Key Insights

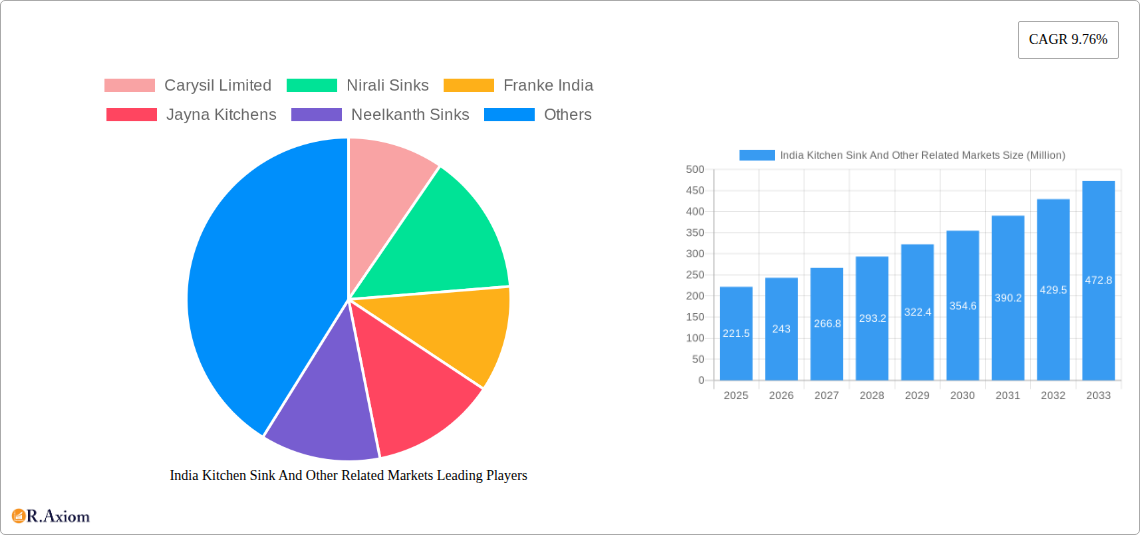

The India kitchen sink and related markets, valued at ₹221.5 million in 2025, are experiencing robust growth, projected at a CAGR of 9.76% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes and a burgeoning middle class are significantly increasing demand for modern, aesthetically pleasing kitchens, driving adoption of high-quality sinks. Furthermore, a shift towards organized retail and increased online sales channels is making premium products more accessible to a wider consumer base. The growing popularity of modular kitchens, which typically incorporate integrated sinks, is another crucial factor contributing to market growth. While challenges like fluctuating raw material prices and intense competition exist, the overall market outlook remains positive. The market is segmented by material type (stainless steel, granite, composite, etc.), style (single bowl, double bowl, farmhouse, etc.), and price range (budget, mid-range, premium), offering diverse options for consumers. Key players like Carysil Limited, Franke India, and Cera Sanitaryware are strategically investing in product innovation and brand building to capture market share. The regional distribution shows significant potential across major metropolitan areas and Tier-1 cities, with expansion into Tier-2 and Tier-3 cities anticipated in the coming years, contributing to further market expansion.

The forecast period (2025-2033) anticipates continued growth driven by urbanization, rising consumer preference for durable and stylish kitchen fixtures, and increased government initiatives promoting affordable housing. This will likely lead to an increase in both the volume and value of kitchen sink sales. Competitive strategies will likely focus on diversification of product offerings, strategic partnerships with interior designers and builders, and enhanced marketing campaigns targeting specific consumer segments. The market is expected to see increased innovation in sink design, functionality, and materials, catering to evolving consumer preferences for smart kitchens and sustainable products. This growth trajectory makes the India kitchen sink market an attractive prospect for both established and emerging players.

India Kitchen Sink and Other Related Markets: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India kitchen sink and related markets, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The report forecasts market trends from 2025-2033, analyzing the historical period of 2019-2024. Key players analyzed include Carysil Limited, Nirali Sinks, Franke India, Jayna Kitchens, Neelkanth Sinks, Alveus India, Shalimar Sinks, Century Sinks, Cera Sanitaryware, and Resteil India (list not exhaustive).

India Kitchen Sink and Other Related Markets Market Concentration & Innovation

This section analyzes the competitive landscape of the Indian kitchen sink market, examining market concentration, innovation drivers, regulatory influences, substitute products, end-user trends, and mergers & acquisitions (M&A) activities. The market is moderately concentrated, with a few major players holding significant market share. Precise market share data for each player is unavailable but estimated to be distributed among the top players in the range of xx% to xx% each for the top five brands, while others have xx%. Innovation is driven by increasing consumer demand for technologically advanced, aesthetically pleasing, and durable sinks. Regulatory frameworks, including those related to water conservation and material safety, influence product development. Stainless steel sinks dominate the market, but substitutes like composite materials and ceramic sinks are gaining traction. End-user trends favor integrated sinks with additional features like drain boards and built-in cutting boards. M&A activity in the sector has been relatively low in recent years; however, a predicted total deal value of xx Million has been observed during the historical period, with smaller deals being more frequent.

India Kitchen Sink and Other Related Markets Industry Trends & Insights

The Indian kitchen sink market exhibits strong growth potential, driven by factors including rising disposable incomes, increasing urbanization, and a preference for modern kitchen designs. The market is expected to register a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the introduction of smart sinks with integrated features, are transforming the market. Consumer preferences are shifting toward stylish, functional, and durable sinks with a focus on hygiene. The competitive landscape is characterized by both established players and new entrants, leading to increased product differentiation and price competition. Market penetration of technologically advanced sinks is still relatively low but is showing a steep upward trend, expected to reach xx% by 2033.

Dominant Markets & Segments in India Kitchen Sink and Other Related Markets

The metropolitan regions of India, particularly Mumbai, Delhi-NCR, Bengaluru, and Chennai, represent dominant markets for kitchen sinks. These regions are characterized by high population density, rising real estate prices, and strong demand for premium products.

- Key Drivers:

- Rapid urbanization and rising disposable incomes.

- Growing preference for modular kitchens and modern homes.

- Increased investment in real estate and infrastructure development.

- Favorable government policies promoting affordable housing.

The stainless steel segment dominates in terms of material, driven by its durability, affordability, and ease of maintenance. However, the composite material segment is experiencing significant growth due to its aesthetic appeal and availability in a wider range of colors and finishes.

India Kitchen Sink and Other Related Markets Product Developments

Recent product innovations include smart sinks with integrated features, such as water filtration systems and waste disposal units. Manufacturers are focusing on enhancing the aesthetic appeal of sinks through innovative designs and finishes. The competitive advantage lies in offering a combination of functionality, durability, and design features that cater to evolving consumer preferences. Technological trends include the integration of smart home technology and the use of sustainable materials.

Report Scope & Segmentation Analysis

The report segments the market based on material (stainless steel, composite, ceramic, etc.), type (single bowl, double bowl, etc.), price range (economy, mid-range, premium), and region (urban, rural). Each segment shows varying growth trajectories based on factors including affordability, consumer preference, and regional economic conditions. For instance, the stainless steel segment is mature but enjoys large market share; composite is experiencing strong growth, with premium segments experiencing faster growth. Competitive dynamics vary across segments, with differing levels of competition and market concentration.

Key Drivers of India Kitchen Sink and Other Related Markets Growth

Several factors contribute to the growth of the Indian kitchen sink market. These include increasing urbanization, rising disposable incomes fueling demand for improved home amenities, growing awareness of hygiene, and a shift toward modern kitchen designs. Government initiatives supporting affordable housing projects also play a significant role. Furthermore, the introduction of innovative products with enhanced features further contributes to market expansion.

Challenges in the India Kitchen Sink and Other Related Markets Sector

The market faces challenges like fluctuating raw material prices impacting production costs, intense competition among manufacturers, and concerns about counterfeiting. Supply chain disruptions, especially post-pandemic, affect product availability and pricing. Furthermore, consumer preference for certain styles can heavily influence sales. These factors impact overall profitability and market stability, resulting in estimated losses of xx Million annually.

Emerging Opportunities in India Kitchen Sink and Other Related Markets

The market presents significant opportunities in the tier-2 and tier-3 cities, which are witnessing rapid urbanization. The growth of online retail channels provides a platform for reaching a wider customer base and increased product visibility. Innovations in sink materials and designs continue to unlock new avenues for expansion.

Leading Players in the India Kitchen Sink and Other Related Markets Market

- Carysil Limited

- Nirali Sinks

- Franke India

- Jayna Kitchens

- Neelkanth Sinks

- Alveus India

- Shalimar Sinks

- Century Sinks

- Cera Sanitaryware

- Resteil India

Key Developments in India Kitchen Sink and Other Related Markets Industry

- June 2024: Ruhe launched a Nano 304-Grade Kitchen Sink with an integrated waterfall, pull-out, and RO faucet.

- February 2024: Kohler launched its Cairn kitchen sinks in India, marking its entry into this market segment.

Strategic Outlook for India Kitchen Sink and Other Related Markets Market

The Indian kitchen sink market is poised for sustained growth, driven by positive economic indicators, evolving consumer preferences, and technological advancements. Strategic partnerships, product diversification, and a focus on innovation will be critical for success in this dynamic market. The market is projected to reach xx Million by 2033, presenting substantial opportunities for established players and new entrants alike.

India Kitchen Sink And Other Related Markets Segmentation

-

1. Number of Bowls

- 1.1. Single

- 1.2. Double

- 1.3. Multi

-

2. Material

- 2.1. Metallic

- 2.2. Granite

-

3. Market

- 3.1. Kitchen Sink Market

- 3.2. Stainless Steel Market

- 3.3. Quartz Kitchen Sink Market

India Kitchen Sink And Other Related Markets Segmentation By Geography

- 1. India

India Kitchen Sink And Other Related Markets REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Urbanization is Driving the Market; Increased Spending on Home Decor and Adoption of Products in the Commercial Sector

- 3.3. Market Restrains

- 3.3.1. Rising Urbanization is Driving the Market; Increased Spending on Home Decor and Adoption of Products in the Commercial Sector

- 3.4. Market Trends

- 3.4.1. Berlin Leads in Total Warehousing Take-up

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Kitchen Sink And Other Related Markets Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Number of Bowls

- 5.1.1. Single

- 5.1.2. Double

- 5.1.3. Multi

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Metallic

- 5.2.2. Granite

- 5.3. Market Analysis, Insights and Forecast - by Market

- 5.3.1. Kitchen Sink Market

- 5.3.2. Stainless Steel Market

- 5.3.3. Quartz Kitchen Sink Market

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Number of Bowls

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Carysil Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nirali Sinks

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Franke India

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jayna Kitchens

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Neelkanth Sinks

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alveus India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shalimar Sinks

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Century Sinks

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cera Sanitaryware

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Resteil India**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Carysil Limited

List of Figures

- Figure 1: India Kitchen Sink And Other Related Markets Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Kitchen Sink And Other Related Markets Share (%) by Company 2024

List of Tables

- Table 1: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Region 2019 & 2032

- Table 3: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Number of Bowls 2019 & 2032

- Table 4: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Number of Bowls 2019 & 2032

- Table 5: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Material 2019 & 2032

- Table 6: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Material 2019 & 2032

- Table 7: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Market 2019 & 2032

- Table 8: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Market 2019 & 2032

- Table 9: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Region 2019 & 2032

- Table 10: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Region 2019 & 2032

- Table 11: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Number of Bowls 2019 & 2032

- Table 12: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Number of Bowls 2019 & 2032

- Table 13: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Material 2019 & 2032

- Table 14: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Material 2019 & 2032

- Table 15: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Market 2019 & 2032

- Table 16: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Market 2019 & 2032

- Table 17: India Kitchen Sink And Other Related Markets Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India Kitchen Sink And Other Related Markets Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Kitchen Sink And Other Related Markets?

The projected CAGR is approximately 9.76%.

2. Which companies are prominent players in the India Kitchen Sink And Other Related Markets?

Key companies in the market include Carysil Limited, Nirali Sinks, Franke India, Jayna Kitchens, Neelkanth Sinks, Alveus India, Shalimar Sinks, Century Sinks, Cera Sanitaryware, Resteil India**List Not Exhaustive.

3. What are the main segments of the India Kitchen Sink And Other Related Markets?

The market segments include Number of Bowls , Material , Market.

4. Can you provide details about the market size?

The market size is estimated to be USD 221.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Urbanization is Driving the Market; Increased Spending on Home Decor and Adoption of Products in the Commercial Sector.

6. What are the notable trends driving market growth?

Berlin Leads in Total Warehousing Take-up.

7. Are there any restraints impacting market growth?

Rising Urbanization is Driving the Market; Increased Spending on Home Decor and Adoption of Products in the Commercial Sector.

8. Can you provide examples of recent developments in the market?

In June 2024, Ruhe, a manufacturer, introduced a Nano 304-Grade Kitchen Sink. This innovative sink features an Integrated Waterfall, Pull-Out, and RO Faucet, measuring 30 x 18 x 9 inches.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Kitchen Sink And Other Related Markets," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Kitchen Sink And Other Related Markets report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Kitchen Sink And Other Related Markets?

To stay informed about further developments, trends, and reports in the India Kitchen Sink And Other Related Markets, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence