Key Insights

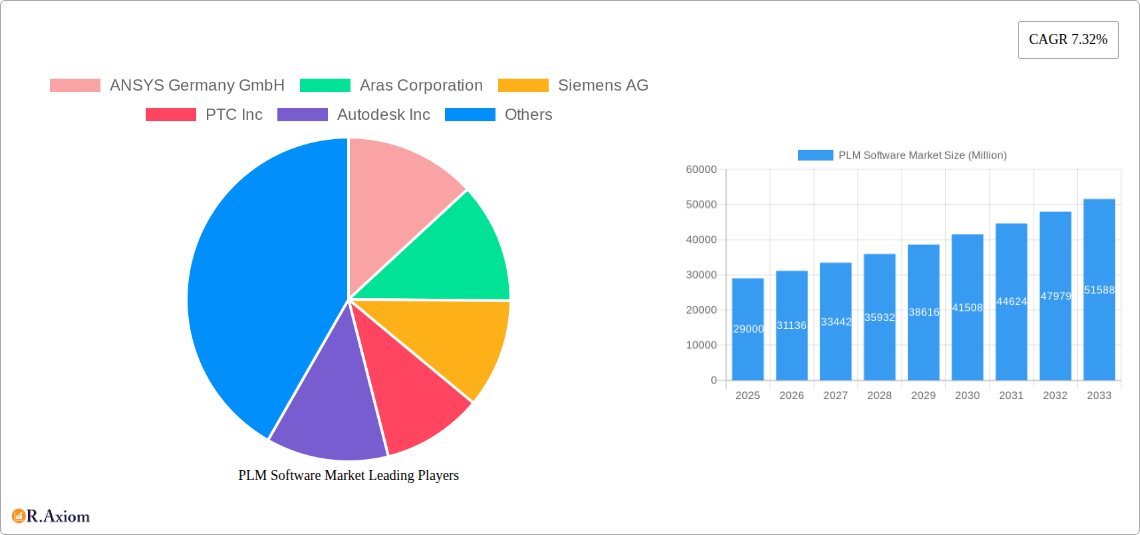

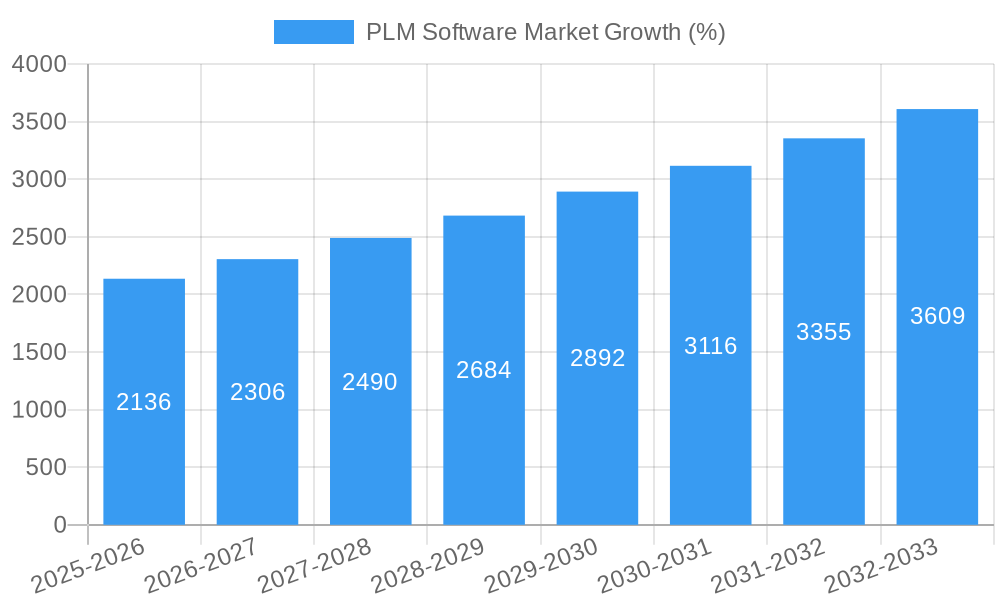

The global Product Lifecycle Management (PLM) software market is experiencing robust growth, projected to reach \$29 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.32% from 2025 to 2033. This expansion is driven by several key factors. Increasing demand for enhanced product development processes across diverse industries, including electronics, automotive, and aerospace & defense, fuels the adoption of PLM software. The shift towards cloud-based deployment models offers scalability and cost-effectiveness, further boosting market growth. Furthermore, the integration of advanced technologies like Artificial Intelligence (AI) and the Internet of Things (IoT) into PLM platforms is enhancing product design, collaboration, and data management capabilities, attracting more businesses. The rising complexity of products and the need for efficient supply chain management also contribute to the market's expansion.

However, the market faces some restraints. High initial investment costs for implementing PLM software, particularly for smaller companies, can hinder widespread adoption. The need for specialized skills and expertise to effectively utilize these sophisticated systems presents another challenge. Moreover, ensuring data security and integrating legacy systems with new PLM platforms can be complex and time-consuming. Despite these limitations, the long-term benefits of improved product quality, reduced development time, and enhanced collaboration are expected to drive continued market growth across all major segments, including on-premise, cloud, and professional services deployments, and across various end-user industries. The competitive landscape is dominated by established players like ANSYS, Siemens, PTC, Autodesk, and Dassault Systèmes, with ongoing innovation and strategic partnerships shaping the market's future trajectory.

PLM Software Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the PLM Software market, covering market size, growth projections, key players, and emerging trends from 2019 to 2033. The study period encompasses historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). This report is invaluable for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market.

PLM Software Market Concentration & Innovation

The PLM software market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous niche players and ongoing innovation ensures a dynamic competitive environment. Market concentration is influenced by factors such as the size and complexity of PLM implementations, the need for industry-specific solutions, and the high switching costs associated with changing platforms. The global market share in 2024 is estimated at xx Million, with the top 5 players holding approximately xx% of the market. Innovation is driven by factors such as the increasing adoption of cloud-based solutions, the integration of AI and machine learning capabilities, and the demand for improved collaboration tools. Regulatory frameworks, such as data privacy regulations (GDPR, CCPA), significantly impact vendor strategies and adoption rates. The market also faces competition from product substitutes, such as alternative data management systems and specialized engineering software. End-user trends towards digitalization and the increasing importance of supply chain resilience are also driving market evolution. Mergers and acquisitions (M&A) activity plays a substantial role in shaping the market landscape, with deal values in the hundreds of Millions in recent years.

- Market Share (2024, Estimated): Top 5 players: xx%

- M&A Deal Values (2019-2024): Total estimated value: xx Million

- Key Innovation Drivers: Cloud computing, AI/ML integration, enhanced collaboration tools.

- Regulatory Influences: GDPR, CCPA, and other data privacy regulations.

PLM Software Market Industry Trends & Insights

The PLM software market is experiencing robust growth, driven by several key factors. The increasing adoption of digital transformation initiatives across various industries, particularly in manufacturing and engineering, is a major catalyst. Technological advancements, like the rise of cloud-based PLM and the integration of IoT technologies, are further propelling market expansion. Consumer preferences for personalized products and faster product development cycles are pushing companies to adopt PLM solutions to streamline their processes. The competitive landscape is marked by both intense competition among established players and the emergence of new entrants offering innovative solutions. The market is witnessing a shift from on-premise to cloud-based deployments, driven by increased scalability, cost-effectiveness, and accessibility. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected at xx%, indicating significant growth potential. Market penetration continues to increase as more businesses recognize the value proposition of PLM software in improving efficiency and reducing costs. The global market is expected to reach xx Million by 2033.

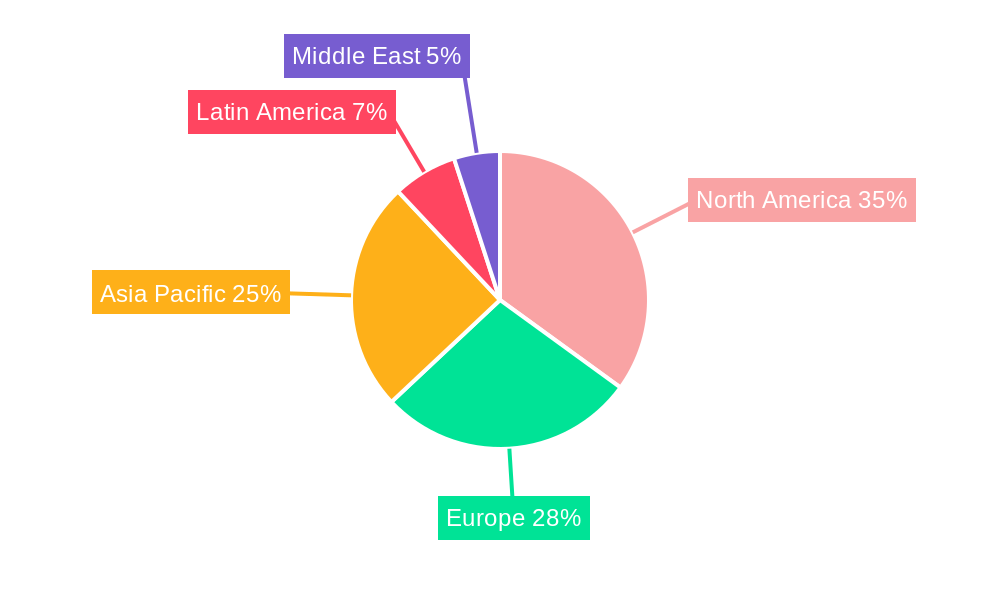

Dominant Markets & Segments in PLM Software Market

The North American region currently holds a dominant position in the PLM software market, driven by factors such as high technological adoption rates, significant investment in research and development, and the presence of major industry players. Europe and Asia Pacific also represent significant markets, with robust growth expected in the coming years. Among end-user industries, the automotive and aerospace & defense sectors are major consumers of PLM software due to the complexity of their products and stringent regulatory requirements. The high-tech and electronics sectors are also significant contributors to market growth. The cloud deployment model is experiencing the fastest growth, driven by the advantages of scalability, cost-effectiveness, and accessibility.

Leading Region: North America

Key Drivers (North America): High technological adoption, R&D investments, established industry players.

Fastest-growing Segment: Cloud deployment

Key End-user Industries: Automotive, Aerospace & Defense, High-tech, Electronics.

Key Drivers (Automotive): Complex product designs, stringent quality standards.

Key Drivers (Aerospace & Defense): Stringent regulations, complex supply chains.

Key Drivers (High-tech & Electronics): Rapid innovation, short product lifecycles.

PLM Software Market Product Developments

Recent product innovations in PLM software focus on enhancing collaboration, improving data management capabilities, and integrating advanced technologies such as AI and machine learning. These advancements enable businesses to accelerate product development, optimize supply chains, and improve product quality. New features like advanced analytics dashboards provide valuable insights into product performance and manufacturing processes. The integration of digital twins is gaining traction, enabling manufacturers to simulate and optimize product designs before physical prototypes are built. This focus on data-driven insights and streamlined processes is enhancing the market fit and competitive advantages of modern PLM platforms.

Report Scope & Segmentation Analysis

This report segments the PLM software market by deployment type (on-premise, cloud, professional services) and by end-user industry (electronics, industrial equipment & high-tech, aerospace & defense, automotive, architecture, engineering & construction (AEC), other end-user industries). Each segment's growth projections, market size, and competitive dynamics are analyzed. The cloud deployment model is expected to show the highest growth rate due to its scalability and accessibility. Within end-user industries, the automotive and aerospace sectors are anticipated to exhibit significant market growth driven by increasing demands for complex product development. The professional services segment is expected to expand as businesses increasingly rely on external expertise for implementing and managing their PLM solutions.

- By Deployment Type: On-premise, Cloud, Professional Services (Growth projections and market sizes provided for each)

- By End-user Industry: Electronics, Industrial Equipment & High-tech, Aerospace & Defense, Automotive, Architecture, Engineering & Construction (AEC), Other End-user Industries (Growth projections and market sizes provided for each)

Key Drivers of PLM Software Market Growth

Several factors are driving the growth of the PLM software market. Firstly, technological advancements, particularly in cloud computing, AI, and IoT, are creating more efficient and sophisticated solutions. Secondly, the increasing need for enhanced collaboration across the product lifecycle is pushing businesses to adopt PLM software. Thirdly, rising regulatory pressures related to data security and compliance necessitate robust PLM solutions. Finally, economic factors such as the increasing focus on optimizing operational efficiency and reducing costs further contribute to the growth of this market.

Challenges in the PLM Software Market Sector

Despite the considerable growth potential, the PLM software market faces challenges. High implementation costs and the complexity of integrating PLM systems with existing IT infrastructure represent significant hurdles. The need for skilled professionals to manage and maintain these systems can also restrict adoption. Furthermore, intense competition among vendors and the emergence of new technologies continuously disrupt the market and create uncertainty. These factors could impact market growth in the medium term by limiting adoption among certain segments of businesses.

Emerging Opportunities in PLM Software Market

The PLM software market presents numerous exciting opportunities. The expansion into emerging economies with growing manufacturing sectors offers significant potential for growth. The integration of extended reality (XR) technologies, such as augmented and virtual reality, for product visualization and collaboration, creates new opportunities for innovation. Furthermore, the increasing adoption of sustainable manufacturing practices necessitates PLM solutions that support environmentally conscious design and production processes, opening new market niches.

Leading Players in the PLM Software Market Market

- ANSYS Germany GmbH

- Aras Corporation

- Siemens AG

- PTC Inc

- Autodesk Inc

- Dassault Systèmes Deutschland GmbH

- Oracle Corporation

- Infor Inc

- Arena Solutions

- SAP SE

Key Developments in PLM Software Market Industry

- January 2023: Hunkemöller selected Bamboo Rose's PLM, sourcing, and purchase order management applications to streamline its operations and support international growth. This highlights the increasing demand for integrated PLM solutions within the fashion and retail industries.

- March 2023: Bamboo Rose acquired Backbone PLM, expanding its product development platform and strengthening its position in the market. This acquisition reflects the ongoing consolidation within the PLM software sector and the increasing importance of designer-centric platforms.

Strategic Outlook for PLM Software Market Market

The future of the PLM software market appears bright, with continued growth driven by technological advancements, increasing digitalization across industries, and the need for improved product development processes. The convergence of PLM with other technologies such as AI, IoT, and cloud computing will create innovative solutions that address evolving business needs. Companies that embrace these technological trends and adapt to evolving market dynamics will be best positioned to succeed in this competitive and dynamic market. The market is expected to experience significant growth over the forecast period, driven by the aforementioned factors.

PLM Software Market Segmentation

-

1. Deployment Type

- 1.1. On-premise

- 1.2. Cloud

- 1.3. Professional Services

-

2. End-user Industry

- 2.1. Electronics, Industrial Equipment, and High-tech

- 2.2. Aerospace and Defense

- 2.3. Automotive

- 2.4. Architecture, Engineering, and Construction (AEC)

- 2.5. Other End-user Industries

PLM Software Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

PLM Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Digitalization to Improve Production; Introduction of Cloud Technology to Consolidate the Information

- 3.3. Market Restrains

- 3.3.1. Lack of Interoperability among Dissimilar Product Versions

- 3.4. Market Trends

- 3.4.1. Increasing Production of Autonomous Vehicles to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PLM Software Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.1.3. Professional Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Electronics, Industrial Equipment, and High-tech

- 5.2.2. Aerospace and Defense

- 5.2.3. Automotive

- 5.2.4. Architecture, Engineering, and Construction (AEC)

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. North America PLM Software Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.1.3. Professional Services

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Electronics, Industrial Equipment, and High-tech

- 6.2.2. Aerospace and Defense

- 6.2.3. Automotive

- 6.2.4. Architecture, Engineering, and Construction (AEC)

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7. Europe PLM Software Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.1.3. Professional Services

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Electronics, Industrial Equipment, and High-tech

- 7.2.2. Aerospace and Defense

- 7.2.3. Automotive

- 7.2.4. Architecture, Engineering, and Construction (AEC)

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8. Asia Pacific PLM Software Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.1.3. Professional Services

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Electronics, Industrial Equipment, and High-tech

- 8.2.2. Aerospace and Defense

- 8.2.3. Automotive

- 8.2.4. Architecture, Engineering, and Construction (AEC)

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9. Latin America PLM Software Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.1.3. Professional Services

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Electronics, Industrial Equipment, and High-tech

- 9.2.2. Aerospace and Defense

- 9.2.3. Automotive

- 9.2.4. Architecture, Engineering, and Construction (AEC)

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10. Middle East and Africa PLM Software Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.1.3. Professional Services

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Electronics, Industrial Equipment, and High-tech

- 10.2.2. Aerospace and Defense

- 10.2.3. Automotive

- 10.2.4. Architecture, Engineering, and Construction (AEC)

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11. North America PLM Software Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe PLM Software Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific PLM Software Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America PLM Software Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East PLM Software Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 ANSYS Germany GmbH

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Aras Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Siemens AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 PTC Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Autodesk Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Dassault Systems Deutschland GmbH

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Oracle Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Infor Inc *List Not Exhaustive

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Arena Solutions

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 SAP SE

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 ANSYS Germany GmbH

List of Figures

- Figure 1: Global PLM Software Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America PLM Software Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America PLM Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe PLM Software Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe PLM Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific PLM Software Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific PLM Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America PLM Software Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America PLM Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East PLM Software Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East PLM Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America PLM Software Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 13: North America PLM Software Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 14: North America PLM Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America PLM Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America PLM Software Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America PLM Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe PLM Software Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 19: Europe PLM Software Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 20: Europe PLM Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe PLM Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe PLM Software Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe PLM Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific PLM Software Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 25: Asia Pacific PLM Software Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 26: Asia Pacific PLM Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific PLM Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific PLM Software Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific PLM Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America PLM Software Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 31: Latin America PLM Software Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 32: Latin America PLM Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America PLM Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America PLM Software Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America PLM Software Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa PLM Software Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 37: Middle East and Africa PLM Software Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 38: Middle East and Africa PLM Software Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa PLM Software Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa PLM Software Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa PLM Software Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global PLM Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global PLM Software Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 3: Global PLM Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global PLM Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global PLM Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global PLM Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global PLM Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global PLM Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global PLM Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global PLM Software Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 16: Global PLM Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global PLM Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global PLM Software Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 21: Global PLM Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 22: Global PLM Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: United Kingdom PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Germany PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: France PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global PLM Software Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 28: Global PLM Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global PLM Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: India PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: China PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Japan PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Asia Pacific PLM Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global PLM Software Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 35: Global PLM Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 36: Global PLM Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Global PLM Software Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 38: Global PLM Software Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 39: Global PLM Software Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PLM Software Market?

The projected CAGR is approximately 7.32%.

2. Which companies are prominent players in the PLM Software Market?

Key companies in the market include ANSYS Germany GmbH, Aras Corporation, Siemens AG, PTC Inc, Autodesk Inc, Dassault Systems Deutschland GmbH, Oracle Corporation, Infor Inc *List Not Exhaustive, Arena Solutions, SAP SE.

3. What are the main segments of the PLM Software Market?

The market segments include Deployment Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Digitalization to Improve Production; Introduction of Cloud Technology to Consolidate the Information.

6. What are the notable trends driving market growth?

Increasing Production of Autonomous Vehicles to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Interoperability among Dissimilar Product Versions.

8. Can you provide examples of recent developments in the market?

January 2023: Hunkemöller, one of the significant global omnichannel lingerie brands, selected Bamboo Rose Product Lifecycle Management, Sourcing, and Purchase Order Management applications to connect and streamline development, sourcing, design, and supply chain processes as the brand primarily pursues various aggressive domestic and international growth plans. The teams have also partnered for years to source, audit, and implement replenishment and allocation systems, manage the master data initiative, optimize the wholesale side of the business, and support the implementation of the Bamboo Rose PLM.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PLM Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PLM Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PLM Software Market?

To stay informed about further developments, trends, and reports in the PLM Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence