Key Insights

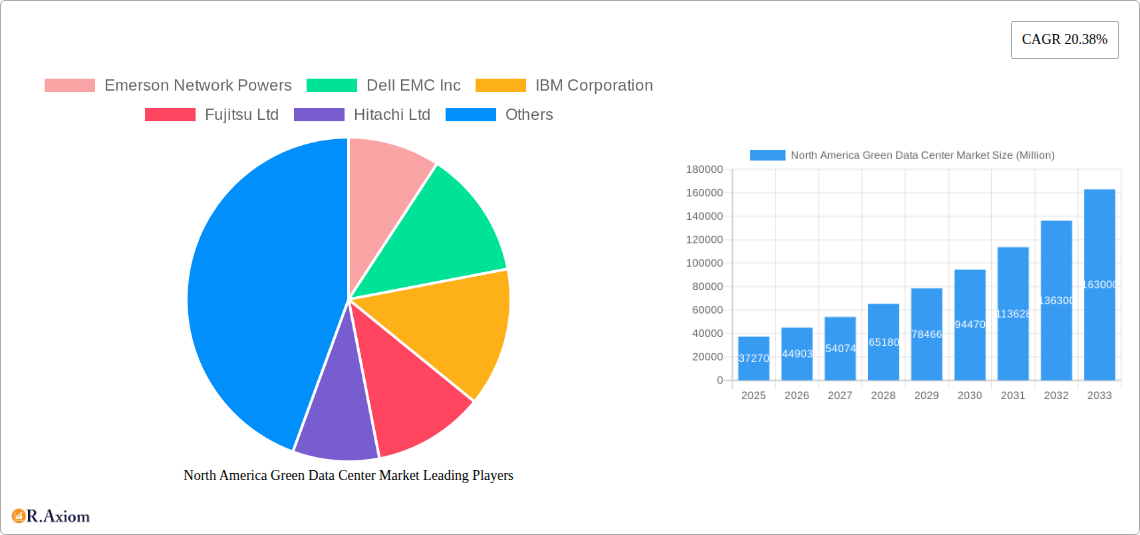

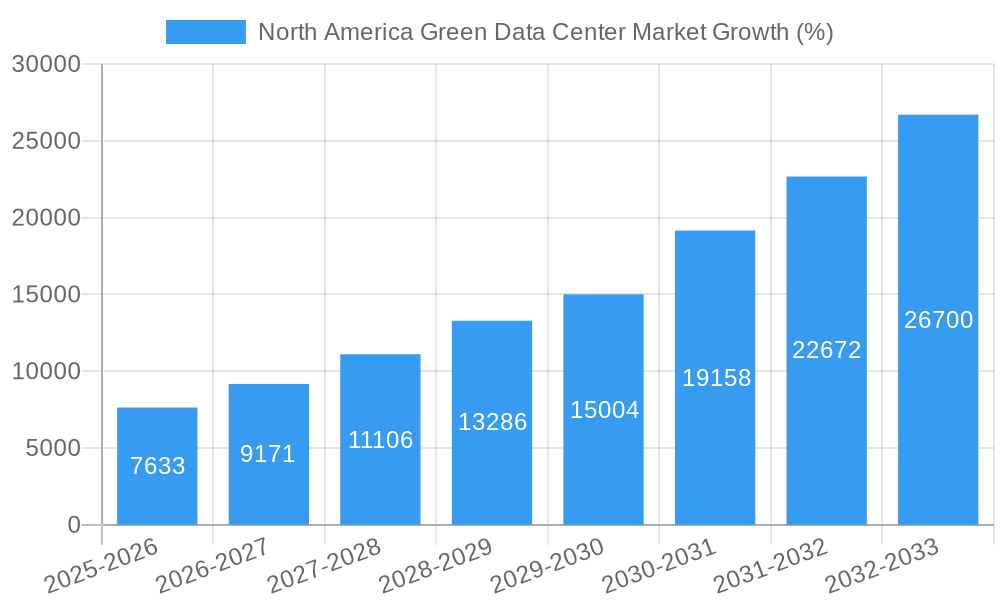

The North America green data center market is experiencing robust growth, projected to reach a substantial market size, driven by increasing environmental concerns and stringent regulatory frameworks promoting energy efficiency. The market's Compound Annual Growth Rate (CAGR) of 20.38% from 2019 to 2024 indicates significant expansion. This growth is fueled by the rising adoption of energy-efficient technologies within data centers, including advanced cooling systems, renewable energy sources, and virtualization technologies. Key drivers include the escalating demand for data storage and processing power, coupled with a growing awareness of the environmental impact of traditional data centers. The increasing focus on sustainability initiatives within both the public and private sectors is further bolstering market expansion. Significant investments in research and development for green technologies are also contributing to innovation and market expansion.

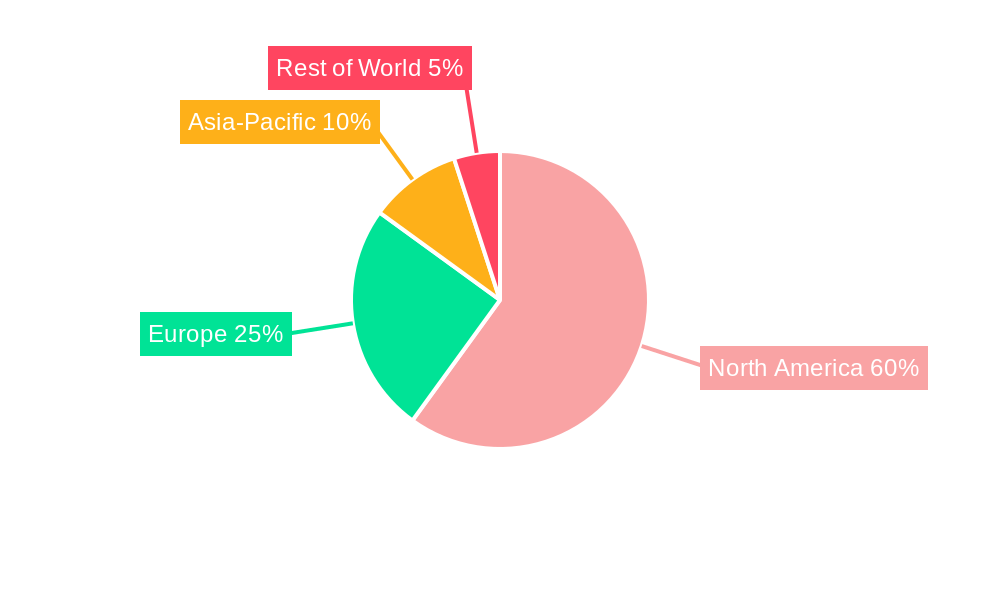

Market segmentation reveals that system integration services, power solutions, and management software comprise substantial portions of the market. Colocation providers, cloud service providers, and enterprises are the leading users of these green data center solutions. The healthcare, financial services, and government sectors represent key end-user industries, driving demand due to stringent data security and regulatory compliance requirements. Major players like Emerson Network Power, Dell EMC, IBM, and Schneider Electric are actively shaping the market landscape through technological advancements and strategic partnerships. While potential restraints include high initial investment costs associated with green technologies, the long-term cost savings and environmental benefits are increasingly outweighing these concerns. The market's future growth is expected to be influenced by technological advancements in areas such as AI-powered energy optimization and the expansion of renewable energy infrastructure. North America, particularly the United States, will continue to dominate the market due to the high concentration of data centers and robust technology infrastructure.

This in-depth report provides a comprehensive analysis of the North America Green Data Center market, offering valuable insights for stakeholders across the industry. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market trends, competitive dynamics, growth drivers, and challenges, providing a detailed forecast for 2025-2033. Key segments analyzed include services (System Integration, Monitoring Services, Professional Services, Other Services), solutions (Power, Servers, Management Software, Networking Technologies, Cooling, Other Solutions), users (Colocation Providers, Cloud Service Providers, Enterprises), and end-user industries (Healthcare, Financial Services, Government, Telecom and IT, Other Industry Verticals). Leading players like Emerson Network Powers, Dell EMC Inc, IBM Corporation, Fujitsu Ltd, Hitachi Ltd, Schneider Electric SE, HP Inc, Cisco Technology Inc, GoGrid LLC, and Eaton Corporation are profiled, highlighting their strategies and market positions. The report also incorporates recent key developments shaping the market landscape.

North America Green Data Center Market Concentration & Innovation

The North America green data center market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. Emerson Network Powers, Dell EMC, and IBM collectively account for an estimated xx% of the market in 2025. However, the market is witnessing increased competition from smaller, specialized providers focusing on niche solutions and sustainable technologies. Innovation is a key driver, fueled by the rising demand for energy-efficient and environmentally friendly data center solutions. Government regulations promoting sustainability and reducing carbon emissions further incentivize innovation in areas such as renewable energy integration, water-cooled systems, and AI-powered optimization software. Product substitutes, while limited, include traditional data centers that lack green initiatives, but their market share is declining due to increasing awareness of environmental and operational cost benefits. End-user trends indicate a strong preference for sustainable solutions, driven by corporate social responsibility initiatives and the need for cost optimization. M&A activities in this sector have seen moderate activity in recent years, with deal values averaging xx Million in the period 2019-2024, reflecting strategic investments and consolidation within the market. Recent examples include smaller acquisitions aimed at enhancing technological capabilities and expanding service offerings.

North America Green Data Center Market Industry Trends & Insights

The North America green data center market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). Several factors contribute to this growth, including increasing data volumes driven by digital transformation, growing awareness of environmental sustainability, and stringent government regulations promoting energy efficiency. Technological disruptions, such as the adoption of AI and machine learning for data center optimization and the emergence of edge computing, are further fueling market expansion. Consumer preferences are increasingly shifting towards sustainable and energy-efficient solutions, resulting in higher market penetration for green data centers. The competitive landscape is dynamic, with established players investing heavily in R&D and smaller companies entering the market with innovative solutions. Market penetration of green data centers is expected to reach xx% by 2033, driven primarily by the adoption of sustainable practices in cloud services and colocation facilities. The increasing adoption of renewable energy sources such as solar and wind power, coupled with advancements in cooling technologies, significantly impacts market growth.

Dominant Markets & Segments in North America Green Data Center Market

Leading Region/Country: The US dominates the North American green data center market, driven by a high concentration of technology companies, robust digital infrastructure, and supportive government policies. California, Texas, and Virginia are key states within the US market.

Dominant Segments:

By Service: System integration services hold the largest market share due to the complexity of designing, building, and deploying green data centers. Monitoring services are also experiencing rapid growth, driven by the need for real-time performance monitoring and optimization.

By Solution: Power solutions (renewable energy integration, power management systems) and cooling technologies (liquid cooling, air-cooled systems) constitute major segments due to their crucial role in energy efficiency and sustainability.

By User: Cloud service providers are a major driving force behind the growth of green data centers, followed by colocation providers and enterprises increasingly adopting sustainable infrastructure.

By End-User Industry: The financial services and telecom/IT sectors are leading adopters due to their high dependency on data center infrastructure and increasing focus on sustainability. The healthcare sector is also showing significant growth due to increasing data volumes and regulatory requirements.

Key drivers for dominance include favorable economic policies promoting green technology adoption, investment in robust digital infrastructure, and a large pool of skilled professionals.

North America Green Data Center Market Product Developments

Recent product innovations focus on enhancing energy efficiency, reducing carbon footprint, and improving operational efficiency. This includes advancements in liquid cooling systems, AI-powered power management, and renewable energy integration. These innovations offer several competitive advantages, including reduced operating costs, improved reliability, and enhanced sustainability credentials, aligning perfectly with the growing market demand for environmentally friendly data center solutions. The trend towards modular and prefabricated data centers is also gaining traction, offering faster deployment and scalability.

Report Scope & Segmentation Analysis

The report provides a comprehensive segmentation analysis across services, solutions, users, and end-user industries. Each segment is analyzed based on historical data (2019-2024), estimated market size (2025), and forecast (2025-2033). Growth projections, market sizes, and competitive dynamics are provided for each segment. For instance, the System Integration segment is projected to experience a CAGR of xx% due to the increasing complexity of green data center deployments. Similarly, the cloud service provider segment is expected to drive substantial growth in the adoption of green data center solutions.

Key Drivers of North America Green Data Center Market Growth

Several factors are driving the growth of the North America green data center market. These include: increasing energy costs, stringent government regulations mandating reduced carbon emissions, rising demand for data storage and processing, the growing adoption of cloud computing, and a heightened awareness of environmental sustainability amongst corporations. Technological advancements, such as improved cooling technologies and renewable energy integration, further accelerate market growth. Specific policies like tax incentives for green technologies and carbon emission reduction targets are also playing a pivotal role.

Challenges in the North America Green Data Center Market Sector

The growth of the North America green data center market faces several challenges. These include high initial investment costs for implementing green technologies, the complexity of integrating renewable energy sources, a limited supply of skilled professionals specializing in green data center design and maintenance, and potential regulatory uncertainties surrounding environmental compliance. Supply chain disruptions and the availability of key components can also impact the market. The impact of these challenges is reflected in the slower adoption rate of some green technologies in certain segments.

Emerging Opportunities in North America Green Data Center Market

Emerging opportunities include the increasing adoption of edge computing, the growing demand for hyperscale data centers, and the potential for innovative business models focusing on green data center-as-a-service. Advances in AI-powered optimization, improved energy storage solutions, and the development of more sustainable cooling technologies present significant market opportunities. Furthermore, expanding into new geographical areas with less developed data center infrastructure creates potential for significant growth.

Leading Players in the North America Green Data Center Market Market

- Emerson Network Powers

- Dell EMC Inc

- IBM Corporation

- Fujitsu Ltd

- Hitachi Ltd

- Schneider Electric SE

- HP Inc

- Cisco Technology Inc

- GoGrid LLC

- Eaton Corporation

Key Developments in North America Green Data Center Market Industry

October 2022: Dell Technologies and NTT collaborated to establish a cutting-edge, environmentally friendly data center for Phone Pay, highlighting the growing adoption of sustainable infrastructure by fintech firms.

April 2022: Iron Mountain's Phoenix data center achieved BREEAM design certification, setting a new benchmark for sustainable data center construction in North America.

Strategic Outlook for North America Green Data Center Market Market

The future of the North America green data center market appears bright, driven by sustained growth in data consumption, increasing regulatory pressure, and a growing focus on sustainability. The market is poised for further expansion as technological innovations lead to greater efficiency, reduced operating costs, and a lower environmental footprint. Companies that effectively adapt to emerging trends and invest in cutting-edge green technologies are well-positioned for success in this rapidly evolving market.

North America Green Data Center Market Segmentation

-

1. Service

- 1.1. System Integration

- 1.2. Monitoring Services

- 1.3. Professional Services

- 1.4. Other Services

-

2. Solution

- 2.1. Power

- 2.2. Servers

- 2.3. Management Software

- 2.4. Networking Technologies

- 2.5. Cooling

- 2.6. Other Solutions

-

3. User

- 3.1. Colocation Providers

- 3.2. Cloud Service Providers

- 3.3. Enterprises

-

4. End-User Industry

- 4.1. Healthcare

- 4.2. Financial Services

- 4.3. Government

- 4.4. Telecom and IT

- 4.5. Other Industry Verticals

North America Green Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Green Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.38% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Data Storage; Focus on Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. Higher Initial Investments

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Data Storage Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Green Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. System Integration

- 5.1.2. Monitoring Services

- 5.1.3. Professional Services

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Solution

- 5.2.1. Power

- 5.2.2. Servers

- 5.2.3. Management Software

- 5.2.4. Networking Technologies

- 5.2.5. Cooling

- 5.2.6. Other Solutions

- 5.3. Market Analysis, Insights and Forecast - by User

- 5.3.1. Colocation Providers

- 5.3.2. Cloud Service Providers

- 5.3.3. Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-User Industry

- 5.4.1. Healthcare

- 5.4.2. Financial Services

- 5.4.3. Government

- 5.4.4. Telecom and IT

- 5.4.5. Other Industry Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. United States North America Green Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Green Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Green Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Green Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Emerson Network Powers

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Dell EMC Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IBM Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fujitsu Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hitachi Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Schneider Electric SE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 HP Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cisco Technology Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 GoGrid LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Eaton Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Emerson Network Powers

List of Figures

- Figure 1: North America Green Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Green Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: North America Green Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Green Data Center Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: North America Green Data Center Market Revenue Million Forecast, by Solution 2019 & 2032

- Table 4: North America Green Data Center Market Revenue Million Forecast, by User 2019 & 2032

- Table 5: North America Green Data Center Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: North America Green Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Green Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Green Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Green Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Green Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America Green Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America Green Data Center Market Revenue Million Forecast, by Service 2019 & 2032

- Table 13: North America Green Data Center Market Revenue Million Forecast, by Solution 2019 & 2032

- Table 14: North America Green Data Center Market Revenue Million Forecast, by User 2019 & 2032

- Table 15: North America Green Data Center Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 16: North America Green Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States North America Green Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada North America Green Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico North America Green Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Green Data Center Market?

The projected CAGR is approximately 20.38%.

2. Which companies are prominent players in the North America Green Data Center Market?

Key companies in the market include Emerson Network Powers, Dell EMC Inc, IBM Corporation, Fujitsu Ltd, Hitachi Ltd, Schneider Electric SE, HP Inc, Cisco Technology Inc, GoGrid LLC, Eaton Corporation.

3. What are the main segments of the North America Green Data Center Market?

The market segments include Service, Solution, User, End-User Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 37.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Data Storage; Focus on Energy Efficiency.

6. What are the notable trends driving market growth?

Increasing Demand for Data Storage Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Higher Initial Investments.

8. Can you provide examples of recent developments in the market?

October 2022: Dell Technologies and NTT collaboratively established a cutting-edge, environmentally friendly data center for the fintech firm Phone Pay. This state-of-the-art facility features robust data security measures, exceptional power efficiency, streamlined operational procedures, and cloud solutions. These innovations enable Phone Pay to create a sustainable and efficient infrastructure, facilitating the seamless nationwide expansion of their operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Green Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Green Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Green Data Center Market?

To stay informed about further developments, trends, and reports in the North America Green Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence