Key Insights

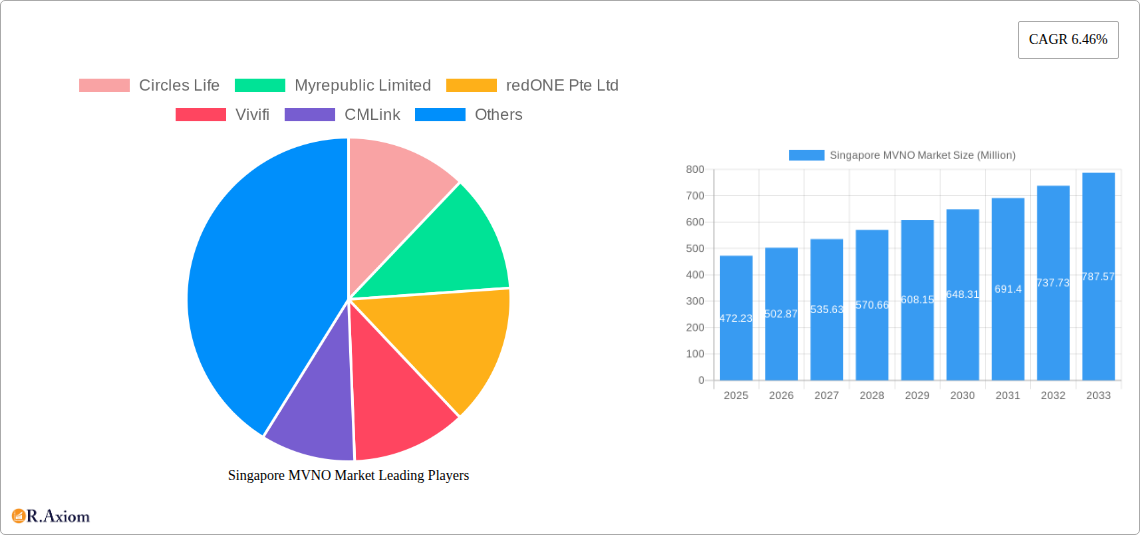

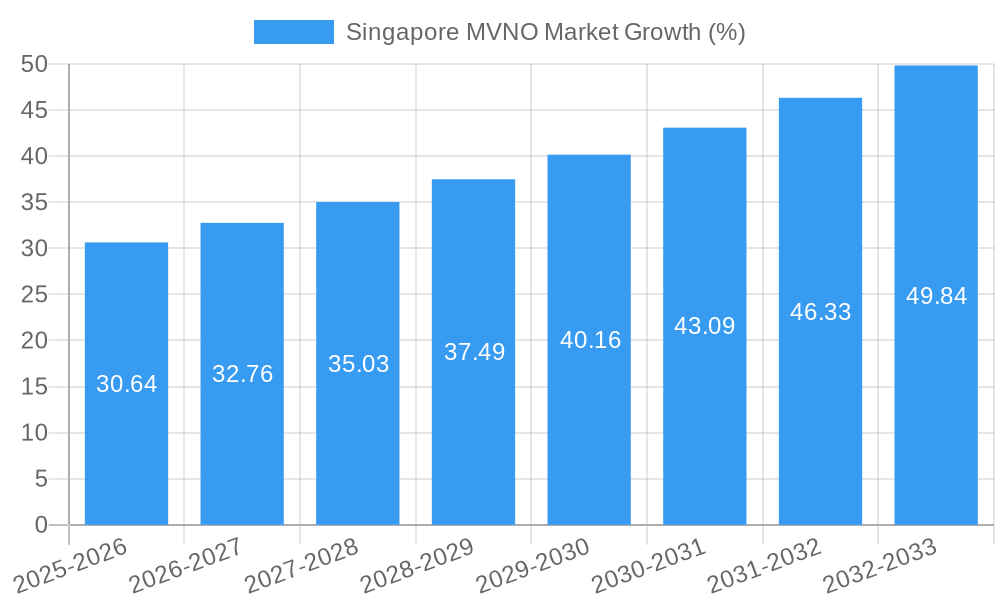

The Singapore MVNO (Mobile Virtual Network Operator) market, valued at $472.23 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.46% from 2025 to 2033. This expansion is fueled by several key drivers. Increased smartphone penetration and data consumption among Singapore's tech-savvy population are significantly boosting demand for affordable and flexible mobile plans. The rising popularity of prepaid services and the emergence of innovative MVNO business models catering to niche segments (e.g., travelers, specific demographics) are further accelerating market growth. Intense competition among established players like Circles.Life, MyRepublic, and redONE, alongside newer entrants, fosters innovation and price competitiveness, benefiting consumers. However, regulatory hurdles and the dependence on infrastructure provided by Mobile Network Operators (MNOs) pose potential constraints. The market is segmented primarily by service type (prepaid, postpaid), with prepaid likely dominating due to its cost-effectiveness. Future growth will likely hinge on successful strategies to leverage 5G technology, offer bundled services, and personalize offerings to meet the evolving needs of diverse customer segments.

The forecast for the Singapore MVNO market paints a positive picture, anticipating consistent expansion over the next decade. The success of existing and new entrants will depend on their agility to adapt to rapid technological advancements and effectively address changing consumer preferences. This includes expanding data offerings, improving customer service, and exploring innovative value-added services. Effective marketing and branding strategies will be crucial to differentiate offerings in a crowded marketplace. Furthermore, strategic partnerships and collaborations with MNOs could provide access to enhanced network infrastructure and streamline operational efficiencies, enabling stronger market positioning. The continued focus on customer experience and the development of tailored solutions will be paramount in securing a larger share of the growing Singaporean mobile market.

This detailed report provides a comprehensive analysis of the Singapore MVNO (Mobile Virtual Network Operator) market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The historical period covered is 2019-2024. Market size estimations are provided in Millions.

Singapore MVNO Market Market Concentration & Innovation

The Singapore MVNO market exhibits a moderately concentrated landscape, with a few key players holding significant market share. However, the presence of numerous smaller MVNOs fosters competition and innovation. Market concentration is influenced by factors such as brand recognition, network infrastructure access, and pricing strategies. The market share of the top three players in 2024 was estimated at xx%, indicating a relatively fragmented market. Innovation is driven by the need to offer competitive pricing, unique value propositions, and superior customer service. Regulatory frameworks, while supportive of competition, also impose certain restrictions. The availability of substitutes, such as VoIP services, influences consumer choices. Recent M&A activities have been limited; however, the potential for consolidation remains, with deal values in the range of xx Million observed historically. End-user trends point towards a growing demand for data-centric plans and bundled services.

Singapore MVNO Market Industry Trends & Insights

The Singapore MVNO market is experiencing substantial growth, driven by increasing smartphone penetration, rising data consumption, and the demand for affordable mobile services. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, indicating a healthy expansion. Technological disruptions, such as the adoption of 5G technology and the rise of IoT (Internet of Things), are creating new opportunities for MVNOs. Consumer preferences are shifting towards greater flexibility, personalized plans, and bundled services. Competitive dynamics are intense, with companies vying for market share through innovative pricing, targeted marketing, and value-added services. Market penetration of MVNO services continues to increase, driven by factors such as price-sensitivity and consumer demand for customized plans. The overall market size in 2025 is estimated at xx Million, with projections indicating continued growth.

Dominant Markets & Segments in Singapore MVNO Market

The Singapore MVNO market is dominated by the prepaid segment, owing to its affordability and flexibility. This segment is expected to maintain its leadership throughout the forecast period.

- Key Drivers for Prepaid Segment Dominance:

- High price sensitivity among consumers.

- Flexibility and convenience of prepaid plans.

- Lower barriers to entry for MVNOs offering prepaid services.

- Effective marketing strategies targeting budget-conscious consumers.

The postpaid segment, while smaller, exhibits potential for growth fueled by increasing data consumption and the rise of bundled services. The dominance of the prepaid segment stems from several key factors, including the significant portion of price-sensitive consumers in Singapore. The robust mobile infrastructure in Singapore and the supportive regulatory environment have also contributed to the sector's growth and maturity.

Singapore MVNO Market Product Developments

Recent product innovations focus on data-centric plans, bundled services (e.g., data, calls, and streaming), and personalized offers tailored to specific user needs. MVNOs are leveraging technology to enhance customer experience through mobile apps, personalized dashboards, and improved customer service channels. The competitive advantage stems from differentiated value propositions, competitive pricing, and strong customer support.

Report Scope & Segmentation Analysis

This report segments the Singapore MVNO market by service type (prepaid and postpaid).

Prepaid Segment: This segment is characterized by high volume, price-sensitive consumers, and intense competition. Growth is expected to be driven by the continuous need for affordable mobile services. Market size in 2025 is estimated at xx Million. Competitive dynamics are characterized by aggressive pricing strategies and innovative promotional offers.

Postpaid Segment: This segment is characterized by higher Average Revenue Per User (ARPU), focusing on value-added services and higher data allowances. Market growth will be driven by rising data usage and increasing adoption of bundled services. Market size in 2025 is estimated at xx Million. Competition focuses on offering premium features and superior customer service.

Key Drivers of Singapore MVNO Market Growth

The Singapore MVNO market's growth is propelled by several key factors:

Increasing Smartphone Penetration: The widespread adoption of smartphones has fueled the demand for mobile data services.

Rising Data Consumption: Consumers are consuming more data than ever before, driving demand for data-centric plans.

Government Initiatives: Supportive regulatory frameworks encourage competition and innovation within the sector.

Competitive Pricing: MVNOs offer competitive pricing compared to traditional mobile network operators (MNOs), attracting price-sensitive consumers.

Challenges in the Singapore MVNO Market Sector

The Singapore MVNO market faces several challenges:

Competition: Intense competition among MVNOs and traditional MNOs puts pressure on pricing and profitability.

Network Dependence: MVNOs rely on the infrastructure of MNOs, making them vulnerable to changes in wholesale pricing or service quality.

Regulatory Hurdles: Navigating regulatory requirements and compliance can be costly and time-consuming.

Emerging Opportunities in Singapore MVNO Market

The Singapore MVNO market presents several emerging opportunities:

5G Adoption: The rollout of 5G networks opens opportunities for new services and higher data speeds.

IoT Integration: MVNOs can integrate IoT devices and offer specialized plans tailored to the needs of IoT applications.

Data Analytics: Leveraging data analytics to provide personalized services and optimize marketing campaigns.

Leading Players in the Singapore MVNO Market Market

- Circles Life

- Myrepublic Limited

- redONE Pte Ltd

- Vivifi

- CMLink

- StarHub Limited (Giga)

- Changi Travel Services Pte Ltd (Changi Mobile)

- GOMO

- Zero1 Pte Ltd

- Geenet Pte Lt

Key Developments in Singapore MVNO Market Industry

December 2023: Giga launched its "Feeling Good" fourth-anniversary campaign, offering new mobile lines for SGD 1 and free data on rainy days.

November 2023: GOMO launched an advertising campaign for its new Databank, focusing on social media engagement to educate consumers on data wastage.

Strategic Outlook for Singapore MVNO Market Market

The Singapore MVNO market is poised for sustained growth driven by technological advancements, increasing data consumption, and the growing demand for flexible and affordable mobile services. The strategic focus should be on innovation, value-added services, and targeted marketing to capture market share and enhance profitability. The continued expansion of 5G technology and the rise of IoT present significant opportunities for MVNOs to diversify their offerings and cater to evolving consumer needs.

Singapore MVNO Market Segmentation

-

1. Overall

-

1.1. By Service Type

- 1.1.1. Voice

- 1.1.2. Data

-

1.1. By Service Type

Singapore MVNO Market Segmentation By Geography

- 1. Singapore

Singapore MVNO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Mobile Penetration; Demand for Online Gaming

- 3.3. Market Restrains

- 3.3.1. ; High Initial Invetsment and Product Cost

- 3.4. Market Trends

- 3.4.1. Voice to be the Largest Service Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore MVNO Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Overall

- 5.1.1. By Service Type

- 5.1.1.1. Voice

- 5.1.1.2. Data

- 5.1.1. By Service Type

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Overall

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Circles Life

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Myrepublic Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 redONE Pte Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vivifi

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CMLink

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 StarHub Limited (Giga)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Changi Travel Services Pte Ltd (Changi Mobile)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GOMO

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zero1 Pte Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Geenet Pte Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Circles Life

List of Figures

- Figure 1: Singapore MVNO Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Singapore MVNO Market Share (%) by Company 2024

List of Tables

- Table 1: Singapore MVNO Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Singapore MVNO Market Revenue Million Forecast, by Overall 2019 & 2032

- Table 3: Singapore MVNO Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Singapore MVNO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Singapore MVNO Market Revenue Million Forecast, by Overall 2019 & 2032

- Table 6: Singapore MVNO Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore MVNO Market?

The projected CAGR is approximately 6.46%.

2. Which companies are prominent players in the Singapore MVNO Market?

Key companies in the market include Circles Life, Myrepublic Limited, redONE Pte Ltd, Vivifi, CMLink, StarHub Limited (Giga), Changi Travel Services Pte Ltd (Changi Mobile), GOMO, Zero1 Pte Ltd, Geenet Pte Lt.

3. What are the main segments of the Singapore MVNO Market?

The market segments include Overall .

4. Can you provide details about the market size?

The market size is estimated to be USD 472.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Mobile Penetration; Demand for Online Gaming.

6. What are the notable trends driving market growth?

Voice to be the Largest Service Type.

7. Are there any restraints impacting market growth?

; High Initial Invetsment and Product Cost.

8. Can you provide examples of recent developments in the market?

December 2023 - Singapore, giga made a splash in town with its fourth-anniversary campaign, "Feeling Good," where customers could give out new mobile lines to family and friends for just SGD 1. Additionally, the company planned to offer free data on rainy days, fuel customer data consumption, and adoption of Giga's services in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore MVNO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore MVNO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore MVNO Market?

To stay informed about further developments, trends, and reports in the Singapore MVNO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence