Key Insights

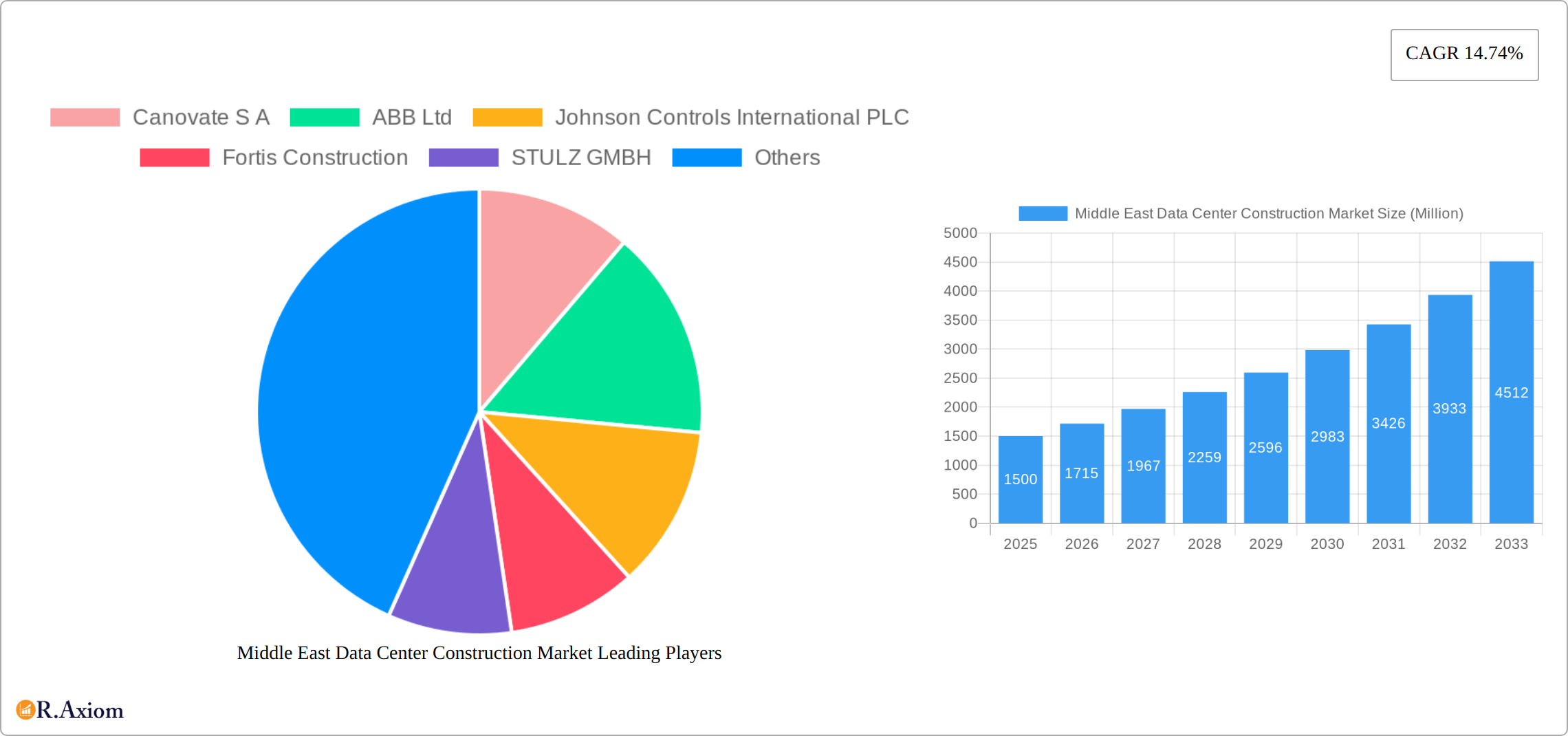

The Middle East data center construction market is experiencing robust growth, driven by the region's burgeoning digital economy, increasing cloud adoption, and government initiatives promoting digital transformation. The market, valued at approximately $XX million in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 14.74% from 2025 to 2033. This significant expansion is fueled by several key factors. Firstly, the rapid growth of e-commerce and digital services across various sectors, including BFSI, IT & Telecommunications, and government, necessitates increased data storage and processing capabilities, directly impacting data center demand. Secondly, the region's strategic geographic location, acting as a crucial link between Asia and Europe, makes it an attractive hub for regional and international data center deployments. Furthermore, substantial investments in advanced infrastructure, including cooling and power infrastructure solutions, are supporting the market's expansion. The increasing adoption of sustainable practices, such as evaporative cooling, is also influencing market trends.

However, challenges remain. While the market presents significant opportunities, restraints like high construction costs, the need for specialized skilled labor, and potential regulatory hurdles could temper growth. The segmentation of the market reveals key growth areas: large and mega data centers are expected to witness significant expansion, driven by the demands of hyperscale cloud providers. Similarly, the cooling infrastructure segment is poised for rapid growth due to the region's hot climate and the increasing need for energy-efficient cooling solutions. The competitive landscape is diverse, with both international giants and regional players vying for market share. Companies like Schneider Electric, ABB, and Johnson Controls are leveraging their expertise in power and cooling solutions, while local firms are capitalizing on regional knowledge and relationships. The forecast period (2025-2033) suggests continued market dominance by the UAE and Saudi Arabia, with other Middle Eastern countries also contributing to the overall growth. The sustained investment in digital infrastructure and the ongoing push for technological advancement will ultimately dictate the long-term trajectory of this dynamic market.

This in-depth report provides a comprehensive analysis of the Middle East data center construction market, offering invaluable insights for stakeholders across the value chain. From market size and segmentation to key players and future trends, this report covers all crucial aspects, utilizing data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033). The study period spans 2019-2033. Estimated market values are presented in Millions.

Middle East Data Center Construction Market Concentration & Innovation

The Middle East data center construction market exhibits a moderately concentrated landscape, with a few major players holding significant market share. While exact figures are proprietary to the full report, leading companies such as Schneider Electric SE, ABB Ltd, and Johnson Controls International PLC command substantial portions of the market, driven by their established brand reputation, extensive product portfolios, and global reach. However, the market also accommodates a number of regional players and specialized firms contributing to a dynamic competitive environment.

Innovation is a key driver, fueled by the increasing demand for advanced technologies like AI and the Internet of Things (IoT). This is pushing the development of more energy-efficient cooling systems, higher-density racks, and enhanced security features. Regulatory frameworks, while generally supportive of data center growth, vary across countries and influence investment decisions. The emergence of sustainable infrastructure solutions, like the Khazna Data Centers solar PV plant project, further underscores innovation within the sector. Product substitutes are limited; however, the increasing adoption of cloud services and edge computing could influence future data center construction strategies. Mergers and acquisitions (M&A) activity is significant, with deal values exceeding XX Million in recent years, further consolidating market power among major players. This activity reflects the desire to expand geographical reach, access new technologies, and enhance service offerings.

- Market Share: Schneider Electric SE, ABB Ltd, and Johnson Controls International PLC hold significant market share (exact figures in full report).

- M&A Activity: Deal values exceeding XX Million observed in recent years.

- Innovation Drivers: Demand for AI and IoT, need for energy efficiency, enhanced security.

- Regulatory Landscape: Varies across Middle Eastern countries, influencing investment decisions.

Middle East Data Center Construction Market Industry Trends & Insights

The Middle East data center construction market is experiencing robust growth, driven by the region's burgeoning digital economy and increasing government investments in digital infrastructure. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, exceeding the global average. This growth is fueled by several factors, including:

- Rising digital adoption: The rapid increase in internet and mobile penetration across the Middle East is creating an immense demand for data storage and processing capabilities.

- Government initiatives: Significant investments in digital transformation programs by governments across the region are accelerating data center development.

- Cloud computing adoption: The growing adoption of cloud services is driving demand for scalable and reliable data center infrastructure.

- Technological advancements: Innovations in cooling technologies, power management, and security systems are improving data center efficiency and resilience.

Market penetration of hyperscale data centers remains relatively low but is expected to increase significantly over the forecast period, driven by the growth of major cloud providers and an increasing reliance on large-scale data processing. However, competitive dynamics are intense, with both international and regional players vying for market share. Consumer preferences are shifting toward sustainable and energy-efficient data center solutions.

Dominant Markets & Segments in Middle East Data Center Construction Market

The UAE and Saudi Arabia represent the dominant markets within the Middle East data center construction sector, fueled by their strong economies, advanced digital infrastructure, and government support for digital transformation initiatives. Within segmentations:

- Tier Type: Tier III and Tier IV data centers are increasingly dominant, reflecting a preference for higher levels of redundancy and reliability.

- Data Center Size: Large and Mega data centers are expected to experience the fastest growth due to the increasing demand for large-scale data processing and storage.

- Infrastructure: Cooling infrastructure and power infrastructure are the largest segments, reflecting the critical role these components play in data center operations. Power Distribution Units (PDUs) are a rapidly expanding sub-segment.

- End-User: The IT & Telecommunication sector and the BFSI sector are the leading end-users, with significant growth anticipated in the government and healthcare sectors.

Key Drivers:

- Strong economic growth: The robust economies of the UAE and Saudi Arabia provide a strong foundation for data center development.

- Government support: Government initiatives promoting digital transformation are creating favorable conditions for market expansion.

- Strategic location: The Middle East's strategic geographical location makes it an attractive hub for data center operations serving regional and international markets.

The dominance of the UAE and Saudi Arabia is likely to continue throughout the forecast period, although other countries in the region are also expected to witness significant growth. This is primarily due to the ongoing investments in digital infrastructure, the increasing adoption of cloud computing, and the expanding needs of various sectors.

Middle East Data Center Construction Market Product Developments

Recent product innovations have focused on increasing energy efficiency, improving security, and enhancing scalability. This includes advancements in liquid cooling, AI-powered power management systems, and modular data center designs. These innovations are designed to meet the growing demand for more sustainable, resilient, and cost-effective data center solutions. The market is witnessing a strong trend towards prefabricated modular data centers, which offer faster deployment and reduced construction costs. These innovations have significantly improved the market fit and competitive advantages for providers.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis, covering various aspects of the Middle East data center construction market, including:

- Tier Type: Tier 1, Tier 2, Tier 3, Tier 4 (Growth projections and market sizes are detailed in the full report).

- Data Center Size: Small, Medium, Large, Mega, Massive (Detailed analysis of each segment's growth and competitive landscape is included in the full report).

- Infrastructure: Cooling Infrastructure (including Evaporative Cooling), Power Infrastructure (including Power Distribution Units - PDUs), Racks and Cabinets, Servers, Networking Equipment, Physical Security Infrastructure, Design and Consulting Services, Other Infrastructure (Full report details market size, growth projections, and key players for each segment).

- End-User: IT & Telecommunication, BFSI, Government, Healthcare, Other End-User (The report provides a detailed analysis of each end-user segment's growth drivers, market size, and key trends).

Each segment is analyzed based on its growth potential, market size, competitive dynamics, and future outlook.

Key Drivers of Middle East Data Center Construction Market Growth

The growth of the Middle East data center construction market is driven by several key factors:

- Government initiatives: Significant government investments in digital transformation and infrastructure development.

- Technological advancements: Innovations in cooling technologies, power management, and security systems.

- Rising digital adoption: The rapid increase in internet and mobile penetration is fueling demand for data centers.

- Strategic location: The Middle East's geographical location makes it an attractive hub for data center operations.

These factors are creating a positive outlook for the market and are expected to continue driving substantial growth in the coming years.

Challenges in the Middle East Data Center Construction Market Sector

Despite the positive outlook, the market faces several challenges:

- High initial investment costs: Constructing data centers requires substantial upfront capital investment.

- Energy consumption: Data centers are significant energy consumers, raising environmental concerns.

- Regulatory hurdles: Varying regulatory environments across different countries can create complexities for businesses.

- Skill shortages: A lack of skilled professionals in the field can hinder project execution.

These factors present significant barriers to market entry and expansion for many businesses.

Emerging Opportunities in Middle East Data Center Construction Market

The Middle East data center construction market presents numerous emerging opportunities:

- Sustainability: Demand for energy-efficient and sustainable data centers is increasing.

- Edge computing: The rise of edge computing is creating demand for smaller, distributed data centers.

- Hyperconverged infrastructure: The adoption of hyperconverged infrastructure solutions is streamlining data center operations.

- Colocation facilities: Colocation facilities are providing flexible and scalable solutions for businesses.

These trends present opportunities for businesses to innovate and capture market share.

Leading Players in the Middle East Data Center Construction Market Market

- Canovate S A

- ABB Ltd

- Johnson Controls International PLC

- Fortis Construction

- STULZ GMBH

- Delta Group

- Schneider Electric SE

- Turner Construction Co

- DPR Construction Inc

- Caterpillar Inc

- Airedale International Air Conditioning Ltd

- Cummins Inc

- AECOM Limited

- Legrand

- CyrusOne Inc

- Future Digital data Systems

- Ashi & Bushnag Co Ltd

- EAE Group

- Alfa Laval AB

- Saan Zahav Ltd

Key Developments in Middle East Data Center Construction Market Industry

- October 2022: Mohamed bin Ali bin Mohamed Al-Mannai, Minister of Communications and Information Technology, launched the M-VAULT 4's fourth data center building in Qatar, expanding cloud service access via Microsoft Cloud.

- October 2022: Khazna Data Centers, Masdar, and EDF partnered to build a ground-mounted solar PV plant, highlighting the growing focus on sustainable data center infrastructure.

Strategic Outlook for Middle East Data Center Construction Market Market

The Middle East data center construction market is poised for continued strong growth, driven by increasing digitalization, government support, and technological advancements. Opportunities exist in sustainable infrastructure, edge computing, and the expansion of cloud services. The market will likely see continued consolidation, with larger players acquiring smaller firms to expand their market share and service offerings. Focus on energy efficiency and sustainability will be paramount, shaping future investment decisions and technological innovation within the sector.

Middle East Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Basic & Smart - Metered & Switched Solutions

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-Voltage

- 1.1.1.3.2. Medium-Voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Other Power Distribution Solutions

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-To-Chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-Row and In-Rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDU - Basic & Smart - Metered & Switched Solutions

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-Voltage

- 2.1.3.2. Medium-Voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Other Power Distribution Solutions

-

2.2. Power Backup Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDU - Basic & Smart - Metered & Switched Solutions

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-Voltage

- 3.3.2. Medium-Voltage

- 3.4. Power Panels and Components

- 3.5. Other Power Distribution Solutions

-

4. Power Backup Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-To-Chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-Row and In-Rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructure

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-To-Chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-Row and In-Rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructure

- 10. General Construction

-

11. Tier Type

- 11.1. Tier 1 and 2

- 11.2. Tier 3

- 11.3. Tier 4

- 12. Tier 1 and 2

- 13. Tier 3

- 14. Tier 4

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

- 21. United Arab Emirates

- 22. Saudi Arabia

- 23. Israel

- 24. Qatar

- 25. Oman

Middle East Data Center Construction Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Renewable Energy Sources; Increase in 5G Deployments Fueling Edge Data Center Investments; Smart City Initiatives Driving Data Center Investments

- 3.3. Market Restrains

- 3.3.1. Security Challenges in Data Centers; Location Constraints on the Development of Data Centers

- 3.4. Market Trends

- 3.4.1. End-User Outlook

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Basic & Smart - Metered & Switched Solutions

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-Voltage

- 5.1.1.1.3.2. Medium-Voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Other Power Distribution Solutions

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-To-Chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-Row and In-Rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDU - Basic & Smart - Metered & Switched Solutions

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-Voltage

- 5.2.1.3.2. Medium-Voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Other Power Distribution Solutions

- 5.2.2. Power Backup Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDU - Basic & Smart - Metered & Switched Solutions

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-Voltage

- 5.3.3.2. Medium-Voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Other Power Distribution Solutions

- 5.4. Market Analysis, Insights and Forecast - by Power Backup Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-To-Chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-Row and In-Rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-To-Chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-Row and In-Rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier 1 and 2

- 5.11.2. Tier 3

- 5.11.3. Tier 4

- 5.12. Market Analysis, Insights and Forecast - by Tier 1 and 2

- 5.13. Market Analysis, Insights and Forecast - by Tier 3

- 5.14. Market Analysis, Insights and Forecast - by Tier 4

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by United Arab Emirates

- 5.22. Market Analysis, Insights and Forecast - by Saudi Arabia

- 5.23. Market Analysis, Insights and Forecast - by Israel

- 5.24. Market Analysis, Insights and Forecast - by Qatar

- 5.25. Market Analysis, Insights and Forecast - by Oman

- 5.26. Market Analysis, Insights and Forecast - by Region

- 5.26.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. United Arab Emirates Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Canovate S A

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Johnson Controls International PLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Fortis Construction

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 STULZ GMBH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Delta Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Schneider Electric SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Turner Construction Co

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 DPR Construction Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Caterpillar Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Airedale International Air Conditioning Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Cummins Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 AECOM Limited

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Legrand

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 CyrusOne Inc

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Future Digital data Systems

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Ashi & Bushnag Co Ltd

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 EAE Group

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 Alfa Laval AB

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 Saan Zahav Ltd

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.1 Canovate S A

List of Figures

- Figure 1: Middle East Data Center Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Data Center Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 3: Middle East Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 4: Middle East Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 5: Middle East Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 6: Middle East Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 7: Middle East Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 8: Middle East Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 9: Middle East Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 10: Middle East Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 11: Middle East Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 12: Middle East Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 13: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 14: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 15: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 16: Middle East Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Middle East Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 18: Middle East Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 19: Middle East Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 20: Middle East Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 21: Middle East Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 22: Middle East Data Center Construction Market Revenue Million Forecast, by United Arab Emirates 2019 & 2032

- Table 23: Middle East Data Center Construction Market Revenue Million Forecast, by Saudi Arabia 2019 & 2032

- Table 24: Middle East Data Center Construction Market Revenue Million Forecast, by Israel 2019 & 2032

- Table 25: Middle East Data Center Construction Market Revenue Million Forecast, by Qatar 2019 & 2032

- Table 26: Middle East Data Center Construction Market Revenue Million Forecast, by Oman 2019 & 2032

- Table 27: Middle East Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 28: Middle East Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Arab Emirates Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Saudi Arabia Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Qatar Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Israel Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Egypt Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Oman Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of Middle East Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Middle East Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 37: Middle East Data Center Construction Market Revenue Million Forecast, by Electrical Infrastructure 2019 & 2032

- Table 38: Middle East Data Center Construction Market Revenue Million Forecast, by Power Distribution Solution 2019 & 2032

- Table 39: Middle East Data Center Construction Market Revenue Million Forecast, by Power Backup Solutions 2019 & 2032

- Table 40: Middle East Data Center Construction Market Revenue Million Forecast, by Service 2019 & 2032

- Table 41: Middle East Data Center Construction Market Revenue Million Forecast, by Mechanical Infrastructure 2019 & 2032

- Table 42: Middle East Data Center Construction Market Revenue Million Forecast, by Cooling Systems 2019 & 2032

- Table 43: Middle East Data Center Construction Market Revenue Million Forecast, by Racks 2019 & 2032

- Table 44: Middle East Data Center Construction Market Revenue Million Forecast, by Other Mechanical Infrastructure 2019 & 2032

- Table 45: Middle East Data Center Construction Market Revenue Million Forecast, by General Construction 2019 & 2032

- Table 46: Middle East Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 47: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 1 and 2 2019 & 2032

- Table 48: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 3 2019 & 2032

- Table 49: Middle East Data Center Construction Market Revenue Million Forecast, by Tier 4 2019 & 2032

- Table 50: Middle East Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 51: Middle East Data Center Construction Market Revenue Million Forecast, by Banking, Financial Services, and Insurance 2019 & 2032

- Table 52: Middle East Data Center Construction Market Revenue Million Forecast, by IT and Telecommunications 2019 & 2032

- Table 53: Middle East Data Center Construction Market Revenue Million Forecast, by Government and Defense 2019 & 2032

- Table 54: Middle East Data Center Construction Market Revenue Million Forecast, by Healthcare 2019 & 2032

- Table 55: Middle East Data Center Construction Market Revenue Million Forecast, by Other End Users 2019 & 2032

- Table 56: Middle East Data Center Construction Market Revenue Million Forecast, by United Arab Emirates 2019 & 2032

- Table 57: Middle East Data Center Construction Market Revenue Million Forecast, by Saudi Arabia 2019 & 2032

- Table 58: Middle East Data Center Construction Market Revenue Million Forecast, by Israel 2019 & 2032

- Table 59: Middle East Data Center Construction Market Revenue Million Forecast, by Qatar 2019 & 2032

- Table 60: Middle East Data Center Construction Market Revenue Million Forecast, by Oman 2019 & 2032

- Table 61: Middle East Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Saudi Arabia Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: United Arab Emirates Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Israel Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Qatar Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Kuwait Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Oman Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Bahrain Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Jordan Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Lebanon Middle East Data Center Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Data Center Construction Market?

The projected CAGR is approximately 14.74%.

2. Which companies are prominent players in the Middle East Data Center Construction Market?

Key companies in the market include Canovate S A, ABB Ltd, Johnson Controls International PLC, Fortis Construction, STULZ GMBH, Delta Group, Schneider Electric SE, Turner Construction Co, DPR Construction Inc, Caterpillar Inc, Airedale International Air Conditioning Ltd, Cummins Inc, AECOM Limited, Legrand, CyrusOne Inc, Future Digital data Systems, Ashi & Bushnag Co Ltd, EAE Group, Alfa Laval AB, Saan Zahav Ltd.

3. What are the main segments of the Middle East Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Backup Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructure, General Construction, Tier Type, Tier 1 and 2, Tier 3, Tier 4, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users, United Arab Emirates, Saudi Arabia, Israel, Qatar, Oman.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Renewable Energy Sources; Increase in 5G Deployments Fueling Edge Data Center Investments; Smart City Initiatives Driving Data Center Investments.

6. What are the notable trends driving market growth?

End-User Outlook.

7. Are there any restraints impacting market growth?

Security Challenges in Data Centers; Location Constraints on the Development of Data Centers.

8. Can you provide examples of recent developments in the market?

October 2022: Mohamed bin Ali bin Mohamed Al-Mannai, Minister of Communications and Information Technology, launched the M-VAULT 4's fourth data center building. Customers in Qatar can access cloud services through the Microsoft Cloud data center region housed in the new data center facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Middle East Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence