Key Insights

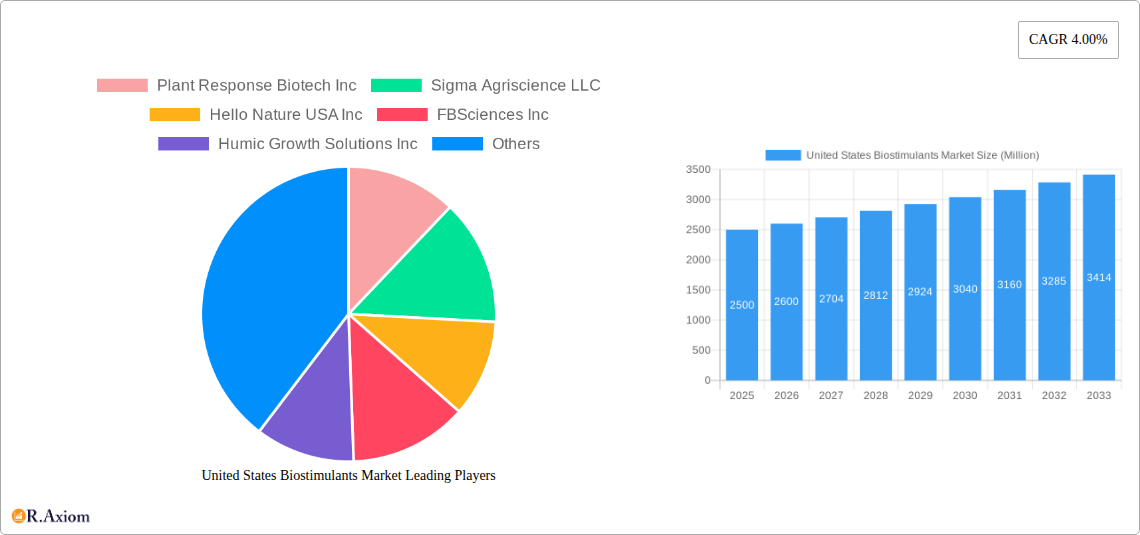

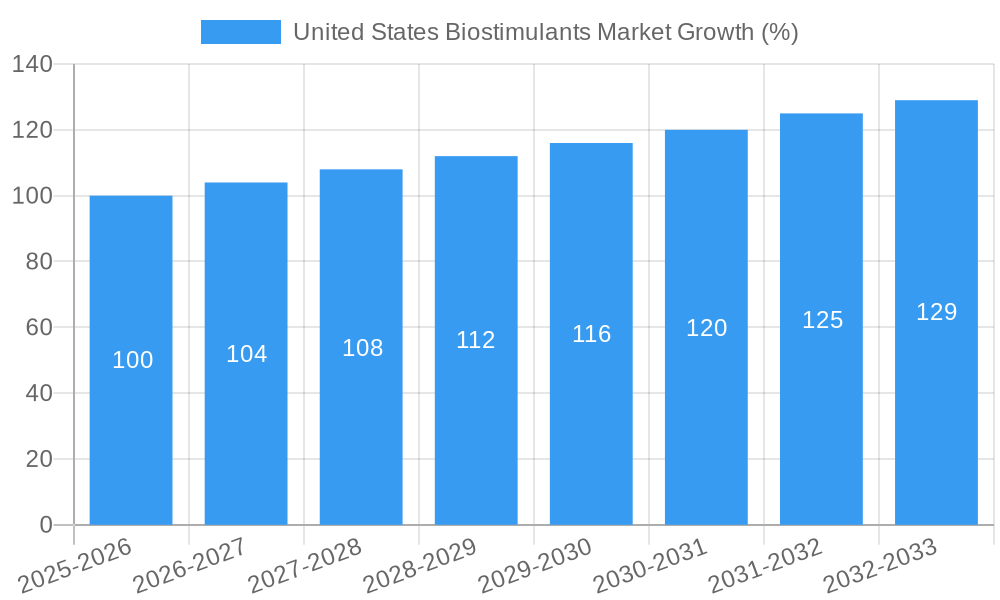

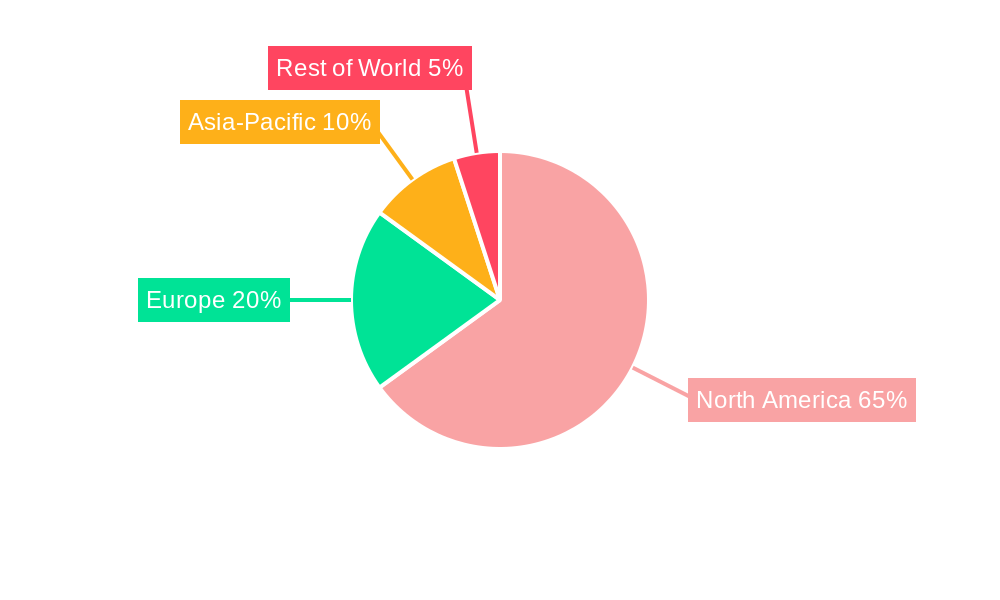

The United States biostimulants market, while experiencing a Compound Annual Growth Rate (CAGR) of 4.00% from 2019 to 2024, is poised for significant expansion in the coming years. Driven by increasing demand for sustainable agricultural practices, rising consumer awareness of environmentally friendly food production, and the need to enhance crop yields and quality, the market is witnessing substantial growth across various segments. The adoption of biostimulants, which are naturally derived substances that enhance plant nutrient uptake and overall health, is particularly strong in cash crops, horticultural crops, and row crops. Amino acids, fulvic acid, humic acid, and protein hydrolysates are among the leading forms of biostimulants utilized, demonstrating the diverse applications of these products across various agricultural settings. Major players like Plant Response Biotech Inc, Sigma Agriscience LLC, and Corteva Agriscience are driving innovation and market penetration through their research and development efforts, leading to the introduction of novel biostimulant formulations and application methods. While regulatory hurdles and variable product efficacy can act as restraints, the overall market outlook remains positive, particularly considering the growing focus on precision agriculture and the increasing adoption of sustainable farming practices within the US.

The market segmentation reveals substantial opportunities within specific crop types. Cash crops, benefiting from increased yields and improved quality, likely account for the largest market share. However, the horticultural and row crop segments are also demonstrating significant growth, mirroring the broader trend toward sustainable and efficient agricultural practices. Competition within the industry is robust, with both established multinational corporations and smaller specialized companies vying for market share. This competitive landscape fosters innovation and drives down prices, further accelerating market penetration. While precise market size data for 2025 is unavailable, extrapolating from the 4.00% CAGR and assuming a reasonable starting point, we can project continued, steady growth throughout the forecast period of 2025-2033, with particular emphasis on product innovation and market expansion in niche segments like organic farming and specialty crops.

This comprehensive report provides an in-depth analysis of the United States biostimulants market, offering valuable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market size, segmentation, growth drivers, challenges, and emerging opportunities. The report leverages extensive primary and secondary research to deliver actionable intelligence for strategic decision-making.

United States Biostimulants Market Market Concentration & Innovation

This section analyzes the competitive landscape of the U.S. biostimulants market, examining market concentration, innovation drivers, regulatory frameworks, and key industry activities. The market is characterized by a mix of large multinational corporations and smaller specialized players. Market share data for key players will be presented, revealing the degree of concentration. The report will quantify the value of significant M&A deals impacting the market, such as the xx Million acquisition of Plant Response Biotech Inc. by The Mosaic Company in February 2022.

- Market Concentration: The report will quantify the market share of the top five players, illustrating the level of consolidation within the market. Data will be presented using tables and charts. xx% of the market is expected to be held by the top five players in 2025.

- Innovation Drivers: Key innovation drivers include the increasing demand for sustainable agriculture practices, advancements in biostimulant formulations (e.g., targeted delivery systems), and the growing adoption of precision agriculture technologies.

- Regulatory Framework: The regulatory landscape, including EPA guidelines and labeling requirements, significantly impacts market growth and product development. The report will analyze the key regulatory aspects affecting market players.

- Product Substitutes: The report will discuss substitute products, such as traditional fertilizers, and their impact on market competition.

- End-User Trends: Growing awareness of environmental sustainability and the increasing need for enhanced crop yields are driving demand for biostimulants across various crop types.

- M&A Activities: The report analyzes recent mergers and acquisitions (M&A) activities in the industry. The acquisition of WISErg by Plant Response Inc. in May 2021 is a key example illustrating the strategic importance of technological advancements and sustainability initiatives.

United States Biostimulants Market Industry Trends & Insights

This section provides a comprehensive overview of the U.S. biostimulants market trends, analyzing market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The report projects a CAGR of xx% for the forecast period (2025-2033), driven by factors such as increasing awareness of environmental sustainability, rising demand for higher crop yields, and favorable government policies promoting sustainable agricultural practices. Market penetration will also be examined, detailing the adoption rate across different segments.

The competitive landscape is highly dynamic, with companies constantly innovating to develop new and improved products. The report will analyze various market segments and their growth potential, including specific applications and crop types. Technological advancements in biostimulant formulation and application methods are key drivers, resulting in improved efficacy and reduced environmental impact. Consumer preferences are shifting toward environmentally friendly and sustainable agricultural practices, further boosting demand for biostimulants.

Dominant Markets & Segments in United States Biostimulants Market

This section identifies the leading segments within the U.S. biostimulants market based on form and crop type.

Form:

- Seaweed Extracts: This segment is projected to dominate due to their versatile functionalities and natural origin, enhancing plant health and resilience. This is driven by growing consumer preference for organic and sustainable products.

- Amino Acids: The demand for amino acid-based biostimulants is expanding owing to their role in enhancing nutrient uptake and stress tolerance in crops. Corteva Agriscience's launch of Sosdia Stress further highlights the importance of this segment.

- Other Biostimulants: This segment includes a wide range of products and demonstrates growth potential due to continuous innovation in formulating novel biostimulants for targeted applications.

Crop Type:

- Row Crops: This segment is expected to hold a significant market share due to the large acreage devoted to row crops in the U.S. and the benefits biostimulants offer in increasing yield and quality.

- Horticultural Crops: The increasing demand for high-quality horticultural products, coupled with the effectiveness of biostimulants in enhancing crop quality and yield, fuels the growth of this segment.

- Cash Crops: The economic importance of cash crops in the U.S. translates into higher investment in technologies that enhance yield and quality; therefore, this segment demonstrates consistent growth potential.

The dominance of these segments is analyzed considering several factors:

- Economic policies supporting sustainable agriculture.

- Favorable climatic conditions in specific regions.

- Technological advancements in biostimulant production and application.

United States Biostimulants Market Product Developments

Recent product innovations focus on enhancing efficacy, targeting specific crop needs, and improving application methods. Companies are developing advanced formulations with improved delivery systems, resulting in greater efficiency and reduced environmental impact. The introduction of Sosdia Stress by Corteva Agriscience exemplifies this trend of developing targeted biostimulants for managing abiotic stresses. The market is moving towards more precise and sustainable solutions tailored to specific crop requirements and environmental conditions.

Report Scope & Segmentation Analysis

This report segments the U.S. biostimulants market based on form (Amino Acids, Fulvic Acid, Humic Acid, Protein Hydrolysates, Seaweed Extracts, Other Biostimulants) and crop type (Cash Crops, Horticultural Crops, Row Crops). Each segment's growth projections, market sizes (in Million), and competitive dynamics are analyzed. The detailed breakdown helps to understand the market potential across different segments and inform strategic decision-making. For instance, the Seaweed Extracts segment is projected to experience significant growth driven by increased consumer demand for organic products. Similarly, the Row Crops segment benefits from large-scale farming operations and increased demand for higher crop yields.

Key Drivers of United States Biostimulants Market Growth

Several factors drive the growth of the U.S. biostimulants market. The increasing demand for sustainable agriculture practices and the growing awareness of environmental concerns are key drivers. Government initiatives promoting sustainable agriculture further bolster market growth. Technological advancements in biostimulant formulations and application techniques enhance product efficacy and contribute to market expansion. The rising demand for high-quality crops and improved yield efficiency are crucial factors driving market growth across various crop types.

Challenges in the United States Biostimulants Market Sector

The U.S. biostimulants market faces challenges such as stringent regulatory requirements that can increase the cost and time required for product registration. Supply chain disruptions and price volatility of raw materials can impact product availability and profitability. Intense competition among established players and new entrants necessitates continuous innovation and product differentiation to maintain a competitive edge. The varying efficacy of biostimulants across different crops and environmental conditions also presents a challenge for widespread adoption.

Emerging Opportunities in United States Biostimulants Market

Emerging opportunities include the development of specialized biostimulants for specific crop needs and environmental conditions. The increasing adoption of precision agriculture technologies presents opportunities for targeted application and improved efficiency. Expanding into new market segments, such as organic farming and hydroponics, offers further growth potential. Advancements in biotechnology and nanotechnology are creating innovative biostimulant formulations with enhanced efficacy and targeted delivery systems.

Leading Players in the United States Biostimulants Market Market

- Plant Response Biotech Inc.

- Sigma Agriscience LLC

- Hello Nature USA Inc

- FBSciences Inc

- Humic Growth Solutions Inc

- Symborg Inc

- Ocean Organics Corp

- Valagro US

- Corteva Agriscience

- BioLine Corporation

Key Developments in United States Biostimulants Market Industry

- July 2022: Corteva Agriscience introduced Sosdia Stress, an abiotic stress mitigator derived from amino acids, to help farmers manage drought-stressed crops. This launch demonstrates the industry's focus on developing specialized products for specific crop needs.

- February 2022: Plant Response Biotech Inc. was acquired by The Mosaic Company, strengthening the company's global presence and signifying the consolidation within the market.

- May 2021: Plant Response Inc. acquired WISErg, a startup upcycling food waste into fertilizer, reflecting a trend towards sustainable and innovative product development.

Strategic Outlook for United States Biostimulants Market Market

The U.S. biostimulants market exhibits significant growth potential driven by a confluence of factors including increasing demand for sustainable agriculture, technological advancements, and supportive government policies. The market is poised for continued expansion as consumers prioritize environmentally friendly products and farmers seek to maximize crop yields and quality while minimizing environmental impact. Strategic investments in research and development, innovative product development, and targeted marketing efforts will be crucial for success in this dynamic and rapidly evolving market. The focus on sustainable and environmentally friendly solutions will continue to be a key driver of growth in the coming years.

United States Biostimulants Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Biostimulants Market Segmentation By Geography

- 1. United States

United States Biostimulants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Increased Food Demand and Need for Increased Agricultural Food Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Biostimulants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. South Africa United States Biostimulants Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Morocco United States Biostimulants Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Egypt United States Biostimulants Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Rest of Africa United States Biostimulants Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Plant Response Biotech Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sigma Agriscience LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hello Nature USA Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 FBSciences Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Humic Growth Solutions Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Symborg Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Ocean Organics Corp

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Valagro US

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Corteva Agriscience

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 BioLine Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Plant Response Biotech Inc

List of Figures

- Figure 1: United States Biostimulants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Biostimulants Market Share (%) by Company 2024

List of Tables

- Table 1: United States Biostimulants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Biostimulants Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: United States Biostimulants Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: United States Biostimulants Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: United States Biostimulants Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: United States Biostimulants Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: United States Biostimulants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Biostimulants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Biostimulants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Biostimulants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Biostimulants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States Biostimulants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Biostimulants Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: United States Biostimulants Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: United States Biostimulants Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: United States Biostimulants Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: United States Biostimulants Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: United States Biostimulants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Biostimulants Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the United States Biostimulants Market?

Key companies in the market include Plant Response Biotech Inc, Sigma Agriscience LLC, Hello Nature USA Inc, FBSciences Inc, Humic Growth Solutions Inc, Symborg Inc, Ocean Organics Corp, Valagro US, Corteva Agriscience, BioLine Corporation.

3. What are the main segments of the United States Biostimulants Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Increased Food Demand and Need for Increased Agricultural Food Productivity.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

July 2022: Corteva Agriscience introduced Sosdia Stress, an abiotic stress mitigator, to help farmers better manage drought-stressed crops. This product is derived from amino acids of natural origin.February 2022: Plant Response was acquired by The Mosaic Company, which is a global fertilizer manufacturer. This acquisition strengthened the company's global presence. Through the acquisition, the company develops new products and solutions for the customers in a sustainable way.May 2021: Plant Response Inc. announced its acquisition of WISErg, which is a startup that upcycles nutrients from recovered food for use in fertilizer and nutrient-efficient products that enhance plant and soil health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Biostimulants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Biostimulants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Biostimulants Market?

To stay informed about further developments, trends, and reports in the United States Biostimulants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence