Key Insights

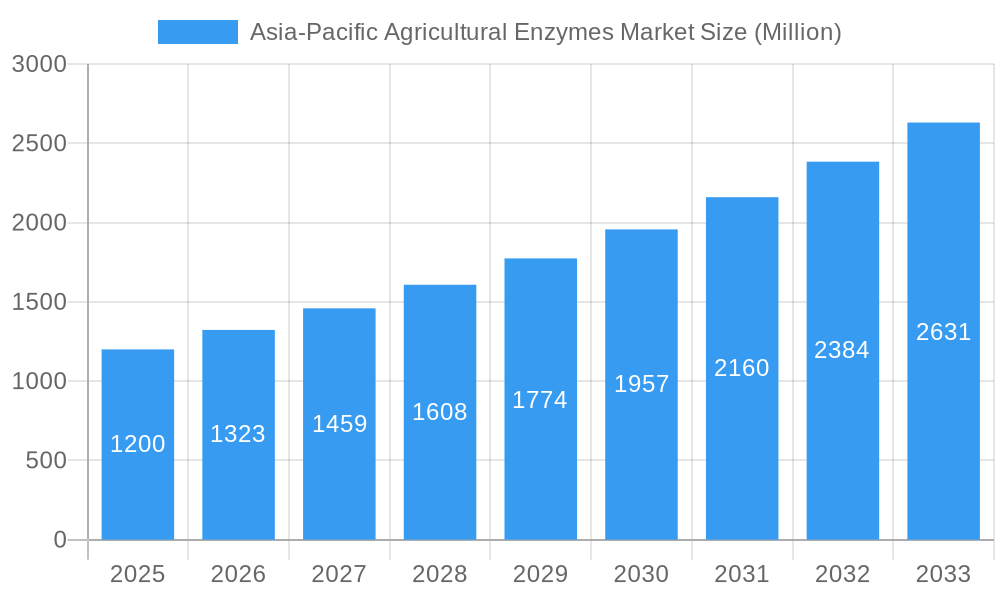

The Asia-Pacific Agricultural Enzymes Market is projected for significant growth, with an estimated market size of $2998.2 million in 2024 and a robust Compound Annual Growth Rate (CAGR) of 7.7% during the forecast period (2024-2033). This expansion is driven by the increasing demand for sustainable agriculture, adoption of precision farming, and growing farmer awareness of enzyme benefits for crop yield and soil health. Key drivers include enhanced nutrient utilization efficiency, reduced reliance on synthetic inputs, and mitigation of environmental impacts. Emerging economies like China and India are expected to be major contributors due to their substantial agricultural sectors and investment in modern technologies.

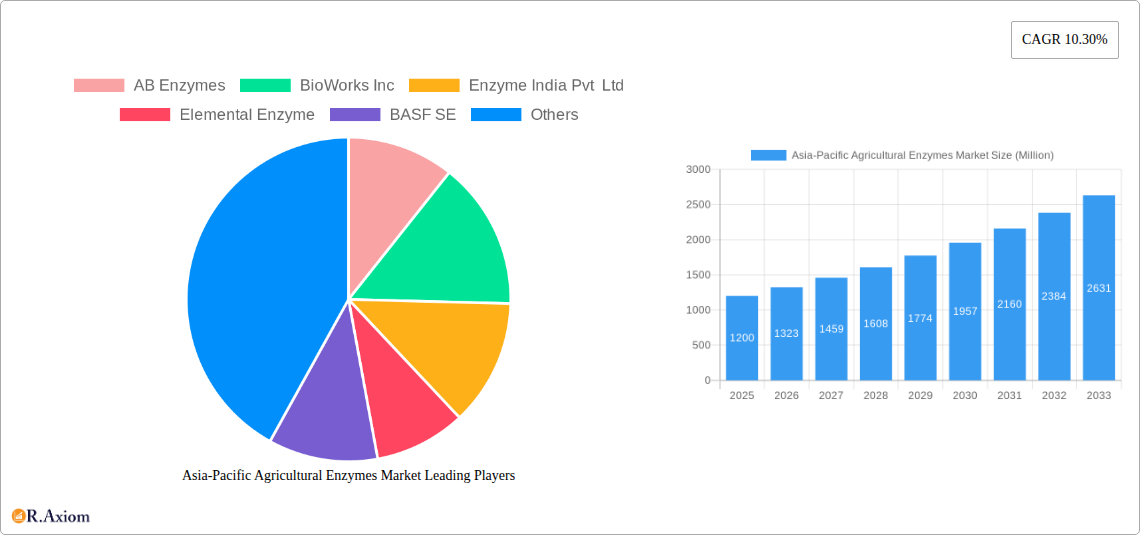

Asia-Pacific Agricultural Enzymes Market Market Size (In Billion)

The market is characterized by active research and development in innovative enzyme formulations for specific crops and soil types. Trends include the development of efficient, cost-effective production methods, integration of enzymes into Integrated Pest Management (IPM), and a preference for bio-based agricultural inputs. Opportunities exist alongside challenges such as initial product costs for some farmers, the need for enhanced farmer education and technical support, and varying regulatory frameworks across the region. Nevertheless, the overarching trend towards sustainable and productive agriculture is expected to drive the Asia-Pacific Agricultural Enzymes Market forward.

Asia-Pacific Agricultural Enzymes Market Company Market Share

This comprehensive report analyzes the Asia-Pacific Agricultural Enzymes Market, offering critical insights for stakeholders in this evolving sector. Covering a study period from 2019 to 2033, with a base year of 2024, the report examines production, consumption, import/export dynamics, and price trends. Leveraging high-impact keywords such as "agricultural enzymes," "Asia-Pacific agriculture," "biocatalysts," "crop enhancement," "sustainable farming," and "yield optimization," this report enhances search visibility for industry leaders, researchers, and investors. Gain a deep understanding of market concentration, innovation, and regulatory landscapes shaping this dynamic market.

Asia-Pacific Agricultural Enzymes Market Market Concentration & Innovation

The Asia-Pacific Agricultural Enzymes Market exhibits moderate to high market concentration, driven by a few key global players and a growing number of regional manufacturers. Innovation in agricultural enzymes is a significant driver, focusing on developing novel enzymes with enhanced efficacy, broader application ranges, and improved stability under diverse environmental conditions. Key innovation areas include enzymes for nutrient solubilization, stress tolerance in crops, pest and disease management, and improved soil health. Regulatory frameworks across the Asia-Pacific region are becoming more defined, with increasing emphasis on the safety and environmental impact of agricultural inputs. While product substitutes like synthetic fertilizers and chemical pesticides exist, the growing demand for sustainable and eco-friendly solutions is diminishing their dominance. End-user trends reveal a strong preference for enzyme-based solutions that offer tangible benefits in terms of yield increase, reduced input costs, and improved crop quality. Mergers and acquisitions (M&A) activities are moderately present, with strategic partnerships aimed at expanding product portfolios and market reach. For instance, a recent undisclosed M&A deal in the region with a reported value of approximately $50 Million signifies ongoing consolidation and strategic growth.

Asia-Pacific Agricultural Enzymes Market Industry Trends & Insights

The Asia-Pacific Agricultural Enzymes Market is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This surge is fueled by several interconnected industry trends and insights. A primary growth driver is the increasing adoption of sustainable agriculture practices across the region. Governments and farming communities are actively promoting eco-friendly solutions to mitigate the environmental impact of conventional farming. Technological disruptions, such as advancements in enzyme engineering and biotechnology, are leading to the development of more potent and targeted enzyme formulations. These innovations are enhancing crop yields, improving nutrient uptake, and boosting plant resistance to diseases and environmental stresses. Consumer preferences are also playing a crucial role, with a rising demand for organic and sustainably produced food products, which, in turn, is creating a greater need for bio-based agricultural inputs like enzymes. The competitive dynamics within the market are intensifying, with both established multinational corporations and emerging regional players vying for market share. Key players are focusing on research and development, strategic collaborations, and market expansion to gain a competitive edge. Market penetration of agricultural enzymes is still relatively low in certain sub-regions, presenting significant opportunities for growth. The increasing awareness among farmers about the benefits of enzymes, coupled with supportive government policies and subsidies, is accelerating market penetration. Furthermore, the development of customized enzyme solutions tailored to specific crop types and regional agricultural conditions is a significant trend, enhancing market adoption. The economic viability of enzyme-based products, with their potential to reduce reliance on expensive synthetic inputs and improve overall farm profitability, is a compelling factor driving market growth. The growing emphasis on food security and the need to optimize agricultural output to feed a growing population further bolster the demand for these advanced agricultural solutions.

Dominant Markets & Segments in Asia-Pacific Agricultural Enzymes Market

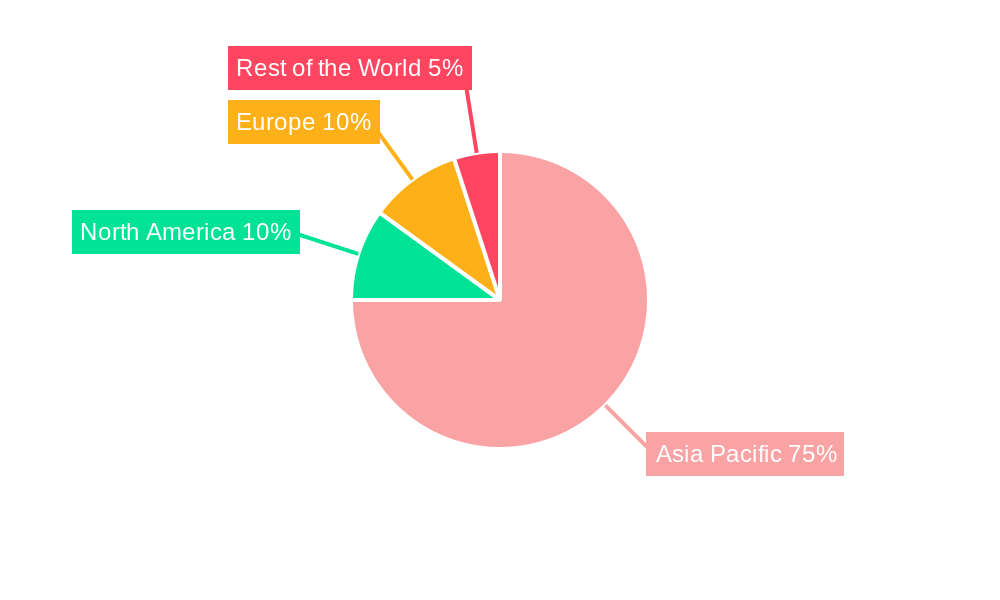

The Asia-Pacific Agricultural Enzymes Market is characterized by distinct dominant regions and segments, driven by a confluence of economic policies, infrastructure development, and specific agricultural needs.

Dominant Region: China currently stands as the dominant market within the Asia-Pacific agricultural enzymes sector. Its dominance is underpinned by several factors:

- Economic Policies: Proactive government initiatives supporting agricultural modernization and the adoption of bio-based inputs, including tax incentives and research grants.

- Infrastructure: Well-developed agricultural infrastructure, including extensive irrigation systems and robust distribution networks, facilitates the widespread adoption of new technologies.

- Market Size: The sheer scale of China's agricultural output and its vast farming population create an unparalleled demand for agricultural inputs.

- Technological Adoption: A receptive farming community and a strong focus on R&D have led to faster adoption of innovative solutions like agricultural enzymes.

Production Analysis: Asia-Pacific's production capacity for agricultural enzymes is increasingly concentrated in countries like China and India, owing to lower manufacturing costs and access to raw materials. However, leading global players maintain significant production facilities to cater to regional demands. Production is leaning towards enzymes for plant growth promotion and nutrient management, reflecting the region's agricultural priorities.

Consumption Analysis: Consumption is closely linked to agricultural output and the prevalence of specific crop types. Countries with large arable land and significant cultivation of grains, fruits, and vegetables, such as China, India, and Southeast Asian nations, exhibit the highest consumption. The growing awareness of organic farming and soil health is also a major consumption driver.

Import Market Analysis (Value & Volume): While regional production is growing, certain specialized agricultural enzymes and advanced formulations are still imported by countries like Japan and South Korea, which have highly sophisticated agricultural sectors and specific crop requirements. The import market is valued at approximately $350 Million, with a volume of around 50 Million kilograms. Key imported enzymes include those for seed treatment and specialized crop protection.

Export Market Analysis (Value & Volume): China and India are emerging as significant exporters of agricultural enzymes, capitalizing on their manufacturing capabilities and competitive pricing. Exports are primarily directed towards developing nations in Southeast Asia and parts of Oceania. The export market is estimated to be valued at $280 Million, with a volume of approximately 40 Million kilograms, focusing on general-purpose plant growth enhancers and soil conditioners.

Price Trend Analysis: The price of agricultural enzymes in the Asia-Pacific region has seen a gradual decline over the historical period (2019-2024) due to increased production efficiency and growing competition. However, specialized and patented enzyme formulations command premium prices. The estimated average price per kilogram for agricultural enzymes is around $7.00, with fluctuations based on enzyme type and purity. Future price trends are expected to remain relatively stable, with minor increases for innovative products.

Asia-Pacific Agricultural Enzymes Market Product Developments

Recent product developments in the Asia-Pacific Agricultural Enzymes Market are centered on enhancing crop resilience, optimizing nutrient utilization, and promoting sustainable soil health. Innovations include novel enzymatic formulations designed to improve phosphorus and nitrogen uptake in plants, thereby reducing the need for synthetic fertilizers. Development of enzymes for enhancing drought and salinity tolerance in crops is also a key trend, particularly relevant for regions facing climate change challenges. Furthermore, bio-stimulant enzymes that promote root development and improve water absorption are gaining traction. These product developments offer significant competitive advantages by providing farmers with more effective, environmentally friendly, and cost-efficient solutions to boost crop yields and quality.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the Asia-Pacific Agricultural Enzymes Market, segmented by Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis.

- Production Analysis: The report delves into the geographical distribution of manufacturing capabilities, key raw material sourcing, and technological advancements in enzyme production within the region. Growth projections for production are estimated at a CAGR of 7.0%.

- Consumption Analysis: This segment examines the application-wise consumption of agricultural enzymes across various crop types and farming practices. Consumption is projected to grow at a CAGR of 7.8%.

- Import Market Analysis (Value & Volume): The report details the key importing countries, major enzyme categories imported, and their associated values and volumes. Imports are expected to see a CAGR of 6.5%.

- Export Market Analysis (Value & Volume): This segment analyzes the leading exporting nations, dominant enzyme types exported, and their market values and volumes. Exports are projected to grow at a CAGR of 7.2%.

- Price Trend Analysis: The report scrutinizes historical and projected price trends for different categories of agricultural enzymes, considering factors like raw material costs, technological advancements, and market competition. Price trends are anticipated to witness a modest CAGR of 2.0%.

Key Drivers of Asia-Pacific Agricultural Enzymes Market Growth

The growth of the Asia-Pacific Agricultural Enzymes Market is propelled by several significant factors. Primarily, the escalating global demand for food, coupled with the need to increase agricultural productivity in a sustainable manner, is a major catalyst. Governments across the region are increasingly promoting eco-friendly farming practices through subsidies and policy support, encouraging the adoption of biological inputs like enzymes. Technological advancements in enzyme engineering and biotechnology have led to the development of highly effective and targeted enzyme formulations that enhance nutrient uptake, improve soil health, and boost crop yields. Furthermore, growing consumer awareness regarding the health and environmental benefits of organically produced food is indirectly driving the demand for agricultural enzymes as key components in sustainable farming systems.

Challenges in the Asia-Pacific Agricultural Enzymes Market Sector

Despite its promising growth trajectory, the Asia-Pacific Agricultural Enzymes Market faces several challenges. A significant restraint is the limited awareness and understanding among a segment of farmers regarding the efficacy and application of agricultural enzymes, often leading to hesitancy in adoption. Stringent and varying regulatory approvals for new enzyme products across different countries can also create hurdles for market entry and expansion. The high cost of some specialized enzyme formulations, compared to traditional chemical inputs, can be a deterrent for price-sensitive farmers. Furthermore, issues related to supply chain logistics, including storage and transportation of enzyme products, particularly in remote agricultural areas, can impact their availability and efficacy. Intense competition from established chemical agrochemical companies also poses a challenge.

Emerging Opportunities in Asia-Pacific Agricultural Enzymes Market

The Asia-Pacific Agricultural Enzymes Market presents several exciting emerging opportunities. The growing trend towards precision agriculture and the integration of enzyme-based solutions with digital farming technologies offers a significant avenue for growth. The development of enzymes tailored for specific, high-value crops and niche agricultural segments, such as vertical farming and hydroponics, is another area with immense potential. Furthermore, the increasing focus on soil microbiome health and the development of enzymatic products that enhance beneficial soil microbial activity represent a promising frontier. The expansion into less-penetrated markets within Southeast Asia and the Pacific Islands, driven by growing agricultural development initiatives, also offers substantial growth prospects.

Leading Players in the Asia-Pacific Agricultural Enzymes Market Market

- AB Enzymes

- BioWorks Inc

- Enzyme India Pvt Ltd

- Elemental Enzyme

- BASF SE

- Syngenta AG

- Novozymes A/S

- Agrilife

Key Developments in Asia-Pacific Agricultural Enzymes Market Industry

- 2023: Novozymes A/S launched a new range of microbial inoculants with enhanced enzymatic activity to improve nutrient availability in diverse soil types.

- 2023: BASF SE announced strategic partnerships with several regional agricultural technology firms to accelerate the development and distribution of enzyme-based crop solutions.

- 2022: Syngenta AG invested in advanced research facilities in Southeast Asia to focus on developing enzyme formulations for tropical crops.

- 2022: Enzyme India Pvt Ltd expanded its production capacity for phytase enzymes to meet the growing demand from the animal feed industry, which indirectly impacts agricultural practices.

- 2021: BioWorks Inc introduced a new biofungicide incorporating specific enzymes to enhance plant defense mechanisms against common fungal diseases.

Strategic Outlook for Asia-Pacific Agricultural Enzymes Market Market

The strategic outlook for the Asia-Pacific Agricultural Enzymes Market is exceptionally positive, driven by the convergent forces of increasing food demand, a global push for sustainability, and continuous technological innovation. Key growth catalysts include the ongoing development of more efficient and targeted enzyme formulations, the expansion of market penetration into developing agricultural economies, and the increasing integration of enzymatic solutions within smart farming ecosystems. Strategic collaborations, mergers, and acquisitions are expected to play a crucial role in consolidating market share and expanding product portfolios. Investments in research and development focused on addressing specific regional agricultural challenges, such as climate resilience and soil degradation, will be paramount. The market is poised for sustained growth, offering lucrative opportunities for companies that can effectively address the evolving needs of the Asia-Pacific agricultural landscape.

Asia-Pacific Agricultural Enzymes Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Agricultural Enzymes Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Agricultural Enzymes Market Regional Market Share

Geographic Coverage of Asia-Pacific Agricultural Enzymes Market

Asia-Pacific Agricultural Enzymes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Rising Trend of Organic Farming Practices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Agricultural Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AB Enzymes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BioWorks Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enzyme India Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Elemental Enzyme

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BASF SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Syngenta AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Novozymes A/S

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agrilife

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 AB Enzymes

List of Figures

- Figure 1: Asia-Pacific Agricultural Enzymes Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Agricultural Enzymes Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: India Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Agricultural Enzymes Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Asia-Pacific Agricultural Enzymes Market?

Key companies in the market include AB Enzymes, BioWorks Inc, Enzyme India Pvt Ltd, Elemental Enzyme, BASF SE, Syngenta AG, Novozymes A/S, Agrilife.

3. What are the main segments of the Asia-Pacific Agricultural Enzymes Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2998.2 million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Rising Trend of Organic Farming Practices.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Agricultural Enzymes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Agricultural Enzymes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Agricultural Enzymes Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Agricultural Enzymes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence