Key Insights

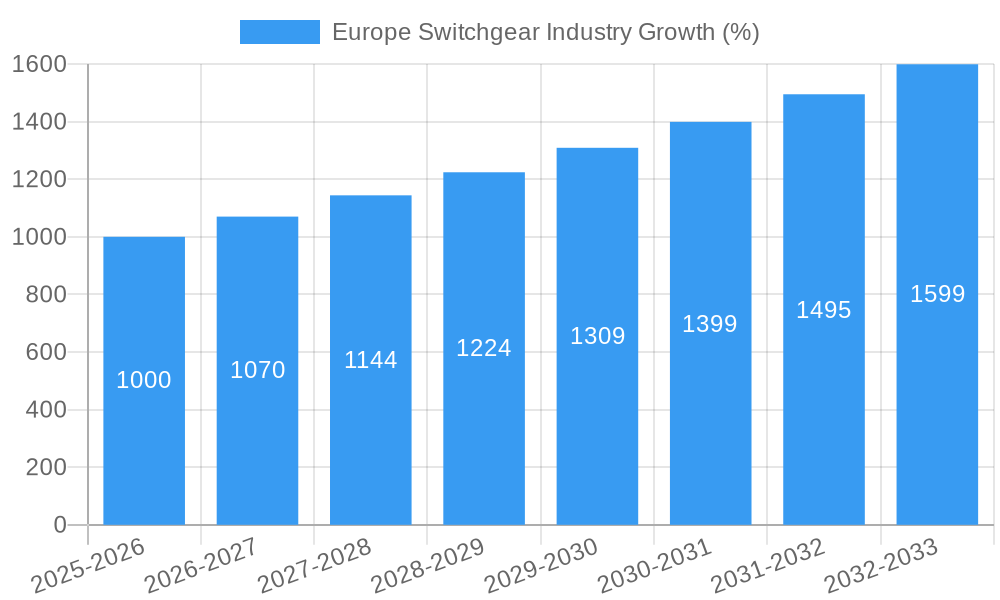

The European switchgear market, valued at approximately €[Estimate based on Market Size XX and currency conversion – e.g., €15 Billion] in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.70% from 2025 to 2033. This expansion is driven primarily by the increasing demand for reliable power distribution across residential, commercial, and industrial sectors. The burgeoning renewable energy sector, particularly in countries like Germany and the UK, significantly contributes to this growth, necessitating sophisticated and efficient switchgear solutions for grid integration and energy management. Furthermore, stringent safety regulations and the upgrading of aging infrastructure across Europe are creating substantial opportunities for switchgear manufacturers. Growth is further fueled by smart grid initiatives aiming to improve energy efficiency and reliability through advanced monitoring and control systems integrated into switchgear.

However, market growth faces certain restraints. Fluctuations in raw material prices, particularly metals, can impact production costs and profitability. Intense competition among established players like ABB, Siemens, Schneider Electric, and Eaton, alongside emerging regional manufacturers, can lead to price pressures. Moreover, the relatively slow pace of infrastructure development in certain Southern European countries may temper overall growth in specific segments. Nevertheless, the long-term outlook for the European switchgear market remains positive, particularly given sustained investment in renewable energy sources and the ongoing need for modernized electrical grids. The market's segmentation by voltage type (high-voltage, low-voltage), insulation type, installation type, and end-user sector allows for a nuanced understanding of various market dynamics and growth pockets within this expanding industry. Germany, the UK, France, and Italy represent the largest national markets, driving a significant share of overall regional growth.

Europe Switchgear Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe switchgear industry, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report examines market size, segmentation, growth drivers, challenges, and emerging opportunities. The report includes detailed analysis of key players, including ABB Ltd, Toshiba International Corporation, Hitachi Ltd, Schneider Electric, Rockwell Automation, Honeywell, Siemens AG, Crompton Greaves Power and Industrial Solutions Limited, Eaton Corporation, and others.

Europe Switchgear Industry Market Concentration & Innovation

The European switchgear market demonstrates a moderately concentrated landscape, with a few major players holding significant market share. ABB Ltd, Siemens AG, and Schneider Electric are among the dominant players, collectively accounting for an estimated xx% of the market in 2025. However, the market also features a number of smaller, specialized companies contributing to market diversity.

Market concentration is influenced by factors including:

- High barriers to entry: Significant capital investment is required for research, development, and manufacturing of advanced switchgear technologies.

- Stringent regulatory frameworks: Compliance with safety and environmental regulations adds to the complexity and cost of market entry.

- Technological innovation: Continuous innovation in switchgear technology, including the development of more efficient and sustainable solutions, shapes market competitiveness.

Mergers and acquisitions (M&A) activity in the industry has been moderate, with deal values totaling an estimated xx Million in the period 2019-2024. These activities primarily aim to enhance market share, expand product portfolios, and access new technologies.

Product substitution is a growing factor, driven by environmental concerns and the search for alternatives to sulfur hexafluoride (SF6), a potent greenhouse gas. This trend is fostering innovation in the development of eco-friendly switchgear solutions utilizing clean-air insulation technology.

End-user trends are also significantly impacting market dynamics. The increasing demand for electricity in industrial and commercial sectors fuels market growth, while the residential sector is experiencing slower but steady expansion.

Europe Switchgear Industry Industry Trends & Insights

The European switchgear market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors:

- Increasing infrastructure development: Ongoing investments in upgrading and expanding power grids across Europe drive demand for advanced switchgear solutions.

- Growing adoption of renewable energy sources: The integration of renewable energy sources, such as solar and wind power, necessitates robust and reliable switchgear infrastructure.

- Rising urbanization and industrialization: Growth in urban populations and industrial activities contribute to the increased demand for electricity and associated switchgear equipment.

- Government initiatives promoting energy efficiency: Regulatory policies incentivizing energy efficiency measures stimulate the adoption of advanced switchgear technologies.

However, market growth faces challenges, including economic downturns that can reduce investment in infrastructure projects and fluctuations in raw material prices impacting manufacturing costs. Market penetration of new technologies like clean-air insulated switchgear is gradually increasing, though it still faces challenges regarding cost and scalability. Competitive dynamics are intense, with major players engaged in price competition, product differentiation, and technological innovation.

Dominant Markets & Segments in Europe Switchgear Industry

The Industrial segment dominates the Europe switchgear market, accounting for the largest share in 2025 (estimated xx%). This dominance is attributable to the significant electricity consumption of industrial processes and the need for reliable and efficient switchgear equipment.

- By Country: Germany and the UK are the leading national markets, driven by robust industrial activity and significant investments in infrastructure modernization.

- By End-User:

- Industrial: High electricity consumption and stringent safety requirements drive demand.

- Commercial: Growth is driven by rising commercial construction and the need for reliable power distribution.

- Residential: This segment exhibits slower growth compared to industrial and commercial, reflecting lower electricity consumption per household.

- By Type: High-voltage switchgear holds a larger market share compared to low-voltage segments, due to its critical role in high-capacity power transmission and distribution. Within high-voltage switchgear, gas-insulated switchgear (GIS) using SF6 is currently dominant, despite growing demand for alternatives.

Key drivers for market dominance include:

- Strong industrial base: Germany and the UK possess large manufacturing sectors that are heavy energy consumers, fueling high demand for switchgear.

- Government support for infrastructure upgrades: Government policies supporting energy infrastructure development significantly influence market expansion.

- Technological advancements: Continuous innovation in switchgear technology improves efficiency, reliability, and safety, boosting market adoption.

Europe Switchgear Industry Product Developments

Recent product innovations focus on improving efficiency, reliability, safety, and environmental sustainability. This includes the development of gas-insulated switchgear (GIS) using alternatives to SF6, such as air or vacuum, and the integration of smart technologies for remote monitoring and control. These developments aim to meet the growing demand for eco-friendly and technologically advanced switchgear solutions. The market fit is driven by increased environmental regulations and customer preference for sustainable products.

Report Scope & Segmentation Analysis

This report segments the European switchgear market based on end-user (residential, commercial, industrial), country (UK, Germany, France, Italy, Rest of Europe), and type (voltage type, high-voltage by insulation type, others by installation type). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. For example, the industrial segment shows robust growth, while the residential segment demonstrates comparatively slower expansion. Germany and the UK are identified as leading national markets, driven by strong industrial activity and investment in grid infrastructure. High-voltage switchgear maintains a significant share, with ongoing developments in sustainable alternatives to SF6 impacting market trends.

Key Drivers of Europe Switchgear Industry Growth

Key growth drivers include increasing energy demand from industrialization and urbanization, investments in renewable energy infrastructure, stringent government regulations promoting energy efficiency, and the ongoing need for upgrading aging power grids. Government initiatives supporting renewable energy integration and grid modernization are particularly important in driving market growth. Technological advancements, including smart grid technologies and SF6 alternatives, are also crucial growth factors.

Challenges in the Europe Switchgear Industry Sector

Challenges include the high initial investment costs associated with switchgear installations, the potential for supply chain disruptions affecting component availability, and intense competition among established and emerging players. Stringent environmental regulations necessitate substantial R&D investments in developing SF6-free alternatives, adding to manufacturing costs. Economic fluctuations can also impact investment decisions related to power grid modernization and industrial expansion.

Emerging Opportunities in Europe Switchgear Industry

Emerging opportunities include the growing demand for smart grid technologies, the development and adoption of SF6-free switchgear, and the increasing focus on energy storage solutions. The integration of renewable energy sources creates new opportunities for advanced switchgear solutions designed to handle intermittent power supply. Expanding into emerging markets within Europe and leveraging digitalization strategies for improved efficiency present further opportunities.

Leading Players in the Europe Switchgear Industry Market

- ABB Ltd

- Toshiba International Corporation

- Hitachi Ltd

- Schneider Electric

- Rockwell Automation

- Honeywell

- Siemens AG

- Crompton Greaves Power and Industrial Solutions Limited

- Eaton Corporation

Key Developments in Europe Switchgear Industry Industry

- June 2021: Siemens Energy and Mitsubishi Electric signed a Memorandum of Understanding (MoU) to develop zero-GWP high-voltage switching systems using clean air insulation. This significantly impacts market dynamics by promoting the adoption of sustainable alternatives to SF6.

- May 2022: Nuventura, a German startup, aims to share its SF6 alternative technology with Chinese industries. This development could accelerate the global shift towards eco-friendly switchgear solutions and impact the competitive landscape.

Strategic Outlook for Europe Switchgear Industry Market

The European switchgear market presents significant growth potential driven by increasing energy demand, renewable energy integration, and the need for grid modernization. Focus on developing and adopting SF6-free technologies and smart grid solutions will be crucial for companies seeking to thrive in this evolving market. The industry’s future success hinges on adapting to environmental regulations and customer preferences for sustainable and technologically advanced switchgear solutions.

Europe Switchgear Industry Segmentation

-

1. Type

-

1.1. Voltage Type

- 1.1.1. Low-Voltage

- 1.1.2. Medium-Voltage

- 1.1.3. High-Voltage

-

1.2. Insulation Type

- 1.2.1. Gas Insulated

- 1.2.2. Air Insulated

- 1.2.3. Others

-

1.3. Installation Type

- 1.3.1. Indoor

- 1.3.2. Outdoor

-

1.1. Voltage Type

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

Europe Switchgear Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Switchgear Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Smart Electricity Grid Infrastructure in the region; Growing Focus on Renewable Energy Sources in Europe to avoid the energy dependency on Russia

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental and Safety Regulations

- 3.4. Market Trends

- 3.4.1. Gas Insulated Switchgear Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Switchgear Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Voltage Type

- 5.1.1.1. Low-Voltage

- 5.1.1.2. Medium-Voltage

- 5.1.1.3. High-Voltage

- 5.1.2. Insulation Type

- 5.1.2.1. Gas Insulated

- 5.1.2.2. Air Insulated

- 5.1.2.3. Others

- 5.1.3. Installation Type

- 5.1.3.1. Indoor

- 5.1.3.2. Outdoor

- 5.1.1. Voltage Type

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Switchgear Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Switchgear Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Switchgear Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Switchgear Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Switchgear Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Switchgear Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Switchgear Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ABB Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Toshiba International Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hitachi Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Schneider Electric

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Rockwell automation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Honeywell

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Siemens AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Crompton Greaves Power and Industrial Solutions Limited*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Eaton Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 ABB Ltd

List of Figures

- Figure 1: Europe Switchgear Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Switchgear Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Switchgear Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Switchgear Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Switchgear Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Europe Switchgear Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Switchgear Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Switchgear Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Switchgear Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 15: Europe Switchgear Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Switchgear Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Switchgear Industry?

The projected CAGR is approximately 6.70%.

2. Which companies are prominent players in the Europe Switchgear Industry?

Key companies in the market include ABB Ltd, Toshiba International Corporation, Hitachi Ltd, Schneider Electric, Rockwell automation, Honeywell, Siemens AG, Crompton Greaves Power and Industrial Solutions Limited*List Not Exhaustive, Eaton Corporation.

3. What are the main segments of the Europe Switchgear Industry?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of Smart Electricity Grid Infrastructure in the region; Growing Focus on Renewable Energy Sources in Europe to avoid the energy dependency on Russia.

6. What are the notable trends driving market growth?

Gas Insulated Switchgear Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Stringent Environmental and Safety Regulations.

8. Can you provide examples of recent developments in the market?

May 2022: Nuventura, a German startup, intends to share its technology with Chinese industries to find an alternative for sulfur hexafluoride, the most destructive greenhouse gas on the planet. For controlling, isolating, and protecting electrical equipment, sulfur hexafluoride is commonly employed in switchgear and circuit breakers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Switchgear Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Switchgear Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Switchgear Industry?

To stay informed about further developments, trends, and reports in the Europe Switchgear Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence