Key Insights

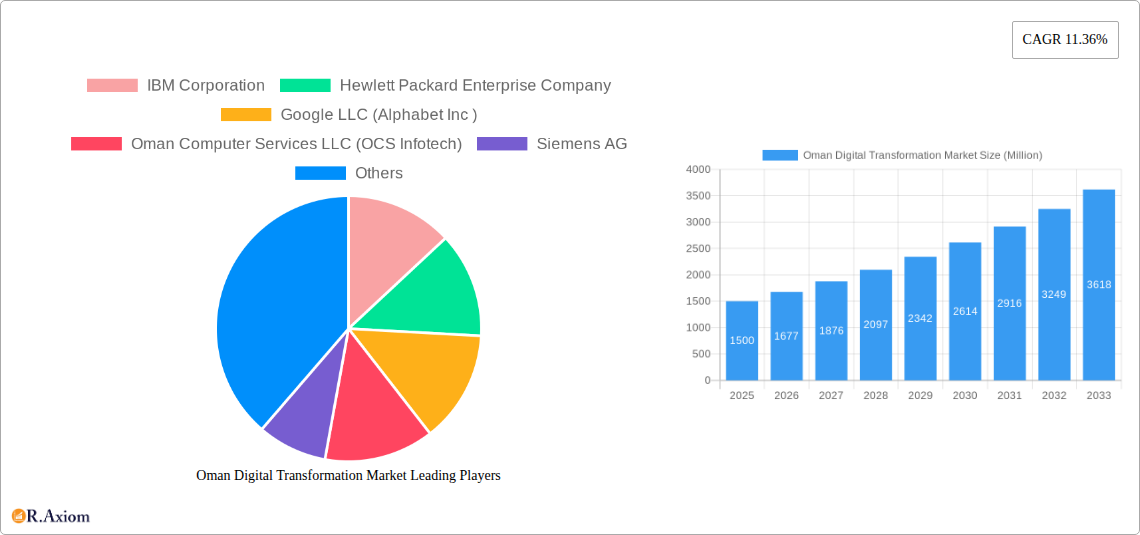

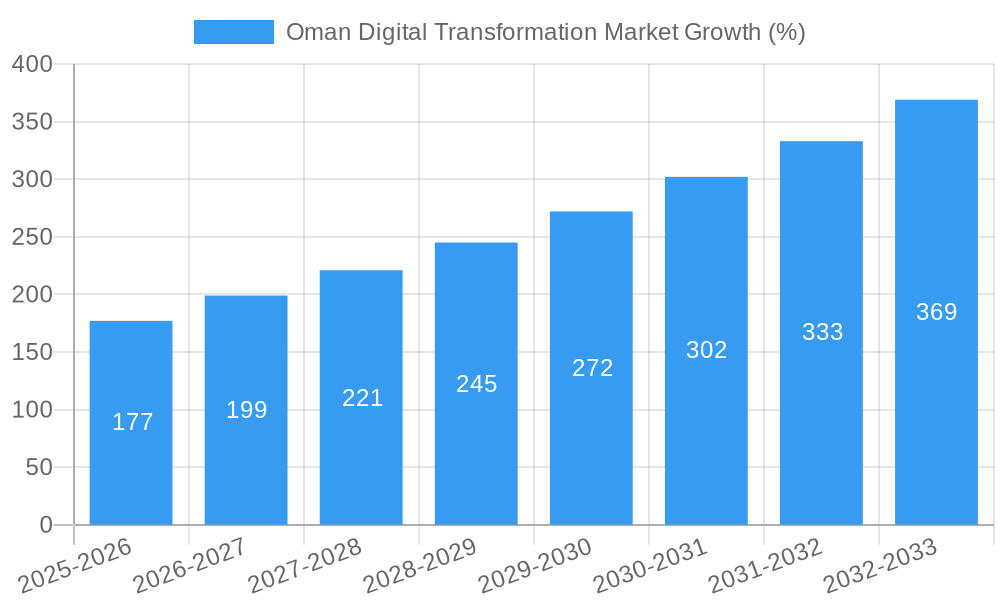

The Oman digital transformation market is experiencing robust growth, projected to reach a substantial market size driven by increasing government initiatives promoting digitalization across sectors, a burgeoning adoption of cloud computing and AI/ML technologies by businesses, and the expanding reach of high-speed internet access. The 11.36% CAGR from 2019-2024 indicates a strong upward trajectory, likely fueled by the nation's strategic focus on diversifying its economy away from oil and gas. Key segments driving this growth include software, IT and infrastructure services, and telecommunications, with significant contributions from analytics, AI/ML, IoT, and cybersecurity solutions. The end-user industries of Oil, Gas, and Utilities, and the Financial Services sector are early adopters, investing heavily in digital solutions to enhance operational efficiency, improve customer service, and gain a competitive edge. However, challenges remain including the need for skilled workforce development to support the transition and address potential cybersecurity threats associated with increased digital dependence. Future growth will likely be determined by the pace of infrastructure development, government support programs, and the successful adoption of transformative technologies across the wider economy.

The forecast period (2025-2033) presents significant opportunities for technology providers and investors. Continued government investment in digital infrastructure, coupled with the private sector’s increasing willingness to adopt advanced technologies, are expected to maintain the high growth trajectory. The market is expected to see increasing competition among both domestic and international players, leading to innovation and price optimization. Strategies focused on delivering tailored solutions catering to specific industry needs, along with robust cybersecurity measures, will be crucial for success in this dynamic market. Specific sub-segments like edge computing and extended reality are poised for significant growth in the coming years, driven by their potential to optimize operational processes and create innovative customer experiences across various sectors.

This comprehensive report provides a detailed analysis of the Oman Digital Transformation Market, covering the period 2019-2033. It offers in-depth insights into market size, growth drivers, challenges, opportunities, and key players, equipping stakeholders with actionable intelligence for strategic decision-making. The report segments the market by component (hardware, software, IT & infrastructure services, telecommunication services), technology (analytics & AI/ML, IoT, edge computing, industrial robotics, extended reality, blockchain, cybersecurity, 3D printing, other technologies), and end-user industry (oil, gas & utilities, travel & hospitality, healthcare, financial services, manufacturing & construction, government & defense, other end-user industries). The base year for the report is 2025, with estimates for 2025 and a forecast period of 2025-2033. The historical period covered is 2019-2024.

Oman Digital Transformation Market Concentration & Innovation

The Oman digital transformation market exhibits a moderately concentrated landscape, with a few major multinational players like IBM, Hewlett Packard Enterprise, and Google holding significant market share. However, local players like Oman Computer Services LLC (OCS Infotech) and Ooredoo Oman are also establishing themselves, creating a dynamic competitive environment. Innovation is driven by government initiatives promoting digitalization across sectors and the increasing adoption of advanced technologies like AI/ML and IoT. The regulatory framework, though evolving, aims to support digital growth while ensuring data security and privacy. Product substitutes are limited, primarily focusing on legacy systems, but the market is increasingly favoring cloud-based solutions. End-user trends reveal a growing demand for integrated solutions that streamline operations and enhance efficiency.

Mergers and acquisitions (M&A) activity is moderate, with strategic partnerships playing a crucial role. While specific M&A deal values are unavailable (xx Million), these transactions typically involve technology providers acquiring smaller companies specializing in niche areas or forming alliances to expand their service offerings. For example, the partnership between Siemens and OTE Group (October 2022) highlights the strategic importance of collaborations in driving market expansion. Overall, the market displays a healthy mix of established players and emerging innovators, shaping a competitive yet collaborative landscape.

- Market Concentration: Moderately concentrated, with multinational and local players coexisting.

- Innovation Drivers: Government initiatives, technological advancements, and increasing end-user demand.

- Regulatory Framework: Evolving, supporting digital growth while prioritizing data security.

- M&A Activity: Moderate, with strategic partnerships playing a crucial role (xx Million in total deal value).

Oman Digital Transformation Market Industry Trends & Insights

The Oman Digital Transformation Market is experiencing robust growth, driven by several key factors. The government's ambitious Vision 2040, focused on economic diversification and technological advancement, is a primary catalyst. The country's substantial investment in infrastructure development, including digital infrastructure, further accelerates adoption. This is reflected in a CAGR of xx% during the historical period (2019-2024) and a projected CAGR of xx% during the forecast period (2025-2033). Market penetration remains relatively low compared to global standards, presenting significant untapped potential. Technological disruptions, particularly the rising adoption of cloud computing, AI/ML, and IoT, are transforming business operations across all sectors. Consumer preferences are shifting towards digital solutions, emphasizing convenience, efficiency, and personalized experiences. The competitive dynamics are intense, with both local and international companies vying for market share, leading to innovation and price competition. The market size in 2025 is estimated at xx Million, with projections reaching xx Million by 2033.

Dominant Markets & Segments in Oman Digital Transformation Market

The Oil, Gas, and Utilities sector currently holds the largest share of the Oman Digital Transformation market, driven by the need for enhanced efficiency and operational safety in resource-intensive industries. The Government and Defense sector is another significant segment, with substantial investments in digital infrastructure and security solutions. Within the technology segments, Analytics and AI/ML and Cybersecurity are experiencing rapid growth, driven by the increasing volume of data generated and the rising concerns over cyber threats.

- By Component: IT and Infrastructure Services are projected to dominate, followed by Software and Hardware.

- By Technology: Analytics and AI/ML and Cybersecurity are leading the technology segments.

- By End-user Industry: Oil, Gas, and Utilities and Government and Defence are the leading segments.

Key Drivers:

- Government Initiatives: Vision 2040, digital infrastructure investments.

- Economic Growth: Diversification efforts and increasing private sector investments.

- Technological Advancements: Cloud computing, AI/ML, IoT adoption.

Oman Digital Transformation Market Product Developments

Recent product innovations focus on integrated solutions combining multiple technologies, such as AI-powered cybersecurity platforms and IoT-enabled smart city initiatives. These solutions aim to provide comprehensive and efficient solutions catering to specific industry needs. Competitive advantages are achieved through superior technology, strong customer support, and strategic partnerships. The market displays a strong inclination towards cloud-based solutions due to their scalability, cost-effectiveness, and ease of implementation.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the Oman Digital Transformation market. The market is segmented by Component (Hardware, Software, IT and Infrastructure Services, Telecommunication Services), Technology (Analytics and AI and ML, IoT, Edge Computing, Industrial Robotics, Extended Reality, Blockchain, Cybersecurity, 3D Printing, Other Technologies), and End-user Industry (Oil, Gas, and Utilities, Travel and Hospitality, Healthcare, Financial Services, Manufacturing and Construction, Government and Defense, Other End-user Industries). Each segment is analyzed based on historical data, current market size, and future growth projections, highlighting the competitive dynamics and potential opportunities. Growth projections vary significantly across segments, with the fastest growth predicted in the analytics and AI/ML segments within the Technology category and the Government and Defence segment in the End-user Industry category.

Key Drivers of Oman Digital Transformation Market Growth

The Oman Digital Transformation Market’s growth is propelled by several factors: government initiatives like Vision 2040, which emphasizes digitalization; substantial investments in digital infrastructure; the rising adoption of advanced technologies like AI/ML and IoT; and increasing demand for efficient and streamlined operations across various sectors. The private sector's growing engagement and investments also contribute significantly to the market expansion. The strategic partnerships forged between international technology giants and Omani companies exemplify the market's dynamic growth trajectory.

Challenges in the Oman Digital Transformation Market Sector

Despite the immense potential, the Oman Digital Transformation Market faces challenges. These include the need for enhanced digital literacy and skills development within the workforce, ensuring data security and privacy in an increasingly connected world, and managing the potential disruptions caused by rapid technological advancements. Supply chain complexities and the need for robust regulatory frameworks also pose obstacles to market growth. Additionally, the relatively high cost of some advanced technologies can hinder wider adoption.

Emerging Opportunities in Oman Digital Transformation Market

Emerging opportunities are plentiful. The government's focus on smart city initiatives and the growing demand for digital solutions across sectors, particularly in the burgeoning tourism and logistics industries, create fertile ground for expansion. The increasing adoption of cloud computing, edge computing, and cybersecurity solutions present lucrative market niches. Furthermore, the development of specialized solutions targeting the unique needs of Oman's specific industries, such as oil & gas, offers significant opportunities for growth and innovation.

Leading Players in the Oman Digital Transformation Market Market

- IBM Corporation

- Hewlett Packard Enterprise Company

- Google LLC (Alphabet Inc)

- Oman Computer Services LLC (OCS Infotech)

- Siemens AG

- Omani Qatari Telecommunications Company SAOG (Ooredoo Oman)

- Microsoft Corporation

- Oman Telecommunications Company

- Amazon Web Services Inc (Amazon Com Inc)

- Oracle Corporation

- SAP SE

Key Developments in Oman Digital Transformation Market Industry

- April 2023: Muscat Leading Investment Group plans to adopt digital transformation solutions using SAP and Inflexion, aiming for enhanced business visibility and responsiveness.

- October 2022: Siemens partners with OTE Group to deliver EV chargers, accelerating Oman's transition to sustainable transportation and smart infrastructure development.

Strategic Outlook for Oman Digital Transformation Market Market

The Oman Digital Transformation Market is poised for sustained growth, driven by government support, technological advancements, and increasing private sector investments. Future opportunities lie in leveraging emerging technologies like AI/ML, IoT, and blockchain to enhance efficiency, optimize resource utilization, and create new value propositions across various industries. The focus on developing a robust digital infrastructure and skilled workforce will further underpin market expansion, making Oman a compelling destination for digital transformation investments.

Oman Digital Transformation Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. IT and Infrastructure Services

- 1.4. Telecommunication Services

-

2. Technology

- 2.1. Analytics and AI and Ml

- 2.2. IoT

- 2.3. Edge Computing

- 2.4. Industrial Robotics

- 2.5. Extended Reality

- 2.6. Blockchain

- 2.7. Cybersecurity

- 2.8. 3D Printing

- 2.9. Other Technologies

-

3. End-user Industry

- 3.1. Oil, Gas, and Utilities

- 3.2. Travel and Hospitality

- 3.3. Healthcare

- 3.4. Financial Services

- 3.5. Manufacturing and Construction

- 3.6. Government and Defense

- 3.7. Other En

Oman Digital Transformation Market Segmentation By Geography

- 1. Oman

Oman Digital Transformation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Events and Tourism Demanding Automation; Government Policies and Ppp Initiatives; Rising Industrial Automation

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Ongoing Events and Tourism Demanding Automation to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Digital Transformation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT and Infrastructure Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Analytics and AI and Ml

- 5.2.2. IoT

- 5.2.3. Edge Computing

- 5.2.4. Industrial Robotics

- 5.2.5. Extended Reality

- 5.2.6. Blockchain

- 5.2.7. Cybersecurity

- 5.2.8. 3D Printing

- 5.2.9. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil, Gas, and Utilities

- 5.3.2. Travel and Hospitality

- 5.3.3. Healthcare

- 5.3.4. Financial Services

- 5.3.5. Manufacturing and Construction

- 5.3.6. Government and Defense

- 5.3.7. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hewlett Packard Enterprise Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Google LLC (Alphabet Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oman Computer Services LLC (OCS Infotech)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Omani Qatari Telecommunications Company SAOG (Ooredoo Oman)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oman Telecommunications Compan

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amazon Web Services Inc (Amazon Com Inc )

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oracle Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SAP SE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Oman Digital Transformation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Digital Transformation Market Share (%) by Company 2024

List of Tables

- Table 1: Oman Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Digital Transformation Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Oman Digital Transformation Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Oman Digital Transformation Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Oman Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Oman Digital Transformation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Oman Digital Transformation Market Revenue Million Forecast, by Component 2019 & 2032

- Table 8: Oman Digital Transformation Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 9: Oman Digital Transformation Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: Oman Digital Transformation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Digital Transformation Market?

The projected CAGR is approximately 11.36%.

2. Which companies are prominent players in the Oman Digital Transformation Market?

Key companies in the market include IBM Corporation, Hewlett Packard Enterprise Company, Google LLC (Alphabet Inc ), Oman Computer Services LLC (OCS Infotech), Siemens AG, Omani Qatari Telecommunications Company SAOG (Ooredoo Oman), Microsoft Corporation, Oman Telecommunications Compan, Amazon Web Services Inc (Amazon Com Inc ), Oracle Corporation, SAP SE.

3. What are the main segments of the Oman Digital Transformation Market?

The market segments include Component, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Events and Tourism Demanding Automation; Government Policies and Ppp Initiatives; Rising Industrial Automation.

6. What are the notable trends driving market growth?

Ongoing Events and Tourism Demanding Automation to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness.

8. Can you provide examples of recent developments in the market?

In April 2023, Muscat Leading Investment Group, a company in Oman, planned to adopt digital transformation solutions using SAP and Inflexion. Through this digital transformation journey powered by Inflexion and SAP, Muscat's Leading Investment Group may get greater visibility and control over all aspects of its business operations, enabling it to respond quickly to the changing needs of all stakeholders and the dynamic business environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Digital Transformation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Digital Transformation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Digital Transformation Market?

To stay informed about further developments, trends, and reports in the Oman Digital Transformation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence