Key Insights

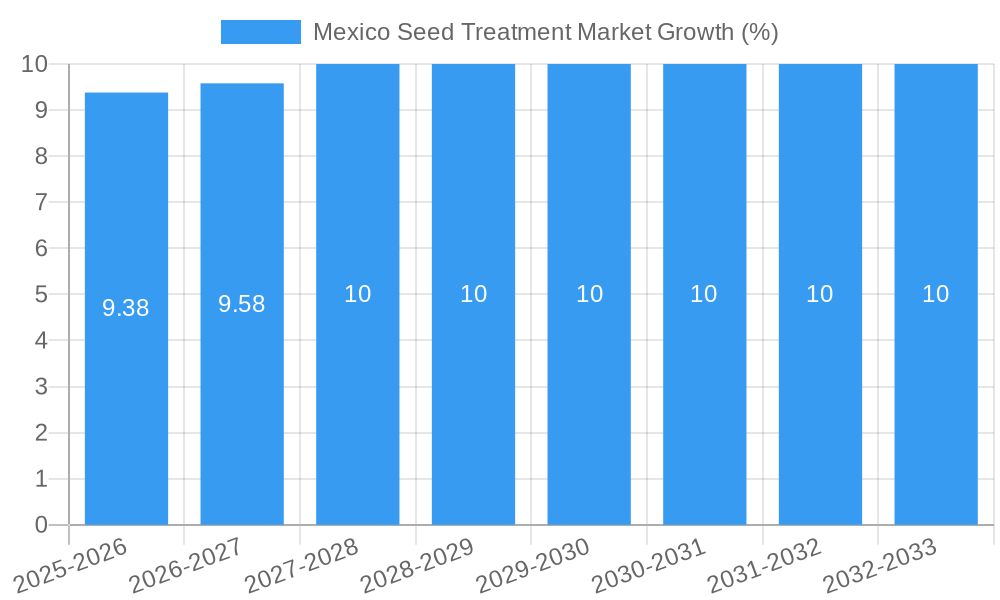

The Mexico seed treatment market, valued at $158.20 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.70% from 2025 to 2033. This growth is fueled by several key factors. Increasing awareness among farmers regarding the benefits of seed treatment, such as enhanced crop yields, improved disease resistance, and better seedling establishment, is a significant driver. Furthermore, the rising prevalence of soilborne diseases and insect pests, coupled with the increasing adoption of modern agricultural practices and precision farming techniques, contributes to market expansion. Government initiatives promoting sustainable agriculture and supporting the use of high-quality seeds are also instrumental in driving market growth. The market is segmented by product type (insecticides, fungicides, nematicides) and crop type (grains and cereals, oilseeds and pulses, fruits and vegetables, commercial crops, turf and ornamentals). The substantial demand for improved crop yields across diverse agricultural segments, particularly in grains and cereals, and fruits and vegetables, further fuels market expansion. Competition in the market is intense, with major players like Syngenta, BASF, Bayer, and UPL actively engaged in product development and market penetration. However, challenges such as fluctuating raw material prices and the need for continuous research and development to combat emerging pest and disease resistance pose potential restraints.

The forecast period (2025-2033) anticipates continued market expansion in Mexico, driven by a growing focus on improving agricultural productivity. The rising adoption of genetically modified seeds and biopesticides is also expected to contribute to the market's growth. Regional variations within Mexico exist, reflecting differences in agricultural practices and crop production patterns. Expansion into new crop segments and advancements in seed treatment technology will continue to shape market dynamics. While challenges persist, the overall outlook for the Mexico seed treatment market remains positive, promising substantial growth opportunities for established players and new entrants alike. Strategic partnerships and collaborations between seed companies and agricultural input suppliers are likely to gain traction in the coming years.

Mexico Seed Treatment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico Seed Treatment Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The study utilizes a robust methodology, incorporating both historical data (2019-2024) and future projections to deliver a precise and actionable market overview. This report is essential for understanding market trends, competitive landscapes, and growth opportunities within the dynamic Mexican agricultural sector.

Mexico Seed Treatment Market Market Concentration & Innovation

The Mexico seed treatment market exhibits a moderately concentrated structure, with key players such as Syngenta International AG, BASF SE, Corteva Agriscience, Bayer CropScience AG, Adama Agricultural Solutions Ltd, UPL Limited, Incotec Group B, and Germains Seed Technology holding significant market share. The combined market share of the top five players is estimated at xx% in 2025. Innovation within the sector is driven by the need for enhanced crop protection, improved seed germination rates, and increased yield efficiency. Regulatory frameworks, including those set by the Mexican government's SENASICA (National Service of Health, Safety and Food Quality), play a crucial role in shaping market dynamics. The market sees continuous development of new seed treatment technologies, focusing on biologicals and systemic formulations. The emergence of resistant pests and diseases is a significant driver of innovation, necessitating the development of novel active ingredients and formulation techniques. Mergers and acquisitions (M&A) have played a pivotal role in shaping the market landscape, with deal values exceeding xx Million in the past five years, primarily driven by the consolidation of smaller players by larger multinational corporations. This has resulted in increased competition and a focus on expanding product portfolios and geographical reach. The presence of substitute products such as traditional soil application methods influences market dynamics, leading to price competition and market share fluctuations. End-user trends, favoring environmentally friendly solutions and improved cost-effectiveness, further push innovation towards sustainable seed treatment solutions.

Mexico Seed Treatment Market Industry Trends & Insights

The Mexico seed treatment market is projected to witness robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the increasing adoption of modern agricultural practices, a growing demand for high-yielding crops, government initiatives promoting agricultural development, and the rising prevalence of crop diseases and pests. Technological disruptions, such as precision agriculture techniques and the use of advanced seed treatment technologies, are significantly contributing to market expansion. Consumer preferences are shifting towards environmentally friendly and sustainable seed treatment solutions, pushing manufacturers to develop products with reduced environmental impact. Market penetration of advanced seed treatments remains relatively low compared to global standards, representing a substantial growth opportunity. The competitive landscape is characterized by intense competition among major players, with a focus on product differentiation, technological advancements, and strategic alliances. Price fluctuations in raw materials and the volatility of agricultural commodity prices pose challenges to market growth. Increased awareness among farmers regarding the benefits of seed treatments, coupled with favorable government policies, contributes positively to market expansion.

Dominant Markets & Segments in Mexico Seed Treatment Market

The grains and cereals segment dominates the Mexico seed treatment market, accounting for approximately xx% of the total market share in 2025. This dominance stems from the significant acreage under cultivation for maize and wheat, which are critical staples in the Mexican diet. The oilseeds and pulses segment shows significant potential for growth due to the increasing demand for oilseeds like soybeans and canola.

Key Drivers for Grains and Cereals Dominance:

- Large cultivated area for staple crops (maize, wheat).

- Government support for grain production.

- High susceptibility to pests and diseases.

Key Drivers for Oilseeds and Pulses Growth:

- Rising demand for edible oils.

- Growing export opportunities.

- Government initiatives promoting oilseed cultivation.

Fungicides currently hold the largest share within the product type segment, followed by insecticides and nematicides. This is primarily driven by the prevalence of fungal diseases in various crops. The fruits and vegetables segment is experiencing strong growth due to the increasing demand for fresh produce. The commercial crops segment is also witnessing considerable growth potential owing to the rising export of Mexican agricultural products, while the turf and ornamentals segment presents a niche market with moderate growth prospects. Regional variations in agricultural practices and climatic conditions influence the demand for specific seed treatment products across different regions of Mexico. Investments in agricultural infrastructure, particularly irrigation and storage facilities, are expected to positively impact the market's growth trajectory.

Mexico Seed Treatment Market Product Developments

Recent product innovations focus on the development of biological seed treatments, offering environmentally friendly alternatives to traditional chemical formulations. These innovations are designed to improve crop resistance against diseases and pests while minimizing environmental risks. Systemic seed treatments provide enhanced protection throughout the plant's life cycle. The market is also seeing a rise in combination products, offering integrated protection against various pests and diseases, providing farmers with comprehensive solutions. These advancements enhance product efficacy and reduce the need for multiple applications, improving cost-efficiency and reducing potential environmental impact.

Report Scope & Segmentation Analysis

This report segments the Mexico seed treatment market based on product type (Insecticides, Fungicides, Nematicides) and crop type (Grains and Cereals, Oilseeds and Pulses, Fruits and Vegetables, Commercial Crops, Turf and Ornamentals). Each segment is analyzed based on market size, growth projections, and competitive dynamics. The Insecticides segment is expected to witness significant growth driven by the increasing prevalence of insect pests. The Fungicides segment is projected to maintain a large market share due to the susceptibility of various crops to fungal diseases. The Nematicides segment is expected to show moderate growth driven by increased awareness of nematode infestations. Similarly, market size projections are provided for each crop type, reflecting their individual growth trajectories.

Key Drivers of Mexico Seed Treatment Market Growth

The Mexico seed treatment market is propelled by several key factors, including increasing pest and disease pressure forcing farmers to adopt protective measures. Government support and initiatives aimed at improving agricultural productivity and yield efficiency are major contributors to growth. Technological advancements in seed treatment formulations lead to better efficacy, resulting in higher crop yields. Rising consumer demand for safe and high-quality agricultural produce boosts the adoption of seed treatments. Favorable climatic conditions in certain regions of Mexico create opportunities for various crop types, thereby increasing the demand for seed treatments.

Challenges in the Mexico Seed Treatment Market Sector

The market faces challenges like stringent regulatory approvals for new seed treatment products, leading to increased development costs and time to market. Fluctuations in raw material prices significantly impact production costs. The availability of counterfeit and substandard products compromises the efficacy and environmental safety of seed treatments. Competition from both domestic and international players leads to price pressure and reduced profit margins. Limited access to modern agricultural technologies and information in certain regions of Mexico poses a challenge to broader market penetration.

Emerging Opportunities in Mexico Seed Treatment Market

The adoption of precision agriculture, coupled with data-driven insights, opens avenues for targeted seed treatment applications, increasing efficiency and minimizing environmental impact. The rising demand for organically produced crops creates opportunities for biological seed treatment solutions. Growing export opportunities for Mexican agricultural products enhance the demand for high-quality seed treatments ensuring improved crop quality and yield. Government initiatives promoting sustainable agriculture practices will support market growth in the long run.

Leading Players in the Mexico Seed Treatment Market Market

- Germains Seed Technology

- Incotec Group B

- Syngenta International AG

- Adama Agricultural Solutions Ltd

- UPL Limited

- BASF SE

- Corteva Agriscience

- Bayer CropScience AG

Key Developments in Mexico Seed Treatment Market Industry

- October 2022: Syngenta launches a new fungicide seed treatment for maize.

- March 2023: BASF announces a partnership with a local distributor to expand its seed treatment portfolio in Mexico.

- June 2024: Corteva Agriscience invests in a new seed treatment facility in Mexico.

- Further developments: xx

Strategic Outlook for Mexico Seed Treatment Market Market

The Mexico seed treatment market holds immense growth potential, driven by increasing agricultural production, government support, and technological advancements. Future market opportunities lie in the development and adoption of sustainable and technologically advanced seed treatment solutions. The focus on enhancing crop resilience against climate change and emerging pests will drive innovation. The increasing collaboration between seed companies, research institutions, and farmers will pave the way for sustainable growth. Expansion into niche markets and tailored solutions for specific crops will further contribute to market expansion.

Mexico Seed Treatment Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

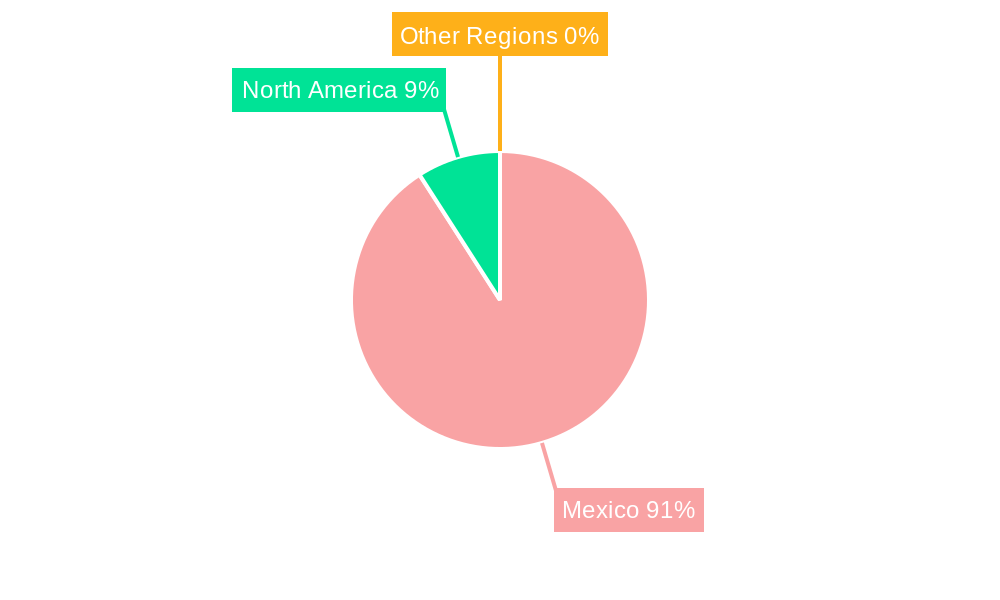

Mexico Seed Treatment Market Segmentation By Geography

- 1. Mexico

Mexico Seed Treatment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Increase in Cost of High-quality Seeds

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Seed Treatment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Germains Seed Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Incotec Group B

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Syngenta International AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adama Agricultural Solutions Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPL Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BASF SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Corteva Agriscience

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bayer CropScience AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Germains Seed Technology

List of Figures

- Figure 1: Mexico Seed Treatment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Seed Treatment Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Seed Treatment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Seed Treatment Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Mexico Seed Treatment Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Mexico Seed Treatment Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Mexico Seed Treatment Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Mexico Seed Treatment Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Mexico Seed Treatment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Mexico Seed Treatment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Mexico Seed Treatment Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Mexico Seed Treatment Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Mexico Seed Treatment Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Mexico Seed Treatment Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Mexico Seed Treatment Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Mexico Seed Treatment Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Seed Treatment Market?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the Mexico Seed Treatment Market?

Key companies in the market include Germains Seed Technology, Incotec Group B, Syngenta International AG, Adama Agricultural Solutions Ltd, UPL Limited, BASF SE, Corteva Agriscience, Bayer CropScience AG.

3. What are the main segments of the Mexico Seed Treatment Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 158.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Increase in Cost of High-quality Seeds.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Seed Treatment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Seed Treatment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Seed Treatment Market?

To stay informed about further developments, trends, and reports in the Mexico Seed Treatment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence