Key Insights

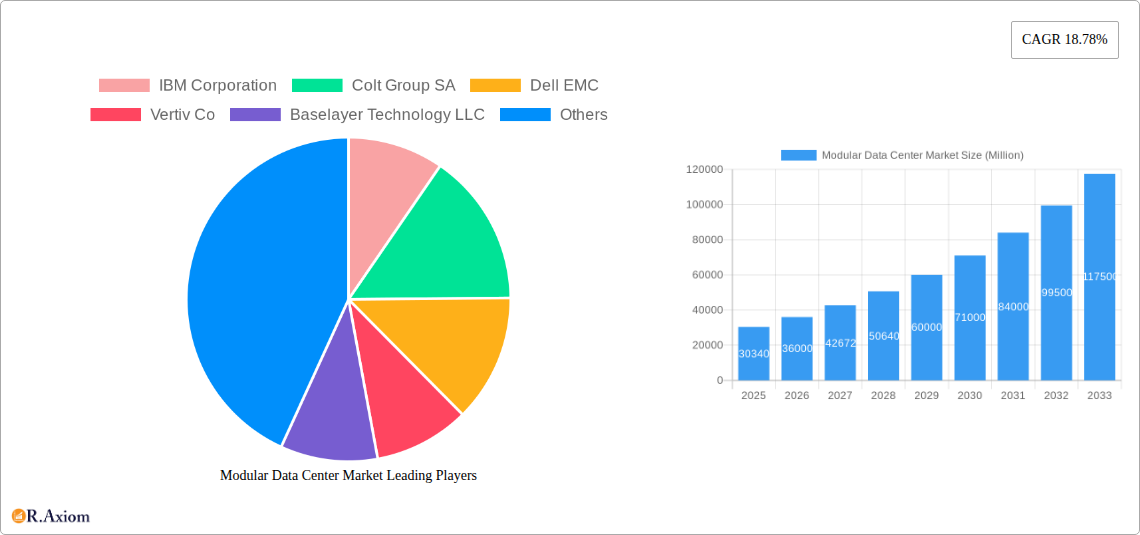

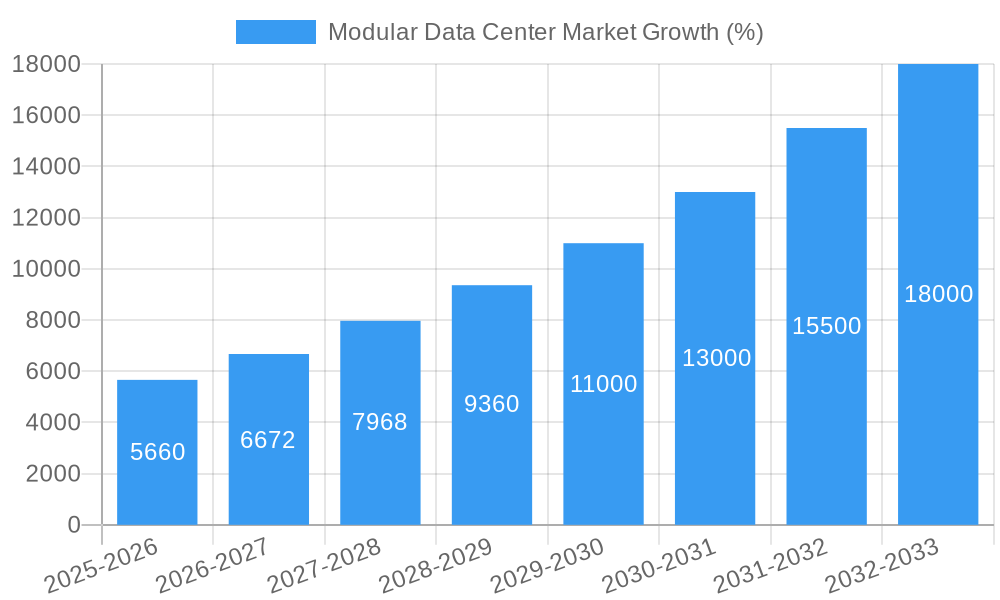

The modular data center market is experiencing robust growth, projected to reach $30.34 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 18.78% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing demand for faster deployment of IT infrastructure, particularly in edge computing and disaster recovery scenarios, necessitates the speed and scalability offered by modular solutions. Secondly, the rising adoption of cloud computing and the growth of data centers globally contribute significantly to this market's expansion. Organizations are seeking efficient, cost-effective, and easily scalable solutions to meet their expanding IT needs, making modular data centers an attractive option. Furthermore, the prefabricated nature of these centers reduces construction time and minimizes disruptions, appealing to businesses seeking rapid deployment and operational efficiency. Finally, advancements in technology, such as improved cooling systems and enhanced security features, are further fueling market growth.

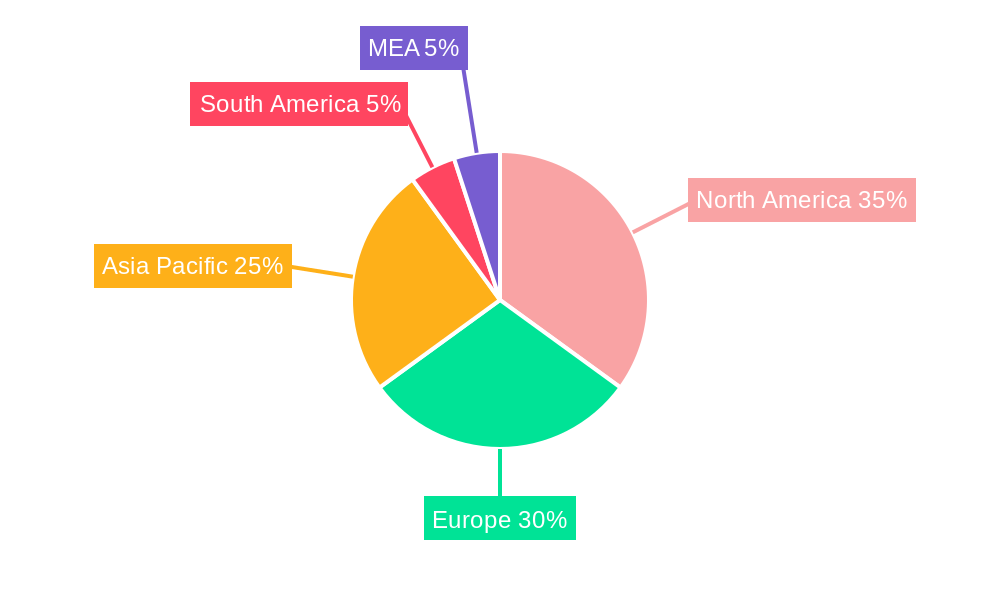

The market segmentation reveals a diverse landscape. The Function Module Solution segment (both individual and all-in-one modules) dominates the solution and services segment, reflecting a preference for customizable and integrated solutions. The application segment shows strong growth across disaster backup, high-performance/edge computing, and data center expansion, indicative of diverse user needs. IT, Telecom, and BFSI sectors lead in end-user adoption, highlighting the critical role of robust and scalable IT infrastructure across various industries. Geographically, North America and Europe currently hold significant market share, but the Asia-Pacific region is projected to experience rapid growth due to increasing digitalization and infrastructure investments in countries like China and India. Competitive rivalry is intense, with established players like IBM, Dell EMC, and Vertiv alongside innovative companies like Baselayer Technology and Bladeroom Group vying for market dominance. This competitive landscape fosters innovation and drives the market towards more efficient and cost-effective solutions.

Modular Data Center Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Modular Data Center market, encompassing market size, segmentation, growth drivers, challenges, and competitive landscape. The study period covers 2019-2033, with 2025 as the base year and forecast period extending to 2033. The report leverages extensive primary and secondary research to deliver actionable insights for industry stakeholders, investors, and businesses operating in this dynamic sector. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Modular Data Center Market Concentration & Innovation

The Modular Data Center market exhibits a moderately concentrated landscape with key players such as IBM Corporation, Colt Group SA, Dell EMC, Vertiv Co, Baselayer Technology LLC, Cannon Technologies Ltd, Schneider Electric SE, Rittal GmbH & Co KG, Huawei Technologies Co Ltd, HPE Company, Bladeroom Group Ltd, and Instant Data Centers LLC holding significant market share. However, the entry of several smaller, specialized companies is increasing competition.

Market Concentration: The top five players collectively account for approximately xx% of the global market share in 2025. This signifies a relatively concentrated market, although this figure is expected to shift slightly due to ongoing consolidation and innovation.

Innovation Drivers: Key innovation drivers include advancements in virtualization, cloud computing, edge computing, and the increasing adoption of sustainable technologies within data centers. The demand for greater efficiency, scalability, and flexibility fuels the development of innovative modular data center solutions.

Regulatory Frameworks: Government regulations focusing on data security, energy efficiency, and environmental sustainability are shaping market dynamics, incentivizing the adoption of compliant modular solutions.

Product Substitutes: Traditional, large-scale data centers still exist as a substitute, although their high capital expenditure and inflexibility are increasingly disadvantaging them against modular alternatives.

End-User Trends: The rising adoption of modular data centers across diverse end-user sectors, including IT, telecom, BFSI, government, and healthcare, is a significant market driver.

M&A Activities: The past five years have witnessed several mergers and acquisitions (M&As) within the modular data center space, with deal values exceeding xx Million in total. These activities illustrate the strategic importance of the market and companies' pursuit of market consolidation and technological expansion.

Modular Data Center Market Industry Trends & Insights

The Modular Data Center market is experiencing robust growth, driven by several factors. The rising demand for faster deployment times, improved scalability, and reduced operational costs is driving adoption across various sectors. Technological advancements, such as improved cooling systems and increased power density, enhance the efficiency and reliability of modular data centers. The global shift towards cloud computing and edge computing necessitates the implementation of scalable and flexible data center solutions, further boosting market growth. Furthermore, the preference for sustainable infrastructure is leading to the development of energy-efficient modular data centers, fostering a positive market outlook.

Dominant Markets & Segments in Modular Data Center Market

Leading Region/Country: North America currently holds the largest market share, driven by significant investments in IT infrastructure and the presence of major technology companies. However, the Asia-Pacific region is experiencing the fastest growth, fueled by rapid technological advancements and increasing digitalization.

Dominant Segments:

Solution and Services: The Function Module Solution segment (both individual and all-in-one) accounts for a significant market share due to its flexibility in accommodating specific needs. Services, including maintenance and support, are also a major segment contributing to market revenue.

Application: High-performance and edge computing applications show strong growth, driven by the need for low-latency data processing. Disaster backup is also a significant application area, ensuring business continuity.

End User: The IT and telecom sectors are the primary drivers of market growth, although the BFSI and government sectors are rapidly adopting modular solutions.

Key Drivers by Region/Segment:

North America: High IT spending, presence of major cloud providers, robust regulatory frameworks supporting data center development.

Asia-Pacific: Rapid digital transformation, increasing government initiatives promoting technological advancement, cost-effective manufacturing hubs.

Europe: Growing adoption of sustainable technologies, increasing data privacy concerns, strong governmental support for digital infrastructure.

Modular Data Center Market Product Developments

Recent product innovations focus on improving energy efficiency, enhancing scalability, and incorporating advanced monitoring and management capabilities. These advancements improve the overall operational efficiency and reduce the total cost of ownership for end users. The modular design allows for customization and adaptability to meet specific requirements, providing a competitive advantage over traditional data center solutions. Miniaturization and the incorporation of AI-powered management systems are also emerging trends.

Report Scope & Segmentation Analysis

The report meticulously segments the Modular Data Center market by solution (Function Module Solution - Individual Function Module and All-in-One Function Module, and Services), application (Disaster Backup, High Performance/Edge Computing, Data Center Expansion, Starter Data Centers), and end-user (IT, Telecom, BFSI, Government, Other End-Users). Each segment's growth projections, market size, and competitive dynamics are comprehensively analyzed, providing a granular understanding of the market landscape. Detailed analysis of each segment provides a complete understanding of each's contribution to the overall market growth.

Key Drivers of Modular Data Center Market Growth

Several key factors fuel the market's growth. Firstly, the rising demand for cloud computing and edge computing necessitates flexible and scalable data center solutions. Secondly, the increasing focus on reducing operational costs and improving energy efficiency promotes the adoption of modular data centers. Finally, advancements in technology, such as increased power density and improved cooling systems, further enhance the appeal of modular data centers.

Challenges in the Modular Data Center Market Sector

Challenges include the high initial investment costs, potential compatibility issues between different modular components from various vendors, and the need for specialized expertise in design and installation. Supply chain disruptions and the complexity of regulatory compliance in different regions can also hinder market growth.

Emerging Opportunities in Modular Data Center Market

Emerging opportunities lie in the expansion into new geographic markets, particularly in developing economies, and in the integration of new technologies such as artificial intelligence (AI) for improved management and automation. The growing demand for sustainable and environmentally friendly data centers presents a significant opportunity for the development of energy-efficient modular solutions.

Leading Players in the Modular Data Center Market Market

- IBM Corporation

- Colt Group SA

- Dell EMC

- Vertiv Co

- Baselayer Technology LLC

- Cannon Technologies Ltd

- Schneider Electric SE

- Rittal GmbH & Co KG

- Huawei Technologies Co Ltd

- HPE Company

- Bladeroom Group Ltd

- Instant Data Centers LLC

Key Developments in Modular Data Center Market Industry

June 2023: Hewlett Packard Enterprise announced an expanded partnership with Equinix, extending the HPE GreenLake private cloud portfolio to Equinix IBX data centers globally. This strategic move enhances the availability of private cloud offerings, increasing market competition and customer choice.

November 2022: Huawei launched the FusionModule2000 6.0 and UPS2000-H, enhancing its Smart Modular Data Center and UPS series. These offerings focus on small/medium-sized data centers and improve efficiency and green digitalization.

Strategic Outlook for Modular Data Center Market Market

The Modular Data Center market is poised for significant growth, driven by the increasing demand for scalable, efficient, and sustainable data center solutions. Continued technological advancements, coupled with expanding adoption across diverse industry sectors, will fuel market expansion in the coming years. The focus on sustainability and the integration of AI and other advanced technologies will further shape the future trajectory of this market.

Modular Data Center Market Segmentation

-

1. Solution and Services

- 1.1. Function

-

2. Application

- 2.1. Disaster Backup

- 2.2. High Performance/ Edge Computing

- 2.3. Data Center Expansion

- 2.4. Starter Data Centers

-

3. End User

- 3.1. IT

- 3.2. Telecom

- 3.3. BFSI

- 3.4. Government

- 3.5. Other En

Modular Data Center Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Modular Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Mobility and Scalability of Modular Data Centers; Disaster Recovery Advantages

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Professionals and Outdated Cybersecurity Technology

- 3.4. Market Trends

- 3.4.1. IT Sector to Hold Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Modular Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution and Services

- 5.1.1. Function

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Disaster Backup

- 5.2.2. High Performance/ Edge Computing

- 5.2.3. Data Center Expansion

- 5.2.4. Starter Data Centers

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT

- 5.3.2. Telecom

- 5.3.3. BFSI

- 5.3.4. Government

- 5.3.5. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution and Services

- 6. North America Modular Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Solution and Services

- 6.1.1. Function

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Disaster Backup

- 6.2.2. High Performance/ Edge Computing

- 6.2.3. Data Center Expansion

- 6.2.4. Starter Data Centers

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. IT

- 6.3.2. Telecom

- 6.3.3. BFSI

- 6.3.4. Government

- 6.3.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by Solution and Services

- 7. Europe Modular Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Solution and Services

- 7.1.1. Function

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Disaster Backup

- 7.2.2. High Performance/ Edge Computing

- 7.2.3. Data Center Expansion

- 7.2.4. Starter Data Centers

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. IT

- 7.3.2. Telecom

- 7.3.3. BFSI

- 7.3.4. Government

- 7.3.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by Solution and Services

- 8. Asia Pacific Modular Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Solution and Services

- 8.1.1. Function

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Disaster Backup

- 8.2.2. High Performance/ Edge Computing

- 8.2.3. Data Center Expansion

- 8.2.4. Starter Data Centers

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. IT

- 8.3.2. Telecom

- 8.3.3. BFSI

- 8.3.4. Government

- 8.3.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by Solution and Services

- 9. Latin America Modular Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Solution and Services

- 9.1.1. Function

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Disaster Backup

- 9.2.2. High Performance/ Edge Computing

- 9.2.3. Data Center Expansion

- 9.2.4. Starter Data Centers

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. IT

- 9.3.2. Telecom

- 9.3.3. BFSI

- 9.3.4. Government

- 9.3.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by Solution and Services

- 10. Middle East and Africa Modular Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Solution and Services

- 10.1.1. Function

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Disaster Backup

- 10.2.2. High Performance/ Edge Computing

- 10.2.3. Data Center Expansion

- 10.2.4. Starter Data Centers

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. IT

- 10.3.2. Telecom

- 10.3.3. BFSI

- 10.3.4. Government

- 10.3.5. Other En

- 10.1. Market Analysis, Insights and Forecast - by Solution and Services

- 11. North America Modular Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Modular Data Center Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Modular Data Center Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Modular Data Center Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Modular Data Center Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Modular Data Center Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 IBM Corporation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Colt Group SA

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Dell EMC

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Vertiv Co

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Baselayer Technology LLC

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Cannon Technologies Ltd

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Schneider Electric SE

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Rittal Gmbh & Co KG

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Huawei Technologies Co Ltd

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 HPE Company

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Bladeroom Group Ltd *List Not Exhaustive

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Instant Data Centers LLC

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 IBM Corporation

List of Figures

- Figure 1: Global Modular Data Center Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Modular Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Modular Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Modular Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Modular Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Modular Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Modular Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Modular Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Modular Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Modular Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Modular Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Modular Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Modular Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Modular Data Center Market Revenue (Million), by Solution and Services 2024 & 2032

- Figure 15: North America Modular Data Center Market Revenue Share (%), by Solution and Services 2024 & 2032

- Figure 16: North America Modular Data Center Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Modular Data Center Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Modular Data Center Market Revenue (Million), by End User 2024 & 2032

- Figure 19: North America Modular Data Center Market Revenue Share (%), by End User 2024 & 2032

- Figure 20: North America Modular Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Modular Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Modular Data Center Market Revenue (Million), by Solution and Services 2024 & 2032

- Figure 23: Europe Modular Data Center Market Revenue Share (%), by Solution and Services 2024 & 2032

- Figure 24: Europe Modular Data Center Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Modular Data Center Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Modular Data Center Market Revenue (Million), by End User 2024 & 2032

- Figure 27: Europe Modular Data Center Market Revenue Share (%), by End User 2024 & 2032

- Figure 28: Europe Modular Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Modular Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Modular Data Center Market Revenue (Million), by Solution and Services 2024 & 2032

- Figure 31: Asia Pacific Modular Data Center Market Revenue Share (%), by Solution and Services 2024 & 2032

- Figure 32: Asia Pacific Modular Data Center Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Asia Pacific Modular Data Center Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Modular Data Center Market Revenue (Million), by End User 2024 & 2032

- Figure 35: Asia Pacific Modular Data Center Market Revenue Share (%), by End User 2024 & 2032

- Figure 36: Asia Pacific Modular Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Pacific Modular Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Modular Data Center Market Revenue (Million), by Solution and Services 2024 & 2032

- Figure 39: Latin America Modular Data Center Market Revenue Share (%), by Solution and Services 2024 & 2032

- Figure 40: Latin America Modular Data Center Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Latin America Modular Data Center Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Latin America Modular Data Center Market Revenue (Million), by End User 2024 & 2032

- Figure 43: Latin America Modular Data Center Market Revenue Share (%), by End User 2024 & 2032

- Figure 44: Latin America Modular Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Latin America Modular Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East and Africa Modular Data Center Market Revenue (Million), by Solution and Services 2024 & 2032

- Figure 47: Middle East and Africa Modular Data Center Market Revenue Share (%), by Solution and Services 2024 & 2032

- Figure 48: Middle East and Africa Modular Data Center Market Revenue (Million), by Application 2024 & 2032

- Figure 49: Middle East and Africa Modular Data Center Market Revenue Share (%), by Application 2024 & 2032

- Figure 50: Middle East and Africa Modular Data Center Market Revenue (Million), by End User 2024 & 2032

- Figure 51: Middle East and Africa Modular Data Center Market Revenue Share (%), by End User 2024 & 2032

- Figure 52: Middle East and Africa Modular Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 53: Middle East and Africa Modular Data Center Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Modular Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Modular Data Center Market Revenue Million Forecast, by Solution and Services 2019 & 2032

- Table 3: Global Modular Data Center Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Modular Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global Modular Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Modular Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Modular Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Belgium Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherland Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Nordics Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Modular Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Southeast Asia Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Phillipes Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Modular Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Peru Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Chile Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Colombia Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Ecuador Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Venezuela Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Modular Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United States Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Canada Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mexico Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Modular Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: United Arab Emirates Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Saudi Arabia Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East and Africa Modular Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Modular Data Center Market Revenue Million Forecast, by Solution and Services 2019 & 2032

- Table 52: Global Modular Data Center Market Revenue Million Forecast, by Application 2019 & 2032

- Table 53: Global Modular Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 54: Global Modular Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global Modular Data Center Market Revenue Million Forecast, by Solution and Services 2019 & 2032

- Table 56: Global Modular Data Center Market Revenue Million Forecast, by Application 2019 & 2032

- Table 57: Global Modular Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 58: Global Modular Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Modular Data Center Market Revenue Million Forecast, by Solution and Services 2019 & 2032

- Table 60: Global Modular Data Center Market Revenue Million Forecast, by Application 2019 & 2032

- Table 61: Global Modular Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 62: Global Modular Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Global Modular Data Center Market Revenue Million Forecast, by Solution and Services 2019 & 2032

- Table 64: Global Modular Data Center Market Revenue Million Forecast, by Application 2019 & 2032

- Table 65: Global Modular Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 66: Global Modular Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 67: Global Modular Data Center Market Revenue Million Forecast, by Solution and Services 2019 & 2032

- Table 68: Global Modular Data Center Market Revenue Million Forecast, by Application 2019 & 2032

- Table 69: Global Modular Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 70: Global Modular Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Modular Data Center Market?

The projected CAGR is approximately 18.78%.

2. Which companies are prominent players in the Modular Data Center Market?

Key companies in the market include IBM Corporation, Colt Group SA, Dell EMC, Vertiv Co, Baselayer Technology LLC, Cannon Technologies Ltd, Schneider Electric SE, Rittal Gmbh & Co KG, Huawei Technologies Co Ltd, HPE Company, Bladeroom Group Ltd *List Not Exhaustive, Instant Data Centers LLC.

3. What are the main segments of the Modular Data Center Market?

The market segments include Solution and Services, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Mobility and Scalability of Modular Data Centers; Disaster Recovery Advantages.

6. What are the notable trends driving market growth?

IT Sector to Hold Significant Market Growth.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Professionals and Outdated Cybersecurity Technology.

8. Can you provide examples of recent developments in the market?

June 2023: Hewlett Packard Enterprise announced an expanded partnership with Equinix to extend the HPE GreenLake private cloud portfolio at Equinix International Business Exchange (IBX) data centers. Hewlett Packard Enterprise will pre-provision HPE GreenLake for Private Cloud Enterprise and HPE GreenLake for Private Cloud Business Edition at strategic Equinix data centers around the world, giving customers rapid access to a broad range of private cloud offerings for more incredible speed, agility, flexibility, and choice in their hybrid cloud strategy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Modular Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Modular Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Modular Data Center Market?

To stay informed about further developments, trends, and reports in the Modular Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence