Key Insights

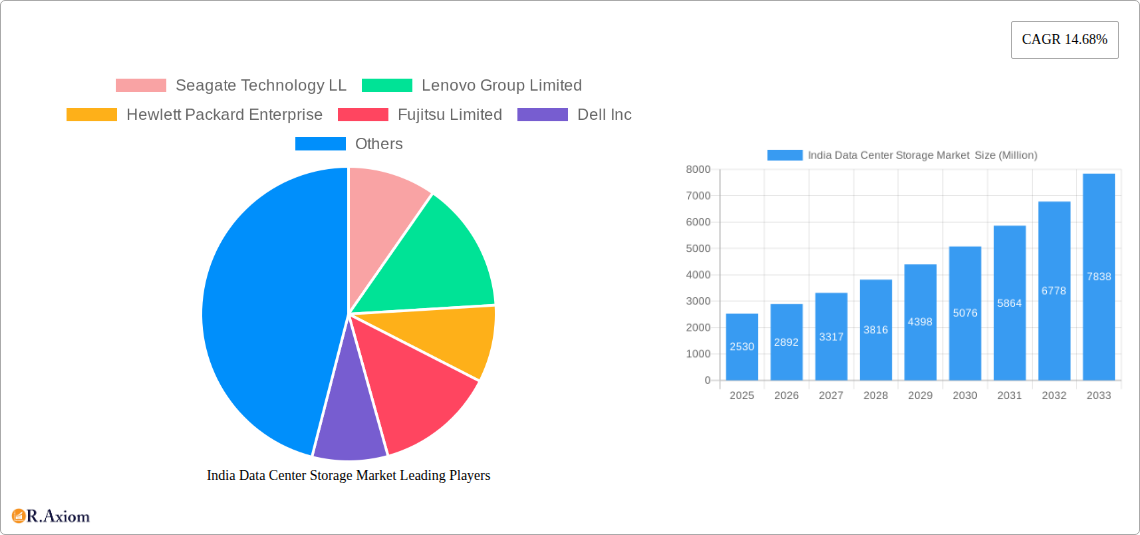

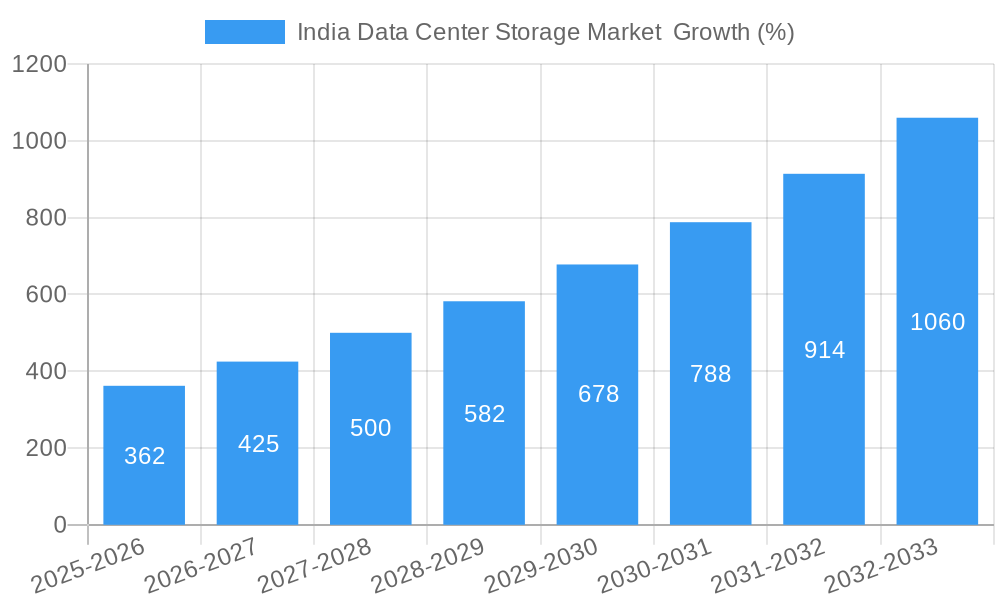

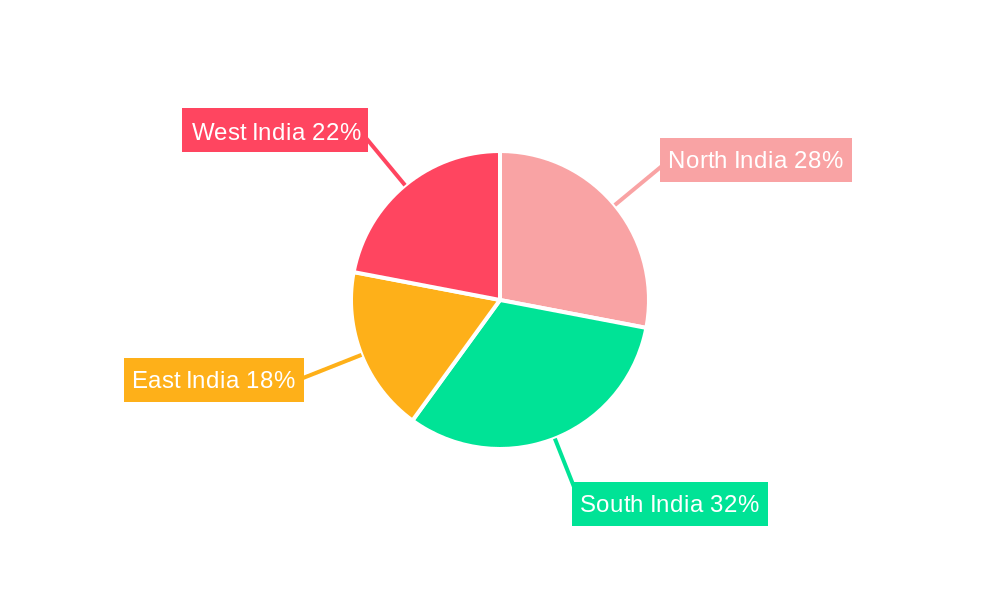

The India data center storage market is experiencing robust growth, projected to reach \$2.53 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.68% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of cloud computing and digital transformation initiatives across various sectors, including IT & Telecommunications, BFSI (Banking, Financial Services, and Insurance), and the government, are driving significant demand for data center storage solutions. Furthermore, the burgeoning media and entertainment industry, with its reliance on high-volume data storage and processing, is contributing significantly to market growth. The market is segmented by storage type (Traditional, All-Flash, Hybrid), end-user sector, and storage technology (NAS, SAN, DAS). All-Flash storage is witnessing particularly rapid adoption due to its superior performance and efficiency compared to traditional storage solutions. Growth is also being propelled by the increasing adoption of advanced technologies such as NVMe and the rise of hyperconverged infrastructure. However, challenges remain, including concerns around data security and the need for robust data management strategies. Regional variations exist within India, with significant growth expected across all regions (North, South, East, and West India) driven by expanding digital infrastructure and government initiatives promoting digitalization.

The competitive landscape is characterized by a mix of global and domestic players, including established names like Seagate, Lenovo, Hewlett Packard Enterprise, Dell, NetApp, and Kingston, alongside emerging technology providers focusing on specialized solutions. The market is witnessing strategic partnerships and mergers & acquisitions, aiming to enhance product offerings and expand market reach. Sustained investment in data center infrastructure and the rising demand for data analytics and big data solutions are expected to further bolster market growth over the forecast period. The growing focus on data sovereignty and compliance regulations in India is also impacting the selection of storage solutions, favoring providers who can effectively address these requirements. This dynamic interplay of drivers and challenges will shape the evolution of the Indian data center storage market in the years to come.

India Data Center Storage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India data center storage market, offering valuable insights for stakeholders, investors, and industry professionals. The report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. It segments the market by storage type (Traditional Storage, All-Flash Storage, Hybrid Storage), end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other End-User), and storage technology (Network Attached Storage (NAS), Storage Area Network (SAN), Direct Attached Storage (DAS), Other Technologies). The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

India Data Center Storage Market Concentration & Innovation

The India data center storage market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Seagate Technology, Dell Inc., NetApp Inc., and Hewlett Packard Enterprise are amongst the leading vendors, collectively accounting for approximately xx% of the market in 2025. However, the market is witnessing increased competition from emerging players offering innovative solutions.

Innovation is a key driver, fueled by the increasing adoption of cloud computing, big data analytics, and the Internet of Things (IoT). The demand for higher storage capacity, faster speeds, and enhanced data security is pushing technological advancements, particularly in all-flash storage and hybrid storage solutions. Regulatory frameworks, such as data localization policies, are also influencing market dynamics, encouraging investments in local data center infrastructure. Product substitution is evident with the gradual shift from traditional storage to newer, more efficient technologies. The market has witnessed significant M&A activity in recent years, with deal values exceeding xx Million in the last five years. This consolidation reflects the increasing strategic importance of data storage and the desire to gain market share. End-user trends favor solutions that offer scalability, flexibility, and cost-effectiveness, driving the demand for cloud-based storage solutions and managed services.

- Market Share of Top 4 Players in 2025: xx%

- Total M&A Deal Value (2020-2024): xx Million

- Key Innovation Drivers: Cloud computing, Big Data, IoT, Data Security

India Data Center Storage Market Industry Trends & Insights

The India data center storage market is experiencing robust growth driven by several factors. The rapid expansion of the IT sector, increasing digitalization across industries, and the government's initiatives to promote digital infrastructure are key contributors. The market is witnessing a significant shift from traditional storage to more efficient and scalable solutions like All-Flash and Hybrid storage. The growing adoption of cloud computing and the need for robust disaster recovery solutions are also driving demand. Technological advancements, such as NVMe (Non-Volatile Memory Express) technology and the emergence of AI-powered storage management tools, are reshaping the market landscape.

Consumer preferences are shifting towards flexible and scalable solutions offered through cloud services, impacting the demand for on-premise storage solutions. The competitive landscape is dynamic, with both established players and new entrants vying for market share. This competition is fostering innovation and driving down prices, benefiting end-users. The market has witnessed a CAGR of xx% during the historical period (2019-2024) and is expected to maintain a strong growth trajectory in the coming years. Market penetration of all-flash storage is increasing, driven by its performance advantages, but the traditional storage segment still maintains a significant share, especially in cost-sensitive applications.

Dominant Markets & Segments in India Data Center Storage Market

The IT & Telecommunication sector currently dominates the India data center storage market, followed by the BFSI and Government sectors. This dominance is driven by the substantial data storage needs of these sectors.

Key Drivers of Segment Dominance:

- IT & Telecommunication: Rapid growth of data centers, cloud computing adoption, increasing internet penetration.

- BFSI: Stringent regulatory compliance requirements, need for robust data security and business continuity solutions.

- Government: Initiatives for digital transformation, e-governance initiatives, and data management for various public services.

Storage Type: All-Flash storage is experiencing the fastest growth, driven by its performance advantages, although Traditional storage still holds a substantial market share due to cost considerations. Hybrid storage provides a balance between performance and cost, gaining significant traction.

Storage Technology: SAN technology holds the largest market share, due to its scalability and enterprise-grade features. However, NAS and DAS also maintain significant segments, particularly in smaller deployments.

India Data Center Storage Market Product Developments

Recent product developments are focused on improving storage performance, scalability, and security. This includes advancements in NVMe technology, the integration of AI/ML for data management and optimization, and the development of more robust security features to protect sensitive data. New products are increasingly designed for cloud integration and ease of management, appealing to both large enterprises and smaller businesses. The market is witnessing a trend toward software-defined storage (SDS) solutions, enhancing flexibility and reducing reliance on proprietary hardware.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation of the India data center storage market based on:

Storage Type: Traditional Storage, All-Flash Storage, Hybrid Storage. Each segment's growth projections, market size, and competitive dynamics are analyzed. All-Flash storage is expected to witness significant growth due to its performance advantages.

End-User: IT & Telecommunication, BFSI, Government, Media & Entertainment, Other End-Users. The IT & Telecommunication sector is currently the dominant segment.

Storage Technology: Network Attached Storage (NAS), Storage Area Network (SAN), Direct Attached Storage (DAS), Other Technologies. SAN currently dominates the market, but the demand for NAS and cloud-based storage solutions is increasing. Each segment's growth rate, market size, and key players are meticulously detailed.

Key Drivers of India Data Center Storage Market Growth

Several factors contribute to the growth of the India data center storage market. These include the rising adoption of cloud computing and big data analytics, which necessitate robust storage infrastructure. Government initiatives promoting digital transformation and the expanding IT sector are also key contributors. Increasing internet penetration and mobile usage generate massive amounts of data, driving demand for sophisticated storage solutions. Furthermore, the need for enhanced data security and disaster recovery solutions adds to the market's expansion.

Challenges in the India Data Center Storage Market Sector

The India data center storage market faces challenges, including the high initial investment costs associated with implementing new storage solutions. Competition from international vendors can be intense, creating price pressure. Furthermore, ensuring data security and compliance with evolving regulatory frameworks pose significant hurdles. Supply chain disruptions and power infrastructure limitations in certain regions can also impact market growth. These factors can collectively affect the overall adoption rate and limit expansion in some areas.

Emerging Opportunities in India Data Center Storage Market

The market presents opportunities in areas such as the increasing demand for edge computing and the adoption of AI-powered data management solutions. The growth of IoT applications is creating a significant need for scalable storage solutions. The development of new data center infrastructure, especially in tier-2 and tier-3 cities, presents substantial growth potential. Furthermore, the increasing focus on data security and compliance creates opportunities for specialized security solutions and managed services.

Leading Players in the India Data Center Storage Market Market

- Seagate Technology LL

- Lenovo Group Limited

- Hewlett Packard Enterprise

- Fujitsu Limited

- Dell Inc

- NetApp Inc

- Kingston Technology Company Inc

- Oracle Corporation

- Pure Storage Inc

- Hitachi Vantara LLC

Key Developments in India Data Center Storage Market Industry

- January 2023: Dell Technologies launched its new PowerStore storage array, emphasizing improved performance and scalability.

- June 2022: NetApp announced a strategic partnership with a local cloud provider to expand its reach in the Indian market.

- October 2021: Seagate introduced a new line of hard disk drives optimized for data center applications. (Further developments can be added here)

Strategic Outlook for India Data Center Storage Market Market

The India data center storage market is poised for continued strong growth, driven by the factors mentioned earlier. The increasing adoption of cloud computing, the expanding IT sector, and government initiatives will continue to fuel demand. Opportunities exist in emerging technologies like edge computing and AI-powered data management. Companies that can adapt to the evolving technological landscape and meet the growing demand for secure and scalable storage solutions are well-positioned for success in this dynamic market. The focus on data localization policies is likely to boost the adoption of locally-based storage infrastructure.

India Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-Flash Storage

- 2.3. Hybrid Storage

-

3. End-User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media & Entertainment

- 3.5. Other End-User

India Data Center Storage Market Segmentation By Geography

- 1. India

India Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of IT Infrastructure to Increase Market Growth; Increased Investments in Hyperscale Data Centers To Increase Market Growth

- 3.3. Market Restrains

- 3.3.1. High Initial Investment Cost To Hinder Market Growth

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-Flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media & Entertainment

- 5.3.5. Other End-User

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. North India India Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Seagate Technology LL

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lenovo Group Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hewlett Packard Enterprise

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fujitsu Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Dell Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NetApp Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kingston Technology Company Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Oracle Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Pure Storage Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Hitachi Vantara LLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Seagate Technology LL

List of Figures

- Figure 1: India Data Center Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Data Center Storage Market Share (%) by Company 2024

List of Tables

- Table 1: India Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 3: India Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 4: India Data Center Storage Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: India Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 12: India Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 13: India Data Center Storage Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 14: India Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Data Center Storage Market ?

The projected CAGR is approximately 14.68%.

2. Which companies are prominent players in the India Data Center Storage Market ?

Key companies in the market include Seagate Technology LL, Lenovo Group Limited, Hewlett Packard Enterprise, Fujitsu Limited, Dell Inc, NetApp Inc, Kingston Technology Company Inc, Oracle Corporation, Pure Storage Inc, Hitachi Vantara LLC.

3. What are the main segments of the India Data Center Storage Market ?

The market segments include Storage Technology, Storage Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of IT Infrastructure to Increase Market Growth; Increased Investments in Hyperscale Data Centers To Increase Market Growth.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

High Initial Investment Cost To Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Data Center Storage Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Data Center Storage Market ?

To stay informed about further developments, trends, and reports in the India Data Center Storage Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence