Key Insights

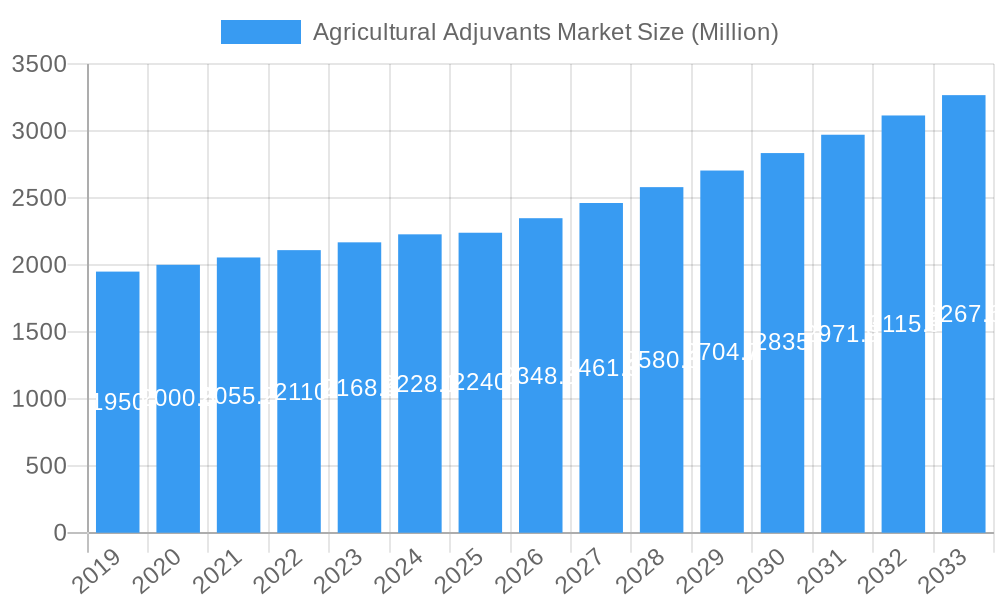

The global Agricultural Adjuvants Market is poised for robust expansion, projected to reach a market size of approximately USD 2.24 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 4.70% anticipated to propel it through 2033. This significant growth is underpinned by several key drivers. Escalating global food demand, driven by a growing population and changing dietary habits, necessitates increased agricultural productivity. Adjuvants play a crucial role in optimizing the efficacy of crop protection products, enabling farmers to achieve higher yields with fewer applications, thus contributing to sustainable agricultural practices. Furthermore, increasing adoption of precision agriculture technologies and a growing awareness among farmers regarding the benefits of adjuvants in enhancing pesticide performance are also significant growth catalysts. The market is also witnessing a trend towards the development and adoption of bio-based and environmentally friendly adjuvants, reflecting a broader shift towards sustainable agriculture and regulatory pressures to reduce the environmental impact of agrochemicals.

Agricultural Adjuvants Market Market Size (In Billion)

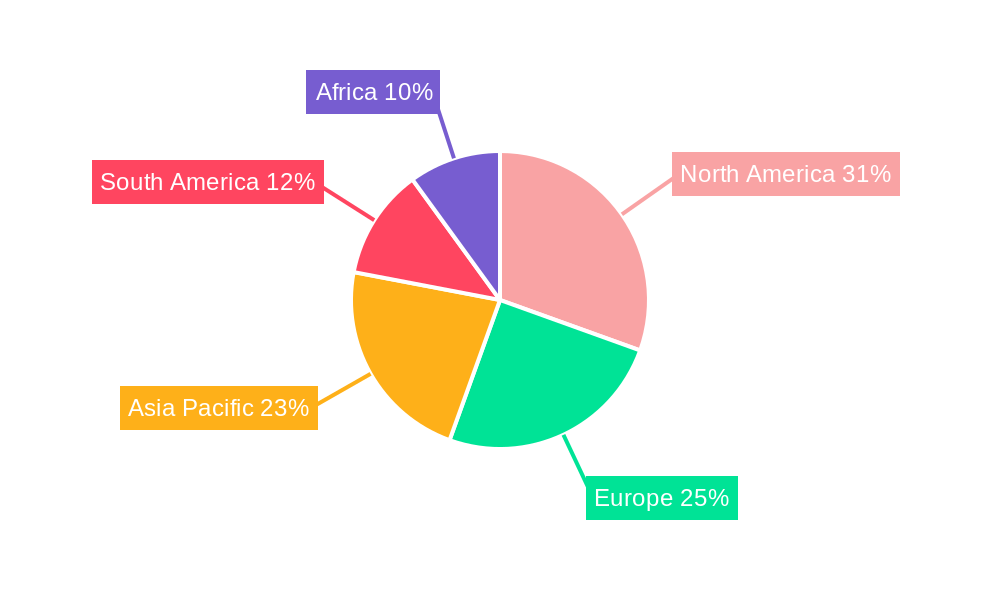

The market segmentation reveals a dynamic landscape. Activator Adjuvants, particularly surfactants and oil adjuvants, are expected to dominate the market due to their widespread application in improving the spreading, sticking, and penetration of pesticides. Utility adjuvants also hold considerable importance in managing spray tank mixtures and improving the overall performance of crop protection solutions. Application-wise, Herbicide Adjuvants are anticipated to command the largest share, followed by Insecticide and Fungicide Adjuvants, reflecting the prevalent use of these crop protection chemicals. Geographically, North America is expected to be a leading region, owing to its advanced agricultural practices and high adoption of crop protection technologies. However, the Asia Pacific region, driven by rapid agricultural modernization and increasing investments in crop protection, is projected to exhibit the fastest growth rate. Key players like Huntsman Corp, Nufarm, Solvay, and Evonik Industries AG are actively investing in research and development to innovate and expand their product portfolios, further shaping the market trajectory.

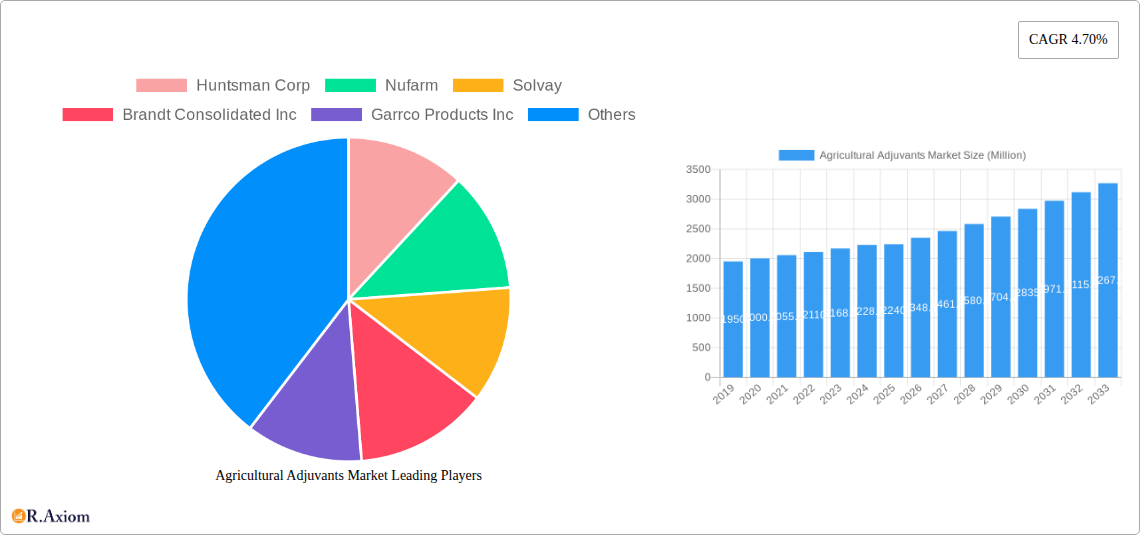

Agricultural Adjuvants Market Company Market Share

Agricultural Adjuvants Market Report: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the global Agricultural Adjuvants Market, offering critical insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the competitive landscape. Spanning the study period from 2019 to 2033, with a base year of 2025, the report utilizes historical data (2019–2024) and robust estimations for the forecast period (2025–2033) to deliver actionable intelligence on market size, trends, and future projections. Discover the intricate interplay of factors shaping the agricultural adjuvants industry, from technological advancements and evolving regulatory frameworks to shifts in end-user preferences and emerging market opportunities. This report is essential for agrochemical manufacturers, distributors, formulators, researchers, and investors.

Agricultural Adjuvants Market Market Concentration & Innovation

The Agricultural Adjuvants Market exhibits a moderate to high level of concentration, with a significant portion of the market share held by a few key players, including Huntsman Corp, Nufarm, Solvay, and Evonik Industries AG. Innovation remains a critical driver, fueled by the continuous need for enhanced pesticide efficacy, reduced environmental impact, and improved crop yields. Research and development efforts are focused on biodegradable formulations, precision agriculture compatibility, and adjuvant systems that minimize spray drift and maximize active ingredient uptake. Regulatory frameworks, while evolving to promote sustainable agricultural practices, also present a barrier to entry for new players, demanding rigorous testing and approval processes. Product substitutes, such as advanced formulation technologies for pesticides themselves, pose a moderate threat. End-user trends are increasingly prioritizing cost-effectiveness, environmental safety, and ease of application, driving demand for specialized and user-friendly adjuvants. Mergers and acquisitions (M&A) activities are prevalent, with deal values often ranging in the tens to hundreds of Millions, as larger companies seek to consolidate market share, acquire innovative technologies, and expand their product portfolios. For instance, strategic acquisitions by companies like Helena Chemical Company and Wilbur-Ellis Company underscore this trend, aiming to bolster their offerings in the expanding agricultural inputs sector.

Agricultural Adjuvants Market Industry Trends & Insights

The global Agricultural Adjuvants Market is poised for substantial growth, driven by a confluence of factors critical to modern agriculture. The escalating global population and the consequent demand for increased food production are primary catalysts, necessitating more efficient and effective crop protection strategies. Agricultural adjuvants play a pivotal role in this by enhancing the performance of pesticides, herbicides, insecticides, and fungicides, thereby optimizing resource utilization and maximizing crop yields. The market is witnessing a compound annual growth rate (CAGR) of approximately 5.5% to 6.5%, projected to reach a valuation of over USD 5,000 Million by 2030. Technological advancements are a significant disruptor, with a growing emphasis on bio-adjuvants derived from renewable resources, nanotechnology-enhanced adjuvants for targeted delivery, and smart adjuvant systems that respond to environmental conditions. These innovations not only improve the efficacy of agrochemicals but also contribute to reduced environmental footprints, aligning with the growing consumer preference for sustainably produced food. Consumer preferences are shifting towards environmentally friendly and safer agricultural practices, which directly translates to a higher demand for adjuvants that minimize the need for higher pesticide concentrations and reduce off-target effects. The competitive dynamics are intensifying, with established players investing heavily in R&D and market expansion, while new entrants are focusing on niche markets and innovative formulations. Market penetration is steadily increasing across developed and developing economies, as farmers recognize the economic benefits of improved pest and disease management, leading to enhanced crop quality and reduced losses. The integration of digital farming technologies also presents an opportunity, as precision agriculture practices increasingly rely on optimized spray applications, where adjuvants are indispensable. The continuous drive for improved agricultural productivity and sustainability underpins the robust growth trajectory of the agricultural adjuvants market.

Dominant Markets & Segments in Agricultural Adjuvants Market

The global Agricultural Adjuvants Market is segmented by type into Activator Adjuvants (further categorized into Surfactants and Oil Adjuvants) and Utility Adjuvants. By application, the market is divided into Herbicide Adjuvants, Insecticide Adjuvants, Fungicide Adjuvants, and Other Applications.

Dominant Segments & Drivers:

Application: Herbicide Adjuvants

- Market Dominance: Herbicide adjuvants represent the largest and most rapidly growing segment within the agricultural adjuvants market. This dominance is driven by the widespread use of herbicides in modern agriculture to manage weed infestations, which directly compete with crops for nutrients, water, and sunlight.

- Key Drivers:

- Increased Weed Resistance: The evolution of herbicide-resistant weeds necessitates the use of advanced adjuvant formulations to enhance the efficacy of existing herbicide active ingredients, ensuring effective weed control and preventing yield losses.

- Demand for Higher Crop Yields: As the global population grows, there is immense pressure to increase food production. Effective weed management through herbicides, amplified by adjuvants, is crucial for maximizing crop yields.

- Introduction of New Herbicide Formulations: Ongoing research and development in herbicide chemistry often involves the co-formulation or recommendation of specific adjuvants to optimize the performance of novel active ingredients.

- Government Policies and Subsidies: Supportive government policies aimed at boosting agricultural productivity and promoting efficient farming practices indirectly fuel the demand for herbicide adjuvants.

- Economic Viability: Herbicide adjuvants offer a cost-effective way for farmers to improve the performance of their pesticide applications, reducing the overall cost of crop protection per unit area.

Type: Activator Adjuvants (Surfactants & Oil Adjuvants)

- Market Dominance: Within the Activator Adjuvants segment, Surfactants and Oil Adjuvants are pivotal. Surfactants, due to their ability to reduce surface tension and improve wetting and spreading, are indispensable for enhancing spray coverage and absorption of active ingredients. Oil adjuvants, particularly crop oil concentrates (COCs) and methylated seed oils (MSOs), excel in improving herbicide penetration through waxy plant cuticles.

- Key Drivers:

- Enhanced Pesticide Efficacy: These adjuvants significantly improve the biological activity of pesticides, allowing for lower application rates and potentially reducing the overall environmental load of agrochemicals.

- Broad Compatibility: Surfactants and oil adjuvants are compatible with a wide range of pesticide formulations, making them versatile choices for farmers.

- Improved Weather Resistance: Certain oil adjuvants help to reduce spray drift and improve rainfastness, ensuring that the pesticide remains on the target surface for effective action.

- Technological Advancements: Continuous innovation in surfactant chemistry and the development of novel oil-based formulations contribute to their sustained dominance.

Geographical Dominance: North America and Europe currently dominate the Agricultural Adjuvants Market, owing to their advanced agricultural infrastructure, high adoption rates of advanced farming technologies, and stringent regulations that necessitate efficient crop protection solutions. However, the Asia-Pacific region is emerging as a significant growth hub, driven by increasing investments in agriculture, rising awareness of modern farming practices, and a growing demand for enhanced food security.

Agricultural Adjuvants Market Product Developments

Product innovations in the agricultural adjuvants market are increasingly focused on enhancing the efficacy and sustainability of crop protection. Key developments include the introduction of silicone-based surfactants for superior spreading and penetration, bio-adjuvants derived from plant-based materials for an eco-friendly profile, and nanotechnology-enabled adjuvants for targeted delivery and controlled release of active ingredients. These advancements aim to reduce spray drift, improve rainfastness, and optimize the absorption of pesticides by target organisms or plants, thereby increasing the overall effectiveness of agrochemical applications. Competitive advantages are being built on the basis of improved environmental safety, enhanced performance in challenging weather conditions, and compatibility with precision agriculture technologies.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Agricultural Adjuvants Market, providing comprehensive segmentation across key parameters. The market is segmented by Type into Activator Adjuvants, which includes Surfactants and Oil Adjuvants, and Utility Adjuvants. Activator Adjuvants are crucial for enhancing the physical and chemical properties of pesticide formulations to improve their performance. Utility Adjuvants, on the other hand, are used to modify water properties or provide other functional benefits. Further segmentation is based on Application, encompassing Herbicide Adjuvants, Insecticide Adjuvants, Fungicide Adjuvants, and Other Applications (such as plant growth regulators and soil conditioners). Herbicide adjuvants are expected to maintain their dominant position due to the widespread use of herbicides in weed management. Insecticide and Fungicide adjuvants are projected to witness steady growth as integrated pest management strategies become more prevalent. The report provides detailed market size estimations, growth projections, and competitive landscape analysis for each of these segments, offering a granular understanding of market dynamics.

Key Drivers of Agricultural Adjuvants Market Growth

The growth of the Agricultural Adjuvants Market is propelled by several key factors. Firstly, the increasing global demand for food security necessitates enhanced agricultural productivity, driving the adoption of advanced crop protection solutions where adjuvants play a crucial role. Secondly, the development of pesticide resistance in weeds, insects, and diseases compels farmers to seek more effective application strategies, often involving adjuvants to boost the efficacy of existing active ingredients. Thirdly, ongoing technological advancements in adjuvant formulations, including the development of bio-based and environmentally friendly options, are expanding their appeal. Finally, supportive government policies and initiatives promoting sustainable agriculture and efficient resource utilization further bolster market growth by encouraging the use of products that optimize pesticide performance and minimize environmental impact.

Challenges in the Agricultural Adjuvants Market Sector

Despite the robust growth, the Agricultural Adjuvants Market faces several challenges. Stringent regulatory frameworks in various regions, requiring extensive testing and approval processes, can lead to prolonged market entry timelines and increased development costs for new products. The inherent volatility in raw material prices, particularly for petrochemical-based components, can impact production costs and profit margins. Moreover, farmer awareness and education regarding the benefits and proper application of specific adjuvants remain inconsistent across diverse agricultural landscapes, leading to suboptimal utilization in some areas. The increasing competition from alternative crop management techniques and advanced pesticide formulations that incorporate adjuvants internally also presents a competitive pressure.

Emerging Opportunities in Agricultural Adjuvants Market

Emerging opportunities in the Agricultural Adjuvants Market are primarily driven by the growing demand for sustainable agriculture and the adoption of precision farming techniques. The development and commercialization of bio-adjuvants derived from renewable resources, offering reduced environmental impact and biodegradability, present a significant avenue for growth. The integration of adjuvants with smart agricultural technologies, such as drone-based spraying and sensor-driven application, allows for more targeted and efficient use of crop protection products, opening new market segments. Furthermore, the expansion of agricultural activities in emerging economies, coupled with increasing farmer adoption of modern farming practices, creates substantial untapped potential for a wide range of adjuvant products.

Leading Players in the Agricultural Adjuvants Market Market

- Huntsman Corp

- Nufarm

- Solvay

- Brandt Consolidated Inc

- Garrco Products Inc

- Lamberti SPA

- Helena Chemical Company

- Evonik Industries AG

- Akzonobel NV

- Momentive Performance Materials Inc

- Adjuvant Plus Inc

- Interagro (UK) Ltd

- Wilbur-Ellis Company

- Croda International PLC

Key Developments in Agricultural Adjuvants Market Industry

- 2023: Launch of new biodegradable surfactant formulations by several key players to meet growing demand for sustainable solutions.

- 2023: Increased M&A activity focused on companies with innovative bio-adjuvant technologies and strong market presence in developing regions.

- 2024: Introduction of nanotechnology-enhanced adjuvants promising improved spray drift reduction and enhanced active ingredient uptake.

- 2024: Focus on developing adjuvant systems compatible with drone application technology for precision agriculture.

- 2024: Growing regulatory scrutiny on adjuvant environmental impact driving innovation towards eco-friendly alternatives.

Strategic Outlook for Agricultural Adjuvants Market Market

The strategic outlook for the Agricultural Adjuvants Market remains highly positive, characterized by sustained growth and innovation. The increasing emphasis on sustainable agriculture and the need for enhanced crop protection efficiency will continue to drive demand for high-performance adjuvants. Companies that invest in research and development for bio-based formulations, smart adjuvant technologies, and products tailored for precision agriculture are best positioned for future success. Strategic partnerships and acquisitions will remain crucial for market players to expand their product portfolios, geographical reach, and technological capabilities. The market will witness a continuous evolution towards more sophisticated and environmentally responsible adjuvant solutions that contribute significantly to global food security and sustainable farming practices.

Agricultural Adjuvants Market Segmentation

-

1. Type

-

1.1. Activator Adjuvants

- 1.1.1. Surfactants

- 1.1.2. Oil Adjuvants

- 1.2. Utility Adjuvants

-

1.1. Activator Adjuvants

-

2. Application

- 2.1. Herbicide Adjuvants

- 2.2. Insecticide Adjuvants

- 2.3. Fungicide Adjuvants

- 2.4. Other Applications

-

3. Type

-

3.1. Activator Adjuvants

- 3.1.1. Surfactants

- 3.1.2. Oil Adjuvants

- 3.2. Utility Adjuvants

-

3.1. Activator Adjuvants

-

4. Application

- 4.1. Herbicide Adjuvants

- 4.2. Insecticide Adjuvants

- 4.3. Fungicide Adjuvants

- 4.4. Other Applications

Agricultural Adjuvants Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Argentina

- 4.2. Brazil

- 4.3. Rest of South America

-

5. Africa

- 5.1. South Africa

- 5.2. Rest of Africa

Agricultural Adjuvants Market Regional Market Share

Geographic Coverage of Agricultural Adjuvants Market

Agricultural Adjuvants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Growing Food Demand and Decrease in Arable Land Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agricultural Adjuvants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Activator Adjuvants

- 5.1.1.1. Surfactants

- 5.1.1.2. Oil Adjuvants

- 5.1.2. Utility Adjuvants

- 5.1.1. Activator Adjuvants

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Herbicide Adjuvants

- 5.2.2. Insecticide Adjuvants

- 5.2.3. Fungicide Adjuvants

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Activator Adjuvants

- 5.3.1.1. Surfactants

- 5.3.1.2. Oil Adjuvants

- 5.3.2. Utility Adjuvants

- 5.3.1. Activator Adjuvants

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Herbicide Adjuvants

- 5.4.2. Insecticide Adjuvants

- 5.4.3. Fungicide Adjuvants

- 5.4.4. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Agricultural Adjuvants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Activator Adjuvants

- 6.1.1.1. Surfactants

- 6.1.1.2. Oil Adjuvants

- 6.1.2. Utility Adjuvants

- 6.1.1. Activator Adjuvants

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Herbicide Adjuvants

- 6.2.2. Insecticide Adjuvants

- 6.2.3. Fungicide Adjuvants

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Activator Adjuvants

- 6.3.1.1. Surfactants

- 6.3.1.2. Oil Adjuvants

- 6.3.2. Utility Adjuvants

- 6.3.1. Activator Adjuvants

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Herbicide Adjuvants

- 6.4.2. Insecticide Adjuvants

- 6.4.3. Fungicide Adjuvants

- 6.4.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Agricultural Adjuvants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Activator Adjuvants

- 7.1.1.1. Surfactants

- 7.1.1.2. Oil Adjuvants

- 7.1.2. Utility Adjuvants

- 7.1.1. Activator Adjuvants

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Herbicide Adjuvants

- 7.2.2. Insecticide Adjuvants

- 7.2.3. Fungicide Adjuvants

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Activator Adjuvants

- 7.3.1.1. Surfactants

- 7.3.1.2. Oil Adjuvants

- 7.3.2. Utility Adjuvants

- 7.3.1. Activator Adjuvants

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Herbicide Adjuvants

- 7.4.2. Insecticide Adjuvants

- 7.4.3. Fungicide Adjuvants

- 7.4.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Agricultural Adjuvants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Activator Adjuvants

- 8.1.1.1. Surfactants

- 8.1.1.2. Oil Adjuvants

- 8.1.2. Utility Adjuvants

- 8.1.1. Activator Adjuvants

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Herbicide Adjuvants

- 8.2.2. Insecticide Adjuvants

- 8.2.3. Fungicide Adjuvants

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Activator Adjuvants

- 8.3.1.1. Surfactants

- 8.3.1.2. Oil Adjuvants

- 8.3.2. Utility Adjuvants

- 8.3.1. Activator Adjuvants

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Herbicide Adjuvants

- 8.4.2. Insecticide Adjuvants

- 8.4.3. Fungicide Adjuvants

- 8.4.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Agricultural Adjuvants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Activator Adjuvants

- 9.1.1.1. Surfactants

- 9.1.1.2. Oil Adjuvants

- 9.1.2. Utility Adjuvants

- 9.1.1. Activator Adjuvants

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Herbicide Adjuvants

- 9.2.2. Insecticide Adjuvants

- 9.2.3. Fungicide Adjuvants

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Activator Adjuvants

- 9.3.1.1. Surfactants

- 9.3.1.2. Oil Adjuvants

- 9.3.2. Utility Adjuvants

- 9.3.1. Activator Adjuvants

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Herbicide Adjuvants

- 9.4.2. Insecticide Adjuvants

- 9.4.3. Fungicide Adjuvants

- 9.4.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Africa Agricultural Adjuvants Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Activator Adjuvants

- 10.1.1.1. Surfactants

- 10.1.1.2. Oil Adjuvants

- 10.1.2. Utility Adjuvants

- 10.1.1. Activator Adjuvants

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Herbicide Adjuvants

- 10.2.2. Insecticide Adjuvants

- 10.2.3. Fungicide Adjuvants

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Activator Adjuvants

- 10.3.1.1. Surfactants

- 10.3.1.2. Oil Adjuvants

- 10.3.2. Utility Adjuvants

- 10.3.1. Activator Adjuvants

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Herbicide Adjuvants

- 10.4.2. Insecticide Adjuvants

- 10.4.3. Fungicide Adjuvants

- 10.4.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Huntsman Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nufarm

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solvay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Brandt Consolidated Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Garrco Products Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lamberti SPA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Helena Chemical Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Evonik Industries AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Akzonobel NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Momentive Performance Materials Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Adjuvant Plus Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Interagro (UK) Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Wilbur-Ellis Compan

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Croda International PLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Huntsman Corp

List of Figures

- Figure 1: Global Agricultural Adjuvants Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Agricultural Adjuvants Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Agricultural Adjuvants Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Agricultural Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Agricultural Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Agricultural Adjuvants Market Revenue (Million), by Type 2025 & 2033

- Figure 7: North America Agricultural Adjuvants Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: North America Agricultural Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 9: North America Agricultural Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Agricultural Adjuvants Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Agricultural Adjuvants Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Agricultural Adjuvants Market Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Agricultural Adjuvants Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Agricultural Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Agricultural Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Agricultural Adjuvants Market Revenue (Million), by Type 2025 & 2033

- Figure 17: Europe Agricultural Adjuvants Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Agricultural Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Europe Agricultural Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Agricultural Adjuvants Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Agricultural Adjuvants Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Agricultural Adjuvants Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Asia Pacific Agricultural Adjuvants Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Agricultural Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 25: Asia Pacific Agricultural Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 26: Asia Pacific Agricultural Adjuvants Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Agricultural Adjuvants Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Agricultural Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific Agricultural Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Agricultural Adjuvants Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Agricultural Adjuvants Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Agricultural Adjuvants Market Revenue (Million), by Type 2025 & 2033

- Figure 33: South America Agricultural Adjuvants Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: South America Agricultural Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 35: South America Agricultural Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: South America Agricultural Adjuvants Market Revenue (Million), by Type 2025 & 2033

- Figure 37: South America Agricultural Adjuvants Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: South America Agricultural Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 39: South America Agricultural Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Agricultural Adjuvants Market Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Agricultural Adjuvants Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Africa Agricultural Adjuvants Market Revenue (Million), by Type 2025 & 2033

- Figure 43: Africa Agricultural Adjuvants Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Africa Agricultural Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 45: Africa Agricultural Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Africa Agricultural Adjuvants Market Revenue (Million), by Type 2025 & 2033

- Figure 47: Africa Agricultural Adjuvants Market Revenue Share (%), by Type 2025 & 2033

- Figure 48: Africa Agricultural Adjuvants Market Revenue (Million), by Application 2025 & 2033

- Figure 49: Africa Agricultural Adjuvants Market Revenue Share (%), by Application 2025 & 2033

- Figure 50: Africa Agricultural Adjuvants Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Africa Agricultural Adjuvants Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Agricultural Adjuvants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Agricultural Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Agricultural Adjuvants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Agricultural Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Agricultural Adjuvants Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Agricultural Adjuvants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Agricultural Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Agricultural Adjuvants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global Agricultural Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Agricultural Adjuvants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Agricultural Adjuvants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 16: Global Agricultural Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Agricultural Adjuvants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Agricultural Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Agricultural Adjuvants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Germany Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Agricultural Adjuvants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Agricultural Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Agricultural Adjuvants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Agricultural Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Agricultural Adjuvants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: China Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Japan Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: India Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Australia Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Asia Pacific Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Agricultural Adjuvants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 37: Global Agricultural Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Agricultural Adjuvants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 39: Global Agricultural Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Agricultural Adjuvants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Argentina Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Brazil Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of South America Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Global Agricultural Adjuvants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 45: Global Agricultural Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 46: Global Agricultural Adjuvants Market Revenue Million Forecast, by Type 2020 & 2033

- Table 47: Global Agricultural Adjuvants Market Revenue Million Forecast, by Application 2020 & 2033

- Table 48: Global Agricultural Adjuvants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 49: South Africa Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Africa Agricultural Adjuvants Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agricultural Adjuvants Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Agricultural Adjuvants Market?

Key companies in the market include Huntsman Corp, Nufarm, Solvay, Brandt Consolidated Inc, Garrco Products Inc, Lamberti SPA, Helena Chemical Company, Evonik Industries AG, Akzonobel NV, Momentive Performance Materials Inc, Adjuvant Plus Inc, Interagro (UK) Ltd, Wilbur-Ellis Compan, Croda International PLC.

3. What are the main segments of the Agricultural Adjuvants Market?

The market segments include Type, Application, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Growing Food Demand and Decrease in Arable Land Driving the Market.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agricultural Adjuvants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agricultural Adjuvants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agricultural Adjuvants Market?

To stay informed about further developments, trends, and reports in the Agricultural Adjuvants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence