Key Insights

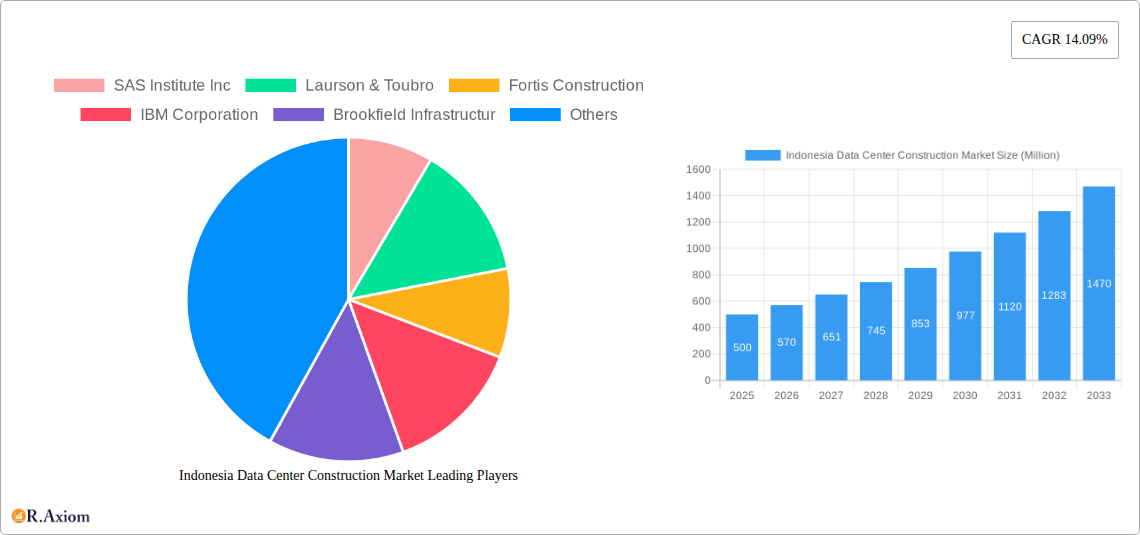

The Indonesian data center construction market is experiencing robust growth, projected to reach a substantial size by 2033. A Compound Annual Growth Rate (CAGR) of 14.09% from 2019 to 2024 indicates a significant upward trajectory fueled by several key drivers. The increasing adoption of cloud computing, e-commerce, and digital services within Indonesia's burgeoning economy necessitates a robust data center infrastructure. Furthermore, government initiatives promoting digital transformation and the expansion of 5G networks are significantly contributing to this growth. The market is segmented by tier type (Tier 1-4), data center size (small to massive), infrastructure components (cooling, power, security, etc.), and end-user sectors (IT & Telecom, BFSI, Government, Healthcare). The presence of major players like IBM, Schneider Electric, and local companies like Laurson & Toubro reflects the market's maturity and potential for further expansion. Competition is likely to intensify as both established international companies and domestic firms vie for market share. While specific challenges such as infrastructure limitations and regulatory hurdles exist, the overall outlook remains positive, presenting lucrative opportunities for investors and industry players. The market’s expansion is likely driven by the country’s digital economy development, leading to a high demand for data storage and processing capabilities. The strong growth is also supported by increasing foreign direct investment in Indonesia's digital infrastructure, aiming to capitalize on the vast untapped market potential.

The forecast period (2025-2033) anticipates continued expansion, albeit potentially at a slightly moderated rate compared to the historical period. The shift towards larger, more sophisticated data center designs (Mega and Massive) is likely, driven by the demand for high capacity and scalability. Growth within specific segments, such as cooling infrastructure and power distribution units (PDUs), is anticipated to outpace the overall market average, reflecting the critical role these components play in data center functionality and reliability. The increasing adoption of sustainable data center practices, focusing on energy efficiency and reduced environmental impact, will also shape future market developments. The Indonesian government's strategic focus on digital infrastructure development provides further impetus, indicating sustained growth for the foreseeable future.

Indonesia Data Center Construction Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Indonesia data center construction market, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report offers actionable intelligence on market size, growth drivers, challenges, and opportunities. The analysis encompasses various segments including Tier types, data center sizes, infrastructure components, end-users, and key players. Projected market values are in Millions.

Indonesia Data Center Construction Market Market Concentration & Innovation

The Indonesian data center construction market exhibits a moderately concentrated landscape, with a few dominant players and several emerging competitors. Market share is primarily influenced by factors such as financial strength, technological capabilities, and established client relationships. While precise market share figures for individual companies are not publicly available for every player and are subject to constant change, the market shows signs of increasing consolidation through mergers and acquisitions (M&A). Recent M&A activity, such as the August 2022 transfer of Telkomsigma's data center business to TDE for IDR 2.01 trillion (approximately xx Million USD), reflects strategic restructuring within the sector and a push toward larger, more integrated players. Innovation is driven by the demand for higher power density, enhanced security features, and sustainable solutions. Government regulations, such as those related to data sovereignty and cybersecurity, significantly influence market dynamics. The presence of substitute technologies, such as edge computing, is gradually impacting the traditional data center model. End-user trends, especially the growing adoption of cloud services and digital transformation initiatives across various sectors (BFSI, IT & Telecommunication, Government), fuel market expansion.

- Market Concentration: Moderately concentrated, with potential for further consolidation.

- M&A Activity: Significant recent activity, indicating strategic restructuring and growth. Estimated deal value in 2022: xx Million USD.

- Innovation Drivers: Demand for higher power density, enhanced security, and sustainable infrastructure.

- Regulatory Framework: Government regulations on data sovereignty and cybersecurity.

- Product Substitutes: Emergence of edge computing and other alternative solutions.

- End-User Trends: Strong growth driven by cloud adoption and digital transformation.

Indonesia Data Center Construction Market Industry Trends & Insights

The Indonesian data center construction market is experiencing robust growth, driven by the rapid expansion of the digital economy, increasing data consumption, and government initiatives promoting digitalization. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%, indicating strong and sustained expansion. Technological advancements, such as the adoption of AI and machine learning for data center optimization and the deployment of innovative cooling technologies, further contribute to market expansion. Consumer preferences are shifting toward scalable, energy-efficient, and secure data center solutions. Competitive dynamics are characterized by both collaboration and rivalry among existing and emerging players, leading to strategic partnerships, technological advancements, and pricing strategies. Market penetration of advanced technologies like liquid cooling systems is steadily rising but faces challenges related to costs and expertise. The overall market is witnessing a significant shift towards higher-tier data centers (Tier III and Tier IV) to meet the needs of hyperscale operators and large enterprises.

Dominant Markets & Segments in Indonesia Data Center Construction Market

The Jakarta metropolitan area currently dominates the Indonesian data center construction market due to its concentration of businesses, skilled workforce, and robust infrastructure. However, other major cities are witnessing increasing investment.

- Key Drivers for Jakarta's Dominance: High concentration of businesses, skilled workforce, established infrastructure, and government support.

Segment Dominance:

- Tier Type: Tier III and Tier IV data centers are showing the most significant growth, driven by hyperscale deployments.

- Data Center Size: Large and Mega data centers are experiencing the highest demand.

- Infrastructure: Power infrastructure (including Power Distribution Units – PDUs) and cooling infrastructure remain crucial segments, with significant investment in advanced solutions.

- End-User: IT & Telecommunication and BFSI sectors are major drivers, followed by the government sector.

The market's growth is influenced by several factors:

- Economic Policies: Government initiatives promoting digitalization and investment in infrastructure are significant catalysts.

- Infrastructure Development: The expansion of fiber optic networks and improved power grids are vital.

Indonesia Data Center Construction Market Product Developments

Significant product innovations are focused on improving energy efficiency, enhancing security, and increasing scalability. This includes advancements in cooling technologies (e.g., liquid cooling, evaporative cooling), modular data center designs, and AI-powered management systems. These innovations offer competitive advantages by reducing operational costs, improving performance, and enhancing security. The market is witnessing a growing adoption of prefabricated modular data centers, offering faster deployment and cost savings.

Report Scope & Segmentation Analysis

This report segments the Indonesian data center construction market based on Tier Type (Tier I, Tier II, Tier III, Tier IV), Data Center Size (Small, Medium, Large, Mega, Massive), Infrastructure (Cooling, Power, Racks & Cabinets, Servers, Networking, Physical Security, Design & Consulting, Other), and End-User (IT & Telecommunication, BFSI, Government, Healthcare, Other). Growth projections for each segment vary depending on factors like technology adoption, regulatory changes, and end-user demand. Market size estimations are based on capacity and investment values. Competitive dynamics within each segment are also analyzed. For instance, the cooling infrastructure segment is seeing increasing competition among providers of various cooling technologies.

Key Drivers of Indonesia Data Center Construction Market Growth

Several factors are driving the growth of the Indonesian data center construction market:

- Rapid Digitalization: Indonesia's growing digital economy is fueling demand for data storage and processing capacity.

- Government Support: Government initiatives to promote digital infrastructure development are encouraging investment.

- Foreign Investment: Increased foreign investment in the Indonesian data center sector is stimulating market expansion.

- Rising Data Consumption: Growing internet and mobile penetration is resulting in increased data consumption.

Challenges in the Indonesia Data Center Construction Market Sector

The Indonesian data center construction market faces several challenges:

- Land Acquisition: Securing suitable land for data center construction can be complex and time-consuming.

- Power Supply Reliability: Ensuring a stable and reliable power supply can be a challenge in some regions.

- Regulatory Hurdles: Navigating regulatory processes and obtaining necessary permits can be cumbersome.

- Skills Gap: A shortage of skilled labor in the data center construction sector can impede development.

Emerging Opportunities in Indonesia Data Center Construction Market

Several emerging opportunities exist in the Indonesian data center construction market:

- Edge Computing: The growth of edge computing offers opportunities for building smaller, distributed data centers.

- Sustainable Data Centers: Demand for environmentally friendly and energy-efficient data center designs is growing.

- Hyperscale Data Centers: Large-scale data center projects by hyperscale providers present significant growth potential.

- Expansion Beyond Java: Developing data centers in other regions of Indonesia can address geographical limitations.

Leading Players in the Indonesia Data Center Construction Market Market

- SAS Institute Inc

- Laurson & Toubro

- Fortis Construction

- IBM Corporation

- Brookfield Infrastructure

- Schneider Electric SE

- Turner Construction Co

- Delta Power Solutions

- Legrand

- NTT Facilities

- AECOM

- Iris Global

Key Developments in Indonesia Data Center Construction Market Industry

- September 2022: A company commenced construction on a 23 MW data center in Jakarta, with 3,430 cabinets, expected to complete by Q4 2023. This reflects the increasing demand for high-power density applications.

- August 2022: PT Telkomsigma transferred its data center business to PT Telkom Data Ekosistem (TDE) for IDR 2.01 trillion (approximately xx Million USD), indicating market consolidation.

Strategic Outlook for Indonesia Data Center Construction Market Market

The Indonesian data center construction market is poised for continued strong growth, driven by the country's rapid digital transformation and increasing demand for data storage and processing. Opportunities exist for companies to capitalize on the expanding market by investing in advanced technologies, focusing on sustainability, and adapting to evolving regulatory landscapes. The focus on hyperscale deployments and the development of robust infrastructure will be key factors in determining future market success.

Indonesia Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDUs - B

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-voltage

- 1.1.1.3.2. Medium-voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Others

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-to-chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-row and In-rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructures

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDUs - B

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-voltage

- 2.1.3.2. Medium-voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Others

-

2.2. Power Backup Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDUs - B

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-voltage

- 3.3.2. Medium-voltage

- 3.4. Power Panels and Components

- 3.5. Others

-

4. Power Backup Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-to-chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-row and In-rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructures

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-to-chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-row and In-rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructures

- 10. General Construction

-

11. Tier Type

- 11.1. Tier-I and-II

- 11.2. Tier-III

- 11.3. Tier-IV

- 12. Tier-I and-II

- 13. Tier-III

- 14. Tier-IV

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

Indonesia Data Center Construction Market Segmentation By Geography

- 1. Indonesia

Indonesia Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.09% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Major ICT Indicators Contributing to the Growth of Data Centre in Indonesia; Rise of Green Data Centers; Government Support in the Form of Tax Incentives for Development of Data Centers

- 3.3. Market Restrains

- 3.3.1. Higher Initial Investments and Low Availability of Resources

- 3.4. Market Trends

- 3.4.1. Major ICT Indicators Contributing to the Growth of Data Centre in Indonesia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDUs - B

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-voltage

- 5.1.1.1.3.2. Medium-voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Others

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-to-chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-row and In-rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructures

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDUs - B

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-voltage

- 5.2.1.3.2. Medium-voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Others

- 5.2.2. Power Backup Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDUs - B

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-voltage

- 5.3.3.2. Medium-voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Power Backup Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-to-chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-row and In-rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructures

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-to-chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-row and In-rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructures

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier-I and-II

- 5.11.2. Tier-III

- 5.11.3. Tier-IV

- 5.12. Market Analysis, Insights and Forecast - by Tier-I and-II

- 5.13. Market Analysis, Insights and Forecast - by Tier-III

- 5.14. Market Analysis, Insights and Forecast - by Tier-IV

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by Region

- 5.21.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SAS Institute Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Laurson & Toubro

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fortis Construction

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IBM Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Brookfield Infrastructur

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schneider Electric SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Turner Construction Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Delta Power Solutions

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Legrand

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NTT Facillities

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 AECOM

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Iris Global

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 SAS Institute Inc

List of Figures

- Figure 1: Indonesia Data Center Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Data Center Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 3: Indonesia Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 4: Indonesia Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 5: Indonesia Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 6: Indonesia Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 7: Indonesia Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 8: Indonesia Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 9: Indonesia Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 10: Indonesia Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructures 2019 & 2032

- Table 11: Indonesia Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 12: Indonesia Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 13: Indonesia Data Center Construction Market Revenue Million Forecast, by Tier-I and-II 2019 & 2032

- Table 14: Indonesia Data Center Construction Market Revenue Million Forecast, by Tier-III 2019 & 2032

- Table 15: Indonesia Data Center Construction Market Revenue Million Forecast, by Tier-IV 2019 & 2032

- Table 16: Indonesia Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Indonesia Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 18: Indonesia Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 19: Indonesia Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 20: Indonesia Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 21: Indonesia Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 22: Indonesia Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 23: Indonesia Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Indonesia Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 25: Indonesia Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 26: Indonesia Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 27: Indonesia Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 28: Indonesia Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 29: Indonesia Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 30: Indonesia Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 31: Indonesia Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 32: Indonesia Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructures 2019 & 2032

- Table 33: Indonesia Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 34: Indonesia Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 35: Indonesia Data Center Construction Market Revenue Million Forecast, by Tier-I and-II 2019 & 2032

- Table 36: Indonesia Data Center Construction Market Revenue Million Forecast, by Tier-III 2019 & 2032

- Table 37: Indonesia Data Center Construction Market Revenue Million Forecast, by Tier-IV 2019 & 2032

- Table 38: Indonesia Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 39: Indonesia Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 40: Indonesia Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 41: Indonesia Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 42: Indonesia Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 43: Indonesia Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 44: Indonesia Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Data Center Construction Market?

The projected CAGR is approximately 14.09%.

2. Which companies are prominent players in the Indonesia Data Center Construction Market?

Key companies in the market include SAS Institute Inc, Laurson & Toubro, Fortis Construction, IBM Corporation, Brookfield Infrastructur, Schneider Electric SE, Turner Construction Co, Delta Power Solutions, Legrand, NTT Facillities, AECOM, Iris Global.

3. What are the main segments of the Indonesia Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Backup Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructures, General Construction, Tier Type, Tier-I and-II, Tier-III, Tier-IV, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Major ICT Indicators Contributing to the Growth of Data Centre in Indonesia; Rise of Green Data Centers; Government Support in the Form of Tax Incentives for Development of Data Centers.

6. What are the notable trends driving market growth?

Major ICT Indicators Contributing to the Growth of Data Centre in Indonesia.

7. Are there any restraints impacting market growth?

Higher Initial Investments and Low Availability of Resources.

8. Can you provide examples of recent developments in the market?

September 2022: The company commenced construction on a 23 MW data center in Jakarta, Indonesia, marking the company's third site in South East Asia as it capitalizes on the region's rapid digital transformation in the wake of the global pandemic. The new facility will offer 3,430 cabinets and an IT load of 23 MW and is designed to cater to the growing demand for high-power density applications from cloud-driven hyperscale deployments, local and international networks, and financial service providers. It is expected to complete by Q4 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Indonesia Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence