Key Insights

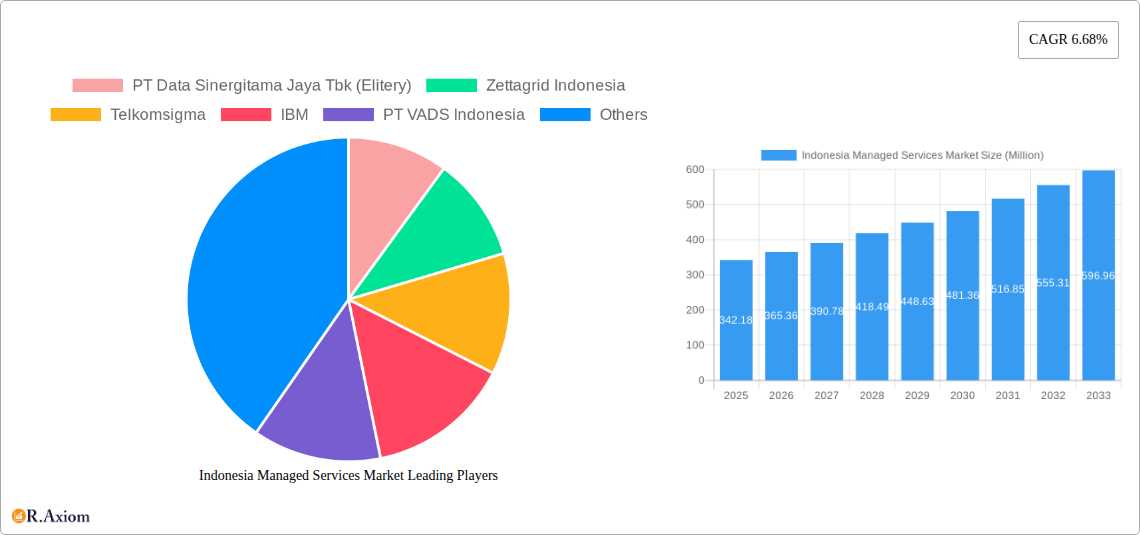

The Indonesia Managed Services Market is experiencing robust growth, projected to reach a market size of $342.18 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.68% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of cloud computing and digital transformation initiatives across various sectors, including finance, healthcare, and e-commerce, are creating significant demand for managed services. Businesses in Indonesia are increasingly outsourcing IT functions to focus on core competencies, leading to higher reliance on external providers for managed services such as data center management, network infrastructure, and cybersecurity. Furthermore, the growing awareness of cost optimization strategies and the need for enhanced IT security are driving market growth. The competitive landscape comprises both domestic and international players, including PT Data Sinergitama Jaya Tbk (Elitery), Zettagrid Indonesia, Telkomsigma, IBM, PT VADS Indonesia, Eranyacloud, Accord Innovations Indonesia, Amazon Web Services, PT Cyberindo Mega Persada (CBNCloud), and Microsoft, fostering innovation and competition.

The market's segmentation, while not explicitly provided, likely reflects the diverse service offerings within the managed services sector. This could include segments based on service type (e.g., cloud managed services, IT infrastructure management, cybersecurity services), industry vertical (e.g., BFSI, government, manufacturing), or deployment model (e.g., on-premise, cloud-based, hybrid). Challenges include the need for skilled IT professionals and the potential for security risks associated with outsourcing sensitive data. Despite these challenges, the long-term outlook remains positive, driven by sustained economic growth and increasing digitalization across Indonesia. The forecast period of 2025-2033 presents significant opportunities for market players to capitalize on the expanding demand for efficient and reliable managed services.

Indonesia Managed Services Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Indonesia Managed Services Market, offering invaluable insights for industry stakeholders, investors, and businesses operating within or considering entry into this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. The report incorporates high-impact keywords to ensure maximum search engine visibility and engagement.

Indonesia Managed Services Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Indonesian managed services market, focusing on market concentration, innovation drivers, regulatory aspects, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of large multinational corporations and smaller, agile local players. While precise market share figures for each player are proprietary data, we estimate that the top five players (including IBM, Microsoft, Amazon Web Services, Telkomsigma, and PT Data Sinergitama Jaya Tbk (Elitery)) collectively hold approximately xx% of the market share in 2025.

- Market Concentration: The market exhibits moderate concentration, with a few dominant players and numerous smaller niche providers.

- Innovation Drivers: Growing adoption of cloud computing, increasing demand for digital transformation, and government initiatives promoting digital infrastructure are major drivers of innovation.

- Regulatory Framework: The Indonesian government's focus on digitalization creates a supportive regulatory environment, though navigating licensing and data privacy regulations remains a key consideration.

- Product Substitutes: Open-source solutions and in-house IT teams pose some level of competition, but the complexity and specialized expertise required often favor managed service providers.

- End-User Trends: Businesses in Indonesia are increasingly outsourcing IT management to focus on core competencies, driving market growth.

- M&A Activity: We predict that the value of M&A deals in this sector will reach approximately xx Million in 2025, driven by consolidation efforts and expansion strategies by larger players.

Indonesia Managed Services Market Industry Trends & Insights

The Indonesia Managed Services Market is experiencing robust growth, driven by factors such as rising digital adoption, increasing government investments in digital infrastructure, and the expanding need for businesses to improve operational efficiency. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is expected to reach approximately xx% by 2033. Technological disruptions, particularly the increasing adoption of cloud-based solutions and artificial intelligence (AI), are reshaping the competitive landscape. Consumer preferences are shifting toward flexible and scalable solutions, emphasizing cost-effectiveness and enhanced security. Competitive dynamics are marked by intense competition, with both global and local players vying for market share through innovation, strategic partnerships, and competitive pricing.

Dominant Markets & Segments in Indonesia Managed Services Market

The Jakarta metropolitan area currently represents the largest and most dominant segment of the Indonesian managed services market, driven by high concentration of businesses and advanced digital infrastructure. This dominance is further amplified by the region's strong economic activity and concentration of skilled IT professionals.

- Key Drivers of Jakarta's Dominance:

- Robust economic growth and a large concentration of businesses across various sectors.

- Well-developed IT infrastructure, including high-speed internet access and robust data centers.

- A large pool of skilled IT professionals and readily available talent.

- Pro-business policies and government incentives aimed at boosting digitalization.

The report further analyzes other key segments, providing detailed analysis of their growth prospects and competitive dynamics. Other significant regions include major metropolitan areas like Surabaya and Bandung, which are experiencing increasing demand for managed services.

Indonesia Managed Services Market Product Developments

Recent product innovations focus on cloud-based solutions, cybersecurity enhancements, and AI-powered automation tools. These advancements provide businesses with improved scalability, enhanced security, and greater operational efficiency. The market is seeing a trend towards integrated solutions offering a comprehensive suite of services under a single contract, simplifying management and improving cost-effectiveness for enterprises.

Report Scope & Segmentation Analysis

The report segments the Indonesia Managed Services Market by service type (cloud services, IT infrastructure management, cybersecurity services, etc.), industry vertical (BFSI, healthcare, retail, etc.), and geographical region. Each segment's growth projections, market sizes, and competitive dynamics are deeply analyzed. For instance, the cloud services segment is projected to be the fastest growing, driven by increasing adoption of cloud computing across various industries.

Key Drivers of Indonesia Managed Services Market Growth

Several factors are driving growth in the Indonesian Managed Services Market. These include the Indonesian government's ambitious digitalization initiatives, accelerating digital transformation across industries, the growing need for robust cybersecurity solutions in an increasingly interconnected world, and the expanding availability of high-speed internet infrastructure. The rise of SMEs actively seeking managed services to optimize their IT operations further propels market growth.

Challenges in the Indonesia Managed Services Market Sector

The market faces challenges like skilled labor shortages, the need for continuous investment in infrastructure to keep pace with technological advancements, and maintaining high levels of cybersecurity to mitigate increasing risks. These challenges can lead to increased operational costs and limit the speed of expansion for some providers. Competition from international players also adds pressure on pricing and service differentiation.

Emerging Opportunities in Indonesia Managed Services Market

Emerging opportunities include the expansion of 5G networks, growth of the IoT sector creating demand for specialized managed services, and increasing adoption of AI and machine learning to enhance operational efficiency and security. The government's focus on digital inclusion also opens opportunities to serve previously underserved markets.

Leading Players in the Indonesia Managed Services Market Market

- PT Data Sinergitama Jaya Tbk (Elitery)

- Zettagrid Indonesia

- Telkomsigma

- IBM

- PT VADS Indonesia

- Eranyacloud

- Accord Innovations Indonesia

- Amazon Web Services

- PT Cyberindo Mega Persada (CBNCloud)

- Microsoft

Key Developments in Indonesia Managed Services Market Industry

- May 2024: Elitery becomes a Google Cloud Managed Services Provider (MSP), strengthening its position in the cloud computing market.

- April 2024: Epsilon Telecommunications partners with Moratelindo to improve internet connectivity for Indonesian businesses, enhancing application performance.

Strategic Outlook for Indonesia Managed Services Market Market

The Indonesian Managed Services Market exhibits significant growth potential fueled by ongoing digital transformation and increasing government support. Strategic partnerships, investments in innovation, and a focus on delivering high-quality, secure, and cost-effective solutions will be crucial for success in this competitive landscape. The market’s future hinges on players' ability to adapt to technological advancements, address cybersecurity concerns effectively, and meet the evolving needs of diverse industries.

Indonesia Managed Services Market Segmentation

-

1. Service Type

- 1.1. Managed Security Service

- 1.2. Managed Network Service

- 1.3. Managed IT Infrastructure and Data Center Service

-

2. Deployment Type

- 2.1. On-premise

- 2.2. Cloud

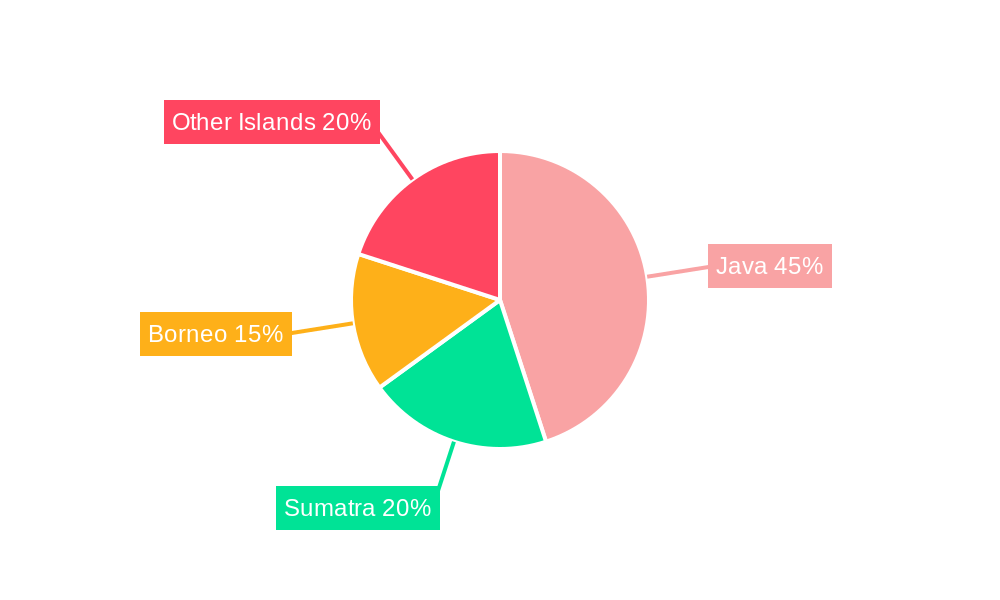

Indonesia Managed Services Market Segmentation By Geography

- 1. Java

- 2. Sumatra

- 3. Kalimantan

- 4. Other Regions

Indonesia Managed Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Computing Services; The Rise of Small and Medium-sized Enterprises

- 3.3. Market Restrains

- 3.3.1. Growing Adoption of Cloud Computing Services; The Rise of Small and Medium-sized Enterprises

- 3.4. Market Trends

- 3.4.1. The Cloud Segment to Drive the Indonesian Managed Services Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Managed Security Service

- 5.1.2. Managed Network Service

- 5.1.3. Managed IT Infrastructure and Data Center Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Java

- 5.3.2. Sumatra

- 5.3.3. Kalimantan

- 5.3.4. Other Regions

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Java Indonesia Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Managed Security Service

- 6.1.2. Managed Network Service

- 6.1.3. Managed IT Infrastructure and Data Center Service

- 6.2. Market Analysis, Insights and Forecast - by Deployment Type

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Sumatra Indonesia Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Managed Security Service

- 7.1.2. Managed Network Service

- 7.1.3. Managed IT Infrastructure and Data Center Service

- 7.2. Market Analysis, Insights and Forecast - by Deployment Type

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Kalimantan Indonesia Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Managed Security Service

- 8.1.2. Managed Network Service

- 8.1.3. Managed IT Infrastructure and Data Center Service

- 8.2. Market Analysis, Insights and Forecast - by Deployment Type

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Other Regions Indonesia Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Managed Security Service

- 9.1.2. Managed Network Service

- 9.1.3. Managed IT Infrastructure and Data Center Service

- 9.2. Market Analysis, Insights and Forecast - by Deployment Type

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 PT Data Sinergitama Jaya Tbk (Elitery)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Zettagrid Indonesia

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Telkomsigma

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 IBM

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PT VADS Indonesia

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Eranyacloud

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Accord Innovations Indonesia

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Amazon Web Services

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 PT Cyberindo Mega Persada (CBNCloud)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Microsof

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 PT Data Sinergitama Jaya Tbk (Elitery)

List of Figures

- Figure 1: Indonesia Managed Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Managed Services Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Managed Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Managed Services Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Indonesia Managed Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Indonesia Managed Services Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 5: Indonesia Managed Services Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 6: Indonesia Managed Services Market Volume Million Forecast, by Deployment Type 2019 & 2032

- Table 7: Indonesia Managed Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Managed Services Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Indonesia Managed Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 10: Indonesia Managed Services Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 11: Indonesia Managed Services Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 12: Indonesia Managed Services Market Volume Million Forecast, by Deployment Type 2019 & 2032

- Table 13: Indonesia Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Indonesia Managed Services Market Volume Million Forecast, by Country 2019 & 2032

- Table 15: Indonesia Managed Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 16: Indonesia Managed Services Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 17: Indonesia Managed Services Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 18: Indonesia Managed Services Market Volume Million Forecast, by Deployment Type 2019 & 2032

- Table 19: Indonesia Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Indonesia Managed Services Market Volume Million Forecast, by Country 2019 & 2032

- Table 21: Indonesia Managed Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 22: Indonesia Managed Services Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 23: Indonesia Managed Services Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 24: Indonesia Managed Services Market Volume Million Forecast, by Deployment Type 2019 & 2032

- Table 25: Indonesia Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Indonesia Managed Services Market Volume Million Forecast, by Country 2019 & 2032

- Table 27: Indonesia Managed Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 28: Indonesia Managed Services Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 29: Indonesia Managed Services Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 30: Indonesia Managed Services Market Volume Million Forecast, by Deployment Type 2019 & 2032

- Table 31: Indonesia Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Indonesia Managed Services Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Managed Services Market?

The projected CAGR is approximately 6.68%.

2. Which companies are prominent players in the Indonesia Managed Services Market?

Key companies in the market include PT Data Sinergitama Jaya Tbk (Elitery), Zettagrid Indonesia, Telkomsigma, IBM, PT VADS Indonesia, Eranyacloud, Accord Innovations Indonesia, Amazon Web Services, PT Cyberindo Mega Persada (CBNCloud), Microsof.

3. What are the main segments of the Indonesia Managed Services Market?

The market segments include Service Type, Deployment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 342.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Computing Services; The Rise of Small and Medium-sized Enterprises.

6. What are the notable trends driving market growth?

The Cloud Segment to Drive the Indonesian Managed Services Market.

7. Are there any restraints impacting market growth?

Growing Adoption of Cloud Computing Services; The Rise of Small and Medium-sized Enterprises.

8. Can you provide examples of recent developments in the market?

May 2024: Elitery, a prominent cloud solutions provider, announced its new status as a Google Cloud Managed Services Provider (MSP). As a Google Cloud MSP, Elitery serves as a trusted partner, assisting businesses in fully leveraging Google Cloud's capabilities through expert management, support, and optimization services. This achievement not only solidifies Elitery's leadership in Indonesia's cloud computing sector but also positions it as one of the first local partners to collaborate with Google Cloud as an MSP.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Managed Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Managed Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Managed Services Market?

To stay informed about further developments, trends, and reports in the Indonesia Managed Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence