Key Insights

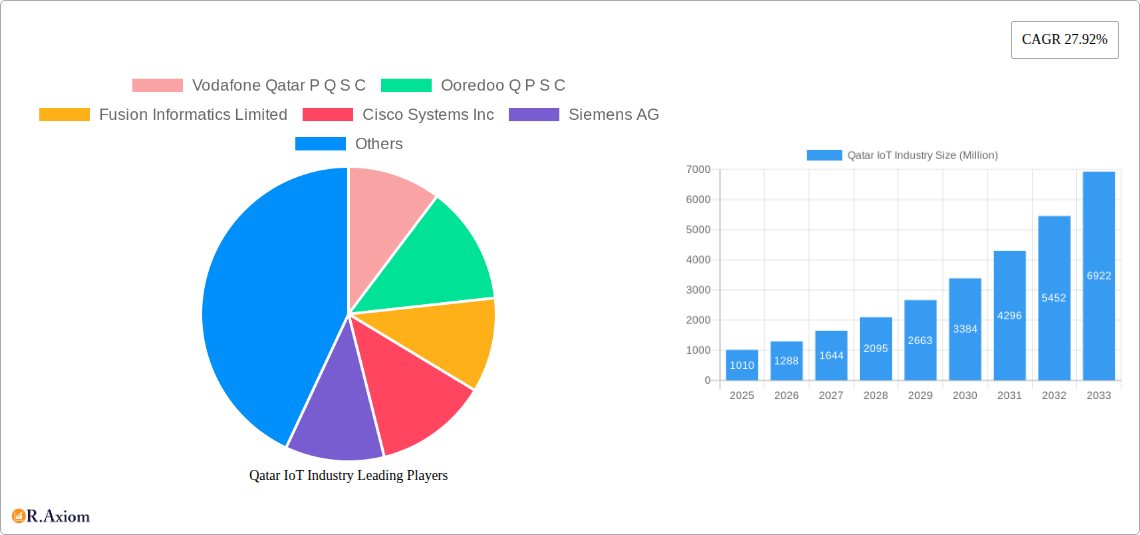

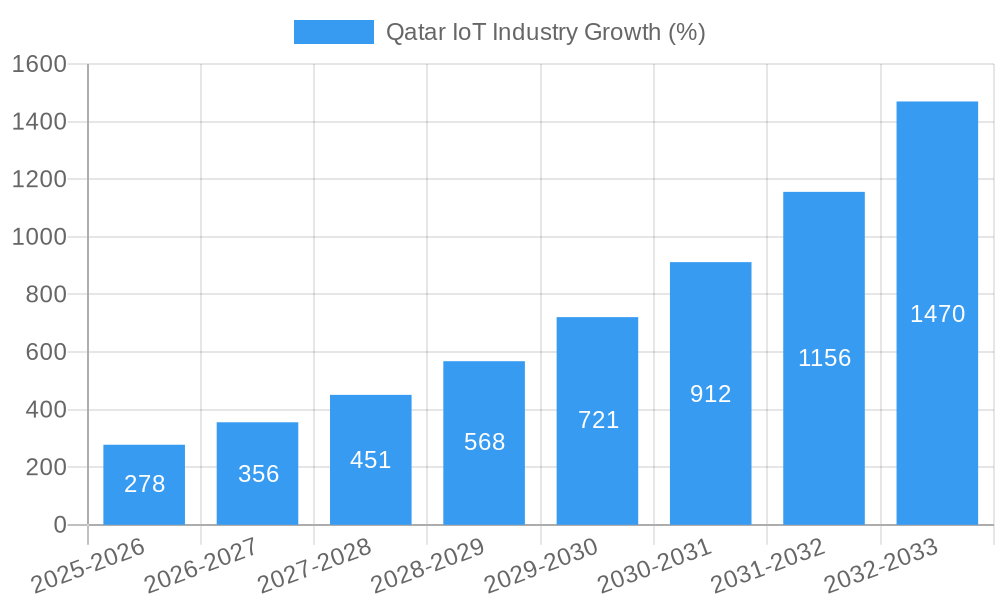

The Qatar IoT market, valued at $1.01 billion in 2025, is poised for substantial growth, exhibiting a Compound Annual Growth Rate (CAGR) of 27.92% from 2025 to 2033. This robust expansion is driven by several key factors. The Qatari government's strategic initiatives to diversify its economy and embrace digital transformation are significantly boosting IoT adoption across various sectors. The nation's robust infrastructure, including advanced telecommunications networks and a growing focus on smart city development, provides fertile ground for IoT deployment. Furthermore, the increasing demand for enhanced operational efficiency and improved data-driven decision-making across industries like manufacturing, transportation and logistics, and utilities are fueling market growth. The rise of smart homes and buildings, coupled with increased investments in connected devices, further contribute to this upward trajectory. Key players like Vodafone Qatar, Ooredoo, and Cisco Systems are actively investing in and expanding their IoT offerings, fostering competition and driving innovation within the ecosystem.

However, the market also faces certain challenges. Data security and privacy concerns remain a major hurdle, requiring robust cybersecurity measures and stringent data protection regulations. The high initial investment costs associated with implementing IoT solutions can hinder adoption, particularly among smaller businesses. Addressing these challenges through public-private partnerships, fostering cybersecurity awareness, and developing cost-effective solutions are crucial for realizing the full potential of the Qatar IoT market. Overcoming these hurdles will be key to ensuring the continued growth and wider adoption of IoT technologies in Qatar throughout the forecast period, ultimately transforming various sectors and positioning the nation as a leader in regional IoT innovation.

Qatar IoT Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Qatar IoT industry, offering invaluable insights for stakeholders, investors, and businesses seeking to navigate this rapidly evolving market. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period extending to 2033. The study leverages extensive primary and secondary research to deliver actionable intelligence, including market sizing, segmentation, competitive landscapes, and future growth projections. Expect detailed analysis of key players like Vodafone Qatar, Ooredoo, and others, along with exploration of significant industry developments.

Qatar IoT Industry Market Concentration & Innovation

This section analyzes the competitive landscape of Qatar's IoT market, examining market concentration, innovation drivers, regulatory influences, and key trends impacting the sector. We assess market share distribution among leading players such as Vodafone Qatar P Q S C, Ooredoo Q P S C, Fusion Informatics Limited, Cisco Systems Inc, Siemens AG, PTC Inc, Huawei Technologies Co Ltd, Labeeb IoT (Qatar Mobility Innovations Center), and Honeywell International Inc. The report quantifies market concentration using metrics such as the Herfindahl-Hirschman Index (HHI) and explores the impact of mergers and acquisitions (M&A) activities, including deal values and their influence on market dynamics. We delve into the role of innovation, analyzing technological advancements, R&D investments, and patent filings as drivers of growth. Regulatory frameworks, including government policies and initiatives promoting IoT adoption, will be thoroughly investigated. The analysis also considers the impact of substitute products and services, evolving end-user preferences, and emerging industry trends. We expect the market concentration to remain moderately high, with a few dominant players holding significant market share in the xx Million range. M&A activity is predicted to continue at a moderate pace, with total deal values reaching an estimated xx Million over the forecast period.

Qatar IoT Industry Industry Trends & Insights

This section presents a deep dive into the key trends shaping the Qatar IoT market. We examine market growth drivers, including increasing government investments in infrastructure development, rising adoption of smart city initiatives, and the burgeoning demand for connected devices across various sectors. We also analyze technological disruptions, such as the emergence of 5G technology, advancements in artificial intelligence (AI) and machine learning (ML) integration within IoT systems, and the expanding capabilities of edge computing. Further, the study explores evolving consumer preferences, focusing on the demand for user-friendly interfaces, enhanced security features, and cost-effective solutions. Competitive dynamics are evaluated, considering factors such as pricing strategies, product differentiation, and partnerships and collaborations among key players. The report projects a Compound Annual Growth Rate (CAGR) of xx% for the Qatar IoT market during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Dominant Markets & Segments in Qatar IoT Industry

This section identifies the leading segments within the Qatar IoT market. We analyze the dominance of specific segments across two key categorizations:

By Component:

- Hardware: The hardware segment is analyzed based on its market size, growth rate, and key drivers. The growth is driven by the increasing demand for smart devices and sensors across various sectors.

- Software: The software segment, including operating systems, application software, and data analytics platforms, is analyzed based on factors such as technological advancements and the increasing need for data management.

- Services (Managed and Professional): This segment includes managed services and professional services for IoT deployment and maintenance, and analysis centers on the growth factors like the growing need for technical expertise in integrating and supporting IoT solutions.

- Communication/Connectivity: The communication and connectivity segment encompasses technologies such as cellular networks, Wi-Fi, and low-power wide-area networks (LPWANs), with growth fueled by factors such as expanding network coverage and the availability of high-speed internet.

By End-user Vertical:

- Manufacturing: This segment focuses on the utilization of IoT in optimizing production processes, enhancing efficiency, and improving product quality. The growth is driven by the country's investments in industrial automation and smart manufacturing.

- Transport and Logistics: This segment focuses on IoT applications improving fleet management, supply chain optimization, and traffic management with growth influenced by modernization efforts in transportation systems.

- Home and Building Automation: This segment centers on the use of IoT to enhance home and building security, energy efficiency, and convenience, driven by increasing adoption of smart home devices.

- Power and Utilities: This segment explores the application of IoT in smart grids, power distribution, and grid management. Growth is fueled by the modernization efforts of electricity and water utilities.

- Government: This segment highlights the use of IoT in improving public services, infrastructure management, and citizen engagement, driven by the government's initiatives in digital transformation.

The report will pinpoint the leading segment based on market size, growth rate, and contribution to overall market revenue in 2025. The detailed analysis will include key drivers such as government policies, economic factors, and existing infrastructure.

Qatar IoT Industry Product Developments

The Qatar IoT market is witnessing rapid innovation, with new products and applications emerging constantly. Companies are focusing on developing solutions that enhance interoperability, security, and data analytics capabilities. Key technological trends include the integration of AI and ML in IoT devices and platforms, the deployment of edge computing solutions for real-time data processing, and the use of blockchain for secure data management. These innovations are finding applications in various sectors, including smart cities, industrial automation, and healthcare, improving efficiency, reducing costs, and enhancing safety.

Report Scope & Segmentation Analysis

This report segments the Qatar IoT market based on component (hardware, software, services, communication/connectivity) and end-user vertical (manufacturing, transport and logistics, home and building automation, power and utilities, government). Each segment is analyzed in detail, providing projections for market size, growth rate, and competitive dynamics. We identify key players in each segment and their respective market share, helping readers understand the competitive landscape of various sub-sectors. Growth projections vary considerably across segments, reflecting varying levels of adoption and technological maturity. The services segment is expected to experience strong growth due to the increasing demand for professional services related to IoT implementation and management. The communication/connectivity segment is anticipated to show significant growth due to the expansion of 5G networks in the country.

Key Drivers of Qatar IoT Growth

Several factors contribute to the growth of Qatar's IoT market. Significant government investment in infrastructure development and digital transformation initiatives is a major catalyst. The increasing adoption of smart city projects, creating a need for advanced sensor networks and data management systems, is also fueling expansion. Economic diversification strategies that promote the growth of technology-driven industries are also significantly impacting market growth. Additionally, the country's focus on sustainable development and energy efficiency, encouraging the adoption of IoT-based solutions in energy management, plays a crucial role.

Challenges in the Qatar IoT Industry Sector

Despite significant growth potential, several challenges hinder the full potential of Qatar's IoT market. High initial investment costs for IoT infrastructure and implementation can be a barrier, particularly for smaller businesses. Concerns over data security and privacy are also significant, requiring robust cybersecurity measures. A lack of skilled professionals to develop, deploy, and maintain IoT systems poses a considerable challenge. The complexity of integrating different IoT systems across diverse platforms, leading to interoperability issues, can also impede broader adoption. These challenges may restrict market growth by an estimated xx Million by 2033.

Emerging Opportunities in Qatar IoT Industry

The Qatar IoT market presents several exciting opportunities. The expansion of 5G networks offers significant potential for increased data speeds and wider IoT deployment. Growing interest in smart city initiatives is creating substantial demand for IoT-enabled solutions in areas such as traffic management, waste management, and public safety. There's also increasing demand for personalized and connected healthcare solutions, improving patient monitoring and healthcare delivery systems. The integration of AI and ML into IoT solutions will lead to smarter and more efficient applications.

Leading Players in the Qatar IoT Industry Market

- Vodafone Qatar P Q S C

- Ooredoo Q P S C

- Fusion Informatics Limited

- Cisco Systems Inc

- Siemens AG

- PTC Inc

- Huawei Technologies Co Ltd

- Labeeb IoT (Qatar Mobility Innovations Center)

- Honeywell International Inc

- List Not Exhaustive

Key Developments in Qatar IoT Industry

- March 2022: Ooredoo announced a major partnership with KDDI APAC to provide IoT connectivity for Lexus cars in Qatar, leveraging Ooredoo's IoT Connect platform. This significantly boosted Ooredoo's position in the automotive IoT segment.

- January 2023: Qatar General Electricity and Water Corporation (Kahramaa) announced the installation of 280,000 smart meters as part of a larger project to install 600,000 advanced digital meters. This substantial investment demonstrates the government's commitment to smart infrastructure and boosts the smart metering market significantly.

Strategic Outlook for Qatar IoT Industry Market

The Qatar IoT market is poised for robust growth, driven by substantial government investment, technological advancements, and the growing adoption of smart city initiatives. The expansion of 5G networks and the integration of AI and ML into IoT applications will further accelerate market expansion. Opportunities abound in diverse sectors, including transportation, healthcare, and energy, creating a dynamic and promising environment for industry players. Continued focus on data security and the development of skilled talent will be crucial for sustaining this growth trajectory.

Qatar IoT Industry Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services (Managed and Professional)

- 1.4. Communication/Connectivity

-

2. End-user Vertical

- 2.1. Manufacturing

- 2.2. Transport and Logistics

- 2.3. Home and Building Automation

- 2.4. Power and Utilities

- 2.5. Government

Qatar IoT Industry Segmentation By Geography

- 1. Qatar

Qatar IoT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 27.92% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Adoption of Smart Home Projects; Roll-out of Government Initiatives in the form of Digital Government Strategies

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness About Benefits of Geospatial Imagery Services

- 3.4. Market Trends

- 3.4.1. Increase in Adoption of Smart Homes Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar IoT Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services (Managed and Professional)

- 5.1.4. Communication/Connectivity

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Manufacturing

- 5.2.2. Transport and Logistics

- 5.2.3. Home and Building Automation

- 5.2.4. Power and Utilities

- 5.2.5. Government

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Vodafone Qatar P Q S C

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ooredoo Q P S C

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fusion Informatics Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PTC Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Huawei Technologies Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Labeeb IoT (Qatar Mobility Innovations Center)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honeywell International Inc *List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Vodafone Qatar P Q S C

List of Figures

- Figure 1: Qatar IoT Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar IoT Industry Share (%) by Company 2024

List of Tables

- Table 1: Qatar IoT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar IoT Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Qatar IoT Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Qatar IoT Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Qatar IoT Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Qatar IoT Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 7: Qatar IoT Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 8: Qatar IoT Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar IoT Industry?

The projected CAGR is approximately 27.92%.

2. Which companies are prominent players in the Qatar IoT Industry?

Key companies in the market include Vodafone Qatar P Q S C, Ooredoo Q P S C, Fusion Informatics Limited, Cisco Systems Inc, Siemens AG, PTC Inc, Huawei Technologies Co Ltd, Labeeb IoT (Qatar Mobility Innovations Center), Honeywell International Inc *List Not Exhaustive.

3. What are the main segments of the Qatar IoT Industry?

The market segments include Component, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Adoption of Smart Home Projects; Roll-out of Government Initiatives in the form of Digital Government Strategies.

6. What are the notable trends driving market growth?

Increase in Adoption of Smart Homes Projects.

7. Are there any restraints impacting market growth?

Lack of Awareness About Benefits of Geospatial Imagery Services.

8. Can you provide examples of recent developments in the market?

January 2023: Qatar General Electricity and Water Corporation (Kahramaa) announced that it had installed 280,000 smart meters of electricity and water equipped with the Internet of Things (IoT). Smart Metering Infrastructure Project, one of the most prominent projects of Kahramaa for digital transformation, targets the installation of 600,000 advanced digital meters to read energy consumption more effectively and accurately and transmit the required information safely and quickly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar IoT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar IoT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar IoT Industry?

To stay informed about further developments, trends, and reports in the Qatar IoT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence