segmentation encompasses production, consumption, imports, exports, and price trends, offering a holistic market view. Leading players such as Yanmar Vietnam, Iseki Corporation, Vietnam Engine and Agricultural Machinery Corporation (VEAM), and Kubota Corporation are actively shaping this dynamic market through innovation and expanded distribution. Vietnam is the central focus, underscoring its importance in the Southeast Asian agro machinery landscape.

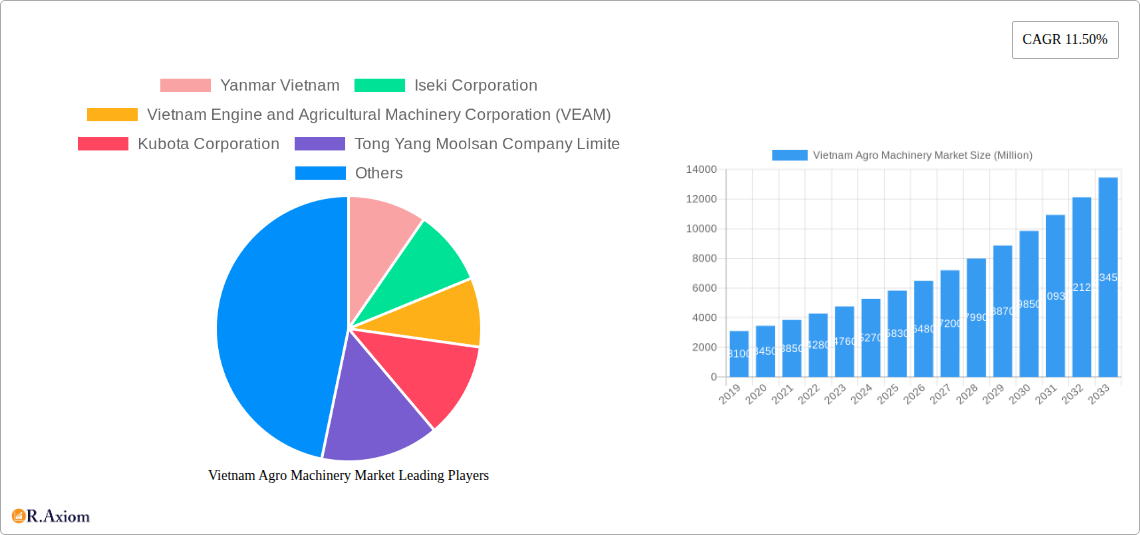

Vietnam Agro Machinery Market Company Market Share

This comprehensive report delivers an in-depth analysis of the Vietnam agro machinery market, providing critical insights into its current state and future trajectory. Covering the historical period (2019-2024), with 2025 as the base and estimated year, and a forecast extending to 2033, this study is an indispensable resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate competitive challenges. The report examines production, consumption, import/export analyses, price trends, and industry developments, offering actionable intelligence for strategic decision-making in Vietnam's rapidly evolving agricultural machinery sector.

Vietnam Agro Machinery Market Market Concentration & Innovation

The Vietnam Agro Machinery Market exhibits a moderate level of market concentration, with a few key international and domestic players dominating significant market shares. Yanmar Vietnam, Iseki Corporation, Vietnam Engine and Agricultural Machinery Corporation (VEAM), Kubota Corporation, and Tong Yang Moolsan Company Limited represent a substantial portion of the market. Innovation is a critical driver, fueled by the need for increased agricultural productivity, labor efficiency, and sustainability. Key innovation areas include the adoption of precision agriculture technologies, automation, and the development of machinery suited to Vietnam's diverse agro-climatic conditions. Regulatory frameworks, while evolving, play a crucial role in shaping the market, often focusing on emission standards, safety certifications, and support for modern farming practices. Product substitutes, such as manual labor and older, less efficient machinery, still exist but are gradually being displaced by advanced solutions. End-user trends are shifting towards mechanization for smaller landholdings and the adoption of smart farming techniques. Mergers and acquisitions (M&A) activities, while not extensively documented in terms of deal values, are anticipated to play a role in consolidation and technology transfer. For instance, THACO Industries' significant investment signals a trend towards increased domestic production and integration.

Vietnam Agro Machinery Market Industry Trends & Insights

The Vietnam Agro Machinery Market is poised for robust growth, driven by a confluence of factors aimed at modernizing the nation's vital agricultural sector. A projected Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033 underscores the significant expansion anticipated. This growth is underpinned by several key trends, including the increasing demand for higher crop yields to meet domestic food security needs and growing export markets. Government initiatives promoting agricultural modernization and mechanization further catalyze market penetration. Technological disruptions are at the forefront, with a notable shift towards smart farming solutions. The collaboration between Kubota and Nvidia to develop self-driving autonomous farm tractors, leveraging AI and advanced processing capabilities, exemplifies this trend. Such innovations aim to address the persistent challenge of a shrinking agricultural workforce, a critical issue in Vietnam and other agriculturally dependent nations. Consumer preferences are increasingly leaning towards fuel-efficient, technologically advanced, and user-friendly machinery that can optimize resource utilization and reduce operational costs. Competitive dynamics are intensifying, with both established global manufacturers and emerging domestic players vying for market share. This competitive landscape drives innovation and encourages competitive pricing strategies, ultimately benefiting the end-users. The emphasis on sustainable agricultural practices is also gaining traction, leading to a demand for machinery that minimizes environmental impact, such as precision sprayers and energy-efficient tractors.

Dominant Markets & Segments in Vietnam Agro Machinery Market

Production Analysis: The production of agricultural machinery in Vietnam is increasingly localized, driven by government incentives and foreign direct investment. Vietnam Engine and Agricultural Machinery Corporation (VEAM) is a significant domestic producer, catering to a broad range of agricultural needs. The southern provinces, with their extensive rice cultivation and diverse agricultural activities, often lead in production output. Key drivers include government policies supporting domestic manufacturing and the availability of skilled labor.

Consumption Analysis: Consumption is highest in regions with intensive agriculture, particularly the Mekong Delta for rice and fruit production, and the Red River Delta for staple crops. Factors influencing consumption include the average farm size, farmer income levels, and the accessibility of credit and financing for machinery acquisition. The demand for specialized machinery for cash crops like coffee, rubber, and aquaculture is also a notable trend.

Import Market Analysis (Value & Volume): Vietnam remains a significant importer of advanced agricultural machinery, particularly for specialized applications and high-horsepower tractors where domestic production is still developing. Kubota Corporation and Yanmar Vietnam are leading import sources. The value of imports is significantly influenced by currency exchange rates and the introduction of new, high-tech equipment. Volume is often driven by seasonal demands and government-supported agricultural development programs.

Export Market Analysis (Value & Volume): While primarily a net importer, Vietnam is gradually developing its export capabilities, particularly for certain components and simpler machinery, often facilitated by companies like THACO Industries aiming for global markets. The export market is currently smaller but shows potential, driven by cost-competitiveness and specific product niches.

Price Trend Analysis: Price trends are influenced by global commodity prices for raw materials, technological advancements, import duties, and domestic manufacturing costs. The introduction of advanced, automated machinery commands a premium, while the market for basic, utilitarian equipment remains more price-sensitive. Government subsidies and financing schemes also play a crucial role in price affordability for farmers.

Vietnam Agro Machinery Market Product Developments

Product development in the Vietnam Agro Machinery Market is characterized by a strong focus on enhancing efficiency, reducing labor dependency, and integrating smart technologies. Innovations range from more powerful and fuel-efficient tractors to sophisticated harvesting equipment and precision planting machinery. The development of autonomous and semi-autonomous farming vehicles, leveraging AI and sensor technology, is a key trend aimed at addressing labor shortages and improving operational accuracy. Competitive advantages are derived from durability, adaptability to local conditions, and the availability of effective after-sales service and support.

Report Scope & Segmentation Analysis

This report segments the Vietnam Agro Machinery Market across several critical dimensions. The Production Analysis segment examines the output of various agricultural machines within Vietnam, including tractors, harvesters, planters, and irrigation equipment, with projected growth driven by domestic manufacturing capacity. The Consumption Analysis segment details the demand for these machines by different farming sectors and regions, anticipating significant growth in mechanization adoption. The Import Market Analysis (Value & Volume) focuses on the inflow of agricultural machinery from international sources, highlighting key product categories and supplier nations, with projected steady growth. The Export Market Analysis (Value & Volume) assesses Vietnam's role as a supplier of agricultural machinery, currently smaller but with emerging potential, particularly in component manufacturing. Finally, the Price Trend Analysis explores the pricing dynamics of various machinery types, influenced by technological advancements, input costs, and market competition, predicting a trend towards premium pricing for advanced solutions.

Key Drivers of Vietnam Agro Machinery Market Growth

Several key drivers are propelling the Vietnam Agro Machinery Market forward. Increasing Agricultural Mechanization: Driven by the need to enhance productivity and efficiency, farmers are increasingly investing in modern machinery. Government Support and Policies: The Vietnamese government actively promotes agricultural modernization through subsidies, preferential loans, and tax incentives, boosting adoption rates. Labor Shortages: A declining rural workforce and an aging farmer population necessitate labor-saving machinery. Technological Advancements: The integration of AI, GPS, and automation in agricultural equipment offers solutions for precision farming and improved yields. Growing Demand for High-Value Crops: The shift towards more profitable crops requires specialized and advanced machinery.

Challenges in the Vietnam Agro Machinery Market Sector

Despite its growth potential, the Vietnam Agro Machinery Market faces several challenges. High Initial Investment Costs: The upfront cost of advanced machinery can be prohibitive for smallholder farmers, despite financing options. Limited Access to Credit and Financing: Inadequate access to affordable credit hinders widespread adoption, especially for smaller farms. Inadequate Infrastructure and After-Sales Support: A lack of robust service networks and spare parts availability in remote areas can limit the adoption and efficient use of machinery. Technological Literacy and Training: Farmers require training to effectively operate and maintain complex modern machinery. Counterfeit Products and Market Irregularities: The presence of substandard or counterfeit machinery can erode trust and pose safety risks.

Emerging Opportunities in Vietnam Agro Machinery Market

The Vietnam Agro Machinery Market presents several emerging opportunities. Precision Agriculture and Smart Farming: The adoption of IoT-enabled machinery, drones, and sensor technology for optimized resource management offers significant potential. Development of Smaller, Affordable Machinery: Catering to the needs of a vast number of smallholder farmers with cost-effective and appropriately sized equipment is a key opportunity. After-Sales Service and Maintenance Networks: Building comprehensive service and repair networks, particularly in rural areas, presents a substantial business opportunity. Leasing and Rental Models: Offering flexible machinery leasing or rental services can lower adoption barriers for farmers. Integration with Digital Platforms: Developing digital platforms for machinery management, diagnostics, and farmer support can enhance value and user experience.

Leading Players in the Vietnam Agro Machinery Market Market

- Yanmar Vietnam

- Iseki Corporation

- Vietnam Engine and Agricultural Machinery Corporation (VEAM)

- Kubota Corporation

- Tong Yang Moolsan Company Limited

- CNH Industrial

- Truong Hai Auto Corporation (THACO)

- ShanDong Huaxin Machinery Co Ltd

- Vietnam Agrotech Co Ltd

- CLAAS KGaA GmbH

Key Developments in Vietnam Agro Machinery Market Industry

- December 2022: THACO Industries, a new subsidiary of automaker THACO Group, has invested USD 550 million for the mass production of agricultural machinery and supporting industrial products such as auto parts and components, semi-trailers, and other supplemental machinery for export and domestic sale in the country.

- October 2020: Kubota has collaborated with the US chipmaker Nvidia to develop highly sophisticated self-driving autonomous farm tractors. The tractors are equipped with Nvidia graphics processing units and artificial intelligence, coupled with cameras to instantly process collected data to provide a labor-saving solution that will help address the shortage of workers in Vietnam's and Japan's agricultural industry.

Strategic Outlook for Vietnam Agro Machinery Market Market

The strategic outlook for the Vietnam Agro Machinery Market is highly promising, driven by a sustained focus on modernization and efficiency within the agricultural sector. Investments in research and development, particularly in automation and smart farming technologies, will be crucial for sustained growth. Partnerships between international and domestic players will facilitate technology transfer and enhance local manufacturing capabilities. The government's continued support through policy interventions and financial aid will remain a significant catalyst. Companies that can offer comprehensive solutions, including financing, training, and robust after-sales service, will be well-positioned to capture market share. The growing demand for sustainable and environmentally friendly agricultural practices will also shape product development and market strategies, opening avenues for eco-efficient machinery.

Vietnam Agro Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Vietnam Agro Machinery Market Segmentation By Geography

- 1. Vietnam

Vietnam Agro Machinery Market Regional Market Share

Geographic Coverage of Vietnam Agro Machinery Market

Vietnam Agro Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Skilled Labor Shortage; Favorable Government Policies

- 3.3. Market Restrains

- 3.3.1. Fragmentation of Land Holdings; Increasing Interest of Farmers Toward Custom Hiring Center

- 3.4. Market Trends

- 3.4.1. Increasing Farm Mechanization with Shortage of Labor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Agro Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Yanmar Vietnam

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Iseki Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vietnam Engine and Agricultural Machinery Corporation (VEAM)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kubota Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tong Yang Moolsan Company Limite

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CNH Industrial

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Truong Hai Auto Corporation (THACO)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ShanDong Huaxin Machinery Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vietnam Agrotech Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CLAAS KGaA GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Yanmar Vietnam

List of Figures

- Figure 1: Vietnam Agro Machinery Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Vietnam Agro Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Agro Machinery Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Vietnam Agro Machinery Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Vietnam Agro Machinery Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Vietnam Agro Machinery Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Vietnam Agro Machinery Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Vietnam Agro Machinery Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: Vietnam Agro Machinery Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: Vietnam Agro Machinery Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Vietnam Agro Machinery Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Vietnam Agro Machinery Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Vietnam Agro Machinery Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Vietnam Agro Machinery Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Agro Machinery Market?

The projected CAGR is approximately 10.6%.

2. Which companies are prominent players in the Vietnam Agro Machinery Market?

Key companies in the market include Yanmar Vietnam, Iseki Corporation, Vietnam Engine and Agricultural Machinery Corporation (VEAM), Kubota Corporation, Tong Yang Moolsan Company Limite, CNH Industrial, Truong Hai Auto Corporation (THACO), ShanDong Huaxin Machinery Co Ltd, Vietnam Agrotech Co Ltd, CLAAS KGaA GmbH.

3. What are the main segments of the Vietnam Agro Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 425.79 million as of 2022.

5. What are some drivers contributing to market growth?

Skilled Labor Shortage; Favorable Government Policies.

6. What are the notable trends driving market growth?

Increasing Farm Mechanization with Shortage of Labor.

7. Are there any restraints impacting market growth?

Fragmentation of Land Holdings; Increasing Interest of Farmers Toward Custom Hiring Center.

8. Can you provide examples of recent developments in the market?

December 2022: THACO Industries, a new subsidiary of automaker THACO Group, has invested USD 550 million for the mass production of agricultural machinery and supporting industrial products such as auto parts and components, semi-trailers, and other supplemental machinery for export and domestic sale in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Agro Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Agro Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Agro Machinery Market?

To stay informed about further developments, trends, and reports in the Vietnam Agro Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence