Key Insights

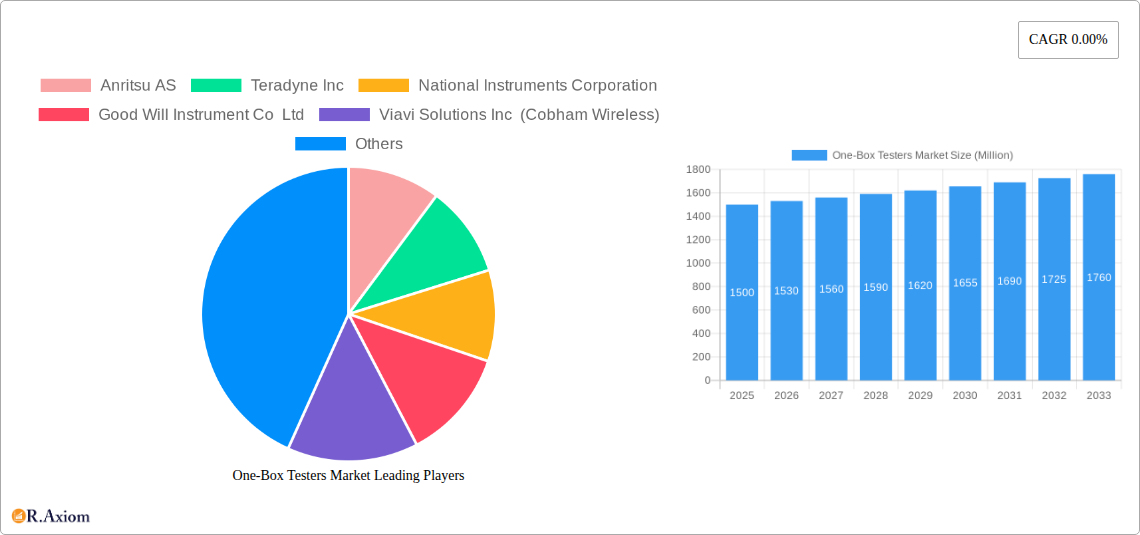

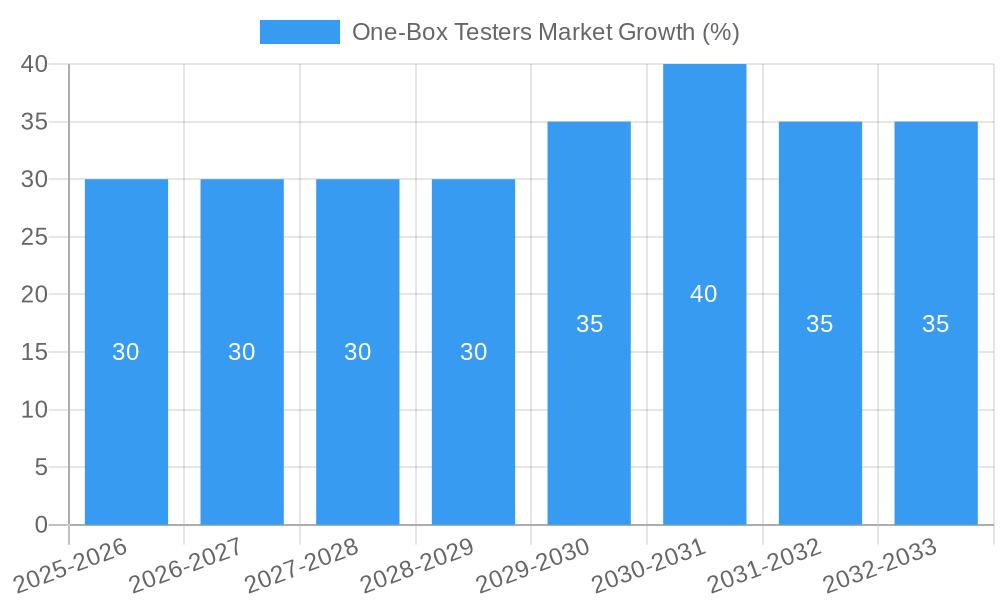

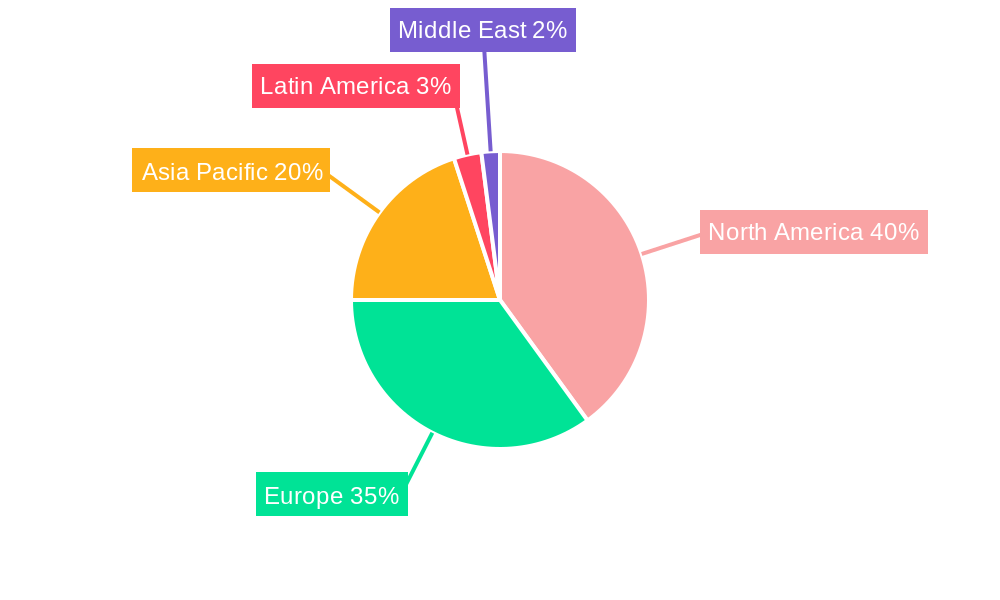

The One-Box Testers market, while exhibiting a currently stagnant CAGR of 0.00, is poised for moderate growth driven by several key factors. The increasing demand for faster and more efficient testing solutions across various end-user applications, particularly in the rapidly expanding telecommunications and consumer electronics sectors, is a significant driver. Automation needs within manufacturing processes are also fueling market expansion, as one-box testers streamline testing procedures and reduce overall costs. Technological advancements, such as the integration of advanced algorithms and artificial intelligence for improved accuracy and speed, contribute to the market's evolving landscape. However, the market faces certain restraints, primarily the high initial investment costs associated with acquiring these advanced testing systems. This can be a barrier to entry for smaller companies, especially in developing regions. Competitive pressure from established players like Keysight Technologies, Rohde & Schwarz, and Teradyne, further shapes the market dynamics. The market segmentation by end-user application highlights the significant contributions of telecommunications, consumer electronics, and automotive industries. While the North American and European markets currently hold a larger share, the Asia-Pacific region is expected to witness significant growth in the coming years due to increasing manufacturing activities and technological adoption. The forecast period of 2025-2033 anticipates a gradual but steady market expansion driven by ongoing technological innovation and the rising demand for sophisticated testing solutions across diverse sectors.

The market's relatively low current CAGR might indicate a period of consolidation and technological refinement before a more significant surge in growth. However, the underlying drivers and emerging trends suggest a positive outlook. Further market penetration into underserved segments, particularly in the industrial and research sectors, presents opportunities for market expansion. The development of more cost-effective, portable, and user-friendly one-box testers could also broaden the market's reach and accelerate adoption. Strategic partnerships and collaborations among key players could also lead to innovative solutions and market expansion. Therefore, a comprehensive understanding of these drivers, trends, and restraints is crucial for stakeholders to navigate this evolving landscape successfully. Future projections are subject to technological advancements and broader economic conditions.

This in-depth report provides a comprehensive analysis of the One-Box Testers market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market concentration, technological advancements, dominant segments, and key players, providing a robust forecast for the period 2025-2033. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

One-Box Testers Market Concentration & Innovation

This section analyzes the competitive landscape of the One-Box Testers market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with key players holding significant market share. Anritsu AS, Teradyne Inc, and Keysight Technologies Inc are among the leading companies, collectively holding an estimated xx% market share in 2025. Innovation is driven by the need for higher throughput, increased accuracy, and reduced testing time. Regulatory frameworks, such as those related to safety and emissions compliance, influence product development and adoption. The emergence of software-defined testing and cloud-based solutions is driving the adoption of substitutes. End-user trends towards miniaturization and higher integration are impacting demand. The M&A landscape has witnessed several deals, with total deal values exceeding xx Million in the past five years, primarily aimed at expanding product portfolios and geographic reach.

- Market Concentration: High (xx%), Moderate (xx%), Low (xx%) – [Further details on the market share distribution will be provided in the full report].

- Innovation Drivers: Higher throughput, improved accuracy, reduced testing time, software-defined testing, cloud-based solutions.

- Regulatory Frameworks: Safety and emissions compliance standards.

- M&A Activity: Total deal value exceeding xx Million in the last five years.

One-Box Testers Market Industry Trends & Insights

This section delves into the key trends and insights shaping the One-Box Testers market. The market is experiencing robust growth, fueled by increasing demand from the telecommunication, automotive, and consumer electronics sectors. Technological advancements, such as the incorporation of artificial intelligence (AI) and machine learning (ML) algorithms for automated testing and predictive maintenance, are revolutionizing testing methodologies. Consumer preferences for faster, smaller, and more energy-efficient devices are driving the demand for advanced testing solutions. The competitive landscape is characterized by intense rivalry, with companies focusing on product innovation, strategic partnerships, and geographic expansion to gain a competitive edge. Market penetration is expected to reach xx% by 2033.

- CAGR: xx% (2025-2033)

- Key Growth Drivers: Increasing demand from major end-user sectors; technological advancements, including AI/ML integration; consumer demand for advanced device features.

- Competitive Dynamics: Intense rivalry, focused on innovation, partnerships, and geographic expansion.

Dominant Markets & Segments in One-Box Testers Market

The telecommunication segment currently dominates the One-Box Testers market, driven by the proliferation of 5G and other advanced wireless technologies. This segment is expected to maintain its leadership throughout the forecast period. Other significant segments include consumer electronics and automotive, each exhibiting strong growth potential.

- Leading Region/Country: [Specific region/country details will be provided in the full report].

- Dominant Segment: Telecommunication

- Key Drivers for Telecommunication Dominance: 5G deployment, increasing demand for high-speed data networks, stringent quality control requirements.

- Key Drivers for Consumer Electronics Segment: Growth in smart devices and wearables.

- Key Drivers for Automotive Segment: Increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles.

One-Box Testers Market Product Developments

Recent product innovations focus on improved accuracy, faster testing times, and integrated functionalities. These advancements cater to the growing need for efficient and reliable testing solutions across various industries. The incorporation of AI and ML algorithms in automated testing is a significant development, enabling faster analysis and predictive maintenance. These innovations enhance the competitive advantages of manufacturers by providing superior performance and functionality.

Report Scope & Segmentation Analysis

This report segments the One-Box Testers market by end-user application: Telecommunication, Consumer Electronics, Automotive, Aerospace & Defense, Industrial, Research & Education, and Other End-user Applications. Each segment exhibits unique growth trajectories and competitive dynamics. For example, the telecommunication segment is projected to experience the highest growth rate due to 5G deployment, while the automotive segment is poised for significant expansion driven by the increasing adoption of electric vehicles and ADAS. Detailed analysis of market size, growth projections, and competitive landscape for each segment is provided within the full report.

Key Drivers of One-Box Testers Market Growth

Several factors contribute to the growth of the One-Box Testers market. Technological advancements, including the integration of AI/ML, enable faster and more efficient testing. Increasing demand from key end-user sectors, particularly telecommunications and automotive, fuels market expansion. Stringent regulatory requirements for product quality and safety further stimulate market growth. Government initiatives promoting technological advancements also positively impact the market.

Challenges in the One-Box Testers Market Sector

The One-Box Testers market faces challenges, including the high cost of advanced testing equipment, the complexity of integrating diverse testing technologies, and intense competition among established players. Supply chain disruptions and the need for skilled technicians also pose challenges. These factors can impact market growth and profitability. [Quantifiable impacts will be detailed in the full report].

Emerging Opportunities in One-Box Testers Market

Emerging opportunities lie in the expansion of the market into new applications, such as renewable energy and healthcare. Technological advancements like 5G and IoT present new testing needs. The adoption of cloud-based testing solutions offers potential for market growth. Furthermore, increased automation and AI/ML integration create new avenues for efficiency and innovation.

Leading Players in the One-Box Testers Market Market

- Anritsu AS

- Teradyne Inc

- National Instruments Corporation

- Good Will Instrument Co Ltd

- Viavi Solutions Inc (Cobham Wireless)

- Tektronics Inc

- Teledyne LeCroy Inc

- Keysight Technologies Inc

- Rohde & Schwarz GmbH & Co KG

- Chroma ATE Inc

Key Developments in One-Box Testers Market Industry

- [Month, Year]: Company X launches a new One-Box Tester with AI-powered capabilities.

- [Month, Year]: Company Y acquires Company Z to expand its product portfolio.

- [Month, Year]: New industry standard for One-Box Testers is established.

- [Further details on key developments will be provided in the full report.]

Strategic Outlook for One-Box Testers Market Market

The One-Box Testers market holds significant potential for future growth, driven by continuous technological advancements, increasing demand from diverse sectors, and the emergence of new applications. Strategic partnerships, investments in research and development, and expansion into emerging markets will be crucial for success in this competitive landscape. The market is expected to witness continued consolidation, with larger players acquiring smaller companies to strengthen their market position.

One-Box Testers Market Segmentation

-

1. End-user Application

- 1.1. Telecommunication

- 1.2. Consumer Electronics

- 1.3. Automotive

- 1.4. Aerospace & Defense

- 1.5. Industrial

- 1.6. Research & Education

- 1.7. Other End-user Applications

One-Box Testers Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

One-Box Testers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Automation Using Wireless Communication Across the Industries; Worldwide Proliferation of 5G Network

- 3.3. Market Restrains

- 3.3.1. ; Lack of Skilled workforce

- 3.4. Market Trends

- 3.4.1. Telecommunication Industry to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global One-Box Testers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Application

- 5.1.1. Telecommunication

- 5.1.2. Consumer Electronics

- 5.1.3. Automotive

- 5.1.4. Aerospace & Defense

- 5.1.5. Industrial

- 5.1.6. Research & Education

- 5.1.7. Other End-user Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End-user Application

- 6. North America One-Box Testers Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-user Application

- 6.1.1. Telecommunication

- 6.1.2. Consumer Electronics

- 6.1.3. Automotive

- 6.1.4. Aerospace & Defense

- 6.1.5. Industrial

- 6.1.6. Research & Education

- 6.1.7. Other End-user Applications

- 6.1. Market Analysis, Insights and Forecast - by End-user Application

- 7. Europe One-Box Testers Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-user Application

- 7.1.1. Telecommunication

- 7.1.2. Consumer Electronics

- 7.1.3. Automotive

- 7.1.4. Aerospace & Defense

- 7.1.5. Industrial

- 7.1.6. Research & Education

- 7.1.7. Other End-user Applications

- 7.1. Market Analysis, Insights and Forecast - by End-user Application

- 8. Asia Pacific One-Box Testers Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-user Application

- 8.1.1. Telecommunication

- 8.1.2. Consumer Electronics

- 8.1.3. Automotive

- 8.1.4. Aerospace & Defense

- 8.1.5. Industrial

- 8.1.6. Research & Education

- 8.1.7. Other End-user Applications

- 8.1. Market Analysis, Insights and Forecast - by End-user Application

- 9. Latin America One-Box Testers Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-user Application

- 9.1.1. Telecommunication

- 9.1.2. Consumer Electronics

- 9.1.3. Automotive

- 9.1.4. Aerospace & Defense

- 9.1.5. Industrial

- 9.1.6. Research & Education

- 9.1.7. Other End-user Applications

- 9.1. Market Analysis, Insights and Forecast - by End-user Application

- 10. Middle East One-Box Testers Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End-user Application

- 10.1.1. Telecommunication

- 10.1.2. Consumer Electronics

- 10.1.3. Automotive

- 10.1.4. Aerospace & Defense

- 10.1.5. Industrial

- 10.1.6. Research & Education

- 10.1.7. Other End-user Applications

- 10.1. Market Analysis, Insights and Forecast - by End-user Application

- 11. North America One-Box Testers Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe One-Box Testers Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific One-Box Testers Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America One-Box Testers Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East One-Box Testers Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Anritsu AS

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Teradyne Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 National Instruments Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Good Will Instrument Co Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Viavi Solutions Inc (Cobham Wireless)

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Tektronics Inc *List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Teledyne LeCroy Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Keysight Technologies Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Rohde & Schwarz GmbH & Co KG

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Chroma ATE Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Anritsu AS

List of Figures

- Figure 1: Global One-Box Testers Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America One-Box Testers Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America One-Box Testers Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe One-Box Testers Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe One-Box Testers Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific One-Box Testers Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific One-Box Testers Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America One-Box Testers Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America One-Box Testers Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East One-Box Testers Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East One-Box Testers Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America One-Box Testers Market Revenue (Million), by End-user Application 2024 & 2032

- Figure 13: North America One-Box Testers Market Revenue Share (%), by End-user Application 2024 & 2032

- Figure 14: North America One-Box Testers Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America One-Box Testers Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe One-Box Testers Market Revenue (Million), by End-user Application 2024 & 2032

- Figure 17: Europe One-Box Testers Market Revenue Share (%), by End-user Application 2024 & 2032

- Figure 18: Europe One-Box Testers Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe One-Box Testers Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific One-Box Testers Market Revenue (Million), by End-user Application 2024 & 2032

- Figure 21: Asia Pacific One-Box Testers Market Revenue Share (%), by End-user Application 2024 & 2032

- Figure 22: Asia Pacific One-Box Testers Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific One-Box Testers Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America One-Box Testers Market Revenue (Million), by End-user Application 2024 & 2032

- Figure 25: Latin America One-Box Testers Market Revenue Share (%), by End-user Application 2024 & 2032

- Figure 26: Latin America One-Box Testers Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America One-Box Testers Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East One-Box Testers Market Revenue (Million), by End-user Application 2024 & 2032

- Figure 29: Middle East One-Box Testers Market Revenue Share (%), by End-user Application 2024 & 2032

- Figure 30: Middle East One-Box Testers Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East One-Box Testers Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global One-Box Testers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global One-Box Testers Market Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 3: Global One-Box Testers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global One-Box Testers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: One-Box Testers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global One-Box Testers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: One-Box Testers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global One-Box Testers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: One-Box Testers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global One-Box Testers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: One-Box Testers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global One-Box Testers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: One-Box Testers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global One-Box Testers Market Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 15: Global One-Box Testers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global One-Box Testers Market Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 17: Global One-Box Testers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global One-Box Testers Market Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 19: Global One-Box Testers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global One-Box Testers Market Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 21: Global One-Box Testers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global One-Box Testers Market Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 23: Global One-Box Testers Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the One-Box Testers Market?

The projected CAGR is approximately 0.00%.

2. Which companies are prominent players in the One-Box Testers Market?

Key companies in the market include Anritsu AS, Teradyne Inc, National Instruments Corporation, Good Will Instrument Co Ltd, Viavi Solutions Inc (Cobham Wireless), Tektronics Inc *List Not Exhaustive, Teledyne LeCroy Inc, Keysight Technologies Inc, Rohde & Schwarz GmbH & Co KG, Chroma ATE Inc.

3. What are the main segments of the One-Box Testers Market?

The market segments include End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Automation Using Wireless Communication Across the Industries; Worldwide Proliferation of 5G Network.

6. What are the notable trends driving market growth?

Telecommunication Industry to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Lack of Skilled workforce.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "One-Box Testers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the One-Box Testers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the One-Box Testers Market?

To stay informed about further developments, trends, and reports in the One-Box Testers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence