Key Insights

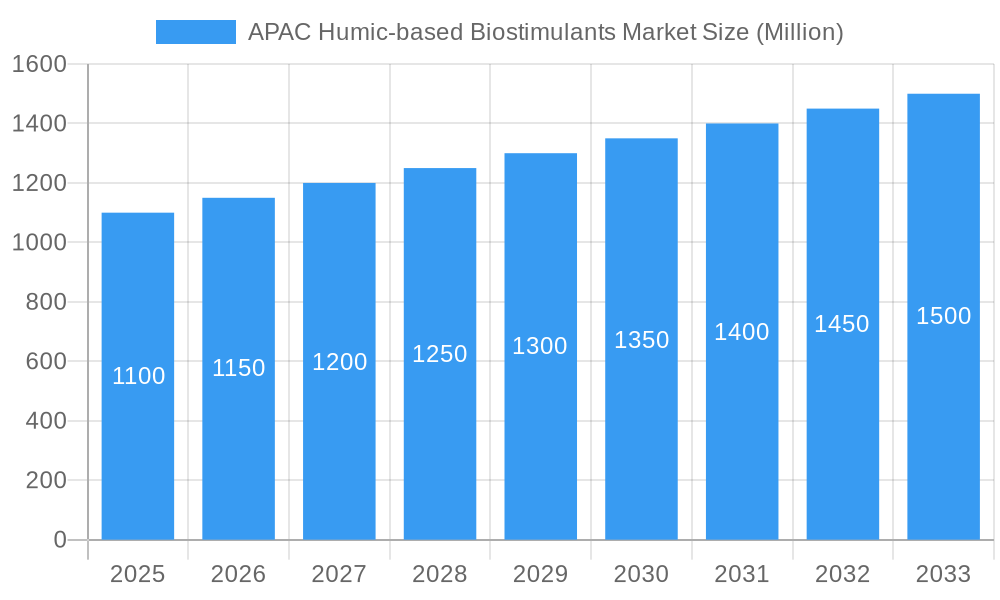

The APAC Humic-based Biostimulants Market is poised for significant expansion, projected to reach approximately USD 1,500 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.56%. This growth trajectory is primarily fueled by the escalating demand for sustainable agriculture practices across the region. Governments are increasingly promoting the use of bio-based inputs to enhance crop yields while minimizing environmental impact, making humic-based biostimulants a cornerstone of modern farming. Key drivers include the imperative to improve soil health, increase nutrient uptake efficiency, and bolster plant resilience against biotic and abiotic stresses, all critical for meeting the food security needs of a burgeoning population. Furthermore, a growing awareness among farmers regarding the long-term benefits of humic substances on soil fertility and crop quality is a significant catalyst. The market is experiencing a surge in research and development focused on creating more effective and targeted humic-based biostimulant formulations.

APAC Humic-based Biostimulants Market Market Size (In Billion)

The market’s dynamism is further shaped by evolving agricultural trends. The increasing adoption of precision agriculture techniques, coupled with the growing preference for organic and residue-free produce, are creating fertile ground for humic-based biostimulants. While the market enjoys substantial growth, it faces certain restraints. These include a lack of standardized regulations in some developing APAC nations, limited farmer education and awareness in certain rural pockets, and the initial cost of high-quality biostimulant products. Nevertheless, strategic investments in product innovation and market penetration by key players like Coromandel International Ltd and Rallis India Ltd are expected to overcome these challenges. The production and consumption analyses reveal a strong domestic demand, supported by substantial import and export volumes, underscoring the region's integral role in the global humic-based biostimulants landscape.

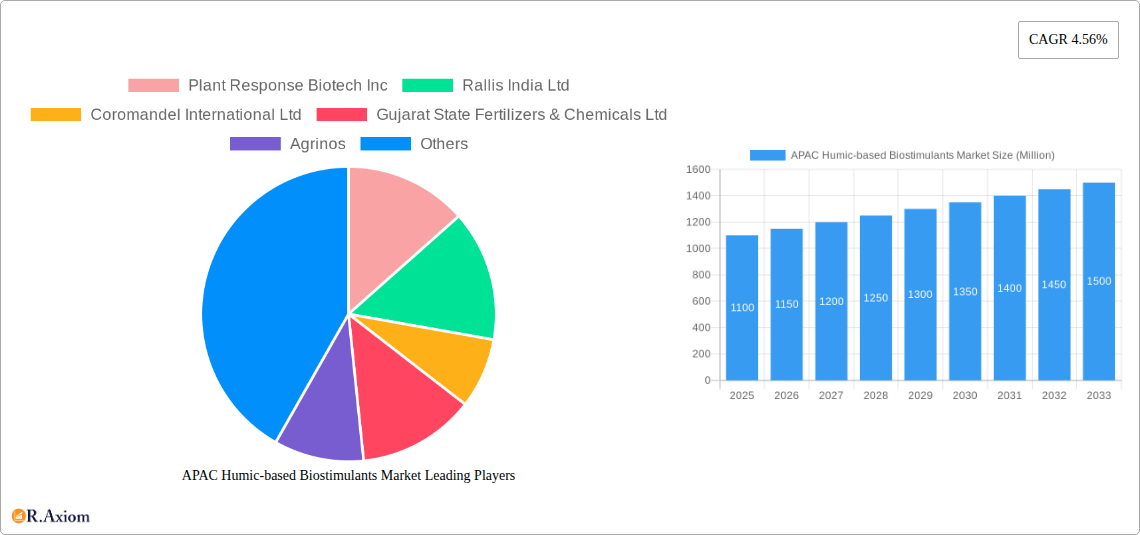

APAC Humic-based Biostimulants Market Company Market Share

APAC Humic-based Biostimulants Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a granular analysis of the APAC Humic-based Biostimulants Market, offering critical insights for industry stakeholders. Covering a study period from 2019 to 2033, with a base year of 2025, the report delves into production, consumption, import/export dynamics, pricing trends, and key industry developments. Leveraging high-traffic keywords such as "humic biostimulants APAC," "organic fertilizers Asia," "sustainable agriculture solutions," and "plant growth promoters," this report aims to enhance search visibility and deliver actionable intelligence for manufacturers, distributors, and agricultural professionals across the Asia-Pacific region.

APAC Humic-based Biostimulants Market Market Concentration & Innovation

The APAC Humic-based Biostimulants Market exhibits a moderate level of market concentration, with a few key players holding significant market share, alongside a growing number of regional and specialized manufacturers. Innovation is a critical driver, fueled by increasing demand for sustainable agricultural practices and the need to enhance crop yields and quality under challenging environmental conditions. Key innovation areas include the development of novel formulations that improve nutrient uptake efficiency, enhance plant resilience to stress (drought, salinity), and promote soil health. Regulatory frameworks are evolving across APAC countries, with a growing emphasis on biostimulant registration and standardization, which can both encourage and constrain market entry. Product substitutes, such as synthetic fertilizers and other biological inputs, pose a competitive challenge, though humic-based biostimulants offer unique soil conditioning and nutrient solubilization benefits. End-user trends are strongly leaning towards organic and sustainable farming, driven by consumer awareness and governmental initiatives. Mergers and acquisitions (M&A) are emerging as a strategy for market expansion and technological integration. For instance, the acquisition of Plant Response by The Mosaic Company in February 2022, valued at an estimated $100 Million, highlights the consolidation trend and the strategic importance of biostimulant portfolios.

APAC Humic-based Biostimulants Market Industry Trends & Insights

The APAC Humic-based Biostimulants Market is experiencing robust growth, driven by a confluence of factors aimed at enhancing agricultural productivity and sustainability across the region. A primary growth driver is the escalating demand for food security due to a burgeoning population, necessitating increased crop yields and improved agricultural efficiency. Humic-based biostimulants, derived from organic matter, play a crucial role by improving soil structure, enhancing nutrient availability, and stimulating plant growth, thereby contributing to higher productivity. Furthermore, a significant shift towards sustainable and organic farming practices is reshaping the agricultural landscape in APAC. Growing environmental concerns, including soil degradation and the adverse effects of chemical fertilizers, are pushing farmers to adopt eco-friendly alternatives. Governments across several APAC nations are actively promoting sustainable agriculture through subsidies, policy changes, and awareness campaigns, further fueling the adoption of humic-based biostimulants. Technological disruptions, such as advancements in extraction and formulation technologies, are leading to more effective and targeted humic-based biostimulant products. These innovations ensure better solubility, stability, and bioavailability, enhancing their performance and market appeal. Consumer preferences are also evolving, with a rising demand for organically grown produce, which directly influences farmers' choices of inputs. The competitive dynamics within the market are characterized by a mix of multinational corporations and local players, each vying for market share through product innovation, strategic partnerships, and expanding distribution networks. The market penetration of humic-based biostimulants is steadily increasing, driven by their proven efficacy in diverse agro-climatic conditions prevalent in the APAC region. The projected Compound Annual Growth Rate (CAGR) for the APAC humic-based biostimulants market is estimated to be around 7.5% during the forecast period (2025-2033), indicating a healthy expansion trajectory.

Dominant Markets & Segments in APAC Humic-based Biostimulants Market

The APAC Humic-based Biostimulants Market is characterized by significant regional variations in demand, production, and adoption rates.

Production Analysis:

- Dominant Countries: China and India are leading producers of humic-based biostimulants, leveraging their vast agricultural sectors, availability of raw materials (lignite, peat), and established chemical and biological industries. Their production capacity is estimated to be over 800 Million tonnes annually.

- Key Drivers: Abundant sources of leonardite and peat, government support for domestic manufacturing, and the presence of large agricultural input companies.

Consumption Analysis:

- Dominant Countries: India, China, and Southeast Asian nations such as Vietnam and Thailand are major consumers of humic-based biostimulants. The estimated consumption is around 750 Million tonnes, projected to grow significantly.

- Key Drivers: Large arable land, diverse cropping patterns, increasing adoption of modern farming techniques, and a growing awareness among farmers about the benefits of biostimulants for crop yield enhancement and soil health improvement.

Import Market Analysis (Value & Volume):

- Dominant Countries: Countries with a focus on high-value horticulture and limited domestic production, such as Australia, Japan, and South Korea, are significant importers. The import value is projected to reach approximately $500 Million by 2025.

- Key Drivers: Demand for specialized biostimulant products, technological advancements, and quality assurance requirements in niche agricultural sectors.

Export Market Analysis (Value & Volume):

- Dominant Countries: China and India are the primary exporters, supplying to other APAC nations and some global markets. Export value is estimated to be around $400 Million in 2025, with a steady upward trend.

- Key Drivers: Competitive pricing, large-scale production capabilities, and increasing international demand for organic agricultural inputs.

Price Trend Analysis:

- Key Trends: Prices are influenced by raw material availability, production costs, formulation complexity, and competitive pressures. Prices for humic acid products range from $1.00 to $5.00 per kilogram, with specialized formulations commanding higher prices.

- Drivers: Fluctuations in raw material prices (e.g., leonardite), energy costs, and the introduction of premium, technologically advanced products.

APAC Humic-based Biostimulants Market Product Developments

Recent product developments in the APAC humic-based biostimulants market focus on enhanced efficacy and targeted applications. Innovations include advanced extraction techniques for higher purity humic and fulvic acids, and synergistic formulations combining humic substances with other beneficial microbes or plant extracts. For example, Atlántica Agrícola's Micomix, developed in January 2021, is a prime illustration of a biostimulant integrating mycorrhizal fungi, rhizobacteria, and chelated micronutrients. This symbiotic approach significantly boosts nutrient and water absorption and improves plant stress tolerance, offering a competitive advantage in arid or challenging agricultural environments. Companies are also developing specialized products for specific crops and soil types, tailoring solutions for improved soil conditioning, nutrient delivery, and plant vigor. These advancements are crucial for addressing regional agricultural challenges and meeting the growing demand for sustainable and effective crop management solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the APAC Humic-based Biostimulants Market. The segmentation includes:

- Production Analysis: Detailed examination of manufacturing capacities and processes across key APAC countries, with an estimated total production volume of 800 Million tonnes.

- Consumption Analysis: Assessment of market demand by country and crop type, projecting consumption to reach 750 Million tonnes by 2025, driven by agricultural intensification.

- Import Market Analysis (Value & Volume): Analysis of import trends, with an estimated import value of $500 Million by 2025, focusing on high-value agricultural regions.

- Export Market Analysis (Value & Volume): Evaluation of export opportunities and trade flows, with an estimated export value of $400 Million in 2025, highlighting key exporting nations.

- Price Trend Analysis: Examination of price fluctuations influenced by raw materials, production costs, and market competition, with average prices ranging from $1.00 to $5.00 per kilogram.

Key Drivers of APAC Humic-based Biostimulants Market Growth

The growth of the APAC Humic-based Biostimulants Market is propelled by several critical factors. The increasing global demand for food to feed a growing population necessitates higher agricultural productivity, a key area where humic biostimulants excel by improving nutrient uptake and soil health. A significant trend towards sustainable and organic farming practices, driven by environmental consciousness and government initiatives, is a major catalyst. Companies are responding to this by developing and promoting eco-friendly alternatives to synthetic fertilizers. Technological advancements in the formulation and application of humic biostimulants are leading to more effective products with enhanced bioavailability and targeted action. Furthermore, supportive government policies and subsidies promoting the adoption of bio-based inputs across various APAC nations are creating a favorable market environment. The rising awareness among farmers regarding the long-term benefits of soil health and crop resilience, coupled with the increasing price volatility of chemical fertilizers, further drives the adoption of humic-based solutions.

Challenges in the APAC Humic-based Biostimulants Market Sector

Despite its promising growth, the APAC Humic-based Biostimulants Market faces several challenges. Regulatory hurdles and varying registration processes across different APAC countries can create complexities and delays in market entry. Lack of standardized quality control and certification for humic-based products can lead to farmer skepticism and inconsistent results, impacting market perception. Limited farmer awareness and education about the specific benefits and correct application of humic biostimulants in diverse agricultural settings remain a significant barrier. Supply chain disruptions and logistical complexities across the vast and diverse APAC region can impact product availability and cost-effectiveness. Moreover, competition from established synthetic fertilizers that offer immediate, albeit temporary, results, poses a persistent challenge, especially in price-sensitive markets.

Emerging Opportunities in APAC Humic-based Biostimulants Market

The APAC Humic-based Biostimulants Market presents numerous emerging opportunities. The growing organic food movement and demand for premium produce creates a niche for high-quality, certified humic-based biostimulants. Advancements in precision agriculture and smart farming technologies offer opportunities for developing sensor-based or drone-applied humic biostimulant solutions, enhancing their efficiency and sustainability. The increasing focus on climate change adaptation and resilience in agriculture opens doors for humic biostimulants that improve crop tolerance to drought, salinity, and extreme temperatures. Untapped potential exists in emerging economies within APAC where agricultural modernization is gaining pace. Furthermore, opportunities lie in developing specialized biostimulant formulations for specific crops, such as high-value fruits, vegetables, and plantation crops, catering to their unique nutritional and physiological needs.

Leading Players in the APAC Humic-based Biostimulants Market Market

- Plant Response Biotech Inc

- Rallis India Ltd

- Coromandel International Ltd

- Gujarat State Fertilizers & Chemicals Ltd

- Agrinos

- Atlántica Agrícola

- T Stanes and Company Limited

- Valagr

- Biostadt India Limited

- Biolchim SpA

Key Developments in APAC Humic-based Biostimulants Market Industry

- February 2022: Gujarat State Fertilizers & Chemicals Ltd launched the Urban Sardar organic fertilizer, an eco-friendly and non-toxic product containing organic sources of nutrients best suitable for all flowering plants and ornamental plants, gardens, and kitchen gardening.

- February 2022: Plant Response was acquired by The Mosaic Company, which is a global fertilizer manufacturer. This acquisition strengthens the company's global presence and helps develop new products and solutions for the customers sustainably.

- January 2021: Atlántica Agrícola developed Micomix, a biostimulant composed primarily of mycorrhizal fungi, rhizobacteria, and chelated micronutrients. The presence and development of these microorganisms in the rhizosphere create a symbiotic relationship with the plant that favors the absorption of water and mineral nutrients and increases its tolerance to water and salt stress.

Strategic Outlook for APAC Humic-based Biostimulants Market Market

The strategic outlook for the APAC Humic-based Biostimulants Market is highly positive, driven by sustained demand for sustainable agricultural solutions. Key growth catalysts include the increasing integration of humic biostimulants into integrated nutrient management programs, supported by robust research and development efforts focused on enhancing product efficacy and expanding application diversity. Strategic partnerships between raw material suppliers, manufacturers, and distributors will be crucial for optimizing supply chains and expanding market reach. Furthermore, a proactive approach to regulatory compliance and a commitment to educating farmers on best practices will foster market trust and accelerate adoption. The market is poised for significant growth as it aligns with regional and global trends towards food security, environmental stewardship, and resilient agricultural systems.

APAC Humic-based Biostimulants Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

APAC Humic-based Biostimulants Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

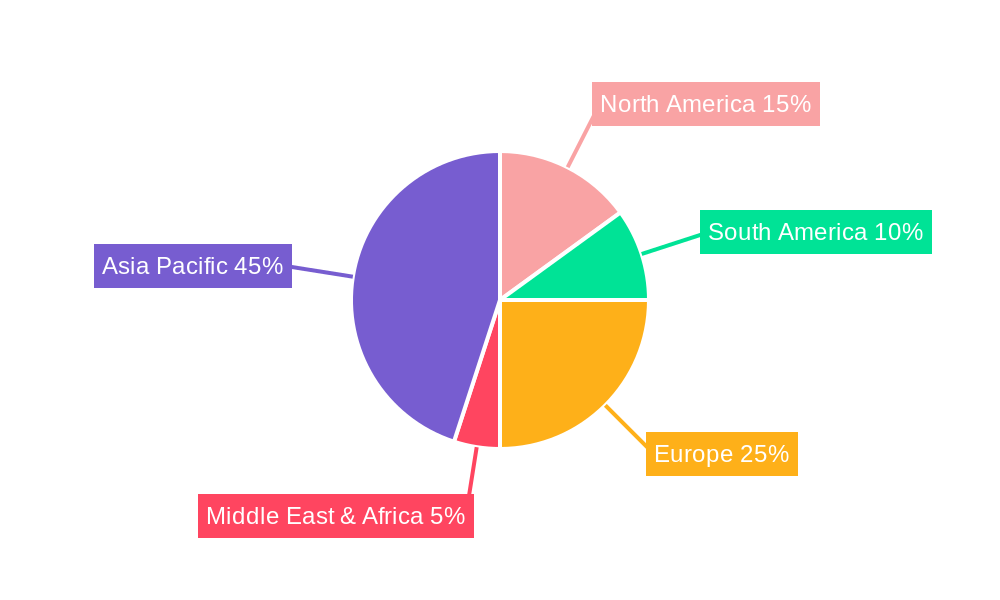

APAC Humic-based Biostimulants Market Regional Market Share

Geographic Coverage of APAC Humic-based Biostimulants Market

APAC Humic-based Biostimulants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Crop Nutrition is the largest Function

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Humic-based Biostimulants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America APAC Humic-based Biostimulants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America APAC Humic-based Biostimulants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe APAC Humic-based Biostimulants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa APAC Humic-based Biostimulants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific APAC Humic-based Biostimulants Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Plant Response Biotech Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rallis India Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Coromandel International Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gujarat State Fertilizers & Chemicals Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Agrinos

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Atlántica Agrícola

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 T Stanes and Company Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Valagr

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Biostadt India Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Biolchim SpA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Plant Response Biotech Inc

List of Figures

- Figure 1: Global APAC Humic-based Biostimulants Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America APAC Humic-based Biostimulants Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 3: North America APAC Humic-based Biostimulants Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America APAC Humic-based Biostimulants Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 5: North America APAC Humic-based Biostimulants Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America APAC Humic-based Biostimulants Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America APAC Humic-based Biostimulants Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America APAC Humic-based Biostimulants Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America APAC Humic-based Biostimulants Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America APAC Humic-based Biostimulants Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 11: North America APAC Humic-based Biostimulants Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America APAC Humic-based Biostimulants Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America APAC Humic-based Biostimulants Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America APAC Humic-based Biostimulants Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 15: South America APAC Humic-based Biostimulants Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America APAC Humic-based Biostimulants Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 17: South America APAC Humic-based Biostimulants Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America APAC Humic-based Biostimulants Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America APAC Humic-based Biostimulants Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America APAC Humic-based Biostimulants Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America APAC Humic-based Biostimulants Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America APAC Humic-based Biostimulants Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 23: South America APAC Humic-based Biostimulants Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America APAC Humic-based Biostimulants Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America APAC Humic-based Biostimulants Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe APAC Humic-based Biostimulants Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 27: Europe APAC Humic-based Biostimulants Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe APAC Humic-based Biostimulants Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 29: Europe APAC Humic-based Biostimulants Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe APAC Humic-based Biostimulants Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe APAC Humic-based Biostimulants Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe APAC Humic-based Biostimulants Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe APAC Humic-based Biostimulants Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe APAC Humic-based Biostimulants Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe APAC Humic-based Biostimulants Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe APAC Humic-based Biostimulants Market Revenue (undefined), by Country 2025 & 2033

- Figure 37: Europe APAC Humic-based Biostimulants Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa APAC Humic-based Biostimulants Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa APAC Humic-based Biostimulants Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa APAC Humic-based Biostimulants Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa APAC Humic-based Biostimulants Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa APAC Humic-based Biostimulants Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa APAC Humic-based Biostimulants Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa APAC Humic-based Biostimulants Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa APAC Humic-based Biostimulants Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa APAC Humic-based Biostimulants Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa APAC Humic-based Biostimulants Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa APAC Humic-based Biostimulants Market Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East & Africa APAC Humic-based Biostimulants Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific APAC Humic-based Biostimulants Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific APAC Humic-based Biostimulants Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific APAC Humic-based Biostimulants Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific APAC Humic-based Biostimulants Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific APAC Humic-based Biostimulants Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific APAC Humic-based Biostimulants Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific APAC Humic-based Biostimulants Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific APAC Humic-based Biostimulants Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific APAC Humic-based Biostimulants Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific APAC Humic-based Biostimulants Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific APAC Humic-based Biostimulants Market Revenue (undefined), by Country 2025 & 2033

- Figure 61: Asia Pacific APAC Humic-based Biostimulants Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 17: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Brazil APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Argentina APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: United Kingdom APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: France APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Italy APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Spain APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Russia APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Benelux APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Nordics APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 41: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Turkey APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Israel APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: GCC APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: North Africa APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: South Africa APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 53: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global APAC Humic-based Biostimulants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: China APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 59: India APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Japan APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 61: South Korea APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: ASEAN APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 63: Oceania APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific APAC Humic-based Biostimulants Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Humic-based Biostimulants Market?

The projected CAGR is approximately 11.9%.

2. Which companies are prominent players in the APAC Humic-based Biostimulants Market?

Key companies in the market include Plant Response Biotech Inc, Rallis India Ltd, Coromandel International Ltd, Gujarat State Fertilizers & Chemicals Ltd, Agrinos, Atlántica Agrícola, T Stanes and Company Limited, Valagr, Biostadt India Limited, Biolchim SpA.

3. What are the main segments of the APAC Humic-based Biostimulants Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Crop Nutrition is the largest Function.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

February 2022: Gujarat State Fertilizers & Chemicals Ltd launched the Urban Sardar organic fertilizer, an eco-friendly and non-toxic product containing organic sources of nutrients best suitable for all flowering plants and ornamental plants, gardens, and kitchen gardening.February 2022: Plant Response was acquired by The Mosaic Company, which is a global fertilizer manufacturer. This acquisition strengthens the company's global presence and helps develop new products and solutions for the customers sustainably.January 2021: Atlántica Agrícola developed Micomix, a biostimulant composed primarily of mycorrhizal fungi, rhizobacteria, and chelated micronutrients. The presence and development of these microorganisms in the rhizosphere create a symbiotic relationship with the plant that favors the absorption of water and mineral nutrients and increases its tolerance to water and salt stress.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Humic-based Biostimulants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Humic-based Biostimulants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Humic-based Biostimulants Market?

To stay informed about further developments, trends, and reports in the APAC Humic-based Biostimulants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence