Key Insights

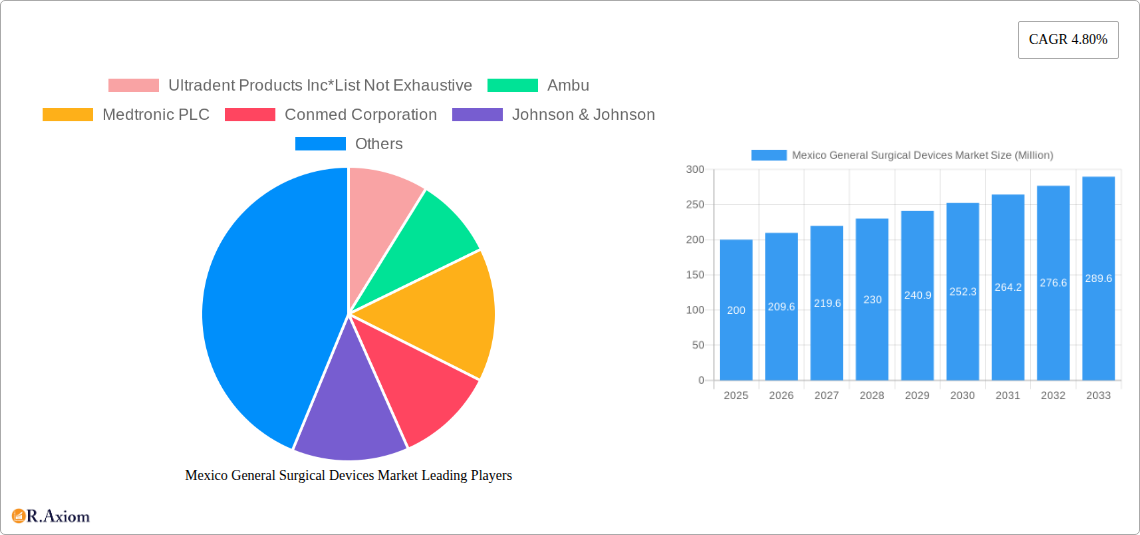

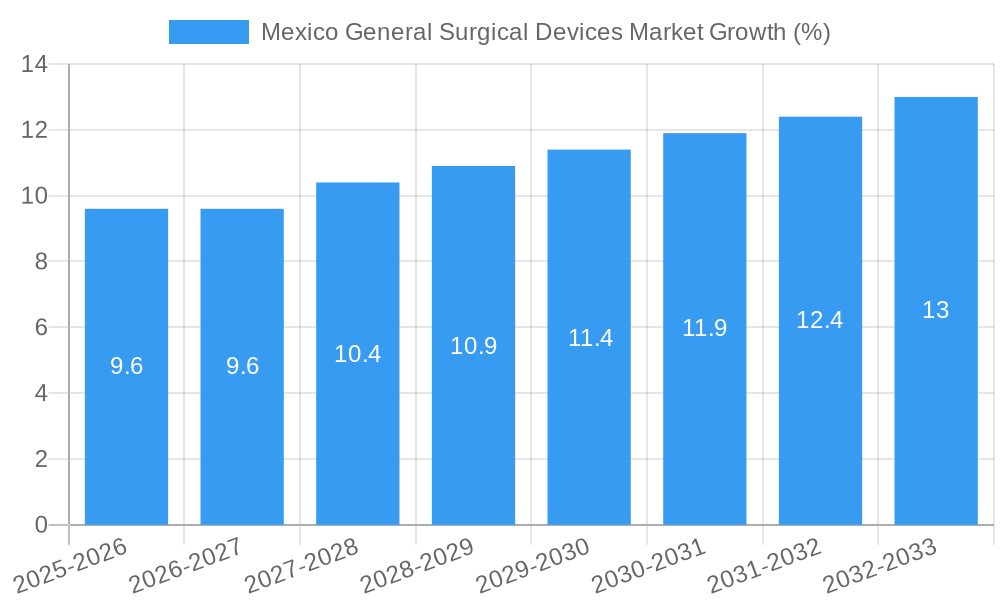

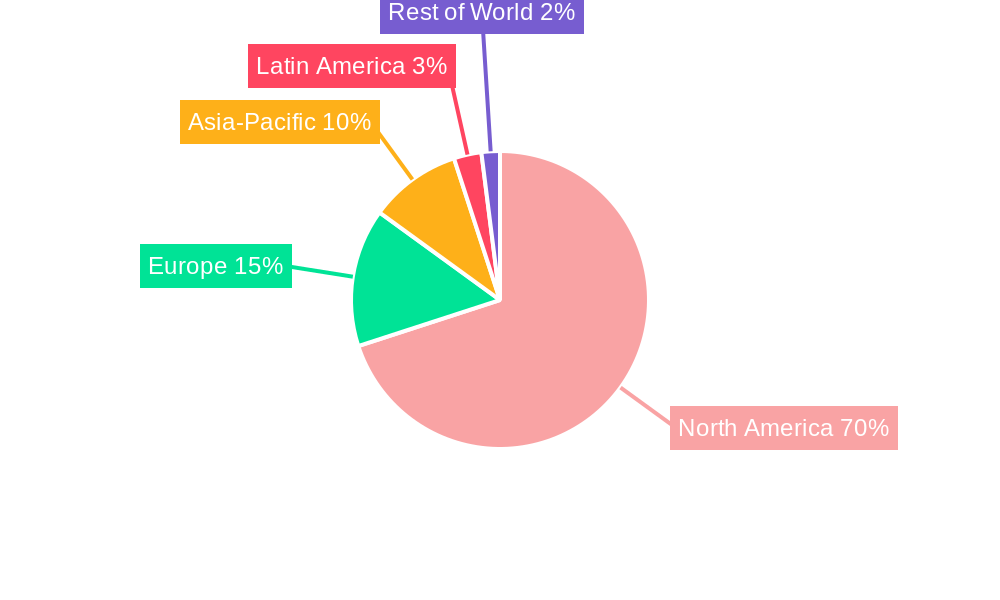

The Mexico general surgical devices market, valued at approximately $XXX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.80% from 2025 to 2033. This expansion is fueled by several key factors. Increasing prevalence of chronic diseases necessitating surgical intervention, coupled with rising healthcare expenditure and improving healthcare infrastructure within Mexico, are significant drivers. Furthermore, a growing geriatric population requiring more complex surgical procedures contributes to market growth. Technological advancements, including the introduction of minimally invasive surgical techniques and the development of sophisticated surgical devices like laparoscopic and electro-surgical instruments, are also boosting market adoption. The market is segmented by product type (handheld devices, laparoscopic devices, electro-surgical devices, wound closure devices, trocars and access devices, and other products) and application (gynecology and urology, cardiology, orthopedics, neurology, and other applications). The increasing preference for minimally invasive surgeries is driving demand for laparoscopic and electro-surgical devices, while the aging population fuels demand for orthopedic and cardiovascular surgical devices.

However, certain challenges restrain market growth. High costs associated with advanced surgical devices, coupled with limited healthcare insurance coverage, can restrict access for a significant portion of the population. Furthermore, regulatory hurdles and stringent approval processes for new medical devices may pose challenges to market entrants. Despite these limitations, the long-term outlook for the Mexico general surgical devices market remains positive, driven by continuous technological advancements and increasing healthcare awareness among the population. The strategic focus on expanding healthcare infrastructure, coupled with government initiatives aimed at improving healthcare accessibility, will further catalyze market growth in the coming years. Key players such as Ultradent Products Inc., Ambu, Medtronic PLC, Conmed Corporation, Johnson & Johnson, B. Braun Melsungen AG, Stryker Corporation, Boston Scientific Corporation, and Integer Holdings Corporation are actively competing in this dynamic market.

Mexico General Surgical Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico General Surgical Devices Market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, competitive landscape, and future growth opportunities, making it an essential resource for industry stakeholders, investors, and strategic planners. The report utilizes a robust methodology, incorporating both historical data (2019-2024) and future projections (2025-2033), with 2025 serving as the base year. The market size is estimated in Millions (USD).

Mexico General Surgical Devices Market Concentration & Innovation

This section analyzes the level of market concentration within the Mexican general surgical devices sector, exploring the influence of key players, their market share, and the impact of mergers and acquisitions (M&A) activities. We delve into the innovation drivers shaping the market, including technological advancements, regulatory frameworks, and the emergence of substitute products. Further, we investigate evolving end-user trends and their implications for market demand.

- Market Concentration: The Mexican general surgical devices market exhibits a moderately concentrated structure, with a few major multinational corporations holding significant market share. Precise market share figures for individual companies are unavailable, but estimates place the top 5 players controlling approximately xx% of the market (2024). Smaller domestic players and niche specialists account for the remaining share. M&A activity is expected to remain steady.

- Innovation Drivers: Technological advancements such as minimally invasive surgical techniques (MIS), robotic surgery, and the integration of advanced imaging technologies are major drivers of innovation. Regulatory approvals, particularly from COFEPRIS (Comisión Federal para la Protección contra Riesgos Sanitarios), are crucial for market entry and influence product development. The market is witnessing a growth of biocompatible and biodegradable materials for improved patient outcomes.

- Regulatory Framework: COFEPRIS's regulations significantly impact market dynamics. Stringent quality control standards and licensing requirements influence the entry of new players and the adoption of innovative technologies. Compliance is a significant cost factor influencing the overall market pricing.

- Product Substitutes: While direct substitutes are limited, innovative solutions like minimally invasive techniques sometimes replace traditional open surgeries, creating a dynamic competitive landscape.

- End-User Trends: Increasing prevalence of chronic diseases, aging population, and rising healthcare expenditure are fueling demand for advanced surgical devices. Hospitals and specialized surgical centers are major end-users, with private clinics gaining importance.

- M&A Activities: While precise deal values are confidential, M&A activity in the Mexican medical device sector is noticeable, mainly driven by larger multinational corporations aiming to expand their regional footprint and gain access to new technologies. The average deal value is estimated to be in the range of xx Million.

Mexico General Surgical Devices Market Industry Trends & Insights

This section explores the growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the Mexican general surgical devices market. We analyze the market's Compound Annual Growth Rate (CAGR) and assess the market penetration of key technologies and product segments.

The market is experiencing robust growth, driven by a number of factors including increasing prevalence of chronic diseases, rising healthcare spending, and growing adoption of minimally invasive surgical procedures. The government's focus on strengthening healthcare infrastructure and improving access to quality care further supports market expansion. Technological advancements such as AI-powered surgical tools, smart implants, and the integration of 3D printing are reshaping the market, opening new possibilities for advanced surgical interventions. Consumer preferences are shifting towards minimally invasive techniques, faster recovery times, and superior patient outcomes, driving innovation and development of advanced devices. The competitive landscape is characterized by both international and domestic players, leading to price competition, technological innovation and consolidation activities. The projected CAGR for the market from 2025 to 2033 is estimated to be xx%. Market penetration of advanced technologies like robotic surgery is steadily increasing, although the adoption rate varies depending on the healthcare infrastructure and economic factors.

Dominant Markets & Segments in Mexico General Surgical Devices Market

This section identifies the leading segments within the Mexican general surgical devices market, both by product type and application. We analyze the key drivers responsible for their dominance.

By Product:

- Laproscopic Devices: This segment holds the largest market share, driven by the increasing adoption of minimally invasive surgical techniques. Key drivers include reduced hospital stay, faster recovery times, and improved cosmetic outcomes.

- Electro Surgical Devices: This is a significant segment driven by the widespread use of electrosurgery in various surgical procedures for improved precision and control.

- Handheld Devices: A sizable segment, particularly for simpler procedures and common surgical interventions.

- Wound Closure Devices: Steady growth due to preference for improved wound healing and reduced complication rates.

- Trocars and Access Devices: A necessary component of minimally invasive procedures, this segment shows strong correlation with Laparoscopic device growth.

By Application:

- Gynecology and Urology: This segment exhibits strong growth due to the prevalence of these related medical conditions and the increasing use of minimally invasive techniques in these specialties.

- Cardiology: Market growth is driven by advancements in minimally invasive cardiovascular procedures.

- Orthopedic: Significant market size with steady growth fueled by an aging population and increased incidents of orthopedic conditions.

- Neurology: While smaller than other segments, it holds significant potential due to technological advancements and increasing demand for neurosurgical procedures.

Key Drivers of Segment Dominance:

- Economic policies: Government initiatives promoting healthcare infrastructure development and access to advanced medical technologies are key contributors.

- Healthcare infrastructure: The concentration of medical facilities in major urban centers influences market segment dominance.

- Prevalence of diseases: Higher prevalence rates of specific conditions significantly influence the demand for corresponding surgical devices.

Mexico General Surgical Devices Market Product Developments

The Mexican general surgical devices market is witnessing significant product innovations focused on improving surgical precision, reducing invasiveness, and enhancing patient outcomes. Miniaturization, improved ergonomics, and integration of advanced imaging technologies are key technological trends. New product launches emphasize ease of use, compatibility with existing surgical workflows, and cost-effectiveness. The market fit for these products is largely dependent on the availability of skilled surgical professionals and appropriate healthcare infrastructure.

Report Scope & Segmentation Analysis

This report segments the Mexico General Surgical Devices Market comprehensively by product type (Handheld Devices, Laproscopic Devices, Electro Surgical Devices, Wound Closure Devices, Trocars and Access Devices, Other Products) and by application (Gynecology and Urology, Cardiology, Orthopaedic, Neurology, Other Applications). Each segment's market size, growth projections, and competitive dynamics are analyzed separately. The forecast period spans from 2025 to 2033. The market is expected to experience significant growth across most segments, driven by factors mentioned above. However, growth rates will vary across segments due to differences in technology adoption rates and specific market conditions. The competitive landscape within each segment will be impacted by both multinational companies and domestic producers.

Key Drivers of Mexico General Surgical Devices Market Growth

Several factors propel the growth of the Mexican general surgical devices market. Firstly, the rising prevalence of chronic diseases such as diabetes, cardiovascular ailments, and cancer contributes significantly to the demand for advanced surgical interventions. Secondly, the growing elderly population requires more surgical procedures, further augmenting market growth. Finally, government initiatives supporting healthcare infrastructure development and technological advancements provide a favorable environment for market expansion. Increased private healthcare spending also boosts demand.

Challenges in the Mexico General Surgical Devices Market Sector

The Mexican surgical devices market faces several challenges. Stringent regulatory procedures and approvals from COFEPRIS can slow down product launches. Supply chain disruptions caused by global events can impact product availability and increase costs. Finally, intense price competition from both domestic and international players creates pressures on profit margins. These factors may affect overall market growth. The impact of these challenges is estimated to be a xx% reduction in overall projected market growth.

Emerging Opportunities in Mexico General Surgical Devices Market

The market offers promising opportunities. Growth in minimally invasive surgeries presents a significant opportunity for manufacturers of laparoscopic and robotic devices. The increasing prevalence of chronic diseases will drive the demand for specialized surgical devices across diverse therapeutic areas. Moreover, government initiatives to expand healthcare access are expected to create additional growth prospects in underserved areas.

Leading Players in the Mexico General Surgical Devices Market Market

- Ultradent Products Inc

- Ambu

- Medtronic PLC

- Conmed Corporation

- Johnson & Johnson

- B Braun Melsungen AG

- Stryker Corporation

- Boston Scientific Corporation

- Integer Holdings Corporation

Key Developments in Mexico General Surgical Devices Market Industry

- October 2022: Ambu established a large manufacturing plant in Ciudad Juárez, Mexico, enhancing its North American supply chain and production capacity. This significantly strengthens Ambu's position in the Mexican market and improves its competitiveness.

- September 2022: Nordson MEDICAL opened a new manufacturing center in Tecate, Mexico, boosting local manufacturing capabilities and potentially attracting more medical device companies to the region. This development indicates growing confidence in Mexico's medical device manufacturing sector.

Strategic Outlook for Mexico General Surgical Devices Market Market

The Mexican general surgical devices market is poised for robust growth in the coming years, driven by a confluence of factors including rising healthcare expenditure, technological advancements, and government support. The focus on minimally invasive surgical techniques, combined with the increasing prevalence of chronic diseases, will continue to fuel demand for advanced surgical devices. Companies adopting innovative strategies to navigate regulatory hurdles, manage supply chain challenges, and offer cost-effective solutions will be best positioned to capitalize on the market's growth potential.

Mexico General Surgical Devices Market Segmentation

-

1. Product

- 1.1. Handheld Devices

- 1.2. Laproscopic Devices

- 1.3. Electro Surgical Devices

- 1.4. Wound Closure Devices

- 1.5. Trocars and Access Devices

- 1.6. Other Products

-

2. Application

- 2.1. Gynecology and Urology

- 2.2. Cardiology

- 2.3. Orthopaedic

- 2.4. Neurology

- 2.5. Other Applications

Mexico General Surgical Devices Market Segmentation By Geography

- 1. Mexico

Mexico General Surgical Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Minimally Invasive Devices; Technological Advancements in General Surgical Devices; Rising Unmet Healthcare Needs

- 3.3. Market Restrains

- 3.3.1. High Capital Expenses Needed to Produce Surgical Equipment

- 3.4. Market Trends

- 3.4.1. Handheld Devices Segment is Expected to Hold a Significant Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico General Surgical Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Handheld Devices

- 5.1.2. Laproscopic Devices

- 5.1.3. Electro Surgical Devices

- 5.1.4. Wound Closure Devices

- 5.1.5. Trocars and Access Devices

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gynecology and Urology

- 5.2.2. Cardiology

- 5.2.3. Orthopaedic

- 5.2.4. Neurology

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ultradent Products Inc*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ambu

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Medtronic PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Conmed Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson & Johnson

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 B Braun Melsungen AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Stryker Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boston Scientific Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Integer Holdings Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Ultradent Products Inc*List Not Exhaustive

List of Figures

- Figure 1: Mexico General Surgical Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico General Surgical Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico General Surgical Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico General Surgical Devices Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Mexico General Surgical Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Mexico General Surgical Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mexico General Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Mexico General Surgical Devices Market Revenue Million Forecast, by Product 2019 & 2032

- Table 7: Mexico General Surgical Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Mexico General Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico General Surgical Devices Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Mexico General Surgical Devices Market?

Key companies in the market include Ultradent Products Inc*List Not Exhaustive, Ambu, Medtronic PLC, Conmed Corporation, Johnson & Johnson, B Braun Melsungen AG, Stryker Corporation, Boston Scientific Corporation, Integer Holdings Corporation.

3. What are the main segments of the Mexico General Surgical Devices Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Minimally Invasive Devices; Technological Advancements in General Surgical Devices; Rising Unmet Healthcare Needs.

6. What are the notable trends driving market growth?

Handheld Devices Segment is Expected to Hold a Significant Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Capital Expenses Needed to Produce Surgical Equipment.

8. Can you provide examples of recent developments in the market?

September 2022: Nordson MEDICAL, a global integrated solutions partner for the design, engineering and manufacturing of complex medical devices and components announced the official opening of its Tecate, Mexico, Medical Device Manufacturing Center of Excellence. The event was marked with a ribbon cutting ceremony with representatives from the local government and Nordson leadership in attendance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico General Surgical Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico General Surgical Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico General Surgical Devices Market?

To stay informed about further developments, trends, and reports in the Mexico General Surgical Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence