Key Insights

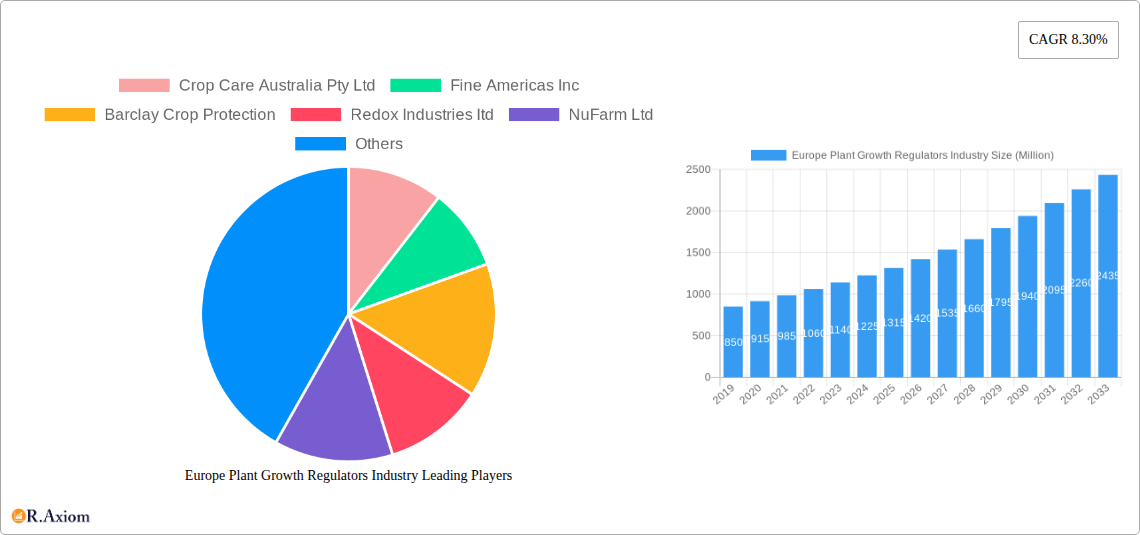

The European Plant Growth Regulators (PGR) market is projected for substantial growth, with an estimated market size of $0.97 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 8.3% from 2025 to 2033. This expansion is driven by the increasing global demand for higher crop yields and superior quality produce, necessitated by a growing population and the imperative of food security. The adoption of advanced agricultural techniques, including precision farming, further fuels market growth as farmers recognize the effectiveness of PGRs in optimizing plant development, managing flowering, and enhancing fruit set. Growing emphasis on sustainable agriculture and the mitigation of crop losses from environmental stressors and diseases also contribute to the adoption of PGRs for improved crop resilience and efficiency. Key market players, such as Bayer Crop Science, BASF SE, Corteva Agriscience, and NuFarm Ltd, are actively investing in research and development for innovative and eco-friendly PGR formulations, focusing on bio-based solutions and targeted application technologies to align with evolving regulatory standards and consumer preferences for safer agricultural inputs.

Europe Plant Growth Regulators Industry Market Size (In Million)

Market segmentation by application includes significant contributions from cereals, fruits, vegetables, and turf & ornamentals. Production analysis reveals a steady increase in manufacturing capacity to meet rising demand, while consumption patterns indicate a broadening adoption across diverse crop types. The import market is robust, supported by the availability of specialized PGRs and raw materials from global suppliers, demonstrating notable value and volume. Concurrently, the export market is expanding as European manufacturers supply high-quality products to international markets. Price trends are anticipated to be influenced by raw material costs, regulatory compliance, and the introduction of advanced, premium PGRs. Market restraints, such as stringent regulatory frameworks and the potential for off-label use, are being addressed through enhanced farmer education and the development of user-friendly products. Europe, particularly the United Kingdom, Germany, and France, commands a significant market share due to advanced agricultural sectors and a strong commitment to sustainable farming practices.

Europe Plant Growth Regulators Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Europe Plant Growth Regulators (PGR) market, covering production, consumption, import/export dynamics, price trends, and key industry developments. With a historical review from 2019 to 2024, a base year of 2025, and a forecast period extending to 2033, this report offers actionable insights for stakeholders navigating this dynamic market. Optimized for search visibility, this report incorporates high-traffic keywords such as "European PGR market," "plant growth regulator market share," "agricultural inputs Europe," "crop yield enhancement solutions," and "sustainable agriculture technology."

Europe Plant Growth Regulators Industry Market Concentration & Innovation

The Europe Plant Growth Regulators (PGR) industry exhibits a moderately concentrated market, with key players like Bayer Crop Science, BASF SE, and Corteva Agriscience holding significant market share, estimated at over 60% collectively in 2025. Innovation is a critical differentiator, driven by the constant demand for enhanced crop yields, improved quality, and reduced environmental impact. Research and development efforts are focused on developing novel PGR formulations with targeted applications, increased efficacy, and better safety profiles. Regulatory frameworks, particularly stringent in the EU, play a crucial role in shaping innovation, necessitating extensive safety and environmental impact assessments for product registration. Product substitutes, such as advanced breeding techniques and precision agriculture technologies, are emerging but currently represent a minor threat to the established PGR market due to their different application areas and integration challenges. End-user trends favor integrated pest management (IPM) strategies and sustainable farming practices, pushing for PGRs that complement these approaches. Mergers and acquisitions (M&A) remain a strategic tool for market consolidation and innovation expansion. Significant M&A deals in the historical period (2019-2024) have seen valuations in the hundreds of millions of Euros, indicating ongoing consolidation and strategic repositioning within the industry.

Europe Plant Growth Regulators Industry Industry Trends & Insights

The Europe Plant Growth Regulators (PGR) industry is poised for robust growth, driven by an escalating need to maximize agricultural productivity amidst evolving environmental challenges and an increasing global population. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% between 2025 and 2033. This growth is underpinned by several key trends. Firstly, the demand for higher crop yields and improved produce quality to meet food security needs is a primary market driver. PGRs play a vital role in achieving these objectives by influencing plant development at critical stages, leading to better fruit setting, enhanced root development, and improved stress tolerance. Secondly, the shift towards sustainable agriculture and precision farming practices is creating new opportunities for specialized PGR formulations. Farmers are increasingly seeking inputs that optimize resource utilization, minimize waste, and reduce the environmental footprint of their operations. This includes PGRs that can enhance nutrient uptake, improve water use efficiency, and reduce the need for synthetic fertilizers.

Technological disruptions are also shaping the industry landscape. Advancements in biotechnology and formulation science are leading to the development of more targeted and effective PGRs with lower application rates and improved biodegradability. For instance, the development of bio-based PGRs derived from natural sources is gaining traction, aligning with consumer preferences for organic and sustainably produced food. Consumer preferences are increasingly influencing agricultural practices, with a growing demand for food produced with fewer chemical inputs. This trend is indirectly benefiting the PGR market by encouraging the adoption of products that enhance natural plant processes rather than solely relying on synthetic interventions.

The competitive dynamics within the Europe PGR market are characterized by intense rivalry among established global agrochemical giants and emerging specialized companies. Companies are focusing on product differentiation through innovative formulations, comprehensive technical support, and strategic partnerships. Market penetration of PGRs is already high in many European countries, but opportunities for growth lie in developing markets and through the introduction of new, value-added applications for existing and novel PGR chemistries. The regulatory environment, while stringent, also acts as a barrier to entry, favoring companies with strong R&D capabilities and robust regulatory compliance mechanisms.

Dominant Markets & Segments in Europe Plant Growth Regulators Industry

The Europe Plant Growth Regulators (PGR) industry is characterized by distinct regional and segment dominance, offering significant opportunities and competitive landscapes.

Production Analysis: Production is concentrated in countries with strong chemical manufacturing bases and established agrochemical industries, notably Germany, France, and the United Kingdom. These nations benefit from advanced manufacturing infrastructure, skilled labor, and supportive industrial policies. Production volumes in these leading countries are estimated to reach over 3,500 million Euros by 2025. Key drivers for this dominance include access to raw materials, proximity to major agricultural markets, and a robust research and development ecosystem.

Consumption Analysis: Consumption of PGRs is highest in Western European nations with intensive agricultural practices and high-value crop production, such as Spain, Italy, France, and the Netherlands. These countries exhibit significant demand for PGRs across a wide range of crops, including fruits, vegetables, and cereals, driven by the need to optimize yields and quality. Estimated consumption value is projected to be over 4,800 million Euros in 2025. Economic policies supporting agricultural modernization, coupled with a strong focus on export-oriented agriculture, fuel this consumption.

Import Market Analysis (Value & Volume): The import market for PGRs is significant, with countries like the Netherlands and Belgium acting as major re-export hubs for the wider European market. Germany and France are also substantial importers due to their large domestic demand. The total import market value for PGRs in Europe is anticipated to reach approximately 1,900 million Euros in 2025, with import volumes reflecting a similar trend. Key drivers include the availability of specialized PGRs not manufactured domestically and the competitive pricing offered by global suppliers.

Export Market Analysis (Value & Volume): European countries, particularly Germany, France, and the United Kingdom, are significant exporters of PGRs to other regions globally. These exports are driven by the high quality and efficacy of European-manufactured PGRs. The estimated export market value for PGRs from Europe is around 1,200 million Euros in 2025. Export growth is supported by strong international demand for advanced agricultural inputs and favorable trade agreements.

Price Trend Analysis: Price trends for PGRs in Europe are influenced by several factors. Raw material costs, regulatory compliance expenses, and the level of market competition play a crucial role. Prices for advanced and patented PGR formulations tend to be higher, reflecting their research and development investment. Conversely, generic PGRs compete on price, creating a bifurcated market. The overall average price is expected to see a moderate increase of around 2-3% annually due to inflation and increased R&D investment, reaching an estimated average price index of 125 in 2025 (with 2019 as the base year at 100). Economic policies related to agricultural subsidies and trade tariffs can also impact price stability.

Europe Plant Growth Regulators Industry Product Developments

Product developments in the Europe Plant Growth Regulators (PGR) industry are increasingly focused on bio-stimulants and precision agriculture applications. Innovations include PGRs that enhance nutrient uptake efficiency, improve plant resilience to abiotic stresses like drought and salinity, and promote more uniform fruit ripening. Companies are leveraging advanced formulation technologies to create slow-release PGRs and targeted delivery systems, minimizing off-target effects and environmental impact. These advancements offer significant competitive advantages by meeting the growing demand for sustainable and eco-friendly agricultural solutions, enhancing crop quality and yield.

Report Scope & Segmentation Analysis

This report segments the Europe Plant Growth Regulators (PGR) industry across Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. Production is analyzed by key manufacturing countries, with projected growth in output by 4% annually. Consumption is segmented by crop type and end-use application, with the fruits and vegetables segment expected to grow at a CAGR of 5.8%. The import and export markets are analyzed by major trading partners and product categories, with import volumes projected to increase by 3.5% and exports by 4.2% annually. Price trends are examined across various PGR chemistries and their application areas, with an anticipated average price increase of 2.5% per year.

Key Drivers of Europe Plant Growth Regulators Industry Growth

The growth of the Europe Plant Growth Regulators (PGR) industry is propelled by several key drivers. Foremost is the imperative to increase agricultural productivity and efficiency to meet rising food demands. Technological advancements in PGR formulations, leading to more effective and environmentally friendly products, are also critical. The growing adoption of precision agriculture techniques and sustainable farming practices by European farmers further bolsters demand. Moreover, favorable government policies promoting agricultural innovation and yield enhancement contribute significantly to market expansion.

Challenges in the Europe Plant Growth Regulators Industry Sector

Despite robust growth prospects, the Europe Plant Growth Regulators (PGR) industry faces several challenges. Stringent regulatory approval processes and evolving environmental regulations in the EU pose significant hurdles for new product development and market entry. The high cost of R&D and product registration can be prohibitive, particularly for smaller companies. Supply chain disruptions and volatility in raw material prices can impact production costs and market stability. Furthermore, increasing competition from alternative crop management solutions and growing consumer concerns regarding chemical residues in food necessitate continuous innovation and transparent communication.

Emerging Opportunities in Europe Plant Growth Regulators Industry

Emerging opportunities within the Europe Plant Growth Regulators (PGR) industry lie in the development and adoption of bio-based and organic PGRs, catering to the expanding organic farming sector and consumer demand for natural products. The integration of PGRs with digital farming technologies and AI-driven precision agriculture platforms presents opportunities for tailored application and enhanced efficacy. Furthermore, there is a growing market for PGRs that improve plant resilience to climate change-induced stresses, such as drought and extreme temperatures, aligning with the continent's focus on climate-resilient agriculture.

Leading Players in the Europe Plant Growth Regulators Industry Market

- Crop Care Australia Pty Ltd

- Fine Americas Inc

- Barclay Crop Protection

- Redox Industries ltd

- NuFarm Ltd

- Sumitomo Chemical Australia Pty Ltd

- Valent BioSciences Corporatio

- Corteva Agriscience

- Bayer Crop Science

- BASF SE

Key Developments in Europe Plant Growth Regulators Industry Industry

- 2023 October: BASF SE launched a new range of bio-stimulants aimed at enhancing nutrient uptake and improving crop resilience.

- 2023 July: Corteva Agriscience announced a strategic partnership to develop novel PGR formulations for specialty crops.

- 2022 December: Bayer Crop Science acquired a significant stake in a European biotech firm focused on plant hormone research.

- 2022 May: NuFarm Ltd introduced a new generation of PGRs with improved environmental profiles.

- 2021 September: Valent BioSciences Corporation expanded its R&D facility in Europe to accelerate innovation in PGR technologies.

Strategic Outlook for Europe Plant Growth Regulators Industry Market

The strategic outlook for the Europe Plant Growth Regulators (PGR) industry is positive, driven by a convergence of factors including increasing demand for food security, technological advancements, and the ongoing shift towards sustainable agricultural practices. Key growth catalysts include the development of innovative bio-stimulants and precision PGRs that offer enhanced efficacy and environmental benefits. Strategic collaborations between agrochemical companies, research institutions, and technology providers will be crucial for unlocking new market potential and addressing evolving regulatory and consumer expectations. The industry is expected to witness continued investment in R&D, focusing on creating solutions that support climate-resilient and efficient farming systems across Europe.

Europe Plant Growth Regulators Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Plant Growth Regulators Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

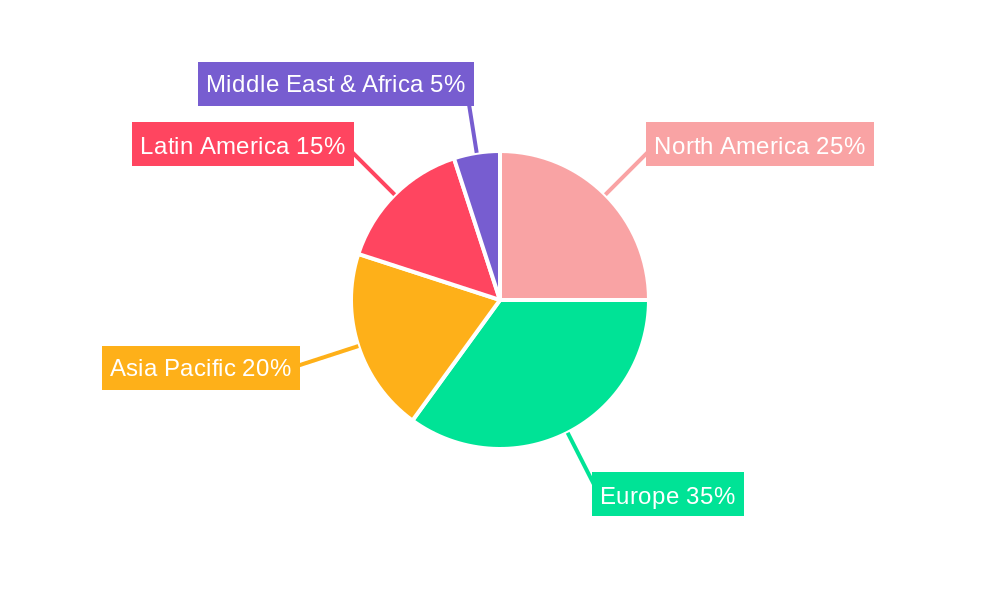

Europe Plant Growth Regulators Industry Regional Market Share

Geographic Coverage of Europe Plant Growth Regulators Industry

Europe Plant Growth Regulators Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. Increasing Organic Farming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Plant Growth Regulators Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Crop Care Australia Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fine Americas Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Barclay Crop Protection

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Redox Industries ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NuFarm Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sumitomo Chemical Australia Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Valent BioSciences Corporatio

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Corteva Agriscience

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bayer Crop Science

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Crop Care Australia Pty Ltd

List of Figures

- Figure 1: Europe Plant Growth Regulators Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Plant Growth Regulators Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Plant Growth Regulators Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Plant Growth Regulators Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Plant Growth Regulators Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Plant Growth Regulators Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Plant Growth Regulators Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Plant Growth Regulators Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Plant Growth Regulators Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Plant Growth Regulators Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Plant Growth Regulators Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Plant Growth Regulators Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Plant Growth Regulators Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Plant Growth Regulators Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Plant Growth Regulators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Plant Growth Regulators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Plant Growth Regulators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Plant Growth Regulators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Plant Growth Regulators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Plant Growth Regulators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Plant Growth Regulators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Plant Growth Regulators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Plant Growth Regulators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Plant Growth Regulators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Plant Growth Regulators Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Plant Growth Regulators Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Europe Plant Growth Regulators Industry?

Key companies in the market include Crop Care Australia Pty Ltd, Fine Americas Inc, Barclay Crop Protection, Redox Industries ltd, NuFarm Ltd, Sumitomo Chemical Australia Pty Ltd, Valent BioSciences Corporatio, Corteva Agriscience, Bayer Crop Science, BASF SE.

3. What are the main segments of the Europe Plant Growth Regulators Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.97 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

Increasing Organic Farming.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Plant Growth Regulators Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Plant Growth Regulators Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Plant Growth Regulators Industry?

To stay informed about further developments, trends, and reports in the Europe Plant Growth Regulators Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence